444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East satellite communications market represents a rapidly evolving sector driven by increasing demand for reliable connectivity solutions across diverse industries and applications. This dynamic market encompasses satellite-based communication services, ground equipment, and infrastructure supporting telecommunications, broadcasting, maritime, aviation, and government sectors throughout the region. Regional governments are investing heavily in satellite infrastructure to support digital transformation initiatives and enhance national security capabilities.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% driven by expanding broadband requirements and increasing adoption of satellite-enabled services. The region’s strategic geographical position makes it a crucial hub for global satellite communications, connecting Europe, Asia, and Africa through advanced satellite networks. Commercial satellite operators are establishing significant presence in the Middle East to capitalize on growing demand from enterprise customers and government agencies.

Technological advancements in high-throughput satellites (HTS) and low Earth orbit (LEO) constellations are transforming the competitive landscape, offering enhanced capacity and reduced latency for end users. The market benefits from strong government support for space programs and satellite communications infrastructure development across key countries including the United Arab Emirates, Saudi Arabia, and Israel.

The Middle East satellite communications market refers to the comprehensive ecosystem of satellite-based communication services, equipment, and infrastructure serving countries across the Middle East region. This market encompasses various satellite communication technologies including geostationary (GEO), medium Earth orbit (MEO), and low Earth orbit (LEO) satellites that provide voice, data, video, and internet services to diverse end-user segments.

Satellite communications in this context includes both commercial and government applications, ranging from direct-to-home broadcasting and mobile satellite services to critical communications for defense and emergency response operations. The market covers satellite operators, service providers, equipment manufacturers, and system integrators working together to deliver comprehensive connectivity solutions across the region’s diverse geographical and demographic landscape.

Regional characteristics define this market through unique requirements including extreme weather resilience, multi-language broadcasting capabilities, and compliance with varying national regulations across different Middle Eastern countries. The market serves both developed urban centers and remote areas where terrestrial infrastructure may be limited or unavailable.

Strategic market positioning places the Middle East satellite communications sector at the forefront of regional digital transformation initiatives. The market demonstrates exceptional resilience and growth potential, supported by increasing government investments in space technology and growing demand for reliable communication services across multiple industry verticals. Key growth drivers include expanding broadband penetration requirements and rising adoption of satellite-enabled IoT applications.

Market segmentation reveals diverse opportunities across commercial, government, and consumer applications, with maritime and aviation sectors showing particularly strong growth trajectories. The region’s strategic location continues to attract international satellite operators seeking to establish regional headquarters and ground infrastructure. Competitive dynamics are intensifying as traditional geostationary satellite operators face competition from emerging LEO constellation providers.

Investment trends indicate substantial capital allocation toward next-generation satellite technologies and ground infrastructure modernization. Regional governments are prioritizing satellite communications as critical infrastructure for economic diversification and national security enhancement. Market consolidation activities are creating larger, more capable service providers better positioned to serve enterprise and government customers with comprehensive solutions.

Primary market insights reveal several critical trends shaping the Middle East satellite communications landscape:

Digital transformation initiatives across the Middle East are creating unprecedented demand for reliable, high-capacity communication services. Government-led smart city projects and Industry 4.0 implementations require robust satellite connectivity to support IoT devices, sensors, and real-time data transmission capabilities. Economic diversification programs in oil-dependent economies are driving investments in technology infrastructure, including satellite communications as enablers of new economic sectors.

Geographic advantages position the Middle East as a natural satellite communications hub, with optimal coverage for serving Europe, Asia, and Africa markets simultaneously. This strategic location attracts international satellite operators and service providers seeking regional expansion opportunities. Maritime traffic growth through the Suez Canal and Persian Gulf shipping lanes increases demand for vessel tracking, crew communications, and cargo monitoring services.

Regulatory support from regional governments is facilitating market growth through streamlined licensing processes, foreign investment incentives, and public-private partnership opportunities. National space agencies are establishing comprehensive satellite communication strategies that encourage both domestic capability development and international collaboration. Security requirements drive demand for secure, resilient communication systems that can operate independently of terrestrial infrastructure vulnerabilities.

Consumer behavior changes toward increased video streaming, social media usage, and mobile data consumption are pushing bandwidth requirements beyond terrestrial network capabilities in many areas. Rural and remote population centers rely heavily on satellite communications for accessing modern digital services and participating in the digital economy.

High capital requirements for satellite infrastructure development and deployment create significant barriers to entry for new market participants. The substantial upfront investments required for satellite manufacturing, launch services, and ground infrastructure can limit market competition and innovation pace. Regulatory complexity across different Middle Eastern countries creates challenges for service providers seeking to operate across multiple national markets with varying licensing requirements and technical standards.

Technical limitations of traditional geostationary satellites, including latency issues and capacity constraints, can limit adoption for certain applications requiring real-time communications or high-bandwidth services. Weather-related service disruptions during sandstorms and extreme weather events can impact service reliability and customer satisfaction. Spectrum interference from terrestrial wireless services and adjacent satellite systems creates operational challenges requiring sophisticated interference mitigation technologies.

Competition from terrestrial alternatives including fiber optic networks, 5G wireless systems, and terrestrial microwave links can limit satellite communications adoption in urban areas with well-developed terrestrial infrastructure. Cost sensitivity among price-conscious consumer segments may limit adoption of premium satellite services. Skilled workforce shortages in satellite technology and operations can constrain market growth and service quality improvement initiatives.

Geopolitical tensions in certain regions can impact cross-border satellite service provision and international collaboration on satellite projects. Export control regulations and technology transfer restrictions may limit access to advanced satellite technologies and components from international suppliers.

Emerging technologies including low Earth orbit satellite constellations present significant opportunities for providing low-latency, high-capacity services that can compete directly with terrestrial alternatives. The development of software-defined satellites and flexible payload technologies enables more efficient spectrum utilization and service customization capabilities. 5G network integration opportunities allow satellite operators to provide backhaul and coverage extension services for terrestrial mobile networks.

Vertical market expansion into sectors such as agriculture, mining, oil and gas, and renewable energy creates new revenue streams for satellite communication providers. Precision agriculture applications using satellite connectivity for IoT sensors and automated equipment represent growing market opportunities. Smart city initiatives across the region require comprehensive connectivity solutions that integrate satellite communications with terrestrial networks.

Public-private partnerships with regional governments offer opportunities for large-scale infrastructure development projects and long-term service contracts. National satellite programs create opportunities for technology transfer, local capability development, and joint venture arrangements. Regional satellite manufacturing capabilities development could reduce costs and improve supply chain resilience for satellite operators.

Maritime and aviation growth in the region creates expanding opportunities for mobility communications services. The development of autonomous vehicles and drones requires reliable satellite communications for command and control functions. Edge computing integration with satellite networks enables new applications requiring distributed processing capabilities at the network edge.

Competitive intensity is increasing as traditional satellite operators face challenges from new entrants offering innovative service models and advanced technologies. Market consolidation activities are creating larger, more capable organizations with enhanced financial resources and technical capabilities. Technology convergence between satellite and terrestrial networks is blurring traditional market boundaries and creating new competitive dynamics.

Customer expectations are evolving toward demanding higher performance, lower costs, and more flexible service options similar to terrestrial communication services. Service providers must balance investment in new technologies with maintaining profitability from existing infrastructure assets. Regulatory evolution is adapting to accommodate new satellite technologies and service models while ensuring fair competition and spectrum efficiency.

Supply chain dynamics are being influenced by global semiconductor shortages, launch service capacity constraints, and geopolitical factors affecting international technology trade. Regional manufacturing capability development is becoming increasingly important for supply chain resilience and cost competitiveness. Innovation cycles are accelerating as satellite technology development benefits from advances in related industries including semiconductors, software, and manufacturing.

Market maturation in traditional segments is driving service providers to seek growth opportunities in emerging applications and underserved market segments. The shift toward managed services and solutions-based offerings is changing revenue models and customer relationships throughout the value chain.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include structured interviews with industry executives, government officials, and end-user organizations across the Middle East region. Secondary research incorporates analysis of public company financial reports, government policy documents, industry association publications, and technical standards organizations.

Data collection processes utilize both quantitative and qualitative research approaches to capture market trends, competitive dynamics, and technology developments. Industry surveys target key stakeholders including satellite operators, service providers, equipment manufacturers, and system integrators. Market modeling incorporates historical data analysis, trend extrapolation, and scenario-based forecasting methodologies.

Validation procedures include cross-referencing multiple data sources, expert review panels, and statistical analysis to ensure data accuracy and reliability. Regional market analysis considers country-specific factors including regulatory environments, economic conditions, and infrastructure development status. Continuous monitoring processes track market developments, technology announcements, and competitive activities to maintain current market intelligence.

MarkWide Research methodologies incorporate advanced analytical techniques including market segmentation analysis, competitive positioning assessment, and technology adoption lifecycle modeling to provide comprehensive market insights for strategic decision-making.

United Arab Emirates leads regional market development with advanced satellite infrastructure and supportive regulatory frameworks. The country’s strategic location and business-friendly environment attract international satellite operators and service providers. UAE market share represents approximately 32% of regional satellite communications revenue, driven by strong demand from telecommunications, broadcasting, and government sectors.

Saudi Arabia demonstrates rapid market growth supported by Vision 2030 initiatives and substantial government investments in space technology. The Kingdom’s large geographic area and diverse economic sectors create significant demand for satellite communications services. Government spending on satellite communications infrastructure accounts for 45% of national market demand.

Israel maintains a strong position in satellite technology development and manufacturing, with advanced capabilities in military and commercial satellite systems. The country’s technology sector drives innovation in satellite communications applications and services. Turkey represents a growing market with increasing investments in national satellite programs and expanding commercial satellite services adoption.

Qatar and Kuwait show strong growth potential driven by economic diversification initiatives and smart city development projects. These markets benefit from high per-capita income levels and government support for advanced technology adoption. Regional distribution indicates that Gulf Cooperation Council countries account for approximately 68% of total market activity.

Egypt offers significant growth opportunities with its large population and expanding telecommunications infrastructure requirements. The country’s strategic location provides advantages for satellite coverage of Africa and the Mediterranean region.

Market leadership is distributed among several key players offering diverse satellite communication services and solutions across the Middle East region:

Competitive strategies focus on technology innovation, service differentiation, and strategic partnerships with regional governments and enterprises. Market participants are investing heavily in next-generation satellite technologies and expanding ground infrastructure capabilities. Strategic alliances between international operators and regional partners are becoming increasingly common to navigate local market requirements and regulatory environments.

New entrants including LEO constellation operators are introducing disruptive technologies and service models that challenge traditional satellite communication approaches. Competition is intensifying across all market segments as operators seek to maintain market share while adapting to changing customer requirements and technological capabilities.

By Technology:

By Application:

By End User:

By Service Type:

Broadcasting segment continues to represent the largest revenue contributor, though growth rates are moderating as markets mature and competition from streaming services intensifies. Traditional direct-to-home satellite television services are adapting to changing consumer preferences through hybrid service offerings and enhanced content packages. Ultra-high-definition content delivery is driving bandwidth requirements and technology upgrades across broadcasting infrastructure.

Broadband services demonstrate the strongest growth potential, particularly in underserved rural and remote areas where terrestrial alternatives are limited. High-throughput satellite technology is enabling competitive broadband services that can rival terrestrial offerings in terms of speed and reliability. Enterprise broadband adoption is accelerating as organizations seek backup connectivity and site diversity for business continuity.

Maritime communications benefit from the region’s strategic position along major shipping routes and growing port infrastructure development. Crew welfare services, vessel tracking, and cargo monitoring applications are driving service adoption across commercial shipping fleets. Fishing industry applications are expanding as regulatory requirements and operational efficiency needs increase.

Government and military applications represent a stable, high-value market segment with specific requirements for secure, resilient communications. National security considerations and sovereignty requirements drive demand for domestic satellite capabilities and secure communication solutions. Emergency response communications are becoming increasingly important as regional governments enhance disaster preparedness capabilities.

Satellite operators benefit from growing demand across multiple market segments and opportunities for service diversification. The region’s strategic location provides natural advantages for serving multiple continental markets from centralized satellite positions. Revenue diversification opportunities exist across commercial, government, and consumer segments, reducing dependence on any single market vertical.

Service providers can leverage satellite communications to extend terrestrial network coverage and provide backup connectivity solutions. Integration opportunities with 5G networks and edge computing platforms create new service possibilities and revenue streams. Managed service models enable recurring revenue generation and stronger customer relationships.

Equipment manufacturers benefit from growing demand for ground terminals, antennas, and satellite communication equipment. Technology advancement opportunities in areas such as flat-panel antennas and software-defined radios create competitive advantages. Regional manufacturing development can reduce costs and improve supply chain resilience.

End users gain access to reliable, high-performance communication services that enable digital transformation initiatives and operational efficiency improvements. Satellite communications provide connectivity independence and disaster recovery capabilities that enhance business resilience. Cost-effective solutions for remote site connectivity eliminate the need for expensive terrestrial infrastructure deployment.

Governments achieve strategic objectives including national security enhancement, economic diversification, and digital inclusion goals through satellite communications infrastructure development. Space industry development creates high-value employment opportunities and technology transfer benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined satellites are transforming the industry by enabling flexible payload reconfiguration and dynamic capacity allocation based on demand patterns. This technology allows operators to optimize satellite utilization and respond quickly to changing market requirements. Artificial intelligence integration is enhancing network management, predictive maintenance, and service optimization capabilities across satellite communication systems.

Hybrid network architectures combining satellite and terrestrial technologies are becoming standard for delivering seamless connectivity experiences. Service providers are developing integrated solutions that automatically switch between satellite and terrestrial networks based on availability and performance requirements. Edge computing deployment at satellite ground stations is reducing latency and enabling new applications requiring real-time processing.

Sustainability initiatives are driving development of more efficient satellites and ground equipment with reduced environmental impact. Satellite operators are implementing space debris mitigation measures and end-of-life disposal procedures to ensure responsible space operations. Green technology adoption includes solar-powered ground terminals and energy-efficient satellite designs.

Service convergence trends show traditional satellite operators expanding into adjacent markets including cloud services, IoT platforms, and managed network services. Customer demand for integrated solutions is driving partnerships between satellite operators and technology companies. API-driven services are enabling easier integration of satellite communications into enterprise applications and platforms.

Major satellite launches continue to expand regional coverage and capacity, with several operators deploying next-generation high-throughput satellites optimized for Middle East markets. Recent launches have significantly increased available bandwidth and improved service quality across the region. Ground infrastructure expansion includes new teleports and gateway facilities supporting growing traffic demands.

Regulatory developments across the region are streamlining satellite service licensing and encouraging foreign investment in satellite infrastructure. Several countries have updated their space laws and telecommunications regulations to accommodate new satellite technologies and service models. Spectrum allocation improvements are providing additional frequency resources for satellite operators.

Partnership announcements between international satellite operators and regional service providers are expanding market reach and local capabilities. These strategic alliances combine global satellite assets with regional market knowledge and customer relationships. Technology transfer agreements are facilitating local capability development and knowledge sharing.

Investment activities include substantial funding for regional satellite operators and service providers seeking to expand their capabilities and market presence. Venture capital and private equity investment in satellite technology startups is increasing, particularly in areas such as small satellites and ground equipment innovation. Government funding for national space programs continues to support satellite infrastructure development and technology advancement initiatives.

Strategic positioning recommendations emphasize the importance of technology differentiation and service innovation to maintain competitive advantages in an increasingly crowded market. Companies should focus on developing unique value propositions that address specific regional market needs and customer requirements. MarkWide Research analysis suggests that successful market participants will be those who can effectively combine global satellite assets with local market expertise and customer relationships.

Investment priorities should focus on next-generation satellite technologies including high-throughput satellites and low Earth orbit constellations that can deliver superior performance and cost competitiveness. Ground infrastructure modernization is equally important to support growing traffic demands and new service requirements. Partnership strategies with regional governments and enterprises can provide stable revenue streams and market access opportunities.

Market expansion opportunities exist in underserved vertical markets including agriculture, mining, and renewable energy sectors that require reliable connectivity for digital transformation initiatives. Service providers should develop specialized solutions tailored to these market segments’ unique requirements. Geographic expansion into adjacent markets in Africa and South Asia can leverage existing satellite infrastructure and operational capabilities.

Risk management strategies should address regulatory compliance, technology obsolescence, and competitive threats from terrestrial alternatives. Companies should maintain flexible business models that can adapt to changing market conditions and customer requirements. Talent development initiatives are essential for building the skilled workforce needed to support market growth and technology advancement.

Long-term growth prospects remain positive for the Middle East satellite communications market, supported by continued economic development, digital transformation initiatives, and government investments in space technology. The market is expected to maintain strong growth momentum with a projected CAGR of 9.1% over the next five years, driven by expanding broadband requirements and emerging application areas.

Technology evolution will continue to reshape the competitive landscape as low Earth orbit constellations become operational and high-throughput satellite deployments expand regional capacity. Integration with 5G networks and edge computing platforms will create new service opportunities and revenue streams. Artificial intelligence adoption will enhance network optimization and service delivery capabilities across satellite communication systems.

Market consolidation activities are likely to continue as operators seek to achieve scale economies and expand their service capabilities through mergers and acquisitions. Strategic partnerships between satellite operators and technology companies will become increasingly important for delivering integrated solutions. Regional capability development will reduce dependence on international suppliers and create local employment opportunities.

Regulatory harmonization efforts across the region may simplify cross-border service provision and encourage greater market integration. Government space programs will continue to drive demand for satellite communications services while supporting domestic capability development. Sustainability requirements will influence satellite design and operations, with increased focus on space debris mitigation and environmental responsibility.

MWR projections indicate that broadband services will represent the fastest-growing segment, with enterprise adoption rates increasing by 18% annually as organizations prioritize connectivity resilience and digital transformation capabilities.

The Middle East satellite communications market presents compelling growth opportunities driven by strong government support, strategic geographic advantages, and increasing demand across multiple industry sectors. Regional economic diversification initiatives and digital transformation programs are creating substantial demand for reliable, high-performance communication services that satellite technology is uniquely positioned to provide.

Market dynamics favor organizations that can effectively combine advanced satellite technology with deep regional market knowledge and strong customer relationships. The competitive landscape is evolving rapidly as new technologies and service models challenge traditional approaches, creating both opportunities and risks for market participants. Success factors include technology innovation, service differentiation, strategic partnerships, and operational excellence.

Future market development will be shaped by continued technology advancement, regulatory evolution, and changing customer requirements across commercial, government, and consumer segments. Organizations that can adapt to these changing conditions while maintaining focus on customer value creation will be best positioned to capitalize on the market’s substantial growth potential and contribute to the region’s continued digital transformation and economic development.

What is Satellite Communications?

Satellite communications refer to the use of satellite technology to transmit data, voice, and video across long distances. This technology is crucial for various applications, including broadcasting, internet services, and military communications.

What are the key players in the Middle East Satellite Communications Market?

Key players in the Middle East Satellite Communications Market include Arabsat, Yahsat, and Eutelsat, which provide a range of satellite services for telecommunications, broadcasting, and data transmission, among others.

What are the growth factors driving the Middle East Satellite Communications Market?

The growth of the Middle East Satellite Communications Market is driven by increasing demand for broadband connectivity, the expansion of mobile networks, and the rising need for secure communication in defense and government sectors.

What challenges does the Middle East Satellite Communications Market face?

Challenges in the Middle East Satellite Communications Market include regulatory hurdles, high operational costs, and competition from terrestrial communication technologies, which can limit market growth.

What opportunities exist in the Middle East Satellite Communications Market?

Opportunities in the Middle East Satellite Communications Market include advancements in satellite technology, the potential for new applications in IoT and smart cities, and increasing investments in infrastructure development.

What trends are shaping the Middle East Satellite Communications Market?

Trends in the Middle East Satellite Communications Market include the rise of high-throughput satellites, the integration of satellite and terrestrial networks, and a growing focus on providing services to remote and underserved areas.

Middle East Satellite Communications Market

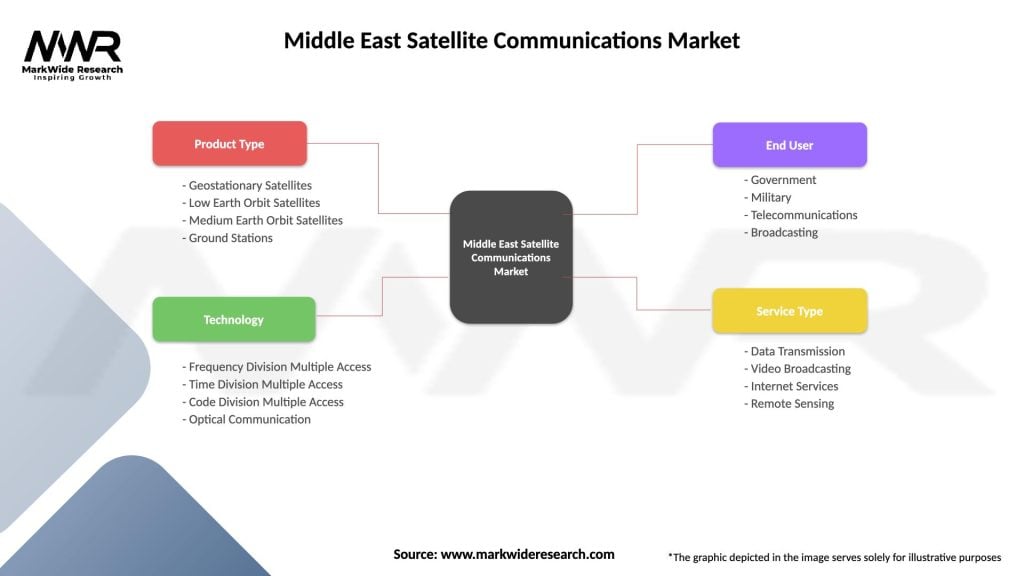

| Segmentation Details | Description |

|---|---|

| Product Type | Geostationary Satellites, Low Earth Orbit Satellites, Medium Earth Orbit Satellites, Ground Stations |

| Technology | Frequency Division Multiple Access, Time Division Multiple Access, Code Division Multiple Access, Optical Communication |

| End User | Government, Military, Telecommunications, Broadcasting |

| Service Type | Data Transmission, Video Broadcasting, Internet Services, Remote Sensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Satellite Communications Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at