444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East ready to drink tea market represents a rapidly expanding segment within the region’s beverage industry, driven by evolving consumer preferences and increasing demand for convenient, healthy beverage options. This dynamic market encompasses a diverse range of products including iced teas, flavored tea beverages, herbal infusions, and premium bottled tea varieties that cater to the region’s sophisticated palate and cultural appreciation for tea consumption.

Market dynamics indicate substantial growth potential across key Middle Eastern countries including the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman. The sector is experiencing robust expansion at a compound annual growth rate (CAGR) of 8.2%, reflecting strong consumer adoption and increasing retail penetration throughout the region.

Consumer behavior patterns reveal a significant shift toward premium, health-conscious beverage choices, with ready-to-drink tea products gaining 65% market acceptance among urban populations. The market benefits from the region’s strategic position as a global trade hub, facilitating efficient distribution networks and enabling access to diverse international tea varieties and brewing technologies.

Regional preferences demonstrate strong demand for traditional flavors including mint, cardamom, and rose-infused varieties, alongside growing interest in green tea, white tea, and functional tea blends. The market’s evolution reflects broader lifestyle changes, urbanization trends, and increasing disposable income levels across Middle Eastern economies.

The Middle East ready to drink tea market refers to the commercial sector encompassing pre-prepared, packaged tea beverages that are manufactured, distributed, and consumed without requiring additional brewing or preparation by end consumers. This market segment includes various product categories ranging from traditional iced teas and sweetened tea beverages to premium artisanal blends and functional tea products designed for immediate consumption.

Product classifications within this market include bottled tea beverages, canned tea products, tetra pack tea drinks, and specialty tea concentrates that offer convenience and consistent quality. The market serves diverse consumer segments including busy professionals, health-conscious individuals, young demographics, and traditional tea enthusiasts seeking modern consumption formats.

Market scope encompasses both domestic production facilities and international imports, with products distributed through multiple channels including supermarkets, convenience stores, restaurants, cafes, and online platforms. The sector represents a modern adaptation of the region’s deep-rooted tea culture, combining traditional flavors with contemporary packaging and marketing approaches.

Strategic market analysis reveals the Middle East ready to drink tea market as a high-growth sector characterized by increasing consumer sophistication, premium product demand, and expanding distribution networks. The market demonstrates strong fundamentals driven by demographic trends, lifestyle changes, and growing health consciousness among regional consumers.

Key performance indicators highlight impressive market penetration rates, with ready-to-drink tea products achieving 42% category growth in major urban centers. The sector benefits from favorable regulatory environments, supportive government policies promoting food and beverage industry development, and substantial foreign investment in manufacturing capabilities.

Competitive landscape features a mix of international beverage giants, regional manufacturers, and emerging local brands competing across price points and product categories. Market leaders are investing heavily in product innovation, sustainable packaging solutions, and localized flavor profiles to capture market share and build brand loyalty.

Future projections indicate continued expansion driven by population growth, increasing urbanization, and rising consumer spending on premium beverage products. The market is expected to benefit from technological advancements in production processes, cold chain logistics improvements, and enhanced retail infrastructure development across the region.

Consumer preference analysis reveals several critical insights shaping market development and strategic positioning within the Middle East ready to drink tea sector:

Demographic transformation serves as a primary catalyst for market expansion, with young, educated populations embracing convenient beverage options that align with busy lifestyles and professional demands. The region’s growing expatriate communities contribute to diverse taste preferences and increased demand for international tea varieties.

Urbanization trends significantly impact consumption patterns, as city dwellers seek convenient, portable beverage solutions that fit modern living requirements. Urban consumers demonstrate higher willingness to experiment with new flavors and premium products, driving innovation and market segmentation strategies.

Health consciousness represents a major market driver, with consumers increasingly seeking beverages that offer functional benefits beyond basic refreshment. Ready-to-drink tea products positioned as healthy alternatives to carbonated soft drinks and artificial beverages gain significant market traction.

Economic prosperity across Gulf Cooperation Council countries enables increased consumer spending on premium beverage products, supporting market premiumization trends and brand differentiation strategies. Rising disposable incomes facilitate trial of new products and brand switching behaviors.

Retail infrastructure development enhances product accessibility through expanded supermarket networks, convenience store chains, and modern trade channels. Improved cold chain logistics ensure product quality maintenance and enable broader geographic distribution coverage.

Tourism industry growth creates additional demand channels through hotels, restaurants, and hospitality venues serving international visitors familiar with ready-to-drink tea consumption patterns. Tourist preferences influence local market development and product variety expansion.

Cultural traditionalism presents challenges for market penetration, as some consumer segments maintain strong preferences for freshly brewed tea prepared using traditional methods. Overcoming cultural resistance requires careful product positioning and respectful marketing approaches that honor local tea traditions.

Price sensitivity among certain demographic segments limits market expansion, particularly for premium product categories. Economic fluctuations and currency volatility can impact consumer purchasing power and willingness to pay premium prices for convenience beverages.

Supply chain complexities create operational challenges including ingredient sourcing, quality control, and distribution logistics across diverse geographic markets. Maintaining consistent product quality and availability requires substantial investment in infrastructure and supply chain management capabilities.

Regulatory compliance requirements vary across different Middle Eastern countries, creating complexity for manufacturers seeking regional market expansion. Food safety standards, labeling requirements, and import regulations require careful navigation and ongoing compliance monitoring.

Seasonal demand fluctuations impact sales consistency, with consumption patterns influenced by climate conditions and cultural practices. Managing inventory levels and production planning requires sophisticated demand forecasting and flexible manufacturing capabilities.

Competition intensity from established beverage categories including carbonated soft drinks, fruit juices, and energy drinks creates market share challenges. Differentiating ready-to-drink tea products requires significant marketing investment and clear value proposition communication.

Product innovation presents substantial opportunities for market expansion through development of unique flavor profiles, functional ingredients, and premium product positioning. Incorporating traditional Middle Eastern spices and herbs into modern tea formulations can create distinctive competitive advantages.

E-commerce growth enables direct consumer engagement and personalized marketing approaches that build brand loyalty and facilitate market penetration. Online platforms provide opportunities for subscription services, bulk purchasing, and targeted promotional campaigns.

Health and wellness trends create opportunities for functional tea beverages containing probiotics, adaptogens, and natural energy boosters. Products positioned as healthy lifestyle choices can command premium pricing and attract health-conscious consumer segments.

Sustainability initiatives offer differentiation opportunities through eco-friendly packaging, ethical sourcing practices, and environmental responsibility messaging. Consumers increasingly value brands demonstrating commitment to sustainability and social responsibility.

Partnership opportunities with local distributors, retail chains, and hospitality providers can accelerate market penetration and brand awareness development. Strategic alliances enable efficient market entry and reduced operational complexity.

Export potential to neighboring regions and international markets provides growth opportunities beyond domestic Middle Eastern markets. The region’s strategic location facilitates access to African, Asian, and European markets seeking authentic tea products.

Supply-demand equilibrium within the Middle East ready to drink tea market reflects complex interactions between consumer preferences, production capabilities, and distribution networks. Market dynamics demonstrate increasing demand outpacing supply capacity in certain premium segments, creating opportunities for new market entrants and capacity expansion.

Competitive pressures drive continuous innovation in product formulations, packaging design, and marketing strategies. Companies compete on multiple dimensions including taste authenticity, health benefits, convenience factors, and brand prestige to capture consumer attention and loyalty.

Technology integration influences market dynamics through improved production processes, quality control systems, and consumer engagement platforms. Digital marketing, social media presence, and mobile commerce capabilities become increasingly important for market success.

Regulatory evolution shapes market dynamics through changing food safety standards, labeling requirements, and import/export regulations. Companies must adapt to regulatory changes while maintaining operational efficiency and product quality standards.

Economic factors including oil prices, currency exchange rates, and regional economic stability impact consumer purchasing power and market growth trajectories. Market participants must navigate economic volatility while maintaining competitive positioning and profitability.

Cultural integration dynamics influence product acceptance and market penetration rates. Successful brands demonstrate cultural sensitivity while introducing modern convenience and quality standards that enhance traditional tea consumption experiences.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable insights into Middle East ready to drink tea market dynamics. Primary research includes consumer surveys, industry interviews, and retail audits conducted across major regional markets to capture authentic consumer perspectives and market trends.

Secondary research incorporates industry reports, trade publications, government statistics, and company financial data to provide comprehensive market context and competitive landscape analysis. Data triangulation ensures research accuracy and validates findings across multiple information sources.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth patterns and identify emerging opportunities. Market sizing methodologies consider production data, import/export statistics, and consumption patterns to develop accurate market assessments.

Qualitative research includes focus groups, expert interviews, and ethnographic studies to understand cultural factors, consumer motivations, and brand perception dynamics. This approach provides deeper insights into market drivers and consumer decision-making processes.

Geographic coverage encompasses major Middle Eastern markets including UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman, with detailed analysis of regional variations and market-specific dynamics. Research methodology accounts for cultural, economic, and regulatory differences across markets.

Data validation processes ensure research quality through cross-verification, expert review, and statistical significance testing. Methodology transparency enables stakeholders to understand research limitations and confidence levels associated with market projections and insights.

United Arab Emirates leads regional market development with sophisticated consumer preferences and advanced retail infrastructure supporting premium ready-to-drink tea adoption. The market demonstrates 35% regional market share driven by Dubai and Abu Dhabi’s cosmopolitan populations and strong tourism industry.

Saudi Arabia represents the largest potential market by population, with growing urbanization and lifestyle changes driving increased demand for convenient beverage options. Government Vision 2030 initiatives supporting food and beverage industry development create favorable market conditions for expansion.

Qatar showcases high per-capita consumption rates and premium product preferences, supported by strong economic fundamentals and sophisticated consumer base. The market benefits from ongoing infrastructure development and preparation for major international events.

Kuwait demonstrates steady market growth with increasing health consciousness and premium brand adoption among affluent consumer segments. The market shows particular strength in traditional flavor varieties adapted to modern consumption formats.

Bahrain serves as a strategic market entry point for regional expansion, offering favorable business environment and diverse consumer base. The market demonstrates strong growth potential despite smaller population size compared to neighboring countries.

Oman presents emerging opportunities with growing urbanization and increasing exposure to international beverage trends. Traditional tea culture provides foundation for ready-to-drink product acceptance when positioned appropriately.

Regional trade dynamics facilitate cross-border distribution and enable economies of scale for manufacturers serving multiple markets. Free trade agreements and customs unions support efficient regional supply chain development and market integration strategies.

Market leadership within the Middle East ready to drink tea sector features diverse competitive dynamics with international beverage companies, regional manufacturers, and emerging local brands competing across multiple market segments and price points.

Competitive strategies focus on product differentiation, brand building, distribution expansion, and strategic partnerships to capture market share and build consumer loyalty. Companies invest heavily in marketing campaigns, product innovation, and retail relationship development.

Market positioning varies across competitors, with some emphasizing premium quality and authenticity while others focus on convenience, health benefits, or value pricing. Successful brands demonstrate clear understanding of target consumer segments and cultural preferences.

Product type segmentation reveals diverse market categories serving different consumer needs and preferences within the Middle East ready to drink tea market:

By Product Type:

By Packaging Format:

By Distribution Channel:

Premium tea segment demonstrates strongest growth potential with consumers willing to pay higher prices for authentic, high-quality products that deliver superior taste experiences. This category benefits from increasing disposable income and growing appreciation for artisanal beverage products.

Health-focused categories including green tea, herbal infusions, and functional tea blends show robust demand growth driven by wellness trends and preventive health consciousness. Products positioned as natural, organic, and beneficial gain significant consumer traction.

Traditional flavor profiles incorporating Middle Eastern spices, herbs, and cultural preferences demonstrate strong market acceptance when presented in modern, convenient formats. Successful products balance authenticity with contemporary packaging and marketing approaches.

Convenience-oriented products targeting busy professionals and on-the-go consumption show consistent demand growth. Single-serve packaging, portable formats, and grab-and-go positioning appeal to urban consumer lifestyles and work patterns.

Seasonal variations influence category performance, with cooling tea varieties performing better during hot weather periods and warming spiced teas gaining popularity during cooler months. Product portfolio management requires seasonal planning and inventory optimization.

Youth-targeted categories featuring innovative flavors, trendy packaging, and social media marketing demonstrate strong engagement rates and brand loyalty development potential. These segments drive market innovation and future growth opportunities.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and growing consumer acceptance of ready-to-drink tea products. The market offers opportunities for product innovation, brand differentiation, and sustainable competitive advantages through quality and authenticity positioning.

Retailers gain access to high-margin beverage categories with strong consumer demand and repeat purchase patterns. Ready-to-drink tea products enhance store profitability, attract health-conscious consumers, and complement existing beverage portfolios effectively.

Distributors benefit from growing market demand, expanding product portfolios, and opportunities for regional market development. The sector offers stable revenue streams and partnership opportunities with both international brands and local manufacturers.

Consumers enjoy convenient access to high-quality tea products that combine traditional flavors with modern convenience. Benefits include consistent taste quality, portable consumption formats, and diverse flavor options that cater to individual preferences and lifestyle needs.

Investors find attractive opportunities in a growing market with strong fundamentals, increasing consumer demand, and potential for significant returns. The sector offers diversification benefits and exposure to regional economic growth and demographic trends.

Government stakeholders benefit from increased tax revenues, job creation, and food and beverage industry development that supports economic diversification objectives. The market contributes to import substitution goals and export potential development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trend drives consumer preference toward high-quality, authentic tea products with superior ingredients and sophisticated packaging. This trend supports higher profit margins and brand differentiation strategies while reflecting increasing consumer sophistication and willingness to pay for quality.

Health and wellness focus influences product development toward functional beverages containing antioxidants, natural ingredients, and wellness-supporting compounds. Consumers increasingly seek beverages that provide health benefits beyond basic refreshment and hydration.

Sustainability consciousness shapes packaging decisions and brand positioning, with consumers favoring environmentally responsible products and companies. Eco-friendly packaging, ethical sourcing, and corporate social responsibility become important competitive differentiators.

Flavor innovation drives product development toward unique taste combinations that blend traditional Middle Eastern flavors with international tea varieties. Successful innovations respect cultural preferences while introducing novel taste experiences that appeal to adventurous consumers.

Digital engagement transforms marketing and consumer interaction through social media campaigns, influencer partnerships, and online community building. Brands leverage digital platforms to build awareness, engage consumers, and create brand loyalty among younger demographics.

Convenience optimization influences packaging design, portion sizing, and distribution strategies to meet modern lifestyle demands. Products designed for on-the-go consumption, workplace environments, and busy schedules gain competitive advantages in urban markets.

Manufacturing investments across the region include new production facilities, capacity expansions, and technology upgrades that enhance product quality and operational efficiency. Major beverage companies establish local manufacturing capabilities to serve regional markets more effectively.

Strategic partnerships between international brands and local distributors facilitate market entry and expansion while leveraging regional expertise and distribution networks. These collaborations combine global product development capabilities with local market knowledge and cultural understanding.

Product launches introduce innovative flavor profiles, premium product lines, and health-focused formulations that address evolving consumer preferences. Companies invest heavily in research and development to create differentiated products that capture market attention and drive sales growth.

Retail expansion includes new distribution channels, enhanced shelf presence, and strategic placement in high-traffic locations. Modern trade development and convenience store proliferation create additional touchpoints for consumer engagement and product trial.

Technology adoption improves production processes, quality control systems, and supply chain management capabilities. Advanced manufacturing technologies enable consistent product quality, cost optimization, and rapid response to market demand fluctuations.

Regulatory developments include updated food safety standards, labeling requirements, and quality certifications that enhance consumer confidence and market credibility. Industry participants adapt to regulatory changes while maintaining competitive positioning and operational efficiency.

Market entry strategies should prioritize cultural sensitivity, local partnership development, and gradual market penetration rather than aggressive expansion approaches. According to MarkWide Research analysis, successful market entry requires deep understanding of regional preferences and respectful integration of traditional tea culture with modern convenience.

Product development recommendations emphasize authentic flavor profiles, premium quality positioning, and health-focused formulations that align with regional wellness trends. Companies should invest in local taste testing, cultural consultation, and iterative product refinement to achieve market acceptance.

Distribution strategy optimization should focus on multi-channel approaches that combine traditional retail, modern trade, and digital commerce platforms. Building strong relationships with local distributors and retailers proves essential for market penetration and sustainable growth.

Brand positioning should balance international credibility with local relevance, emphasizing quality, authenticity, and cultural respect. Marketing messages must resonate with regional values while communicating clear product benefits and differentiation factors.

Investment priorities should include supply chain development, quality control systems, and consumer education initiatives that build market awareness and product trial. Long-term success requires patient capital deployment and commitment to market development rather than quick returns.

Risk management strategies should address cultural sensitivity, regulatory compliance, and economic volatility through diversified approaches and flexible operational capabilities. Companies must prepare for market fluctuations while maintaining strategic focus and competitive positioning.

Growth projections indicate continued market expansion driven by demographic trends, lifestyle changes, and increasing consumer acceptance of ready-to-drink tea products. MWR forecasts suggest sustained growth momentum with particular strength in premium segments and health-focused categories.

Market evolution will likely feature increased product sophistication, enhanced distribution networks, and stronger brand differentiation as the market matures. Consumer preferences will continue shifting toward premium, authentic products that deliver superior taste experiences and functional benefits.

Technology integration will enhance production capabilities, supply chain efficiency, and consumer engagement through digital platforms and data analytics. Smart manufacturing, predictive analytics, and personalized marketing will become increasingly important competitive advantages.

Sustainability initiatives will gain prominence as environmental consciousness grows among consumers and regulatory requirements evolve. Companies investing in sustainable practices and eco-friendly packaging will gain competitive advantages and consumer preference.

Regional integration will facilitate cross-border trade, standardized regulations, and economies of scale that benefit market participants. Enhanced cooperation between Middle Eastern countries will create larger addressable markets and improved operational efficiency.

Innovation acceleration will drive continuous product development, flavor innovation, and functional enhancement that keeps pace with evolving consumer preferences. Companies maintaining strong research and development capabilities will capture disproportionate market share and growth opportunities.

The Middle East ready to drink tea market represents a compelling growth opportunity characterized by strong fundamentals, evolving consumer preferences, and favorable market dynamics. The sector benefits from the region’s deep cultural appreciation for tea consumption, growing economic prosperity, and increasing demand for convenient, high-quality beverage options that align with modern lifestyles.

Market success requires careful attention to cultural sensitivity, product authenticity, and quality excellence while embracing innovation and modern convenience factors. Companies that effectively balance traditional tea culture with contemporary consumer needs will capture significant market share and build sustainable competitive advantages in this expanding sector.

Strategic positioning should emphasize premium quality, health benefits, and cultural relevance while leveraging advanced distribution networks and digital engagement platforms. The market rewards patient, thoughtful approaches that prioritize long-term relationship building over short-term gains, creating opportunities for sustained growth and profitability in this dynamic and promising market segment.

What is Ready to Drink Tea?

Ready to Drink Tea refers to pre-packaged tea beverages that are ready for consumption without the need for brewing. These products are available in various flavors and formulations, catering to diverse consumer preferences in the beverage market.

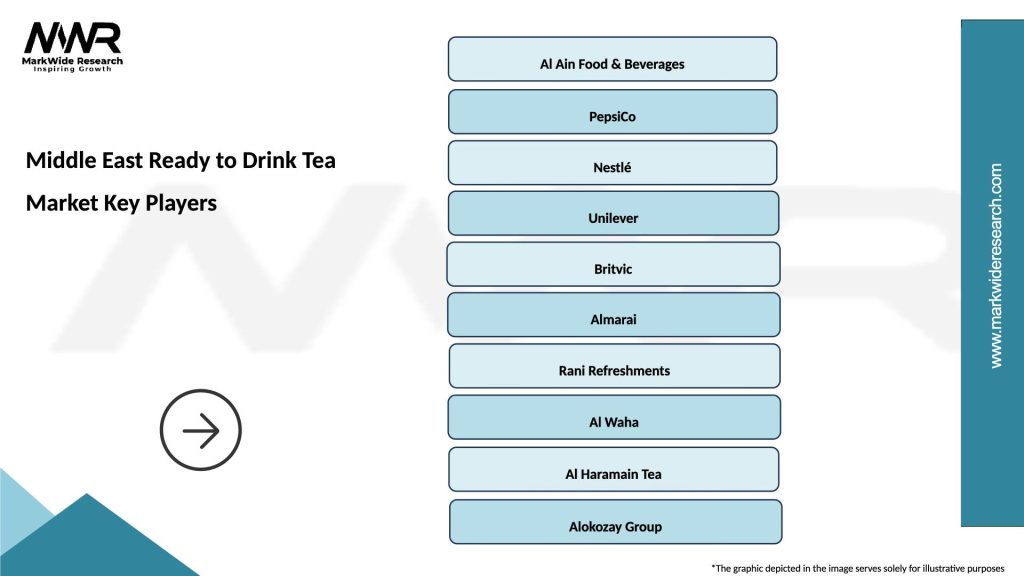

What are the key players in the Middle East Ready to Drink Tea Market?

Key players in the Middle East Ready to Drink Tea Market include companies like PepsiCo, Nestlé, and Unilever, which offer a range of ready-to-drink tea products. These companies compete on flavor variety, packaging, and distribution channels, among others.

What are the growth factors driving the Middle East Ready to Drink Tea Market?

The Middle East Ready to Drink Tea Market is driven by increasing health consciousness among consumers, a growing preference for convenient beverage options, and the rising popularity of tea as a refreshing drink. Additionally, innovative flavors and packaging are attracting more consumers.

What challenges does the Middle East Ready to Drink Tea Market face?

Challenges in the Middle East Ready to Drink Tea Market include intense competition among brands, fluctuating raw material prices, and changing consumer preferences. These factors can impact profitability and market share for companies operating in this space.

What opportunities exist in the Middle East Ready to Drink Tea Market?

Opportunities in the Middle East Ready to Drink Tea Market include expanding product lines to include organic and functional teas, tapping into the growing e-commerce sector, and targeting younger demographics who are increasingly seeking convenient beverage options.

What trends are shaping the Middle East Ready to Drink Tea Market?

Trends in the Middle East Ready to Drink Tea Market include the rise of premium and artisanal tea products, the incorporation of health-focused ingredients, and the use of sustainable packaging solutions. These trends reflect changing consumer preferences towards quality and environmental responsibility.

Middle East Ready to Drink Tea Market

| Segmentation Details | Description |

|---|---|

| Product Type | Black Tea, Green Tea, Herbal Tea, Fruit Tea |

| Packaging Type | Bottles, Cans, Tetra Packs, Pouches |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Stores |

| End User | Individuals, Restaurants, Cafés, Hotels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Ready to Drink Tea Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at