444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East power sector gas turbine MRO market represents a critical component of the region’s energy infrastructure, encompassing comprehensive maintenance, repair, and overhaul services for gas turbine systems across power generation facilities. This specialized market has experienced substantial growth driven by the region’s expanding power generation capacity, increasing energy demand, and the need for reliable turbine performance in challenging operational environments.

Market dynamics in the Middle East reflect the region’s unique position as a major energy producer and consumer, with gas turbines playing a pivotal role in electricity generation across countries including Saudi Arabia, UAE, Qatar, Kuwait, and other Gulf Cooperation Council nations. The market demonstrates robust expansion with projected growth rates of 6.2% CAGR through the forecast period, supported by ongoing infrastructure development and modernization initiatives.

Regional characteristics significantly influence MRO requirements, with extreme temperatures, sand ingestion, and high-capacity utilization creating demanding operational conditions that necessitate specialized maintenance approaches. The market encompasses various service categories including scheduled maintenance, emergency repairs, component replacement, and comprehensive overhaul programs designed to optimize turbine performance and extend operational lifecycles.

Technology advancement continues to reshape MRO practices, with digital monitoring systems, predictive maintenance technologies, and advanced diagnostic tools becoming integral to service delivery. These innovations enable more efficient maintenance scheduling, reduced downtime, and improved overall equipment effectiveness across the region’s diverse power generation portfolio.

The Middle East power sector gas turbine MRO market refers to the comprehensive ecosystem of maintenance, repair, and overhaul services specifically designed for gas turbine systems operating within power generation facilities across Middle Eastern countries. This market encompasses all activities required to maintain optimal turbine performance, reliability, and operational efficiency throughout the equipment lifecycle.

MRO services include preventive maintenance programs, corrective repairs, component refurbishment, complete overhaul procedures, and performance optimization initiatives. These services are essential for ensuring continuous power generation capacity while minimizing unplanned outages and maximizing return on investment for power plant operators.

Market scope extends beyond basic maintenance to include advanced services such as condition monitoring, vibration analysis, thermal imaging, borescope inspections, and comprehensive performance assessments. Service providers utilize sophisticated diagnostic equipment and specialized expertise to identify potential issues before they result in costly failures or extended downtime periods.

Strategic importance of this market stems from the critical role gas turbines play in the Middle East’s power generation infrastructure, where reliable electricity supply is essential for economic development, industrial operations, and quality of life. Effective MRO programs ensure sustained power generation capacity while optimizing operational costs and environmental performance.

Market positioning of the Middle East power sector gas turbine MRO market reflects strong fundamentals driven by substantial installed capacity, increasing power demand, and the need for reliable maintenance services in challenging operational environments. The market demonstrates consistent growth trajectory supported by ongoing infrastructure investments and modernization programs across the region.

Key growth drivers include expanding power generation capacity, aging turbine fleets requiring increased maintenance attention, and growing adoption of advanced MRO technologies. The market benefits from 78% of regional power generation relying on gas-fired systems, creating substantial demand for specialized maintenance services.

Service evolution continues toward predictive maintenance approaches, with digital technologies enabling more efficient service delivery and improved equipment reliability. Original equipment manufacturers and independent service providers are investing heavily in advanced diagnostic capabilities and regional service infrastructure to meet growing market demands.

Competitive landscape features established international service providers alongside emerging regional specialists, creating a dynamic market environment focused on service quality, response times, and cost-effectiveness. The market demonstrates strong potential for continued expansion as power generation capacity increases and maintenance requirements become more sophisticated.

Market fundamentals reveal several critical insights that shape the Middle East power sector gas turbine MRO landscape:

Strategic implications of these insights indicate a market transitioning toward more sophisticated, technology-enabled service delivery models that emphasize predictive maintenance, performance optimization, and operational excellence. Service providers must adapt to evolving customer expectations while maintaining cost competitiveness in an increasingly demanding market environment.

Primary growth drivers propelling the Middle East power sector gas turbine MRO market include expanding electricity demand, infrastructure modernization initiatives, and the critical need for reliable power generation capacity across the region. These fundamental drivers create sustained demand for comprehensive maintenance services.

Capacity expansion programs across Gulf countries represent a major market driver, with substantial investments in new power generation facilities requiring comprehensive MRO support from commissioning through operational lifecycle. The region’s commitment to meeting growing electricity demand through gas-fired generation creates substantial opportunities for service providers.

Aging infrastructure presents significant opportunities as existing turbine fleets require increased maintenance attention to maintain performance standards and extend operational lifecycles. Many facilities installed during previous decades now require major overhauls and component replacements, driving demand for specialized MRO services.

Operational efficiency requirements continue to intensify as power plant operators seek to optimize performance, reduce operational costs, and meet increasingly stringent environmental regulations. Advanced MRO practices enable improved heat rates, reduced emissions, and enhanced overall equipment effectiveness.

Technology advancement in monitoring and diagnostic systems creates opportunities for more sophisticated maintenance approaches that reduce costs while improving reliability. Digital transformation initiatives across the power sector drive adoption of predictive maintenance technologies and data-driven service delivery models.

Significant challenges facing the Middle East power sector gas turbine MRO market include skilled workforce shortages, supply chain complexities, and the high costs associated with specialized maintenance services. These restraints require strategic approaches to ensure continued market development.

Technical expertise limitations represent a primary constraint, as gas turbine MRO requires highly specialized skills and certifications that are in limited supply across the region. The complexity of modern turbine systems demands extensive training and experience, creating workforce development challenges for service providers.

Supply chain dependencies create vulnerabilities in service delivery, particularly for specialized components and materials that must be sourced from international suppliers. Extended lead times, logistics complexities, and inventory management challenges can impact maintenance scheduling and project execution.

Cost pressures from power plant operators seeking to optimize operational expenses create challenges for MRO service providers who must balance service quality with competitive pricing. The need for specialized equipment, skilled personnel, and comprehensive insurance coverage contributes to high service costs.

Regulatory complexities across different Middle Eastern countries create challenges for service providers operating regionally, requiring compliance with varying safety standards, certification requirements, and operational procedures. These regulatory differences can complicate service delivery and increase operational complexity.

Substantial opportunities exist within the Middle East power sector gas turbine MRO market, driven by infrastructure expansion, technology advancement, and evolving customer requirements. These opportunities enable service providers to develop innovative solutions and expand market presence.

Digital transformation initiatives create significant opportunities for service providers to develop advanced monitoring, diagnostic, and maintenance management systems. The integration of artificial intelligence, machine learning, and IoT technologies enables more efficient service delivery and improved customer value propositions.

Regional service expansion opportunities exist as power plant operators seek to reduce dependence on international service providers and develop local capabilities. Establishing regional service centers, training facilities, and parts distribution networks can provide competitive advantages and improved customer service.

Performance optimization services represent growing opportunities as operators seek to maximize efficiency and reduce environmental impact. Advanced MRO practices that focus on performance enhancement, emissions reduction, and fuel efficiency optimization create premium service opportunities.

Fleet modernization programs across the region create opportunities for comprehensive upgrade and refurbishment services. Aging turbine fleets require significant investment in component replacement, technology upgrades, and performance enhancements to meet current operational standards.

Renewable energy integration creates new opportunities for flexible operation MRO services as gas turbines increasingly operate in load-following and peaking modes to complement renewable generation. This operational profile requires specialized maintenance approaches and creates new service categories.

Complex market dynamics characterize the Middle East power sector gas turbine MRO market, with multiple factors influencing service demand, pricing structures, and competitive positioning. Understanding these dynamics is essential for successful market participation and strategic planning.

Demand patterns reflect the region’s power generation requirements, with peak maintenance activities typically scheduled during lower demand periods to minimize impact on electricity supply. Seasonal variations in power demand influence maintenance scheduling and resource allocation across service providers.

Competitive dynamics feature established original equipment manufacturers competing with independent service providers and regional specialists. Market share distribution shows 45% concentration among major international providers, with growing participation from regional companies offering specialized services and competitive pricing.

Technology evolution continues to reshape market dynamics, with advanced diagnostic systems enabling more precise maintenance planning and improved service efficiency. Digital technologies create opportunities for new service models while potentially disrupting traditional maintenance approaches.

Customer relationships play a crucial role in market dynamics, with long-term service agreements becoming increasingly common. Power plant operators seek reliable service partnerships that provide predictable costs, guaranteed performance levels, and comprehensive support throughout equipment lifecycles.

Regulatory influences impact market dynamics through safety requirements, environmental standards, and operational guidelines that affect service delivery approaches. Compliance requirements create barriers to entry while ensuring service quality and safety standards across the market.

Comprehensive research methodology employed for analyzing the Middle East power sector gas turbine MRO market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry stakeholders, including power plant operators, MRO service providers, equipment manufacturers, and regulatory officials across key Middle Eastern markets. These interviews provide firsthand insights into market conditions, challenges, and opportunities.

Secondary research components encompass analysis of industry reports, government publications, company financial statements, and technical documentation to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and trends.

Data collection methods utilize structured questionnaires, expert interviews, and industry surveys to gather quantitative and qualitative information about market size, growth rates, competitive positioning, and future prospects. Multiple validation steps ensure data accuracy and consistency.

Analytical frameworks include market sizing models, competitive analysis matrices, and trend projection methodologies that provide robust foundations for market assessment and forecasting. These frameworks incorporate regional variations and sector-specific factors that influence market development.

Quality assurance processes involve cross-validation of data sources, expert review panels, and statistical verification to ensure research reliability and accuracy. Regular updates and revisions maintain currency and relevance of market intelligence throughout the research period.

Regional market distribution across the Middle East reveals significant variations in MRO demand, service capabilities, and market maturity levels. Saudi Arabia represents the largest market segment with 35% regional market share, driven by substantial power generation capacity and ongoing infrastructure expansion programs.

Saudi Arabia demonstrates the most mature MRO market, with established service infrastructure, skilled workforce development programs, and comprehensive regulatory frameworks. The kingdom’s Vision 2030 initiatives drive continued investment in power sector modernization and efficiency improvements, creating substantial MRO opportunities.

United Arab Emirates maintains 22% market share with sophisticated service capabilities and strong international service provider presence. The UAE’s focus on operational excellence and technology adoption creates demand for advanced MRO services and innovative maintenance solutions.

Qatar represents a rapidly growing market segment with 15% regional share, driven by infrastructure development and increasing power generation capacity. The country’s emphasis on reliability and efficiency creates opportunities for premium MRO services and long-term service partnerships.

Kuwait and other Gulf states collectively account for the remaining market share, with varying levels of market development and service capabilities. These markets demonstrate strong growth potential as power generation capacity expands and maintenance requirements become more sophisticated.

Market maturity levels vary significantly across the region, with established markets demonstrating advanced service capabilities while emerging markets present opportunities for service infrastructure development and workforce training initiatives.

Competitive environment within the Middle East power sector gas turbine MRO market features a diverse mix of international service providers, regional specialists, and emerging local companies competing across various service categories and market segments.

Market leaders include established players with comprehensive service capabilities:

Regional service providers are gaining market share through competitive pricing, local expertise, and specialized service offerings. These companies often focus on specific market segments or geographic regions, providing tailored solutions that meet local requirements.

Competitive strategies emphasize service quality, response times, cost-effectiveness, and long-term partnership development. Leading providers invest heavily in regional service infrastructure, workforce development, and technology advancement to maintain competitive advantages.

Market consolidation trends indicate increasing collaboration between international providers and regional companies, creating strategic partnerships that combine global expertise with local market knowledge and service capabilities.

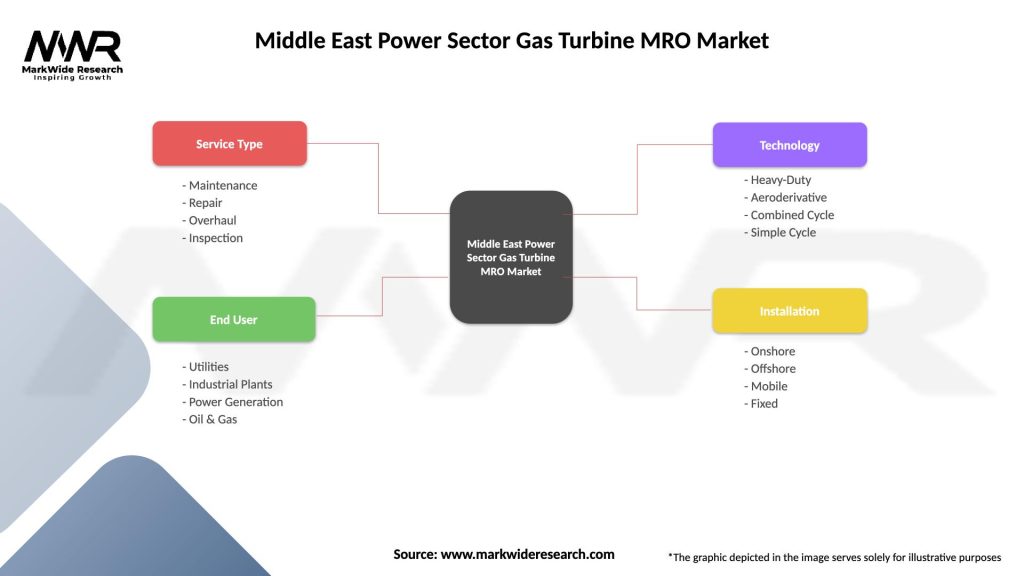

Market segmentation of the Middle East power sector gas turbine MRO market reveals distinct categories based on service type, turbine class, application, and customer segments, each presenting unique characteristics and growth opportunities.

By Service Type:

By Turbine Class:

By Application:

Customer segmentation includes utility companies, independent power producers, industrial facilities, and government entities, each with distinct service requirements and procurement approaches.

Service category analysis reveals distinct patterns in demand, pricing, and service delivery approaches across different MRO segments within the Middle East power sector gas turbine market.

Preventive Maintenance Services represent the largest market segment, accounting for 42% of total MRO activities. This category includes routine inspections, scheduled component replacements, and performance monitoring activities that prevent unexpected failures and optimize turbine performance.

Major Overhaul Services constitute a significant market segment with high-value, complex projects that require specialized expertise and extended service periods. These services typically occur at predetermined intervals and involve comprehensive turbine refurbishment and component replacement.

Emergency Repair Services represent a critical market category with premium pricing structures due to urgent response requirements and potential impact on power generation capacity. Service providers maintain specialized response capabilities and parts inventory to address emergency situations.

Performance Optimization Services demonstrate growing market importance as operators seek to maximize efficiency and reduce environmental impact. These services focus on fine-tuning turbine performance, reducing fuel consumption, and minimizing emissions through advanced diagnostic and adjustment procedures.

Digital Services represent an emerging category with substantial growth potential, including remote monitoring, predictive analytics, and condition-based maintenance programs that leverage advanced technologies to improve service efficiency and equipment reliability.

Substantial benefits accrue to various stakeholders participating in the Middle East power sector gas turbine MRO market, creating value through improved operational performance, cost optimization, and enhanced service capabilities.

Power Plant Operators benefit from:

MRO Service Providers gain advantages through:

Equipment Manufacturers benefit from sustained aftermarket revenue streams, customer relationship maintenance, and opportunities for technology advancement and service innovation.

Regional Economies gain through workforce development, technology transfer, and reduced dependence on international service providers, contributing to economic diversification and industrial capability development.

Comprehensive SWOT analysis reveals the strategic position of the Middle East power sector gas turbine MRO market, highlighting internal strengths and weaknesses alongside external opportunities and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Significant market trends are reshaping the Middle East power sector gas turbine MRO landscape, driven by technological advancement, operational requirements, and evolving customer expectations. According to MarkWide Research analysis, these trends indicate fundamental shifts in service delivery approaches and market dynamics.

Digital Transformation represents the most significant trend, with 68% of operators implementing or planning digital monitoring systems. Advanced analytics, artificial intelligence, and machine learning technologies enable predictive maintenance approaches that optimize service scheduling and reduce costs while improving equipment reliability.

Predictive Maintenance Adoption continues accelerating as operators recognize the benefits of condition-based maintenance strategies. This trend moves beyond traditional scheduled maintenance toward data-driven approaches that predict component failures and optimize maintenance timing.

Service Localization gains momentum as regional service capabilities expand and operators seek to reduce dependence on international providers. This trend includes establishment of regional service centers, local workforce development, and supply chain localization initiatives.

Performance Optimization Focus intensifies as operators seek to maximize efficiency and reduce environmental impact. Advanced MRO practices that enhance heat rates, reduce emissions, and optimize fuel consumption become increasingly important service differentiators.

Long-term Service Agreements become more prevalent as operators seek predictable maintenance costs and guaranteed performance levels. These comprehensive agreements often include performance guarantees, parts supply, and complete maintenance management services.

Remote Monitoring Capabilities expand rapidly, enabling continuous equipment surveillance and early problem detection. These systems reduce the need for physical inspections while providing detailed performance data for maintenance optimization.

Recent industry developments highlight the dynamic nature of the Middle East power sector gas turbine MRO market, with significant investments in technology, infrastructure, and service capabilities reshaping competitive dynamics and market opportunities.

Technology Investments by major service providers include development of advanced diagnostic systems, digital twin technologies, and automated inspection equipment. These investments enhance service capabilities while reducing costs and improving accuracy of maintenance activities.

Regional Service Expansion continues as international providers establish local facilities and partnerships to better serve Middle Eastern markets. Recent developments include new service centers, training facilities, and parts distribution networks across the region.

Workforce Development Programs gain prominence as industry participants address skilled labor shortages through comprehensive training initiatives, certification programs, and partnerships with educational institutions. These programs focus on developing specialized gas turbine maintenance expertise.

Strategic Partnerships between international service providers and regional companies create new service delivery models that combine global expertise with local market knowledge. These partnerships often focus on specific market segments or geographic regions.

Regulatory Developments across the region impact service requirements and standards, with increasing emphasis on safety, environmental compliance, and operational efficiency. These developments drive demand for specialized MRO services and advanced compliance capabilities.

Innovation Initiatives focus on developing new maintenance technologies, improving service efficiency, and reducing environmental impact. Recent innovations include advanced materials, improved diagnostic techniques, and automated maintenance procedures.

Strategic recommendations for stakeholders in the Middle East power sector gas turbine MRO market emphasize the importance of technology adoption, service capability development, and strategic positioning to capitalize on market opportunities while addressing key challenges.

For Service Providers:

For Power Plant Operators:

For Market Entrants:

Future market prospects for the Middle East power sector gas turbine MRO market appear highly favorable, with sustained growth expected driven by expanding power generation capacity, technology advancement, and evolving service requirements. MWR projections indicate continued market expansion with growth rates of 6.8% CAGR anticipated through the next decade.

Technology evolution will fundamentally transform MRO service delivery, with artificial intelligence, machine learning, and advanced analytics enabling more sophisticated maintenance approaches. Digital twin technologies and remote monitoring capabilities will become standard service components, improving efficiency while reducing costs.

Market maturation will continue across the region, with emerging markets developing more sophisticated service capabilities and infrastructure. This maturation process will create opportunities for specialized service providers while intensifying competitive dynamics in established markets.

Service model evolution toward outcome-based agreements and performance guarantees will reshape customer relationships and service delivery approaches. Providers will increasingly assume responsibility for equipment performance and availability, creating new risk management and service delivery requirements.

Regional capability development will accelerate as governments and industry participants invest in local workforce training, service infrastructure, and supply chain development. This trend will reduce dependence on international providers while creating new competitive dynamics.

Environmental considerations will become increasingly important as operators seek to optimize efficiency and reduce emissions. MRO services that enable improved environmental performance will command premium pricing and create competitive advantages for service providers.

Market consolidation may occur as smaller providers seek partnerships or acquisition opportunities to compete effectively with larger, more capable service organizations. This consolidation will likely result in improved service capabilities and more comprehensive service offerings.

The Middle East power sector gas turbine MRO market represents a dynamic and rapidly evolving industry segment with substantial growth potential driven by expanding power generation capacity, technology advancement, and increasing service sophistication. Market fundamentals remain strong, supported by the region’s continued reliance on gas-fired power generation and the critical importance of reliable maintenance services.

Key success factors for market participants include technology adoption, regional service capability development, and strategic partnership formation. The transition toward predictive maintenance approaches and digital service delivery models creates opportunities for differentiation while improving service efficiency and customer value.

Market challenges including skilled workforce shortages, supply chain complexities, and competitive pressures require strategic approaches and sustained investment in capability development. However, these challenges also create barriers to entry that protect established market participants with comprehensive service capabilities.

Future prospects remain highly favorable, with sustained growth expected across all market segments and geographic regions. The combination of expanding installed capacity, aging equipment fleets, and evolving service requirements creates a robust foundation for continued market development and service provider success in this critical industry segment.

What is Gas Turbine MRO?

Gas Turbine MRO refers to the maintenance, repair, and overhaul services for gas turbines used in power generation. This includes routine maintenance, component repairs, and complete overhauls to ensure optimal performance and longevity of the turbines.

What are the key players in the Middle East Power Sector Gas Turbine MRO Market?

Key players in the Middle East Power Sector Gas Turbine MRO Market include General Electric, Siemens, and Mitsubishi Power, among others. These companies provide a range of services and solutions to enhance the efficiency and reliability of gas turbines.

What are the growth factors driving the Middle East Power Sector Gas Turbine MRO Market?

The growth of the Middle East Power Sector Gas Turbine MRO Market is driven by increasing energy demand, the need for efficient power generation, and the aging infrastructure of existing gas turbines. Additionally, investments in renewable energy integration are also influencing MRO activities.

What challenges does the Middle East Power Sector Gas Turbine MRO Market face?

Challenges in the Middle East Power Sector Gas Turbine MRO Market include the high costs associated with maintenance and the availability of skilled labor. Furthermore, geopolitical factors can impact supply chains and service delivery.

What opportunities exist in the Middle East Power Sector Gas Turbine MRO Market?

Opportunities in the Middle East Power Sector Gas Turbine MRO Market include the adoption of advanced technologies such as predictive maintenance and digital monitoring. There is also potential for growth in service contracts as new power plants are commissioned.

What trends are shaping the Middle East Power Sector Gas Turbine MRO Market?

Trends in the Middle East Power Sector Gas Turbine MRO Market include a shift towards more sustainable practices, increased automation in maintenance processes, and the integration of IoT technologies for real-time monitoring. These trends aim to enhance operational efficiency and reduce downtime.

Middle East Power Sector Gas Turbine MRO Market

| Segmentation Details | Description |

|---|---|

| Service Type | Maintenance, Repair, Overhaul, Inspection |

| End User | Utilities, Industrial Plants, Power Generation, Oil & Gas |

| Technology | Heavy-Duty, Aeroderivative, Combined Cycle, Simple Cycle |

| Installation | Onshore, Offshore, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Power Sector Gas Turbine MRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at