444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Middle East Liability Insurance Market is a significant component of the region’s insurance landscape, providing coverage against legal liabilities and risks faced by businesses and individuals. Liability insurance is designed to protect policyholders from financial losses arising from third-party claims, including bodily injury, property damage, and legal expenses. As businesses expand and regulatory environments evolve, the demand for liability insurance in the Middle East has grown, reflecting a heightened awareness of potential risks and a focus on mitigating legal exposures.

Meaning: Liability insurance involves policies that safeguard individuals and businesses from financial losses resulting from legal responsibilities and obligations. These responsibilities may include bodily injury, property damage, or legal costs incurred in defending against lawsuits.

Executive Summary: The Middle East Liability Insurance Market plays a crucial role in supporting economic activities by providing financial protection to businesses and individuals against unforeseen liabilities. The market encompasses various forms of liability coverage, including general liability, professional liability, and product liability. The growth of industries, increased legal awareness, and regulatory changes contribute to the expansion of the liability insurance market in the Middle East.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Middle East Liability Insurance Market operates within dynamic forces that shape its landscape:

Regional Analysis: The Middle East Liability Insurance Market exhibits variations across countries, influenced by factors such as economic development, industry composition, and regulatory environments. Key regions contributing to market dynamics include:

Competitive Landscape:

Leading Companies in Middle East Liability Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

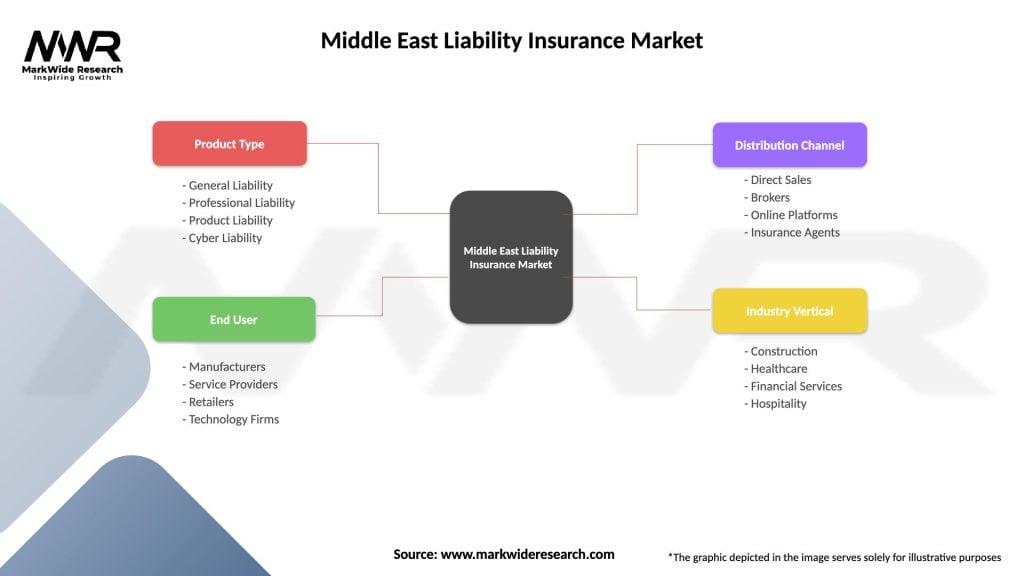

Segmentation: The Middle East Liability Insurance Market can be segmented based on various criteria, including:

SWOT Analysis: A SWOT analysis of the Middle East Liability Insurance Market provides insights into internal strengths and weaknesses, along with external opportunities and threats:

Market Trends:

Covid-19 Impact: The Covid-19 pandemic has influenced the Middle East Liability Insurance Market in several ways:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Middle East Liability Insurance Market is characterized by opportunities for innovation, adaptation to evolving risks, and collaboration with stakeholders. Key trends shaping the market’s future include:

Conclusion: The Middle East Liability Insurance Market is a vital component of the region’s risk management landscape, providing essential coverage to businesses and individuals facing legal liabilities. As economic activities expand and industries diversify, the demand for liability insurance continues to grow. The market’s future holds promise, with opportunities for customization, technological integration, and innovative solutions. Insurers that actively engage in addressing the evolving needs of businesses, navigating regulatory dynamics, and embracing sustainability considerations are well-positioned to thrive in the dynamic landscape of the Middle East Liability Insurance Market. The convergence of risk awareness, proactive risk management, and insurance solutions contributes to a resilient and adaptive liability insurance market in the Middle East, fostering a secure environment for businesses to thrive.

What is Liability Insurance?

Liability insurance is a type of insurance that provides protection against claims resulting from injuries and damage to people or property. It covers legal costs and payouts for which the insured party would be found liable, making it essential for businesses and individuals alike.

What are the key players in the Middle East Liability Insurance Market?

Key players in the Middle East Liability Insurance Market include companies such as AXA, Allianz, and Abu Dhabi National Insurance Company. These firms offer a range of liability insurance products tailored to various sectors, including construction, healthcare, and transportation, among others.

What are the growth factors driving the Middle East Liability Insurance Market?

The growth of the Middle East Liability Insurance Market is driven by increasing business activities, regulatory requirements for insurance coverage, and a rising awareness of risk management among companies. Additionally, the expansion of sectors like construction and tourism contributes to the demand for liability insurance.

What challenges does the Middle East Liability Insurance Market face?

The Middle East Liability Insurance Market faces challenges such as regulatory complexities, varying levels of awareness about liability coverage, and competition from alternative risk transfer solutions. These factors can hinder market growth and the adoption of liability insurance products.

What opportunities exist in the Middle East Liability Insurance Market?

Opportunities in the Middle East Liability Insurance Market include the potential for product innovation, such as customized liability policies for emerging industries, and the increasing demand for comprehensive coverage in sectors like technology and healthcare. Additionally, the growing emphasis on corporate governance and compliance presents further avenues for growth.

What trends are shaping the Middle East Liability Insurance Market?

Trends shaping the Middle East Liability Insurance Market include the rise of digital insurance platforms, increased focus on environmental liability, and the integration of technology in underwriting processes. These trends are transforming how liability insurance is marketed and delivered to consumers.

Middle East Liability Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | General Liability, Professional Liability, Product Liability, Cyber Liability |

| End User | Manufacturers, Service Providers, Retailers, Technology Firms |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Insurance Agents |

| Industry Vertical | Construction, Healthcare, Financial Services, Hospitality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at