444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East LED lights market represents a rapidly expanding sector driven by increasing energy efficiency demands, government sustainability initiatives, and smart city development projects across the region. LED lighting technology has gained substantial traction in countries including the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, and other Gulf Cooperation Council nations, where energy conservation and environmental sustainability have become strategic priorities.

Market dynamics indicate robust growth potential, with the region experiencing a 12.5% compound annual growth rate in LED adoption across residential, commercial, and industrial applications. The market encompasses various LED lighting solutions including general lighting, automotive lighting, backlighting, and specialty applications, each contributing to the overall expansion of this technology-driven sector.

Government initiatives promoting energy efficiency standards and green building regulations have significantly accelerated LED market penetration. Countries like the UAE have implemented comprehensive LED retrofit programs, while Saudi Arabia’s Vision 2030 emphasizes sustainable infrastructure development, creating substantial opportunities for LED lighting manufacturers and suppliers.

Regional characteristics such as extreme climate conditions, extended daylight hours, and high energy consumption patterns make LED lighting particularly attractive for Middle Eastern markets. The technology’s durability, energy efficiency, and reduced maintenance requirements align perfectly with the region’s operational needs and environmental goals.

The Middle East LED lights market refers to the comprehensive ecosystem of light-emitting diode lighting products, technologies, and services across Middle Eastern countries, encompassing manufacturing, distribution, installation, and maintenance of LED lighting solutions for various applications including residential, commercial, industrial, and infrastructure projects.

LED technology represents a semiconductor-based lighting solution that converts electrical energy directly into light through electroluminescence, offering superior energy efficiency, longer lifespan, and enhanced performance compared to traditional incandescent and fluorescent lighting systems. This market includes various LED product categories such as bulbs, tubes, panels, strips, and specialized lighting fixtures.

Market scope encompasses both indoor and outdoor LED lighting applications, ranging from residential home lighting and commercial office illumination to street lighting, architectural lighting, and industrial facility lighting. The market also includes smart LED systems integrated with IoT capabilities, enabling remote control, dimming, and energy management functionalities.

Strategic positioning of the Middle East LED lights market demonstrates exceptional growth momentum, driven by regional energy diversification strategies, urbanization trends, and increasing awareness of environmental sustainability. The market benefits from substantial government investments in smart city initiatives and infrastructure modernization projects across major Middle Eastern economies.

Key growth drivers include rising electricity costs, stringent energy efficiency regulations, and growing adoption of green building standards. The region’s construction boom, particularly in commercial and residential sectors, has created significant demand for advanced LED lighting solutions that offer both energy savings and enhanced aesthetic appeal.

Market penetration varies across different countries, with the UAE and Saudi Arabia leading adoption rates at approximately 68% market share in commercial applications. The residential sector shows increasing acceptance, with LED adoption rates reaching 45% penetration in urban areas, while rural markets present substantial untapped potential for future expansion.

Competitive landscape features both international LED manufacturers and regional distributors, creating a dynamic market environment that promotes innovation, competitive pricing, and localized service offerings. The market structure supports both premium and value-oriented LED solutions, catering to diverse customer segments and application requirements.

Market intelligence reveals several critical insights that shape the Middle East LED lights market trajectory and strategic opportunities for industry participants:

Energy conservation imperatives serve as the primary catalyst for LED market expansion across the Middle East region. Rising electricity consumption, increasing utility costs, and government sustainability commitments create compelling economic incentives for LED adoption across all market segments.

Government policy support through energy efficiency standards, green building codes, and public sector LED retrofit programs provides substantial market momentum. Countries like the UAE have implemented comprehensive LED transition strategies, while Saudi Arabia’s NEOM project showcases advanced LED lighting integration in smart city development.

Economic diversification strategies across Gulf countries emphasize reduced energy dependency and enhanced operational efficiency, making LED lighting an attractive investment for both public and private sector organizations. The technology’s long-term cost benefits align with regional economic transformation objectives.

Urbanization trends and population growth drive increased demand for residential and commercial lighting solutions. Rapid urban development, particularly in cities like Dubai, Riyadh, and Doha, creates substantial opportunities for LED lighting installations in new construction projects and infrastructure development.

Climate considerations including extreme temperatures and extended operating hours make LED lighting particularly suitable for Middle Eastern conditions. The technology’s durability, heat resistance, and consistent performance under challenging environmental conditions provide significant operational advantages over traditional lighting alternatives.

High initial investment requirements for LED lighting systems continue to present adoption barriers, particularly for price-sensitive market segments and smaller organizations with limited capital budgets. Despite long-term energy savings, the upfront costs can be substantial for comprehensive lighting upgrades.

Technical complexity associated with LED system integration, particularly for smart and connected lighting solutions, requires specialized expertise and installation capabilities that may not be readily available across all regional markets. This complexity can delay project implementation and increase overall costs.

Market fragmentation with numerous suppliers offering varying quality levels creates challenges for customers in product selection and performance evaluation. Inconsistent product standards and quality variations can impact market confidence and adoption rates.

Economic volatility related to oil price fluctuations and regional economic conditions can affect capital investment decisions and project funding availability. Economic uncertainty may cause organizations to defer lighting upgrade projects or seek lower-cost alternatives.

Cultural preferences and traditional lighting expectations in certain market segments may slow LED adoption, particularly in residential applications where consumers have established preferences for conventional lighting characteristics and aesthetics.

Smart city initiatives across the Middle East present unprecedented opportunities for advanced LED lighting integration. Major projects like Saudi Arabia’s NEOM, UAE’s Smart Dubai, and Qatar’s National Vision 2030 require sophisticated LED lighting systems with IoT connectivity and intelligent control capabilities.

Retrofit market potential remains substantial, with millions of existing lighting fixtures across the region suitable for LED conversion. Commercial buildings, industrial facilities, and residential complexes offer significant opportunities for energy-efficient lighting upgrades and modernization projects.

Renewable energy integration creates synergistic opportunities for LED lighting systems powered by solar and other clean energy sources. The region’s abundant solar resources make solar-powered LED lighting particularly attractive for outdoor and remote applications.

Tourism and hospitality expansion drives demand for premium LED lighting solutions in hotels, resorts, entertainment venues, and cultural attractions. The region’s growing tourism industry requires sophisticated lighting systems that enhance visitor experiences while maintaining energy efficiency.

Industrial modernization across manufacturing, logistics, and petrochemical sectors creates opportunities for specialized LED lighting solutions designed for harsh industrial environments. These applications often justify premium pricing due to safety, productivity, and maintenance benefits.

Supply chain evolution in the Middle East LED market reflects increasing localization of distribution networks, technical support capabilities, and installation services. Regional distributors are expanding their capabilities to provide comprehensive LED solutions including design, installation, and maintenance services.

Technology advancement continues to drive market dynamics, with innovations in LED efficiency, color quality, smart controls, and system integration creating new market opportunities and competitive advantages. MarkWide Research analysis indicates that technological improvements contribute to 15% annual performance gains in LED lighting systems.

Price competition intensifies as LED technology matures and manufacturing costs decline. This trend makes LED lighting more accessible across market segments while encouraging innovation in value-added features and services to maintain competitive differentiation.

Regulatory environment evolution includes stricter energy efficiency standards, building codes requiring LED lighting, and incentive programs supporting LED adoption. These regulatory changes create both opportunities and compliance requirements that shape market development strategies.

Customer sophistication increases as end users become more knowledgeable about LED technology benefits, performance characteristics, and total cost of ownership considerations. This trend drives demand for higher-quality products and comprehensive service offerings.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East LED lights market. Primary research includes extensive interviews with industry stakeholders, manufacturers, distributors, and end users across key regional markets.

Data collection methods encompass both quantitative and qualitative research approaches, including structured surveys, in-depth interviews, focus groups, and expert consultations. This multi-faceted approach provides comprehensive market understanding and validates findings through multiple sources.

Secondary research incorporates analysis of industry reports, government publications, trade association data, and company financial statements to supplement primary research findings. This approach ensures comprehensive market coverage and historical trend analysis.

Market modeling utilizes advanced analytical techniques to project market trends, growth patterns, and future opportunities. Statistical analysis and forecasting models incorporate multiple variables including economic indicators, regulatory changes, and technology advancement trends.

Quality assurance processes include data validation, cross-referencing multiple sources, and expert review to ensure accuracy and reliability of market insights and projections. Regular updates incorporate the latest market developments and emerging trends.

United Arab Emirates leads the Middle East LED market with advanced adoption rates across commercial, residential, and infrastructure applications. Dubai’s smart city initiatives and Abu Dhabi’s sustainability programs drive significant LED demand, with the country achieving 72% LED penetration in new commercial construction projects.

Saudi Arabia represents the largest market opportunity, driven by Vision 2030 initiatives, NEOM development, and extensive infrastructure modernization projects. The kingdom’s focus on energy efficiency and economic diversification creates substantial demand for LED lighting solutions across multiple sectors.

Qatar demonstrates strong LED adoption in preparation for major international events and ongoing urban development projects. The country’s emphasis on sustainable infrastructure and energy efficiency drives consistent LED market growth, particularly in commercial and hospitality applications.

Kuwait and Oman show increasing LED market activity, with government energy efficiency programs and private sector adoption contributing to steady growth. These markets offer significant potential for LED expansion, particularly in retrofit and infrastructure upgrade projects.

Regional distribution patterns indicate that GCC countries account for the majority of LED market activity, while other Middle Eastern countries including Jordan, Lebanon, and Iraq present emerging opportunities with growing infrastructure investment and energy efficiency awareness.

Market leadership in the Middle East LED lights market features a combination of international manufacturers, regional distributors, and local service providers creating a dynamic competitive environment:

Competitive strategies include product innovation, localized service offerings, competitive pricing, and strategic partnerships with regional distributors and system integrators. Companies increasingly focus on value-added services including design consultation, energy auditing, and maintenance programs.

By Product Type:

By Application:

By Technology:

Residential LED lighting shows strong growth momentum driven by increasing consumer awareness of energy savings and government incentive programs. Smart home integration and aesthetic considerations drive demand for premium LED solutions with advanced features and design flexibility.

Commercial LED applications dominate market activity, with office buildings, retail spaces, and hospitality facilities leading adoption rates. Energy cost savings, improved lighting quality, and reduced maintenance requirements make LED lighting attractive for commercial property owners and operators.

Industrial LED lighting gains traction in manufacturing, logistics, and petrochemical facilities where harsh operating conditions and safety requirements favor LED technology’s durability and performance characteristics. Specialized LED solutions designed for industrial environments command premium pricing.

Infrastructure LED projects including street lighting, traffic systems, and public facilities benefit from government energy efficiency mandates and smart city initiatives. These applications often involve large-scale procurement and long-term service contracts.

Automotive LED lighting represents a growing segment as vehicle manufacturers increasingly adopt LED technology for both functional and aesthetic applications. The region’s luxury vehicle market drives demand for advanced LED lighting systems.

Manufacturers benefit from expanding market opportunities, premium pricing for advanced LED solutions, and growing demand across multiple application segments. The region’s focus on quality and performance creates opportunities for technology leaders and innovative product developers.

Distributors and retailers gain from increasing LED market penetration, recurring revenue from maintenance and replacement services, and opportunities to provide value-added services including design consultation and energy auditing.

End users realize significant benefits including reduced energy costs, lower maintenance requirements, improved lighting quality, and enhanced operational efficiency. MWR analysis indicates that LED adoption typically delivers 60-75% energy savings compared to traditional lighting systems.

Government entities achieve energy efficiency objectives, reduced infrastructure operating costs, and environmental sustainability goals through LED adoption in public facilities and infrastructure projects.

Installation and service providers benefit from growing demand for LED system integration, maintenance services, and retrofit projects requiring specialized technical expertise and local market knowledge.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents a dominant trend, with LED systems increasingly incorporating IoT connectivity, sensors, and intelligent control capabilities. This trend enables energy optimization, predictive maintenance, and enhanced user experiences across residential and commercial applications.

Circadian lighting solutions gain popularity as awareness grows regarding lighting’s impact on human health and productivity. LED systems with tunable color temperature and intensity help regulate circadian rhythms and improve occupant well-being in commercial and residential environments.

Solar-powered LED systems expand rapidly, particularly for outdoor and remote applications where grid connectivity is challenging or expensive. The region’s abundant solar resources make this combination particularly attractive for street lighting and infrastructure applications.

Human-centric lighting design principles increasingly influence LED system specifications and installation practices. This approach considers lighting’s impact on human comfort, productivity, and health, driving demand for sophisticated LED solutions with advanced control capabilities.

Sustainable lighting practices including LED recycling programs, energy-efficient manufacturing, and circular economy principles gain importance as environmental consciousness increases across the region.

Strategic partnerships between international LED manufacturers and regional distributors strengthen market presence and service capabilities. These collaborations enhance local technical support, reduce delivery times, and improve customer service quality across Middle Eastern markets.

Technology innovations including improved LED efficiency, enhanced color quality, and advanced control systems continue to drive market evolution. Recent developments in LED chip technology and optical design deliver better performance and new application possibilities.

Government initiatives such as LED retrofit programs, energy efficiency standards, and green building requirements create substantial market opportunities while establishing quality and performance benchmarks for LED products and systems.

Manufacturing localization efforts by major LED companies establish regional production capabilities, reducing costs and improving supply chain reliability. These investments demonstrate long-term commitment to Middle Eastern markets and support local economic development.

Digital transformation initiatives integrate LED lighting with building management systems, smart city platforms, and IoT networks, creating new value propositions and revenue opportunities for LED system providers and service companies.

Market entry strategies should focus on establishing strong local partnerships, understanding regional preferences, and providing comprehensive service capabilities. Success requires combining global LED technology expertise with local market knowledge and customer relationships.

Product positioning recommendations emphasize energy efficiency benefits, total cost of ownership advantages, and advanced features that address specific regional requirements such as extreme climate conditions and extended operating hours.

Investment priorities should include technical training programs, service infrastructure development, and inventory management systems that support rapid market growth and customer satisfaction requirements across diverse regional markets.

Competitive differentiation opportunities exist through specialized LED solutions, value-added services, and innovative financing options that address customer budget constraints and project requirements. MarkWide Research suggests that service-oriented strategies deliver 25% higher customer retention rates.

Risk management strategies should address economic volatility, supply chain disruptions, and competitive pressures through diversified market approaches, flexible pricing models, and strong local partnerships that provide market stability and growth opportunities.

Long-term growth prospects for the Middle East LED lights market remain highly positive, driven by continued urbanization, infrastructure development, and energy efficiency imperatives. The market is expected to maintain robust growth momentum through the next decade as LED technology becomes the dominant lighting solution across all applications.

Technology evolution will continue driving market expansion through improved LED performance, reduced costs, and enhanced functionality. Emerging technologies including Li-Fi communication, advanced sensors, and AI-powered lighting controls will create new market opportunities and applications.

Market maturation patterns suggest increasing focus on service offerings, system integration, and value-added solutions as basic LED products become commoditized. Companies that develop comprehensive service capabilities and specialized expertise will maintain competitive advantages.

Regional development initiatives including smart city projects, renewable energy integration, and sustainable infrastructure development will continue driving LED market demand. These mega-projects require sophisticated LED lighting solutions and create substantial business opportunities.

Industry consolidation trends may accelerate as market growth attracts new entrants while established players seek to strengthen their positions through acquisitions, partnerships, and expanded service offerings. This consolidation will likely improve market efficiency and service quality.

The Middle East LED lights market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by energy efficiency imperatives, government sustainability initiatives, and technological advancement. The market benefits from strong regional economic development, urbanization trends, and increasing awareness of LED technology benefits across residential, commercial, and industrial applications.

Strategic opportunities abound for industry participants who can effectively combine global LED technology expertise with local market knowledge, service capabilities, and customer relationships. Success requires understanding regional preferences, regulatory requirements, and economic conditions while delivering superior products and comprehensive service offerings.

Future market development will be characterized by continued technology innovation, expanding smart lighting integration, and growing emphasis on human-centric lighting solutions. Companies that invest in advanced LED technologies, service infrastructure, and local partnerships will be well-positioned to capitalize on the substantial growth opportunities in this evolving market landscape.

What is LED Lights?

LED lights, or light-emitting diodes, are energy-efficient lighting solutions that convert electricity into light. They are widely used in various applications, including residential, commercial, and industrial settings due to their longevity and low energy consumption.

What are the key players in the Middle East LED Lights Market?

Key players in the Middle East LED Lights Market include Philips Lighting, Osram, Cree, and General Electric. These companies are known for their innovative lighting solutions and significant market presence, among others.

What are the growth factors driving the Middle East LED Lights Market?

The growth of the Middle East LED Lights Market is driven by increasing energy efficiency regulations, rising demand for sustainable lighting solutions, and the expansion of smart city initiatives. Additionally, the growing awareness of the benefits of LED technology contributes to market growth.

What challenges does the Middle East LED Lights Market face?

The Middle East LED Lights Market faces challenges such as high initial costs of LED technology and competition from traditional lighting solutions. Additionally, the lack of awareness and understanding of LED benefits among consumers can hinder market growth.

What opportunities exist in the Middle East LED Lights Market?

Opportunities in the Middle East LED Lights Market include the increasing adoption of smart lighting systems and the integration of IoT technology. Furthermore, the growing focus on energy conservation and sustainability presents significant growth potential for LED manufacturers.

What trends are shaping the Middle East LED Lights Market?

Trends shaping the Middle East LED Lights Market include the rise of smart lighting solutions, advancements in LED technology, and a shift towards energy-efficient products. Additionally, the increasing use of LEDs in outdoor and architectural lighting is becoming more prevalent.

Middle East LED Lights Market

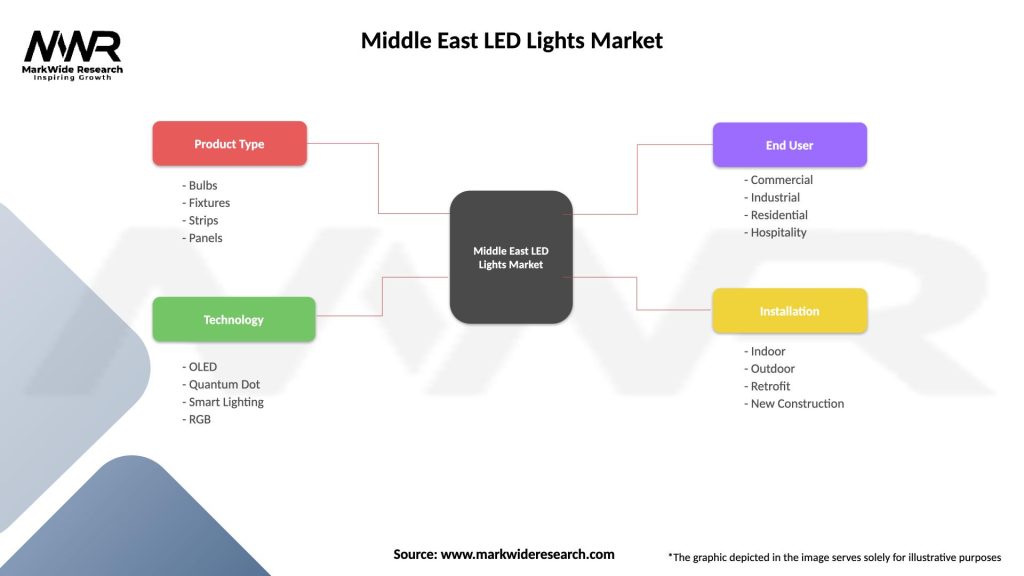

| Segmentation Details | Description |

|---|---|

| Product Type | Bulbs, Fixtures, Strips, Panels |

| Technology | OLED, Quantum Dot, Smart Lighting, RGB |

| End User | Commercial, Industrial, Residential, Hospitality |

| Installation | Indoor, Outdoor, Retrofit, New Construction |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East LED Lights Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at