444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East Islamic finance market has emerged as a robust and rapidly growing sector within the global financial landscape. Islamic finance is based on principles derived from Sharia law, which prohibits usury and promotes ethical financial practices. The Middle East, with its deep-rooted Islamic traditions and growing economies, has become a key hub for Islamic finance.

Meaning

Islamic finance refers to financial transactions that adhere to the principles of Sharia law. These principles emphasize ethical and socially responsible investment, asset-backed financing, risk-sharing, and prohibition of interest. Islamic financial products are designed to provide alternative solutions for individuals and businesses seeking financial services that align with their religious beliefs.

Executive Summary

The Middle East Islamic finance market has experienced significant growth over the years, driven by the increasing demand for Sharia-compliant financial products and services. The market offers a wide range of offerings, including Islamic banking, sukuk (Islamic bonds), takaful (Islamic insurance), and Islamic investment funds. With favorable demographics, strong economic growth, and supportive regulatory frameworks, the Middle East has become a prominent player in the global Islamic finance industry.

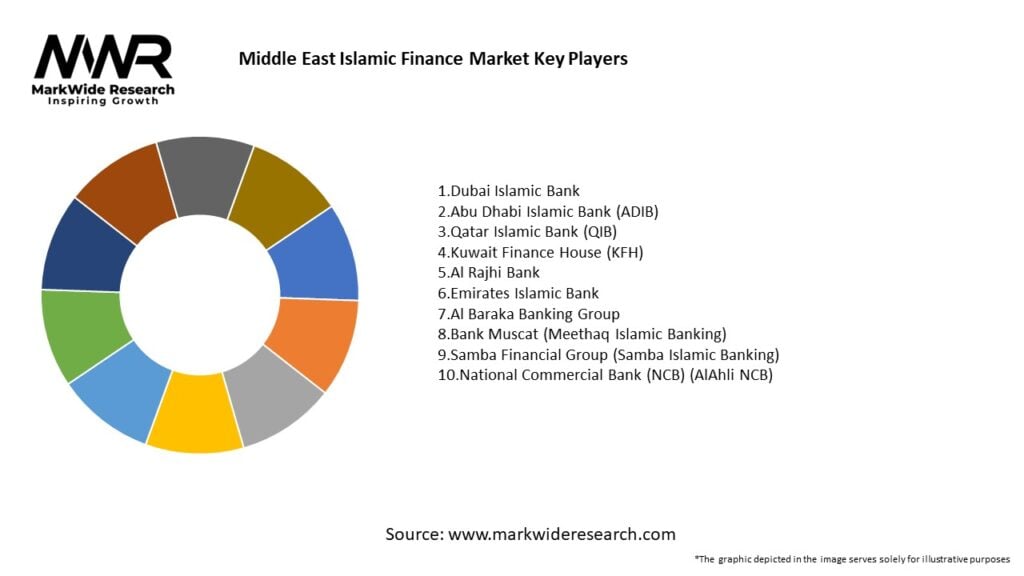

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Middle East Islamic finance market operates in a dynamic environment, influenced by various factors such as changing demographics, economic conditions, regulatory developments, and investor preferences. Market participants need to adapt to these dynamics by continuously innovating products, improving customer experiences, and expanding their geographical reach.

Regional Analysis

The Middle East Islamic finance market is comprised of several countries, each with its unique characteristics and market dynamics. Some of the prominent markets in the region include:

Competitive Landscape

Leading Companies in Middle East Islamic Finance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

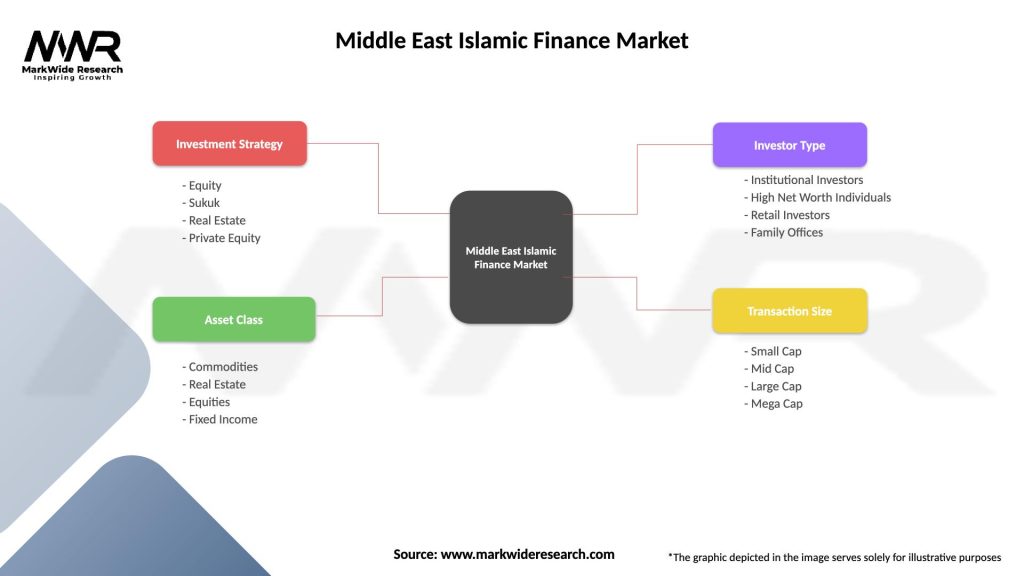

The Middle East Islamic finance market can be segmented based on the following factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Middle East Islamic finance market. While the pandemic caused disruptions across various industries, Islamic finance institutions showed resilience and adaptability. Some key effects of the pandemic on the market include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Middle East Islamic finance market is highly promising. Several factors indicate continued growth and development in the sector:

Conclusion

The Middle East Islamic finance market has emerged as a dynamic and rapidly growing sector, driven by the demand for Sharia-compliant financial products and services. With a favorable regulatory environment, growing awareness, and supportive government initiatives, the market offers significant opportunities for industry participants. However, challenges such as lack of standardization, talent shortage, and risk perception need to be addressed to unlock the full potential of the market. With continued innovation, collaboration, and focus on customer needs, the Middle East Islamic finance market is poised for sustained growth and expansion in the coming years.

What is Islamic Finance?

Islamic Finance refers to financial activities that comply with Islamic law (Sharia). It encompasses various financial products and services, including banking, investment, and insurance, that adhere to principles such as the prohibition of interest (riba) and excessive uncertainty (gharar).

What are the key players in the Middle East Islamic Finance Market?

Key players in the Middle East Islamic Finance Market include institutions like Al Baraka Banking Group, Dubai Islamic Bank, and Abu Dhabi Islamic Bank. These companies offer a range of Sharia-compliant financial products and services, catering to both individual and corporate clients, among others.

What are the growth factors driving the Middle East Islamic Finance Market?

The growth of the Middle East Islamic Finance Market is driven by increasing demand for Sharia-compliant financial products, rising awareness of Islamic finance principles, and the expansion of Islamic banking services. Additionally, government support and regulatory frameworks are enhancing market growth.

What challenges does the Middle East Islamic Finance Market face?

The Middle East Islamic Finance Market faces challenges such as a lack of standardization in Sharia interpretations, limited awareness among potential customers, and competition from conventional financial institutions. These factors can hinder the growth and acceptance of Islamic finance products.

What opportunities exist in the Middle East Islamic Finance Market?

Opportunities in the Middle East Islamic Finance Market include the potential for product innovation, expansion into new markets, and increasing collaboration between Islamic and conventional financial institutions. The growing interest in ethical investing also presents new avenues for growth.

What trends are shaping the Middle East Islamic Finance Market?

Trends shaping the Middle East Islamic Finance Market include the rise of fintech solutions offering Sharia-compliant services, increased focus on sustainable finance, and the integration of digital banking technologies. These trends are transforming how Islamic finance products are delivered and accessed.

Middle East Islamic Finance Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Equity, Sukuk, Real Estate, Private Equity |

| Asset Class | Commodities, Real Estate, Equities, Fixed Income |

| Investor Type | Institutional Investors, High Net Worth Individuals, Retail Investors, Family Offices |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Mega Cap |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Middle East Islamic Finance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at