444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East geospatial analytics market represents a rapidly evolving technological landscape that combines geographic information systems, satellite imagery, and advanced data analytics to provide location-based insights across various industries. This dynamic market encompasses countries including the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman, and other regional economies that are increasingly investing in digital transformation initiatives. The region’s strategic focus on smart city development, infrastructure modernization, and economic diversification has created substantial demand for geospatial analytics solutions.

Market growth in the Middle East is being driven by significant government investments in Vision 2030 programs, NEOM city development, and various national transformation initiatives. The integration of geospatial analytics with emerging technologies such as artificial intelligence, machine learning, and Internet of Things (IoT) is creating new opportunities for businesses and government agencies to optimize operations, enhance decision-making, and improve service delivery. Current market trends indicate a compound annual growth rate of 12.8%, reflecting the region’s commitment to technological advancement and digital innovation.

Regional adoption varies significantly across different countries, with the UAE and Saudi Arabia leading in terms of implementation and investment. The market serves diverse applications including urban planning, oil and gas exploration, transportation management, environmental monitoring, and defense applications. Growing emphasis on sustainability, climate change mitigation, and resource optimization is further accelerating the adoption of geospatial analytics solutions throughout the region.

The Middle East geospatial analytics market refers to the comprehensive ecosystem of technologies, services, and solutions that collect, process, analyze, and visualize location-based data to support decision-making processes across various sectors in Middle Eastern countries. This market encompasses geographic information systems (GIS), remote sensing technologies, global positioning systems (GPS), spatial databases, and advanced analytics platforms that transform raw geographic data into actionable business intelligence.

Geospatial analytics combines traditional mapping and surveying techniques with modern data science methodologies to create sophisticated analytical frameworks. These systems integrate multiple data sources including satellite imagery, aerial photography, sensor networks, mobile device data, and social media information to provide comprehensive spatial insights. The technology enables organizations to understand patterns, relationships, and trends that have geographic components, supporting everything from urban development planning to supply chain optimization.

Market participants include technology vendors, system integrators, consulting firms, government agencies, and end-user organizations across industries such as oil and gas, telecommunications, transportation, utilities, and public safety. The ecosystem also encompasses data providers, cloud service platforms, and specialized analytics software companies that contribute to the overall value chain of geospatial intelligence solutions.

Strategic market positioning in the Middle East geospatial analytics sector reflects the region’s ambitious digital transformation agenda and commitment to becoming a global technology hub. Government initiatives across the Gulf Cooperation Council (GCC) countries are driving substantial investments in smart infrastructure, sustainable development projects, and advanced analytics capabilities. The market demonstrates strong growth momentum with increasing adoption across both public and private sectors.

Technology integration trends show significant advancement in cloud-based geospatial platforms, real-time analytics capabilities, and mobile-first solutions that cater to the region’s tech-savvy population. Organizations are increasingly leveraging geospatial analytics for operational efficiency, risk management, and strategic planning purposes. The integration of artificial intelligence and machine learning algorithms is enhancing predictive analytics capabilities and enabling more sophisticated spatial modeling applications.

Market dynamics indicate strong demand from key sectors including urban development, energy, telecommunications, and transportation. Government spending on smart city initiatives accounts for approximately 35% of total market demand, while private sector adoption continues to expand across various industries. The region’s strategic location as a global trade hub is creating additional opportunities for logistics and supply chain optimization applications.

Primary market drivers include accelerating urbanization rates, increasing government investments in digital infrastructure, and growing awareness of location intelligence benefits across various industries. The following key insights characterize the current market landscape:

Market maturation is evident through the establishment of specialized geospatial analytics centers, increased local talent development programs, and growing partnerships between international technology providers and regional system integrators. The emergence of indigenous technology companies is also contributing to market growth and innovation.

Government digitization initiatives represent the most significant driver of geospatial analytics adoption across the Middle East region. National transformation programs such as Saudi Arabia’s Vision 2030, UAE’s Vision 2071, and Qatar’s National Vision 2030 are creating substantial demand for location-based analytics solutions. These comprehensive programs require sophisticated spatial analysis capabilities to support urban planning, infrastructure development, and service delivery optimization.

Smart city development projects are generating unprecedented demand for geospatial analytics platforms. Cities like Dubai, Riyadh, and Doha are implementing comprehensive smart city strategies that rely heavily on location intelligence for traffic management, utility optimization, and citizen services. The integration of IoT sensors, mobile applications, and real-time analytics is creating complex data ecosystems that require advanced geospatial processing capabilities.

Economic diversification efforts across oil-dependent economies are driving investments in new industries and sectors that rely on geospatial analytics. Tourism development, logistics hubs, financial services, and technology sectors all require sophisticated location-based insights to optimize operations and identify growth opportunities. The development of economic zones and free trade areas is creating additional demand for spatial analysis and planning tools.

Infrastructure modernization programs throughout the region are incorporating geospatial analytics for project planning, execution monitoring, and asset management. Large-scale transportation projects, utility upgrades, and telecommunications network expansions require comprehensive spatial analysis capabilities to ensure optimal design and implementation. The emphasis on sustainable development is also driving demand for environmental impact assessment and monitoring solutions.

High implementation costs continue to present significant barriers for many organizations considering geospatial analytics adoption. The comprehensive nature of these solutions often requires substantial upfront investments in software licenses, hardware infrastructure, data acquisition, and professional services. Smaller organizations and government agencies with limited budgets may struggle to justify the initial capital expenditure despite long-term benefits.

Skills shortage in geospatial analytics represents a critical constraint on market growth throughout the region. The specialized nature of GIS technology, spatial analysis, and data science requires highly trained professionals who are in limited supply. Educational institutions are gradually developing relevant programs, but the current talent gap continues to slow adoption rates and increase implementation costs for organizations.

Data quality and availability challenges affect the effectiveness of geospatial analytics implementations across various applications. Inconsistent data standards, limited historical datasets, and restricted access to certain geographic information can compromise analytical accuracy and limit use case scenarios. The need for high-quality, up-to-date spatial data often requires significant ongoing investments in data collection and maintenance.

Regulatory complexity surrounding data privacy, cross-border data transfer, and national security considerations creates implementation challenges for multinational organizations and regional projects. Varying regulations across different countries in the region can complicate solution architecture decisions and limit the scalability of geospatial analytics platforms. Compliance requirements may also increase implementation timelines and costs.

Artificial intelligence integration presents substantial opportunities for enhancing geospatial analytics capabilities and creating new market segments. The combination of machine learning algorithms with spatial data analysis is enabling predictive modeling, automated pattern recognition, and intelligent decision support systems. Organizations that successfully integrate AI capabilities into their geospatial platforms can achieve significant competitive advantages and market differentiation.

Climate change adaptation initiatives across the region are creating new demand for environmental monitoring and analysis solutions. Rising temperatures, water scarcity, and extreme weather events require sophisticated spatial modeling capabilities to support mitigation and adaptation strategies. The growing focus on sustainability and environmental stewardship is driving investments in geospatial analytics for carbon footprint tracking, renewable energy planning, and ecosystem monitoring.

Digital twin development represents an emerging opportunity that combines geospatial analytics with real-time sensor data and simulation capabilities. Cities and organizations are increasingly interested in creating digital replicas of physical assets and environments to support planning, optimization, and predictive maintenance activities. This convergence of technologies creates new market opportunities for specialized solution providers.

Regional integration projects such as the GCC Railway network, cross-border logistics corridors, and shared infrastructure initiatives require comprehensive geospatial analytics capabilities. These large-scale projects create opportunities for solution providers who can deliver standardized platforms that support multi-country implementations and cross-border data sharing requirements.

Competitive landscape evolution in the Middle East geospatial analytics market reflects a dynamic interplay between established international vendors and emerging regional players. Global technology leaders are establishing local partnerships and regional offices to better serve Middle Eastern customers, while indigenous companies are developing specialized solutions tailored to regional requirements. This competitive environment is driving innovation and creating more diverse solution options for end users.

Technology advancement cycles are accelerating the introduction of new capabilities and use cases across the geospatial analytics ecosystem. Cloud computing adoption is enabling more scalable and cost-effective implementations, while edge computing capabilities are supporting real-time analytics applications. The integration of 5G networks is expected to further enhance mobile geospatial applications and enable new IoT-based use cases.

Customer expectations are evolving toward more intuitive, self-service analytics platforms that enable business users to access geospatial insights without requiring specialized technical expertise. This trend is driving demand for user-friendly interfaces, automated analysis capabilities, and pre-built industry-specific applications. Organizations are also seeking more flexible deployment options that support hybrid cloud and multi-cloud strategies.

Partnership ecosystems are becoming increasingly important for delivering comprehensive geospatial analytics solutions that address complex customer requirements. System integrators, consulting firms, and technology vendors are forming strategic alliances to combine complementary capabilities and expand market reach. These partnerships are particularly important for large-scale government projects and cross-industry implementations.

Comprehensive market analysis for the Middle East geospatial analytics market employs a multi-faceted research approach that combines primary and secondary data sources to provide accurate and actionable insights. The methodology incorporates quantitative analysis of market trends, qualitative assessment of industry dynamics, and strategic evaluation of competitive positioning across different market segments and geographic regions.

Primary research activities include structured interviews with industry executives, technology vendors, system integrators, and end-user organizations across various sectors. These interviews provide insights into current market conditions, technology adoption patterns, implementation challenges, and future growth expectations. Survey data collection from market participants helps quantify adoption rates, spending patterns, and technology preferences across different customer segments.

Secondary research sources encompass government publications, industry reports, academic studies, and technology vendor documentation to provide comprehensive market context and validate primary research findings. Analysis of public procurement data, project announcements, and investment activities helps identify market trends and growth opportunities. Regulatory analysis ensures understanding of policy impacts on market development.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. Market sizing methodologies employ bottom-up and top-down approaches to provide robust market estimates and growth projections. Scenario analysis considers various factors that could influence market development trajectories.

United Arab Emirates leads the regional geospatial analytics market with approximately 28% market share, driven by Dubai’s smart city initiatives and Abu Dhabi’s economic diversification programs. The country’s advanced digital infrastructure, supportive regulatory environment, and strategic location as a regional business hub create favorable conditions for geospatial analytics adoption. Major projects include Dubai’s autonomous transportation system, smart grid implementations, and comprehensive urban planning initiatives.

Saudi Arabia represents the fastest-growing market segment with significant investments in NEOM city development, Riyadh metro project, and Vision 2030 transformation initiatives. The kingdom’s focus on economic diversification and sustainable development is driving substantial demand for geospatial analytics across urban planning, energy, and transportation sectors. Government spending on digital transformation accounts for a significant portion of market growth in this region.

Qatar demonstrates strong market potential with ongoing infrastructure development for post-World Cup legacy projects and National Vision 2030 implementation. The country’s emphasis on smart city development, environmental sustainability, and economic diversification creates opportunities for geospatial analytics providers. Doha’s comprehensive urban planning initiatives and industrial zone development are key market drivers.

Kuwait, Bahrain, and Oman collectively represent emerging market opportunities with growing government investments in digital transformation and smart city initiatives. These countries are increasingly recognizing the value of location-based analytics for urban planning, resource management, and economic development. Regional collaboration projects and GCC integration initiatives are creating additional market opportunities across these markets.

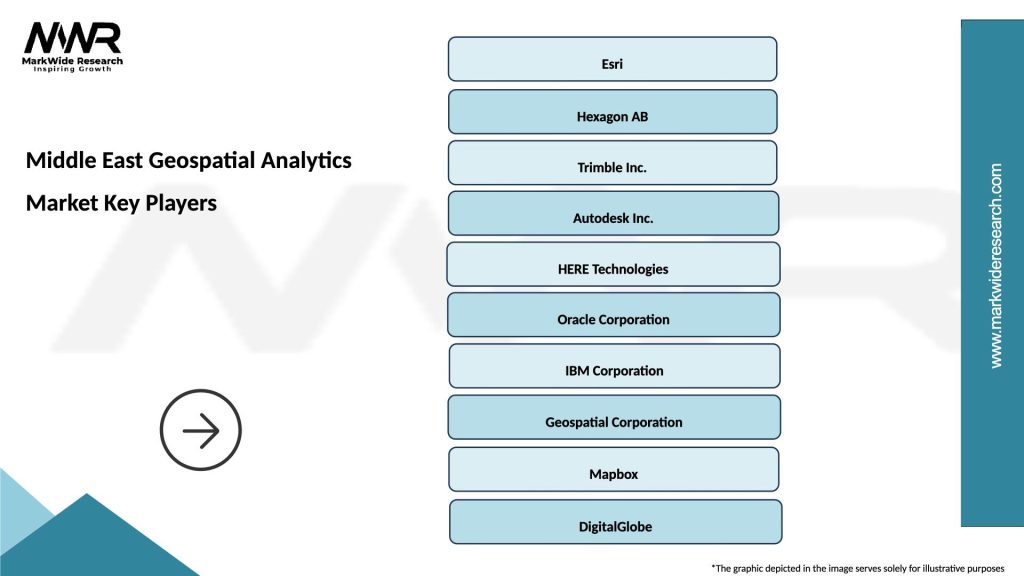

Market leadership in the Middle East geospatial analytics sector is characterized by a diverse ecosystem of international technology vendors, regional system integrators, and specialized solution providers. The competitive landscape reflects the complex requirements of Middle Eastern customers and the need for localized expertise and support capabilities.

Regional players are increasingly important in delivering localized solutions and support services that address specific Middle Eastern requirements. These companies often partner with international vendors to provide comprehensive implementation and support services for complex government and enterprise projects.

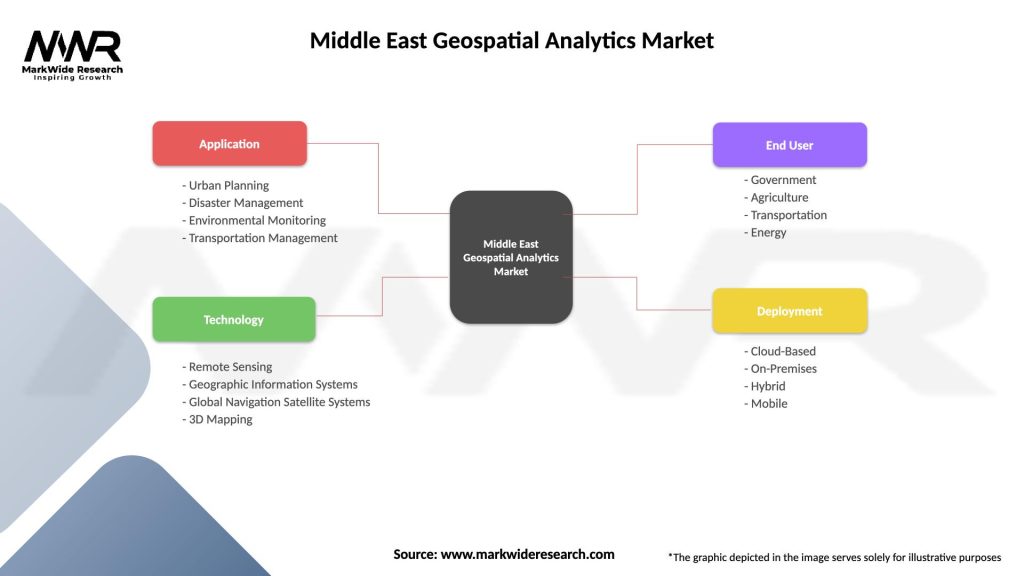

By Technology:

By Application:

By Deployment:

Government sector applications dominate the Middle East geospatial analytics market, accounting for approximately 42% of total adoption. Smart city initiatives, urban planning projects, and infrastructure development programs are driving substantial investments in comprehensive geospatial platforms. Government agencies are increasingly recognizing the value of location-based analytics for service delivery optimization, resource allocation, and citizen engagement applications.

Energy sector adoption remains strong throughout the region, with oil and gas companies leveraging geospatial analytics for exploration, production optimization, and environmental monitoring. The sector’s digital transformation initiatives are incorporating advanced spatial analysis capabilities for asset management, pipeline monitoring, and safety applications. Renewable energy development projects are also creating new demand for geospatial analytics solutions.

Transportation and logistics represent rapidly growing application areas with increasing adoption of location-based optimization solutions. The region’s strategic position as a global trade hub is driving investments in port management, supply chain optimization, and multimodal transportation planning. E-commerce growth and last-mile delivery optimization are creating additional market opportunities in this sector.

Telecommunications sector adoption is accelerating with 5G network deployment and smart city infrastructure development. Telecom operators are using geospatial analytics for network planning, coverage optimization, and customer experience enhancement. The integration of IoT devices and smart city applications is creating new requirements for location-based network management and service delivery.

Enhanced decision-making capabilities represent the primary benefit for organizations implementing geospatial analytics solutions. The ability to visualize complex data relationships, identify spatial patterns, and conduct scenario analysis enables more informed strategic planning and operational decisions. Organizations report significant improvements in planning accuracy and resource allocation efficiency through location-based insights.

Operational efficiency improvements are achieved through optimized routing, asset utilization, and resource deployment based on spatial analysis. Transportation companies report fuel cost reductions of 15-25% through route optimization, while utility companies achieve improved maintenance scheduling and outage response times. The integration of real-time data with geospatial analytics enables dynamic optimization and responsive operations management.

Risk management enhancement is particularly valuable in the Middle East region where organizations face various environmental, security, and operational risks. Geospatial analytics enables comprehensive risk assessment, early warning systems, and emergency response planning. Organizations can identify vulnerable areas, assess potential impacts, and develop mitigation strategies based on spatial analysis and modeling.

Customer experience improvements are achieved through location-based services, personalized offerings, and optimized service delivery. Retail organizations use geospatial analytics for site selection, market analysis, and customer segmentation. Service providers leverage location intelligence for field service optimization, response time improvement, and customer satisfaction enhancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first adoption is transforming the geospatial analytics landscape throughout the Middle East region. Organizations are increasingly preferring cloud-based solutions for their scalability, cost-effectiveness, and rapid deployment capabilities. This trend is particularly strong among government agencies implementing smart city initiatives and private companies seeking to minimize infrastructure investments while accessing advanced analytics capabilities.

Mobile-first design is becoming essential for geospatial analytics platforms as organizations seek to enable field workers, citizens, and stakeholders to access location-based insights through mobile devices. The high smartphone penetration rates across the region are driving demand for responsive, mobile-optimized interfaces that support real-time data collection and analysis capabilities.

Real-time analytics integration is gaining momentum as organizations require immediate insights for operational decision-making and emergency response applications. The combination of IoT sensors, streaming data processing, and geospatial analytics is enabling dynamic monitoring and automated response systems for smart cities, transportation networks, and industrial facilities.

Sustainability focus is driving new applications for geospatial analytics in environmental monitoring, carbon footprint tracking, and renewable energy planning. Organizations are using location-based analysis to support sustainability initiatives, comply with environmental regulations, and optimize resource utilization. Climate change adaptation planning is creating additional demand for sophisticated spatial modeling capabilities.

Industry-specific solutions are emerging as vendors develop specialized applications tailored to specific sector requirements. Rather than generic platforms, organizations are seeking pre-configured solutions that address industry-specific use cases, regulatory requirements, and operational workflows. This trend is particularly evident in sectors such as oil and gas, telecommunications, and urban planning.

Strategic partnerships between international technology vendors and regional system integrators are reshaping the competitive landscape. These alliances combine global technology expertise with local market knowledge and implementation capabilities. Recent partnerships focus on delivering comprehensive solutions for large-scale government projects and cross-industry implementations that require specialized regional expertise.

Government policy initiatives are creating new market opportunities and driving standardization efforts across the region. National digital transformation strategies, smart city frameworks, and data governance policies are establishing requirements for geospatial analytics capabilities. These policy developments are creating more predictable demand patterns and encouraging long-term investments by solution providers.

Technology innovation is accelerating with the introduction of AI-powered analytics, edge computing capabilities, and advanced visualization tools. MarkWide Research analysis indicates that organizations implementing AI-enhanced geospatial analytics report productivity improvements of 30-40% compared to traditional approaches. These technological advances are enabling new use cases and improving the return on investment for geospatial analytics implementations.

Regional collaboration projects such as the GCC Railway network and cross-border logistics initiatives are creating demand for standardized geospatial analytics platforms. These large-scale infrastructure projects require comprehensive spatial analysis capabilities that can support multi-country implementations and cross-border data sharing requirements.

Educational initiatives are addressing the skills gap through specialized training programs, university partnerships, and certification courses. Government agencies and private organizations are investing in talent development programs to build local expertise in geospatial analytics and reduce dependence on external consultants and contractors.

Investment prioritization should focus on cloud-based platforms that offer scalability, cost-effectiveness, and rapid deployment capabilities. Organizations should evaluate solutions based on their ability to integrate with existing systems, support mobile access, and provide industry-specific functionality. The emphasis should be on platforms that can grow with organizational needs and adapt to changing requirements over time.

Skills development represents a critical success factor for organizations implementing geospatial analytics solutions. Companies should invest in training programs, partner with educational institutions, and consider hybrid implementation approaches that combine internal capabilities with external expertise. Building internal competency is essential for maximizing the value of geospatial analytics investments.

Data strategy development should address data quality, standardization, and governance requirements from the outset of geospatial analytics initiatives. Organizations need to establish clear data collection procedures, quality assurance processes, and integration protocols to ensure analytical accuracy and reliability. Investment in data infrastructure and management capabilities is essential for long-term success.

Vendor selection should consider not only technical capabilities but also local presence, support services, and partnership ecosystems. Organizations should evaluate vendors based on their ability to provide ongoing support, system integration services, and knowledge transfer capabilities. The importance of local expertise and cultural understanding should not be underestimated in vendor selection decisions.

Pilot project approaches are recommended for organizations new to geospatial analytics to demonstrate value and build internal support before large-scale implementations. Starting with specific use cases that have clear business benefits and measurable outcomes can help establish credibility and secure additional investment for expanded implementations.

Market expansion is expected to continue at a robust pace with projected growth rates of 12-15% annually over the next five years. Government investments in smart city initiatives, infrastructure development, and digital transformation programs will remain primary growth drivers. The increasing recognition of geospatial analytics value across various industries is expected to broaden market adoption beyond traditional sectors.

Technology evolution will focus on artificial intelligence integration, real-time analytics capabilities, and enhanced user experience design. The convergence of geospatial analytics with emerging technologies such as digital twins, augmented reality, and 5G networks will create new application possibilities and market opportunities. MWR projections indicate that AI-enhanced geospatial solutions will account for over 60% of new implementations by 2028.

Regional integration initiatives will create opportunities for standardized platforms and cross-border applications. The development of regional infrastructure projects, trade corridors, and collaborative initiatives will require comprehensive geospatial analytics capabilities that can support multi-country implementations and data sharing requirements.

Sustainability applications will become increasingly important as organizations focus on environmental monitoring, carbon footprint reduction, and climate change adaptation. The growing emphasis on sustainable development and environmental stewardship will drive new use cases and create additional market opportunities for specialized geospatial analytics solutions.

Market maturation will be characterized by increased standardization, improved interoperability, and more sophisticated analytical capabilities. The development of industry-specific solutions, specialized consulting services, and comprehensive support ecosystems will enhance market accessibility and accelerate adoption rates across various sectors and organization sizes.

The Middle East geospatial analytics market represents a dynamic and rapidly evolving sector that is fundamental to the region’s digital transformation and economic diversification objectives. Strong government support, substantial infrastructure investments, and increasing recognition of location-based analytics value are driving robust market growth across multiple industries and applications. The convergence of geospatial analytics with emerging technologies such as artificial intelligence, cloud computing, and IoT is creating new opportunities and enhancing solution capabilities.

Market challenges including skills shortages, high implementation costs, and data quality issues are being addressed through educational initiatives, technology advancement, and improved solution accessibility. The competitive landscape continues to evolve with strategic partnerships between international vendors and regional players creating comprehensive solution ecosystems that address local requirements and provide specialized expertise.

Future growth prospects remain strong with expanding applications in sustainability, smart cities, and regional integration projects. Organizations that invest in geospatial analytics capabilities today will be well-positioned to capitalize on emerging opportunities and achieve competitive advantages in an increasingly location-aware business environment. The Middle East geospatial analytics market is poised for continued expansion as digital transformation initiatives accelerate and location intelligence becomes integral to organizational success across the region.

What is Geospatial Analytics?

Geospatial Analytics refers to the collection, analysis, and visualization of data related to geographic locations. It is used in various applications such as urban planning, environmental monitoring, and transportation management.

What are the key players in the Middle East Geospatial Analytics Market?

Key players in the Middle East Geospatial Analytics Market include Esri, Hexagon AB, and Trimble, among others. These companies provide advanced geospatial solutions and technologies that cater to various industries.

What are the main drivers of the Middle East Geospatial Analytics Market?

The main drivers of the Middle East Geospatial Analytics Market include the increasing demand for location-based services, the growth of smart city initiatives, and advancements in satellite imagery technology. These factors are enhancing the adoption of geospatial analytics across various sectors.

What challenges does the Middle East Geospatial Analytics Market face?

The Middle East Geospatial Analytics Market faces challenges such as data privacy concerns, high implementation costs, and a lack of skilled professionals. These issues can hinder the growth and adoption of geospatial technologies in the region.

What opportunities exist in the Middle East Geospatial Analytics Market?

Opportunities in the Middle East Geospatial Analytics Market include the expansion of IoT applications, the integration of AI and machine learning for data analysis, and the increasing focus on environmental sustainability. These trends are expected to drive innovation and growth in the market.

What trends are shaping the Middle East Geospatial Analytics Market?

Trends shaping the Middle East Geospatial Analytics Market include the rise of cloud-based geospatial solutions, the use of real-time data analytics, and the growing importance of mobile geospatial applications. These trends are transforming how organizations utilize geospatial data.

Middle East Geospatial Analytics Market

| Segmentation Details | Description |

|---|---|

| Application | Urban Planning, Disaster Management, Environmental Monitoring, Transportation Management |

| Technology | Remote Sensing, Geographic Information Systems, Global Navigation Satellite Systems, 3D Mapping |

| End User | Government, Agriculture, Transportation, Energy |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Geospatial Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at