444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East gas pipeline infrastructure market represents one of the most strategically important energy sectors in the global economy, serving as the backbone for natural gas transportation across the region and beyond. This comprehensive network of pipelines facilitates the movement of natural gas from production sites to distribution centers, industrial facilities, and export terminals throughout the Middle East. The region’s abundant natural gas reserves, combined with increasing domestic demand and export opportunities, drive continuous investment in pipeline infrastructure development.

Regional significance of the Middle East gas pipeline infrastructure cannot be overstated, as the area contains approximately 40% of global proven natural gas reserves. Countries including Qatar, Iran, Saudi Arabia, and the United Arab Emirates lead the development of sophisticated pipeline networks that support both domestic consumption and international trade. The infrastructure encompasses various pipeline types, from high-pressure transmission lines spanning hundreds of kilometers to local distribution networks serving urban and industrial areas.

Market dynamics are influenced by several factors including geopolitical considerations, technological advancements, environmental regulations, and evolving energy policies. The sector experiences robust growth driven by increasing natural gas demand for power generation, industrial applications, and petrochemical production. Additionally, the region’s strategic position as an energy hub connecting Asia, Europe, and Africa creates substantial opportunities for transit pipeline development.

The Middle East gas pipeline infrastructure market refers to the comprehensive ecosystem of natural gas transportation systems, including transmission pipelines, distribution networks, compression stations, and associated facilities that enable the movement of natural gas throughout the Middle Eastern region. This infrastructure encompasses both onshore and offshore pipeline systems designed to transport natural gas from production fields to end-users, including power plants, industrial facilities, residential areas, and export terminals.

Pipeline infrastructure in this context includes high-pressure transmission pipelines that transport large volumes of natural gas over long distances, medium-pressure distribution pipelines that serve regional markets, and low-pressure local distribution systems that deliver gas to individual consumers. The market also encompasses supporting infrastructure such as compressor stations, metering facilities, valve stations, and pipeline integrity management systems that ensure safe and efficient gas transportation.

Strategic importance of this infrastructure extends beyond regional boundaries, as many Middle Eastern pipeline systems connect to international networks, facilitating natural gas exports to global markets. The market includes both greenfield pipeline projects that establish new transportation routes and brownfield projects that upgrade or expand existing infrastructure to meet growing demand and enhance operational efficiency.

Market expansion in the Middle East gas pipeline infrastructure sector demonstrates remarkable momentum, driven by increasing natural gas production, growing domestic demand, and strategic export initiatives. The region’s pipeline network continues to evolve with advanced technologies, enhanced safety measures, and improved operational efficiency. Key market participants focus on developing integrated pipeline systems that support both domestic energy security and international trade objectives.

Investment trends indicate substantial capital allocation toward pipeline infrastructure development, with governments and private sector entities collaborating on major projects. The market benefits from supportive regulatory frameworks, strategic geographic positioning, and abundant natural gas resources. Regional cooperation initiatives facilitate cross-border pipeline development, creating opportunities for enhanced energy integration and trade facilitation.

Technological advancement plays a crucial role in market evolution, with smart pipeline technologies, advanced materials, and digital monitoring systems improving operational performance. The sector experiences growth rates of approximately 6.2% annually, reflecting strong demand fundamentals and continued infrastructure investment. Market participants prioritize sustainability initiatives, incorporating environmental considerations into pipeline design and operation practices.

Strategic positioning of the Middle East gas pipeline infrastructure market reveals several critical insights that shape industry development and investment decisions:

Primary growth drivers propelling the Middle East gas pipeline infrastructure market encompass multiple interconnected factors that create sustained demand for pipeline development and expansion. The region’s abundant natural gas reserves serve as the fundamental driver, providing the resource base necessary to justify substantial infrastructure investments and long-term development strategies.

Domestic demand growth represents a significant market driver, with increasing natural gas consumption for power generation, industrial applications, and residential use. The region’s growing population, expanding industrial base, and rising living standards contribute to sustained demand growth, requiring continuous pipeline infrastructure expansion to meet consumption needs. Power generation sector demand alone accounts for approximately 55% of regional natural gas consumption.

Export opportunities drive substantial pipeline infrastructure investment, as Middle Eastern countries seek to monetize their natural gas resources through international trade. Growing global demand for cleaner energy sources positions natural gas as an attractive export commodity, encouraging the development of pipeline connections to international markets and export terminals. Regional governments actively promote natural gas exports as part of economic diversification strategies.

Industrial development initiatives across the Middle East create additional demand for natural gas transportation infrastructure. The expansion of petrochemical complexes, steel production facilities, and other energy-intensive industries requires reliable natural gas supply systems, driving pipeline network development in industrial zones and economic development areas.

Geopolitical challenges represent significant restraints affecting the Middle East gas pipeline infrastructure market, with regional tensions, sanctions, and political instability creating uncertainties that can delay or complicate pipeline projects. Cross-border pipeline development faces particular challenges due to diplomatic relations, security concerns, and regulatory complexities that may impact project timelines and investment decisions.

High capital requirements for pipeline infrastructure development create barriers to market entry and project implementation. The substantial upfront investments required for pipeline construction, including materials, labor, technology, and regulatory compliance costs, can strain financial resources and limit the number of viable projects. Economic volatility and fluctuating energy prices add additional financial risk considerations.

Environmental regulations and sustainability requirements increasingly influence pipeline development, with stricter environmental standards, emission reduction targets, and ecological protection measures adding complexity and costs to infrastructure projects. Compliance with international environmental standards and local regulations requires additional investment in environmental protection measures and monitoring systems.

Technical challenges associated with pipeline construction in challenging geographical conditions, including desert environments, mountainous terrain, and offshore locations, increase project complexity and costs. Extreme weather conditions, corrosive environments, and geological challenges require specialized engineering solutions and advanced materials, impacting project feasibility and economics.

Regional integration initiatives present substantial opportunities for Middle East gas pipeline infrastructure development, with various cooperation frameworks and economic partnerships facilitating cross-border pipeline projects. The development of integrated regional gas networks can enhance energy security, optimize resource utilization, and create new revenue streams for participating countries.

Technology advancement opportunities enable the implementation of smart pipeline systems, advanced monitoring technologies, and digital infrastructure management solutions. These technological improvements can enhance operational efficiency, reduce maintenance costs, improve safety performance, and extend pipeline lifespan. The adoption of artificial intelligence and IoT technologies creates opportunities for predictive maintenance and optimized operations.

Export market expansion offers significant growth opportunities as global demand for natural gas continues to increase, particularly in Asia and Europe. The development of new export routes, including pipeline connections to international markets and supply agreements with major consumers, can drive substantial infrastructure investment and create long-term revenue opportunities.

Energy transition support positions natural gas pipeline infrastructure as essential for regional energy transition strategies, with natural gas serving as a bridge fuel supporting renewable energy integration and carbon emission reduction goals. This strategic positioning creates opportunities for continued investment in pipeline infrastructure as part of comprehensive energy system development.

Supply and demand dynamics in the Middle East gas pipeline infrastructure market reflect the complex interplay between natural gas production capabilities, consumption patterns, and transportation requirements. The region’s substantial production capacity, growing at approximately 4.8% annually, drives continuous demand for enhanced transportation infrastructure to connect production sites with consumption centers and export facilities.

Competitive dynamics involve multiple stakeholders including national oil companies, international energy corporations, pipeline construction companies, and technology providers. Market participants compete on factors including technical capabilities, project execution expertise, cost efficiency, and technological innovation. Strategic partnerships and joint ventures are common approaches to managing project risks and accessing specialized capabilities.

Regulatory dynamics significantly influence market development, with government policies, environmental regulations, and international agreements shaping pipeline infrastructure investment decisions. Regulatory frameworks continue to evolve, incorporating sustainability requirements, safety standards, and cross-border cooperation mechanisms that impact project planning and implementation strategies.

Economic dynamics reflect the relationship between energy prices, infrastructure investment costs, and project economics. Natural gas price volatility, construction cost fluctuations, and financing conditions influence project viability and investment timing decisions. Long-term supply contracts and government support mechanisms help stabilize project economics and facilitate infrastructure development.

Comprehensive research approach employed in analyzing the Middle East gas pipeline infrastructure market incorporates multiple data sources, analytical methods, and validation techniques to ensure accuracy and reliability of market insights. The methodology combines quantitative analysis of market data with qualitative assessment of industry trends, regulatory developments, and strategic initiatives.

Primary research activities include structured interviews with industry executives, government officials, technical experts, and market participants to gather firsthand insights on market conditions, challenges, and opportunities. Survey methodologies capture quantitative data on market trends, investment plans, and operational performance metrics from key stakeholders across the value chain.

Secondary research sources encompass government publications, industry reports, regulatory filings, company announcements, and technical literature to provide comprehensive market coverage and historical context. Data validation processes ensure consistency and accuracy across multiple information sources, with cross-referencing and verification procedures maintaining research quality standards.

Analytical frameworks utilize statistical modeling, trend analysis, and scenario planning techniques to develop market projections and identify key success factors. The research methodology incorporates regional analysis, competitive assessment, and technology evaluation to provide comprehensive market understanding and strategic insights for industry participants and stakeholders.

Gulf Cooperation Council countries dominate the Middle East gas pipeline infrastructure market, with Qatar, Saudi Arabia, and the UAE leading in terms of pipeline network development and natural gas transportation capacity. These countries benefit from substantial natural gas reserves, advanced infrastructure, and strong government support for energy sector development. Qatar’s pipeline network supports both domestic consumption and LNG export operations, while Saudi Arabia focuses on expanding pipeline infrastructure to support industrial development and power generation needs.

Iran’s pipeline infrastructure represents one of the most extensive networks in the region, connecting major production areas with domestic consumption centers and potential export routes. The country’s strategic location provides opportunities for transit pipeline development, connecting Central Asian gas supplies with regional and international markets. Iran’s pipeline network accounts for approximately 28% of regional pipeline capacity.

Iraq and Kuwait are expanding their pipeline infrastructure to support growing domestic demand and export potential. Iraq’s pipeline development focuses on connecting southern gas fields with northern consumption centers and potential export routes. Kuwait’s infrastructure expansion supports industrial development and power generation requirements, with cross-border connections enhancing regional energy integration.

Eastern Mediterranean developments include pipeline projects connecting regional gas discoveries with consumption centers and export facilities. Countries including Israel, Cyprus, and Lebanon are developing pipeline infrastructure to monetize offshore gas discoveries and enhance energy security. These developments create opportunities for regional cooperation and energy trade facilitation.

Market leadership in the Middle East gas pipeline infrastructure sector involves a diverse range of participants, from national oil companies to international engineering and construction firms. The competitive landscape reflects the complex nature of pipeline infrastructure development, requiring specialized technical capabilities, substantial financial resources, and extensive project management expertise.

Strategic partnerships and joint ventures are common in the market, enabling participants to combine technical expertise, financial resources, and local market knowledge. International companies often partner with regional entities to access local markets and navigate regulatory requirements, while regional companies benefit from advanced technology and project management capabilities.

By Pipeline Type: The Middle East gas pipeline infrastructure market segments into transmission pipelines, distribution pipelines, and gathering pipelines, each serving specific functions within the overall transportation network. Transmission pipelines represent the largest segment, accounting for approximately 65% of total pipeline infrastructure investment, due to their high-capacity, long-distance transportation capabilities.

By Application: Market segmentation by application includes domestic supply, industrial supply, power generation, and export transportation. Power generation applications dominate demand, driven by the region’s growing electricity needs and natural gas-fired power plant development. Industrial applications, particularly petrochemical and manufacturing sectors, represent significant growth opportunities.

By Material: Pipeline infrastructure utilizes various materials including carbon steel, stainless steel, and composite materials, with carbon steel dominating due to cost-effectiveness and proven performance. Advanced materials gain market share in challenging environments and high-pressure applications, offering enhanced durability and corrosion resistance.

By Diameter: Pipeline diameter segmentation ranges from small-diameter distribution lines to large-diameter transmission pipelines. Large-diameter pipelines (above 36 inches) represent the highest value segment, supporting high-volume transportation requirements for major supply routes and export connections.

Transmission Pipeline Category dominates the market landscape, representing the backbone of regional gas transportation networks. These high-pressure, large-diameter pipelines transport natural gas over long distances from production areas to distribution centers, industrial facilities, and export terminals. The transmission category benefits from substantial government investment and strategic importance in energy security planning.

Distribution Pipeline Category focuses on medium-pressure systems that deliver natural gas from transmission networks to end-users including residential, commercial, and small industrial consumers. This category experiences steady growth driven by urbanization, population growth, and increasing natural gas adoption for heating, cooking, and commercial applications.

Offshore Pipeline Category represents a specialized segment connecting offshore gas fields with onshore processing facilities and transportation networks. This category requires advanced engineering capabilities, specialized materials, and sophisticated installation techniques, commanding premium pricing and attracting specialized service providers.

Cross-border Pipeline Category encompasses international pipeline connections that facilitate regional energy trade and cooperation. This category faces unique challenges including diplomatic considerations, regulatory complexity, and security requirements, but offers significant strategic and economic benefits for participating countries.

Energy Security Enhancement represents a primary benefit for regional governments and consumers, with robust pipeline infrastructure ensuring reliable natural gas supply for power generation, industrial operations, and residential use. Diversified pipeline networks reduce supply risks and enhance energy system resilience against disruptions or geopolitical challenges.

Economic Development Opportunities arise from pipeline infrastructure investment, creating employment opportunities, supporting local industries, and attracting foreign investment. Pipeline projects generate substantial economic activity during construction phases and provide long-term operational employment, contributing to regional economic diversification and growth.

Revenue Generation Potential benefits resource-rich countries through natural gas monetization and export opportunities. Pipeline infrastructure enables efficient transportation of natural gas to high-value markets, maximizing resource value and generating foreign exchange earnings. Transit pipeline operations provide additional revenue streams for countries positioned along major transportation routes.

Environmental Benefits include reduced carbon emissions compared to alternative energy sources, improved air quality in urban areas, and support for renewable energy integration. Natural gas pipeline infrastructure facilitates the transition from higher-emission fuels while providing backup power generation capabilities for renewable energy systems.

Industrial Competitiveness improves through reliable, cost-effective natural gas supply for manufacturing, petrochemical production, and other industrial applications. Pipeline infrastructure reduces energy costs, enhances supply security, and supports industrial expansion and competitiveness in global markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation emerges as a dominant trend in Middle East gas pipeline infrastructure, with companies implementing advanced monitoring systems, predictive maintenance technologies, and automated control systems. These digital solutions enhance operational efficiency, reduce maintenance costs, and improve safety performance. The adoption rate of digital pipeline technologies has increased by approximately 35% over the past three years.

Sustainability Integration becomes increasingly important as regional governments and companies incorporate environmental considerations into pipeline infrastructure planning and operations. This trend includes the use of environmentally friendly materials, emission reduction technologies, and renewable energy integration for pipeline operations. MarkWide Research indicates that sustainability initiatives now influence over 70% of new pipeline projects in the region.

Modular Construction Approaches gain popularity as a method to reduce construction time, improve quality control, and minimize on-site risks. Prefabricated pipeline modules and standardized components enable faster project delivery and enhanced safety performance, particularly important in challenging geographical and security environments.

Cross-border Cooperation intensifies as regional countries recognize the benefits of integrated pipeline networks for energy security and economic development. Bilateral and multilateral agreements facilitate pipeline connections and create opportunities for energy trade and regional integration initiatives.

Major Infrastructure Projects continue to reshape the Middle East gas pipeline landscape, with several significant developments enhancing regional transportation capacity and connectivity. The completion of major transmission pipelines connecting production areas with consumption centers and export facilities demonstrates the sector’s continued expansion and strategic importance.

Technology Partnerships between regional companies and international technology providers accelerate the adoption of advanced pipeline technologies and digital solutions. These collaborations bring cutting-edge monitoring systems, advanced materials, and innovative construction techniques to regional pipeline projects, enhancing performance and reliability.

Regulatory Framework Evolution includes updated safety standards, environmental regulations, and cross-border cooperation mechanisms that facilitate pipeline development while ensuring operational safety and environmental protection. New regulatory frameworks streamline approval processes and provide clearer guidelines for international pipeline projects.

Investment Announcements from both government and private sector entities demonstrate continued confidence in the sector’s growth potential. Major investment commitments support pipeline network expansion, technology upgrades, and capacity enhancement projects across the region.

Strategic Focus Areas for market participants should prioritize technology integration, sustainability initiatives, and regional cooperation opportunities. Companies should invest in digital pipeline technologies, environmental protection measures, and cross-border partnership development to maintain competitive advantages and meet evolving market requirements.

Risk Management Strategies must address geopolitical uncertainties, regulatory changes, and market volatility through diversified project portfolios, flexible contract structures, and comprehensive insurance coverage. Effective risk management enables companies to navigate challenges while capitalizing on growth opportunities.

Investment Priorities should focus on high-impact projects that enhance energy security, support economic development, and provide long-term value creation. Priority areas include transmission pipeline expansion, cross-border connections, and technology upgrade initiatives that improve operational efficiency and environmental performance.

Partnership Development recommendations emphasize the importance of strategic alliances, joint ventures, and technology partnerships in accessing specialized capabilities, sharing project risks, and entering new markets. Successful partnerships combine complementary strengths and create synergistic value for all participants.

Long-term Growth Prospects for the Middle East gas pipeline infrastructure market remain positive, supported by abundant natural gas resources, growing regional demand, and expanding export opportunities. The market is projected to experience sustained growth at approximately 5.8% annually over the next decade, driven by continued infrastructure investment and regional integration initiatives.

Technology Evolution will continue transforming pipeline infrastructure operations, with artificial intelligence, IoT sensors, and advanced materials enhancing system performance and reliability. Smart pipeline technologies are expected to achieve 80% adoption rates among major regional operators within the next five years, according to MWR projections.

Regional Integration Acceleration is anticipated as countries recognize the strategic and economic benefits of interconnected pipeline networks. Cross-border pipeline projects and regional cooperation initiatives will likely expand, creating integrated energy transportation systems that enhance security and facilitate trade.

Sustainability Focus will intensify as environmental regulations become more stringent and companies prioritize carbon footprint reduction. Pipeline infrastructure development will increasingly incorporate environmental protection measures, renewable energy integration, and emission reduction technologies to meet evolving sustainability requirements.

Market transformation in the Middle East gas pipeline infrastructure sector reflects the dynamic interplay of abundant natural resources, growing energy demand, technological advancement, and regional cooperation initiatives. The sector demonstrates resilience and adaptability in addressing challenges while capitalizing on substantial growth opportunities across diverse market segments and applications.

Strategic importance of pipeline infrastructure continues to grow as regional countries prioritize energy security, economic diversification, and export revenue generation. The sector’s role in supporting industrial development, power generation, and international energy trade positions it as a critical component of regional economic development strategies and energy transition planning.

Future success in the Middle East gas pipeline infrastructure market will depend on effective technology integration, sustainable development practices, strategic partnerships, and adaptive risk management approaches. Companies that successfully navigate geopolitical complexities, embrace digital transformation, and prioritize environmental stewardship will be best positioned to capitalize on the sector’s substantial growth potential and contribute to regional energy security and economic prosperity.

What is Gas Pipeline Infrastructure?

Gas Pipeline Infrastructure refers to the network of pipelines and associated facilities used for the transportation of natural gas from production sites to consumers. This includes gathering systems, transmission pipelines, and distribution networks that ensure the efficient delivery of gas to various sectors such as residential, commercial, and industrial users.

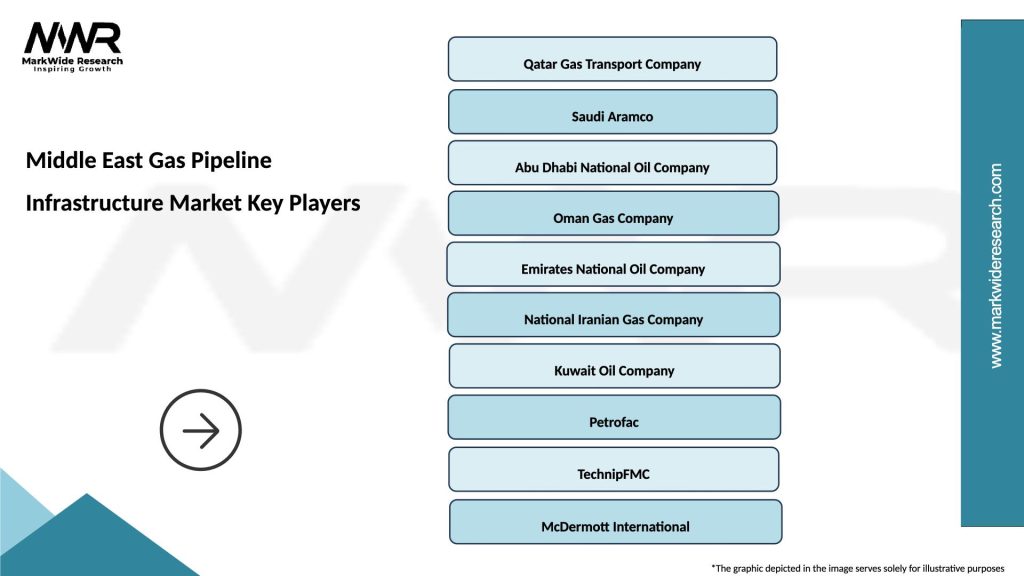

What are the key players in the Middle East Gas Pipeline Infrastructure Market?

Key players in the Middle East Gas Pipeline Infrastructure Market include companies like Qatar Gas, Abu Dhabi Gas Industries, and Saudi Aramco, which are involved in the development and operation of gas pipeline systems. These companies play a crucial role in enhancing the region’s energy security and supply chain efficiency, among others.

What are the main drivers of the Middle East Gas Pipeline Infrastructure Market?

The main drivers of the Middle East Gas Pipeline Infrastructure Market include the increasing demand for natural gas in power generation and industrial applications, as well as the need for energy diversification in the region. Additionally, government initiatives to enhance energy infrastructure and attract foreign investment are also significant growth factors.

What challenges does the Middle East Gas Pipeline Infrastructure Market face?

The Middle East Gas Pipeline Infrastructure Market faces challenges such as geopolitical tensions that can disrupt supply routes, regulatory hurdles that may delay project approvals, and environmental concerns related to pipeline construction and operation. These factors can impact the overall development and reliability of gas infrastructure.

What opportunities exist in the Middle East Gas Pipeline Infrastructure Market?

Opportunities in the Middle East Gas Pipeline Infrastructure Market include the potential for cross-border pipeline projects that enhance regional connectivity and energy trade. Additionally, advancements in pipeline technology and the integration of renewable energy sources present avenues for innovation and growth in the sector.

What trends are shaping the Middle East Gas Pipeline Infrastructure Market?

Trends shaping the Middle East Gas Pipeline Infrastructure Market include the increasing adoption of digital technologies for pipeline monitoring and management, as well as a shift towards more sustainable practices in gas transportation. Furthermore, the focus on reducing carbon emissions is driving investments in cleaner gas technologies and infrastructure upgrades.

Middle East Gas Pipeline Infrastructure Market

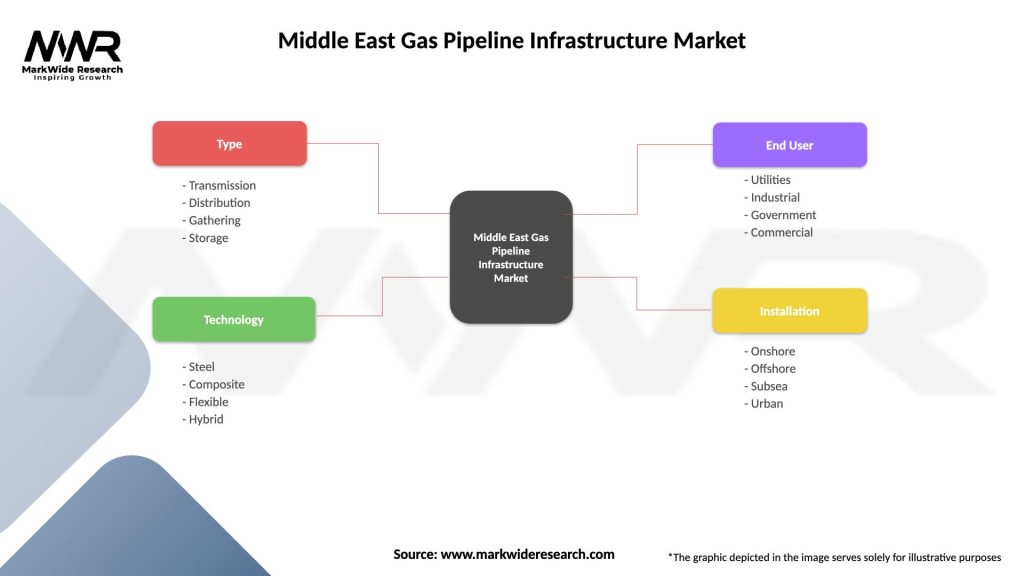

| Segmentation Details | Description |

|---|---|

| Type | Transmission, Distribution, Gathering, Storage |

| Technology | Steel, Composite, Flexible, Hybrid |

| End User | Utilities, Industrial, Government, Commercial |

| Installation | Onshore, Offshore, Subsea, Urban |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Gas Pipeline Infrastructure Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at