444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Middle East Financial Planning Software Market stands at the forefront of the region’s technological landscape, providing essential tools and solutions for individuals and businesses to optimize their financial strategies. This comprehensive overview delves into the dynamics, challenges, and opportunities shaping the market.

Meaning: Financial planning software encompasses a range of digital tools designed to assist individuals, businesses, and financial professionals in managing their finances, investments, and overall financial well-being. In the Middle East, the adoption of financial planning software is gaining traction as a strategic approach to achieve fiscal goals and navigate complex financial landscapes.

Executive Summary: The Middle East Financial Planning Software Market is experiencing notable growth, fueled by the region’s increasing focus on financial literacy, the growing sophistication of financial services, and the rising demand for personalized financial solutions. This market offers a diverse range of software applications designed to empower users in making informed financial decisions.

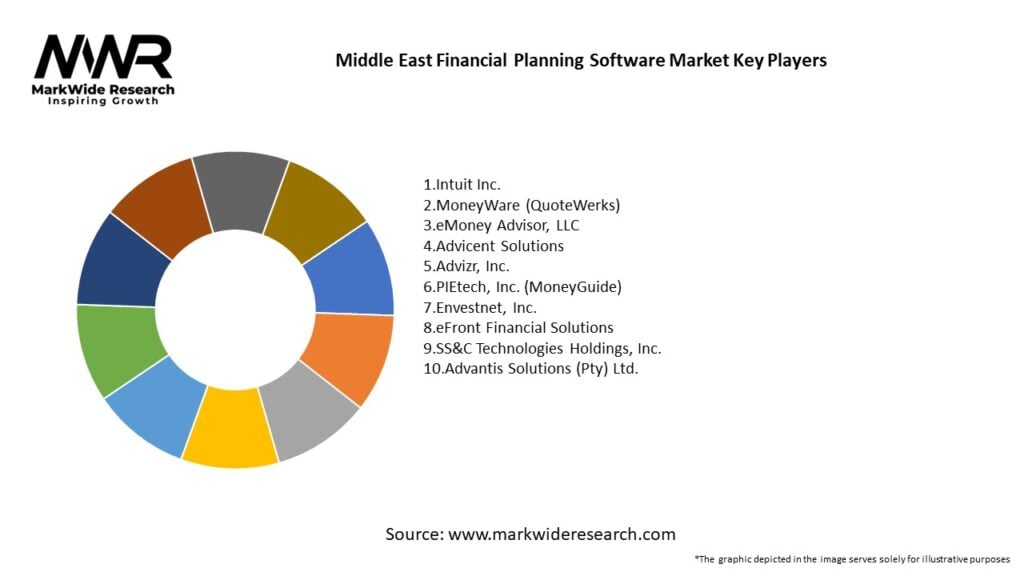

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Middle East Financial Planning Software Market operates within a dynamic environment influenced by factors such as technological advancements, regulatory changes, user preferences, and market competition. Understanding and adapting to these dynamics are critical for both software developers and end-users.

Regional Analysis: A comprehensive regional analysis of the Middle East Financial Planning Software Market explores variations in user demographics, regulatory landscapes, and financial preferences across different countries in the region. This analysis provides insights into localized market trends and user behaviors.

Competitive Landscape:

Leading Companies in Middle East Financial Planning Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: Segmentation of the financial planning software market in the Middle East can be based on factors such as user type (individuals, businesses, financial professionals), features (budgeting, investment planning, retirement planning), and deployment models (cloud-based, on-premises).

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides an overview of the strengths, weaknesses, opportunities, and threats facing participants in the Middle East Financial Planning Software Market.

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has accelerated the digital transformation of financial services in the Middle East, including the adoption of financial planning software. Remote work, changing economic conditions, and a heightened focus on financial resilience have driven increased interest in these tools.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Middle East Financial Planning Software Market is optimistic, with sustained growth expected as digital adoption continues to expand. The integration of advanced technologies, collaboration with financial institutions, and a focus on user education will shape the trajectory of the market.

Conclusion: In conclusion, the Middle East Financial Planning Software Market is positioned at the intersection of technological innovation and financial empowerment. As individuals and businesses in the region recognize the value of proactive financial planning, the market is poised for continued growth. Strategic investments in security, customization, and collaboration will be instrumental in ensuring the success of financial planning software in the Middle East.

Middle East Financial Planning Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | Cloud, On-premise, Hybrid, SaaS |

| Solution | Budgeting, Forecasting, Risk Management, Compliance |

| End User | Banks, Insurance Companies, Investment Firms, Wealth Managers |

| Application | Portfolio Management, Tax Planning, Estate Planning, Retirement Planning |

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at