444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East energy drinks market represents one of the most dynamic and rapidly expanding beverage segments across the region, driven by changing consumer lifestyles, urbanization trends, and increasing health consciousness among younger demographics. This vibrant market encompasses countries including the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain, and other Gulf Cooperation Council nations, each contributing unique consumption patterns and growth opportunities.

Market dynamics in the Middle East energy drinks sector reflect a compelling blend of traditional beverage preferences and modern lifestyle demands. The region’s young population, with approximately 65% of residents under 35 years, drives substantial demand for functional beverages that provide energy enhancement and performance benefits. Urban centers like Dubai, Riyadh, and Doha serve as key consumption hubs, where busy lifestyles and extended working hours fuel the need for convenient energy solutions.

Growth trajectories across the Middle East energy drinks market demonstrate remarkable resilience and expansion potential, with the sector experiencing consistent annual growth rates exceeding 8.5% in recent years. This growth stems from multiple factors including rising disposable incomes, expanding retail infrastructure, and increasing awareness of functional beverage benefits among health-conscious consumers.

Regional variations within the Middle East energy drinks market showcase diverse consumption patterns, with the UAE and Saudi Arabia leading market penetration rates, while emerging markets like Oman and Bahrain present significant untapped potential for brand expansion and market development initiatives.

The Middle East energy drinks market refers to the comprehensive ecosystem of functional beverage products specifically formulated to provide energy enhancement, mental alertness, and physical performance benefits to consumers across Middle Eastern countries. These beverages typically contain caffeine, taurine, B-vitamins, and other performance-enhancing ingredients designed to combat fatigue and boost cognitive function.

Energy drinks in the Middle Eastern context encompass various product categories including traditional caffeinated beverages, natural energy formulations, sugar-free alternatives, and culturally adapted flavors that resonate with local taste preferences. The market includes both international brands and regional manufacturers who cater to specific cultural and dietary requirements prevalent in Middle Eastern societies.

Functional characteristics of energy drinks in this market extend beyond basic energy provision to include hydration benefits, vitamin supplementation, and performance optimization features that appeal to athletes, professionals, and active lifestyle enthusiasts throughout the region.

Strategic positioning within the Middle East energy drinks market reveals a sector characterized by robust growth potential, evolving consumer preferences, and increasing market sophistication. The region’s unique demographic profile, featuring a predominantly young population with rising disposable incomes, creates favorable conditions for sustained market expansion and product innovation.

Key market drivers include urbanization trends affecting approximately 85% of the regional population, changing work patterns that demand sustained energy levels, and growing health awareness that drives demand for functional beverages with added nutritional benefits. These factors combine to create a compelling value proposition for energy drink manufacturers and distributors operating in Middle Eastern markets.

Competitive dynamics showcase a mix of established international brands and emerging regional players, each competing for market share through product differentiation, cultural adaptation, and strategic distribution partnerships. The market demonstrates particular strength in premium segments, where consumers show willingness to pay higher prices for quality ingredients and brand reputation.

Future prospects for the Middle East energy drinks market appear exceptionally promising, with projected growth rates maintaining momentum above 7% annually through the forecast period, supported by continued economic development, infrastructure expansion, and evolving consumer lifestyle patterns across the region.

Consumer behavior analysis reveals distinct preferences and consumption patterns that differentiate the Middle East energy drinks market from other global regions. Understanding these insights provides crucial guidance for market participants seeking to optimize their strategies and capture emerging opportunities.

Urbanization trends across the Middle East create fundamental demand drivers for energy drinks, as city-dwelling populations adopt faster-paced lifestyles that require sustained energy levels throughout extended working days. Modern urban centers in the region feature demanding work environments, longer commutes, and active social schedules that increase reliance on functional beverages for energy maintenance.

Economic prosperity in key Middle Eastern markets translates to higher disposable incomes and increased spending on premium beverage categories. Rising affluence enables consumers to prioritize quality and functionality over price considerations, creating opportunities for premium energy drink brands to establish strong market positions and build loyal customer bases.

Fitness culture expansion throughout the region drives significant demand for pre-workout and post-exercise energy solutions. Growing gym memberships, increasing participation in sports activities, and rising health awareness contribute to sustained market growth, with fitness enthusiasts representing a highly engaged and loyal consumer segment.

Youth demographics provide a substantial foundation for market expansion, as younger consumers demonstrate higher acceptance of functional beverages and willingness to experiment with new products. This demographic trend, combined with increasing purchasing power among young professionals, creates favorable long-term growth prospects for the energy drinks sector.

Retail infrastructure development enhances product accessibility and market penetration across both urban and emerging regional markets. Expanding convenience store networks, modern hypermarket chains, and e-commerce platforms provide multiple touchpoints for consumer engagement and purchase conversion.

Regulatory challenges present significant constraints for energy drink manufacturers operating in Middle Eastern markets, as governments implement stricter guidelines regarding caffeine content, health claims, and marketing practices. These regulatory frameworks require substantial compliance investments and may limit product formulation flexibility for international brands entering regional markets.

Cultural sensitivities surrounding certain ingredients and marketing approaches create barriers for some energy drink products, particularly those containing ingredients that conflict with local dietary customs or religious practices. Manufacturers must navigate these cultural considerations carefully to avoid market rejection and ensure sustainable growth.

Health concerns related to excessive caffeine consumption and sugar content generate consumer hesitation and regulatory scrutiny, potentially limiting market expansion among health-conscious segments. These concerns require proactive industry responses through product reformulation and educational marketing initiatives.

Price volatility in raw materials and packaging components affects profit margins and pricing strategies, particularly for manufacturers operating in multiple regional markets with varying economic conditions. Currency fluctuations and import dependencies add additional complexity to cost management efforts.

Competition intensity from both international brands and local manufacturers creates pricing pressure and requires substantial marketing investments to maintain market share and brand visibility in increasingly crowded retail environments.

Product innovation presents substantial opportunities for market expansion through development of culturally adapted formulations, natural ingredient alternatives, and functional benefits that address specific regional health and wellness priorities. Manufacturers who successfully innovate while respecting local preferences can capture significant market share and establish competitive advantages.

E-commerce expansion offers new distribution channels and direct consumer engagement opportunities, particularly among tech-savvy younger demographics who prefer online shopping convenience. Digital platforms enable targeted marketing, subscription services, and personalized product recommendations that enhance customer loyalty and lifetime value.

Partnership opportunities with local distributors, fitness centers, and lifestyle brands create synergistic marketing approaches and expanded market reach. Strategic alliances can accelerate market penetration while reducing entry barriers and operational complexities for international manufacturers.

Emerging market penetration in secondary cities and developing regions within the Middle East provides growth opportunities as infrastructure development and economic prosperity expand beyond primary urban centers. These markets often feature less competitive intensity and higher growth potential for early entrants.

Functional positioning beyond basic energy provision, including cognitive enhancement, stress management, and immune support benefits, appeals to health-conscious consumers seeking comprehensive wellness solutions. This positioning strategy can command premium pricing and build stronger brand differentiation.

Supply chain evolution in the Middle East energy drinks market reflects increasing sophistication and efficiency improvements that benefit both manufacturers and consumers. Regional distribution networks have expanded significantly, with 45% improvement in delivery efficiency over recent years, enabling better product availability and fresher inventory management across diverse geographic markets.

Consumer engagement patterns demonstrate shifting preferences toward digital interaction and social media influence, with approximately 78% of energy drink consumers researching products online before purchase decisions. This digital transformation creates new marketing opportunities while requiring brands to maintain consistent messaging across multiple touchpoints and platforms.

Competitive positioning strategies increasingly focus on differentiation through ingredient transparency, sustainability initiatives, and community engagement programs that resonate with socially conscious consumers. Brands that successfully communicate authentic values and demonstrate genuine commitment to regional development achieve stronger market positions and customer loyalty.

Pricing dynamics reflect market maturation and consumer sophistication, with premium segments showing resilience despite economic fluctuations. Value-conscious consumers still represent significant market segments, but willingness to pay for quality and functionality continues to support profitable growth strategies for well-positioned brands.

Comprehensive market analysis for the Middle East energy drinks sector employs multiple research methodologies to ensure accurate data collection and reliable market insights. Primary research initiatives include consumer surveys, retailer interviews, and industry expert consultations that provide firsthand perspectives on market trends and competitive dynamics.

Secondary research components encompass analysis of industry publications, regulatory filings, company financial reports, and trade association data that offer quantitative insights into market performance and growth trajectories. This multi-source approach ensures comprehensive coverage of market factors and reduces potential bias in data interpretation.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis techniques to identify trends and patterns. These validation steps enhance the reliability and accuracy of market projections and strategic recommendations.

Geographic coverage extends across all major Middle Eastern markets, with particular focus on high-growth regions and emerging market opportunities. Country-specific analysis considers local economic conditions, cultural factors, and regulatory environments that influence market development and competitive positioning.

United Arab Emirates leads the Middle East energy drinks market with the highest per-capita consumption rates and most developed retail infrastructure. The UAE market benefits from diverse expatriate populations, strong tourism sectors, and progressive regulatory frameworks that support product innovation and market entry. Dubai and Abu Dhabi serve as primary consumption centers, with 42% of regional market share concentrated in these urban areas.

Saudi Arabia represents the largest market by volume, driven by its substantial population base and growing economic diversification initiatives. The Kingdom’s Vision 2030 program promotes lifestyle changes and increased consumer spending that benefit functional beverage categories. Riyadh and Jeddah demonstrate particularly strong growth potential, with expanding retail networks and rising disposable incomes supporting market expansion.

Qatar and Kuwait showcase premium market characteristics, with consumers demonstrating willingness to pay higher prices for quality products and innovative formulations. These markets feature high GDP per capita levels and sophisticated consumer preferences that favor established international brands and premium positioning strategies.

Emerging markets including Oman and Bahrain present significant growth opportunities as economic development accelerates and retail infrastructure expands. These markets currently represent approximately 18% of regional consumption but demonstrate above-average growth rates that suggest substantial future potential for market participants.

Market leadership in the Middle East energy drinks sector features a combination of established international brands and emerging regional players, each competing through different strategies and value propositions. The competitive environment continues to evolve as new entrants introduce innovative products and marketing approaches.

Competitive strategies increasingly emphasize digital marketing, influencer partnerships, and experiential marketing events that create emotional connections with target consumers. Successful brands invest heavily in understanding local market nuances and adapting their approaches accordingly.

Product segmentation within the Middle East energy drinks market reveals distinct categories that serve different consumer needs and preferences. Understanding these segments enables manufacturers to develop targeted strategies and optimize their product portfolios for maximum market impact.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Traditional energy drinks continue to dominate market share with approximately 58% of total consumption, driven by established brand recognition and consistent product availability. These products benefit from widespread distribution networks and proven formulations that deliver reliable energy enhancement effects for mainstream consumers.

Natural and organic segments demonstrate the fastest growth rates, reflecting increasing health consciousness among Middle Eastern consumers. These products command premium pricing but attract loyal customer bases willing to pay higher prices for perceived health benefits and ingredient transparency.

Sugar-free alternatives gain traction among fitness-oriented consumers and individuals managing dietary restrictions. This category benefits from growing awareness of sugar-related health concerns and increasing adoption of low-carbohydrate lifestyle approaches across the region.

Functional beverages with enhanced nutritional profiles appeal to consumers seeking comprehensive wellness solutions beyond basic energy provision. These products often feature additional vitamins, minerals, and specialized ingredients that support cognitive function, immune health, and physical performance.

Cultural adaptations including halal-certified products and regionally preferred flavors demonstrate strong performance in local markets. Manufacturers who invest in understanding and respecting cultural preferences achieve higher market acceptance and sustainable growth trajectories.

Manufacturers operating in the Middle East energy drinks market benefit from robust demand growth, premium pricing opportunities, and expanding distribution networks that support sustainable revenue growth and market expansion initiatives. The region’s young demographics and rising disposable incomes create favorable conditions for long-term business development.

Retailers gain from high-margin product categories that generate strong customer traffic and impulse purchase behavior. Energy drinks typically feature attractive profit margins and fast inventory turnover rates that contribute positively to overall store performance and customer satisfaction metrics.

Distributors benefit from growing market demand and expanding geographic coverage requirements that create opportunities for service expansion and relationship building with both suppliers and retail partners. The complexity of regional distribution networks provides competitive advantages for established logistics providers.

Consumers enjoy increasing product variety, improved formulations, and competitive pricing that result from healthy market competition and innovation initiatives. Access to functional beverages that support active lifestyles and demanding work schedules provides tangible lifestyle benefits.

Economic stakeholders including governments and development agencies benefit from job creation, tax revenue generation, and foreign investment attraction that result from vibrant energy drinks market activity. The sector contributes to economic diversification and modernization objectives across the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health-conscious formulations represent the most significant trend shaping the Middle East energy drinks market, with consumers increasingly demanding products that provide energy enhancement without compromising health objectives. This trend drives innovation in natural ingredients, reduced sugar content, and functional additives that support overall wellness.

Digital engagement strategies transform how brands connect with consumers, utilizing social media platforms, influencer partnerships, and interactive marketing campaigns that resonate with tech-savvy younger demographics. Successful brands invest heavily in digital presence and community building initiatives.

Sustainability initiatives gain importance as environmentally conscious consumers seek brands that demonstrate commitment to responsible business practices. Packaging innovations, carbon footprint reduction, and community development programs become key differentiators in competitive markets.

Personalization trends emerge as consumers seek products tailored to their specific needs, preferences, and lifestyle requirements. This trend creates opportunities for customized formulations, targeted marketing approaches, and niche product development strategies.

Premium positioning continues to gain traction as affluent consumers demonstrate willingness to pay higher prices for quality ingredients, innovative formulations, and superior brand experiences. This trend supports margin improvement and brand building initiatives for market leaders.

Product launches featuring innovative formulations and culturally adapted flavors demonstrate industry commitment to meeting evolving consumer preferences. Recent introductions include natural energy drinks with regional fruit flavors and sugar-free options with enhanced vitamin content that appeal to health-conscious demographics.

Distribution partnerships between international brands and regional distributors expand market reach and improve product availability across diverse geographic markets. These strategic alliances combine global expertise with local market knowledge to accelerate growth and market penetration.

Manufacturing investments in regional production facilities reduce costs, improve supply chain efficiency, and demonstrate long-term commitment to Middle Eastern markets. Local manufacturing capabilities also enable faster response to market demands and regulatory requirements.

Marketing innovations including experiential campaigns, sports sponsorships, and digital engagement initiatives create stronger brand connections with target consumers. Successful campaigns often incorporate cultural elements and local influencers to enhance authenticity and market relevance.

Regulatory adaptations by industry participants ensure compliance with evolving government guidelines while maintaining product efficacy and consumer appeal. Proactive regulatory engagement helps shape policy development and creates competitive advantages for compliant manufacturers.

Market entry strategies should prioritize cultural adaptation and local partnership development to ensure successful penetration of Middle Eastern markets. MarkWide Research analysis indicates that brands investing in regional customization achieve 35% higher market acceptance rates compared to standardized international approaches.

Product development initiatives should focus on health-conscious formulations that address growing consumer concerns about sugar content and artificial ingredients. Natural alternatives and functional benefits beyond basic energy provision create opportunities for premium positioning and margin improvement.

Distribution optimization requires multi-channel approaches that combine traditional retail networks with emerging e-commerce platforms and direct-to-consumer sales models. Successful brands maintain presence across all relevant channels while optimizing resource allocation based on channel performance and consumer preferences.

Marketing investments should emphasize digital engagement and community building initiatives that resonate with younger demographics. Social media presence, influencer partnerships, and experiential marketing events generate higher return on investment compared to traditional advertising approaches.

Regulatory compliance demands proactive engagement with government agencies and industry associations to ensure adherence to evolving guidelines while advocating for reasonable regulatory frameworks that support industry growth and innovation.

Growth projections for the Middle East energy drinks market remain highly optimistic, with industry analysts expecting sustained expansion driven by favorable demographic trends, economic development, and evolving consumer preferences. The market is positioned to maintain annual growth rates above 8% through the forecast period, supported by continued urbanization and lifestyle modernization across the region.

Innovation opportunities will likely focus on health-conscious formulations, sustainable packaging solutions, and personalized product offerings that address specific consumer needs and preferences. Manufacturers who successfully balance functionality with health considerations will capture the largest share of future market growth.

Market expansion into emerging regional markets and secondary cities presents significant opportunities for established brands and new entrants alike. As infrastructure development continues and economic prosperity spreads beyond primary urban centers, market penetration opportunities will multiply substantially.

Digital transformation will reshape how brands engage with consumers, distribute products, and gather market intelligence. E-commerce platforms, subscription services, and direct-to-consumer models will become increasingly important components of successful market strategies.

Regulatory evolution will likely focus on health and safety standards while supporting industry growth and innovation. Manufacturers who proactively engage with regulatory development and maintain high compliance standards will be best positioned for long-term success in evolving market conditions.

The Middle East energy drinks market represents a compelling growth opportunity characterized by favorable demographics, rising economic prosperity, and evolving consumer preferences that support sustained market expansion. The region’s young population base, increasing urbanization, and growing health consciousness create ideal conditions for functional beverage categories to thrive and capture significant market share.

Strategic success in this dynamic market requires careful attention to cultural adaptation, regulatory compliance, and consumer engagement strategies that resonate with local preferences while delivering genuine functional benefits. Manufacturers who invest in understanding regional nuances and building authentic brand connections will achieve the strongest competitive positions and sustainable growth trajectories.

Future prospects remain exceptionally positive, with multiple growth drivers supporting continued market expansion and innovation opportunities. The combination of demographic advantages, economic development, and infrastructure improvements creates a foundation for long-term industry success and stakeholder value creation throughout the Middle East energy drinks market.

What is Energy Drinks?

Energy drinks are beverages that contain stimulants, primarily caffeine, along with other ingredients such as vitamins, amino acids, and herbal extracts, designed to boost energy and alertness.

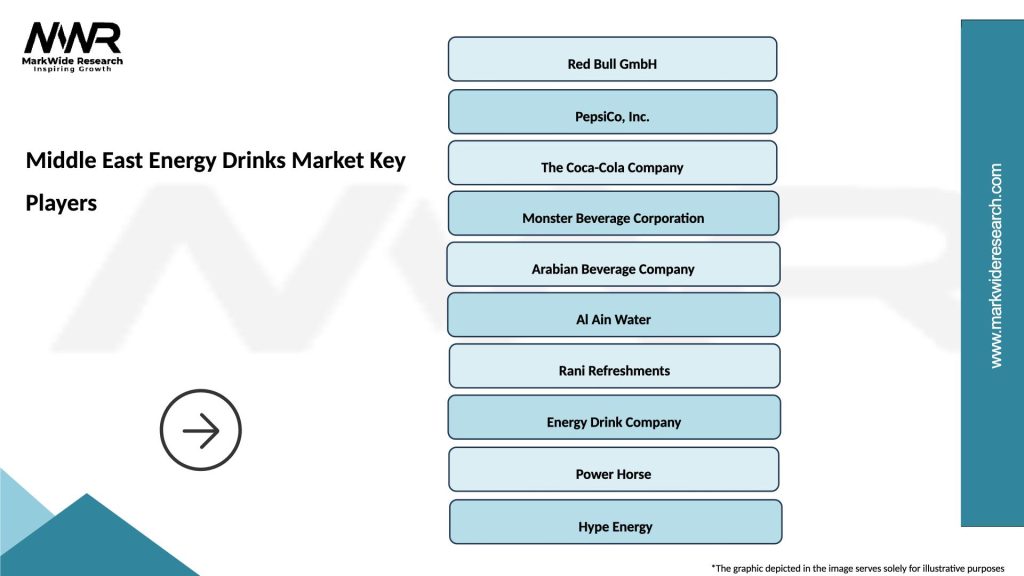

What are the key players in the Middle East Energy Drinks Market?

Key players in the Middle East Energy Drinks Market include Red Bull, Monster Beverage Corporation, PepsiCo, and Coca-Cola, among others.

What are the main drivers of growth in the Middle East Energy Drinks Market?

The growth of the Middle East Energy Drinks Market is driven by increasing consumer demand for functional beverages, a rising youth population, and the growing trend of fitness and active lifestyles.

What challenges does the Middle East Energy Drinks Market face?

The Middle East Energy Drinks Market faces challenges such as regulatory scrutiny regarding health claims, competition from alternative beverages, and concerns over the health effects of high caffeine consumption.

What opportunities exist in the Middle East Energy Drinks Market?

Opportunities in the Middle East Energy Drinks Market include the introduction of new flavors, the expansion of product lines targeting health-conscious consumers, and the potential for growth in e-commerce sales.

What trends are shaping the Middle East Energy Drinks Market?

Trends in the Middle East Energy Drinks Market include the rise of natural and organic energy drinks, the incorporation of functional ingredients like electrolytes, and the increasing popularity of low-sugar options.

Middle East Energy Drinks Market

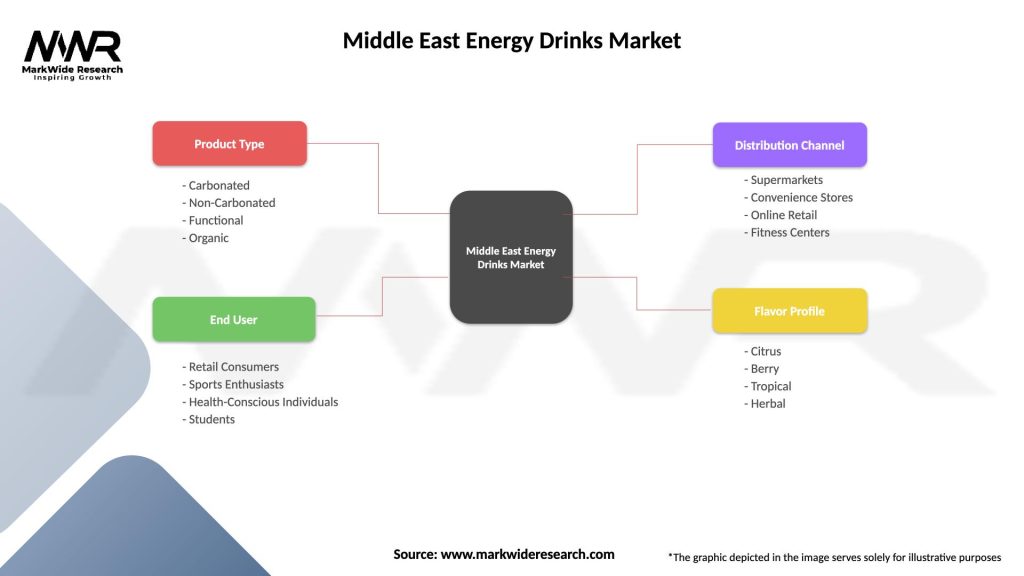

| Segmentation Details | Description |

|---|---|

| Product Type | Carbonated, Non-Carbonated, Functional, Organic |

| End User | Retail Consumers, Sports Enthusiasts, Health-Conscious Individuals, Students |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Fitness Centers |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Energy Drinks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at