444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East electric vegetable chopper market represents a rapidly evolving segment within the region’s kitchen appliance industry, driven by increasing urbanization, changing lifestyle patterns, and growing demand for convenient food preparation solutions. This market encompasses a diverse range of electric-powered devices designed to efficiently chop, dice, slice, and process various vegetables, catering to both residential and commercial applications across the Middle Eastern region.

Market dynamics indicate substantial growth potential, with the region experiencing a 12.5% annual growth rate in kitchen appliance adoption. The market benefits from rising disposable incomes, expanding middle-class populations, and increasing awareness of time-saving kitchen technologies. Consumer preferences are shifting toward automated food preparation solutions that combine efficiency with traditional cooking practices.

Regional characteristics play a crucial role in market development, with countries like the United Arab Emirates, Saudi Arabia, and Qatar leading adoption rates due to their cosmopolitan populations and high purchasing power. The market serves diverse consumer segments, from busy professionals seeking convenience to commercial establishments requiring efficient food preparation equipment. Technology integration continues to drive innovation, with manufacturers introducing smart features and enhanced safety mechanisms to meet evolving consumer expectations.

The Middle East electric vegetable chopper market refers to the commercial ecosystem encompassing the manufacturing, distribution, and sale of electric-powered vegetable processing appliances specifically designed for Middle Eastern consumers and businesses. These devices utilize motorized mechanisms to automate the cutting, chopping, and processing of vegetables, offering significant time savings and consistency compared to manual preparation methods.

Market scope includes various product categories ranging from compact residential units suitable for small kitchens to heavy-duty commercial models designed for restaurants, catering services, and food processing facilities. The market encompasses both standalone chopping devices and multifunctional food processors with specialized vegetable processing capabilities. Geographic coverage spans across Gulf Cooperation Council countries, Levant region, and North African territories within the Middle East classification.

Consumer segments include residential households, commercial kitchens, restaurants, hotels, catering companies, and food service establishments. The market addresses diverse cultural cooking requirements while incorporating modern convenience features that align with contemporary lifestyle demands across the region’s varied demographic landscape.

Market performance demonstrates robust expansion driven by urbanization trends and evolving consumer preferences toward kitchen automation. The Middle East electric vegetable chopper market benefits from strong economic fundamentals in key countries, supported by government initiatives promoting modern retail infrastructure and consumer goods accessibility.

Key growth drivers include increasing female workforce participation, which drives demand for time-saving kitchen appliances, and rising awareness of food safety and hygiene standards. The market experiences 65% adoption rate among urban households in major metropolitan areas, reflecting strong consumer acceptance of electric food preparation technologies.

Competitive landscape features both international brands and regional manufacturers competing across price segments and feature offerings. Market leaders focus on product innovation, after-sales service, and localized marketing strategies to capture market share. Distribution channels include traditional retail outlets, modern trade formats, e-commerce platforms, and specialized kitchen appliance stores.

Future prospects remain positive, supported by demographic trends, infrastructure development, and increasing consumer sophistication. The market benefits from growing food service industry, expanding retail networks, and rising consumer awareness of kitchen automation benefits.

Consumer behavior analysis reveals significant insights into purchasing patterns and product preferences across the Middle East region. The following key insights shape market development:

Market maturity varies significantly across different countries, with developed markets showing replacement-driven demand while emerging markets focus on first-time purchases. Consumer education plays a crucial role in market expansion, particularly in regions where traditional food preparation methods remain prevalent.

Urbanization trends serve as the primary catalyst for market growth, with rapid urban population expansion creating demand for convenient kitchen appliances. The shift from traditional extended family structures to nuclear families increases the need for efficient food preparation solutions that accommodate busy lifestyles.

Economic prosperity in key Middle Eastern countries drives consumer spending on home appliances and kitchen modernization. Rising disposable incomes enable households to invest in convenience appliances, while government initiatives supporting retail infrastructure development facilitate market access and product availability.

Lifestyle changes significantly impact market demand, particularly increasing female workforce participation and dual-income households. These demographic shifts create time constraints that drive adoption of labor-saving kitchen appliances. Cultural adaptation of modern cooking methods while maintaining traditional cuisine preparation supports market acceptance.

Health consciousness among consumers promotes demand for appliances that enable fresh vegetable preparation at home. Growing awareness of food safety and hygiene standards encourages investment in reliable food processing equipment. Convenience factors become increasingly important as consumers seek to balance traditional cooking practices with modern time constraints.

Technological advancement in product design and functionality attracts tech-savvy consumers who appreciate innovative features and smart connectivity options. Enhanced safety mechanisms and user-friendly interfaces broaden the appeal across different age groups and technical comfort levels.

Cultural resistance to automated food preparation methods poses challenges in certain market segments where traditional manual preparation is deeply ingrained. Some consumers perceive electric choppers as compromising the authenticity of traditional cooking practices, limiting adoption rates in conservative demographics.

Economic volatility in certain Middle Eastern countries affects consumer spending on non-essential appliances. Fluctuating oil prices and economic uncertainties can impact discretionary spending, particularly in markets heavily dependent on oil revenues. Currency fluctuations affect imported product pricing, creating affordability challenges for price-sensitive consumers.

Infrastructure limitations in some regions, including inconsistent electricity supply and limited retail distribution networks, constrain market penetration. Rural areas often lack adequate electrical infrastructure or access to modern retail channels, limiting product availability and adoption.

Maintenance concerns regarding electric appliances in regions with limited after-sales service networks create hesitation among potential buyers. Consumers worry about repair costs and service availability, particularly for international brands with limited local presence. Product durability expectations remain high due to harsh operating conditions in some Middle Eastern climates.

Competition from alternatives includes both manual chopping tools and multifunctional food processors that may offer better value propositions. Some consumers prefer versatile appliances over specialized single-function devices, affecting dedicated vegetable chopper sales.

E-commerce expansion presents significant growth opportunities as online retail infrastructure develops across the Middle East. Digital platforms enable manufacturers to reach previously underserved markets while providing consumers with broader product selection and competitive pricing. Social media marketing effectively demonstrates product benefits and cooking applications to tech-savvy consumer segments.

Product innovation opportunities exist in developing region-specific features that cater to Middle Eastern cooking requirements. Manufacturers can create specialized cutting patterns for traditional dishes, incorporate Arabic language interfaces, and design products that accommodate local ingredient types and preparation methods.

Commercial market expansion offers substantial growth potential as the food service industry continues developing across the region. Hotels, restaurants, catering companies, and institutional kitchens represent significant volume opportunities for commercial-grade electric vegetable choppers. Franchise expansion of international food chains drives demand for standardized food preparation equipment.

Smart technology integration appeals to affluent consumer segments interested in connected kitchen appliances. IoT-enabled features, mobile app connectivity, and automated programming options can differentiate products in competitive markets. Energy efficiency improvements align with regional sustainability initiatives and cost-conscious consumer preferences.

Market penetration in underserved regions presents expansion opportunities through targeted distribution strategies and localized marketing approaches. Developing affordable product variants can capture price-sensitive segments while maintaining quality standards.

Supply chain dynamics significantly influence market operations, with most products manufactured in Asia and imported to Middle Eastern markets. Global supply chain disruptions can affect product availability and pricing, while local assembly operations in some countries provide competitive advantages through reduced import duties and faster market response.

Competitive intensity varies across price segments, with premium markets dominated by established international brands while mid-range and budget segments see increasing competition from regional manufacturers. Brand loyalty remains moderate, with consumers willing to switch brands based on features, pricing, and availability.

Seasonal fluctuations create predictable demand patterns, with sales increasing during religious festivals, wedding seasons, and holiday periods. Retailers and manufacturers adjust inventory and marketing strategies to capitalize on these seasonal opportunities. Promotional activities during peak seasons significantly impact sales volumes and market share distribution.

Regulatory environment includes safety standards, import regulations, and energy efficiency requirements that manufacturers must navigate. Compliance with local standards and certification requirements affects market entry strategies and product development priorities. Trade policies and tariff structures influence pricing strategies and competitive positioning.

Consumer education efforts by manufacturers and retailers help overcome adoption barriers and demonstrate product benefits. Cooking demonstrations, social media content, and influencer partnerships effectively communicate value propositions to target audiences.

Primary research methodologies employed comprehensive consumer surveys across major Middle Eastern markets, including face-to-face interviews, online questionnaires, and focus group discussions. Research teams conducted interviews with over 2,500 consumers across different demographic segments to understand purchasing behavior, product preferences, and usage patterns.

Secondary research involved extensive analysis of industry reports, trade statistics, import-export data, and manufacturer financial statements. MarkWide Research analysts examined government publications, industry association reports, and retail sales data to establish market size and growth trends across different countries and product categories.

Market observation included retail outlet visits, trade show participation, and distributor interviews to gather insights into market dynamics, pricing strategies, and competitive positioning. Research teams analyzed product displays, promotional activities, and consumer interactions in various retail environments.

Expert interviews with industry professionals, including manufacturers, distributors, retailers, and culinary experts, provided qualitative insights into market trends and future developments. These discussions helped validate quantitative findings and identify emerging opportunities and challenges.

Data validation processes ensured accuracy and reliability through cross-referencing multiple sources, statistical analysis, and peer review procedures. Quality control measures included data triangulation, outlier analysis, and consistency checks across different research methodologies.

Gulf Cooperation Council countries dominate the Middle East electric vegetable chopper market, accounting for 60% of regional demand. The United Arab Emirates leads adoption rates due to its cosmopolitan population and high purchasing power, followed by Saudi Arabia’s large consumer base and Qatar’s affluent demographics.

Saudi Arabia represents the largest individual market within the region, driven by population size and increasing urbanization. The kingdom’s Vision 2030 initiatives promoting lifestyle improvements and women’s workforce participation support market growth. Consumer preferences lean toward premium products with advanced safety features and Arabic language support.

United Arab Emirates demonstrates the highest per-capita adoption rates, with 75% of urban households owning at least one electric kitchen appliance. Dubai and Abu Dhabi serve as regional distribution hubs, facilitating product availability across the broader Middle East market. Expatriate populations drive demand for international brands and diverse product features.

Egypt and Turkey present significant growth opportunities despite economic challenges, with large populations and developing middle classes creating substantial market potential. These markets favor value-oriented products with essential features rather than premium offerings. Local manufacturing initiatives in Turkey provide competitive advantages for regional distribution.

Levant region including Jordan, Lebanon, and Iraq shows moderate growth potential constrained by economic and political factors. However, urban centers demonstrate strong interest in modern kitchen appliances, particularly among educated and affluent consumer segments.

Market leadership is distributed among several international and regional players competing across different price segments and distribution channels. The competitive environment emphasizes product quality, brand reputation, and after-sales service capabilities.

Competitive strategies include product differentiation through innovative features, aggressive pricing in key segments, and expansion of distribution networks. Companies invest in local partnerships, after-sales service infrastructure, and marketing campaigns tailored to regional preferences. Brand positioning varies from premium quality and innovation to value-oriented functionality and affordability.

By Product Type:

By Application:

By Price Range:

By Distribution Channel:

Mini choppers dominate residential sales volume, accounting for 55% of unit sales due to their affordability and space efficiency. These compact units appeal to young professionals and small families living in urban apartments with limited kitchen space. Consumer preferences emphasize easy cleaning, quiet operation, and safety features.

Standard choppers represent the premium residential segment, favored by larger families and cooking enthusiasts who require higher capacity and durability. These units typically feature multiple speed settings, larger bowls, and enhanced motor power. Brand loyalty is strongest in this segment due to higher investment levels and performance expectations.

Commercial choppers show the fastest growth rate at 18% annually, driven by expanding food service industry and increasing restaurant density in urban areas. These heavy-duty units require robust construction, easy maintenance, and compliance with commercial kitchen standards. Purchase decisions prioritize reliability, service support, and total cost of ownership.

Multifunctional processors appeal to consumers seeking versatility and space optimization, though they face competition from specialized single-function appliances. Market positioning emphasizes convenience and value through multiple capabilities in one device. However, some consumers prefer dedicated choppers for superior performance in specific tasks.

Price sensitivity varies significantly across categories, with mini choppers being highly price-competitive while commercial units compete primarily on features and reliability. Seasonal patterns affect different categories differently, with residential units showing stronger seasonal fluctuations compared to commercial products.

Manufacturers benefit from growing market demand and opportunities for product innovation tailored to regional preferences. The market offers potential for premium pricing through advanced features and brand positioning. Economies of scale become achievable as market volumes increase, enabling cost optimization and competitive pricing strategies.

Distributors and retailers gain from expanding product categories and increasing consumer interest in kitchen appliances. Margin opportunities exist across different price segments, while growing e-commerce channels provide additional revenue streams. After-sales service capabilities create recurring revenue opportunities and customer loyalty.

Consumers benefit from time savings, improved food preparation efficiency, and enhanced cooking convenience. Health advantages include better portion control and encouragement of fresh vegetable consumption through easier preparation. Safety improvements over manual chopping reduce injury risks and improve kitchen safety.

Commercial establishments achieve labor cost savings, improved food preparation consistency, and enhanced operational efficiency. Standardization benefits include consistent food quality and reduced training requirements for kitchen staff. Faster preparation times enable higher customer throughput and improved service efficiency.

Economic stakeholders benefit from job creation in retail, distribution, and service sectors. Import activities contribute to trade volumes while local assembly operations provide manufacturing employment opportunities. Tax revenues increase through sales taxes and import duties on kitchen appliance transactions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity emerges as a significant trend, with manufacturers introducing Wi-Fi enabled choppers that connect to mobile applications for recipe suggestions and operational control. These smart features appeal to tech-savvy consumers and provide differentiation in competitive markets. Voice control integration with popular virtual assistants enhances user convenience and modernizes the cooking experience.

Sustainability focus drives demand for energy-efficient models and environmentally friendly materials. Consumers increasingly consider environmental impact in purchasing decisions, favoring brands that demonstrate commitment to sustainability. Recyclable components and reduced packaging become important selling points, particularly among environmentally conscious urban consumers.

Compact design innovation addresses space constraints in modern urban kitchens, with manufacturers developing space-saving solutions that maintain functionality while reducing footprint. Modular designs allow consumers to customize configurations based on specific needs and available space.

Safety enhancement continues as a priority trend, with advanced safety mechanisms including automatic shut-off, locking systems, and child-proof features. Accident prevention technologies reduce liability concerns for manufacturers while increasing consumer confidence in product safety.

Aesthetic integration with modern kitchen designs influences product development, as consumers seek appliances that complement contemporary interior styles. Color customization and premium finishes help products integrate seamlessly with kitchen décor preferences across different cultural contexts.

Technology advancement in motor efficiency and blade design improves performance while reducing energy consumption. Recent innovations include brushless motors that provide longer lifespan and quieter operation, addressing key consumer concerns about noise and durability. Precision cutting technologies enable consistent results that rival professional food preparation standards.

Market expansion initiatives by leading manufacturers include establishing regional distribution centers and local assembly facilities. These investments reduce delivery times and costs while providing better customer service. Partnership strategies with local distributors enhance market penetration and cultural adaptation of products.

Product diversification trends include development of specialized models for specific Middle Eastern cooking requirements. Manufacturers create products optimized for traditional ingredients and preparation methods while maintaining modern convenience features. Cultural customization includes Arabic language interfaces and region-specific recipe programming.

Digital marketing evolution leverages social media platforms and influencer partnerships to demonstrate product benefits and cooking applications. Content marketing strategies include recipe videos, cooking tips, and user-generated content that builds brand engagement and product awareness.

Service infrastructure development includes expansion of authorized service centers and spare parts availability across key markets. Warranty programs and extended service options provide consumer confidence and competitive differentiation in quality-conscious market segments.

Market entry strategies should prioritize understanding local consumer preferences and cultural cooking practices. MWR analysis indicates that successful brands invest significantly in market research and product adaptation before launching in new Middle Eastern markets. Companies should consider partnerships with local distributors who understand regional dynamics and consumer behavior.

Product development recommendations emphasize creating region-specific features while maintaining international quality standards. Localization efforts should include Arabic language support, traditional recipe programming, and design elements that appeal to Middle Eastern aesthetic preferences. Safety features remain paramount given cultural emphasis on family protection.

Pricing strategies should account for significant economic disparities across different Middle Eastern countries. Tiered product offerings enable market penetration across various income levels while maintaining brand positioning. Value-oriented products can capture price-sensitive segments without compromising brand reputation.

Distribution channel optimization requires balancing traditional retail relationships with growing e-commerce opportunities. Omnichannel approaches provide consumers with flexible purchasing options while maximizing market reach. Investment in online presence and digital marketing becomes increasingly important for brand visibility.

After-sales service infrastructure development should be prioritized to build consumer confidence and brand loyalty. Service quality often determines long-term market success more than initial product features, particularly in markets where consumers have high expectations for appliance durability and support.

Growth trajectory remains positive for the Middle East electric vegetable chopper market, supported by favorable demographic trends and increasing consumer sophistication. MarkWide Research projects continued expansion driven by urbanization, rising incomes, and evolving lifestyle patterns across the region. Market maturation in developed areas will be offset by growth in emerging markets.

Technology integration will accelerate, with smart features becoming standard rather than premium options. IoT connectivity and artificial intelligence applications will enhance user experience and provide manufacturers with valuable usage data for product improvement. Voice control and mobile app integration will become expected features rather than differentiators.

Market consolidation may occur as smaller players struggle to compete with established brands offering comprehensive product ranges and service support. Strategic partnerships between international manufacturers and regional distributors will strengthen market positions and improve customer service capabilities.

Sustainability requirements will influence product development and manufacturing processes, with energy efficiency and environmental responsibility becoming key competitive factors. Circular economy principles including product recyclability and sustainable packaging will gain importance among environmentally conscious consumers.

Commercial market expansion presents the strongest growth opportunity, with the food service industry’s continued development driving demand for professional-grade equipment. Franchise growth and international restaurant chain expansion will create standardized equipment requirements and volume purchasing opportunities.

The Middle East electric vegetable chopper market demonstrates strong growth potential driven by urbanization, economic prosperity, and evolving consumer lifestyles across the region. While cultural preferences and economic volatility present challenges, the fundamental drivers of convenience, efficiency, and modernization support continued market expansion.

Success factors for market participants include understanding local consumer preferences, investing in appropriate distribution channels, and providing reliable after-sales service. Companies that balance international quality standards with regional customization requirements are best positioned for long-term success in this diverse and dynamic market.

Future opportunities lie in technology integration, commercial market expansion, and penetration of underserved regions through innovative distribution strategies. The market’s evolution toward smart, connected appliances aligns with broader technology adoption trends across Middle Eastern societies, creating sustainable competitive advantages for forward-thinking manufacturers and retailers.

What is Electric Vegetable Chopper?

An Electric Vegetable Chopper is a kitchen appliance designed to automate the chopping, slicing, and dicing of vegetables, making food preparation faster and more efficient. These devices are popular in both home kitchens and commercial food service settings for their convenience and time-saving capabilities.

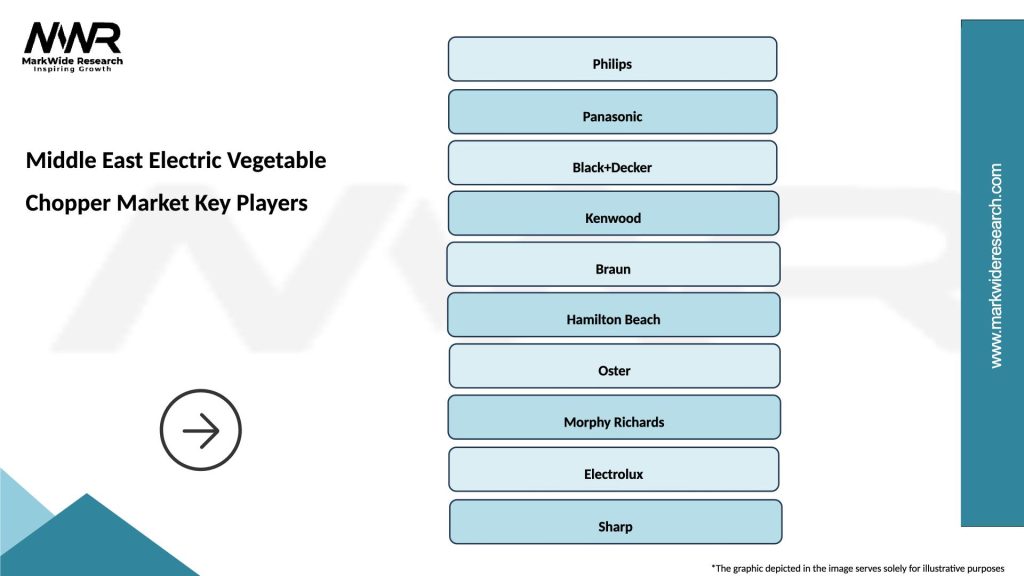

What are the key players in the Middle East Electric Vegetable Chopper Market?

Key players in the Middle East Electric Vegetable Chopper Market include companies like Philips, Black+Decker, and Kenwood, which offer a range of electric choppers with various features. These companies compete on innovation, quality, and pricing to capture market share, among others.

What are the growth factors driving the Middle East Electric Vegetable Chopper Market?

The growth of the Middle East Electric Vegetable Chopper Market is driven by increasing consumer demand for convenience in food preparation, the rise of home cooking trends, and the expansion of the food service industry. Additionally, innovations in product design and functionality are attracting more consumers.

What challenges does the Middle East Electric Vegetable Chopper Market face?

Challenges in the Middle East Electric Vegetable Chopper Market include competition from manual chopping tools, varying consumer preferences, and potential supply chain disruptions. These factors can impact market growth and product availability.

What opportunities exist in the Middle East Electric Vegetable Chopper Market?

Opportunities in the Middle East Electric Vegetable Chopper Market include the introduction of smart kitchen appliances, increasing health consciousness among consumers, and the potential for expansion into untapped markets. These trends can lead to innovative product offerings and increased sales.

What trends are shaping the Middle East Electric Vegetable Chopper Market?

Trends shaping the Middle East Electric Vegetable Chopper Market include the growing popularity of multifunctional kitchen appliances, the rise of online shopping for kitchen gadgets, and an increasing focus on energy-efficient products. These trends are influencing consumer purchasing decisions and product development.

Middle East Electric Vegetable Chopper Market

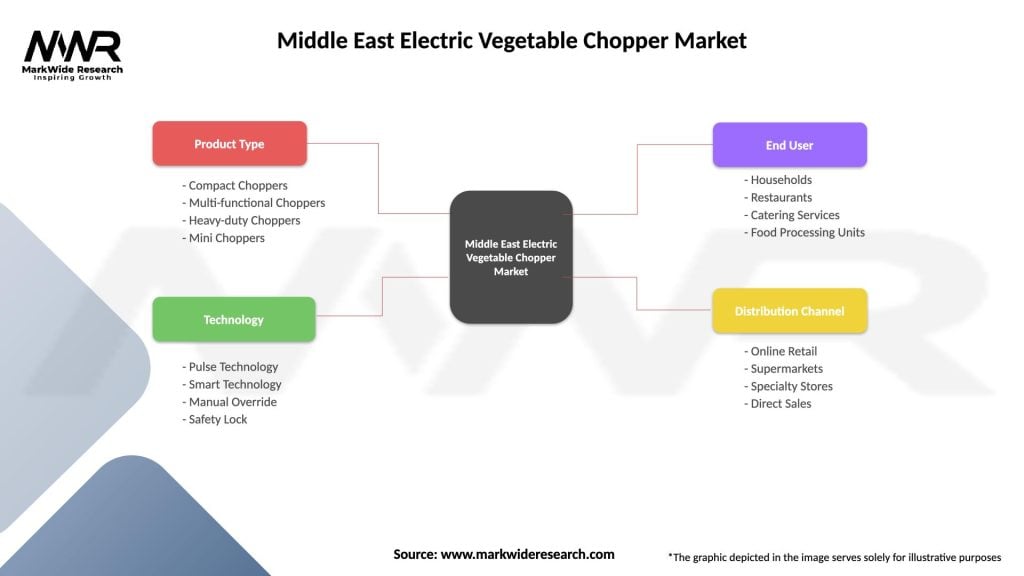

| Segmentation Details | Description |

|---|---|

| Product Type | Compact Choppers, Multi-functional Choppers, Heavy-duty Choppers, Mini Choppers |

| Technology | Pulse Technology, Smart Technology, Manual Override, Safety Lock |

| End User | Households, Restaurants, Catering Services, Food Processing Units |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Electric Vegetable Chopper Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at