444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Middle East Distribution Meter market is a crucial segment within the broader energy sector, playing a pivotal role in monitoring and managing electricity distribution. Distribution meters are instrumental in measuring, recording, and analyzing electricity consumption at various points in the distribution network. This market’s significance lies in its contribution to ensuring efficient energy management, billing accuracy, and the overall stability of the electricity distribution infrastructure across the Middle East region.

Meaning:

Distribution meters, in the context of the Middle East energy landscape, refer to devices designed to measure and monitor the flow of electricity at different stages of the distribution network. These meters are deployed across residential, commercial, and industrial areas to accurately quantify energy consumption. The data collected by distribution meters is essential for utilities, regulatory bodies, and consumers to make informed decisions related to energy usage, billing, and infrastructure planning.

Executive Summary:

The Middle East Distribution Meter market has experienced notable growth due to increasing urbanization, industrialization, and a growing focus on modernizing the energy infrastructure. Advanced metering technologies, such as smart meters, are gaining prominence, offering enhanced capabilities in terms of real-time data monitoring and two-way communication. The market’s evolution aligns with regional initiatives aimed at achieving energy efficiency, sustainability, and ensuring the reliability of electricity supply.

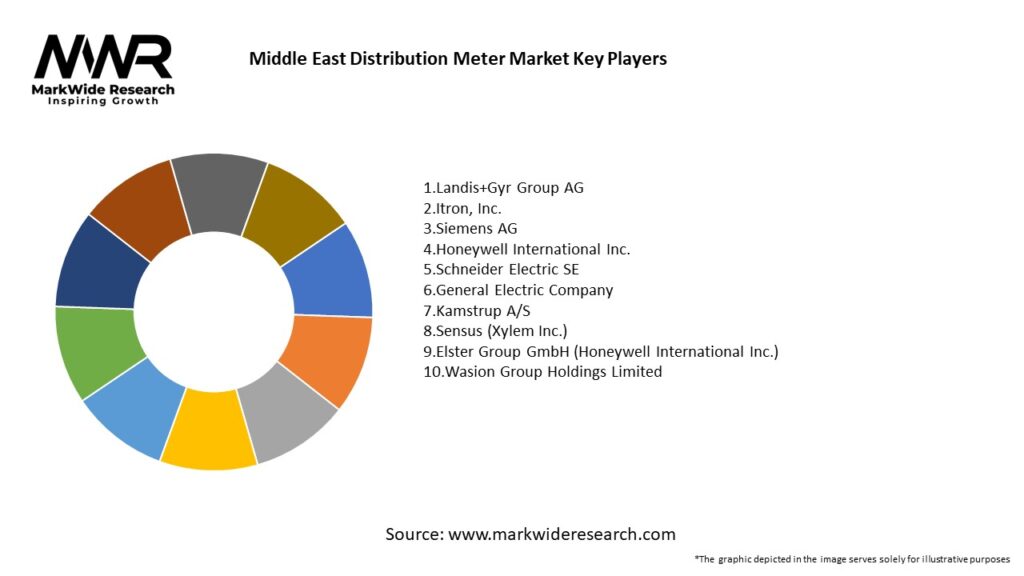

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Middle East Distribution Meter market operates in a dynamic environment influenced by technological advancements, regulatory changes, and the broader energy landscape. The integration of smart technologies, the shift towards renewable energy, and the need for real-time data analytics are shaping the market dynamics.

Regional Analysis:

The distribution meter market in the Middle East exhibits variations across different countries due to differences in energy policies, regulatory frameworks, and infrastructure development. Countries with ambitious smart city initiatives and renewable energy targets are likely to drive the demand for advanced distribution meters.

Competitive Landscape:

Leading Companies in Middle East Distribution Meter Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The Middle East Distribution Meter market can be segmented based on various factors:

Segmentation provides a nuanced understanding of the market dynamics, allowing stakeholders to tailor their strategies based on specific regional and technological considerations.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

A SWOT analysis provides a comprehensive understanding of the Middle East Distribution Meter market:

Understanding these factors through a SWOT analysis assists stakeholders in developing strategies to capitalize on strengths, address weaknesses, explore opportunities, and mitigate potential threats.

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has had varying impacts on the Middle East Distribution Meter market:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The Middle East Distribution Meter market is poised for significant growth in the coming years. The convergence of smart technologies, regulatory support, and the region’s commitment to sustainable development will drive the adoption of advanced metering solutions. The market’s future will be characterized by increased integration of IoT, data-driven decision-making, and a shift towards more dynamic and resilient energy infrastructure.

Conclusion:

The Middle East Distribution Meter market is a dynamic and integral component of the region’s energy sector. The adoption of advanced metering solutions, including smart meters and IoT-enabled technologies, is transforming the way electricity distribution is monitored and managed. While facing challenges such as initial implementation costs and cybersecurity concerns, the market presents substantial opportunities for stakeholders to contribute to energy efficiency, grid reliability, and sustainable development. With a strategic focus on innovation, collaboration, and addressing consumer needs, the distribution meter market in the Middle East is poised for a resilient and progressive future.

What is Distribution Meter?

Distribution meters are devices used to measure the consumption of electricity, gas, or water in residential, commercial, and industrial settings. They play a crucial role in energy management and billing processes.

What are the key players in the Middle East Distribution Meter Market?

Key players in the Middle East Distribution Meter Market include Siemens, Schneider Electric, and Honeywell, among others. These companies are known for their innovative solutions and contributions to smart metering technologies.

What are the growth factors driving the Middle East Distribution Meter Market?

The growth of the Middle East Distribution Meter Market is driven by increasing energy demand, the push for smart grid technologies, and government initiatives aimed at enhancing energy efficiency. Additionally, the rise in renewable energy sources is also contributing to market expansion.

What challenges does the Middle East Distribution Meter Market face?

Challenges in the Middle East Distribution Meter Market include regulatory hurdles, high initial investment costs, and the need for skilled personnel to manage advanced metering infrastructure. These factors can hinder the adoption of new technologies.

What opportunities exist in the Middle East Distribution Meter Market?

Opportunities in the Middle East Distribution Meter Market include the increasing adoption of smart meters, advancements in IoT technology, and the growing focus on sustainable energy solutions. These trends are expected to create new avenues for growth.

What trends are shaping the Middle East Distribution Meter Market?

Trends in the Middle East Distribution Meter Market include the integration of advanced data analytics, the rise of smart city initiatives, and the development of user-friendly interfaces for consumers. These innovations are enhancing the functionality and appeal of distribution meters.

Middle East Distribution Meter Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Meters, Analog Meters, Prepaid Meters, Multi-Utility Meters |

| Technology | Wireless Communication, Power Line Communication, Zigbee, Cellular |

| End User | Utilities, Industrial Facilities, Commercial Buildings, Residential Users |

| Installation | On-site Installation, Remote Installation, Retrofit Installation, Standard Installation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Middle East Distribution Meter Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at