444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East dairy market represents one of the most dynamic and rapidly evolving food sectors in the region, characterized by substantial growth potential and increasing consumer demand for high-quality dairy products. This market encompasses a diverse range of products including milk, cheese, yogurt, butter, and specialized dairy formulations that cater to the unique dietary preferences and cultural requirements of Middle Eastern consumers.

Regional consumption patterns indicate a strong preference for traditional dairy products alongside growing acceptance of innovative dairy alternatives and functional foods. The market demonstrates remarkable resilience with consistent growth rates of approximately 6.2% CAGR across key product categories, driven by population growth, urbanization, and rising disposable incomes throughout the region.

Market dynamics are significantly influenced by the region’s strategic geographic position, which facilitates both domestic production and international trade partnerships. Countries such as Saudi Arabia, UAE, Egypt, and Iran represent the largest consumption markets, while nations like Turkey and Israel have established themselves as major production hubs with advanced dairy processing capabilities.

The sector benefits from substantial government support through agricultural development programs and food security initiatives, with many countries implementing policies to reduce import dependency and enhance local dairy production capacity. Consumer preferences are shifting toward premium products, organic offerings, and culturally appropriate formulations that align with Islamic dietary requirements and regional taste preferences.

The Middle East dairy market refers to the comprehensive ecosystem of dairy product manufacturing, distribution, and consumption across the Middle Eastern region, encompassing both traditional and modern dairy processing operations that serve diverse consumer segments with varying nutritional and cultural requirements.

This market definition includes all forms of dairy products derived from cow, goat, sheep, and camel milk, processed through various traditional and industrial methods to create products ranging from basic fluid milk to sophisticated value-added dairy formulations. The market structure incorporates local artisanal producers, medium-scale regional processors, and large multinational dairy corporations operating across multiple countries.

Geographic scope encompasses the Gulf Cooperation Council (GCC) countries, Levant region, North African Middle Eastern territories, and other culturally aligned nations where dairy consumption patterns reflect Middle Eastern dietary traditions and preferences. The market serves both urban and rural populations with distinct product requirements and purchasing behaviors.

Product categories within this market include fresh dairy products, fermented dairy items, processed cheese varieties, dairy-based beverages, infant nutrition products, and specialized formulations designed for specific demographic groups or dietary restrictions common in the region.

The Middle East dairy market demonstrates exceptional growth momentum driven by favorable demographic trends, increasing health consciousness, and expanding retail infrastructure across the region. Market penetration rates have reached approximately 78% in urban areas, with rural markets showing accelerating adoption of packaged dairy products.

Key growth drivers include population expansion, rising per capita incomes, urbanization trends, and growing awareness of dairy products’ nutritional benefits. The market benefits from strategic government initiatives promoting food security and local production capabilities, resulting in enhanced domestic manufacturing capacity and reduced import dependency.

Product innovation plays a crucial role in market expansion, with manufacturers introducing culturally adapted formulations, extended shelf-life products, and premium offerings that cater to evolving consumer preferences. Functional dairy products incorporating probiotics, vitamins, and minerals have gained significant traction among health-conscious consumers.

Competitive landscape features a mix of international dairy giants and strong regional players, creating a dynamic market environment that fosters innovation and competitive pricing. Distribution networks have expanded significantly, with modern retail channels accounting for approximately 65% of total sales volume in major urban markets.

Future prospects remain highly positive, supported by continued economic development, infrastructure improvements, and evolving consumer lifestyles that favor convenient, nutritious dairy products aligned with regional cultural preferences and dietary requirements.

Consumer behavior analysis reveals distinct preferences for dairy products that combine traditional flavors with modern convenience and nutritional enhancement. The following insights characterize current market dynamics:

Demographic expansion serves as the primary catalyst for Middle East dairy market growth, with regional population growth rates consistently exceeding global averages. Young demographics, comprising approximately 60% of the total population, demonstrate strong affinity for dairy products and drive demand for innovative formulations and convenient packaging formats.

Economic prosperity across key markets has resulted in increased disposable income levels, enabling consumers to purchase premium dairy products and explore diverse product categories. Rising living standards correlate directly with increased per capita dairy consumption, particularly in urban areas where modern retail infrastructure supports product availability and variety.

Health awareness campaigns promoted by government health agencies and international organizations have significantly enhanced consumer understanding of dairy products’ nutritional benefits. Educational initiatives highlighting calcium, protein, and vitamin content have positioned dairy products as essential components of healthy diets, particularly for children and elderly populations.

Urbanization trends continue reshaping consumption patterns, with urban consumers demonstrating preferences for packaged, branded dairy products over traditional unprocessed alternatives. Modern lifestyle requirements favor convenient, ready-to-consume dairy products that align with busy schedules and changing meal patterns.

Government support initiatives including agricultural subsidies, food security programs, and local production incentives create favorable operating environments for dairy manufacturers. Policy frameworks promoting domestic production capacity and quality standards enhance market stability and growth prospects.

Infrastructure development including cold chain logistics, modern retail facilities, and improved transportation networks facilitates efficient product distribution and extends market reach to previously underserved areas, expanding the overall addressable market significantly.

Climate challenges pose significant constraints on dairy production capabilities across the Middle East region, with extreme temperatures and limited water resources affecting livestock productivity and feed availability. These environmental factors increase production costs and create supply chain vulnerabilities that impact market stability.

Import dependency for key raw materials and finished products exposes the market to international price volatility and supply disruptions. Currency fluctuations and trade policy changes can significantly impact product pricing and availability, creating uncertainty for both manufacturers and consumers.

Cultural and religious considerations require careful product formulation and certification processes, potentially limiting ingredient options and increasing compliance costs. Halal certification requirements and cultural dietary restrictions necessitate specialized production processes that may constrain operational efficiency.

Price sensitivity among significant consumer segments limits premium product adoption and constrains profit margins for manufacturers. Economic uncertainties and income disparities create challenges in balancing product quality with affordability requirements across diverse market segments.

Regulatory complexity across different countries creates compliance challenges for manufacturers operating in multiple markets. Varying quality standards, labeling requirements, and import regulations increase operational complexity and market entry barriers for new participants.

Traditional consumption patterns in rural areas may resist adoption of modern dairy products, preferring traditional preparation methods and local sources. This cultural inertia can slow market penetration in certain geographic areas and demographic segments.

Product innovation opportunities abound in developing culturally adapted dairy formulations that combine traditional Middle Eastern flavors with modern nutritional enhancement. Manufacturers can capitalize on growing demand for functional dairy products by incorporating region-specific ingredients and health benefits that resonate with local consumer preferences.

E-commerce expansion presents significant growth potential as digital retail platforms gain traction across the region. Online dairy product sales offer opportunities to reach underserved markets, provide convenient delivery services, and introduce premium products to tech-savvy consumer segments with higher purchasing power.

Organic and natural products represent emerging market segments with substantial growth potential, driven by increasing health consciousness and environmental awareness. Premium positioning of organic dairy products can command higher margins while addressing evolving consumer preferences for clean-label, sustainable food options.

Export market development offers opportunities for established regional producers to expand beyond domestic markets. Strategic partnerships and trade agreements can facilitate access to international markets, particularly in neighboring regions with similar cultural and dietary preferences.

Value-added processing creates opportunities to develop specialized dairy products for specific demographic groups, including infant nutrition, elderly care, and sports nutrition segments. These niche markets often support premium pricing and demonstrate strong growth potential.

Cold chain infrastructure investment can unlock previously inaccessible rural markets and enable distribution of fresh dairy products across wider geographic areas. Strategic infrastructure development partnerships can create competitive advantages and expand market reach significantly.

Supply chain evolution continues transforming the Middle East dairy market through technological advancement and infrastructure development. Modern processing facilities equipped with advanced automation and quality control systems enhance production efficiency while ensuring consistent product quality that meets international standards.

Consumer preference shifts toward premium and functional dairy products create dynamic market conditions requiring continuous innovation and adaptation. Manufacturers must balance traditional flavor profiles with modern nutritional enhancement to satisfy evolving consumer expectations and maintain competitive positioning.

Competitive intensity has increased significantly as international dairy companies establish regional operations alongside growing local producers. This competition drives innovation, improves product quality, and creates pricing pressures that ultimately benefit consumers through enhanced value propositions.

Regulatory harmonization efforts across regional markets facilitate trade and reduce compliance complexity for manufacturers operating in multiple countries. Standardized quality requirements and certification processes create more efficient market conditions and reduce operational barriers.

Technology adoption in dairy processing and distribution enhances operational efficiency and product quality. Advanced packaging technologies, cold chain monitoring systems, and quality assurance protocols improve product shelf life and consumer satisfaction while reducing waste and operational costs.

Sustainability initiatives are becoming increasingly important as environmental awareness grows among consumers and regulatory bodies. Dairy companies implementing sustainable practices and environmental responsibility programs gain competitive advantages and align with evolving market expectations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Middle East dairy market dynamics. Primary research activities include extensive consumer surveys, industry expert interviews, and direct engagement with key market participants across major regional markets.

Data collection processes incorporate both quantitative and qualitative research approaches, utilizing structured questionnaires, focus group discussions, and in-depth interviews with industry stakeholders. Consumer behavior analysis examines purchasing patterns, preference drivers, and demographic correlations across diverse market segments.

Secondary research components involve analysis of government statistics, industry publications, trade association reports, and regulatory documentation to establish market context and validate primary research findings. Historical data analysis provides insights into market trends and growth patterns over extended time periods.

Market sizing methodologies employ bottom-up and top-down approaches to establish accurate market parameters and growth projections. Regional consumption data, production statistics, and trade flow analysis contribute to comprehensive market quantification and segmentation analysis.

Quality assurance protocols ensure research accuracy through data triangulation, expert validation, and cross-reference verification. Multiple data sources and analytical approaches provide confidence in research conclusions and market projections presented in this analysis.

Analytical frameworks incorporate industry-standard market research techniques including Porter’s Five Forces analysis, SWOT assessment, and competitive positioning evaluation to provide comprehensive market understanding and strategic insights for industry participants.

Gulf Cooperation Council (GCC) countries represent the most developed dairy markets in the Middle East region, with Saudi Arabia and UAE leading consumption volumes and demonstrating strong preference for premium dairy products. These markets show approximately 85% penetration rates for packaged dairy products, with modern retail channels dominating distribution networks.

Saudi Arabia maintains the largest dairy market in the region, supported by substantial government investment in local production capabilities and food security initiatives. The market demonstrates strong growth in functional dairy products and premium formulations, with urban consumers driving demand for innovative product categories.

United Arab Emirates serves as a regional hub for dairy product distribution and showcases the highest per capita consumption rates in the region. The diverse expatriate population creates demand for international dairy brands alongside traditional Middle Eastern products, resulting in a highly competitive and dynamic market environment.

Egypt represents the largest population-based market with significant growth potential, though price sensitivity remains a key market characteristic. Local production capabilities are expanding rapidly, with government support for dairy farming development and processing facility modernization creating favorable market conditions.

Turkey combines substantial domestic consumption with strong export capabilities, serving as a major dairy producer for regional markets. Advanced processing technologies and established distribution networks position Turkish dairy companies as significant regional competitors with growing market share.

Iran demonstrates strong domestic production capabilities and growing consumer demand for dairy products, though international trade restrictions create unique market dynamics. Local manufacturers focus on serving domestic demand while developing innovative products adapted to local preferences and economic conditions.

Market leadership in the Middle East dairy sector is characterized by a diverse mix of international corporations and strong regional players, each leveraging distinct competitive advantages to capture market share and drive growth across different product categories and geographic markets.

Competitive strategies focus on product innovation, distribution network expansion, and cultural adaptation to local preferences. Companies invest heavily in modern processing facilities, quality assurance systems, and cold chain infrastructure to maintain competitive advantages and ensure product quality consistency.

Market positioning varies significantly among competitors, with some focusing on premium segments while others target mainstream consumers through competitive pricing and wide product availability. Strategic partnerships and acquisitions continue reshaping the competitive landscape as companies seek to expand market reach and capabilities.

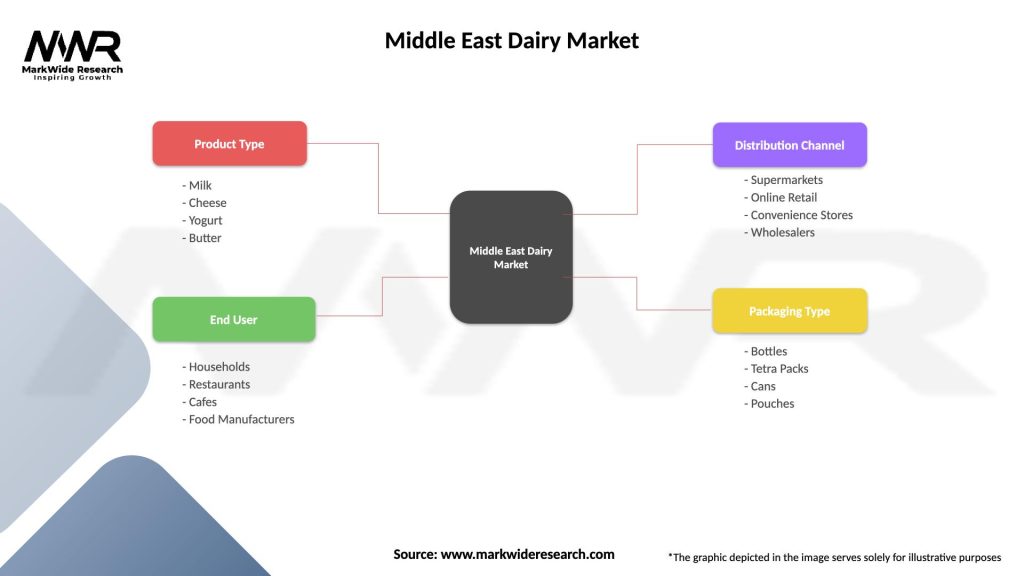

Product-based segmentation reveals distinct market dynamics across different dairy categories, with each segment demonstrating unique growth patterns, consumer preferences, and competitive characteristics that influence overall market development and strategic positioning.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Fresh milk category maintains dominant market position with consistent demand across all demographic segments, though growth rates vary significantly between regular and value-added formulations. Premium milk products including organic and grass-fed varieties show approximately 12% annual growth in urban markets, while standard milk products demonstrate steady but slower expansion.

Cheese segment dynamics reflect cultural preferences for both traditional Middle Eastern varieties and international cheese types. Processed cheese products designed for hot climate conditions show strong performance, while artisanal and specialty cheeses gain traction among affluent consumer segments seeking premium culinary experiences.

Yogurt and fermented products benefit from strong cultural acceptance and growing health awareness, with probiotic-enhanced formulations showing exceptional growth potential. Traditional yogurt preparation methods influence consumer preferences, creating opportunities for products that combine traditional flavors with modern convenience and nutritional enhancement.

Functional dairy products represent the fastest-growing category, driven by increasing health consciousness and awareness of dairy products’ nutritional benefits. Products incorporating vitamins, minerals, and probiotics demonstrate superior growth rates compared to standard formulations, particularly among educated urban consumers.

Infant and child nutrition segments show strong growth supported by demographic trends and increasing parental focus on childhood nutrition. Specialized formulations addressing regional dietary requirements and cultural preferences create competitive advantages for manufacturers understanding local market dynamics.

Dairy-based beverages emerge as innovative category combining traditional dairy benefits with modern flavor profiles and convenience packaging. Ready-to-drink formulations and extended shelf-life products address busy lifestyle requirements while maintaining nutritional value and taste satisfaction.

Manufacturers benefit from expanding market opportunities driven by favorable demographic trends, increasing consumer purchasing power, and growing acceptance of premium dairy products. Operational advantages include access to modern processing technologies, improved supply chain infrastructure, and supportive government policies promoting local production capabilities.

Retailers gain from strong consumer demand for dairy products, which serve as traffic drivers and contribute to overall store profitability. Dairy categories offer opportunities for private label development, premium positioning, and cross-merchandising strategies that enhance customer engagement and increase average transaction values.

Distributors capitalize on expanding market reach requirements as dairy companies seek to access previously underserved geographic areas and demographic segments. Cold chain logistics expertise becomes increasingly valuable as market demand for fresh and frozen dairy products continues growing across the region.

Consumers enjoy enhanced product variety, improved quality standards, and competitive pricing resulting from increased market competition and innovation. Access to nutritionally enhanced dairy products supports health and wellness objectives while convenient packaging and extended shelf life improve lifestyle compatibility.

Agricultural stakeholders including dairy farmers and feed suppliers benefit from increased demand for local milk production and government support for agricultural development. Investment in modern farming techniques and quality improvement programs creates opportunities for premium pricing and market expansion.

Technology providers find growing demand for dairy processing equipment, packaging solutions, and cold chain infrastructure as manufacturers invest in capacity expansion and quality enhancement. Innovation opportunities exist in developing climate-appropriate technologies and culturally adapted processing methods.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness focus drives significant transformation in dairy product development, with manufacturers increasingly incorporating functional ingredients, reducing sugar content, and enhancing nutritional profiles to meet evolving consumer expectations. Probiotic dairy products show particularly strong growth momentum, with adoption rates reaching approximately 35% among health-conscious consumers.

Premium positioning strategies gain traction as consumers demonstrate willingness to pay higher prices for superior quality, organic certification, and enhanced nutritional benefits. Artisanal and specialty dairy products command significant price premiums while building strong brand loyalty among affluent consumer segments.

Packaging innovation addresses regional climate challenges through advanced materials and design solutions that extend shelf life and maintain product quality in extreme temperature conditions. Smart packaging technologies incorporating freshness indicators and temperature monitoring enhance consumer confidence and reduce product waste.

Sustainability initiatives become increasingly important as environmental awareness grows among consumers and regulatory bodies. Dairy companies implementing sustainable farming practices, renewable energy utilization, and environmentally responsible packaging gain competitive advantages and positive brand positioning.

Digital transformation reshapes marketing, distribution, and customer engagement strategies as dairy companies leverage social media, e-commerce platforms, and digital marketing techniques to reach tech-savvy consumer segments and build brand awareness.

Cultural adaptation continues influencing product development as manufacturers recognize the importance of aligning products with local taste preferences, dietary restrictions, and cultural practices. Traditional flavor profiles combined with modern convenience create successful product formulations that resonate with regional consumers.

Production capacity expansion initiatives across the region reflect growing market confidence and demand projections. Major dairy companies are investing substantially in new processing facilities, advanced equipment, and quality assurance systems to meet increasing consumer demand and improve operational efficiency.

Strategic partnerships between international dairy companies and regional players create synergies that combine global expertise with local market knowledge. These collaborations facilitate technology transfer, market access, and product development capabilities that benefit all stakeholders involved.

Regulatory harmonization efforts across regional markets simplify compliance requirements and facilitate trade between countries. Standardized quality standards and certification processes reduce operational complexity and enable more efficient market operations for manufacturers serving multiple countries.

Cold chain infrastructure development receives significant investment from both private companies and government agencies, recognizing its critical importance for dairy product quality and market expansion. Modern refrigeration and transportation systems enable access to previously underserved markets and improve product quality consistency.

Research and development initiatives focus on developing climate-appropriate dairy products and processing technologies that address regional challenges while maintaining product quality and nutritional value. Innovation centers and technical partnerships advance industry capabilities and competitive positioning.

Sustainability programs gain momentum as dairy companies implement environmental responsibility initiatives including water conservation, renewable energy adoption, and waste reduction strategies. These programs align with growing consumer environmental awareness and regulatory expectations for sustainable business practices.

Market entry strategies should prioritize cultural adaptation and local partnership development to navigate complex regulatory environments and consumer preferences effectively. MarkWide Research analysis indicates that companies demonstrating deep understanding of regional dietary requirements and cultural practices achieve superior market penetration and brand acceptance.

Product development focus should emphasize functional dairy products incorporating health benefits while maintaining traditional flavor profiles that resonate with local consumers. Innovation opportunities exist in developing climate-appropriate formulations and packaging solutions that address regional environmental challenges.

Distribution strategy optimization requires balanced approach combining modern retail channel development with traditional trade network maintenance. Rural market penetration demands investment in cold chain infrastructure and culturally appropriate marketing approaches that build consumer trust and brand awareness.

Pricing strategies must carefully balance premium positioning opportunities with price sensitivity considerations across different consumer segments. Value-based pricing approaches that clearly communicate product benefits and quality advantages can justify premium positioning while maintaining market accessibility.

Technology investment priorities should focus on processing efficiency, quality assurance, and supply chain optimization to improve operational performance and product consistency. Advanced packaging technologies and cold chain monitoring systems provide competitive advantages in challenging climate conditions.

Sustainability integration becomes increasingly important for long-term market success as environmental awareness grows among consumers and regulatory bodies. Companies implementing comprehensive sustainability programs gain competitive advantages and positive brand positioning that supports premium pricing strategies.

Long-term growth prospects for the Middle East dairy market remain exceptionally positive, supported by favorable demographic trends, increasing urbanization, and rising consumer awareness of dairy products’ nutritional benefits. MWR projections indicate sustained growth momentum with particularly strong performance expected in functional and premium dairy product categories.

Market evolution will likely favor companies that successfully combine traditional regional preferences with modern convenience and nutritional enhancement. Innovation in product development, packaging solutions, and distribution strategies will determine competitive positioning and market share gains over the forecast period.

Technology adoption will accelerate across all aspects of dairy operations, from farm-level production optimization to advanced processing techniques and smart distribution systems. Companies investing in technological capabilities will achieve operational advantages and improved product quality that supports premium positioning strategies.

Regional integration trends suggest increasing harmonization of quality standards, regulatory requirements, and trade facilitation measures that will create more efficient market conditions and expand opportunities for regional dairy companies to serve broader geographic markets.

Consumer sophistication will continue driving demand for premium, functional, and specialty dairy products as education levels rise and health awareness increases. Market growth rates of approximately 8.5% annually are projected for premium dairy segments, significantly exceeding standard product category growth rates.

Sustainability requirements will become increasingly important competitive factors as environmental regulations strengthen and consumer environmental awareness grows. Companies implementing comprehensive sustainability programs will gain competitive advantages and access to premium market segments that prioritize environmental responsibility.

The Middle East dairy market presents exceptional opportunities for growth and development, driven by favorable demographic trends, increasing consumer purchasing power, and growing awareness of dairy products’ nutritional benefits. Market dynamics favor companies that understand regional cultural preferences while leveraging modern technology and innovation to deliver superior products and services.

Success factors in this dynamic market include cultural adaptation, quality excellence, strategic distribution network development, and continuous innovation in product development and packaging solutions. Companies that invest in understanding local consumer preferences while maintaining international quality standards will achieve sustainable competitive advantages and market leadership positions.

Future market development will be characterized by increasing sophistication in consumer preferences, growing demand for premium and functional products, and continued expansion of modern retail infrastructure. The market’s evolution toward higher-value products and enhanced convenience creates opportunities for companies positioned to meet these evolving requirements effectively.

Strategic recommendations emphasize the importance of balanced approaches that combine respect for traditional preferences with modern innovation and convenience. Companies that successfully navigate cultural requirements while delivering superior product quality and value propositions will capture the substantial growth opportunities available in this dynamic and expanding market.

What is Dairy?

Dairy refers to products made from the milk of mammals, primarily cows, goats, and sheep. In the context of the Middle East Dairy Market, it includes a variety of products such as milk, cheese, yogurt, and butter, which are integral to the region’s culinary traditions.

What are the key players in the Middle East Dairy Market?

Key players in the Middle East Dairy Market include Almarai, Danone, and Nestlé, which are known for their extensive range of dairy products. These companies compete in various segments such as fresh milk, cheese, and yogurt, catering to diverse consumer preferences.

What are the growth factors driving the Middle East Dairy Market?

The Middle East Dairy Market is driven by increasing consumer demand for dairy products, rising health consciousness, and the growing popularity of yogurt and cheese. Additionally, urbanization and changing dietary habits contribute to the market’s expansion.

What challenges does the Middle East Dairy Market face?

The Middle East Dairy Market faces challenges such as fluctuating milk prices, supply chain disruptions, and competition from plant-based alternatives. These factors can impact profitability and market stability for dairy producers.

What opportunities exist in the Middle East Dairy Market?

Opportunities in the Middle East Dairy Market include the potential for product innovation, such as lactose-free and fortified dairy products, and the expansion of e-commerce channels for dairy sales. Additionally, increasing health trends present avenues for growth.

What trends are shaping the Middle East Dairy Market?

Trends in the Middle East Dairy Market include a rising preference for organic and natural dairy products, as well as the introduction of functional dairy items that offer health benefits. Sustainability practices are also becoming more prominent among consumers and producers.

Middle East Dairy Market

| Segmentation Details | Description |

|---|---|

| Product Type | Milk, Cheese, Yogurt, Butter |

| End User | Households, Restaurants, Cafes, Food Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesalers |

| Packaging Type | Bottles, Tetra Packs, Cans, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Dairy Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at