444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East chocolate market represents one of the most dynamic and rapidly evolving confectionery sectors in the global food industry. This region, encompassing countries such as the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain, and other Gulf Cooperation Council nations, has witnessed unprecedented growth in chocolate consumption and premium product adoption. Market dynamics indicate robust expansion driven by rising disposable incomes, changing consumer preferences, and increasing urbanization across the region.

Consumer behavior patterns in the Middle East have shifted significantly toward premium and artisanal chocolate products, with local and international brands competing for market share. The region’s strategic geographic position as a trading hub has facilitated the introduction of diverse chocolate varieties from European, American, and Asian manufacturers. Growth trajectories show consistent upward momentum, with the market experiencing a compound annual growth rate of 6.2% over recent years, reflecting strong consumer demand and market maturation.

Cultural integration of chocolate consumption has become increasingly prominent during religious festivals, social celebrations, and gift-giving occasions. The market demonstrates particular strength in premium segments, with consumers showing willingness to invest in high-quality products that align with their sophisticated taste preferences and lifestyle aspirations.

The Middle East chocolate market refers to the comprehensive ecosystem of chocolate production, distribution, retail, and consumption across Middle Eastern countries, encompassing both domestic manufacturing capabilities and imported premium products. This market includes various chocolate categories such as milk chocolate, dark chocolate, white chocolate, filled chocolates, and specialty confectionery items tailored to regional taste preferences and cultural requirements.

Market scope extends beyond traditional chocolate bars to include seasonal products, gift packaging, corporate gifting solutions, and halal-certified chocolate options that comply with Islamic dietary laws. The definition encompasses both mass-market products available through conventional retail channels and premium artisanal chocolates distributed through specialty stores, luxury hotels, and high-end retail establishments.

Regional characteristics distinguish this market through unique flavor profiles, packaging preferences, and consumption patterns that reflect local cultural values and international influences. The market includes both established multinational brands and emerging local manufacturers who understand regional preferences and dietary requirements.

Strategic analysis reveals that the Middle East chocolate market has emerged as a significant growth opportunity for both international confectionery giants and regional manufacturers. The market demonstrates exceptional resilience and expansion potential, driven by demographic advantages including a young population, increasing urbanization, and growing exposure to global food trends through tourism and digital media.

Key performance indicators highlight remarkable market penetration rates, with chocolate consumption per capita increasing by 18% over the past three years. Premium segment growth has been particularly impressive, capturing 35% of total market share as consumers increasingly prioritize quality over quantity in their chocolate purchasing decisions.

Competitive landscape features a balanced mix of international brands such as Ferrero, Mondelez International, Mars Wrigley, and Nestlé, alongside regional players who have successfully carved out market niches through localized product offerings and culturally relevant marketing strategies. The market shows strong potential for continued expansion, supported by favorable economic conditions and evolving consumer preferences toward premium confectionery products.

Consumer preference analysis reveals several critical insights that define the Middle East chocolate market landscape:

Economic prosperity across Gulf Cooperation Council countries serves as the primary catalyst for chocolate market expansion. Rising disposable incomes, particularly among the growing middle class, have created substantial purchasing power for premium confectionery products. Urbanization trends continue to drive market growth as city dwellers adopt Western consumption patterns and develop sophisticated taste preferences for international food products.

Tourism industry growth significantly contributes to market expansion through increased exposure to global chocolate brands and consumption habits. International visitors and expatriate populations introduce diverse chocolate preferences, creating demand for varied product offerings. Retail infrastructure development has enhanced product accessibility through modern shopping malls, hypermarkets, and specialty confectionery stores.

Cultural evolution toward accepting and embracing international food products has removed traditional barriers to chocolate consumption. Younger demographics, in particular, demonstrate strong affinity for chocolate products as part of their lifestyle choices. Digital marketing effectiveness through social media platforms has successfully promoted chocolate brands and created aspirational consumption patterns among target demographics.

Health and wellness trends have paradoxically driven demand for premium dark chocolate products positioned as healthier alternatives to traditional confectionery. Consumer education about antioxidant benefits and moderate consumption guidelines has legitimized chocolate as an acceptable indulgence within health-conscious lifestyles.

Religious and cultural considerations present ongoing challenges for chocolate market penetration in certain consumer segments. Traditional dietary preferences and religious observances may limit chocolate consumption during specific periods or among particular demographic groups. Health concerns related to sugar content, obesity rates, and diabetes prevalence create consumer hesitation toward regular chocolate consumption.

Price sensitivity remains a significant constraint, particularly for premium chocolate products that command higher price points. Economic fluctuations and currency volatility can impact consumer purchasing power and willingness to invest in luxury confectionery items. Supply chain complexities associated with importing chocolate products create cost pressures and potential availability issues.

Climate challenges in the region pose storage and distribution difficulties for chocolate products, requiring specialized cold chain logistics that increase operational costs. Regulatory requirements for halal certification and food safety standards add compliance costs and complexity for manufacturers and importers.

Competition from traditional sweets and local confectionery products creates market share challenges for chocolate brands. Regional preferences for dates, baklava, and other traditional desserts may limit chocolate market penetration in certain consumer segments and occasions.

Product innovation opportunities abound through the development of culturally adapted chocolate formulations that incorporate regional flavors and ingredients. Fusion products combining traditional Middle Eastern tastes with chocolate offer significant market potential for brands willing to invest in localized product development. The growing demand for artisanal and craft chocolate presents opportunities for small-scale manufacturers and specialty retailers.

E-commerce expansion offers substantial growth potential as online shopping adoption accelerates across the region. Digital platforms enable brands to reach consumers directly, offer personalized products, and create subscription-based purchasing models. Corporate gifting markets represent untapped opportunities for bulk sales and customized packaging solutions.

Health-focused product lines including sugar-free, organic, and functional chocolate products can capture the growing health-conscious consumer segment. Seasonal and limited edition products aligned with religious holidays and cultural celebrations offer opportunities for premium pricing and increased sales volumes.

Retail partnership expansion through luxury hotels, high-end restaurants, and specialty food stores can enhance brand visibility and market penetration. Export opportunities exist for regional manufacturers to supply neighboring markets and leverage the region’s strategic geographic position for broader distribution.

Supply and demand equilibrium in the Middle East chocolate market reflects complex interactions between consumer preferences, economic conditions, and competitive pressures. Demand patterns show consistent growth with seasonal fluctuations corresponding to religious holidays and cultural celebrations. The market demonstrates price elasticity variations across different consumer segments, with premium buyers showing lower price sensitivity compared to mass-market consumers.

Competitive dynamics feature intense rivalry between international brands seeking market share expansion and local manufacturers leveraging cultural understanding and cost advantages. Innovation cycles drive continuous product development as brands compete to introduce novel flavors, packaging formats, and positioning strategies that resonate with regional consumers.

Distribution channel evolution reflects changing retail landscapes with traditional grocery stores competing against modern trade formats and emerging e-commerce platforms. Consumer behavior shifts toward premium products have created opportunities for market segmentation and targeted marketing approaches.

Regulatory environment changes continue to shape market dynamics through food safety requirements, labeling standards, and import regulations. Economic factors including oil prices, currency fluctuations, and government spending policies directly impact consumer purchasing power and market growth trajectories.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Middle East chocolate market. Primary research activities included structured interviews with industry executives, retail managers, and consumer focus groups across major metropolitan areas in the Gulf Cooperation Council countries.

Secondary research components involved extensive analysis of industry reports, trade publications, government statistics, and company financial statements. Data triangulation methods ensured consistency and reliability across different information sources and research approaches.

Market sizing calculations utilized bottom-up and top-down approaches, incorporating retail sales data, import statistics, and consumption pattern analysis. Competitive intelligence gathering included monitoring of brand activities, product launches, pricing strategies, and marketing campaigns across the region.

Consumer survey methodologies employed both online and in-person data collection techniques to capture diverse demographic perspectives and purchasing behaviors. Expert consultation processes included discussions with industry specialists, retail analysts, and regional market experts to validate findings and insights.

United Arab Emirates leads the regional chocolate market with the highest per capita consumption rates and strongest retail infrastructure. Dubai and Abu Dhabi serve as primary distribution hubs with sophisticated retail environments that support premium chocolate brands. The UAE market demonstrates 42% preference for imported European chocolate brands, reflecting consumer sophistication and international exposure.

Saudi Arabia represents the largest market by volume, driven by population size and increasing urbanization rates. Riyadh and Jeddah metropolitan areas show particularly strong growth in premium chocolate consumption. The market benefits from government initiatives promoting economic diversification and retail sector development.

Qatar and Kuwait exhibit the highest spending per capita on luxury confectionery products, with consumers showing strong preference for premium positioning and exclusive brand offerings. These markets demonstrate 28% annual growth in artisanal chocolate purchases, indicating sophisticated consumer preferences.

Oman and Bahrain present emerging opportunities with growing middle-class populations and increasing retail modernization. These markets show potential for both mass-market and premium chocolate segments, with local preference rates of 65% for milk chocolate varieties over dark chocolate alternatives.

Market leadership in the Middle East chocolate sector features a diverse mix of international confectionery giants and regional specialists. The competitive environment demonstrates dynamic interactions between established brands and emerging market entrants.

Product type segmentation reveals distinct consumer preferences and market opportunities across different chocolate categories:

By Product Type:

By Distribution Channel:

By Price Range:

Premium chocolate category demonstrates exceptional growth momentum with consumers increasingly willing to invest in high-quality products that offer superior taste experiences and luxury positioning. This segment benefits from gift-giving culture and special occasion consumption patterns prevalent throughout the region.

Seasonal chocolate products show remarkable sales performance during religious holidays, particularly Ramadan and Eid celebrations. Ramadan-specific packaging and product formulations have become essential strategies for brands seeking to maximize seasonal opportunities. The category experiences sales increases of up to 75% during peak holiday periods.

Health-focused chocolate variants including sugar-free, organic, and dark chocolate options represent the fastest-growing category segment. Consumer education about health benefits and moderate consumption has legitimized chocolate as an acceptable indulgence within wellness-oriented lifestyles.

Artisanal and craft chocolate categories show strong potential for market expansion as consumers seek unique flavor experiences and authentic production methods. Local manufacturers incorporating regional ingredients such as dates, pistachios, and traditional spices have found success in this premium segment.

Manufacturers benefit from expanding market opportunities driven by growing consumer demand and increasing purchasing power across the region. Production efficiency gains through economies of scale and regional distribution networks create competitive advantages and improved profit margins.

Retailers experience enhanced customer traffic and higher average transaction values through chocolate category expansion. Premium product positioning enables improved margins while seasonal demand patterns provide predictable revenue opportunities throughout the year.

Distributors gain from expanding product portfolios and strengthened relationships with both international brands and local manufacturers. Logistics optimization through regional hub strategies creates operational efficiencies and service level improvements.

Consumers benefit from increased product variety, competitive pricing, and improved accessibility through expanding retail networks. Quality improvements and innovation in product formulations provide enhanced taste experiences and value propositions.

Economic stakeholders including governments and trade organizations benefit from increased tax revenues, employment opportunities, and foreign investment attraction through market growth and industry development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trend continues to reshape the Middle East chocolate market as consumers increasingly prioritize quality over quantity in their purchasing decisions. Luxury positioning strategies have become essential for brands seeking to capture higher-value market segments and improve profit margins.

Cultural fusion innovation represents a significant trend with manufacturers developing products that combine traditional Middle Eastern flavors with chocolate formulations. Date-filled chocolates, pistachio-infused varieties, and rose-flavored options have gained substantial consumer acceptance and market traction.

Sustainability consciousness among consumers has created demand for ethically sourced and environmentally responsible chocolate products. Fair trade certification and organic ingredients have become important differentiating factors for premium brands targeting socially conscious consumers.

Digital marketing evolution through social media platforms and influencer partnerships has transformed brand communication strategies. Instagram-worthy packaging and experiential marketing campaigns have become crucial for reaching younger demographic segments and building brand loyalty.

Personalization trends in product offerings and packaging solutions cater to individual preferences and gift-giving occasions. Customizable chocolate boxes and personalized messaging options have created new revenue streams and enhanced customer engagement levels.

Manufacturing expansion initiatives by international brands have established local production facilities to reduce costs and improve supply chain efficiency. Regional manufacturing hubs in the UAE and Saudi Arabia have attracted significant foreign investment and created employment opportunities.

Retail format innovation includes the introduction of chocolate cafés, experiential stores, and pop-up retail concepts that combine product sales with entertainment and education. Interactive retail experiences have enhanced brand engagement and customer loyalty development.

Technology integration in production processes has improved quality control, efficiency, and product consistency. Automated packaging systems and temperature-controlled logistics have enhanced product quality and shelf life management.

Partnership developments between international brands and local distributors have strengthened market penetration and cultural adaptation capabilities. Joint venture agreements have facilitated knowledge transfer and market access for global chocolate manufacturers.

Regulatory harmonization efforts across Gulf Cooperation Council countries have simplified import procedures and standardized quality requirements. Streamlined certification processes have reduced market entry barriers and operational complexities for international brands.

Market entry strategies should prioritize cultural adaptation and local partnership development to ensure successful penetration of regional markets. MarkWide Research analysis indicates that brands achieving the highest success rates invest significantly in understanding local consumer preferences and cultural nuances.

Product development focus should emphasize premium positioning and unique flavor profiles that differentiate offerings from established competitors. Innovation investment in culturally relevant formulations and packaging designs will be crucial for long-term market success and brand loyalty development.

Distribution strategy optimization requires multi-channel approaches that balance traditional retail presence with emerging e-commerce opportunities. Omnichannel integration will become increasingly important as consumer shopping behaviors continue evolving toward digital platforms.

Marketing communication strategies should leverage digital platforms while respecting cultural sensitivities and religious considerations. Influencer partnerships and social media engagement offer effective methods for reaching younger demographics and building brand awareness.

Supply chain resilience development through regional sourcing and local manufacturing partnerships will provide competitive advantages and risk mitigation capabilities. Cold chain logistics investment remains essential for maintaining product quality in challenging climate conditions.

Growth projections for the Middle East chocolate market remain highly optimistic, with continued expansion expected across all major market segments. MWR forecasts indicate sustained growth momentum driven by demographic advantages, economic prosperity, and evolving consumer preferences toward premium confectionery products.

Market maturation trends suggest increasing sophistication in consumer preferences and growing demand for artisanal and specialty chocolate products. Premium segment expansion is expected to outpace overall market growth, with luxury positioning becoming increasingly important for brand success.

Technology integration will continue transforming manufacturing processes, distribution networks, and customer engagement strategies. Digital commerce platforms are projected to capture 25% of total market share within the next five years, reflecting changing consumer shopping behaviors.

Sustainability initiatives will become increasingly important as environmental consciousness grows among regional consumers. Ethical sourcing practices and sustainable packaging solutions will evolve from competitive advantages to market requirements for successful brand positioning.

Regional manufacturing development is expected to accelerate as brands seek to reduce costs and improve supply chain control. Local production capabilities will enhance market responsiveness and enable greater customization for regional taste preferences and cultural requirements.

The Middle East chocolate market presents exceptional opportunities for growth and expansion, driven by favorable demographic trends, increasing economic prosperity, and evolving consumer preferences toward premium confectionery products. Market dynamics indicate sustained momentum across all major segments, with particular strength in premium and culturally adapted product categories.

Strategic success factors include cultural sensitivity, product innovation, distribution channel optimization, and brand positioning that resonates with regional values and aspirations. Companies that invest in understanding local preferences while maintaining international quality standards are positioned to capture significant market share and achieve sustainable growth.

Future market evolution will be characterized by continued premiumization, digital commerce expansion, and increasing demand for personalized and sustainable product offerings. The region’s strategic importance as a global trading hub and its growing reputation as a luxury destination will continue supporting chocolate market development and international brand investment in the coming years.

What is Chocolate?

Chocolate is a food product made from roasted and ground cacao seeds, often sweetened and flavored. It is widely consumed in various forms, including bars, beverages, and confections, and is a significant part of culinary traditions in many cultures.

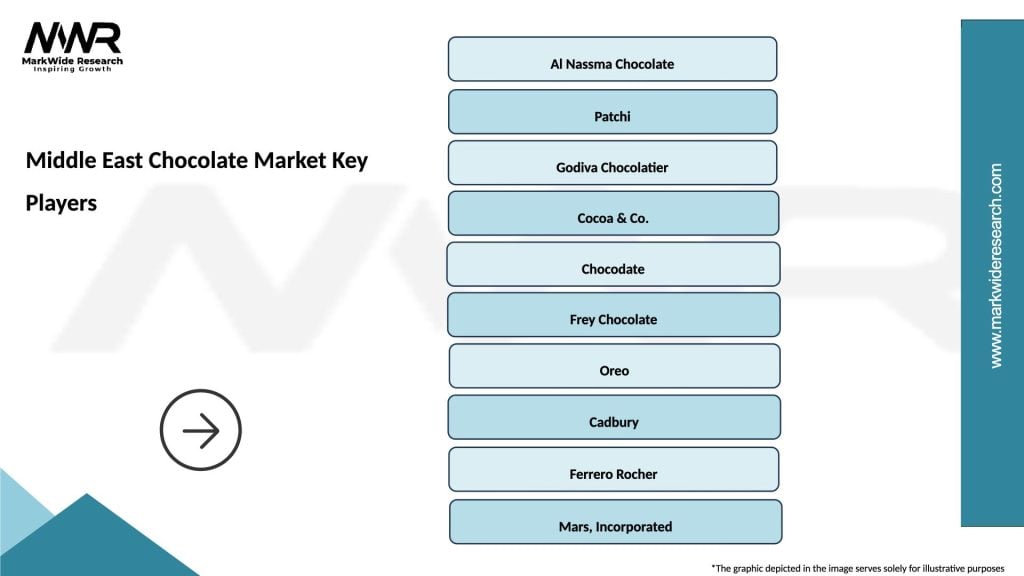

What are the key companies in the Middle East Chocolate Market?

Key companies in the Middle East Chocolate Market include Mars, Nestlé, and Mondelez International, which are known for their diverse product offerings and strong market presence. These companies compete in various segments such as premium chocolates, confectionery, and seasonal products, among others.

What are the growth factors driving the Middle East Chocolate Market?

The growth of the Middle East Chocolate Market is driven by increasing consumer demand for premium and artisanal chocolates, rising disposable incomes, and the popularity of gifting chocolates during festivals and special occasions. Additionally, the expansion of retail channels enhances accessibility.

What challenges does the Middle East Chocolate Market face?

The Middle East Chocolate Market faces challenges such as fluctuating cocoa prices, which can impact production costs, and changing consumer preferences towards healthier snacks. Additionally, regulatory issues related to food safety and labeling can pose hurdles for manufacturers.

What opportunities exist in the Middle East Chocolate Market?

Opportunities in the Middle East Chocolate Market include the growing trend of online shopping, which allows brands to reach a wider audience, and the increasing interest in organic and ethically sourced chocolates. Innovations in flavors and packaging also present avenues for market expansion.

What trends are shaping the Middle East Chocolate Market?

Trends shaping the Middle East Chocolate Market include the rise of dark chocolate due to its perceived health benefits, the popularity of vegan and plant-based chocolate options, and the incorporation of local flavors and ingredients into chocolate products. These trends reflect changing consumer preferences and a focus on sustainability.

Middle East Chocolate Market

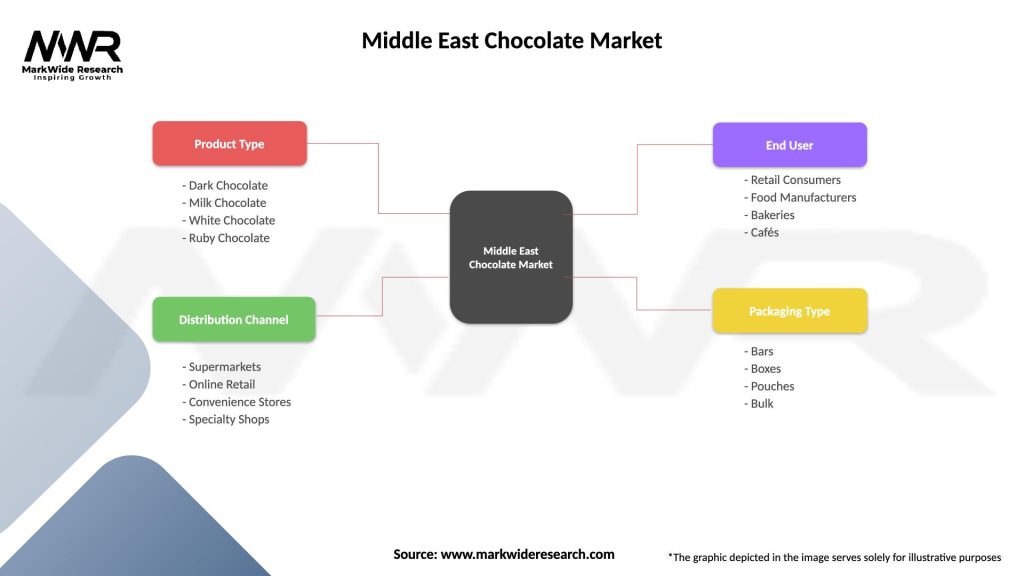

| Segmentation Details | Description |

|---|---|

| Product Type | Dark Chocolate, Milk Chocolate, White Chocolate, Ruby Chocolate |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Specialty Shops |

| End User | Retail Consumers, Food Manufacturers, Bakeries, Cafés |

| Packaging Type | Bars, Boxes, Pouches, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Chocolate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at