444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Middle East Business Income Insurance Market serves as a crucial component of the region’s insurance landscape, providing essential coverage for businesses against income losses resulting from unforeseen events. This comprehensive overview delves into the dynamics, challenges, and opportunities defining the market.

Meaning: Business income insurance, also known as business interruption insurance, safeguards enterprises against financial losses stemming from interruptions to their normal operations due to covered perils such as natural disasters, fires, or other unforeseen events. In the Middle East context, this insurance plays a vital role in protecting businesses’ financial stability amid challenging operating environments.

Executive Summary: The Middle East Business Income Insurance Market is witnessing significant growth driven by the region’s expanding commercial landscape and the increasing awareness among businesses regarding the importance of risk management. This market offers indispensable protection for enterprises seeking to mitigate the financial impacts of unexpected disruptions to their operations.

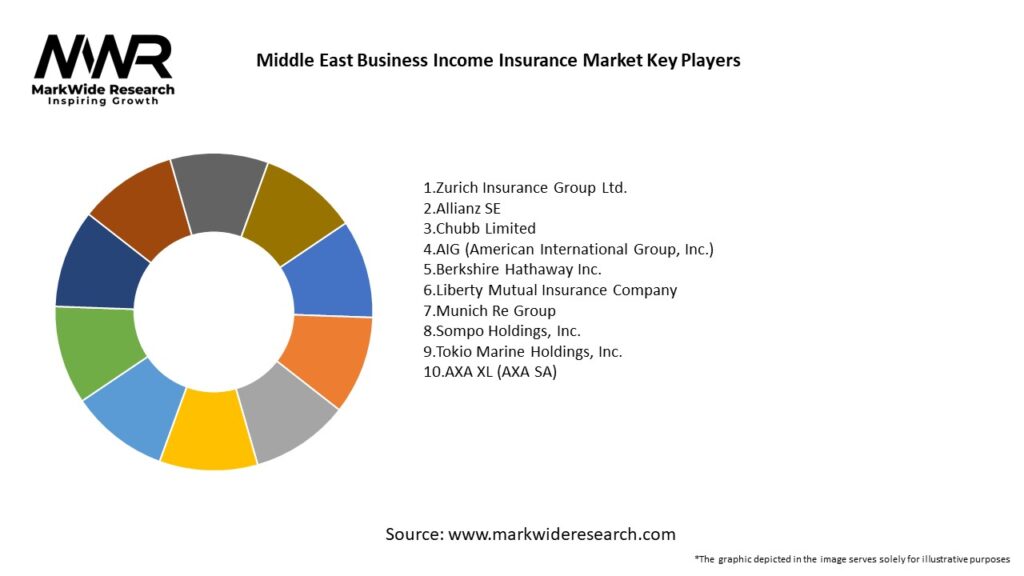

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Middle East Business Income Insurance Market operates within a dynamic environment shaped by evolving business landscapes, regulatory frameworks, and emerging risk factors. Understanding and adapting to these dynamics are crucial for insurers seeking to effectively address the needs of businesses in the region.

Regional Analysis: A comprehensive regional analysis of the Middle East Business Income Insurance Market explores the unique market dynamics, regulatory environments, and business landscapes across countries in the region. Variations in economic conditions, industry sectors, and risk profiles influence market trends and opportunities.

Competitive Landscape:

Leading Companies in Middle East Business Income Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The market segmentation of business income insurance in the Middle East can be based on various factors, including industry sectors, business sizes, coverage types, and geographical regions. Tailoring insurance products and services to specific market segments enables insurers to effectively address the diverse needs of businesses.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis offers insights into the strengths, weaknesses, opportunities, and threats facing participants in the Middle East Business Income Insurance Market.

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has underscored the importance of business income insurance in the Middle East, with businesses grappling with income losses due to lockdowns, supply chain disruptions, and reduced consumer spending. The pandemic has heightened awareness of the need for robust risk management and insurance solutions.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Middle East Business Income Insurance Market is optimistic, with sustained growth anticipated as businesses recognize the importance of comprehensive risk management. Insurers that embrace digital transformation, innovate their product offerings, and focus on customer-centric solutions are poised for success.

Conclusion: In conclusion, the Middle East Business Income Insurance Market is an integral part of the region’s risk management landscape, offering vital protection for businesses against income losses. As businesses navigate a complex operating environment marked by diverse risks, the role of business income insurance becomes increasingly pivotal. Insurers, regulators, and businesses need to work collaboratively to enhance awareness, streamline processes, and foster a resilient business ecosystem in the Middle East.

What is Business Income Insurance?

Business Income Insurance is a type of coverage that protects businesses from loss of income due to disruptions, such as natural disasters or other unforeseen events. It helps cover ongoing expenses and lost profits during the period of recovery.

What are the key players in the Middle East Business Income Insurance Market?

Key players in the Middle East Business Income Insurance Market include companies like AXA, Allianz, and Zurich Insurance. These firms offer various insurance products tailored to the needs of businesses in the region, among others.

What are the growth factors driving the Middle East Business Income Insurance Market?

The growth of the Middle East Business Income Insurance Market is driven by increasing awareness of risk management, the rise in small and medium-sized enterprises, and the growing frequency of natural disasters that disrupt business operations.

What challenges does the Middle East Business Income Insurance Market face?

Challenges in the Middle East Business Income Insurance Market include regulatory complexities, a lack of understanding of insurance products among businesses, and the variability of risks across different regions, which can complicate coverage options.

What opportunities exist in the Middle East Business Income Insurance Market?

Opportunities in the Middle East Business Income Insurance Market include the potential for product innovation, the expansion of digital insurance solutions, and the increasing demand for customized coverage options as businesses seek to mitigate risks.

What trends are shaping the Middle East Business Income Insurance Market?

Trends in the Middle East Business Income Insurance Market include the adoption of technology for claims processing, a shift towards more comprehensive coverage options, and an increased focus on sustainability and resilience in business operations.

Middle East Business Income Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Comprehensive, Standard, Premium, Basic |

| Industry Vertical | Manufacturing, Technology, Hospitality, Education |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Customer Type | Small Enterprises, Medium Enterprises, Large Enterprises, Startups |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at