444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and African airport passenger screening systems market represents a rapidly evolving sector driven by increasing security concerns, growing air traffic, and technological advancements. This dynamic market encompasses sophisticated security technologies designed to enhance passenger safety while maintaining operational efficiency at airports across the region. Security infrastructure modernization has become a critical priority for aviation authorities, with airports investing heavily in advanced screening technologies to meet international security standards.

Regional growth patterns indicate substantial expansion opportunities, with the market experiencing robust development driven by infrastructure investments and rising passenger volumes. The region’s strategic position as a global aviation hub has accelerated the adoption of cutting-edge screening technologies, including millimeter wave scanners, explosive detection systems, and advanced imaging technologies. Market dynamics show a 12.5% annual growth rate in technology adoption across major airports, reflecting the sector’s commitment to enhanced security measures.

Technological innovation continues to reshape the landscape, with artificial intelligence integration and automated threat detection systems gaining significant traction. The market’s evolution reflects broader trends in aviation security, emphasizing the balance between thorough screening procedures and passenger convenience. Smart screening solutions are increasingly becoming the standard, with airports seeking systems that can process higher passenger volumes while maintaining stringent security protocols.

The Middle East and African airport passenger screening systems market refers to the comprehensive ecosystem of security technologies, equipment, and services designed to detect prohibited items and potential threats in airport environments across the MEA region. This market encompasses various screening technologies including X-ray systems, metal detectors, explosive trace detection equipment, body scanners, and integrated security management platforms that ensure passenger safety and regulatory compliance.

Market scope extends beyond traditional screening equipment to include software solutions, maintenance services, and system integration capabilities. The definition encompasses both checkpoint screening systems for passenger processing and baggage screening technologies for luggage inspection. Modern screening systems integrate multiple detection technologies to provide comprehensive threat identification while minimizing false alarms and processing delays.

Operational framework includes various stakeholder categories, from equipment manufacturers and system integrators to airport operators and security service providers. The market’s meaning also encompasses the regulatory environment, international security standards, and compliance requirements that drive technology adoption and system specifications across different airport categories and passenger volume levels.

Strategic market positioning reveals the Middle East and African airport passenger screening systems market as a high-growth sector characterized by rapid technological advancement and increasing security investment. The region’s airports are experiencing unprecedented passenger growth, necessitating sophisticated screening solutions that can handle increased volumes while maintaining security effectiveness. Technology adoption rates show a 68% preference for integrated screening platforms over standalone systems.

Key market drivers include expanding airport infrastructure, rising security threats, regulatory compliance requirements, and passenger experience enhancement initiatives. The market benefits from substantial government investments in aviation security infrastructure and the region’s position as a major international transit hub. Automation integration has become a critical success factor, with airports seeking solutions that reduce manual intervention while improving detection accuracy.

Competitive dynamics feature established international technology providers alongside emerging regional players offering specialized solutions. Market consolidation trends indicate increasing partnerships between technology vendors and local system integrators to provide comprehensive security solutions. Innovation focus centers on artificial intelligence integration, biometric authentication, and contactless screening technologies that address both security and health safety concerns.

Future trajectory points toward continued market expansion driven by airport modernization projects, increasing passenger traffic, and evolving security requirements. The market’s evolution reflects broader digital transformation trends in aviation, with smart airports driving demand for integrated, data-driven security solutions that provide real-time threat assessment and operational insights.

Technology penetration analysis reveals significant opportunities for advanced screening system deployment across the region’s diverse airport landscape. The market demonstrates strong growth potential driven by infrastructure development projects and increasing focus on aviation security enhancement.

Market maturity levels vary significantly across different countries and airport categories, with major international hubs leading technology adoption while smaller regional airports present substantial growth opportunities. Investment patterns show increasing focus on comprehensive security solutions rather than individual equipment purchases, reflecting the industry’s shift toward integrated security ecosystems.

Security threat evolution represents the primary driver for advanced screening system adoption across Middle Eastern and African airports. Rising global security concerns and sophisticated threat methodologies require corresponding advances in detection technologies and screening procedures. Regulatory compliance mandates from international aviation authorities necessitate continuous technology upgrades and system enhancements to maintain operational certifications.

Passenger traffic growth creates substantial pressure on existing screening infrastructure, driving demand for high-throughput screening solutions that can process increased volumes without compromising security effectiveness. The region’s position as a global aviation hub amplifies this challenge, with airports serving as critical transit points for international passengers. Operational efficiency requirements push airports toward automated screening technologies that reduce processing times while maintaining thorough security protocols.

Infrastructure modernization initiatives across the region provide significant opportunities for screening system deployment and upgrade projects. Government investments in airport expansion and renovation projects typically include comprehensive security system overhauls. Technology advancement in artificial intelligence, machine learning, and sensor technologies enables more sophisticated threat detection capabilities while improving user experience.

Economic diversification strategies in many regional countries emphasize tourism and business travel development, requiring world-class airport security infrastructure to support these objectives. International partnerships and aviation agreements often include security cooperation components that drive technology standardization and capability enhancement across participating airports.

High implementation costs present significant barriers for smaller airports and developing market segments within the region. Advanced screening technologies require substantial capital investments, ongoing maintenance expenses, and specialized technical expertise that may exceed available budgets. Budget constraints particularly affect regional airports and smaller aviation facilities that struggle to justify expensive security system deployments.

Technical complexity associated with modern screening systems creates operational challenges for airports lacking adequate technical infrastructure and skilled personnel. Integration requirements with existing security systems and airport operations can complicate deployment processes and extend implementation timelines. Training requirements for security personnel add additional costs and operational complexity to system adoption decisions.

Regulatory variations across different countries within the region create compliance challenges for standardized screening system deployments. Varying security requirements and certification processes can complicate technology selection and implementation strategies. Cultural considerations regarding privacy and screening procedures may influence technology acceptance and deployment approaches in certain markets.

Infrastructure limitations in some regional locations may constrain advanced screening system deployment due to power supply, connectivity, or physical space restrictions. Maintenance challenges in remote locations can affect system reliability and operational effectiveness, particularly for sophisticated technologies requiring specialized technical support and regular calibration procedures.

Airport expansion projects across the region present substantial opportunities for comprehensive screening system deployments and infrastructure development. Major hub airports are investing heavily in terminal expansions and modernization initiatives that require state-of-the-art security technologies. New airport construction projects provide opportunities for integrated security system design and deployment from the ground up.

Technology integration opportunities exist for developing comprehensive security ecosystems that combine screening technologies with broader airport management systems. Smart airport initiatives create demand for connected screening solutions that provide real-time data and operational insights. The integration of screening systems with passenger flow management and airport operations presents significant value creation opportunities.

Regional security cooperation initiatives may drive standardization and technology sharing opportunities across multiple airports and countries. Public-private partnerships offer alternative financing and deployment models that can accelerate screening system adoption in budget-constrained environments. These partnerships can provide access to advanced technologies while distributing implementation costs and risks.

Emerging market segments including cargo screening, private aviation, and specialized facility security present additional growth opportunities beyond traditional passenger screening applications. Service-based business models including screening-as-a-service and managed security services create recurring revenue opportunities while reducing customer capital investment requirements.

Competitive intensity within the Middle East and African airport passenger screening systems market reflects the sector’s growth potential and strategic importance. Established international technology providers compete alongside regional specialists and emerging technology companies, creating a dynamic competitive environment that drives innovation and competitive pricing. Market consolidation trends indicate increasing collaboration between technology vendors and local partners to provide comprehensive solutions.

Technology evolution cycles significantly impact market dynamics, with rapid advancement in artificial intelligence, sensor technologies, and data analytics creating continuous upgrade opportunities and competitive differentiation. Customer expectations continue to evolve, demanding screening solutions that balance security effectiveness with passenger convenience and operational efficiency. The market shows a 78% preference for solutions that integrate multiple security functions into unified platforms.

Supply chain considerations affect market dynamics through technology availability, pricing structures, and delivery timelines. Global supply chain disruptions have highlighted the importance of regional manufacturing capabilities and local technical support infrastructure. Regulatory changes and security standard updates create both challenges and opportunities for market participants, requiring continuous adaptation and system enhancement capabilities.

Economic factors including oil prices, tourism trends, and regional economic development significantly influence airport investment priorities and screening system procurement decisions. Geopolitical considerations may affect technology sourcing decisions and international cooperation in security system development and deployment initiatives.

Comprehensive market analysis employs multiple research methodologies to provide accurate and actionable insights into the Middle East and African airport passenger screening systems market. Primary research activities include extensive interviews with industry stakeholders, airport operators, technology vendors, and regulatory authorities to gather firsthand market intelligence and trend analysis.

Secondary research components encompass detailed analysis of industry reports, regulatory documents, technology specifications, and market data from authoritative sources. Data triangulation methods ensure accuracy and reliability by cross-referencing information from multiple sources and validating findings through expert consultation and industry feedback.

Market sizing methodologies utilize bottom-up and top-down approaches to develop comprehensive market assessments and growth projections. Quantitative analysis techniques include statistical modeling, trend analysis, and correlation studies to identify market patterns and growth drivers. Qualitative research methods provide deeper insights into market dynamics, competitive positioning, and strategic opportunities.

Regional analysis frameworks account for varying market conditions, regulatory environments, and development stages across different countries and airport categories within the MEA region. Technology assessment protocols evaluate screening system capabilities, performance metrics, and market adoption patterns to provide comprehensive technology landscape analysis.

Gulf Cooperation Council countries represent the most mature segment of the regional market, with major aviation hubs in the UAE, Saudi Arabia, and Qatar driving significant screening system investments. These markets demonstrate 85% adoption rates for advanced screening technologies and continue to lead regional innovation in airport security infrastructure. Hub airport strategies in these countries emphasize world-class security capabilities to support their positions as global aviation centers.

North African markets show substantial growth potential driven by tourism recovery and infrastructure development initiatives. Countries including Egypt, Morocco, and Tunisia are investing in airport modernization projects that include comprehensive screening system upgrades. Regional connectivity improvements and increasing international flight operations drive demand for enhanced security capabilities.

Sub-Saharan African markets present significant opportunities despite infrastructure and budget challenges. Major airports in South Africa, Kenya, and Nigeria are implementing screening system modernization projects to support growing passenger volumes and international connectivity. Development financing from international organizations supports security infrastructure improvements in emerging markets.

Levant region countries including Jordan and Lebanon maintain focus on security system enhancement despite regional challenges. These markets emphasize reliable, cost-effective screening solutions that can operate effectively in challenging environments. Regional cooperation initiatives may provide opportunities for coordinated security system development and technology sharing programs.

Market leadership positions are held by established international technology providers with comprehensive screening system portfolios and regional presence. The competitive environment features both global corporations and specialized regional players offering targeted solutions for specific market segments and applications.

Competitive strategies focus on technology innovation, regional partnerships, and comprehensive service offerings that address complete security system requirements. Market differentiation occurs through advanced detection capabilities, operational efficiency improvements, and integration with broader airport management systems. Partnership approaches with local system integrators and service providers enable market access and ongoing support capabilities.

Innovation competition centers on artificial intelligence integration, automated threat detection, and user experience enhancement. Companies invest heavily in research and development to maintain technological leadership and address evolving security requirements.

Technology-based segmentation reveals distinct market categories with varying growth patterns and adoption characteristics. X-ray screening systems represent the largest segment, encompassing both traditional and advanced computed tomography technologies for baggage and carry-on inspection. Metal detection systems continue to serve as fundamental screening components while evolving to include advanced discrimination capabilities.

Application-based categories include passenger checkpoint screening, baggage handling screening, and cargo inspection systems. Checkpoint screening represents the highest-volume segment, driven by passenger traffic growth and processing efficiency requirements. Baggage screening systems show strong growth due to regulatory requirements and automation initiatives.

Airport size segmentation differentiates between major international hubs, regional airports, and smaller domestic facilities. Hub airports drive demand for high-capacity, advanced screening systems with comprehensive threat detection capabilities. Regional airports focus on cost-effective solutions that meet security requirements while managing operational budgets.

End-user categories include government-operated airports, private airport operators, and specialized aviation facilities. Government facilities often emphasize comprehensive security capabilities and regulatory compliance, while private operators may prioritize operational efficiency and passenger experience alongside security effectiveness.

By Technology: Advanced imaging technologies including millimeter wave scanners and backscatter X-ray systems demonstrate the highest growth rates, driven by superior threat detection capabilities and passenger acceptance. Computed tomography systems for baggage screening show increasing adoption due to enhanced explosive detection capabilities and reduced manual inspection requirements.

Explosive detection systems represent a critical growth category, with trace detection and bulk detection technologies becoming standard requirements for comprehensive security operations. Biometric integration technologies show emerging growth potential as airports seek to streamline passenger processing while maintaining security effectiveness.

By Application: Passenger screening applications dominate market volume and investment, with focus shifting toward automated screening lanes and integrated processing systems. Baggage screening shows strong growth driven by regulatory requirements and operational efficiency initiatives. Cargo screening represents an emerging opportunity as air freight volumes increase and security requirements expand.

By Airport Type: International hub airports lead technology adoption and investment, driving demand for cutting-edge screening systems and comprehensive security platforms. Regional airports present significant growth opportunities as passenger volumes increase and infrastructure modernization projects advance. Specialized facilities including private aviation and cargo terminals create niche market opportunities for targeted screening solutions.

Airport operators benefit from enhanced security capabilities that enable compliance with international standards while improving operational efficiency and passenger experience. Advanced screening systems provide automated threat detection capabilities that reduce manual intervention requirements and improve processing throughput. Integrated platforms offer centralized management and real-time monitoring capabilities that enhance overall security operations.

Technology vendors gain access to a growing market with substantial investment potential and long-term service opportunities. The market’s emphasis on comprehensive solutions creates opportunities for expanded product portfolios and integrated service offerings. Regional partnerships enable market access and local support capabilities that enhance competitive positioning.

Passengers experience improved security processing with reduced wait times and enhanced convenience through automated screening technologies. Advanced detection capabilities provide increased security assurance while minimizing intrusive screening procedures. Contactless technologies address health safety concerns while maintaining security effectiveness.

Government stakeholders achieve enhanced aviation security capabilities that support economic development objectives and international cooperation initiatives. Standardized screening systems facilitate regulatory compliance and international aviation agreements. Technology advancement supports broader economic diversification and technology development objectives.

System integrators benefit from growing demand for comprehensive security solutions and ongoing maintenance services. Service-based business models create recurring revenue opportunities while providing value-added capabilities to airport customers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming airport passenger screening systems across the region. Machine learning algorithms enhance threat detection accuracy while reducing false alarm rates, improving both security effectiveness and operational efficiency. Automated decision-making capabilities enable faster processing and reduced manual intervention requirements.

Contactless screening technologies have gained substantial momentum, driven by health safety concerns and operational efficiency objectives. Touchless interfaces and automated processing systems minimize physical contact while maintaining security standards. This trend shows 92% acceptance rates among passengers and airport operators seeking enhanced safety protocols.

Biometric authentication integration streamlines passenger identification and screening processes while enhancing security capabilities. Facial recognition systems and fingerprint authentication technologies provide seamless passenger processing experiences. Multi-modal biometric systems offer enhanced accuracy and security assurance for high-risk screening applications.

Cloud-based security platforms enable centralized management and real-time monitoring across multiple airport locations and screening checkpoints. Data analytics capabilities provide operational insights and predictive maintenance features that optimize system performance. Remote monitoring and diagnostic capabilities reduce maintenance costs and improve system reliability.

Modular screening system designs allow flexible deployment and scalable capacity expansion to accommodate varying passenger volumes and operational requirements. Portable screening solutions address temporary and remote screening needs while maintaining security standards.

Technology advancement initiatives continue to reshape the screening systems landscape with breakthrough innovations in detection capabilities and operational efficiency. Next-generation computed tomography systems provide enhanced explosive detection while reducing manual bag inspection requirements. Advanced imaging technologies offer improved threat detection with reduced privacy concerns and faster processing times.

Strategic partnerships between international technology providers and regional system integrators enhance market access and local support capabilities. MarkWide Research analysis indicates increasing collaboration between global vendors and local partners to provide comprehensive security solutions tailored to regional requirements.

Regulatory developments including updated security standards and certification requirements drive continuous system enhancement and technology adoption. International cooperation initiatives promote standardization and best practice sharing across regional airports and security authorities.

Investment announcements from major airports across the region indicate substantial screening system modernization projects and capacity expansion initiatives. Public-private partnerships provide alternative financing mechanisms for large-scale security infrastructure projects.

Innovation programs including technology incubators and research collaborations accelerate development of next-generation screening solutions. Pilot projects and demonstration programs enable testing and validation of emerging technologies before full-scale deployment.

Strategic positioning recommendations emphasize the importance of comprehensive solution offerings that address complete airport security requirements rather than individual equipment sales. Market participants should focus on developing integrated platforms that combine multiple screening technologies with centralized management and analytics capabilities.

Regional partnership strategies are essential for successful market penetration and long-term growth. Technology vendors should establish strong relationships with local system integrators and service providers to ensure effective deployment and ongoing support capabilities. Cultural sensitivity and regulatory compliance expertise are critical success factors for regional market development.

Investment priorities should focus on artificial intelligence integration, automated screening technologies, and contactless processing solutions that address current market demands and future growth opportunities. Research and development investments in emerging technologies including biometric integration and advanced analytics will provide competitive differentiation.

Service-based business models offer significant opportunities for recurring revenue generation and customer relationship development. Screening-as-a-service and managed security services can reduce customer capital investment requirements while providing ongoing value creation opportunities.

Market timing considerations suggest optimal entry strategies should align with major airport expansion projects and infrastructure modernization initiatives. Early engagement with airport planning processes enables influence on system specifications and procurement decisions.

Growth trajectory projections indicate sustained market expansion driven by increasing passenger traffic, infrastructure development, and technology advancement. The market is expected to maintain robust growth rates with annual expansion of 11.8% in technology adoption and system deployment across the region. Long-term prospects remain positive despite short-term economic uncertainties and regional challenges.

Technology evolution will continue to drive market transformation with artificial intelligence, machine learning, and advanced analytics becoming standard features in screening systems. Integration capabilities with broader airport management systems and smart airport initiatives will become increasingly important for competitive positioning. MWR forecasts indicate 75% market penetration for AI-enabled screening systems within the next five years.

Market consolidation trends may accelerate as technology vendors seek to expand capabilities and market reach through strategic acquisitions and partnerships. Regional players with specialized expertise and local market knowledge will become attractive acquisition targets for international corporations seeking regional expansion.

Regulatory evolution will continue to influence market development through updated security standards and certification requirements. International harmonization of security standards may create opportunities for standardized screening system deployments across multiple countries and airport categories.

Investment patterns suggest increasing focus on comprehensive security ecosystems rather than individual equipment purchases, creating opportunities for integrated solution providers and service-based business models. Sustainability considerations may influence technology selection and deployment strategies as airports emphasize environmental responsibility alongside security effectiveness.

The Middle East and African airport passenger screening systems market presents substantial growth opportunities driven by increasing security requirements, passenger traffic expansion, and technological advancement. The region’s strategic position as a global aviation hub creates sustained demand for world-class screening technologies and comprehensive security solutions.

Market dynamics favor integrated screening platforms that combine multiple detection technologies with advanced analytics and automated processing capabilities. Technology trends including artificial intelligence integration, contactless screening, and biometric authentication are reshaping the competitive landscape and creating new value creation opportunities for market participants.

Regional diversity requires tailored approaches that address varying market conditions, regulatory requirements, and infrastructure capabilities across different countries and airport categories. Successful market strategies emphasize comprehensive solution offerings, regional partnerships, and service-based business models that provide ongoing value to airport customers.

Future prospects remain positive despite economic uncertainties and regional challenges, with continued investment in airport infrastructure and security capabilities supporting sustained market growth. The Middle East and African airport passenger screening systems market will continue to evolve as a critical component of the region’s aviation security infrastructure and economic development objectives.

What is Airport Passenger Screening Systems?

Airport Passenger Screening Systems refer to the technologies and processes used to ensure the safety and security of passengers at airports. These systems include various screening methods such as X-ray machines, metal detectors, and advanced imaging technology to detect prohibited items.

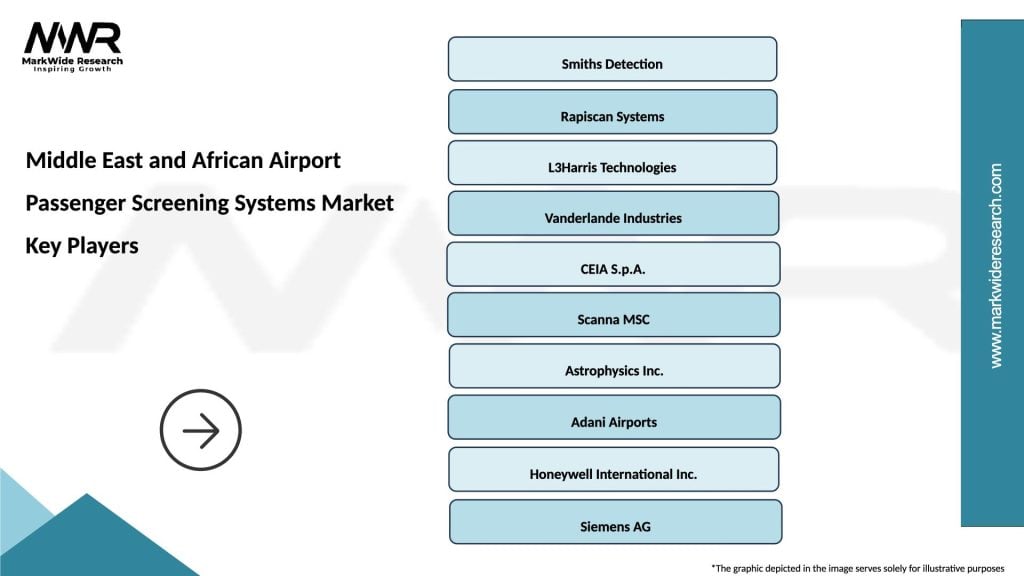

What are the key players in the Middle East and African Airport Passenger Screening Systems Market?

Key players in the Middle East and African Airport Passenger Screening Systems Market include companies like Smiths Detection, Rapiscan Systems, and L3Harris Technologies, among others. These companies are known for their innovative security solutions and technologies tailored for airport environments.

What are the growth factors driving the Middle East and African Airport Passenger Screening Systems Market?

The growth of the Middle East and African Airport Passenger Screening Systems Market is driven by increasing air travel, heightened security concerns, and advancements in screening technologies. Additionally, government regulations mandating enhanced security measures at airports contribute to market expansion.

What challenges does the Middle East and African Airport Passenger Screening Systems Market face?

Challenges in the Middle East and African Airport Passenger Screening Systems Market include the high costs of advanced screening technologies and the need for continuous updates to comply with evolving security regulations. Additionally, the integration of new technologies with existing systems can pose operational difficulties.

What opportunities exist in the Middle East and African Airport Passenger Screening Systems Market?

Opportunities in the Middle East and African Airport Passenger Screening Systems Market include the development of AI-driven screening solutions and the expansion of airport infrastructure. As airports modernize, there is a growing demand for more efficient and effective screening systems.

What trends are shaping the Middle East and African Airport Passenger Screening Systems Market?

Trends in the Middle East and African Airport Passenger Screening Systems Market include the increasing use of biometric screening technologies and the integration of automated systems to enhance passenger flow. Additionally, there is a focus on sustainability and reducing the environmental impact of security operations.

Middle East and African Airport Passenger Screening Systems Market

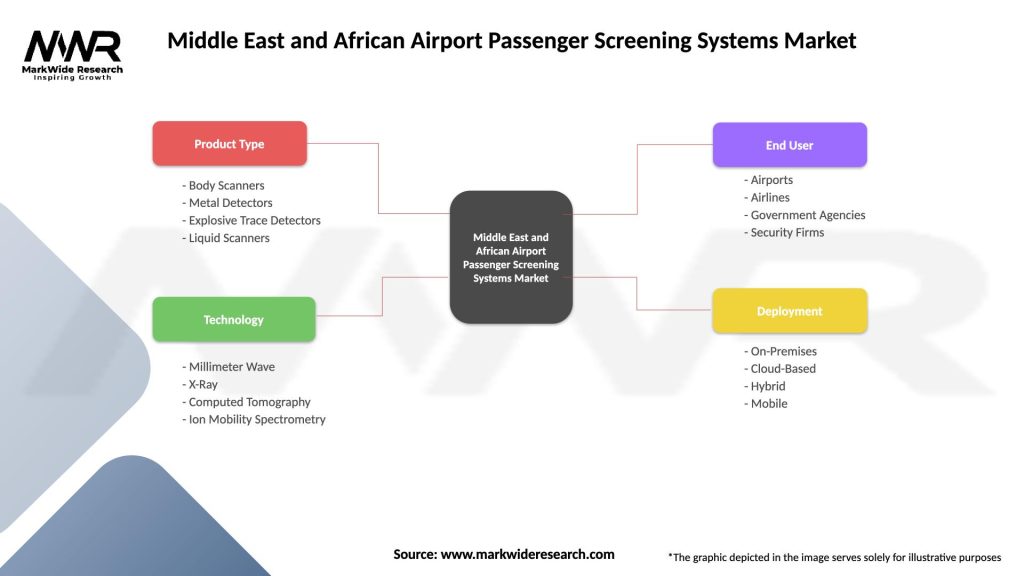

| Segmentation Details | Description |

|---|---|

| Product Type | Body Scanners, Metal Detectors, Explosive Trace Detectors, Liquid Scanners |

| Technology | Millimeter Wave, X-Ray, Computed Tomography, Ion Mobility Spectrometry |

| End User | Airports, Airlines, Government Agencies, Security Firms |

| Deployment | On-Premises, Cloud-Based, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and African Airport Passenger Screening Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at