444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa video surveillance market represents one of the fastest-growing security technology sectors in the region, driven by increasing security concerns, urbanization, and government initiatives for smart city development. This dynamic market encompasses a comprehensive range of surveillance solutions including IP cameras, analog cameras, video management systems, and cloud-based surveillance platforms that serve diverse applications across commercial, residential, and government sectors.

Regional growth patterns indicate that the Middle East and Africa video surveillance market is experiencing robust expansion, with the sector demonstrating a compound annual growth rate of 12.8% over the forecast period. The market’s evolution is characterized by technological advancement, increasing adoption of artificial intelligence integration, and growing demand for remote monitoring capabilities across various industry verticals.

Key market dynamics include the rising need for enhanced security infrastructure, government investments in smart city projects, and the increasing prevalence of IP-based surveillance systems. The region’s unique security challenges, combined with rapid economic development and infrastructure modernization, have created substantial opportunities for video surveillance technology providers and system integrators.

The Middle East and Africa video surveillance market refers to the comprehensive ecosystem of security monitoring technologies, systems, and services deployed across the MEA region to provide visual monitoring, recording, and analysis capabilities for various applications. This market encompasses hardware components such as cameras, storage devices, and networking equipment, alongside software solutions including video management systems, analytics platforms, and cloud-based services.

Video surveillance systems in this context include both traditional analog solutions and modern Internet Protocol (IP) cameras that offer advanced features such as high-definition recording, remote access, motion detection, and artificial intelligence-powered analytics. The market serves diverse end-users including government agencies, commercial enterprises, residential complexes, educational institutions, healthcare facilities, and critical infrastructure operators.

Market scope extends beyond basic monitoring to include sophisticated applications such as facial recognition, behavioral analytics, perimeter security, and integrated access control systems. The regional market’s definition encompasses both standalone surveillance solutions and comprehensive security management platforms that integrate multiple technologies for enhanced protection and operational efficiency.

Market performance in the Middle East and Africa video surveillance sector demonstrates exceptional growth momentum, driven by increasing security investments and technological modernization across the region. The market benefits from strong government support for smart city initiatives, rising commercial development, and growing awareness of security threats that require advanced monitoring solutions.

Technology trends show a significant shift toward IP-based systems, with adoption rates reaching 78% of new installations across major metropolitan areas. The integration of artificial intelligence and machine learning capabilities has become a key differentiator, enabling advanced features such as automated threat detection, crowd monitoring, and predictive analytics that enhance overall security effectiveness.

Regional variations indicate that the Gulf Cooperation Council countries lead in market adoption, while African nations show rapid growth in mobile surveillance solutions and wireless camera systems. The market’s evolution toward cloud-based platforms has accelerated, with 65% of enterprises considering or implementing cloud surveillance solutions to reduce infrastructure costs and improve scalability.

Competitive dynamics feature a mix of international technology leaders and regional specialists, with increasing emphasis on local partnerships and customized solutions that address specific regional requirements and regulatory compliance needs.

Primary market drivers encompass several critical factors that shape the Middle East and Africa video surveillance landscape:

Market segmentation reveals diverse application areas with varying growth patterns and technology requirements, creating opportunities for specialized solution providers and system integrators.

Security concerns represent the primary catalyst driving video surveillance market growth across the Middle East and Africa region. Increasing threats from terrorism, crime, and civil unrest have prompted governments and private organizations to invest heavily in comprehensive monitoring systems that provide real-time situational awareness and forensic capabilities.

Government initiatives play a crucial role in market expansion, with national security programs and smart city development projects creating substantial demand for advanced surveillance infrastructure. Countries across the region are implementing large-scale public safety systems that integrate video surveillance with other security technologies to enhance overall protection capabilities.

Economic development and infrastructure modernization drive commercial adoption of video surveillance systems. The region’s growing retail sector, expanding hospitality industry, and increasing commercial construction create ongoing demand for loss prevention systems, employee monitoring, and operational security solutions.

Technological advancement enables new applications and improved system performance, making video surveillance more attractive to end-users. The availability of high-definition cameras, intelligent analytics, and cloud-based platforms provides enhanced value propositions that justify investment in modern surveillance infrastructure.

Regulatory requirements in sectors such as banking, healthcare, and critical infrastructure mandate the implementation of comprehensive monitoring systems, creating consistent demand for compliant surveillance solutions.

High implementation costs present significant barriers to market adoption, particularly for small and medium-sized enterprises that require comprehensive surveillance coverage but face budget constraints. The total cost of ownership for advanced IP camera systems and video management platforms can be substantial, especially when including installation, maintenance, and ongoing support requirements.

Technical complexity challenges many organizations in the region, as modern video surveillance systems require specialized expertise for design, installation, and maintenance. The shortage of qualified system integrators and technical support personnel can limit market growth and increase implementation risks for end-users.

Privacy concerns and regulatory restrictions create obstacles for surveillance system deployment in certain applications and locations. Balancing security needs with privacy rights requires careful system design and compliance with evolving data protection regulations across different countries in the region.

Infrastructure limitations in some areas of the region, particularly regarding network connectivity and power reliability, can constrain the deployment of advanced IP-based surveillance systems that require robust communication infrastructure and consistent power supply.

Integration challenges with existing security systems and IT infrastructure can complicate surveillance system implementation, particularly in organizations with legacy systems that require compatibility with new technologies.

Artificial intelligence integration presents substantial opportunities for market growth and differentiation. The development of AI-powered analytics that can provide automated threat detection, behavioral analysis, and predictive capabilities creates new value propositions for surveillance systems across various applications.

Cloud-based solutions offer significant potential for market expansion, particularly among organizations seeking to reduce infrastructure costs and improve system scalability. Video Surveillance as a Service (VSaaS) models provide accessible entry points for smaller organizations while offering enterprise-grade capabilities.

Mobile surveillance applications represent growing opportunities in the region, driven by the need for temporary security solutions, construction site monitoring, and remote location surveillance. Wireless camera systems and solar-powered solutions address specific regional requirements for flexible deployment options.

Vertical market specialization creates opportunities for solution providers to develop industry-specific offerings that address unique requirements in sectors such as oil and gas, mining, transportation, and critical infrastructure. Customized solutions that integrate with operational systems provide enhanced value for specialized applications.

Smart city integration opportunities continue to expand as regional governments invest in comprehensive urban management systems that incorporate video surveillance with traffic management, environmental monitoring, and emergency response capabilities.

Technology evolution drives fundamental changes in the Middle East and Africa video surveillance market, with the transition from analog to IP-based systems accelerating across all market segments. This technological shift enables advanced features such as remote monitoring, centralized management, and intelligent analytics that provide enhanced security capabilities and operational efficiency.

Competitive landscape dynamics show increasing collaboration between international technology providers and regional system integrators to deliver localized solutions that meet specific market requirements. Partnership strategies enable global vendors to access regional expertise while local companies gain access to advanced technologies and international best practices.

Customer expectations continue to evolve toward more sophisticated solutions that provide actionable intelligence rather than simple recording capabilities. End-users increasingly demand proactive monitoring systems that can identify potential threats and provide automated responses to security incidents.

Regulatory environment changes across the region influence market development, with new standards for data protection, system interoperability, and cybersecurity creating both challenges and opportunities for solution providers. Compliance requirements drive demand for systems that meet international security standards while addressing local regulatory needs.

Economic factors including oil price fluctuations and regional development priorities affect government spending on security infrastructure, creating cyclical patterns in market demand that require adaptive business strategies from industry participants.

Comprehensive market analysis for the Middle East and Africa video surveillance market employs multiple research methodologies to ensure accurate and reliable insights. The research approach combines primary data collection through industry interviews, surveys, and expert consultations with secondary research from industry reports, government publications, and company financial statements.

Primary research activities include structured interviews with key industry stakeholders such as technology vendors, system integrators, end-users, and government officials responsible for security infrastructure development. These interviews provide insights into market trends, competitive dynamics, and future development plans that shape market evolution.

Secondary research encompasses analysis of industry publications, trade association reports, government statistics, and company annual reports to validate primary findings and provide comprehensive market context. This approach ensures that research conclusions are supported by multiple data sources and industry perspectives.

Market sizing methodology utilizes bottom-up analysis based on regional deployment patterns, technology adoption rates, and end-user spending patterns to develop accurate market assessments. The research considers regional variations in technology adoption, economic conditions, and regulatory environments that influence market development.

Data validation processes include cross-referencing findings with industry experts, comparing results with historical trends, and conducting sensitivity analysis to ensure research accuracy and reliability for strategic decision-making purposes.

Gulf Cooperation Council countries lead the Middle East and Africa video surveillance market, accounting for approximately 45% of regional market share. The UAE and Saudi Arabia drive significant adoption through large-scale smart city projects, government security initiatives, and commercial development programs that require comprehensive surveillance infrastructure.

North African markets demonstrate strong growth potential, with Egypt, Morocco, and Tunisia showing increasing adoption of IP-based surveillance systems driven by tourism security requirements, commercial development, and government modernization programs. These markets show particular interest in cost-effective solutions and mobile surveillance applications.

Sub-Saharan Africa represents an emerging market segment with substantial long-term potential, characterized by growing demand for wireless surveillance solutions and solar-powered systems that address infrastructure limitations. South Africa leads regional adoption with 22% market share in the African segment, followed by Nigeria and Kenya.

Regional variations in technology adoption reflect different economic conditions, infrastructure development levels, and security priorities. While Gulf countries focus on advanced AI-powered systems and smart city integration, African markets prioritize reliable basic surveillance and cost-effective deployment options.

Cross-border opportunities emerge from regional security cooperation initiatives and multinational infrastructure projects that require standardized surveillance solutions across multiple countries, creating demand for scalable and interoperable systems.

Market leadership in the Middle East and Africa video surveillance sector features a diverse mix of international technology giants and specialized regional providers. The competitive environment emphasizes technological innovation, local partnerships, and customized solutions that address specific regional requirements and market conditions.

Key market participants include:

Competitive strategies focus on local partnerships, technology localization, and vertical market specialization to address specific regional needs and regulatory requirements while maintaining competitive pricing and comprehensive support capabilities.

Technology segmentation reveals distinct market categories with varying growth patterns and application focus:

By Camera Type:

By System Type:

By Deployment Model:

Government and Public Safety applications represent the largest market category, driven by national security initiatives and smart city development programs. This segment emphasizes high-resolution cameras, facial recognition capabilities, and integration with emergency response systems to enhance public safety and security effectiveness.

Commercial and Retail sectors show strong adoption of loss prevention systems and operational monitoring solutions. Retailers particularly value people counting analytics, heat mapping, and inventory monitoring capabilities that provide business intelligence alongside security functions.

Critical Infrastructure including oil and gas facilities, power plants, and transportation hubs require specialized surveillance solutions with explosion-proof cameras, thermal imaging, and perimeter intrusion detection capabilities that meet stringent safety and security requirements.

Residential and Commercial Buildings increasingly adopt IP-based systems with mobile access and cloud storage capabilities. This segment values easy installation, remote monitoring, and integration with home automation systems for comprehensive property management.

Transportation and Logistics applications focus on vehicle monitoring, cargo security, and fleet management integration. According to MarkWide Research analysis, this segment shows 15% annual growth driven by expanding logistics operations and e-commerce development across the region.

Technology vendors benefit from expanding market opportunities driven by regional security investments and infrastructure development. The growing demand for advanced analytics and AI-powered solutions creates opportunities for premium pricing and differentiated offerings that provide enhanced value to end-users.

System integrators gain from increasing complexity of surveillance deployments that require specialized expertise in design, installation, and maintenance. The trend toward integrated security platforms creates opportunities for comprehensive service offerings that combine multiple technologies and ongoing support services.

End-users achieve enhanced security capabilities, operational efficiency, and regulatory compliance through modern surveillance systems. Cost reduction through improved incident response, loss prevention, and operational monitoring provides measurable return on investment for surveillance system deployments.

Government agencies benefit from improved public safety capabilities, enhanced border security, and better emergency response coordination through comprehensive surveillance infrastructure. Smart city integration enables more efficient urban management and improved citizen services.

Investors and stakeholders find attractive opportunities in a growing market with strong fundamentals driven by security needs, technological advancement, and government support for infrastructure development across the Middle East and Africa region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend shaping the Middle East and Africa video surveillance market. AI-powered analytics enable advanced capabilities such as facial recognition, behavioral analysis, and predictive threat detection that transform surveillance from passive recording to proactive security management.

Cloud-Based Solutions gain increasing adoption as organizations seek to reduce infrastructure costs and improve system scalability. Video Surveillance as a Service models provide accessible entry points for smaller organizations while offering enterprise-grade capabilities and automatic system updates.

Mobile and Wireless Technologies address regional infrastructure challenges and deployment flexibility requirements. Solar-powered cameras, cellular connectivity, and battery-powered systems enable surveillance deployment in remote locations and temporary applications.

Integration and Convergence trends show surveillance systems increasingly connecting with other security technologies, building management systems, and operational platforms to provide comprehensive situational awareness and automated response capabilities.

Edge Computing adoption enables real-time analytics processing at camera level, reducing bandwidth requirements and improving system responsiveness for time-critical security applications.

Technology partnerships between international vendors and regional system integrators accelerate market development and localization of surveillance solutions. These collaborations enable global technology providers to access regional expertise while local companies gain advanced technology capabilities and international market reach.

Government initiatives across the region continue to drive large-scale surveillance deployments, with smart city projects in Dubai, Riyadh, and Cairo creating substantial market opportunities for comprehensive monitoring systems that integrate with urban management platforms.

Product innovations focus on AI-powered analytics, thermal imaging integration, and cybersecurity enhancements that address evolving security threats and regulatory requirements. Manufacturers increasingly emphasize edge computing capabilities and cloud connectivity to provide flexible deployment options.

Market consolidation activities include strategic acquisitions and partnerships that strengthen technology portfolios and regional market presence. These developments create more comprehensive solution offerings and improved customer support capabilities across the region.

Regulatory developments in data protection and cybersecurity influence product development and deployment strategies, with manufacturers focusing on compliance features and security certifications that meet international standards and local requirements.

Market entry strategies should emphasize local partnerships and regional expertise to navigate diverse regulatory environments and cultural considerations across the Middle East and Africa region. Successful market participants invest in understanding local security challenges and developing customized solutions that address specific regional requirements.

Technology focus recommendations include prioritizing AI-powered analytics, cloud integration, and mobile accessibility to meet evolving customer expectations for intelligent and flexible surveillance solutions. Companies should balance advanced features with cost-effectiveness to serve diverse market segments.

Vertical market specialization offers opportunities for differentiation and premium positioning through industry-specific solutions that integrate with operational systems and address unique security challenges in sectors such as oil and gas, mining, and critical infrastructure.

Service capabilities development becomes increasingly important as surveillance systems grow more complex and customers seek comprehensive support throughout system lifecycle. Investment in local technical expertise and support infrastructure enhances competitive positioning and customer satisfaction.

Cybersecurity emphasis should be integrated into all product development and deployment activities, as security concerns and regulatory requirements increasingly focus on system protection and data privacy in surveillance applications.

Market growth trajectory indicates continued expansion of the Middle East and Africa video surveillance market, with MWR projecting sustained growth driven by ongoing security investments, smart city development, and technological advancement. The market’s evolution toward intelligent surveillance systems creates opportunities for premium solutions and value-added services.

Technology evolution will emphasize artificial intelligence integration, edge computing capabilities, and cloud-based platforms that provide enhanced functionality while reducing total cost of ownership. The convergence of surveillance with other security and operational technologies will create comprehensive management platforms for diverse applications.

Regional development patterns suggest continued leadership by Gulf countries in advanced technology adoption, while African markets show strong potential for wireless solutions and cost-effective systems that address infrastructure limitations and budget constraints.

Application expansion beyond traditional security monitoring will include business intelligence, operational efficiency, and regulatory compliance applications that provide additional value justification for surveillance system investments across various industry sectors.

Market maturation will likely result in increased emphasis on system integration, professional services, and ongoing support as customers seek comprehensive solutions rather than standalone products, creating opportunities for service-oriented business models and long-term customer relationships.

The Middle East and Africa video surveillance market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing security awareness, government initiatives, and technological advancement. The market’s transformation from basic recording systems to intelligent, AI-powered platforms creates new opportunities for technology providers, system integrators, and end-users across diverse applications and industry sectors.

Regional market dynamics reflect varying development patterns, with Gulf countries leading in advanced technology adoption while African markets show strong potential for innovative solutions that address infrastructure challenges and cost considerations. The increasing emphasis on smart city integration and comprehensive security management platforms indicates continued market evolution toward more sophisticated and interconnected systems.

Success factors for market participants include understanding regional requirements, developing localized solutions, and building strong partnerships that combine international technology expertise with regional market knowledge. The growing importance of artificial intelligence, cloud computing, and mobile accessibility requires ongoing investment in technology development and customer education to maximize market opportunities and competitive positioning in this expanding sector.

What is Video Surveillance?

Video surveillance refers to the use of video cameras to transmit a signal to a specific place, on a limited set of monitors. It is commonly used for security purposes in various sectors, including retail, transportation, and public safety.

What are the key players in the Middle East And Africa Video Surveillance Market?

Key players in the Middle East And Africa Video Surveillance Market include Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems, among others.

What are the main drivers of the Middle East And Africa Video Surveillance Market?

The main drivers of the Middle East And Africa Video Surveillance Market include increasing security concerns, the rise in crime rates, and the growing adoption of smart city initiatives. Additionally, advancements in technology, such as AI and IoT integration, are enhancing surveillance capabilities.

What challenges does the Middle East And Africa Video Surveillance Market face?

Challenges in the Middle East And Africa Video Surveillance Market include privacy concerns, high installation costs, and the need for skilled personnel to manage and maintain surveillance systems. Regulatory compliance can also pose hurdles for market growth.

What opportunities exist in the Middle East And Africa Video Surveillance Market?

Opportunities in the Middle East And Africa Video Surveillance Market include the increasing demand for cloud-based surveillance solutions and the integration of advanced analytics. The expansion of infrastructure projects and urban development also presents significant growth potential.

What trends are shaping the Middle East And Africa Video Surveillance Market?

Trends shaping the Middle East And Africa Video Surveillance Market include the shift towards IP-based surveillance systems, the use of artificial intelligence for real-time analytics, and the growing emphasis on cybersecurity measures to protect surveillance data.

Middle East And Africa Video Surveillance Market

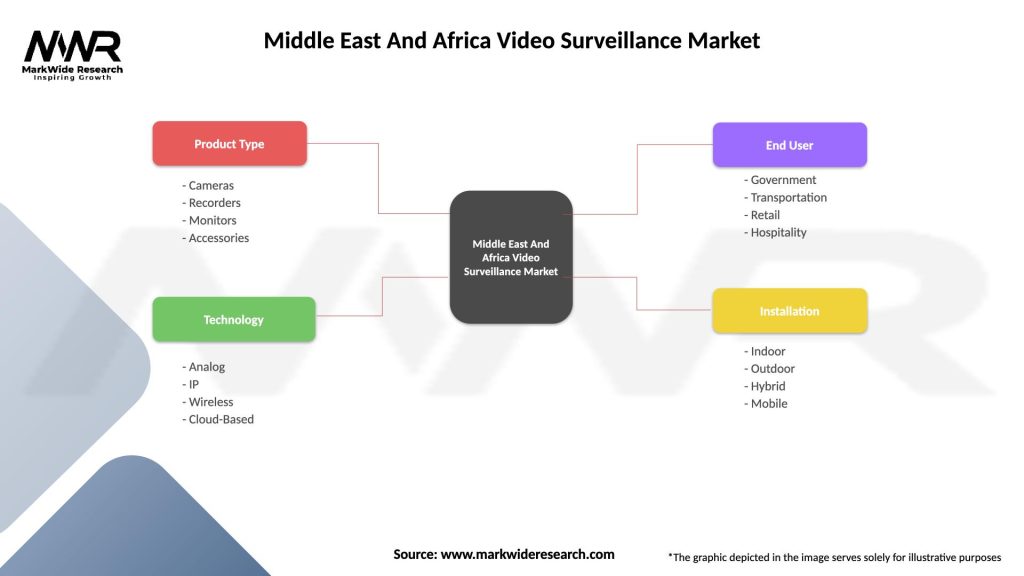

| Segmentation Details | Description |

|---|---|

| Product Type | Cameras, Recorders, Monitors, Accessories |

| Technology | Analog, IP, Wireless, Cloud-Based |

| End User | Government, Transportation, Retail, Hospitality |

| Installation | Indoor, Outdoor, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Video Surveillance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at