444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa telehealth service market represents one of the fastest-growing digital healthcare segments globally, driven by rapid technological advancement and increasing healthcare accessibility demands. This dynamic market encompasses a comprehensive range of remote healthcare services, including telemedicine consultations, remote patient monitoring, digital therapeutics, and mobile health applications across diverse geographical regions.

Market expansion in the MEA region has been particularly accelerated by the COVID-19 pandemic, which catalyzed widespread adoption of digital healthcare solutions. The region is experiencing a compound annual growth rate of 18.5%, significantly outpacing global averages as governments and healthcare providers invest heavily in digital infrastructure and telemedicine platforms.

Healthcare digitization across Middle Eastern and African countries varies considerably, with Gulf Cooperation Council nations leading adoption rates while sub-Saharan African markets show tremendous growth potential. The market benefits from increasing smartphone penetration, which has reached 78% across major urban centers, enabling broader access to telehealth services.

Investment patterns indicate strong government support for digital health initiatives, with several countries implementing national telehealth strategies and regulatory frameworks. The integration of artificial intelligence, machine learning, and Internet of Things technologies is transforming traditional healthcare delivery models throughout the region.

The Middle East and Africa telehealth service market refers to the comprehensive ecosystem of digital healthcare technologies and services that enable remote medical consultations, patient monitoring, health education, and clinical support across the MEA region. This market encompasses various technological solutions designed to bridge geographical healthcare gaps and improve medical accessibility.

Telehealth services include synchronous video consultations, asynchronous store-and-forward communications, remote patient monitoring systems, mobile health applications, digital therapeutics platforms, and electronic health record integration. These services facilitate healthcare delivery across vast geographical distances, particularly crucial in regions with limited healthcare infrastructure.

Market definition extends beyond simple telemedicine to include comprehensive digital health ecosystems that integrate with existing healthcare infrastructure, supporting both urban and rural populations with varying levels of technological sophistication and internet connectivity.

Strategic market positioning of telehealth services in the Middle East and Africa demonstrates exceptional growth momentum, driven by demographic shifts, technological advancement, and evolving healthcare needs. The market represents a critical component of regional healthcare transformation initiatives, supported by substantial government investments and private sector innovation.

Key growth drivers include increasing chronic disease prevalence, healthcare professional shortages, expanding internet infrastructure, and growing consumer acceptance of digital health solutions. The market benefits from 65% smartphone adoption rates across target demographics, enabling widespread service accessibility.

Competitive landscape features both international technology providers and regional healthcare innovators, creating a diverse ecosystem of solutions tailored to local market needs. Major market segments include primary care consultations, specialist referrals, mental health services, and chronic disease management programs.

Future projections indicate continued robust expansion, with particular strength in mobile health applications and AI-powered diagnostic tools. The market is expected to maintain strong growth trajectories as healthcare systems increasingly integrate digital solutions into standard care protocols.

Market intelligence reveals several critical insights shaping the Middle East and Africa telehealth landscape:

Healthcare accessibility challenges represent the primary driver for telehealth adoption across the Middle East and Africa region. Many areas face significant healthcare professional shortages, with some regions experiencing physician-to-population ratios 40% below World Health Organization recommendations. Telehealth services effectively address these gaps by enabling remote consultations and specialist access.

Technological infrastructure development continues accelerating market growth, with expanding 4G and emerging 5G networks improving service quality and reliability. Government investments in digital infrastructure create enabling environments for telehealth service deployment and scaling across diverse geographical areas.

Demographic transitions throughout the region drive increased healthcare demand, particularly for chronic disease management and elderly care services. Rising urbanization rates and changing lifestyle patterns contribute to growing healthcare needs that traditional delivery models struggle to address efficiently.

Cost optimization pressures on healthcare systems encourage telehealth adoption as a means to improve efficiency and reduce operational expenses. Healthcare providers recognize telehealth’s potential to serve more patients with existing resources while maintaining quality care standards.

Regulatory support from governments across the region facilitates market development through favorable policies, licensing frameworks, and reimbursement mechanisms. Several countries have established national telehealth strategies that encourage innovation and investment in digital health solutions.

Infrastructure limitations continue constraining market growth in certain regions, particularly rural and remote areas with limited internet connectivity and unreliable power supply. These challenges create digital divides that prevent equitable access to telehealth services across all population segments.

Regulatory complexity varies significantly across different countries within the MEA region, creating compliance challenges for service providers operating across multiple markets. Inconsistent licensing requirements, data privacy regulations, and cross-border service restrictions complicate market expansion strategies.

Cultural barriers and traditional healthcare preferences in some communities resist digital health adoption, particularly among older populations who prefer face-to-face medical consultations. Building trust and acceptance for remote healthcare delivery requires significant education and awareness efforts.

Reimbursement limitations restrict market growth as many insurance providers and government healthcare systems lack comprehensive coverage for telehealth services. Limited payment mechanisms reduce patient access and provider incentives for service adoption.

Cybersecurity concerns regarding patient data protection and privacy create hesitation among both healthcare providers and patients. Ensuring robust security measures while maintaining user-friendly interfaces presents ongoing technical and operational challenges.

Artificial intelligence integration presents substantial opportunities for market advancement, enabling automated diagnosis support, predictive analytics, and personalized treatment recommendations. AI-powered telehealth solutions can significantly enhance service quality while reducing costs and improving patient outcomes.

Rural healthcare expansion represents a massive untapped opportunity, with remote and underserved areas showing strong demand for accessible healthcare services. Innovative delivery models using satellite connectivity and mobile health units can extend telehealth reach to previously inaccessible populations.

Chronic disease management programs offer significant growth potential as regional populations experience increasing rates of diabetes, hypertension, and cardiovascular conditions. Comprehensive remote monitoring and management solutions can improve patient outcomes while reducing healthcare system burdens.

Public-private partnerships create opportunities for large-scale telehealth implementations, combining government resources with private sector innovation and efficiency. These collaborations can accelerate market development while ensuring sustainable service delivery models.

Mobile health innovation leverages the region’s high mobile phone penetration rates to deliver healthcare services through accessible, user-friendly applications. Opportunities exist for developing culturally appropriate, multilingual solutions that address specific regional health challenges.

Supply and demand dynamics in the Middle East and Africa telehealth market demonstrate strong growth momentum, with demand consistently outpacing service availability in many regions. Healthcare provider capacity constraints drive continued investment in telehealth infrastructure and service expansion initiatives.

Technology adoption cycles vary significantly across different market segments and geographical areas, with urban centers leading innovation adoption while rural areas follow with adapted solutions. This creates dynamic market conditions requiring flexible service delivery approaches and technology solutions.

Competitive pressures intensify as both international technology companies and regional healthcare providers enter the market, driving innovation and service improvement. Market consolidation trends emerge as successful platforms acquire smaller competitors to expand service offerings and geographical reach.

Regulatory evolution continues shaping market dynamics as governments develop more comprehensive telehealth frameworks and standards. According to MarkWide Research analysis, regulatory clarity improvements have accelerated market growth by 23% annually in countries with established telehealth policies.

Investment flows into telehealth startups and established healthcare technology companies indicate strong market confidence and growth expectations. Venture capital and government funding support innovation and market expansion across diverse service categories and technological approaches.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable market insights. Primary research included extensive surveys and interviews with healthcare providers, technology vendors, government officials, and end-users across major markets within the Middle East and Africa region.

Data collection strategies incorporated both quantitative and qualitative research approaches, utilizing structured questionnaires, focus group discussions, and in-depth expert interviews. Research covered diverse stakeholder perspectives including healthcare professionals, patients, technology providers, and regulatory authorities.

Secondary research analyzed existing market reports, government publications, healthcare statistics, technology adoption studies, and industry publications to provide comprehensive market context and validation of primary research findings.

Market sizing methodologies employed bottom-up and top-down approaches, analyzing service utilization rates, pricing models, and market penetration across different segments and geographical areas. Cross-validation techniques ensured data accuracy and reliability.

Quality assurance processes included peer review, expert validation, and statistical verification to maintain research integrity and provide actionable market intelligence for stakeholders across the telehealth ecosystem.

Gulf Cooperation Council countries lead regional telehealth adoption, with the United Arab Emirates and Saudi Arabia demonstrating the highest service penetration rates and technological sophistication. These markets benefit from advanced telecommunications infrastructure, government support, and high disposable incomes that facilitate premium service adoption.

North African markets show strong growth potential, particularly Egypt and Morocco, where large populations and improving internet connectivity create substantial opportunities for telehealth service expansion. Government healthcare initiatives increasingly incorporate digital health components to address population health challenges.

Sub-Saharan Africa represents the fastest-growing regional segment, with countries like Kenya, Nigeria, and South Africa leading mobile health innovation. These markets demonstrate mobile-first adoption rates of 89%, leveraging widespread smartphone usage to deliver healthcare services to underserved populations.

East African countries benefit from regional technology hubs and innovation ecosystems that support telehealth development. Rwanda and Uganda have implemented national digital health strategies that encourage telehealth adoption and integration with existing healthcare systems.

Market maturity levels vary significantly across the region, with Gulf states showing advanced implementation while many African countries remain in early adoption phases. This diversity creates opportunities for tailored solutions addressing specific regional needs and infrastructure capabilities.

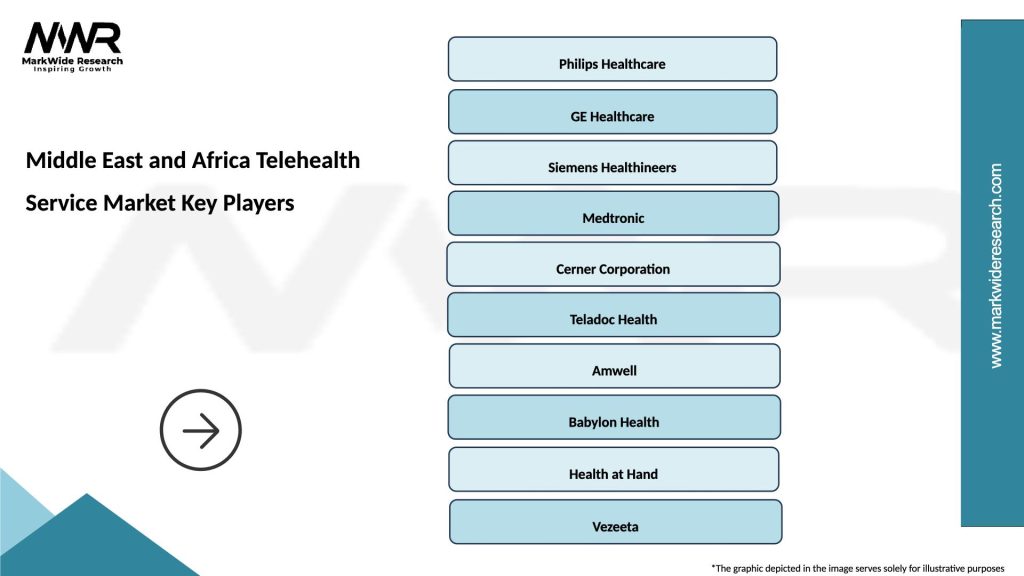

Market leadership in the Middle East and Africa telehealth sector includes both international technology giants and regional healthcare innovators. The competitive landscape demonstrates increasing consolidation as successful platforms expand their service offerings and geographical reach.

Key market participants include:

Competitive strategies focus on localization, regulatory compliance, and integration with existing healthcare systems. Successful companies demonstrate strong understanding of regional cultural preferences, language requirements, and healthcare delivery challenges.

By Service Type:

By Technology Platform:

By End User:

Primary Care Telehealth dominates market utilization, addressing routine medical consultations, prescription renewals, and basic health assessments. This category benefits from high patient acceptance rates and straightforward implementation requirements, making it ideal for market entry and expansion strategies.

Specialty Care Services show strong growth in areas like dermatology, cardiology, and endocrinology, where visual assessments and remote monitoring provide effective alternatives to in-person visits. These services often command premium pricing and demonstrate high patient satisfaction rates.

Mental Health Telehealth experiences rapid expansion, addressing growing awareness of psychological wellness and reducing stigma associated with mental health treatment. The category benefits from privacy advantages and accessibility improvements that traditional therapy models cannot match.

Chronic Disease Management represents a high-value category with strong growth potential, particularly for diabetes, hypertension, and cardiovascular conditions prevalent in the region. Remote monitoring and management solutions demonstrate measurable improvements in patient outcomes and healthcare cost reduction.

Emergency Consultations provide critical services for urgent but non-emergency medical situations, reducing emergency room visits and providing immediate medical guidance. This category shows particular strength in regions with limited emergency healthcare infrastructure.

Healthcare Providers benefit from expanded patient reach, improved operational efficiency, and reduced overhead costs through telehealth implementation. Providers can serve more patients with existing resources while offering convenient access to specialized care services.

Patients gain improved healthcare access, reduced travel time and costs, and greater convenience in managing their health needs. Telehealth services provide particular benefits for patients in remote areas or those with mobility limitations.

Healthcare Systems achieve cost optimization, improved resource allocation, and enhanced population health management capabilities. Telehealth integration helps address healthcare professional shortages while maintaining quality care delivery.

Technology Providers access rapidly expanding markets with strong growth potential and government support. The sector offers opportunities for innovation, partnership development, and sustainable revenue generation through subscription-based service models.

Governments can improve healthcare accessibility, reduce infrastructure requirements, and enhance emergency response capabilities through telehealth adoption. Digital health initiatives support broader economic development and technology advancement goals.

Insurance Companies benefit from reduced claim costs, improved patient outcomes, and enhanced risk management through preventive care and early intervention capabilities enabled by telehealth services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant technological trend, with AI-powered diagnostic tools, chatbots, and predictive analytics enhancing service quality and efficiency. Machine learning algorithms improve over time, providing increasingly accurate health assessments and treatment recommendations.

Mobile-First Design dominates platform development strategies, with telehealth services optimized for smartphone usage and mobile internet connectivity. This trend reflects regional preferences and infrastructure realities that favor mobile over desktop access.

Multilingual Localization becomes increasingly important as services expand across diverse linguistic regions. Arabic, French, English, and local language support significantly improve user engagement and service adoption rates.

Integrated Care Platforms emerge as providers seek comprehensive solutions that combine telemedicine, electronic health records, appointment scheduling, and payment processing. Integration reduces complexity and improves user experience for both providers and patients.

Wearable Device Integration expands remote monitoring capabilities, enabling continuous health tracking and real-time data collection. Smartwatches and fitness trackers provide valuable health metrics that enhance telehealth consultations and chronic disease management.

Blockchain Technology gains traction for secure health data management and interoperability between different healthcare systems. Blockchain solutions address privacy concerns while enabling secure data sharing across providers and platforms.

Regulatory Framework Evolution continues across the region, with several countries implementing comprehensive telehealth regulations and licensing requirements. The UAE and Saudi Arabia have established leading regulatory frameworks that other regional markets are adopting as models.

Strategic Partnerships between international technology companies and regional healthcare providers accelerate market development and service localization. These collaborations combine global expertise with local market knowledge and regulatory compliance capabilities.

Government Digital Health Initiatives expand across multiple countries, with national telehealth strategies and funding programs supporting market growth. Rwanda’s digital health strategy and Egypt’s telemedicine initiatives exemplify government-led market development efforts.

Investment Acceleration in telehealth startups and established companies indicates strong market confidence. MWR data shows venture capital investment in regional telehealth companies has increased by 156% annually over the past three years.

Technology Infrastructure Improvements through 5G network deployments and fiber optic expansion enhance service quality and reliability. These infrastructure developments enable more sophisticated telehealth applications and improved user experiences.

Cross-Border Service Expansion increases as successful platforms extend their reach across multiple countries within the region. Regulatory harmonization efforts facilitate this expansion while maintaining quality and compliance standards.

Market Entry Strategies should prioritize regulatory compliance and local partnership development to navigate complex regional requirements successfully. Companies entering the market should invest in understanding cultural preferences and healthcare delivery expectations across different countries.

Technology Investment recommendations emphasize mobile-first development, multilingual support, and AI integration to meet evolving user expectations and competitive requirements. Platforms should prioritize user experience optimization and seamless integration with existing healthcare workflows.

Partnership Development with local healthcare providers, government agencies, and technology companies can accelerate market penetration and reduce regulatory risks. Strategic alliances provide market access, credibility, and operational support for international companies.

Service Differentiation through specialized offerings, superior user experience, and comprehensive care coordination can establish competitive advantages in increasingly crowded markets. Focus on specific medical specialties or underserved populations can create sustainable market positions.

Regulatory Engagement with government authorities and industry associations helps shape favorable policy environments while ensuring compliance with evolving requirements. Active participation in regulatory development processes can influence market-friendly policies.

Infrastructure Investment in cybersecurity, data protection, and service reliability builds trust and ensures sustainable operations. Robust technical infrastructure supports scaling and maintains service quality as user bases expand.

Market trajectory for Middle East and Africa telehealth services indicates continued robust expansion over the next decade, driven by demographic trends, technology advancement, and healthcare system evolution. The market is expected to maintain strong growth momentum as digital health becomes integral to healthcare delivery across the region.

Technology evolution will likely focus on AI enhancement, 5G connectivity utilization, and Internet of Things integration to create more sophisticated and effective healthcare solutions. Advanced analytics and machine learning will enable predictive healthcare and personalized treatment approaches.

Geographic expansion will extend telehealth services to previously underserved rural and remote areas as infrastructure improvements and innovative delivery models overcome traditional barriers. Satellite connectivity and mobile health units will play crucial roles in expanding access.

Service sophistication will increase as platforms integrate comprehensive care coordination, electronic health records, and multi-specialty collaboration capabilities. According to MarkWide Research projections, integrated care platforms will represent 67% of market adoption by 2030.

Regulatory maturation across the region will create more standardized frameworks that facilitate cross-border service delivery and international investment. Harmonized regulations will reduce compliance complexity while maintaining quality and safety standards.

Investment continuation in telehealth infrastructure, technology development, and market expansion will support sustained growth and innovation. Public and private sector funding will drive continued advancement in service capabilities and accessibility.

The Middle East and Africa telehealth service market represents a transformative force in regional healthcare delivery, addressing critical access challenges while leveraging advanced technologies to improve patient outcomes and system efficiency. The market demonstrates exceptional growth potential driven by demographic needs, government support, and technological advancement.

Strategic opportunities abound for healthcare providers, technology companies, and investors willing to navigate regulatory complexities and cultural considerations. Success in this market requires deep understanding of local needs, robust technology platforms, and sustainable business models that address diverse economic conditions across the region.

Future success will depend on continued innovation, regulatory collaboration, and infrastructure development that supports equitable access to quality healthcare services. The telehealth market in the Middle East and Africa is positioned to become a global leader in mobile-first healthcare delivery and innovative service models that address unique regional challenges while setting standards for emerging markets worldwide.

What is the Middle East and Africa Telehealth Service Market?

The Middle East and Africa Telehealth Service Market refers to the delivery of healthcare services through digital platforms. This includes virtual consultations, remote patient monitoring, and mobile health applications, enhancing access to medical care in the region.

Who are the key companies in the Middle East and Africa Telehealth Service Market?

Key companies in the Middle East and Africa Telehealth Service Market include Teladoc Health, DabaDoc, and Healthigo. These organizations are at the forefront of providing innovative telehealth solutions tailored to regional healthcare needs.

What are the main drivers of the Middle East and Africa Telehealth Service Market?

Drivers of the Middle East and Africa Telehealth Service Market include increasing smartphone penetration, a growing demand for accessible healthcare, and advancements in telecommunication technologies. These factors are fostering greater adoption of telehealth services across various demographics.

What challenges does the Middle East and Africa Telehealth Service Market face?

The Middle East and Africa Telehealth Service Market faces challenges such as regulatory hurdles, concerns regarding data privacy, and varying levels of technological infrastructure across countries. These issues can hinder the widespread adoption of telehealth solutions.

What opportunities exist in the Middle East and Africa Telehealth Service Market?

Opportunities in the Middle East and Africa Telehealth Service Market include the expansion of internet connectivity and the rising acceptance of digital health solutions among consumers. Additionally, partnerships between tech companies and healthcare providers can enhance service delivery.

What trends are shaping the Middle East and Africa Telehealth Service Market?

Trends in the Middle East and Africa Telehealth Service Market include the integration of artificial intelligence in diagnostics, increased focus on mental health services, and the rise of personalized telehealth solutions. These trends are reshaping how healthcare is delivered in the region.

Middle East and Africa Telehealth Service Market

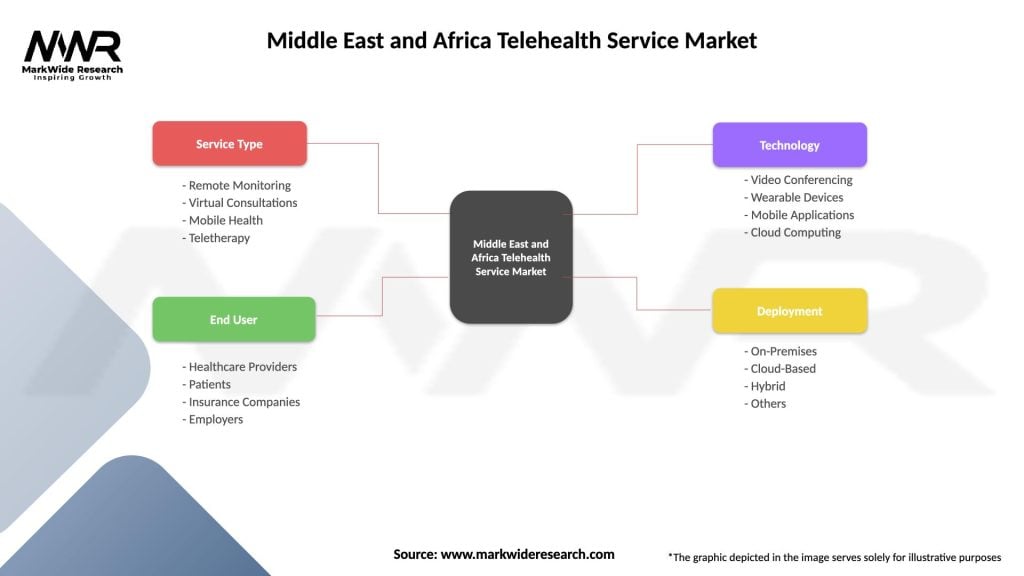

| Segmentation Details | Description |

|---|---|

| Service Type | Remote Monitoring, Virtual Consultations, Mobile Health, Teletherapy |

| End User | Healthcare Providers, Patients, Insurance Companies, Employers |

| Technology | Video Conferencing, Wearable Devices, Mobile Applications, Cloud Computing |

| Deployment | On-Premises, Cloud-Based, Hybrid, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Telehealth Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at