444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa soft drinks packaging market represents a dynamic and rapidly evolving sector driven by changing consumer preferences, urbanization trends, and technological innovations in packaging solutions. This market encompasses various packaging formats including plastic bottles, aluminum cans, glass containers, and flexible pouches designed specifically for carbonated beverages, fruit juices, energy drinks, and other non-alcoholic beverages across the MEA region.

Regional dynamics in the Middle East and Africa present unique opportunities and challenges for soft drinks packaging manufacturers. The market is experiencing robust growth with an estimated CAGR of 6.2% driven by increasing disposable income, growing youth population, and expanding retail infrastructure. Countries such as Saudi Arabia, UAE, South Africa, and Nigeria are emerging as key growth markets, each presenting distinct packaging preferences and regulatory requirements.

Sustainability initiatives are reshaping the packaging landscape, with manufacturers increasingly adopting eco-friendly materials and recyclable solutions. The shift towards lightweight packaging, reduced plastic usage, and innovative barrier technologies is transforming traditional packaging approaches. Consumer awareness regarding environmental impact is driving demand for sustainable packaging alternatives, creating new market opportunities for innovative packaging solutions.

Market penetration varies significantly across different countries within the region, with urban areas showing higher adoption rates of premium packaging formats compared to rural markets. The growing influence of international beverage brands and local manufacturers is contributing to packaging standardization while maintaining regional customization requirements.

The Middle East and Africa soft drinks packaging market refers to the comprehensive ecosystem of packaging materials, technologies, and solutions specifically designed for non-alcoholic beverage products distributed across the MEA region. This market encompasses primary packaging that directly contains the beverage, secondary packaging for distribution and retail display, and tertiary packaging for logistics and transportation purposes.

Packaging formats within this market include various container types such as PET bottles, aluminum cans, glass bottles, cartons, pouches, and specialized packaging for different beverage categories. The market also includes packaging components like closures, labels, sleeves, and protective films that ensure product integrity, brand differentiation, and consumer convenience throughout the supply chain.

Geographic scope covers diverse markets from the oil-rich Gulf Cooperation Council countries to emerging African economies, each with distinct consumer behaviors, regulatory frameworks, and infrastructure capabilities. This diversity creates a complex market environment requiring tailored packaging solutions that address local preferences while maintaining cost-effectiveness and operational efficiency.

Market dynamics in the Middle East and Africa soft drinks packaging sector are characterized by strong growth momentum, technological innovation, and increasing sustainability focus. The market benefits from favorable demographic trends, with approximately 60% of the population under 30 years of age, driving higher consumption of packaged beverages and creating sustained demand for innovative packaging solutions.

Key growth drivers include rapid urbanization, expanding modern retail channels, rising health consciousness leading to demand for functional beverages, and increasing adoption of on-the-go consumption patterns. The market is witnessing significant investments in local manufacturing capabilities, reducing dependence on imports and improving cost competitiveness for regional packaging solutions.

Competitive landscape features a mix of global packaging giants and regional specialists, with companies focusing on technological advancement, sustainability initiatives, and strategic partnerships with beverage manufacturers. The market shows strong potential for consolidation as smaller players seek scale advantages and larger companies expand their regional footprint.

Future prospects remain positive, supported by continued economic development, infrastructure improvements, and growing consumer sophistication. However, challenges including raw material price volatility, regulatory compliance requirements, and environmental concerns require strategic adaptation from market participants.

Strategic insights reveal several critical trends shaping the Middle East and Africa soft drinks packaging market landscape:

Consumer behavior analysis indicates growing preference for convenient, portable packaging formats that align with active lifestyles and mobile consumption patterns prevalent across the region’s young demographic.

Demographic advantages represent the primary growth catalyst for the Middle East and Africa soft drinks packaging market. The region’s young population, rapid urbanization, and increasing disposable income create favorable conditions for packaged beverage consumption. Rising literacy rates and digital connectivity are exposing consumers to global beverage trends, driving demand for diverse packaging formats and premium solutions.

Economic development across key markets is supporting infrastructure improvements, retail modernization, and supply chain enhancement. Government initiatives promoting local manufacturing, foreign investment incentives, and economic diversification programs are creating opportunities for packaging industry expansion and technological advancement.

Lifestyle changes driven by urbanization and modernization are increasing demand for convenient, portable beverage packaging. The growing prevalence of on-the-go consumption, workplace beverage consumption, and outdoor activities is driving preference for lightweight, resealable, and easy-to-carry packaging formats.

Health and wellness trends are creating demand for functional beverages, natural products, and reduced-sugar alternatives, requiring specialized packaging solutions that preserve nutritional integrity and communicate health benefits effectively. This trend is particularly strong among educated urban consumers who prioritize health-conscious choices.

Retail evolution including the expansion of modern trade channels, convenience stores, and e-commerce platforms is creating new packaging requirements focused on shelf appeal, product protection during transportation, and consumer convenience. The growth of organized retail is standardizing packaging requirements and driving quality improvements.

Raw material costs present significant challenges for packaging manufacturers, with petroleum-based materials experiencing price volatility due to global oil market fluctuations. The dependency on imported raw materials in many MEA countries creates additional cost pressures and supply chain vulnerabilities that impact packaging affordability and availability.

Infrastructure limitations in certain markets constrain packaging distribution, recycling capabilities, and manufacturing efficiency. Inadequate transportation networks, limited cold chain facilities, and insufficient waste management systems create operational challenges and increase packaging requirements for product protection and shelf life extension.

Regulatory complexity across different countries within the region creates compliance challenges for packaging manufacturers. Varying food safety standards, labeling requirements, environmental regulations, and import restrictions necessitate customized approaches that increase operational complexity and costs.

Environmental concerns regarding plastic waste, marine pollution, and landfill accumulation are creating regulatory pressure and consumer resistance to certain packaging formats. The lack of comprehensive recycling infrastructure in many markets limits the effectiveness of sustainability initiatives and creates reputational risks for packaging companies.

Economic volatility in some regional markets affects consumer purchasing power and demand patterns. Currency fluctuations, political instability, and economic sanctions in certain countries create market uncertainty and investment risks that constrain long-term planning and capacity expansion decisions.

Sustainability innovation presents substantial opportunities for packaging companies to develop eco-friendly solutions that address environmental concerns while meeting performance requirements. The development of biodegradable materials, improved recycling technologies, and circular economy approaches can create competitive advantages and align with global sustainability trends.

Technology integration offers opportunities to enhance packaging functionality through smart labels, temperature indicators, freshness sensors, and interactive consumer engagement features. The growing smartphone penetration and digital literacy in the region create favorable conditions for technology-enabled packaging solutions.

Local manufacturing expansion provides opportunities to reduce costs, improve supply chain efficiency, and capture growing domestic demand. Government incentives for local production, import substitution policies, and infrastructure development programs support manufacturing investment and capacity building initiatives.

Premium segment growth driven by increasing affluence and consumer sophistication creates opportunities for high-value packaging solutions. Luxury packaging formats, limited edition designs, and premium materials can command higher margins while serving the growing upper-middle-class consumer segment.

E-commerce packaging represents an emerging opportunity as online beverage sales grow across the region. Specialized packaging designed for direct-to-consumer shipping, subscription services, and digital retail channels can capture this expanding market segment while addressing unique logistics requirements.

Supply chain evolution is transforming the Middle East and Africa soft drinks packaging market through improved logistics networks, regional manufacturing hubs, and strategic partnerships between packaging suppliers and beverage manufacturers. The development of specialized packaging clusters and industrial zones is enhancing operational efficiency and reducing transportation costs.

Consumer preferences are shifting toward sustainable, convenient, and aesthetically appealing packaging solutions that align with lifestyle changes and environmental awareness. The influence of social media and digital marketing is increasing the importance of packaging design and visual appeal in purchase decisions, particularly among younger consumers.

Technological advancement in packaging machinery, materials science, and production processes is enabling manufacturers to improve quality, reduce costs, and develop innovative solutions. Automation, digitalization, and Industry 4.0 technologies are enhancing manufacturing efficiency and enabling mass customization capabilities.

Regulatory landscape is evolving toward stricter environmental standards, enhanced food safety requirements, and improved labeling transparency. These changes are driving investment in compliance systems, quality assurance processes, and sustainable packaging alternatives while creating barriers for non-compliant suppliers.

Market consolidation trends are creating opportunities for scale advantages, technology sharing, and market expansion through strategic acquisitions and partnerships. The integration of packaging value chains is improving coordination between material suppliers, converters, and end-users while reducing overall system costs.

Primary research methodology employed comprehensive data collection through structured interviews with industry executives, packaging manufacturers, beverage companies, and retail partners across key markets in the Middle East and Africa. The research included surveys of over 500 industry participants to gather insights on market trends, challenges, and growth opportunities.

Secondary research involved extensive analysis of industry reports, government publications, trade association data, and company financial statements to validate primary findings and establish market baselines. The research team analyzed packaging trade flows, production statistics, and consumption patterns across different countries and beverage categories.

Market modeling utilized advanced statistical techniques to project market growth, segment analysis, and competitive dynamics. The methodology incorporated macroeconomic indicators, demographic trends, and industry-specific factors to develop robust forecasting models and scenario analyses.

Expert validation ensured research accuracy through consultation with industry experts, academic researchers, and regulatory specialists familiar with regional market conditions. The validation process included peer review of findings, cross-verification of data sources, and sensitivity analysis of key assumptions.

Data triangulation combined multiple research approaches to ensure comprehensive market coverage and minimize bias. The methodology integrated quantitative analysis with qualitative insights to provide balanced perspectives on market dynamics and future trends.

Gulf Cooperation Council countries represent the most mature and sophisticated segment of the Middle East soft drinks packaging market, with Saudi Arabia and UAE leading in terms of consumption volume and packaging innovation adoption. The GCC market shows strong preference for premium packaging formats, with aluminum cans capturing approximately 35% market share in urban areas, driven by high disposable income and quality consciousness.

North Africa markets, particularly Egypt and Morocco, demonstrate strong growth potential with large population bases and improving economic conditions. These markets show preference for cost-effective packaging solutions, with PET bottles dominating at approximately 55% market share. The region benefits from proximity to European markets and established manufacturing infrastructure.

Sub-Saharan Africa presents diverse market conditions with South Africa leading in terms of packaging sophistication and Nigeria showing rapid growth in consumption volumes. The region demonstrates strong potential for flexible packaging formats, particularly in rural markets where affordability and portion control are key considerations.

Levant region markets including Jordan and Lebanon show resilience despite regional challenges, with growing demand for premium packaging solutions and sustainable alternatives. The market benefits from educated consumer base and strong cultural affinity for beverage consumption.

East Africa markets including Kenya and Ethiopia are emerging as high-growth opportunities with improving infrastructure and rising urbanization rates. These markets show increasing adoption of modern packaging formats while maintaining strong demand for affordable solutions.

Market leadership in the Middle East and Africa soft drinks packaging sector is characterized by a mix of global packaging giants and strong regional players, each leveraging different competitive advantages:

Competitive strategies focus on technological innovation, sustainability leadership, cost optimization, and strategic partnerships with major beverage manufacturers. Companies are investing in local manufacturing capabilities, digital technologies, and sustainable packaging alternatives to maintain competitive advantages.

Market positioning varies from premium quality and innovation leadership to cost competitiveness and operational efficiency, with successful companies often combining multiple value propositions to serve diverse market segments effectively.

By Material Type:

By Beverage Type:

By Package Size:

Plastic packaging category maintains market leadership through continuous innovation in lightweight designs, improved barrier properties, and enhanced recyclability. PET bottles benefit from established recycling infrastructure and consumer familiarity, while new bio-based plastics are gaining attention for sustainability applications. The category shows strong growth in specialized applications including hot-fill bottles and enhanced barrier solutions.

Aluminum packaging category demonstrates robust growth driven by premium positioning, excellent recyclability, and superior product protection. The category benefits from growing environmental consciousness and preference for infinitely recyclable materials. Innovation focus includes lightweight designs, enhanced printing capabilities, and specialized shapes for brand differentiation.

Glass packaging category serves premium and health-conscious segments with emphasis on product purity, taste preservation, and luxury positioning. Despite higher costs and weight disadvantages, glass maintains strong appeal for premium beverages and health-focused consumers. Innovation includes lightweight designs and enhanced durability features.

Flexible packaging category shows strong potential in price-sensitive markets and portion control applications. Pouches and sachets offer cost advantages and convenience benefits, particularly in rural markets and developing economies. The category benefits from improved barrier technologies and enhanced graphics capabilities.

Composite packaging category addresses specialized applications requiring enhanced barrier properties, extended shelf life, and product protection. Multi-layer structures and specialized coatings enable superior performance for sensitive beverages and challenging distribution environments.

Beverage manufacturers benefit from diverse packaging options that enable brand differentiation, cost optimization, and market expansion. Advanced packaging technologies improve product quality, extend shelf life, and enhance consumer appeal while supporting sustainability objectives and regulatory compliance requirements.

Packaging suppliers gain access to growing markets with diverse requirements, enabling portfolio expansion and revenue growth. The market offers opportunities for technological innovation, premium positioning, and strategic partnerships that create competitive advantages and long-term customer relationships.

Retailers and distributors benefit from improved packaging designs that enhance shelf appeal, reduce handling costs, and improve inventory management. Advanced packaging features including better stackability, reduced breakage, and enhanced graphics support sales growth and operational efficiency.

Consumers enjoy improved product quality, convenience features, and sustainable options that align with lifestyle preferences and environmental values. Enhanced packaging functionality including resealability, portion control, and product freshness indicators improve user experience and satisfaction.

Environmental stakeholders benefit from industry initiatives toward sustainable packaging, improved recycling rates, and reduced environmental impact. The development of circular economy approaches and eco-friendly materials supports environmental protection objectives while maintaining packaging performance requirements.

Government and regulatory bodies benefit from industry compliance with safety standards, environmental regulations, and economic development objectives. The packaging industry contributes to local employment, technology transfer, and export opportunities while supporting food safety and consumer protection goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable packaging revolution is transforming the Middle East and Africa soft drinks packaging market through adoption of recyclable materials, biodegradable alternatives, and circular economy principles. Companies are investing in plant-based plastics, improved recycling technologies, and packaging reduction strategies to address environmental concerns and regulatory requirements.

Smart packaging integration is gaining momentum with QR codes, NFC technology, and interactive features becoming standard in premium beverage packaging. These technologies enable consumer engagement, product authentication, supply chain tracking, and marketing activation while providing valuable data insights for manufacturers.

Lightweighting initiatives continue to drive packaging innovation with manufacturers developing thinner walls, optimized designs, and advanced materials that reduce material usage while maintaining performance. This trend supports cost reduction, transportation efficiency, and environmental sustainability objectives.

Premiumization trends are creating demand for sophisticated packaging designs, luxury materials, and enhanced functionality that justify higher price points. Limited edition packaging, artisanal designs, and premium finishes are becoming important differentiation tools in competitive markets.

Localization strategies are increasing as companies establish regional manufacturing capabilities, develop local supplier networks, and customize products for specific market requirements. This trend reduces costs, improves supply chain resilience, and enables faster response to market changes.

Health-focused packaging is emerging to support functional beverages, natural products, and health-conscious consumers through specialized barrier properties, nutritional preservation, and clear health messaging. Packaging designs increasingly emphasize natural ingredients, nutritional benefits, and wellness positioning.

Manufacturing expansion initiatives across the region include new production facilities, capacity upgrades, and technology installations by major packaging companies. Recent investments focus on sustainable packaging capabilities, automation technologies, and regional supply chain optimization to serve growing demand efficiently.

Strategic partnerships between packaging suppliers and beverage manufacturers are creating integrated solutions, co-development programs, and long-term supply agreements. These collaborations enable innovation acceleration, cost optimization, and market expansion while sharing risks and resources effectively.

Sustainability commitments from major industry players include ambitious recycling targets, renewable energy adoption, and circular economy initiatives. Companies are investing in recycled content integration, biodegradable alternatives, and closed-loop recycling systems to address environmental challenges.

Technology acquisitions and licensing agreements are enabling companies to access advanced packaging technologies, digital capabilities, and specialized expertise. These developments accelerate innovation timelines and enhance competitive positioning in technology-driven market segments.

Regulatory developments including plastic reduction mandates, extended producer responsibility programs, and enhanced labeling requirements are reshaping industry practices and investment priorities. Companies are adapting operations and developing compliant solutions to meet evolving regulatory standards.

Digital transformation initiatives including Industry 4.0 implementation, supply chain digitalization, and customer engagement platforms are improving operational efficiency and market responsiveness. These developments enable better demand forecasting, quality control, and customer service capabilities.

MarkWide Research recommends that packaging companies prioritize sustainability innovation and circular economy approaches to address growing environmental concerns and regulatory requirements. Investment in recycling technologies, biodegradable materials, and packaging reduction strategies will create competitive advantages and align with global sustainability trends.

Strategic focus should emphasize local manufacturing capabilities and regional supply chain development to reduce costs, improve responsiveness, and capture growing domestic demand. Companies should leverage government incentives and infrastructure development programs to establish competitive manufacturing positions in key markets.

Technology integration including smart packaging features, digital printing capabilities, and automation technologies should be prioritized to enhance product differentiation and operational efficiency. Investment in Industry 4.0 technologies will improve quality control, reduce costs, and enable mass customization capabilities.

Market diversification across different beverage categories, packaging formats, and geographic markets will reduce risk exposure and capture growth opportunities. Companies should develop specialized capabilities for emerging segments including functional beverages, premium products, and health-focused applications.

Partnership strategies with beverage manufacturers, technology providers, and sustainability organizations will accelerate innovation, share development costs, and access new market opportunities. Collaborative approaches enable faster market entry and risk mitigation in complex regional markets.

Regulatory compliance and proactive engagement with environmental standards will be critical for long-term success. Companies should invest in compliance systems, sustainability reporting, and stakeholder engagement to maintain market access and reputation.

Growth trajectory for the Middle East and Africa soft drinks packaging market remains positive, supported by favorable demographic trends, economic development, and increasing consumer sophistication. The market is expected to maintain robust growth with projected CAGR of 6.8% over the next five years, driven by urbanization, rising disposable income, and expanding retail infrastructure.

Sustainability transformation will accelerate as environmental regulations tighten and consumer awareness increases. The market will witness significant investment in recyclable materials, biodegradable alternatives, and circular economy solutions. Companies that successfully navigate this transformation will gain competitive advantages and market leadership positions.

Technology adoption will reshape packaging capabilities through smart features, advanced materials, and digital integration. The convergence of packaging and technology will create new value propositions, enhance consumer engagement, and improve supply chain efficiency. Early adopters will capture premium market segments and establish technology leadership.

Market consolidation is expected to continue as companies seek scale advantages, technology access, and geographic expansion. Strategic acquisitions and partnerships will reshape the competitive landscape while creating opportunities for specialized players and innovative solutions.

Regional integration through trade agreements and economic cooperation will facilitate market expansion and standardization. Companies with regional capabilities and cross-border expertise will benefit from increased market access and operational efficiency.

MWR analysis indicates that successful companies will combine sustainability leadership, technological innovation, and operational excellence to capture growth opportunities while addressing environmental and regulatory challenges in this dynamic market environment.

The Middle East and Africa soft drinks packaging market represents a compelling growth opportunity characterized by favorable demographics, economic development, and evolving consumer preferences. The market’s trajectory toward sustainability, technology integration, and premium positioning creates multiple avenues for value creation and competitive differentiation.

Strategic success in this market requires balancing growth ambitions with sustainability commitments, operational excellence with innovation capabilities, and global standards with local customization. Companies that effectively navigate these dynamics while building strong regional partnerships and technological capabilities will capture the most significant opportunities.

Future market leaders will be those organizations that embrace circular economy principles, invest in advanced technologies, and develop deep understanding of diverse regional markets. The convergence of sustainability, technology, and consumer sophistication will define the next phase of market evolution and competitive advantage.

Investment priorities should focus on sustainable packaging solutions, local manufacturing capabilities, and digital transformation initiatives that enhance operational efficiency and market responsiveness. The market’s long-term potential remains strong, supported by fundamental demographic and economic trends that will sustain demand growth across the region.

What is Soft Drinks Packaging?

Soft Drinks Packaging refers to the materials and methods used to contain and protect soft drinks, including bottles, cans, and cartons. This packaging is essential for preserving the quality and safety of beverages while also providing branding and convenience for consumers.

What are the key players in the Middle East and Africa Soft Drinks Packaging Market?

Key players in the Middle East and Africa Soft Drinks Packaging Market include Coca-Cola, PepsiCo, and Nestlé, which are known for their extensive product lines and innovative packaging solutions. Other notable companies include Ball Corporation and Amcor, among others.

What are the growth factors driving the Middle East and Africa Soft Drinks Packaging Market?

The growth of the Middle East and Africa Soft Drinks Packaging Market is driven by increasing consumer demand for convenience, the rise of health-conscious beverages, and innovations in sustainable packaging materials. Additionally, the expansion of retail channels contributes to market growth.

What challenges does the Middle East and Africa Soft Drinks Packaging Market face?

Challenges in the Middle East and Africa Soft Drinks Packaging Market include regulatory compliance regarding packaging materials, competition from alternative beverage packaging, and the need for sustainable practices to reduce environmental impact. These factors can hinder market growth and innovation.

What opportunities exist in the Middle East and Africa Soft Drinks Packaging Market?

Opportunities in the Middle East and Africa Soft Drinks Packaging Market include the development of eco-friendly packaging solutions, the introduction of smart packaging technologies, and the potential for growth in emerging markets. These trends can enhance brand loyalty and consumer engagement.

What trends are shaping the Middle East and Africa Soft Drinks Packaging Market?

Trends shaping the Middle East and Africa Soft Drinks Packaging Market include the increasing use of biodegradable materials, the shift towards lightweight packaging, and the integration of digital printing technologies for customization. These trends reflect changing consumer preferences and environmental concerns.

Middle East and Africa Soft Drinks Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Bottles, Cans, Cartons, Pouches |

| Material | Plastic, Glass, Aluminum, Paperboard |

| End User | Retail, Food Service, E-commerce, Wholesale |

| Size | Small, Medium, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

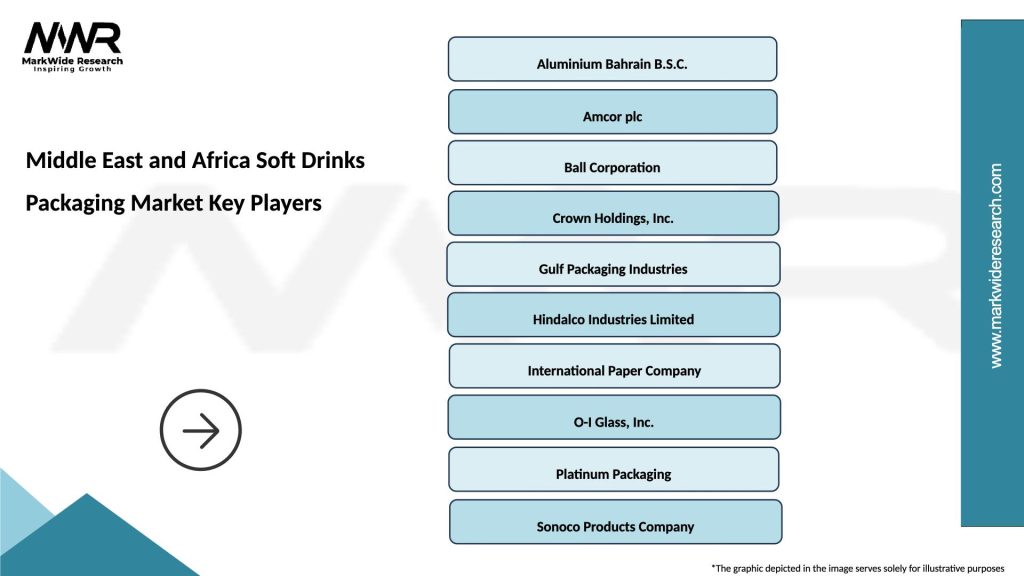

Leading companies in the Middle East and Africa Soft Drinks Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at