444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa rigid bulk packaging market represents a dynamic and rapidly evolving sector that serves as a critical component of the region’s industrial infrastructure. This market encompasses a comprehensive range of packaging solutions including intermediate bulk containers (IBCs), drums, pails, and specialized containers designed for the safe storage and transportation of bulk materials across diverse industries. Market dynamics in the MEA region are characterized by robust industrial growth, expanding manufacturing capabilities, and increasing demand for efficient packaging solutions that can withstand harsh environmental conditions.

Regional growth patterns indicate that the Middle East and Africa rigid bulk packaging market is experiencing significant expansion, driven by the region’s strategic position as a global trade hub and its growing industrial base. The market demonstrates a compound annual growth rate of 6.2%, reflecting strong demand across key sectors including chemicals, pharmaceuticals, food and beverages, and oil and gas industries. Infrastructure development initiatives across the region, particularly in the Gulf Cooperation Council (GCC) countries and emerging African markets, continue to fuel demand for advanced packaging solutions.

Industrial diversification efforts throughout the MEA region have created new opportunities for rigid bulk packaging manufacturers and suppliers. Countries such as the United Arab Emirates, Saudi Arabia, South Africa, and Nigeria are investing heavily in manufacturing capabilities, creating substantial demand for reliable packaging solutions. The market’s growth trajectory is further supported by increasing export activities and the region’s role as a key logistics and distribution center connecting Asia, Europe, and Africa.

The Middle East and Africa rigid bulk packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and utilization of solid, non-flexible containers designed for the storage, handling, and transportation of bulk materials in liquid, powder, or granular form across the MEA region. This market encompasses various packaging formats including steel drums, plastic containers, intermediate bulk containers, and specialized industrial packaging solutions that meet stringent safety and regulatory requirements.

Rigid bulk packaging distinguishes itself from flexible alternatives through its structural integrity, durability, and ability to maintain product quality during extended storage periods and challenging transportation conditions. These packaging solutions are engineered to withstand extreme temperatures, humidity variations, and mechanical stress commonly encountered in Middle Eastern and African operating environments. Market participants include manufacturers, distributors, end-users, and service providers who collectively contribute to a robust supply chain network.

The market’s scope extends beyond simple container provision to include value-added services such as reconditioning, cleaning, testing, and logistics support. This comprehensive approach ensures that businesses across the region have access to packaging solutions that meet international standards while addressing local market requirements and regulatory compliance needs.

Strategic market positioning reveals that the Middle East and Africa rigid bulk packaging market is experiencing unprecedented growth driven by industrial expansion, infrastructure development, and increasing trade activities. The market demonstrates remarkable resilience and adaptability, with manufacturers and suppliers continuously innovating to meet evolving customer requirements and regulatory standards. Key performance indicators show sustained growth across multiple market segments, with particularly strong demand in the chemicals and petrochemicals sectors.

Market consolidation trends indicate that leading players are expanding their regional presence through strategic acquisitions, partnerships, and facility expansions. The competitive landscape is characterized by a mix of international corporations and regional specialists who leverage their understanding of local market conditions to deliver customized solutions. Technology adoption rates are accelerating, with companies investing in advanced manufacturing processes and digital tracking systems to enhance operational efficiency.

Regulatory compliance remains a critical factor influencing market dynamics, with increasing emphasis on environmental sustainability and safety standards. The market shows a 25% increase in demand for eco-friendly packaging solutions, reflecting growing environmental consciousness among businesses and consumers. Future growth prospects remain positive, supported by continued economic diversification efforts and expanding industrial capabilities across the region.

Market segmentation analysis reveals distinct growth patterns across different packaging categories and end-user industries. The following key insights provide a comprehensive understanding of market dynamics:

Industrial expansion across the Middle East and Africa region serves as the primary catalyst for rigid bulk packaging market growth. Countries throughout the region are implementing ambitious industrialization programs, creating substantial demand for reliable packaging solutions. The petrochemical sector continues to be a major growth driver, with new refineries and chemical processing facilities requiring sophisticated packaging systems for product storage and distribution.

Infrastructure development initiatives, particularly in transportation and logistics, are enhancing the region’s capacity to handle bulk materials efficiently. Major port expansions, railway projects, and industrial zone developments are creating new opportunities for packaging suppliers. The food processing industry is experiencing rapid growth due to increasing population and changing dietary preferences, driving demand for food-grade packaging solutions that meet international safety standards.

Economic diversification efforts across oil-dependent economies are fostering the development of new industries that require specialized packaging solutions. Manufacturing sectors including pharmaceuticals, cosmetics, and specialty chemicals are expanding rapidly, creating diverse market opportunities. Export growth initiatives are also contributing to increased demand, as businesses seek packaging solutions that can maintain product integrity during long-distance transportation.

Regulatory compliance requirements are driving market growth as businesses invest in packaging solutions that meet stringent safety and environmental standards. The implementation of international quality standards and increasing focus on worker safety are creating demand for advanced packaging technologies and materials.

Economic volatility in certain regions poses challenges to market growth, with fluctuating oil prices and currency instability affecting industrial investment decisions. Political instability and security concerns in some areas create uncertainty for businesses and can disrupt supply chains, impacting demand for packaging solutions. Infrastructure limitations in certain African markets continue to constrain market development, with inadequate transportation networks and storage facilities limiting market penetration.

Raw material price fluctuations present ongoing challenges for packaging manufacturers, affecting profit margins and pricing strategies. The volatility of steel and plastic resin prices can significantly impact production costs and market competitiveness. Skilled labor shortages in specialized manufacturing and technical roles limit the industry’s ability to expand production capacity and implement advanced technologies.

Environmental regulations are becoming increasingly stringent, requiring significant investments in sustainable packaging solutions and waste management systems. While this drives innovation, it also increases compliance costs and complexity for market participants. Competition from alternative packaging formats, including flexible packaging solutions, poses challenges to traditional rigid packaging applications.

Import dependencies for certain raw materials and specialized components create supply chain vulnerabilities and cost pressures. Trade restrictions and tariff policies can also impact market dynamics and competitive positioning.

Sustainability initiatives present significant opportunities for companies developing eco-friendly packaging solutions. The growing emphasis on circular economy principles and waste reduction is creating demand for reusable, recyclable, and biodegradable packaging options. Companies that can offer innovative sustainable solutions are well-positioned to capture market share and command premium pricing.

Digital transformation opportunities include the integration of IoT sensors, RFID tracking, and blockchain technology into packaging solutions. These smart packaging innovations can provide real-time monitoring of product conditions, enhance supply chain visibility, and improve inventory management. The market shows 35% interest growth in digital packaging solutions among large industrial users.

Regional manufacturing expansion offers opportunities for companies to establish local production facilities and reduce logistics costs. Government incentives and free trade zone benefits in many countries make local manufacturing increasingly attractive. Pharmaceutical sector growth presents substantial opportunities, with the region’s healthcare infrastructure expansion driving demand for specialized pharmaceutical packaging.

E-commerce growth is creating new packaging requirements and distribution channels, particularly for smaller-volume bulk packaging solutions. The expansion of online B2B marketplaces is opening new sales channels and enabling better customer reach. Value-added services such as packaging reconditioning, testing, and logistics support offer opportunities for revenue diversification and customer retention.

Supply chain evolution is fundamentally reshaping the Middle East and Africa rigid bulk packaging market, with companies investing in more resilient and flexible distribution networks. The integration of advanced logistics technologies and strategic partnerships is enabling more efficient product delivery and customer service. Customer expectations are evolving toward more comprehensive packaging solutions that include technical support, regulatory compliance assistance, and sustainability features.

Competitive dynamics are intensifying as both international and regional players vie for market share through innovation, pricing strategies, and service differentiation. The market is witnessing increased consolidation activity, with larger companies acquiring specialized manufacturers to expand their product portfolios and geographic reach. Technology adoption is accelerating across the value chain, with manufacturers implementing automation, quality control systems, and predictive maintenance capabilities.

Regulatory landscape changes are influencing market dynamics, with new safety standards and environmental regulations requiring continuous adaptation and investment. The harmonization of standards across different countries is creating opportunities for standardized solutions while reducing compliance complexity. Market maturation in certain segments is driving companies to focus on value-added services and specialized applications to maintain growth and profitability.

Customer behavior patterns show increasing preference for long-term partnerships and integrated solutions rather than transactional relationships. This trend is driving packaging suppliers to develop more comprehensive service offerings and technical capabilities.

Comprehensive market analysis for the Middle East and Africa rigid bulk packaging market employs a multi-faceted research approach combining primary and secondary data sources. The methodology incorporates extensive industry interviews with key stakeholders including manufacturers, distributors, end-users, and regulatory authorities to gather firsthand insights into market trends and dynamics.

Primary research activities include structured surveys and in-depth interviews with industry executives, procurement managers, and technical specialists across major markets in the region. Focus group discussions with end-users provide valuable insights into product requirements, purchasing decisions, and emerging needs. Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary findings.

Data triangulation methods ensure accuracy and reliability of market insights by cross-referencing information from multiple sources. Quantitative analysis includes statistical modeling and trend analysis to project market growth patterns and identify key drivers. Regional market assessment involves detailed analysis of individual country markets, regulatory environments, and competitive landscapes to provide comprehensive regional coverage.

Quality assurance procedures include peer review processes and expert validation to ensure research findings meet the highest standards of accuracy and relevance. The methodology incorporates regular updates and revisions to reflect changing market conditions and emerging trends.

Gulf Cooperation Council (GCC) countries represent the largest and most mature segment of the Middle East and Africa rigid bulk packaging market, accounting for approximately 45% of regional demand. The UAE and Saudi Arabia lead market development with their advanced industrial infrastructure and strategic positioning as regional trade hubs. Petrochemical industries in these countries drive substantial demand for specialized packaging solutions, while growing manufacturing sectors create opportunities for diversified packaging applications.

North African markets, including Egypt, Morocco, and Algeria, demonstrate strong growth potential driven by expanding manufacturing capabilities and increasing trade activities. Egypt’s position as a regional manufacturing center and its growing pharmaceutical industry create significant opportunities for packaging suppliers. Infrastructure investments in these countries are improving logistics capabilities and market accessibility.

Sub-Saharan Africa presents emerging opportunities with countries like South Africa, Nigeria, and Kenya leading market development. South Africa’s established industrial base and advanced regulatory framework make it an attractive market for premium packaging solutions. Economic growth in Nigeria and other West African countries is driving demand for packaging solutions across multiple industries.

East African markets show promising growth prospects, with Ethiopia, Tanzania, and Kenya investing heavily in industrial development. The region’s growing agricultural processing and manufacturing sectors create demand for food-grade and industrial packaging solutions. Regional trade integration initiatives are facilitating market expansion and cross-border business development.

Market leadership in the Middle East and Africa rigid bulk packaging sector is characterized by a diverse mix of international corporations and regional specialists. The competitive environment features both established global players leveraging their technological capabilities and local companies utilizing their market knowledge and customer relationships.

Strategic positioning among competitors focuses on product innovation, service quality, and regional market penetration. Companies are investing in local manufacturing capabilities, technical support services, and sustainability initiatives to differentiate their offerings and build competitive advantages.

Product-based segmentation reveals distinct market dynamics across different packaging categories. The market encompasses several key product segments, each serving specific industry requirements and applications:

By Product Type:

By Material Type:

By End-Use Industry:

Chemical and Petrochemical Applications dominate the rigid bulk packaging market, representing the most mature and stable segment. This category requires packaging solutions that can handle corrosive materials, extreme temperatures, and hazardous substances while maintaining product integrity and safety compliance. Innovation focus in this segment centers on enhanced safety features, improved handling characteristics, and extended service life.

Food and Beverage Packaging represents the fastest-growing category, driven by expanding food processing industries and increasing quality standards. This segment requires packaging solutions that meet stringent hygiene requirements and food safety regulations. Market trends include growing demand for larger-volume containers for bulk ingredients and increasing emphasis on traceability and contamination prevention.

Pharmaceutical Packaging commands premium pricing due to strict regulatory requirements and quality standards. This category demands specialized materials, precise manufacturing tolerances, and comprehensive documentation. Growth drivers include expanding pharmaceutical manufacturing in the region and increasing adoption of international quality standards.

Agricultural Chemicals packaging serves the region’s growing agricultural sector with solutions for fertilizers, pesticides, and other crop protection products. This category requires packaging that can withstand harsh environmental conditions while ensuring product stability and safety. Market development is supported by agricultural modernization initiatives and increasing crop production.

Manufacturers benefit from expanding market opportunities driven by regional industrial growth and diversification initiatives. The market offers potential for premium pricing through specialized solutions and value-added services. Operational advantages include economies of scale from growing production volumes and opportunities for vertical integration across the supply chain.

End-users gain access to improved packaging solutions that enhance product quality, reduce handling costs, and ensure regulatory compliance. Advanced packaging technologies provide better inventory management, reduced product loss, and enhanced safety performance. Cost benefits include reduced total cost of ownership through improved durability and reusability of packaging solutions.

Distributors and logistics providers benefit from growing trade volumes and expanding distribution networks. The market offers opportunities for service diversification and value-added offerings such as packaging reconditioning and testing services. Strategic advantages include building long-term customer relationships and expanding geographic coverage.

Regulatory authorities benefit from improved safety standards and environmental compliance as the industry adopts advanced packaging technologies and sustainable practices. Enhanced traceability and quality control systems support regulatory oversight and public safety objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation is reshaping the rigid bulk packaging landscape, with companies increasingly adopting circular economy principles and developing eco-friendly solutions. The trend toward reusable packaging systems is gaining momentum, driven by both environmental considerations and cost optimization objectives. Companies are investing in packaging designs that maximize reuse cycles and minimize environmental impact.

Digital integration is revolutionizing packaging operations through the adoption of IoT sensors, RFID tracking, and blockchain technology. These innovations enable real-time monitoring of product conditions, enhanced supply chain visibility, and improved inventory management. Smart packaging solutions are becoming increasingly sophisticated, offering features such as temperature monitoring, tamper detection, and automated inventory tracking.

Customization and specialization trends are driving demand for tailored packaging solutions that meet specific industry requirements. Companies are developing specialized coatings, barrier properties, and design features to address unique product characteristics and handling requirements. Modular packaging systems are gaining popularity, allowing customers to adapt packaging configurations to different applications and volumes.

Service integration is becoming a key differentiator, with packaging suppliers expanding their offerings to include logistics support, reconditioning services, and technical consulting. This trend toward comprehensive solutions reflects customer preference for integrated partnerships rather than transactional relationships.

Manufacturing capacity expansion initiatives are transforming the regional packaging landscape, with several major companies announcing significant investments in new production facilities. These developments include state-of-the-art manufacturing plants incorporating advanced automation and quality control systems. Technology upgrades at existing facilities are enhancing production efficiency and product quality while reducing environmental impact.

Strategic partnerships and acquisitions are reshaping the competitive landscape, with companies seeking to expand their geographic reach and technical capabilities. Recent developments include joint ventures between international corporations and regional specialists, creating synergies in market access and technical expertise. Vertical integration initiatives are enabling companies to better control quality and costs while improving customer service.

Regulatory harmonization efforts across the region are creating opportunities for standardized solutions and simplified compliance procedures. New safety and environmental standards are driving innovation in packaging design and materials. Certification programs are being established to ensure quality and safety standards across different market segments.

Research and development investments are accelerating, with companies focusing on sustainable materials, smart packaging technologies, and specialized applications. Innovation centers and technical facilities are being established to support product development and customer collaboration.

MarkWide Research analysis indicates that companies should prioritize sustainability initiatives and circular economy principles to capture emerging market opportunities. Investment in eco-friendly packaging solutions and waste reduction programs will become increasingly important for competitive positioning. Strategic recommendations include developing comprehensive recycling programs and establishing partnerships with waste management companies.

Technology adoption should focus on digital integration and smart packaging solutions that provide measurable value to customers. Companies should invest in IoT capabilities, data analytics, and customer portal systems to enhance service delivery and operational efficiency. Innovation priorities should include developing packaging solutions that optimize supply chain performance and reduce total cost of ownership.

Market expansion strategies should emphasize regional manufacturing capabilities and local partnerships to reduce costs and improve customer service. Companies should consider establishing production facilities in key markets and developing relationships with local distributors and service providers. Geographic diversification across multiple countries can help mitigate political and economic risks.

Service differentiation through value-added offerings such as technical consulting, training programs, and logistics support can create competitive advantages and improve customer retention. Companies should develop comprehensive service portfolios that address the full spectrum of customer needs beyond basic packaging supply.

Long-term growth prospects for the Middle East and Africa rigid bulk packaging market remain positive, supported by continued industrial expansion and economic diversification initiatives across the region. MWR projections indicate sustained growth driven by expanding manufacturing capabilities, increasing trade activities, and growing emphasis on quality and safety standards. The market is expected to maintain a growth trajectory of 6.5% annually over the next five years.

Industry transformation will be characterized by increasing automation, sustainability focus, and digital integration. Companies that successfully adapt to these trends will be well-positioned to capture market share and achieve sustainable growth. Technology adoption will accelerate, with smart packaging solutions becoming standard offerings rather than premium options.

Market consolidation is expected to continue, with larger companies acquiring specialized manufacturers and regional players to expand their capabilities and geographic reach. This trend will create opportunities for innovation and efficiency improvements while potentially reducing the number of independent suppliers. Strategic partnerships between international corporations and regional specialists will become increasingly important for market success.

Regulatory evolution will drive continued investment in sustainable packaging solutions and advanced safety features. Environmental regulations will become more stringent, requiring companies to develop innovative approaches to waste reduction and resource efficiency. Quality standards will continue to evolve, with increasing emphasis on traceability and supply chain transparency.

The Middle East and Africa rigid bulk packaging market represents a dynamic and rapidly evolving sector with substantial growth potential driven by industrial expansion, infrastructure development, and increasing trade activities. Market fundamentals remain strong, supported by the region’s strategic geographic position, abundant resources, and growing manufacturing capabilities. The industry’s ability to adapt to changing customer requirements and regulatory standards positions it well for continued growth and development.

Key success factors for market participants include embracing sustainability initiatives, investing in technology and innovation, and developing comprehensive service offerings that address evolving customer needs. Companies that can effectively balance cost competitiveness with quality and service excellence will be best positioned to capture market opportunities and achieve sustainable growth. Strategic focus on regional manufacturing, digital integration, and specialized applications will be critical for long-term success.

The market’s future trajectory will be shaped by continued economic diversification, technological advancement, and increasing emphasis on environmental sustainability. Industry participants who proactively address these trends and invest in capabilities that support customer success will thrive in this dynamic and growing market. The Middle East and Africa rigid bulk packaging market offers compelling opportunities for companies committed to innovation, quality, and customer service excellence.

What is Rigid Bulk Packaging?

Rigid bulk packaging refers to sturdy containers designed to hold large quantities of products, often used in industries such as food and beverage, chemicals, and pharmaceuticals. These containers are typically made from materials like plastic, metal, or glass, ensuring durability and protection during transportation and storage.

What are the key players in the Middle East And Africa Rigid Bulk Packaging Market?

Key players in the Middle East And Africa Rigid Bulk Packaging Market include companies like Greif, Inc., Mauser Packaging Solutions, and Sonoco Products Company, which provide a range of rigid packaging solutions for various industries, among others.

What are the growth factors driving the Middle East And Africa Rigid Bulk Packaging Market?

The growth of the Middle East And Africa Rigid Bulk Packaging Market is driven by increasing demand for efficient packaging solutions in the food and beverage sector, rising industrialization, and the need for sustainable packaging options. Additionally, the expansion of e-commerce is contributing to the demand for robust packaging.

What challenges does the Middle East And Africa Rigid Bulk Packaging Market face?

Challenges in the Middle East And Africa Rigid Bulk Packaging Market include fluctuating raw material prices, stringent regulations regarding packaging materials, and competition from alternative packaging solutions. These factors can impact production costs and market dynamics.

What opportunities exist in the Middle East And Africa Rigid Bulk Packaging Market?

Opportunities in the Middle East And Africa Rigid Bulk Packaging Market include the growing trend towards sustainable packaging solutions and innovations in materials that enhance product safety and shelf life. Additionally, the rise in demand for bulk packaging in emerging markets presents significant growth potential.

What trends are shaping the Middle East And Africa Rigid Bulk Packaging Market?

Trends shaping the Middle East And Africa Rigid Bulk Packaging Market include the increasing adoption of eco-friendly materials, advancements in packaging technology, and a shift towards automation in packaging processes. These trends are influencing how companies approach packaging design and functionality.

Middle East And Africa Rigid Bulk Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Drums, Containers, Pallets, IBCs |

| Material | Plastic, Metal, Glass, Composite |

| End User | Food & Beverage, Chemicals, Pharmaceuticals, Agriculture |

| Packaging Type | Flexible, Rigid, Semi-Rigid, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

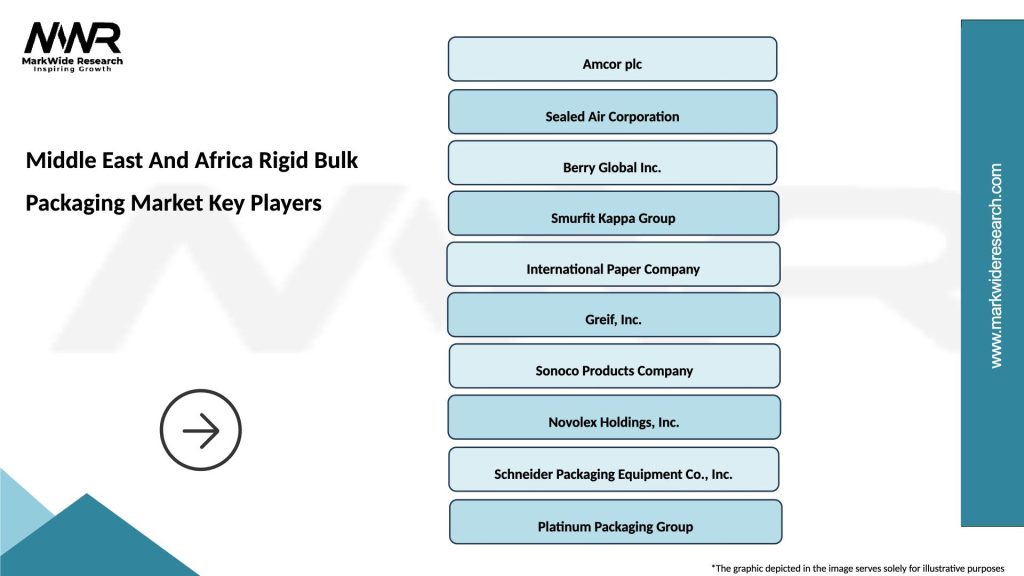

Leading companies in the Middle East And Africa Rigid Bulk Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at