444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa rechargeable battery market represents one of the fastest-growing energy storage sectors globally, driven by increasing demand for portable electronics, electric vehicles, and renewable energy storage solutions. This dynamic market encompasses various battery technologies including lithium-ion, nickel-metal hydride, and lead-acid batteries across diverse applications ranging from consumer electronics to industrial energy storage systems.

Regional dynamics in the Middle East and Africa present unique opportunities for rechargeable battery adoption, with countries like South Africa, UAE, and Saudi Arabia leading the charge in renewable energy initiatives. The market is experiencing robust growth with a projected CAGR of 12.8% over the forecast period, significantly outpacing global averages due to rapid industrialization and increasing focus on sustainable energy solutions.

Key market drivers include the region’s ambitious renewable energy targets, growing automotive electrification, and expanding telecommunications infrastructure requiring reliable backup power solutions. The market benefits from substantial government investments in clean energy projects and smart city initiatives across major economies in the region.

Technology adoption varies significantly across the region, with developed markets in the Gulf Cooperation Council (GCC) countries showing higher penetration of advanced lithium-ion technologies, while emerging markets in Sub-Saharan Africa demonstrate strong demand for cost-effective lead-acid and emerging battery solutions.

The Middle East and Africa rechargeable battery market refers to the comprehensive ecosystem of secondary battery technologies that can be recharged and reused multiple times across the MEA region. These energy storage solutions encompass various electrochemical technologies designed to store and release electrical energy on demand, serving applications from small consumer devices to large-scale grid storage systems.

Rechargeable batteries in this market context include lithium-ion, lithium-polymer, nickel-metal hydride, nickel-cadmium, and lead-acid technologies, each offering distinct advantages for specific applications. The market encompasses manufacturing, distribution, integration, and recycling activities across the entire battery value chain within the MEA geographical boundaries.

Market scope extends beyond traditional consumer electronics to include emerging applications in electric mobility, renewable energy storage, telecommunications backup systems, and industrial automation. The definition encompasses both imported battery solutions and locally manufactured products, reflecting the region’s evolving manufacturing capabilities and strategic importance in global supply chains.

Market performance in the Middle East and Africa rechargeable battery sector demonstrates exceptional growth momentum, with lithium-ion technology capturing approximately 68% market share due to superior energy density and declining costs. The region’s strategic position as a renewable energy hub and growing electric vehicle adoption creates substantial opportunities for battery manufacturers and technology providers.

Key growth segments include automotive applications, which account for the largest share of market expansion, followed by renewable energy storage and consumer electronics. The automotive segment is experiencing particularly rapid growth as governments implement electric vehicle incentives and charging infrastructure development programs.

Regional leadership varies by application, with the UAE and Saudi Arabia dominating renewable energy storage applications, while South Africa leads in automotive battery adoption. Nigeria and Egypt represent significant emerging markets with substantial growth potential driven by improving economic conditions and infrastructure development.

Competitive dynamics feature a mix of international battery manufacturers establishing regional operations and emerging local players focusing on specific market segments. The market benefits from increasing foreign direct investment and technology transfer agreements that enhance local manufacturing capabilities and reduce import dependencies.

Strategic insights reveal several critical factors shaping the Middle East and Africa rechargeable battery market landscape:

Market intelligence indicates that the region’s unique combination of abundant renewable energy resources, strategic geographical location, and supportive government policies creates an ideal environment for rechargeable battery market expansion and technological advancement.

Primary growth drivers propelling the Middle East and Africa rechargeable battery market include accelerating renewable energy deployment, with solar and wind projects requiring substantial energy storage capacity. The region’s commitment to diversifying energy sources away from fossil fuels creates unprecedented demand for advanced battery technologies.

Electric vehicle adoption represents another significant driver, with governments implementing supportive policies including purchase incentives, charging infrastructure development, and fleet electrification mandates. The automotive sector’s transformation toward electrification generates substantial demand for high-performance lithium-ion batteries with improved energy density and fast-charging capabilities.

Telecommunications expansion across the region drives demand for reliable backup power solutions, particularly in areas with unstable grid infrastructure. The rollout of 5G networks and digital transformation initiatives requires sophisticated battery systems to ensure continuous connectivity and service reliability.

Industrial automation and smart manufacturing initiatives create additional demand for rechargeable battery solutions in robotics, automated guided vehicles, and portable industrial equipment. The region’s focus on economic diversification and Industry 4.0 adoption supports sustained battery market growth.

Consumer electronics penetration continues expanding across the region, driven by increasing disposable incomes, urbanization, and digital literacy. The growing adoption of smartphones, tablets, laptops, and wearable devices creates consistent demand for compact, high-performance rechargeable batteries.

Cost considerations remain a significant restraint, particularly for advanced lithium-ion technologies in price-sensitive markets across Africa. High initial investment costs for electric vehicles and renewable energy storage systems can limit adoption rates despite long-term economic benefits.

Infrastructure limitations in certain regions create challenges for battery deployment and maintenance, particularly in remote areas lacking adequate electrical grid connectivity and technical support services. Limited charging infrastructure for electric vehicles constrains market growth in several countries.

Supply chain vulnerabilities expose the market to raw material price volatility and availability constraints, particularly for critical materials like lithium, cobalt, and nickel. Dependence on imports for key battery components creates potential supply disruptions and cost fluctuations.

Technical challenges include thermal management in extreme climate conditions, battery performance degradation in high-temperature environments, and limited local technical expertise for advanced battery systems maintenance and repair.

Regulatory inconsistencies across different countries create market fragmentation and compliance challenges for manufacturers and distributors. Varying safety standards, import regulations, and environmental requirements complicate market entry and expansion strategies.

Recycling infrastructure remains underdeveloped across much of the region, creating environmental concerns and limiting the circular economy potential of rechargeable battery systems. Limited end-of-life battery management capabilities pose sustainability challenges.

Renewable energy integration presents the most significant opportunity, with massive solar and wind projects across the region requiring grid-scale energy storage solutions. The combination of abundant renewable resources and declining battery costs creates favorable conditions for large-scale deployment.

Manufacturing localization opportunities emerge as governments prioritize supply chain security and local value addition. Establishing regional battery manufacturing facilities can reduce costs, improve supply reliability, and create employment opportunities while serving growing local demand.

Electric mobility expansion offers substantial growth potential as governments implement supportive policies and charging infrastructure develops. The transition from internal combustion engines to electric powertrains creates opportunities across passenger vehicles, commercial transport, and two-wheeler segments.

Off-grid applications represent significant opportunities in rural and remote areas lacking reliable electricity access. Rechargeable battery systems combined with solar panels can provide clean, reliable power for residential, commercial, and community applications.

Industrial applications continue expanding as manufacturing sectors adopt automation and digitalization technologies. Material handling equipment, backup power systems, and portable tools create diverse opportunities for specialized battery solutions.

Technology innovation opportunities include developing battery solutions optimized for regional conditions, such as high-temperature performance, dust resistance, and cost-effectiveness for emerging market applications.

Supply-demand dynamics in the Middle East and Africa rechargeable battery market reflect rapid demand growth outpacing local supply capabilities, creating opportunities for both imports and local manufacturing development. The market experiences seasonal variations tied to renewable energy project deployment cycles and consumer electronics demand patterns.

Price dynamics show declining trends for lithium-ion batteries, with costs reducing by approximately 15% annually due to technological improvements and scale economies. This price reduction enhances market accessibility and accelerates adoption across various applications, particularly in price-sensitive segments.

Technology dynamics feature rapid innovation in battery chemistry, energy density, and charging speeds. The market witnesses increasing adoption of lithium iron phosphate (LFP) batteries for stationary storage applications due to improved safety and cost-effectiveness compared to traditional lithium-ion technologies.

Competitive dynamics intensify as international manufacturers establish regional operations while local companies develop specialized solutions for regional requirements. Strategic partnerships between global technology providers and local distributors create hybrid business models optimizing market reach and technical support.

Regulatory dynamics evolve toward supporting clean energy adoption and electric mobility through incentives, standards development, and infrastructure investment. Government policies increasingly favor rechargeable battery technologies over traditional alternatives, creating favorable market conditions.

Research approach employed comprehensive primary and secondary research methodologies to analyze the Middle East and Africa rechargeable battery market. Primary research included structured interviews with industry executives, technology providers, distributors, and end-users across key markets in the region.

Data collection methods encompassed surveys of market participants, expert interviews with industry specialists, and analysis of company financial reports and strategic announcements. Secondary research utilized industry publications, government statistics, trade association reports, and regulatory filings to validate primary findings.

Market sizing methodology applied bottom-up and top-down approaches, analyzing demand patterns across different applications and regions. The research team conducted detailed analysis of import-export data, production statistics, and consumption patterns to establish accurate market parameters.

Validation processes included cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis to ensure data accuracy and reliability. Regional experts provided local market insights and cultural context to enhance research quality.

Analytical framework incorporated Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive market understanding. The research methodology ensures robust, actionable insights for market participants and stakeholders.

Gulf Cooperation Council countries lead the regional market with approximately 45% market share, driven by substantial investments in renewable energy projects and smart city initiatives. The UAE and Saudi Arabia dominate this segment, with major solar projects requiring grid-scale battery storage solutions.

South Africa represents the largest single-country market in Africa, accounting for roughly 25% of regional demand. The country’s advanced automotive industry, renewable energy programs, and established manufacturing base create favorable conditions for rechargeable battery adoption across multiple applications.

North African markets including Egypt, Morocco, and Algeria show strong growth potential driven by renewable energy development and improving economic conditions. Egypt’s large population and industrial base create substantial demand for consumer electronics and automotive applications.

West African markets led by Nigeria demonstrate emerging opportunities in telecommunications backup power and off-grid energy solutions. The region’s growing middle class and urbanization trends support increasing demand for consumer electronics and portable devices.

East African countries including Kenya and Ethiopia show promise in renewable energy storage and rural electrification applications. According to MarkWide Research analysis, these markets demonstrate strong potential for cost-effective battery solutions supporting economic development initiatives.

Market leadership features a diverse mix of international battery manufacturers and regional distributors serving the Middle East and Africa rechargeable battery market:

Competitive strategies focus on establishing local manufacturing capabilities, developing region-specific products, and building comprehensive distribution networks. Companies increasingly emphasize sustainability, recycling capabilities, and total cost of ownership to differentiate their offerings.

Market positioning varies by segment, with premium manufacturers targeting high-performance applications while value-oriented suppliers focus on cost-sensitive markets. Strategic partnerships between global manufacturers and local companies enhance market penetration and customer support capabilities.

By Technology:

By Application:

By End-user:

Automotive Category demonstrates the strongest growth trajectory with electric vehicle sales increasing by 35% annually across key markets. This segment benefits from government incentives, improving charging infrastructure, and declining battery costs making electric vehicles more accessible to consumers.

Energy Storage Category experiences robust expansion driven by utility-scale renewable energy projects and distributed energy resources. Grid-scale battery installations show particular strength in GCC countries with major solar projects requiring substantial storage capacity for grid stability and energy security.

Consumer Electronics Category maintains steady growth supported by increasing smartphone penetration, particularly in emerging markets across Africa. The segment benefits from improving economic conditions, urbanization trends, and growing digital literacy across the region.

Industrial Category shows promising growth as manufacturing sectors adopt automation technologies and require reliable backup power solutions. Material handling equipment, automated guided vehicles, and portable tools drive consistent demand for specialized battery solutions.

Telecommunications Category remains critical for network reliability, with 5G rollout and digital infrastructure expansion creating demand for advanced backup power systems. The segment requires high-reliability batteries capable of extended operation during grid outages.

Manufacturers benefit from expanding market opportunities across diverse applications and regions, with growing demand supporting capacity utilization and economies of scale. The market’s growth trajectory provides attractive returns on investment in manufacturing facilities and technology development.

Distributors and Retailers gain from increasing product demand and expanding customer base across consumer and commercial segments. The market’s diversification reduces dependence on single applications while creating opportunities for value-added services and technical support.

End-users benefit from improving battery performance, declining costs, and expanding product options meeting specific application requirements. Enhanced energy density, longer cycle life, and faster charging capabilities improve operational efficiency and total cost of ownership.

Government Stakeholders achieve policy objectives including renewable energy targets, emission reductions, and economic diversification through supporting rechargeable battery market development. Local manufacturing creates employment opportunities and reduces import dependencies.

Investors find attractive opportunities in a rapidly growing market with strong fundamentals and supportive regulatory environment. The sector’s strategic importance and growth potential offer compelling investment returns across the value chain.

Technology Providers benefit from increasing demand for advanced battery management systems, charging infrastructure, and recycling technologies. The market’s evolution creates opportunities for innovation and technology differentiation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology Integration trends show increasing adoption of smart battery management systems with IoT connectivity and predictive maintenance capabilities. These advanced systems optimize battery performance, extend operational life, and provide real-time monitoring for critical applications.

Sustainability Focus drives development of battery recycling infrastructure and circular economy initiatives. Companies increasingly emphasize environmental responsibility, developing closed-loop recycling systems and sustainable manufacturing processes to address growing environmental concerns.

Localization Strategies gain momentum as manufacturers establish regional operations to reduce supply chain risks and improve customer service. Local assembly and manufacturing facilities enhance supply security while creating employment opportunities and technology transfer benefits.

Application Diversification expands beyond traditional uses into emerging sectors including energy storage, electric aviation, and marine applications. This diversification reduces market concentration risk while creating new growth opportunities for battery manufacturers and technology providers.

Cost Optimization continues through technological improvements, manufacturing scale economies, and supply chain efficiency gains. MWR data indicates that battery costs are declining by approximately 12% annually, making advanced technologies more accessible across price-sensitive market segments.

Performance Enhancement focuses on improving energy density, charging speeds, and operational life while maintaining safety standards. Next-generation battery technologies promise significant performance improvements supporting expanded application possibilities.

Manufacturing Investments include several major announcements of battery manufacturing facilities across the region, with companies establishing production capabilities to serve growing local demand and export opportunities. These investments represent substantial commitments to regional market development and technology transfer.

Technology Partnerships between international battery manufacturers and regional companies create hybrid business models combining global expertise with local market knowledge. These collaborations accelerate technology adoption while building local capabilities and market presence.

Infrastructure Development encompasses charging network expansion, grid-scale storage installations, and recycling facility establishment. Government and private sector investments in supporting infrastructure create favorable conditions for battery market growth and adoption.

Regulatory Developments include new safety standards, environmental regulations, and incentive programs supporting clean energy adoption. These policy initiatives create market structure and competitive dynamics while ensuring sustainable industry development.

Research Initiatives focus on developing battery technologies optimized for regional conditions, including high-temperature performance, dust resistance, and cost-effectiveness. Local research institutions collaborate with industry partners to address specific regional requirements and challenges.

Market Consolidation activities include strategic acquisitions, joint ventures, and distribution partnerships aimed at strengthening market position and expanding geographical reach. These developments reshape competitive dynamics while creating operational synergies.

Strategic Recommendations for market participants include prioritizing local manufacturing capabilities to reduce supply chain risks and improve cost competitiveness. Companies should consider establishing regional production facilities or partnerships to serve growing local demand while building long-term market presence.

Technology Focus should emphasize developing battery solutions optimized for regional conditions, including high-temperature performance, extended cycle life, and cost-effectiveness for emerging market applications. Innovation in battery chemistry and management systems can create competitive advantages.

Market Entry Strategies should consider phased approaches beginning with distribution partnerships and progressing to local assembly and manufacturing as market conditions mature. Understanding local regulatory requirements and customer preferences is essential for successful market penetration.

Investment Priorities should include charging infrastructure development, recycling capabilities, and technical support services to create comprehensive value propositions. These supporting services differentiate offerings while building customer loyalty and market barriers.

Partnership Development with local companies, government agencies, and research institutions can accelerate market entry while building necessary capabilities and relationships. Strategic alliances provide market access, regulatory navigation, and cultural understanding essential for success.

Sustainability Integration should be prioritized from the outset, including recycling programs, environmental compliance, and circular economy initiatives. These considerations are increasingly important for regulatory compliance and customer acceptance.

Market trajectory indicates sustained growth momentum with the Middle East and Africa rechargeable battery market expected to maintain robust expansion over the next decade. The combination of supportive government policies, declining technology costs, and expanding applications creates favorable long-term growth conditions.

Technology evolution will likely feature continued improvements in lithium-ion performance while emerging technologies like solid-state and sodium-ion batteries gain commercial viability. These technological advances will expand application possibilities while improving cost-effectiveness and safety characteristics.

Regional development patterns suggest increasing market maturation in GCC countries while African markets demonstrate accelerating growth potential. The region’s strategic importance as a renewable energy hub and growing manufacturing base positions it for sustained market expansion.

Application expansion will likely extend into new sectors including electric aviation, marine applications, and grid-scale storage as technology capabilities improve and costs decline. This diversification reduces market concentration risk while creating new growth opportunities.

Manufacturing evolution toward regional production capabilities will reduce import dependence while creating employment opportunities and technology transfer benefits. Local manufacturing development supports supply chain security and cost competitiveness for regional markets.

Sustainability initiatives will become increasingly important, with circular economy principles and recycling infrastructure development essential for long-term market sustainability. Environmental considerations will influence technology choices and business model development across the industry.

The Middle East and Africa rechargeable battery market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by renewable energy adoption, electric vehicle deployment, and expanding industrial applications. The market’s strategic importance extends beyond regional boundaries, positioning the area as a critical hub for global battery supply chains and technology development.

Key success factors for market participants include understanding regional diversity, developing localized solutions, and building comprehensive support infrastructure. The market’s evolution from import-dependent to emerging manufacturing hub creates opportunities for companies willing to invest in long-term regional presence and capability development.

Future prospects remain highly positive, with supportive government policies, declining technology costs, and expanding applications creating sustained growth momentum. According to MarkWide Research projections, the market will continue outpacing global growth rates while developing increasing technological sophistication and manufacturing capabilities.

Strategic implications suggest that early market entry and investment in regional capabilities will provide competitive advantages as the market matures. Companies that successfully navigate regional complexity while building local partnerships and capabilities are positioned to capture substantial value from this rapidly growing market opportunity.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

What are the key players in the Middle East And Africa Rechargeable Battery Market?

Key players in the Middle East And Africa Rechargeable Battery Market include Samsung SDI, LG Chem, and BYD Company, among others. These companies are involved in the production and innovation of rechargeable battery technologies.

What are the growth factors driving the Middle East And Africa Rechargeable Battery Market?

The growth of the Middle East And Africa Rechargeable Battery Market is driven by the increasing demand for electric vehicles, the rise in renewable energy projects, and the growing consumer electronics sector. These factors contribute to a higher need for efficient energy storage solutions.

What challenges does the Middle East And Africa Rechargeable Battery Market face?

The Middle East And Africa Rechargeable Battery Market faces challenges such as supply chain disruptions, high production costs, and limited recycling infrastructure. These issues can hinder market growth and sustainability efforts.

What opportunities exist in the Middle East And Africa Rechargeable Battery Market?

Opportunities in the Middle East And Africa Rechargeable Battery Market include advancements in battery technology, increasing investments in electric mobility, and government initiatives promoting renewable energy. These factors can enhance market potential and innovation.

What trends are shaping the Middle East And Africa Rechargeable Battery Market?

Trends in the Middle East And Africa Rechargeable Battery Market include the shift towards lithium-ion batteries, the development of solid-state batteries, and the integration of smart technologies in battery management systems. These trends are influencing the future of energy storage solutions.

Middle East And Africa Rechargeable Battery Market

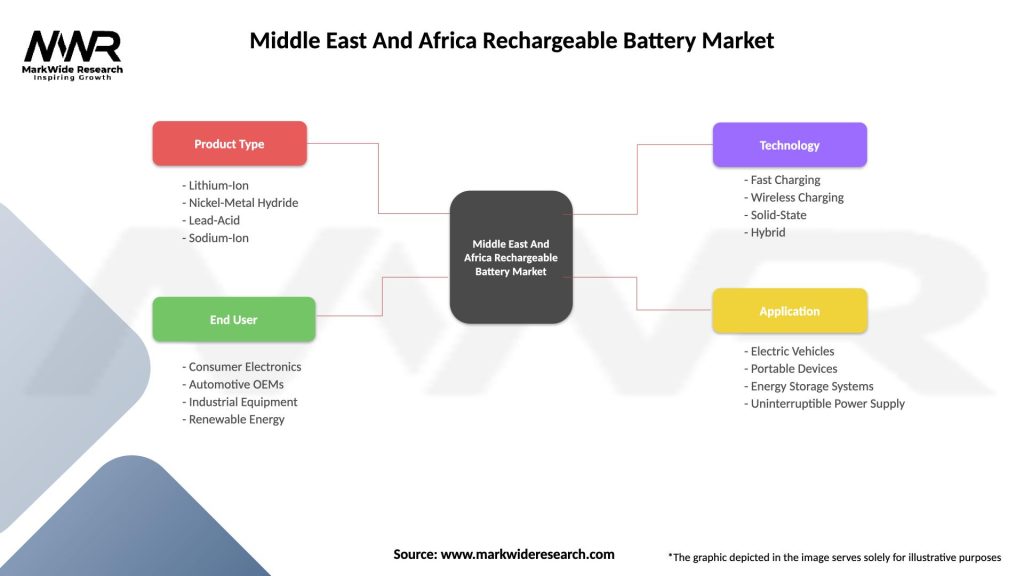

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-Ion, Nickel-Metal Hydride, Lead-Acid, Sodium-Ion |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Technology | Fast Charging, Wireless Charging, Solid-State, Hybrid |

| Application | Electric Vehicles, Portable Devices, Energy Storage Systems, Uninterruptible Power Supply |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Rechargeable Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at