444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East and Africa Payments Market is experiencing significant growth and transformation in recent years. With the advancement of technology and the increasing adoption of digital payment solutions, the payments landscape in the region is undergoing a major shift. This market overview aims to provide a comprehensive understanding of the Middle East and Africa payments market, covering key insights, trends, opportunities, and challenges.

Meaning

The Middle East and Africa payments market refers to the ecosystem of financial transactions and payment services in the region. It encompasses various payment methods, including cash, cards, mobile payments, digital wallets, and online banking. The market includes both consumer-to-business (C2B) and business-to-business (B2B) transactions, catering to a wide range of industries and sectors.

Executive Summary

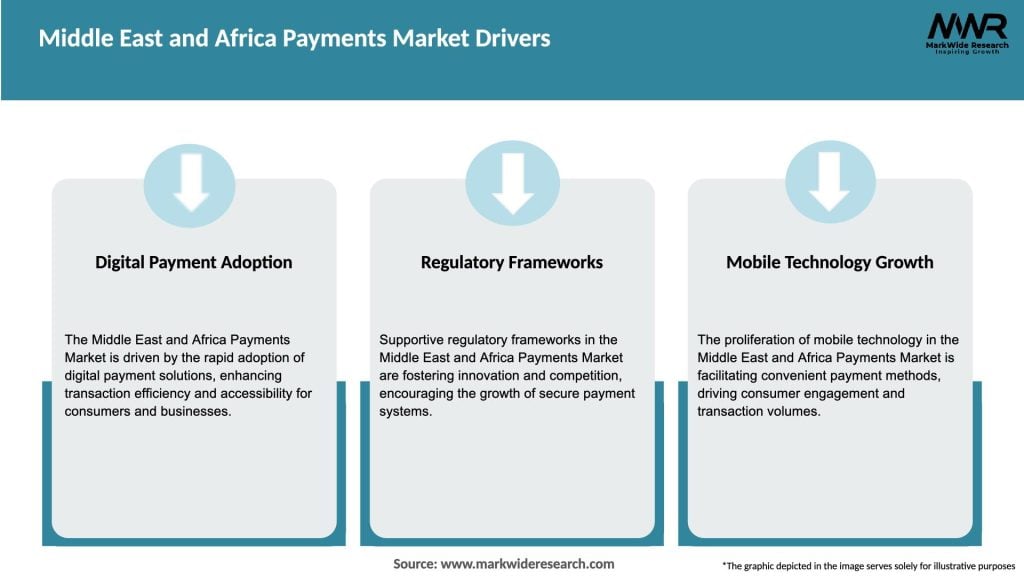

The Middle East and Africa payments market is witnessing rapid growth due to several factors, such as the increasing smartphone penetration, rising e-commerce activities, and favorable government initiatives promoting digital payments. The market offers significant opportunities for payment service providers, technology companies, financial institutions, and other stakeholders to capitalize on the evolving payment landscape in the region.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Middle East and Africa payments market is characterized by dynamic factors that shape its growth and evolution. These dynamics include technological advancements, changing consumer behavior, regulatory developments, and competitive landscapes. Understanding and adapting to these dynamics is crucial for industry participants to stay competitive and capitalize on emerging opportunities.

Regional Analysis

The Middle East and Africa payments market can be analyzed on a regional level to gain insights into specific market trends and dynamics. The region can be divided into sub-regions, such as the Gulf Cooperation Council (GCC) countries, North Africa, West Africa, East Africa, and Southern Africa. Each sub-region has its unique payment landscape, regulatory environment, and consumer preferences, presenting diverse opportunities and challenges for market players.

Competitive Landscape

Leading Companies in Middle East and Africa Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

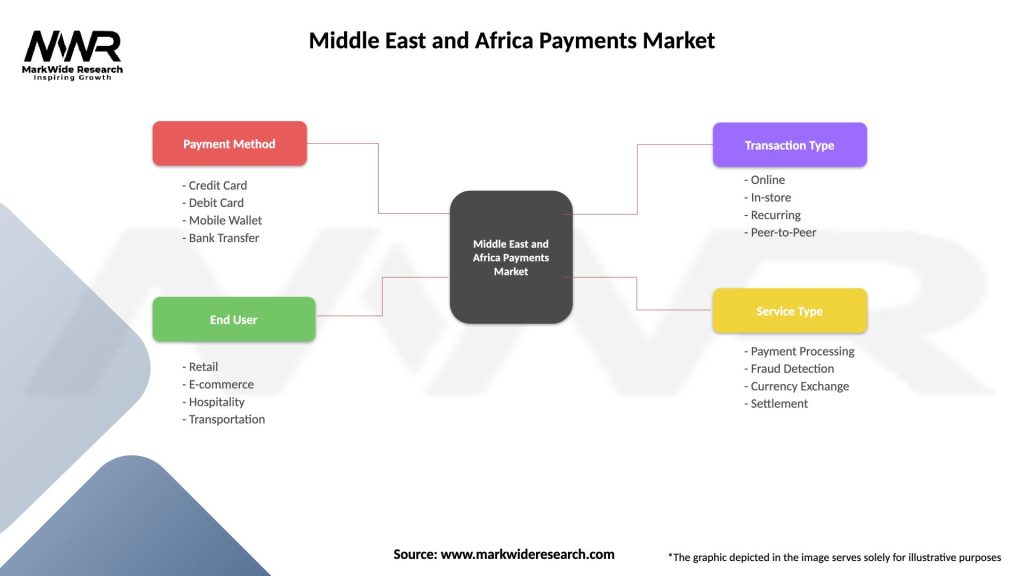

Segmentation

The Middle East and Africa payments market can be segmented based on various factors, including payment method, industry vertical, and end-user. Common payment methods include cards (credit, debit, prepaid), mobile payments, digital wallets, and online banking. Industry verticals such as retail, e-commerce, healthcare, hospitality, and transportation have specific payment requirements. End-users can be categorized as consumers, businesses, government organizations, and financial institutions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the shift towards digital payments in the Middle East and Africa region. Lockdown measures, social distancing norms, and hygiene concerns have prompted consumers and businesses to rely more on contactless and online payment methods. The pandemic has highlighted the importance of safe and efficient digital payment solutionsto ensure business continuity and minimize physical contact. As a result, the adoption of mobile payments, digital wallets, and online banking has witnessed significant growth during the pandemic. Furthermore, the government’s push for digital transformation and financial inclusion has gained further momentum in response to the crisis. The pandemic has acted as a catalyst for the digital payments revolution in the region.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Middle East and Africa payments market looks promising, with continued growth and innovation on the horizon. The region’s increasing smartphone penetration, expanding e-commerce activities, and supportive government initiatives provide a strong foundation for the growth of digital payment solutions. Technological advancements, such as blockchain, AI, and biometrics, will play a significant role in shaping the future of payments. Furthermore, partnerships and collaborations are expected to drive innovation and expand the range of payment services offered to consumers and businesses. The market will continue to evolve, catering to changing consumer preferences and driving financial inclusion in the region.

Conclusion

The Middle East and Africa payments market is undergoing a transformation, driven by the growing adoption of digital payment solutions, government support for digital transformation, and the rise of fintech startups. The market offers significant opportunities for industry participants to capitalize on the evolving payment landscape, expand their operations, and drive revenue growth. However, challenges such as limited internet infrastructure, security concerns, and cultural preferences for cash transactions need to be addressed. By focusing on innovation, collaboration, security, and user experience, industry participants can navigate the market dynamics and shape the future of payments in the Middle East and Africa region.

What is Middle East and Africa Payments?

Middle East and Africa Payments refer to the various methods and systems used for transferring money and settling transactions within the region. This includes digital wallets, bank transfers, and mobile payment solutions that cater to both consumers and businesses.

What are the key players in the Middle East and Africa Payments Market?

Key players in the Middle East and Africa Payments Market include companies like PayU, Flutterwave, and PayPal, which provide diverse payment solutions. These companies are instrumental in facilitating online transactions and enhancing financial inclusion in the region, among others.

What are the main drivers of growth in the Middle East and Africa Payments Market?

The growth of the Middle East and Africa Payments Market is driven by increasing smartphone penetration, the rise of e-commerce, and a growing preference for cashless transactions. Additionally, government initiatives to promote digital payments are also contributing to market expansion.

What challenges does the Middle East and Africa Payments Market face?

The Middle East and Africa Payments Market faces challenges such as regulatory hurdles, cybersecurity threats, and a lack of infrastructure in certain areas. These factors can hinder the adoption of digital payment solutions and limit market growth.

What opportunities exist in the Middle East and Africa Payments Market?

Opportunities in the Middle East and Africa Payments Market include the expansion of fintech startups, the increasing adoption of blockchain technology, and the potential for cross-border payment solutions. These developments can enhance transaction efficiency and broaden market access.

What trends are shaping the Middle East and Africa Payments Market?

Trends shaping the Middle East and Africa Payments Market include the rise of contactless payments, the integration of artificial intelligence in fraud detection, and the growing popularity of buy now, pay later services. These trends are transforming consumer payment behaviors and enhancing user experiences.

Middle East and Africa Payments Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, Bank Transfer |

| End User | Retail, E-commerce, Hospitality, Transportation |

| Transaction Type | Online, In-store, Recurring, Peer-to-Peer |

| Service Type | Payment Processing, Fraud Detection, Currency Exchange, Settlement |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Middle East and Africa Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at