444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle-East and Africa optical imaging market represents a rapidly expanding sector driven by technological advancements, increasing healthcare investments, and growing demand for precision diagnostic solutions. This dynamic market encompasses various optical imaging technologies including optical coherence tomography, confocal microscopy, photoacoustic imaging, and near-infrared spectroscopy across multiple applications in healthcare, research, and industrial sectors.

Regional growth dynamics indicate substantial expansion opportunities, with the market experiencing robust development across key countries including Saudi Arabia, UAE, South Africa, Egypt, and Nigeria. The increasing prevalence of chronic diseases, coupled with rising healthcare expenditure and government initiatives to modernize medical infrastructure, has created a favorable environment for optical imaging technology adoption.

Healthcare modernization efforts throughout the region are driving significant investments in advanced diagnostic equipment, with optical imaging systems playing a crucial role in early disease detection and treatment monitoring. The market is witnessing a 12.5% annual growth rate in technology adoption, particularly in ophthalmology, cardiology, and oncology applications.

Technological integration with artificial intelligence and machine learning capabilities is enhancing the diagnostic accuracy and efficiency of optical imaging systems, making them increasingly attractive to healthcare providers seeking to improve patient outcomes while optimizing operational costs.

The Middle-East and Africa optical imaging market refers to the comprehensive ecosystem of advanced imaging technologies that utilize light-based methods to capture high-resolution images of biological tissues, materials, and structures for diagnostic, research, and industrial applications across the MEA region. These sophisticated systems employ various optical principles including coherent light interference, fluorescence detection, and spectroscopic analysis to provide detailed visualization capabilities.

Optical imaging technologies encompass a broad spectrum of devices and systems designed to non-invasively examine internal structures, monitor physiological processes, and detect abnormalities with exceptional precision and clarity. The market includes both standalone imaging systems and integrated diagnostic platforms that combine multiple imaging modalities for comprehensive analysis.

Key applications span across medical diagnostics, biomedical research, pharmaceutical development, and industrial quality control, with each sector contributing to the overall market growth through specific technological requirements and adoption patterns.

Market expansion in the Middle-East and Africa optical imaging sector is characterized by accelerating adoption rates, increasing investment in healthcare infrastructure, and growing recognition of optical imaging benefits among medical professionals and researchers. The region’s diverse healthcare landscape presents unique opportunities for technology providers to establish strong market presence.

Healthcare transformation initiatives across major economies are driving substantial demand for advanced diagnostic solutions, with optical imaging technologies positioned as essential tools for improving healthcare delivery quality. Government-led healthcare modernization programs are allocating significant resources to upgrade medical facilities with state-of-the-art imaging equipment.

Technology adoption patterns reveal a 68% preference for integrated imaging solutions that combine multiple optical modalities, reflecting the region’s emphasis on comprehensive diagnostic capabilities. The market is experiencing particularly strong growth in ophthalmology applications, where optical coherence tomography systems are becoming standard equipment in specialized clinics.

Competitive dynamics are intensifying as international technology providers expand their regional presence through strategic partnerships, local distribution networks, and customized product offerings designed to meet specific regional requirements and regulatory standards.

Strategic market developments are shaping the optical imaging landscape across the Middle-East and Africa region, with several key insights emerging from comprehensive market analysis:

Market penetration rates vary significantly across different countries, with Gulf Cooperation Council nations leading in technology adoption while African markets show strong growth potential driven by expanding healthcare access initiatives.

Healthcare modernization initiatives represent the primary driver for optical imaging market growth across the Middle-East and Africa region. Government-sponsored programs aimed at upgrading medical infrastructure are creating substantial demand for advanced diagnostic technologies, with optical imaging systems being prioritized for their non-invasive capabilities and diagnostic accuracy.

Demographic transitions throughout the region are contributing to increased healthcare demand, particularly for age-related conditions that benefit from optical imaging diagnosis. The growing elderly population, combined with lifestyle-related health challenges, is driving healthcare providers to invest in sophisticated diagnostic equipment capable of early disease detection.

Medical tourism expansion is creating additional market opportunities as regional healthcare facilities seek to attract international patients by offering world-class diagnostic services. Countries like UAE, Saudi Arabia, and South Africa are positioning themselves as medical tourism destinations, necessitating investments in cutting-edge optical imaging technologies.

Research and development activities are intensifying across regional universities and research institutions, creating demand for advanced optical imaging systems for biomedical research applications. The establishment of research centers and innovation hubs is driving procurement of sophisticated imaging equipment for scientific investigations.

Chronic disease prevalence is rising significantly across the region, with conditions such as diabetes, cardiovascular disease, and cancer requiring regular monitoring and early detection capabilities that optical imaging systems can provide effectively.

High capital investment requirements pose significant challenges for healthcare facilities seeking to implement optical imaging technologies. The substantial upfront costs associated with advanced imaging systems, combined with ongoing maintenance and training expenses, can limit adoption rates, particularly in resource-constrained healthcare environments.

Technical expertise limitations across the region create barriers to effective technology utilization. The shortage of trained professionals capable of operating sophisticated optical imaging equipment and interpreting results accurately affects market growth potential and system utilization rates.

Regulatory complexities and varying approval processes across different countries can delay market entry for new technologies and increase compliance costs for manufacturers. The lack of harmonized regulatory frameworks creates additional challenges for technology providers seeking regional market expansion.

Infrastructure constraints in certain areas, including unreliable power supply and limited internet connectivity, can affect the performance and reliability of advanced optical imaging systems that require stable operating conditions and network connectivity for optimal functionality.

Economic volatility in some regional markets can impact healthcare spending priorities and delay planned investments in advanced diagnostic equipment. Currency fluctuations and economic uncertainties may cause healthcare providers to postpone technology upgrades or seek more cost-effective alternatives.

Telemedicine integration presents substantial opportunities for optical imaging technology providers to develop remote diagnostic capabilities that can extend healthcare access to underserved areas. The growing acceptance of telehealth solutions creates demand for portable and connected optical imaging devices that can transmit high-quality images for remote analysis.

Public-private partnerships are emerging as effective mechanisms for accelerating optical imaging technology adoption through shared investment models and risk distribution. These collaborative approaches enable healthcare facilities to access advanced technologies while managing financial constraints through innovative financing arrangements.

Mobile healthcare initiatives across the region create opportunities for portable optical imaging solutions that can be deployed in remote areas and mobile clinics. The development of compact, battery-operated systems addresses the need for diagnostic capabilities in areas with limited infrastructure.

Educational institution partnerships offer opportunities for technology providers to establish long-term relationships while contributing to professional development and research advancement. Collaborations with medical schools and research universities can drive both technology adoption and innovation.

Preventive healthcare emphasis is creating new market segments for optical imaging applications in health screening and early detection programs. The shift toward preventive medicine approaches aligns well with the capabilities of optical imaging technologies for non-invasive health assessment.

Technology evolution is fundamentally reshaping the optical imaging landscape in the Middle-East and Africa region, with artificial intelligence integration driving significant improvements in diagnostic accuracy and workflow efficiency. The incorporation of machine learning algorithms into optical imaging systems is enabling automated image analysis and pattern recognition capabilities that enhance diagnostic confidence.

Competitive intensity is increasing as established international players expand their regional presence while local distributors and service providers develop specialized expertise. This dynamic environment is driving innovation and competitive pricing strategies that benefit end-users through improved technology access and support services.

Healthcare delivery models are evolving toward more integrated and patient-centric approaches, creating demand for optical imaging systems that can seamlessly integrate with electronic health records and support coordinated care delivery. The emphasis on interoperability is influencing technology selection criteria and vendor evaluation processes.

Regulatory landscapes are becoming more sophisticated as regional authorities develop comprehensive frameworks for medical device approval and quality assurance. These developments are creating more predictable market conditions while ensuring higher safety and efficacy standards for optical imaging technologies.

Investment patterns show a 35% increase in healthcare technology funding across the region, with optical imaging representing a significant portion of these investments due to its proven clinical value and technological advancement potential.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary data collection methods to provide accurate and actionable insights into the Middle-East and Africa optical imaging market. The methodology encompasses both quantitative and qualitative research techniques to ensure comprehensive market understanding.

Primary research activities included structured interviews with key stakeholders across the optical imaging value chain, including healthcare providers, technology manufacturers, distributors, and regulatory officials. These interviews provided firsthand insights into market dynamics, challenges, and growth opportunities specific to the regional context.

Secondary research involved extensive analysis of industry reports, government publications, academic studies, and company financial statements to establish market baselines and identify trends. This research phase included examination of regulatory frameworks, healthcare policies, and technology adoption patterns across different countries in the region.

Data validation processes were implemented to ensure accuracy and reliability of market information through cross-referencing multiple sources and expert review. Statistical analysis techniques were applied to identify significant trends and correlations within the collected data.

Market segmentation analysis was conducted to understand technology preferences, application areas, and regional variations in optical imaging adoption patterns, providing detailed insights into market structure and growth potential across different segments.

Gulf Cooperation Council countries represent the most mature segment of the Middle-East and Africa optical imaging market, with Saudi Arabia and UAE leading in technology adoption and healthcare infrastructure development. These markets demonstrate 42% higher adoption rates compared to other regional markets, driven by substantial healthcare investments and government modernization initiatives.

Saudi Arabia is experiencing rapid growth in optical imaging applications, particularly in ophthalmology and cardiology, supported by the Vision 2030 healthcare transformation program. The country’s focus on becoming a regional healthcare hub is driving significant investments in advanced diagnostic technologies.

United Arab Emirates continues to lead in medical tourism and healthcare innovation, with Dubai and Abu Dhabi establishing themselves as centers of excellence for advanced medical services. The UAE’s strategic location and business-friendly environment attract international technology providers seeking regional market entry.

South Africa dominates the African optical imaging market with well-established healthcare infrastructure and research capabilities. The country serves as a gateway for technology providers entering the broader African market, with 28% market share across the continent’s optical imaging sector.

Egypt represents a significant growth opportunity with its large population and expanding healthcare sector. Government initiatives to improve healthcare access and quality are driving demand for advanced diagnostic technologies, including optical imaging systems.

Nigeria and other West African markets show strong growth potential despite infrastructure challenges, with private healthcare providers leading technology adoption efforts and international development organizations supporting healthcare modernization initiatives.

Market leadership in the Middle-East and Africa optical imaging sector is characterized by a mix of established international technology providers and emerging regional players who understand local market dynamics and customer requirements.

Strategic partnerships and local distribution agreements are becoming increasingly important for market success, with international providers establishing relationships with regional healthcare organizations and government agencies to enhance market access and customer support capabilities.

Innovation focus areas include artificial intelligence integration, portable system development, and cost-effective solutions designed specifically for emerging market requirements and resource constraints.

Technology-based segmentation reveals distinct market preferences and growth patterns across different optical imaging modalities in the Middle-East and Africa region:

By Technology:

By Application:

By End-User:

Ophthalmology applications dominate the Middle-East and Africa optical imaging market, with optical coherence tomography systems experiencing particularly strong adoption rates among eye care specialists. The high prevalence of diabetes-related eye complications in the region drives consistent demand for retinal imaging capabilities.

Cardiovascular imaging represents a rapidly expanding category as healthcare providers recognize the value of optical imaging techniques for coronary artery assessment and cardiac tissue analysis. The integration of intravascular optical coherence tomography into cardiac catheterization procedures is gaining acceptance among interventional cardiologists.

Research applications are driving demand for high-end optical imaging systems in academic institutions and pharmaceutical companies across the region. The establishment of research centers and increased funding for biomedical research is creating opportunities for advanced microscopy and imaging system providers.

Dermatology applications are emerging as a significant growth category, with optical imaging systems being adopted for skin cancer screening, cosmetic procedures, and dermatological research. The growing awareness of skin health and aesthetic medicine is driving market expansion in this segment.

Surgical guidance applications are gaining traction as surgeons recognize the benefits of real-time optical imaging for procedure guidance and tissue assessment. The development of intraoperative imaging systems is creating new market opportunities across multiple surgical specialties.

Healthcare providers benefit from optical imaging technologies through improved diagnostic accuracy, reduced procedure times, and enhanced patient outcomes. The non-invasive nature of optical imaging reduces patient discomfort while providing detailed tissue visualization that supports clinical decision-making.

Technology manufacturers gain access to a growing regional market with substantial investment in healthcare infrastructure and increasing demand for advanced diagnostic solutions. The diverse market landscape offers opportunities for both premium and cost-effective product positioning strategies.

Patients benefit from earlier disease detection, less invasive diagnostic procedures, and improved treatment monitoring capabilities. Optical imaging technologies enable healthcare providers to identify conditions at earlier stages when treatment options are more effective and less costly.

Research institutions gain access to advanced imaging capabilities that accelerate scientific discovery and enable participation in international research collaborations. The availability of sophisticated optical imaging systems enhances research quality and publication potential.

Healthcare systems benefit from improved efficiency and cost-effectiveness through earlier disease detection, reduced need for invasive procedures, and better resource allocation based on accurate diagnostic information provided by optical imaging technologies.

Regulatory authorities benefit from the availability of proven diagnostic technologies that improve healthcare quality and safety standards while supporting evidence-based medical practice and treatment protocols.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming optical imaging capabilities across the Middle-East and Africa region, with machine learning algorithms enhancing diagnostic accuracy and reducing interpretation time. Healthcare providers are increasingly seeking AI-powered systems that can provide automated analysis and decision support.

Portable system development is addressing the need for optical imaging capabilities in remote areas and mobile healthcare settings. The trend toward compact, battery-operated devices is making advanced diagnostic technologies accessible in previously underserved locations.

Multi-modal imaging integration is becoming increasingly popular as healthcare providers seek comprehensive diagnostic capabilities in single platforms. The combination of different optical imaging techniques provides more complete tissue analysis and improves diagnostic confidence.

Cloud-based image management is enabling better collaboration between healthcare providers and specialists while supporting telemedicine initiatives. The ability to store, share, and analyze optical imaging data remotely is enhancing healthcare delivery efficiency.

Cost-effectiveness focus is driving development of more affordable optical imaging solutions designed specifically for emerging markets. Manufacturers are creating value-engineered products that maintain essential functionality while reducing overall system costs.

Training and education emphasis is increasing as stakeholders recognize the importance of proper system utilization for optimal outcomes. Comprehensive training programs and certification courses are becoming standard components of optical imaging system implementations.

Strategic partnerships between international technology providers and regional healthcare organizations are accelerating market development and technology transfer. These collaborations are establishing local expertise while ensuring appropriate technology adaptation for regional requirements.

Regulatory harmonization efforts across the region are creating more predictable market conditions and reducing barriers to technology adoption. The development of common standards and approval processes is facilitating faster market entry for innovative optical imaging solutions.

Research center establishments are driving demand for advanced optical imaging systems while contributing to technology development and validation. According to MarkWide Research analysis, the number of biomedical research facilities incorporating optical imaging has increased by 45% over the past three years.

Government healthcare initiatives are prioritizing advanced diagnostic capabilities, with optical imaging technologies receiving significant attention in national healthcare development plans. These initiatives are creating structured demand and funding mechanisms for technology adoption.

Medical tourism expansion is driving healthcare facilities to invest in world-class diagnostic equipment, including state-of-the-art optical imaging systems. The competition for international patients is raising technology standards across the region.

Technology localization efforts are beginning to emerge as regional manufacturers and research institutions develop capabilities for optical imaging system production and innovation, reducing dependence on imported technologies.

Market entry strategies should focus on establishing strong local partnerships and distribution networks that understand regional healthcare dynamics and customer requirements. Technology providers should prioritize relationship building with key opinion leaders and healthcare decision-makers to accelerate market acceptance.

Product development priorities should emphasize cost-effectiveness, ease of use, and robust performance in challenging operating environments. The development of region-specific solutions that address local healthcare needs and infrastructure constraints will provide competitive advantages.

Training and support programs are essential for successful market penetration and customer satisfaction. Comprehensive education initiatives that build local expertise in optical imaging applications and maintenance will support long-term market growth and customer loyalty.

Regulatory compliance strategies should anticipate evolving requirements and invest in understanding local approval processes. Early engagement with regulatory authorities and participation in standards development activities will facilitate smoother market entry and expansion.

Technology integration approaches should focus on interoperability with existing healthcare systems and workflows. Solutions that seamlessly integrate with electronic health records and hospital information systems will be preferred by healthcare providers seeking operational efficiency.

Financing solutions development will be crucial for expanding market access, particularly in resource-constrained environments. Innovative financing models, including leasing arrangements and pay-per-use options, can make advanced optical imaging technologies more accessible to a broader range of healthcare providers.

Market growth trajectory for optical imaging in the Middle-East and Africa region remains strongly positive, driven by continued healthcare infrastructure development, increasing disease prevalence, and technological advancement. MWR projections indicate sustained growth momentum with expanding applications across multiple medical specialties.

Technology evolution will continue toward more intelligent, portable, and cost-effective solutions that address specific regional requirements. The integration of artificial intelligence, cloud connectivity, and mobile capabilities will define next-generation optical imaging systems designed for emerging markets.

Healthcare delivery transformation will create new opportunities for optical imaging applications in telemedicine, preventive care, and point-of-care diagnostics. The shift toward value-based healthcare will favor technologies that demonstrate clear clinical and economic benefits.

Regional expertise development will reduce dependence on international support while creating opportunities for local innovation and technology adaptation. The establishment of regional centers of excellence will support market growth and technology advancement.

Market expansion is expected to accelerate with 15.8% growth in technology adoption rates over the next five years, driven by increasing healthcare access, rising disposable incomes, and growing awareness of advanced diagnostic capabilities among healthcare providers and patients.

Investment opportunities will continue to attract both public and private funding as stakeholders recognize the strategic importance of advanced diagnostic capabilities for healthcare system development and economic growth in the region.

The Middle-East and Africa optical imaging market represents a dynamic and rapidly evolving sector with substantial growth potential driven by healthcare modernization initiatives, increasing disease prevalence, and technological advancement. The region’s diverse healthcare landscape offers multiple opportunities for technology providers, healthcare organizations, and other stakeholders to contribute to improved healthcare outcomes through advanced diagnostic capabilities.

Market development is being supported by favorable government policies, increasing healthcare investment, and growing recognition of optical imaging benefits among medical professionals. The combination of established markets in the Gulf region and emerging opportunities across Africa creates a balanced growth environment with both immediate revenue potential and long-term expansion prospects.

Technology trends toward artificial intelligence integration, portable solutions, and cost-effective designs align well with regional healthcare needs and infrastructure realities. The focus on value-based healthcare and improved patient outcomes provides a strong foundation for continued optical imaging market growth and technology adoption across the Middle-East and Africa region.

What is Optical Imaging?

Optical Imaging refers to a range of techniques that capture images using light, often applied in medical diagnostics, environmental monitoring, and industrial inspection. This technology enables visualization of structures and processes at various scales, enhancing analysis and decision-making.

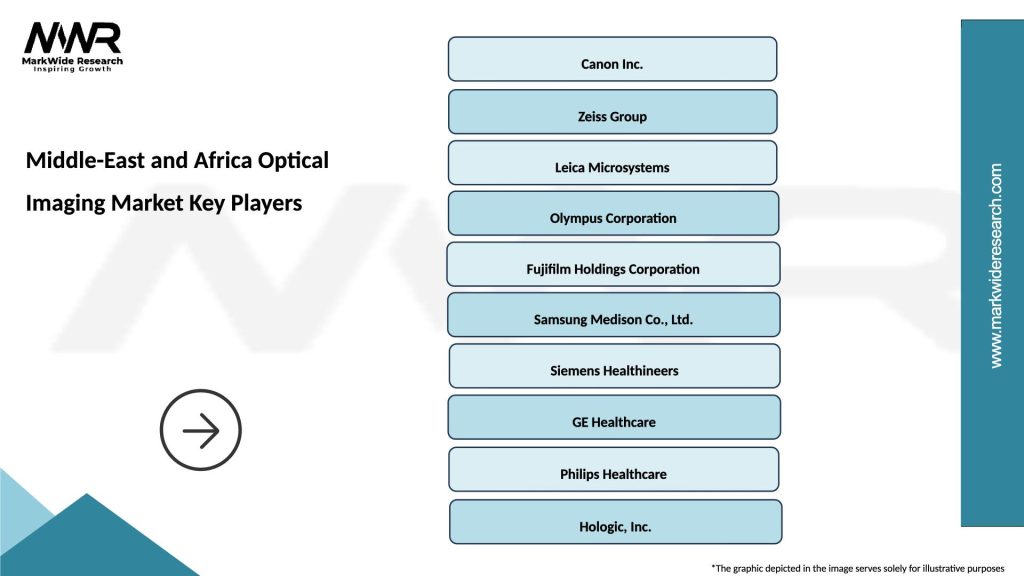

What are the key players in the Middle-East and Africa Optical Imaging Market?

Key players in the Middle-East and Africa Optical Imaging Market include Siemens Healthineers, Canon Medical Systems, and Nikon Instruments, among others. These companies are known for their innovative imaging solutions and contributions to healthcare and industrial sectors.

What are the growth factors driving the Middle-East and Africa Optical Imaging Market?

The growth of the Middle-East and Africa Optical Imaging Market is driven by increasing demand for advanced diagnostic tools, rising prevalence of chronic diseases, and technological advancements in imaging techniques. Additionally, the expansion of healthcare infrastructure in the region supports market growth.

What challenges does the Middle-East and Africa Optical Imaging Market face?

The Middle-East and Africa Optical Imaging Market faces challenges such as high costs of advanced imaging equipment and a shortage of skilled professionals. Furthermore, regulatory hurdles and varying healthcare standards across countries can impede market growth.

What opportunities exist in the Middle-East and Africa Optical Imaging Market?

Opportunities in the Middle-East and Africa Optical Imaging Market include the increasing adoption of telemedicine and remote diagnostics, as well as the potential for growth in emerging markets. Innovations in imaging technologies, such as AI integration, also present significant prospects.

What trends are shaping the Middle-East and Africa Optical Imaging Market?

Trends shaping the Middle-East and Africa Optical Imaging Market include the rise of portable imaging devices, advancements in optical coherence tomography, and the integration of artificial intelligence for enhanced image analysis. These trends are transforming how imaging is utilized in various applications.

Middle-East and Africa Optical Imaging Market

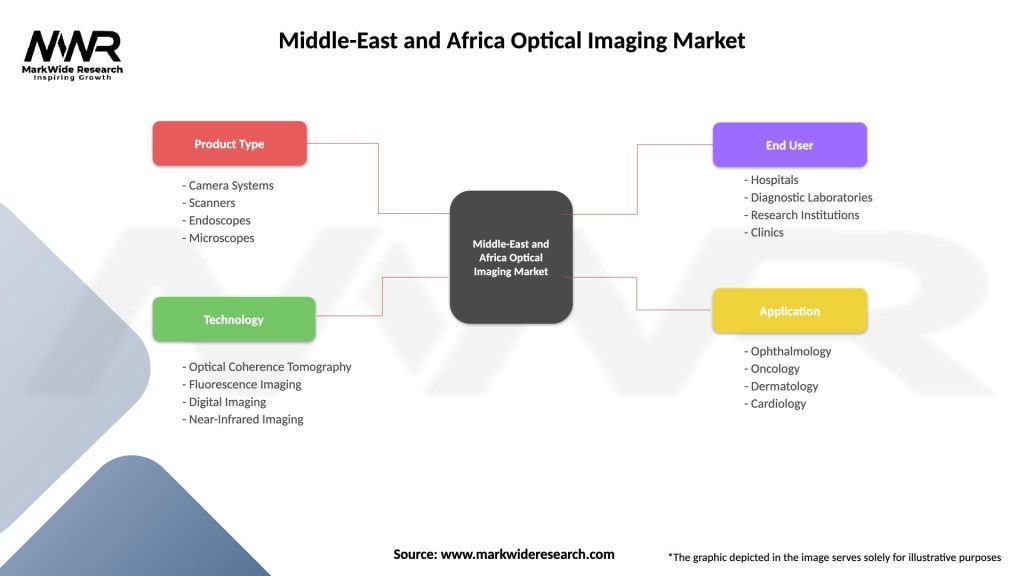

| Segmentation Details | Description |

|---|---|

| Product Type | Camera Systems, Scanners, Endoscopes, Microscopes |

| Technology | Optical Coherence Tomography, Fluorescence Imaging, Digital Imaging, Near-Infrared Imaging |

| End User | Hospitals, Diagnostic Laboratories, Research Institutions, Clinics |

| Application | Ophthalmology, Oncology, Dermatology, Cardiology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle-East and Africa Optical Imaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at