444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East and Africa Nutraceutical Excipients market is experiencing significant growth and is poised for further expansion in the coming years. Nutraceutical excipients play a crucial role in the manufacturing of nutraceutical products by ensuring stability, bioavailability, and improved performance of active ingredients. These excipients are widely used in the formulation of dietary supplements, functional foods, and pharmaceuticals.

Meaning

Nutraceutical excipients are inert substances that are added to nutraceutical products to enhance their physical properties, stability, and bioavailability. They act as carriers for active ingredients, improve their absorption, and ensure uniformity in the final product. Nutraceutical excipients can be of various types, including fillers, binders, diluents, disintegrants, lubricants, and flavoring agents. These excipients are carefully selected based on their compatibility with active ingredients and their ability to meet the desired functional requirements of the product.

Executive Summary

The Middle East and Africa Nutraceutical Excipients market is witnessing robust growth due to the increasing demand for nutraceutical products, rising consumer awareness regarding health and wellness, and the growing aging population. The market is characterized by intense competition among key players, who are focusing on product innovation and development to gain a competitive edge. With the growing popularity of functional foods and dietary supplements, the demand for nutraceutical excipients is expected to witness a steady rise in the coming years.

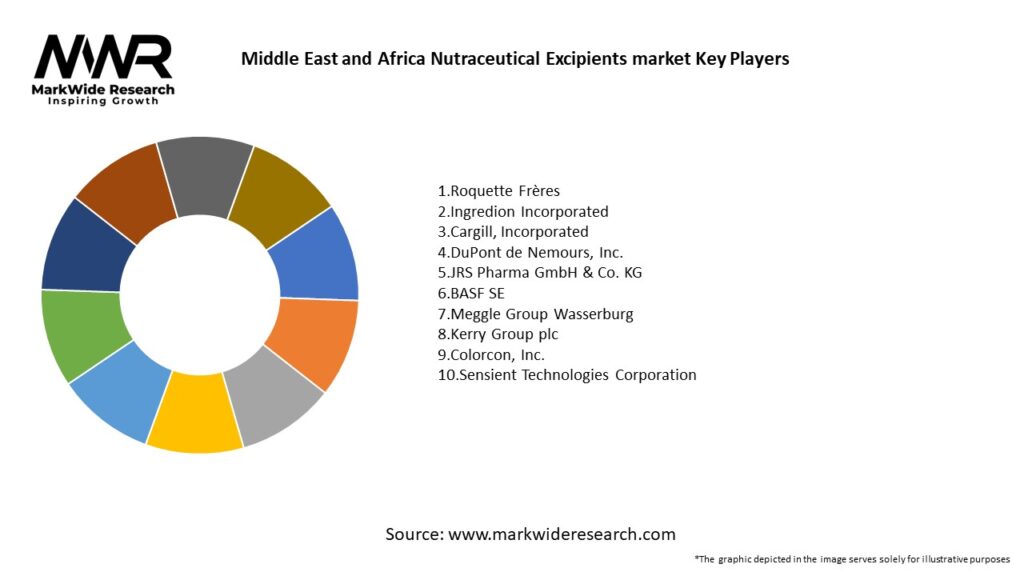

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Middle East and Africa Nutraceutical Excipients market is characterized by dynamic and evolving market dynamics. Several factors influence the growth and development of the market, including changing consumer preferences, advancements in manufacturing technologies, regulatory landscape, and market competition. Understanding these dynamics is crucial for market players to stay competitive and capitalize on emerging opportunities.

Regional Analysis

The Middle East and Africa region is witnessing a significant growth in the nutraceutical industry, driven by factors such as rising disposable income, changing consumer lifestyles, and increasing awareness about health and wellness. Within this region, countries like Saudi Arabia, UAE, South Africa, and Nigeria are emerging as key markets for nutraceutical excipients. These countries have a large consumer base and are experiencing a shift towards healthier dietary habits, creating a favorable environment for the growth of the nutraceutical excipients market.

Competitive Landscape

Leading Companies in Middle East and Africa Nutraceutical Excipients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Middle East and Africa Nutraceutical Excipients market can be segmented based on type, form, functionality, and application. By type, the market can be categorized into binders, fillers, diluents, disintegrants, lubricants, and flavoring agents. Based on form, nutraceutical excipients can be classified as powders, granules, and liquids. In terms of functionality, they can be segmented into bulking agents, flavoring agents, coating agents, and others. The application segment includes dietary supplements, functional foods, and pharmaceuticals.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the nutraceutical industry, including the market for nutraceutical excipients in the Middle East and Africa. While the pandemic initially disrupted the supply chain and manufacturing operations, the demand for nutraceutical products remained resilient. Consumers became more conscious of their health and immune function, leading to increased consumption of dietary supplements and functional foods.

The pandemic also highlighted the importance of preventive healthcare and boosted the demand for nutraceutical products that support immune health. Nutraceutical excipients played a vital role in formulating these immune-boosting products, ensuring their stability and efficacy.

However, the pandemic also posed challenges in terms of supply chain disruptions, raw material availability, and regulatory compliance. Manufacturers had to adapt their operations to meet the increased demand and implement safety measures to protect their employees and consumers.

Overall, the COVID-19 pandemic accelerated the growth of the nutraceutical industry and highlighted the significance of nutraceutical excipients in supporting public health and wellness.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Middle East and Africa Nutraceutical Excipients market is expected to witness steady growth in the coming years. Factors such as increasing consumer awareness about health and wellness, rising demand for natural and organic products, and advancements in manufacturing technologies will drive market expansion.

The demand for nutraceutical excipients is likely to be driven by the growing aging population, rising prevalence of lifestyle diseases, and regulatory support for nutraceutical products. Manufacturers who can offer innovative excipients that enhance product performance, stability, and bioavailability will be well-positioned to capture market share.

However, challenges such as stringent regulations, high research and development costs, and price volatility of raw materials will need to be addressed. Collaboration, research and development investments, and strategic partnerships will play a crucial role in overcoming these challenges and fostering market growth.

Conclusion

In conclusion, the Middle East and Africa Nutraceutical Excipients market presents significant opportunities for industry participants and stakeholders. By focusing on product innovation, market diversification, sustainability, and compliance with regulatory standards, manufacturers can thrive in this dynamic and evolving market.

What is Nutraceutical Excipients?

Nutraceutical excipients are substances used in the formulation of nutraceutical products to enhance their stability, bioavailability, and overall effectiveness. They play a crucial role in the delivery of active ingredients in dietary supplements and functional foods.

What are the key players in the Middle East and Africa Nutraceutical Excipients market?

Key players in the Middle East and Africa Nutraceutical Excipients market include companies like BASF SE, DuPont de Nemours, Inc., and Ashland Global Holdings Inc., among others. These companies are involved in the development and supply of excipients tailored for nutraceutical applications.

What are the growth factors driving the Middle East and Africa Nutraceutical Excipients market?

The growth of the Middle East and Africa Nutraceutical Excipients market is driven by increasing health awareness, a rising demand for dietary supplements, and the growing trend of preventive healthcare. Additionally, innovations in excipient formulations are enhancing product efficacy.

What challenges does the Middle East and Africa Nutraceutical Excipients market face?

The Middle East and Africa Nutraceutical Excipients market faces challenges such as regulatory hurdles, varying quality standards, and competition from synthetic alternatives. These factors can impact the availability and acceptance of natural excipients in the market.

What opportunities exist in the Middle East and Africa Nutraceutical Excipients market?

Opportunities in the Middle East and Africa Nutraceutical Excipients market include the increasing demand for clean-label products, the expansion of e-commerce for health products, and the potential for growth in emerging markets. These trends are likely to drive innovation and investment in the sector.

What trends are shaping the Middle East and Africa Nutraceutical Excipients market?

Trends shaping the Middle East and Africa Nutraceutical Excipients market include a shift towards plant-based excipients, advancements in nanotechnology for improved delivery systems, and a focus on sustainability in sourcing and production. These trends are influencing product development and consumer preferences.

Middle East and Africa Nutraceutical Excipients market

| Segmentation Details | Description |

|---|---|

| Product Type | Binders, Fillers, Disintegrants, Coatings |

| End User | Pharmaceuticals, Dietary Supplements, Food Industry, Cosmetics |

| Form | Powder, Granules, Tablets, Capsules |

| Application | Functional Foods, Nutraceuticals, Herbal Products, Others |

Leading Companies in Middle East and Africa Nutraceutical Excipients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at