444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa neo banking services market represents one of the most dynamic and rapidly evolving segments within the global fintech landscape. This transformative sector encompasses digital-first banking solutions that operate without traditional physical branch networks, leveraging cutting-edge technology to deliver comprehensive financial services through mobile applications and web platforms. The region’s unique demographic profile, characterized by a young, tech-savvy population and significant smartphone penetration rates of approximately 78%, creates an ideal environment for neo banking adoption.

Market dynamics in the Middle East and Africa are particularly compelling due to the substantial unbanked and underbanked populations across various countries. Traditional banking infrastructure limitations, combined with increasing digital literacy rates growing at 12% annually, have created unprecedented opportunities for neo banking services to bridge financial inclusion gaps. The regulatory landscape has evolved considerably, with several countries implementing progressive fintech-friendly policies that encourage innovation while maintaining consumer protection standards.

Regional variations within the Middle East and Africa present distinct market characteristics. The Gulf Cooperation Council countries demonstrate higher adoption rates of premium neo banking services, while African markets show remarkable growth in basic digital banking solutions. According to MarkWide Research analysis, the market exhibits robust growth potential driven by increasing smartphone adoption, improving internet connectivity, and evolving consumer preferences toward digital-first financial solutions.

The Middle East and Africa neo banking services market refers to the comprehensive ecosystem of digital-only financial institutions and services that operate primarily through mobile applications and online platforms without traditional physical branch networks. These innovative banking solutions leverage advanced technologies including artificial intelligence, machine learning, and blockchain to deliver personalized financial services, real-time transaction processing, and enhanced customer experiences across the diverse markets of the Middle East and Africa region.

Neo banking services encompass a wide range of financial products and solutions including digital current accounts, savings products, payment processing, money transfers, lending services, and investment platforms. Unlike traditional banks, neo banks focus on user experience optimization, cost-effective operations, and rapid service deployment. The market includes both standalone neo banks and digital banking arms of established financial institutions seeking to capture the growing demand for digital financial services.

Key characteristics of this market include mobile-first design principles, API-driven architecture, real-time analytics, and seamless integration with third-party financial services. The sector addresses specific regional challenges such as cross-border remittances, financial inclusion for underserved populations, and the need for Sharia-compliant banking solutions in Islamic markets.

Strategic market positioning within the Middle East and Africa neo banking services sector reveals exceptional growth opportunities driven by demographic advantages, technological infrastructure improvements, and evolving regulatory frameworks. The market benefits from a predominantly young population with 65% under 35 years of age, creating a natural affinity for digital banking solutions and mobile-first financial services.

Competitive landscape dynamics showcase both international neo banking platforms expanding into the region and homegrown fintech companies developing localized solutions. The market demonstrates significant potential for financial inclusion, with traditional banking penetration rates varying considerably across different countries. Digital payment adoption has accelerated substantially, with mobile payment usage increasing by 45% over recent periods.

Investment flows into the regional fintech sector have intensified, with venture capital funding supporting innovative neo banking startups and established players expanding their digital capabilities. The market exhibits strong fundamentals including improving telecommunications infrastructure, supportive government initiatives promoting digital transformation, and increasing consumer confidence in digital financial services.

Future growth trajectories indicate sustained expansion across multiple market segments, with particular strength in retail banking, small business financial services, and cross-border payment solutions. The convergence of Islamic finance principles with digital banking innovation presents unique opportunities for Sharia-compliant neo banking services.

Fundamental market drivers reveal several critical insights shaping the Middle East and Africa neo banking services landscape:

Market penetration patterns demonstrate varying adoption rates across different countries and demographic segments, with urban areas showing significantly higher neo banking usage compared to rural regions. The insights reveal strong potential for continued expansion as digital literacy rates improve and smartphone costs continue declining.

Technological advancement serves as the primary catalyst driving neo banking services adoption across the Middle East and Africa. The widespread deployment of advanced mobile networks, with 5G coverage expanding at 25% annually in major metropolitan areas, enables sophisticated banking applications and real-time financial services. Cloud computing infrastructure development supports scalable banking platforms capable of handling millions of transactions while maintaining security and compliance standards.

Demographic advantages create unprecedented market opportunities for neo banking services. The region’s youthful population demonstrates high digital literacy rates and strong preference for mobile-first solutions. Traditional banking relationships show declining loyalty among younger consumers who prioritize convenience, transparency, and innovative features over established banking relationships. This demographic shift accelerates neo banking adoption across multiple market segments.

Financial inclusion initiatives supported by governments and international organizations drive neo banking expansion into previously underserved markets. Digital banking solutions address geographical barriers, reduce operational costs, and enable financial service delivery to remote areas lacking traditional banking infrastructure. Microfinance integration with neo banking platforms creates comprehensive financial ecosystems supporting small business development and individual economic empowerment.

Regulatory support from progressive financial authorities encourages neo banking innovation while maintaining consumer protection standards. Regulatory sandboxes allow fintech companies to test innovative products and services under relaxed regulatory requirements, accelerating time-to-market for new banking solutions. Open banking initiatives promote competition and innovation by enabling secure data sharing between financial institutions and third-party service providers.

Regulatory complexity across diverse jurisdictions within the Middle East and Africa creates significant operational challenges for neo banking services. Varying compliance requirements, licensing procedures, and consumer protection standards necessitate substantial legal and regulatory expertise. Some markets maintain restrictive banking regulations that limit neo banking operations or require partnerships with established financial institutions, constraining independent growth strategies.

Cybersecurity concerns represent critical challenges for neo banking adoption, particularly among security-conscious consumers and businesses. High-profile data breaches and fraud incidents in the broader fintech sector create consumer hesitancy toward digital-only banking solutions. The sophisticated cybersecurity infrastructure required for secure banking operations demands substantial ongoing investment in security technologies, monitoring systems, and compliance frameworks.

Digital literacy gaps limit market penetration in certain demographic segments and geographical regions. Rural populations and older consumers demonstrate lower comfort levels with digital banking interfaces, preferring traditional banking relationships and physical branch interactions. Language barriers and cultural preferences for face-to-face financial consultations create additional adoption challenges in diverse markets.

Infrastructure limitations in some regions constrain neo banking service delivery and customer experience quality. Inconsistent internet connectivity, limited smartphone penetration in rural areas, and inadequate payment infrastructure affect service reliability and accessibility. Power supply challenges and telecommunications network limitations impact the consistent availability of digital banking services.

Financial inclusion expansion presents the most significant opportunity for neo banking services across the Middle East and Africa. With substantial unbanked populations in many countries, digital banking solutions can bridge traditional banking gaps through innovative product offerings and accessible service delivery models. Microfinance integration, mobile money services, and simplified account opening procedures enable financial service access for previously excluded demographics.

Islamic finance digitization creates unique market opportunities for Sharia-compliant neo banking services. The growing demand for digital Islamic banking products, including profit-sharing accounts, Islamic investment platforms, and halal financing solutions, represents a substantial market segment. Neo banks specializing in Islamic finance can leverage technology to deliver transparent, compliant financial products while maintaining competitive cost structures.

Cross-border payment solutions address significant market needs driven by increasing intra-regional trade, remittance flows, and international business activities. Neo banking platforms can offer efficient, cost-effective international transfer services, multi-currency accounts, and trade finance solutions. The growing African Continental Free Trade Area creates additional opportunities for seamless cross-border banking services.

Small business banking represents an underserved market segment with substantial growth potential. Neo banking services can provide comprehensive business banking solutions including simplified account opening, integrated payment processing, expense management tools, and embedded lending services. The growing entrepreneurial ecosystem across the region creates increasing demand for accessible, technology-enabled business financial services.

Competitive intensity within the Middle East and Africa neo banking services market continues escalating as both international players and regional startups compete for market share. Established global neo banks are expanding into high-potential markets while local fintech companies develop solutions tailored to specific regional needs and preferences. This competitive environment drives innovation, improves service quality, and reduces costs for consumers.

Partnership strategies emerge as critical success factors, with neo banks forming strategic alliances with telecommunications companies, retail networks, and traditional financial institutions. These partnerships enable expanded distribution channels, enhanced service offerings, and improved market penetration. Collaboration with mobile network operators facilitates mobile money integration and expands customer acquisition capabilities.

Technology evolution continuously reshapes market dynamics through artificial intelligence implementation, blockchain integration, and advanced analytics capabilities. Neo banks leverage these technologies to enhance customer experience, improve risk management, and develop personalized financial products. The integration of emerging technologies creates competitive advantages and enables innovative service delivery models.

Regulatory evolution influences market dynamics through changing compliance requirements, licensing procedures, and operational standards. Progressive regulatory frameworks support market growth while evolving consumer protection measures ensure sustainable development. According to MWR analysis, regulatory clarity and supportive policies significantly impact neo banking expansion strategies and investment decisions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East and Africa neo banking services market. Primary research includes extensive interviews with industry executives, regulatory officials, technology providers, and end-users across different market segments and geographical regions. These interviews provide qualitative insights into market trends, challenges, and opportunities from diverse stakeholder perspectives.

Secondary research encompasses analysis of industry reports, regulatory publications, financial statements, and academic studies related to neo banking services and fintech development. Market data collection includes transaction volumes, user adoption rates, regulatory changes, and competitive landscape developments. This comprehensive approach ensures thorough market understanding and accurate trend identification.

Quantitative analysis utilizes statistical modeling and data analytics to identify market patterns, growth trajectories, and correlation factors. Survey methodologies capture consumer preferences, adoption barriers, and service satisfaction levels across different demographic segments. Market sizing and forecasting employ multiple analytical approaches to ensure robust projections and reliable market estimates.

Expert validation processes involve consultation with industry specialists, academic researchers, and regulatory experts to verify findings and ensure analytical accuracy. Cross-referencing multiple data sources and validation through expert panels enhances research reliability and provides confidence in market insights and projections.

Gulf Cooperation Council markets demonstrate the highest neo banking adoption rates within the Middle East and Africa region, driven by advanced telecommunications infrastructure, high smartphone penetration, and supportive regulatory frameworks. The UAE leads regional development with 85% smartphone adoption and progressive fintech regulations attracting international neo banking platforms. Saudi Arabia’s Vision 2030 initiative promotes digital transformation and financial sector modernization, creating favorable conditions for neo banking expansion.

North African markets show substantial growth potential despite varying development levels across different countries. Egypt’s large population and improving digital infrastructure create significant opportunities for neo banking services, while Morocco’s progressive fintech regulations support market development. Tunisia and Algeria demonstrate emerging potential as telecommunications infrastructure improves and regulatory frameworks evolve.

Sub-Saharan Africa presents the most dynamic growth opportunities driven by substantial unbanked populations and mobile money ecosystem development. South Africa leads regional fintech innovation with established regulatory frameworks and advanced banking infrastructure. Nigeria’s large population and growing fintech sector create substantial market opportunities, while Kenya’s mobile money success provides a foundation for neo banking expansion.

East African markets benefit from established mobile money ecosystems and progressive regulatory approaches to fintech innovation. Rwanda’s digital transformation initiatives and supportive government policies create favorable conditions for neo banking development. Ethiopia’s recent telecommunications liberalization opens new opportunities for digital financial services expansion.

Market leadership within the Middle East and Africa neo banking services sector encompasses both international platforms expanding into the region and homegrown fintech companies developing localized solutions. The competitive environment demonstrates increasing intensity as established players strengthen their market positions while new entrants introduce innovative service offerings.

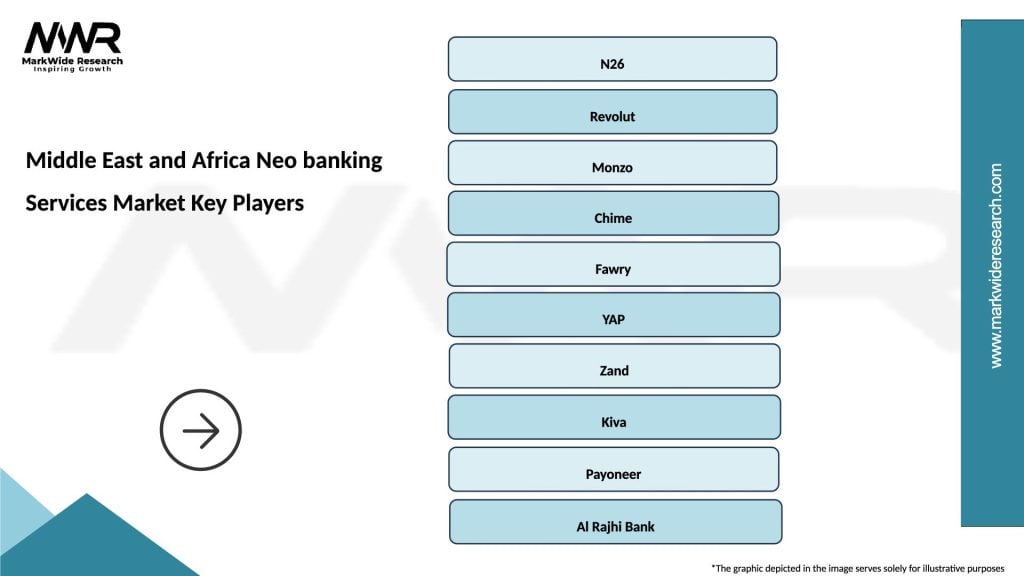

Key market participants include:

Competitive strategies focus on customer experience optimization, cost-effective service delivery, and innovative product development. Market participants invest heavily in technology infrastructure, regulatory compliance, and customer acquisition while developing differentiated value propositions for specific market segments.

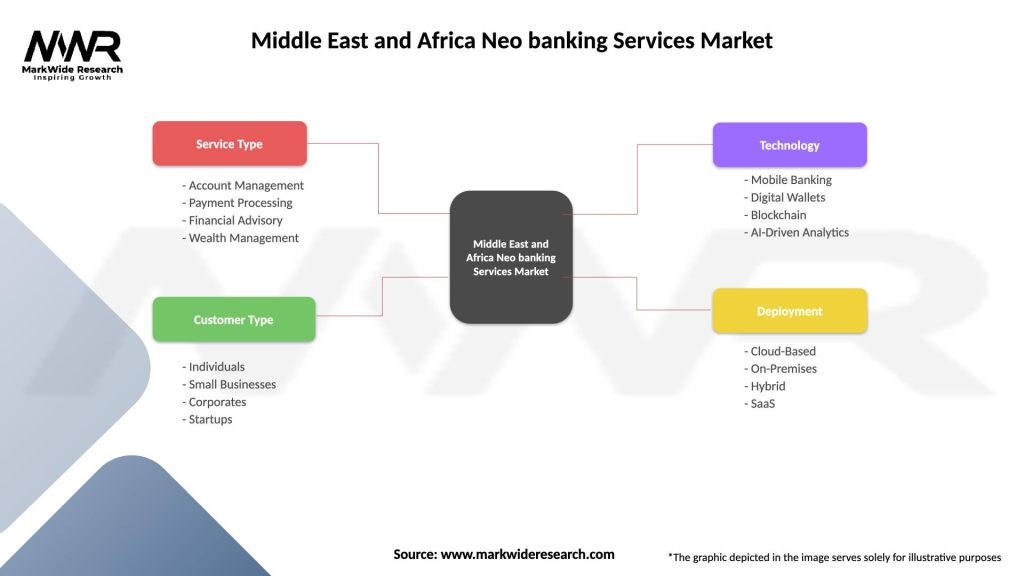

Service type segmentation reveals diverse neo banking offerings across the Middle East and Africa market:

Customer segment analysis identifies distinct market categories:

Geographical segmentation encompasses diverse regional markets with varying development levels, regulatory frameworks, and consumer preferences across the Middle East and Africa region.

Digital payment services represent the fastest-growing category within the Middle East and Africa neo banking services market, driven by increasing e-commerce adoption and mobile payment preferences. This segment benefits from growing smartphone penetration rates of 78% and improving digital payment infrastructure across major markets. Cross-border payment solutions address significant market needs driven by remittance flows and international business activities.

Personal banking services demonstrate strong growth potential as consumers seek alternatives to traditional banking relationships. Digital current accounts, savings products, and personal financial management tools attract customers through transparent pricing, innovative features, and superior user experiences. The category benefits from changing consumer preferences toward digital-first financial services and declining loyalty to traditional banking institutions.

Business banking solutions emerge as a high-potential category addressing underserved small and medium enterprise markets. Integrated business banking platforms offer comprehensive financial services including account management, payment processing, expense tracking, and embedded lending solutions. The growing entrepreneurial ecosystem across the region creates increasing demand for accessible, technology-enabled business financial services.

Islamic banking products represent a unique category combining traditional Sharia-compliant finance principles with modern digital banking technology. This segment addresses specific market needs in Islamic finance markets while leveraging technology to deliver transparent, compliant financial products. The category demonstrates substantial growth potential as digital Islamic banking adoption accelerates across Muslim-majority markets.

Financial institutions benefit from neo banking services through reduced operational costs, expanded market reach, and enhanced customer engagement capabilities. Digital-first banking models eliminate expensive branch networks while enabling scalable service delivery and improved cost efficiency. Advanced analytics and customer data insights support personalized product development and targeted marketing strategies.

Consumers gain access to convenient, transparent, and cost-effective banking services through neo banking platforms. Benefits include 24/7 service availability, simplified account opening procedures, real-time transaction processing, and innovative financial management tools. Transparent pricing structures and reduced fees provide significant cost advantages compared to traditional banking services.

Small businesses access comprehensive financial services previously available only to larger enterprises through integrated neo banking platforms. Benefits include streamlined business banking operations, embedded payment processing, automated expense management, and accessible lending solutions. Digital banking platforms support business growth through efficient financial service delivery and reduced administrative overhead.

Regulatory authorities achieve improved financial inclusion, enhanced consumer protection, and increased market competition through neo banking development. Digital banking platforms provide better transaction monitoring, improved compliance reporting, and enhanced financial system transparency. The sector supports broader economic development objectives through increased financial access and innovation.

Technology providers benefit from growing demand for banking technology solutions, cybersecurity services, and digital infrastructure development. The expanding neo banking market creates opportunities for cloud computing providers, payment processors, and fintech solution developers across the Middle East and Africa region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend reshaping neo banking services across the Middle East and Africa. AI-powered chatbots, personalized financial advice, and automated customer service enhance user experiences while reducing operational costs. Machine learning algorithms improve fraud detection, risk assessment, and credit scoring capabilities, enabling more accurate and efficient banking operations.

Open banking adoption accelerates across progressive markets, enabling secure data sharing between financial institutions and third-party service providers. This trend supports innovation through API-driven banking services, integrated financial ecosystems, and enhanced customer choice. Open banking frameworks promote competition while maintaining security and consumer protection standards.

Embedded finance solutions gain traction as neo banks integrate financial services into non-financial platforms and applications. This trend includes payment processing integration in e-commerce platforms, lending services embedded in business applications, and insurance products integrated into lifestyle apps. Embedded finance expands market reach and creates new revenue opportunities.

Sustainability focus influences neo banking development through green finance products, carbon footprint tracking, and sustainable investment options. Environmental consciousness among younger consumers drives demand for banking services aligned with sustainability values. Neo banks leverage their digital platforms to promote financial products supporting environmental and social objectives.

Blockchain technology adoption enhances security, transparency, and efficiency in neo banking operations. Distributed ledger technology supports secure transaction processing, improved identity verification, and enhanced cross-border payment capabilities. Smart contracts enable automated banking processes and reduce operational complexity.

Regulatory framework evolution continues shaping the Middle East and Africa neo banking landscape through progressive fintech policies and regulatory sandboxes. Recent developments include the UAE’s comprehensive fintech strategy, Saudi Arabia’s open banking initiatives, and South Africa’s regulatory framework updates supporting digital financial services innovation.

Strategic partnerships between neo banks and established institutions accelerate market development and service expansion. Notable collaborations include telecommunications companies partnering with fintech startups, traditional banks launching digital banking subsidiaries, and technology providers developing specialized banking solutions for regional markets.

Investment activity intensifies across the regional fintech sector, with venture capital funding supporting neo banking startups and established players expanding their digital capabilities. Recent funding rounds demonstrate investor confidence in the market’s growth potential and support continued innovation and expansion activities.

Technology infrastructure development enhances neo banking service delivery through improved telecommunications networks, cloud computing capabilities, and cybersecurity solutions. Infrastructure investments support scalable banking platforms capable of handling growing transaction volumes while maintaining security and reliability standards.

Product innovation drives market differentiation through specialized banking solutions, integrated financial services, and enhanced customer experience features. Recent developments include Islamic banking digital products, small business integrated platforms, and cross-border payment solutions tailored to regional market needs.

Market entry strategies should prioritize regulatory compliance, local partnership development, and customer-centric product design. Successful neo banking expansion requires thorough understanding of local market conditions, consumer preferences, and regulatory requirements. MarkWide Research recommends focusing on specific market segments and building strong local presence before expanding service offerings.

Technology investment priorities should emphasize cybersecurity infrastructure, mobile platform optimization, and scalable cloud-based architectures. Robust security measures are essential for building consumer trust and ensuring regulatory compliance. Investment in advanced analytics capabilities supports personalized service delivery and improved risk management.

Partnership strategies offer significant advantages for market penetration and service expansion. Collaborations with telecommunications companies, retail networks, and established financial institutions provide distribution channels, customer acquisition support, and operational expertise. Strategic partnerships can accelerate market entry while reducing operational risks and costs.

Customer acquisition approaches should leverage digital marketing channels, referral programs, and community engagement initiatives. Building brand awareness and consumer trust requires consistent communication, transparent pricing, and superior customer service. Focus on specific demographic segments and geographical markets enables more effective resource allocation and marketing strategies.

Regulatory engagement remains critical for sustainable market development and operational success. Proactive communication with regulatory authorities, participation in industry associations, and compliance with evolving standards support long-term business viability and market expansion opportunities.

Growth projections for the Middle East and Africa neo banking services market indicate sustained expansion driven by demographic advantages, technology infrastructure improvements, and evolving consumer preferences. The market is expected to maintain robust growth rates of approximately 18% CAGR over the forecast period, supported by increasing smartphone adoption, improving digital literacy, and supportive regulatory frameworks.

Technology evolution will continue reshaping the neo banking landscape through artificial intelligence advancement, blockchain integration, and enhanced mobile banking capabilities. Emerging technologies including 5G networks, Internet of Things connectivity, and advanced biometric authentication will enable more sophisticated banking services and improved customer experiences.

Market maturation patterns suggest increasing consolidation as successful players expand their market presence while smaller competitors face challenges in achieving sustainable scale. Strategic partnerships, mergers, and acquisitions will likely reshape the competitive landscape as the market develops and matures.

Financial inclusion expansion represents the most significant long-term opportunity, with digital banking solutions addressing traditional banking gaps across diverse markets. The growing focus on sustainable development goals and financial accessibility will drive continued innovation in inclusive banking solutions and underserved market segments.

Regional integration trends suggest increasing harmonization of regulatory frameworks and cross-border banking services. The African Continental Free Trade Area and regional economic integration initiatives will create opportunities for seamless cross-border neo banking services and expanded market reach.

The Middle East and Africa neo banking services market represents a transformative opportunity within the global fintech landscape, driven by unique demographic advantages, substantial unbanked populations, and rapidly evolving digital infrastructure. The market’s exceptional growth potential stems from a predominantly young, tech-savvy population demonstrating strong preference for digital-first financial solutions and mobile banking convenience.

Strategic market dynamics reveal compelling opportunities across multiple segments, from retail banking and small business services to Islamic finance digitization and cross-border payment solutions. The convergence of progressive regulatory frameworks, improving telecommunications infrastructure, and increasing consumer confidence in digital financial services creates favorable conditions for sustained market expansion and innovation.

Competitive landscape evolution demonstrates increasing sophistication as both international players and regional startups develop differentiated value propositions tailored to specific market needs and consumer preferences. Success factors include regulatory compliance expertise, robust cybersecurity infrastructure, strategic partnership development, and customer-centric service design that addresses local market requirements while leveraging global best practices.

Future market development will be characterized by continued technology integration, expanding financial inclusion initiatives, and increasing market consolidation as successful players strengthen their positions. The Middle East and Africa neo banking services market is positioned to play a crucial role in advancing financial inclusion, supporting economic development, and transforming the regional banking landscape through innovative digital solutions and enhanced customer experiences.

What is Neo banking Services?

Neo banking services refer to digital-only banking solutions that operate without traditional physical branches. They offer a range of financial services, including payment processing, savings accounts, and personal finance management, primarily through mobile applications and online platforms.

What are the key players in the Middle East and Africa Neo banking Services Market?

Key players in the Middle East and Africa Neo banking services market include companies like N26, Revolut, and YAP, which provide innovative banking solutions tailored to the needs of tech-savvy consumers. These companies focus on enhancing user experience and offering competitive financial products, among others.

What are the growth factors driving the Middle East and Africa Neo banking Services Market?

The growth of the Middle East and Africa Neo banking services market is driven by increasing smartphone penetration, a growing preference for digital financial solutions, and the rise of fintech innovations. Additionally, the demand for convenient and cost-effective banking options is propelling market expansion.

What challenges does the Middle East and Africa Neo banking Services Market face?

The Middle East and Africa Neo banking services market faces challenges such as regulatory compliance, cybersecurity threats, and competition from traditional banks. These factors can hinder the growth and adoption of neo banking solutions in the region.

What opportunities exist in the Middle East and Africa Neo banking Services Market?

Opportunities in the Middle East and Africa Neo banking services market include the potential for partnerships with local businesses, expansion into underserved markets, and the integration of advanced technologies like AI and blockchain. These factors can enhance service offerings and customer engagement.

What trends are shaping the Middle East and Africa Neo banking Services Market?

Trends shaping the Middle East and Africa Neo banking services market include the rise of personalized banking experiences, the adoption of open banking frameworks, and the increasing use of artificial intelligence for customer service. These trends are transforming how consumers interact with financial services.

Middle East and Africa Neo banking Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Account Management, Payment Processing, Financial Advisory, Wealth Management |

| Customer Type | Individuals, Small Businesses, Corporates, Startups |

| Technology | Mobile Banking, Digital Wallets, Blockchain, AI-Driven Analytics |

| Deployment | Cloud-Based, On-Premises, Hybrid, SaaS |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Neo banking Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at