444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa mobile payments services market represents one of the most dynamic and rapidly evolving financial technology sectors globally. This transformative market encompasses a comprehensive range of digital payment solutions, including mobile wallets, contactless payments, peer-to-peer transfers, and merchant payment systems. The region has witnessed unprecedented growth in mobile payment adoption, driven by increasing smartphone penetration, growing digital literacy, and supportive regulatory frameworks across various countries.

Market dynamics indicate that the Middle East and Africa region is experiencing a digital payment revolution, with mobile payment services growing at a remarkable CAGR of 18.5% over the forecast period. This growth trajectory is particularly notable in countries like Kenya, Nigeria, South Africa, and the United Arab Emirates, where mobile payment infrastructure has reached significant maturity levels. The market’s expansion is further accelerated by the region’s large unbanked population, which represents approximately 66% of adults in sub-Saharan Africa, creating substantial opportunities for mobile financial inclusion.

Regional variations in mobile payment adoption showcase diverse market characteristics, with East Africa leading in mobile money penetration while the Gulf Cooperation Council countries demonstrate strong growth in contactless and digital wallet solutions. The market encompasses various stakeholder categories, including mobile network operators, financial institutions, fintech companies, and technology providers, all contributing to the ecosystem’s robust development and innovation.

The Middle East and Africa mobile payments services market refers to the comprehensive ecosystem of digital financial services that enable users to conduct monetary transactions through mobile devices, including smartphones, tablets, and feature phones. This market encompasses various payment methodologies, from basic SMS-based money transfers to sophisticated near-field communication (NFC) enabled contactless payments and blockchain-based digital currencies.

Mobile payment services in this context include mobile wallets, mobile banking applications, peer-to-peer transfer platforms, merchant payment solutions, bill payment services, and cross-border remittance systems. These services leverage mobile network infrastructure, internet connectivity, and advanced security protocols to facilitate seamless financial transactions across diverse demographic segments and geographic locations throughout the Middle East and Africa region.

The market definition extends beyond traditional payment processing to include value-added services such as micro-lending, savings products, insurance services, and investment platforms accessible through mobile interfaces. This comprehensive approach to mobile financial services has positioned the region as a global leader in mobile money innovation and financial inclusion initiatives.

The Middle East and Africa mobile payments services market stands at the forefront of global digital financial transformation, demonstrating exceptional growth potential and innovation across diverse economic landscapes. The market’s evolution is characterized by strong adoption rates, technological advancement, and increasing regulatory support from governments seeking to promote financial inclusion and digital economic development.

Key market drivers include the region’s substantial unbanked population, rapid smartphone adoption, improving internet infrastructure, and growing merchant acceptance of digital payment methods. Mobile network operators have played a pivotal role in market development, with services like M-Pesa in Kenya serving as global benchmarks for mobile money success. The market has achieved 45% mobile money account penetration in several East African countries, significantly outpacing global averages.

Technological innovation continues to drive market expansion, with emerging technologies such as artificial intelligence, blockchain, and biometric authentication enhancing security, user experience, and service accessibility. The integration of mobile payments with e-commerce platforms, government services, and utility providers has created comprehensive digital ecosystems that support economic growth and financial inclusion objectives.

Market challenges include regulatory complexity, cybersecurity concerns, infrastructure limitations in rural areas, and varying levels of digital literacy across different demographic segments. However, these challenges are being addressed through collaborative efforts between public and private sector stakeholders, resulting in improved market conditions and expanded service accessibility.

Strategic market analysis reveals several critical insights that define the Middle East and Africa mobile payments services landscape. The market demonstrates unique characteristics that differentiate it from other global regions, particularly in terms of leapfrogging traditional banking infrastructure and achieving direct transition to mobile-first financial services.

The Middle East and Africa mobile payments services market is propelled by a confluence of technological, economic, and social factors that create favorable conditions for sustained growth and innovation. These drivers represent fundamental market forces that continue to shape the industry’s trajectory and expansion patterns across the region.

Smartphone proliferation serves as a primary market driver, with mobile device penetration reaching 78% across major urban centers in the region. The increasing availability of affordable smartphones and improved mobile network coverage has created the essential infrastructure foundation for mobile payment service adoption. This technological accessibility has enabled service providers to reach previously underserved populations and expand their user base significantly.

Financial inclusion initiatives represent another critical driver, as governments and international organizations prioritize expanding access to financial services. The region’s substantial unbanked population creates enormous market potential, with mobile payments serving as the most viable solution for achieving comprehensive financial inclusion. These initiatives are supported by favorable regulatory policies and public-private partnerships that facilitate market development.

Economic digitization trends across the Middle East and Africa are accelerating mobile payment adoption as businesses and consumers embrace digital transformation. The COVID-19 pandemic has further accelerated this trend, with contactless payment preferences driving increased adoption rates. E-commerce growth, digital government services, and online business operations all contribute to expanding mobile payment usage scenarios and transaction volumes.

Despite significant growth potential, the Middle East and Africa mobile payments services market faces several constraints that impact adoption rates and market expansion. These restraints require strategic attention from industry stakeholders to ensure continued market development and overcome existing barriers to growth.

Infrastructure limitations pose significant challenges, particularly in rural and remote areas where mobile network coverage remains inconsistent. Internet connectivity issues, power supply constraints, and limited telecommunications infrastructure can restrict service accessibility and reliability. These infrastructure gaps create uneven market development patterns and limit the reach of mobile payment services to certain geographic areas.

Regulatory complexity across different countries creates operational challenges for service providers seeking to expand across multiple markets. Varying regulatory requirements, compliance standards, and licensing procedures can increase operational costs and complexity. Additionally, some regulatory frameworks have not kept pace with technological innovation, creating uncertainty and potential barriers to new service launches.

Digital literacy constraints among certain demographic segments limit market penetration and user adoption rates. While younger populations demonstrate strong digital adoption, older demographics and rural populations may require additional education and support to effectively utilize mobile payment services. Security concerns and trust issues also contribute to adoption hesitancy among some user segments.

Cybersecurity challenges represent ongoing market restraints, as increasing digitization creates new vulnerability points and security risks. Fraud prevention, data protection, and transaction security require continuous investment and innovation to maintain user confidence and regulatory compliance.

The Middle East and Africa mobile payments services market presents substantial opportunities for growth, innovation, and market expansion across multiple dimensions. These opportunities reflect the region’s unique characteristics, emerging trends, and evolving consumer needs that create favorable conditions for market development.

Cross-border payment solutions represent a significant opportunity, given the region’s substantial remittance flows and increasing intra-regional trade. Developing efficient, cost-effective cross-border payment systems could capture a substantial portion of the traditional remittance market while supporting regional economic integration. This opportunity is particularly relevant for countries with large diaspora populations and growing trade relationships.

Small and medium enterprise (SME) digitization offers extensive market opportunities as businesses seek digital payment solutions to improve operational efficiency and customer service. The region’s large SME sector, which represents 85% of businesses in many countries, presents substantial potential for mobile payment service adoption. Tailored solutions for different industry sectors could drive significant market expansion.

Government service integration provides opportunities for mobile payment providers to partner with public sector organizations in delivering digital government services. Tax payments, utility bills, licensing fees, and social benefit distributions can all be facilitated through mobile payment platforms, creating stable revenue streams and expanding user adoption.

Financial services expansion beyond basic payments offers opportunities to develop comprehensive fintech ecosystems. Micro-lending, savings products, insurance services, and investment platforms can be integrated with mobile payment services to create holistic financial service offerings that address diverse user needs and generate multiple revenue streams.

The Middle East and Africa mobile payments services market operates within a complex ecosystem of interconnected forces that shape its evolution, competitive landscape, and growth trajectory. Understanding these market dynamics is essential for stakeholders seeking to navigate the market effectively and capitalize on emerging opportunities.

Competitive dynamics in the market are characterized by diverse player categories, including mobile network operators, traditional banks, fintech startups, and international technology companies. This diversity creates a dynamic competitive environment where innovation, partnerships, and customer experience differentiation are key success factors. Market leaders are increasingly focusing on ecosystem development rather than standalone payment services.

Technology evolution continues to reshape market dynamics, with emerging technologies such as artificial intelligence, blockchain, and biometric authentication creating new possibilities for service innovation and security enhancement. The integration of these technologies is enabling more sophisticated fraud detection, personalized user experiences, and improved transaction processing capabilities.

Regulatory evolution significantly influences market dynamics, with governments increasingly recognizing mobile payments as critical infrastructure for economic development and financial inclusion. Progressive regulatory approaches, including regulatory sandboxes and innovation-friendly policies, are creating favorable conditions for market growth and innovation.

Consumer behavior shifts toward digital-first financial services are accelerating market transformation. Younger demographics demonstrate strong preference for mobile payment solutions, while increasing digital literacy across all age groups is expanding the addressable market. The COVID-19 pandemic has further accelerated these behavioral changes, with contactless payment preferences becoming more prevalent.

The comprehensive analysis of the Middle East and Africa mobile payments services market employs a multi-faceted research approach that combines quantitative data analysis, qualitative insights, and industry expert perspectives. This methodology ensures accurate market assessment and reliable forecasting for stakeholders across the mobile payments ecosystem.

Primary research activities include extensive interviews with industry executives, mobile network operators, financial institutions, fintech companies, regulatory authorities, and end-users across different market segments. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics that shape the industry landscape.

Secondary research encompasses comprehensive analysis of industry reports, regulatory publications, financial statements, company announcements, and academic research related to mobile payments and financial technology in the Middle East and Africa region. This research foundation provides historical context and market trend analysis essential for accurate forecasting.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure accuracy and reliability of market insights. The research methodology incorporates both top-down and bottom-up analysis approaches to provide comprehensive market coverage and validate findings across different analytical perspectives.

Market modeling techniques utilize advanced statistical methods, trend analysis, and scenario planning to develop robust market forecasts and growth projections. These models account for various market variables, including economic conditions, regulatory changes, technology adoption rates, and competitive dynamics.

The Middle East and Africa mobile payments services market demonstrates significant regional variations in adoption patterns, technological infrastructure, regulatory frameworks, and market maturity levels. This regional diversity creates unique opportunities and challenges that require tailored market strategies and service offerings.

East Africa leads the region in mobile money adoption and innovation, with countries like Kenya, Tanzania, and Uganda achieving exceptional penetration rates. Kenya’s mobile money market demonstrates 73% adult population usage, making it a global benchmark for mobile financial services success. The region’s success is attributed to supportive regulatory frameworks, strong mobile network operator leadership, and significant unbanked population needs.

West Africa represents substantial growth potential, with countries like Nigeria, Ghana, and Senegal experiencing rapid mobile payment adoption. Nigeria’s large population and growing fintech ecosystem position it as a key market for mobile payment services expansion. The region benefits from increasing smartphone penetration and improving internet infrastructure that support mobile payment service growth.

Southern Africa shows strong development in mobile payment services, with South Africa leading in technological innovation and regulatory advancement. The region demonstrates 42% mobile payment adoption rates among urban populations, with growing expansion into rural markets. Countries like Botswana and Zambia are experiencing accelerated growth in mobile financial services adoption.

Middle East markets, including the Gulf Cooperation Council countries, demonstrate sophisticated mobile payment ecosystems with high smartphone penetration and advanced technological infrastructure. The United Arab Emirates and Saudi Arabia lead in contactless payment adoption and digital wallet usage, with 68% of consumers regularly using mobile payment services for retail transactions.

The Middle East and Africa mobile payments services market features a diverse competitive landscape characterized by multiple player categories, strategic partnerships, and continuous innovation. This competitive environment drives market development and creates opportunities for both established companies and emerging fintech startups.

Strategic partnerships between mobile network operators, banks, and fintech companies are reshaping the competitive landscape. These collaborations enable companies to leverage complementary strengths, expand market reach, and accelerate innovation in mobile payment services.

Innovation focus areas include user experience enhancement, security improvement, value-added services development, and cross-border payment facilitation. Companies are investing heavily in artificial intelligence, blockchain technology, and biometric authentication to differentiate their offerings and improve service quality.

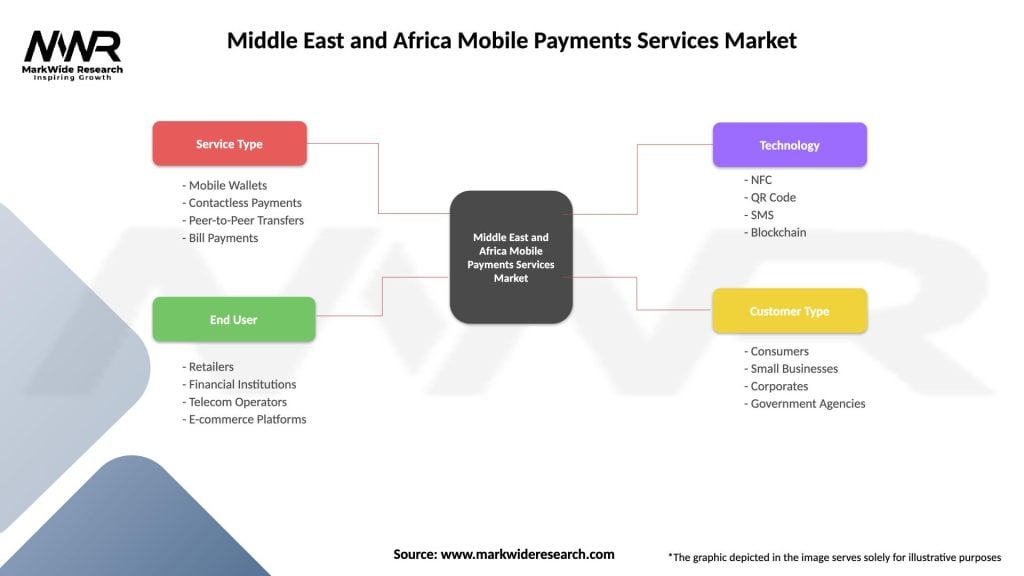

The Middle East and Africa mobile payments services market can be segmented across multiple dimensions to provide detailed analysis of different market components, user categories, and service types. This segmentation approach enables stakeholders to understand market dynamics and identify specific opportunities within different market segments.

By Service Type:

By Technology:

By End User:

Mobile wallet services represent the fastest-growing segment within the Middle East and Africa mobile payments market, driven by increasing smartphone adoption and user preference for comprehensive financial service platforms. These digital wallets offer integrated solutions including payments, savings, lending, and investment services, creating sticky user relationships and multiple revenue streams for service providers.

Peer-to-peer transfer services maintain strong market position due to the region’s substantial remittance flows and family support networks. These services have achieved 89% user satisfaction rates in major markets, demonstrating their importance in daily financial activities. The segment benefits from network effects, where increased user adoption drives greater utility and value for all participants.

Merchant payment solutions are experiencing rapid growth as businesses recognize the benefits of digital payment acceptance. Small and medium enterprises represent the largest opportunity segment, with many businesses transitioning from cash-only operations to digital payment acceptance. This transition is supported by simplified onboarding processes and competitive transaction fees.

Cross-border remittance services through mobile platforms are disrupting traditional money transfer operators by offering faster, more convenient, and often more cost-effective solutions. This segment particularly benefits from the region’s large diaspora populations and increasing intra-regional trade relationships.

Bill payment services provide stable transaction volumes and user engagement, serving as gateway services that introduce users to mobile payment platforms. Utility companies and service providers increasingly partner with mobile payment platforms to improve collection efficiency and customer convenience.

The Middle East and Africa mobile payments services market offers substantial benefits across the entire ecosystem, from service providers and financial institutions to end-users and economic development stakeholders. These benefits create value propositions that drive continued market growth and innovation.

For Service Providers:

For Financial Institutions:

For End Users:

For Economic Development:

Strengths:

Weaknesses:

Opportunities:

Threats:

The Middle East and Africa mobile payments services market is experiencing several transformative trends that are reshaping the industry landscape and creating new opportunities for growth and innovation. These trends reflect evolving consumer preferences, technological advancement, and market maturation across the region.

Artificial Intelligence Integration is becoming increasingly prevalent in mobile payment services, with AI-powered fraud detection, personalized user experiences, and automated customer service capabilities. Service providers are leveraging machine learning algorithms to improve transaction security, reduce false positives in fraud detection, and provide customized financial product recommendations to users.

Blockchain Technology Adoption is gaining momentum for cross-border payments, identity verification, and smart contract implementation. Several mobile payment providers are exploring blockchain solutions to reduce transaction costs, improve transparency, and enable more efficient cross-border remittance services. This technology trend is particularly relevant for addressing the region’s substantial remittance market needs.

Super App Development represents a significant trend where mobile payment platforms are evolving into comprehensive digital service ecosystems. These super apps integrate payments, e-commerce, transportation, food delivery, and other services into single platforms, increasing user engagement and creating multiple revenue streams for service providers.

Biometric Authentication is becoming standard practice for mobile payment security, with fingerprint, facial recognition, and voice authentication technologies improving user experience while enhancing security. This trend addresses both security concerns and user convenience, contributing to increased adoption rates across different demographic segments.

Open Banking Implementation is facilitating greater innovation and competition in mobile payment services through standardized APIs and data sharing protocols. This trend enables fintech companies to develop innovative solutions while providing users with more choice and better integrated financial services.

Recent industry developments in the Middle East and Africa mobile payments services market demonstrate the dynamic nature of the sector and the continuous innovation driving market evolution. These developments reflect strategic initiatives by market participants and regulatory authorities to enhance service offerings and market accessibility.

Strategic partnerships between mobile network operators and international fintech companies are expanding service capabilities and geographic reach. These collaborations enable local operators to leverage global expertise and technology while providing international companies with market access and local knowledge. Such partnerships are particularly important for cross-border payment service development.

Regulatory sandbox initiatives launched by various countries are fostering innovation and enabling fintech companies to test new services in controlled environments. These regulatory approaches are accelerating product development cycles and enabling more rapid market entry for innovative mobile payment solutions.

Infrastructure investments in mobile network expansion and internet connectivity are improving service accessibility and reliability across the region. Major telecommunications companies are investing heavily in 4G and 5G network deployment, creating the foundation for more sophisticated mobile payment services and improved user experiences.

Government digitization programs are creating new opportunities for mobile payment integration with public services. Several countries have launched initiatives to digitize government payments, tax collection, and social benefit distribution through mobile payment platforms, creating stable revenue streams and expanding user adoption.

Acquisition activities in the fintech sector are consolidating market capabilities and creating stronger competitive positions. Established financial institutions and mobile network operators are acquiring innovative fintech companies to enhance their service offerings and accelerate digital transformation initiatives.

Industry analysts recommend that mobile payment service providers in the Middle East and Africa focus on several strategic priorities to capitalize on market opportunities and address existing challenges. These recommendations are based on comprehensive market analysis and emerging trend identification.

MarkWide Research suggests that companies prioritize user education and digital literacy programs to accelerate adoption among underserved populations. Investing in comprehensive user onboarding, training programs, and customer support capabilities can significantly improve adoption rates and user satisfaction levels across different demographic segments.

Partnership strategy development should focus on creating comprehensive ecosystems that provide integrated solutions for users and businesses. Collaborations between mobile network operators, banks, fintech companies, and merchants can create synergistic value propositions that benefit all stakeholders while improving market competitiveness.

Technology investment priorities should emphasize security enhancement, user experience improvement, and service reliability. Implementing advanced fraud detection systems, biometric authentication, and robust infrastructure can build user trust and support sustainable market growth.

Market expansion strategies should consider regional integration opportunities and cross-border service development. Creating interoperable payment systems that facilitate regional trade and remittance flows can capture significant market opportunities while supporting economic integration objectives.

Regulatory engagement remains critical for market success, with companies advised to actively participate in policy development discussions and maintain compliance with evolving regulatory requirements. Proactive regulatory engagement can help shape favorable market conditions and ensure sustainable business operations.

The Middle East and Africa mobile payments services market is positioned for continued robust growth and innovation over the forecast period, driven by fundamental market drivers that remain strong and emerging opportunities that create additional growth potential. The market’s future development will be characterized by technological advancement, geographic expansion, and service diversification.

Growth projections indicate that the market will maintain strong momentum, with mobile payment adoption rates expected to reach 75% of the adult population in major urban centers by 2028. This growth will be supported by continued smartphone penetration, improving internet infrastructure, and expanding merchant acceptance networks across the region.

Technology evolution will continue to drive market transformation, with artificial intelligence, blockchain, and Internet of Things technologies creating new service possibilities and improving existing capabilities. These technological advances will enable more sophisticated financial services, enhanced security, and improved user experiences that support continued market expansion.

Regional integration initiatives are expected to accelerate, with increasing focus on cross-border payment interoperability and regional trade facilitation. According to MWR analysis, cross-border mobile payment volumes are projected to grow at 25% annually as regional economic integration deepens and trade relationships strengthen.

Service diversification will expand beyond basic payment services to include comprehensive financial ecosystems encompassing lending, savings, insurance, and investment products. This evolution will create more sustainable business models and stronger customer relationships while addressing diverse financial needs across different market segments.

Market maturation in leading countries will drive innovation and best practice development that can be replicated across other markets in the region. This knowledge transfer will accelerate market development in emerging markets and contribute to overall regional growth in mobile payment services adoption.

The Middle East and Africa mobile payments services market represents one of the most dynamic and promising sectors in the global fintech landscape, characterized by exceptional growth potential, innovative service development, and significant socioeconomic impact. The market’s evolution from basic mobile money services to comprehensive digital financial ecosystems demonstrates the region’s capacity for technological leapfrogging and innovation leadership.

Market fundamentals remain exceptionally strong, with supportive demographic trends, improving technological infrastructure, progressive regulatory frameworks, and substantial unbanked populations creating favorable conditions for continued growth. The region’s success in mobile financial services has established global benchmarks and demonstrated the transformative potential of mobile payments for economic development and financial inclusion.

Strategic opportunities across multiple dimensions, including cross-border payments, SME digitization, government service integration, and value-added financial services, provide substantial potential for market expansion and innovation. These opportunities, combined with emerging technologies and evolving consumer preferences, create a compelling investment and development environment for industry participants.

The market’s future trajectory points toward continued robust growth, technological advancement, and regional integration that will further strengthen the Middle East and Africa’s position as a global leader in mobile payment innovation. Success in this market will require strategic focus on user experience, security, partnership development, and regulatory compliance while maintaining the innovation and agility that have characterized the sector’s remarkable development to date.

What is Mobile Payments Services?

Mobile Payments Services refer to financial transactions conducted through mobile devices, allowing users to make payments, transfer money, and manage their finances using applications or mobile wallets. This service is increasingly popular in various sectors, including retail, e-commerce, and banking.

What are the key players in the Middle East and Africa Mobile Payments Services Market?

Key players in the Middle East and Africa Mobile Payments Services Market include companies like PayPal, Flutterwave, and M-Pesa, which provide innovative payment solutions and mobile wallet services. These companies are driving the growth of mobile payments in the region through technology and partnerships, among others.

What are the main drivers of the Middle East and Africa Mobile Payments Services Market?

The main drivers of the Middle East and Africa Mobile Payments Services Market include the increasing smartphone penetration, the growing demand for cashless transactions, and the rise of e-commerce. Additionally, government initiatives to promote digital payments are also contributing to market growth.

What challenges does the Middle East and Africa Mobile Payments Services Market face?

The Middle East and Africa Mobile Payments Services Market faces challenges such as regulatory hurdles, security concerns regarding fraud, and the need for consumer education on mobile payment technologies. These factors can hinder the adoption of mobile payment solutions in certain areas.

What opportunities exist in the Middle East and Africa Mobile Payments Services Market?

Opportunities in the Middle East and Africa Mobile Payments Services Market include the expansion of fintech startups, the integration of blockchain technology, and the potential for partnerships with traditional banks. These developments can enhance service offerings and improve customer experiences.

What trends are shaping the Middle East and Africa Mobile Payments Services Market?

Trends shaping the Middle East and Africa Mobile Payments Services Market include the rise of contactless payments, the adoption of QR code payments, and the increasing use of artificial intelligence for fraud detection. These trends are transforming how consumers and businesses engage in financial transactions.

Middle East and Africa Mobile Payments Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile Wallets, Contactless Payments, Peer-to-Peer Transfers, Bill Payments |

| End User | Retailers, Financial Institutions, Telecom Operators, E-commerce Platforms |

| Technology | NFC, QR Code, SMS, Blockchain |

| Customer Type | Consumers, Small Businesses, Corporates, Government Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Mobile Payments Services Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at