444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa IP camera market represents one of the fastest-growing surveillance technology segments in the region, driven by increasing security concerns, smart city initiatives, and digital transformation across various industries. IP cameras, also known as network cameras or internet protocol cameras, have revolutionized the surveillance landscape by offering superior image quality, remote accessibility, and advanced analytics capabilities compared to traditional analog systems.

Regional dynamics indicate that the Middle East and Africa are experiencing unprecedented growth in surveillance infrastructure deployment, with countries like the UAE, Saudi Arabia, South Africa, and Nigeria leading adoption rates. The market is characterized by a compound annual growth rate (CAGR) of approximately 12.5%, reflecting the region’s commitment to enhancing security infrastructure and embracing digital surveillance technologies.

Government initiatives across the region have significantly contributed to market expansion, with substantial investments in smart city projects, border security enhancement, and critical infrastructure protection. The integration of artificial intelligence, machine learning, and cloud-based storage solutions has further accelerated the adoption of IP camera systems across commercial, residential, and industrial sectors.

The Middle East and Africa IP camera market refers to the comprehensive ecosystem of internet protocol-based surveillance cameras, supporting infrastructure, software solutions, and related services deployed across the MEA region. IP cameras are digital video cameras that transmit data over computer networks and the internet, enabling remote monitoring, high-definition recording, and advanced video analytics capabilities for security and surveillance applications.

These systems encompass various camera types including dome cameras, bullet cameras, PTZ (pan-tilt-zoom) cameras, and specialized variants designed for specific environmental conditions prevalent in the Middle East and Africa. The market includes both hardware components such as cameras, storage devices, and networking equipment, as well as software solutions for video management, analytics, and cloud-based services.

Market participants range from multinational technology corporations to regional system integrators, distributors, and end-users across sectors including government, retail, transportation, healthcare, education, and residential applications. The ecosystem also encompasses supporting services such as installation, maintenance, monitoring, and consulting services tailored to regional requirements.

The Middle East and Africa IP camera market demonstrates robust growth momentum, driven by escalating security concerns, technological advancements, and substantial government investments in surveillance infrastructure. Key market drivers include the region’s focus on smart city development, increasing urbanization rates, and the need for enhanced border security and critical infrastructure protection.

Market segmentation reveals diverse applications across government and defense sectors, which currently account for approximately 35% of total market adoption, followed by commercial and retail applications. The residential segment is experiencing rapid growth, particularly in affluent areas of the Gulf Cooperation Council (GCC) countries and urban centers across Africa.

Technological evolution toward high-definition cameras, artificial intelligence integration, and cloud-based solutions has transformed the competitive landscape. Leading market participants are focusing on developing region-specific solutions that address unique challenges such as extreme weather conditions, power infrastructure limitations, and diverse regulatory requirements across different countries.

Future prospects indicate continued expansion driven by digital transformation initiatives, increasing awareness of security benefits, and declining technology costs. The market is expected to witness significant growth in analytics-enabled cameras, wireless solutions, and integrated security platforms that combine video surveillance with access control and alarm systems.

Strategic market analysis reveals several critical insights that define the current and future trajectory of the Middle East and Africa IP camera market:

Security concerns represent the primary driver for IP camera market growth across the Middle East and Africa, with rising crime rates, terrorism threats, and geopolitical tensions necessitating enhanced surveillance capabilities. Government initiatives to modernize security infrastructure and implement comprehensive surveillance networks have created substantial market opportunities for IP camera manufacturers and system integrators.

Smart city development projects across major urban centers have emerged as significant growth catalysts, with cities like Dubai, Riyadh, Cairo, and Johannesburg investing heavily in intelligent surveillance systems. These initiatives integrate IP cameras with traffic management, emergency response, and urban planning systems, creating demand for sophisticated camera networks with advanced analytics capabilities.

Economic diversification efforts in oil-dependent economies have led to increased investments in tourism, retail, and commercial infrastructure, all requiring comprehensive security solutions. The growth of shopping malls, hotels, airports, and business districts has created substantial demand for high-quality IP camera systems with features such as facial recognition, crowd analytics, and behavioral monitoring.

Technological advancements have made IP cameras more accessible and cost-effective, with improved image quality, reduced power consumption, and enhanced connectivity options. The integration of artificial intelligence and machine learning capabilities has transformed IP cameras from passive recording devices into intelligent security tools capable of real-time threat detection and automated response systems.

High initial investment costs continue to pose significant challenges for market expansion, particularly in price-sensitive segments and developing economies across Africa. The total cost of ownership, including cameras, storage infrastructure, networking equipment, and professional installation services, can be prohibitive for small businesses and residential users seeking comprehensive surveillance solutions.

Infrastructure limitations in certain regions, particularly regarding reliable internet connectivity and stable power supply, constrain the deployment of advanced IP camera systems. Bandwidth constraints and inconsistent network performance can affect the quality and reliability of video transmission, limiting the effectiveness of surveillance systems and deterring potential adopters.

Technical complexity associated with IP camera system design, installation, and maintenance requires specialized expertise that may be limited in certain markets. The shortage of qualified technicians and system integrators capable of deploying and maintaining sophisticated surveillance networks presents ongoing challenges for market growth and customer satisfaction.

Privacy concerns and regulatory uncertainties across different countries create compliance challenges for organizations implementing comprehensive surveillance systems. Varying data protection laws, privacy regulations, and government policies regarding surveillance technology deployment can complicate market entry strategies and limit adoption in certain sectors and regions.

Artificial intelligence integration presents substantial opportunities for market expansion, with AI-enabled cameras offering advanced features such as facial recognition, license plate recognition, and behavioral analytics. The growing demand for intelligent surveillance solutions that can automatically detect and respond to security threats creates opportunities for technology providers to develop specialized applications for regional markets.

Smart building integration represents a significant growth opportunity, particularly in commercial and residential developments across the Gulf states and major African cities. The integration of IP cameras with building management systems, access control, and IoT devices creates comprehensive security ecosystems that appeal to property developers and facility managers seeking integrated solutions.

Vertical market specialization offers opportunities for companies to develop industry-specific solutions tailored to sectors such as oil and gas, mining, agriculture, and transportation. Specialized cameras designed for harsh environmental conditions, explosion-proof enclosures, and industry-specific analytics can command premium pricing and create competitive advantages.

Service-based business models including video surveillance as a service (VSaaS) and managed security services present opportunities for recurring revenue generation. These models reduce upfront costs for customers while providing ongoing revenue streams for service providers, making advanced surveillance technology accessible to a broader range of organizations and applications.

Competitive dynamics in the Middle East and Africa IP camera market are characterized by intense competition between global technology leaders and regional specialists. International manufacturers leverage advanced technology capabilities and global scale advantages, while regional players compete on local market knowledge, customized solutions, and competitive pricing strategies.

Technology evolution continues to reshape market dynamics, with the transition from standard definition to high-definition and ultra-high-definition cameras driving replacement cycles and new installations. The integration of edge computing capabilities directly into cameras reduces bandwidth requirements and enables real-time processing, creating new value propositions for end users.

Channel partnerships play crucial roles in market dynamics, with manufacturers relying on local distributors, system integrators, and value-added resellers to reach diverse customer segments. The development of strong channel networks with technical expertise and local market presence is essential for successful market penetration and customer support.

Regulatory influences significantly impact market dynamics, with government policies regarding surveillance technology, data privacy, and cybersecurity affecting adoption patterns and competitive positioning. Companies must navigate complex regulatory environments while ensuring compliance with local laws and international standards for surveillance equipment and data handling.

Comprehensive market research for the Middle East and Africa IP camera market employs multiple methodological approaches to ensure accurate and reliable insights. Primary research involves extensive interviews with industry executives, technology providers, system integrators, and end-users across different countries and market segments to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to validate primary findings and provide comprehensive market context. MarkWide Research utilizes proprietary databases and analytical frameworks to process and interpret market data from multiple sources, ensuring comprehensive coverage of market dynamics.

Quantitative analysis includes statistical modeling, trend analysis, and forecasting methodologies to project market growth patterns and identify emerging opportunities. Data validation processes involve cross-referencing information from multiple sources and conducting consistency checks to ensure accuracy and reliability of market estimates and projections.

Regional analysis methodology incorporates country-specific factors such as economic conditions, regulatory environments, infrastructure development, and cultural considerations that influence IP camera adoption patterns. This approach ensures that market insights reflect the diverse conditions and requirements across different Middle Eastern and African markets.

The Gulf Cooperation Council (GCC) countries represent the most mature and technologically advanced segment of the Middle East and Africa IP camera market, accounting for approximately 45% of regional market share. United Arab Emirates leads in smart city initiatives and high-end surveillance technology adoption, with Dubai and Abu Dhabi implementing comprehensive city-wide surveillance networks integrated with traffic management and emergency response systems.

Saudi Arabia demonstrates significant growth potential driven by Vision 2030 initiatives and massive infrastructure development projects including NEOM and other mega-cities. The kingdom’s focus on economic diversification and tourism development has created substantial demand for advanced surveillance solutions across commercial, hospitality, and entertainment sectors.

North African markets, particularly Egypt and Morocco, show strong growth in government and commercial applications, with increasing investments in border security and urban surveillance systems. These markets demonstrate preference for cost-effective solutions while gradually adopting more advanced features as economic conditions improve and technology costs decline.

Sub-Saharan Africa presents diverse market conditions, with South Africa leading in technology adoption and market maturity, while Nigeria, Kenya, and Ghana show rapid growth in commercial and residential applications. The region’s focus on addressing security challenges and supporting economic development creates opportunities for scalable and affordable IP camera solutions tailored to local requirements and infrastructure conditions.

The competitive landscape of the Middle East and Africa IP camera market features a diverse mix of global technology leaders, regional specialists, and emerging local players. Market leadership is distributed among several key categories of participants, each bringing distinct competitive advantages and market positioning strategies.

Regional players and system integrators play crucial roles in market dynamics by providing localized support, customized solutions, and competitive pricing for specific market segments. These companies often partner with global manufacturers to offer comprehensive solutions while maintaining strong relationships with local customers and understanding regional requirements.

Technology-based segmentation reveals distinct market preferences and adoption patterns across the Middle East and Africa IP camera market:

By Technology:

By Resolution:

By Application:

Government and public safety applications continue to dominate the Middle East and Africa IP camera market, representing approximately 38% of total installations. This segment benefits from substantial government investments in national security infrastructure, smart city initiatives, and public safety enhancement programs across the region.

Commercial and retail segments demonstrate strong growth momentum, driven by expanding retail infrastructure, shopping mall developments, and increasing awareness of loss prevention benefits. Advanced analytics capabilities including people counting, heat mapping, and customer behavior analysis are becoming standard requirements for retail surveillance systems.

Residential applications show the highest growth rates, particularly in affluent neighborhoods and gated communities across the Gulf states and major African cities. The segment benefits from declining camera costs, improved ease of installation, and growing awareness of home security benefits among middle and upper-income households.

Industrial and critical infrastructure applications require specialized cameras designed for harsh environmental conditions, explosion-proof enclosures, and integration with industrial control systems. This segment commands premium pricing due to specialized requirements and stringent safety standards, creating opportunities for companies with appropriate technical capabilities and certifications.

Technology providers benefit from expanding market opportunities driven by increasing security awareness, government investments, and digital transformation initiatives across the region. The growing demand for advanced features such as artificial intelligence, cloud integration, and mobile accessibility creates opportunities for premium pricing and differentiated product positioning.

System integrators and installers experience growing demand for professional services including system design, installation, maintenance, and monitoring services. The complexity of modern IP camera systems and integration requirements with other security technologies create ongoing revenue opportunities and strengthen customer relationships through comprehensive service offerings.

End-users across all segments benefit from improved security capabilities, reduced crime rates, enhanced operational efficiency, and better risk management. Advanced analytics features provide additional value through business intelligence, operational insights, and automated monitoring capabilities that extend beyond traditional security applications.

Government agencies and public sector organizations achieve enhanced public safety, improved emergency response capabilities, and better resource allocation through comprehensive surveillance networks. The integration of IP cameras with smart city platforms enables data-driven decision making and improved urban management across multiple domains including traffic, public safety, and infrastructure monitoring.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the Middle East and Africa IP camera market, with AI-enabled cameras becoming standard rather than premium offerings. Advanced analytics capabilities including facial recognition, license plate recognition, and behavioral analysis are increasingly demanded across government, commercial, and residential applications.

Cloud-based solutions are gaining significant traction, particularly among small and medium enterprises seeking to reduce upfront infrastructure investments while accessing advanced video management capabilities. Hybrid cloud deployments combining on-premises storage with cloud-based analytics and remote access are becoming popular for organizations with specific data sovereignty requirements.

Mobile integration trends reflect changing user expectations for remote monitoring capabilities, with smartphone and tablet applications becoming essential features for modern surveillance systems. The demand for real-time alerts, remote camera control, and mobile video viewing drives development of user-friendly mobile interfaces and optimized streaming protocols.

Edge computing adoption is accelerating as organizations seek to reduce bandwidth requirements and improve system responsiveness. Cameras with built-in processing capabilities can perform analytics locally, reducing network traffic and enabling real-time decision making without dependence on centralized processing infrastructure.

Strategic partnerships between global technology providers and regional system integrators have intensified, with companies seeking to combine international expertise with local market knowledge and customer relationships. These collaborations enable faster market penetration and more effective customer support across diverse regional markets.

Product innovation continues at a rapid pace, with manufacturers introducing cameras specifically designed for Middle Eastern and African environmental conditions. Enhanced durability features including improved dust resistance, extended temperature ranges, and corrosion-resistant materials address regional climate challenges and extend equipment lifespan.

Cybersecurity enhancements have become critical focus areas following increased awareness of network security vulnerabilities. Manufacturers are implementing advanced encryption, secure boot processes, and regular security updates to address growing concerns about surveillance system security and data protection.

Regulatory compliance initiatives are driving development of region-specific features and capabilities to meet local privacy laws, data protection requirements, and government surveillance standards. Companies are investing in compliance frameworks and certification processes to ensure market access across different countries with varying regulatory requirements.

Market participants should prioritize development of cost-effective solutions tailored to price-sensitive segments while maintaining advanced feature sets that differentiate products from commodity offerings. MarkWide Research analysis indicates that companies successfully balancing affordability with technological sophistication achieve the strongest market positioning across diverse regional markets.

Investment in local partnerships and distribution networks remains crucial for sustained market success, with companies requiring deep understanding of regional requirements, cultural considerations, and regulatory environments. Building strong relationships with local system integrators and service providers enables more effective market penetration and customer support capabilities.

Technology roadmap alignment with emerging trends such as artificial intelligence, edge computing, and cloud integration will determine long-term competitive positioning. Companies should invest in research and development capabilities that address specific regional challenges while incorporating global technology trends and standards.

Service-oriented business models present significant opportunities for revenue diversification and customer relationship strengthening. Developing comprehensive service offerings including monitoring, maintenance, and managed security services can create competitive advantages and recurring revenue streams while addressing customer concerns about system complexity and ongoing support requirements.

The Middle East and Africa IP camera market is positioned for continued robust growth over the next decade, driven by sustained security concerns, ongoing digital transformation initiatives, and expanding smart city projects across the region. Market evolution will be characterized by increasing sophistication of surveillance systems and growing integration with broader security and urban management platforms.

Technology advancement will continue to drive market expansion, with artificial intelligence, machine learning, and advanced analytics becoming standard features across all market segments. The integration of IP cameras with IoT devices, smart building systems, and city-wide platforms will create new value propositions and market opportunities for innovative companies.

Regional market dynamics indicate that the Gulf states will maintain leadership in high-end technology adoption, while African markets will experience the strongest growth rates as economic development and infrastructure investments accelerate. The convergence of declining technology costs and improving economic conditions across the region will expand market accessibility to new customer segments.

Emerging applications including retail analytics, traffic management, and industrial automation will drive demand for specialized camera solutions with advanced capabilities. MWR projections suggest that these new applications could account for approximately 25% of market growth over the next five years, creating opportunities for companies with appropriate technical capabilities and market positioning strategies.

The Middle East and Africa IP camera market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing security awareness, government investments, and technological advancement. The market’s trajectory reflects broader regional trends toward digitization, smart city development, and enhanced security infrastructure across diverse applications and customer segments.

Success in this market requires careful balance of technological sophistication with cost-effectiveness, deep understanding of regional requirements and regulatory environments, and strong local partnerships for effective market penetration and customer support. Companies that can navigate the complex regional dynamics while delivering innovative solutions tailored to specific market needs are positioned for sustained growth and market leadership.

Future market development will be shaped by continued technology evolution, expanding applications beyond traditional security, and growing integration with smart city and IoT platforms. The convergence of improving economic conditions, declining technology costs, and increasing security awareness creates favorable conditions for sustained market expansion across the Middle East and Africa region, making this one of the most promising surveillance technology markets globally.

What is IP Camera?

IP Camera refers to a digital video camera that transmits data over a network, allowing for remote monitoring and recording. These cameras are widely used in security systems, surveillance, and various applications across different industries.

What are the key players in the Middle East And Africa IP Camera Market?

Key players in the Middle East And Africa IP Camera Market include Hikvision, Dahua Technology, and Axis Communications, among others. These companies are known for their innovative products and extensive distribution networks in the region.

What are the main drivers of growth in the Middle East And Africa IP Camera Market?

The main drivers of growth in the Middle East And Africa IP Camera Market include increasing security concerns, the rise in smart city initiatives, and advancements in technology such as AI and IoT integration. These factors are leading to higher demand for surveillance solutions.

What challenges does the Middle East And Africa IP Camera Market face?

The Middle East And Africa IP Camera Market faces challenges such as high installation costs, concerns over data privacy, and varying regulatory standards across countries. These factors can hinder market growth and adoption rates.

What opportunities exist in the Middle East And Africa IP Camera Market?

Opportunities in the Middle East And Africa IP Camera Market include the growing demand for smart home solutions, increased investment in infrastructure, and the potential for cloud-based surveillance services. These trends are expected to drive innovation and market expansion.

What trends are shaping the Middle East And Africa IP Camera Market?

Trends shaping the Middle East And Africa IP Camera Market include the adoption of advanced analytics, the integration of AI for enhanced security features, and the shift towards wireless camera systems. These innovations are transforming how surveillance is conducted.

Middle East And Africa IP Camera Market

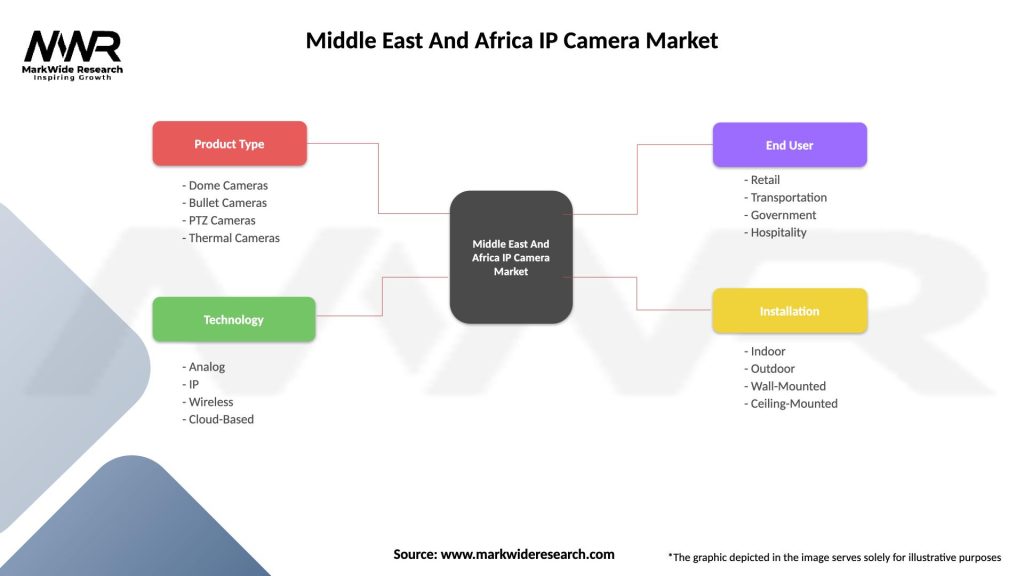

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras |

| Technology | Analog, IP, Wireless, Cloud-Based |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Wall-Mounted, Ceiling-Mounted |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa IP Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at