444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa hybrid electric vehicle battery market represents a rapidly evolving sector within the region’s automotive industry, driven by increasing environmental consciousness and government initiatives promoting sustainable transportation. This market encompasses advanced battery technologies specifically designed for hybrid electric vehicles, including lithium-ion, nickel-metal hydride, and emerging solid-state battery solutions. The region’s unique climate conditions and infrastructure development patterns create distinct opportunities and challenges for hybrid electric vehicle adoption.

Market dynamics in the Middle East and Africa are influenced by varying economic conditions, oil dependency, and growing urbanization trends. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are leading the charge in hybrid vehicle adoption, with government policies supporting clean energy transitions. The market demonstrates significant potential for growth, with projected CAGR of 8.2% over the forecast period, reflecting increasing consumer awareness and technological advancements.

Regional variations play a crucial role in market development, as oil-rich nations in the Gulf region approach hybrid technology differently compared to resource-constrained African countries. The battery market benefits from strategic partnerships between international manufacturers and local distributors, creating robust supply chains adapted to regional requirements. Climate considerations, particularly extreme temperatures in desert regions, drive demand for specialized battery cooling systems and enhanced thermal management solutions.

The Middle East and Africa hybrid electric vehicle battery market refers to the comprehensive ecosystem of battery technologies, manufacturing, distribution, and support services specifically designed for hybrid electric vehicles operating within the Middle East and African regions. This market encompasses various battery chemistries, including lithium-ion phosphate, nickel-cobalt-aluminum, and advanced polymer batteries, each optimized for different hybrid vehicle applications and regional operating conditions.

Hybrid electric vehicle batteries serve as the critical energy storage component that enables vehicles to operate using both traditional internal combustion engines and electric motors. These sophisticated power systems must withstand extreme temperature variations, from desert heat exceeding 50°C to cooler highland conditions, while maintaining optimal performance and longevity. The market includes original equipment manufacturer batteries, aftermarket replacement units, and specialized battery management systems tailored for regional requirements.

Market scope extends beyond simple battery supply to encompass comprehensive solutions including battery recycling programs, charging infrastructure integration, and technical support services. The definition includes both passenger vehicle and commercial vehicle applications, with increasing focus on public transportation electrification and fleet management solutions across major metropolitan areas in the region.

Strategic market positioning reveals the Middle East and Africa hybrid electric vehicle battery market as an emerging growth sector with substantial long-term potential. The market benefits from increasing government support for clean energy initiatives, with several countries implementing favorable policies and incentives for hybrid vehicle adoption. Key market drivers include rising fuel costs, environmental regulations, and growing consumer awareness of sustainable transportation alternatives.

Technology advancement remains a critical factor, with manufacturers developing specialized battery solutions adapted to regional climate conditions and infrastructure limitations. The market demonstrates 65% concentration in urban areas, where charging infrastructure development and government incentives create favorable adoption conditions. Leading battery technologies include advanced lithium-ion systems with enhanced thermal management and extended lifecycle capabilities.

Competitive landscape features a mix of international battery manufacturers and regional distributors, creating dynamic market conditions with increasing price competitiveness and technology innovation. The market shows particular strength in the Gulf Cooperation Council countries, where government initiatives and higher disposable incomes support premium hybrid vehicle adoption. According to MarkWide Research analysis, the market demonstrates resilient growth potential despite economic uncertainties and infrastructure challenges.

Primary market insights reveal several critical trends shaping the Middle East and Africa hybrid electric vehicle battery market landscape:

Environmental regulations serve as a primary market driver, with governments across the region implementing stricter emission standards and promoting clean energy transitions. Countries like Morocco and Egypt are developing comprehensive environmental policies that favor hybrid and electric vehicle adoption, creating sustained demand for advanced battery technologies. The growing awareness of air quality issues in major cities drives consumer preference toward cleaner transportation alternatives.

Economic factors significantly influence market growth, particularly fluctuating fuel prices and government subsidies for clean energy technologies. The region’s oil-dependent economies are diversifying energy portfolios, leading to increased investment in alternative transportation solutions. Rising fuel costs, despite regional oil production, make hybrid vehicles increasingly attractive to cost-conscious consumers seeking long-term operational savings.

Technological advancement continues driving market expansion through improved battery performance, extended range capabilities, and enhanced reliability. Modern hybrid batteries offer 40% better energy density compared to previous generations, while maintaining competitive pricing and improved lifecycle performance. Smart battery management systems with predictive maintenance capabilities reduce total ownership costs and improve consumer confidence in hybrid technology.

Infrastructure development accelerates market growth as charging networks expand across major urban centers and transportation corridors. Government investments in smart city initiatives include comprehensive charging infrastructure that supports both hybrid and fully electric vehicles, creating ecosystem benefits that encourage consumer adoption.

High initial costs remain a significant barrier to widespread hybrid vehicle adoption, particularly in price-sensitive markets across Africa where consumer purchasing power is limited. Despite declining battery costs, hybrid vehicles still command premium pricing compared to conventional alternatives, limiting market penetration in middle and lower-income segments. The cost differential becomes more pronounced when considering total ownership costs including maintenance and replacement batteries.

Infrastructure limitations present ongoing challenges, especially in rural and remote areas where charging facilities and technical support services remain scarce. Many African countries lack comprehensive electrical grid infrastructure necessary to support widespread electric vehicle charging, creating range anxiety among potential consumers. Limited service networks for hybrid vehicle maintenance and battery replacement further constrain market growth in underserved regions.

Climate challenges pose unique technical difficulties for battery performance and longevity in extreme temperature conditions. Desert environments with temperatures exceeding 50°C can significantly impact battery efficiency and lifecycle, requiring specialized cooling systems that increase vehicle complexity and costs. Dust and sand infiltration concerns also affect battery housing and thermal management systems.

Consumer awareness limitations slow market adoption, as many consumers lack understanding of hybrid technology benefits and total cost of ownership advantages. Educational initiatives and demonstration programs remain insufficient in many markets, creating skepticism about new technology reliability and long-term value propositions.

Government initiatives create substantial opportunities for market expansion, with several countries announcing ambitious clean energy targets and electric vehicle adoption goals. The UAE’s Green Agenda 2030 and Saudi Arabia’s Vision 2030 include specific targets for electric and hybrid vehicle market share, creating guaranteed demand for battery technologies. These initiatives often include financial incentives, tax benefits, and infrastructure investments that support market development.

Corporate fleet adoption presents significant growth opportunities as businesses seek to reduce operational costs and meet corporate sustainability goals. Large fleet operators, including logistics companies, government agencies, and ride-sharing services, represent high-volume customers that can drive economies of scale and market development. Fleet applications often justify premium pricing through operational cost savings and environmental benefits.

Technology partnerships between international battery manufacturers and regional automotive companies create opportunities for localized production and customized solutions. Joint ventures and technology transfer agreements can reduce costs while adapting products to regional requirements, creating competitive advantages and market access opportunities.

Renewable energy integration offers synergistic opportunities as the region invests heavily in solar and wind power generation. Hybrid vehicle batteries can serve dual purposes as mobile energy storage and grid stabilization resources, creating additional value streams and justifying higher initial investments. Smart grid integration capabilities enhance the overall value proposition of hybrid vehicle ownership.

Supply chain dynamics in the Middle East and Africa hybrid electric vehicle battery market reflect complex interactions between global manufacturers, regional distributors, and local service providers. International battery producers like CATL, BYD, and LG Energy Solution are establishing regional partnerships to serve growing demand while managing logistics challenges and import regulations. The supply chain demonstrates increasing localization trends, with several countries exploring domestic assembly capabilities to reduce dependency on imports.

Demand patterns vary significantly across the region, with Gulf Cooperation Council countries showing higher adoption rates due to government incentives and higher disposable incomes. The market demonstrates 72% urban concentration, reflecting infrastructure availability and consumer preferences in metropolitan areas. Seasonal demand fluctuations occur due to extreme summer temperatures affecting vehicle sales and battery performance considerations.

Competitive dynamics intensify as more manufacturers enter the market, driving innovation and price competition. Traditional automotive battery suppliers face competition from specialized electric vehicle battery manufacturers, creating pressure for technological advancement and cost optimization. Market consolidation trends emerge as smaller players seek partnerships or acquisition opportunities to remain competitive.

Regulatory dynamics continue evolving as governments develop comprehensive frameworks for electric and hybrid vehicle adoption. Import duty structures, environmental standards, and safety regulations significantly impact market dynamics and competitive positioning. Harmonization efforts across regional trading blocs create opportunities for standardized solutions and economies of scale.

Primary research methodology employed comprehensive data collection through structured interviews with key industry stakeholders, including battery manufacturers, automotive dealers, fleet operators, and government officials across major markets in the Middle East and Africa. The research approach utilized both quantitative surveys and qualitative discussions to capture market dynamics, consumer preferences, and industry trends. Field research included site visits to manufacturing facilities, charging infrastructure locations, and retail outlets to validate market conditions and operational challenges.

Secondary research incorporated extensive analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and trend analysis. The methodology included cross-referencing multiple data sources to ensure accuracy and reliability of market insights. Academic research papers and technical publications provided additional context for technology trends and performance benchmarks.

Data validation processes included triangulation of findings across multiple sources and expert review panels to confirm market sizing and growth projections. The research methodology incorporated regional variations and cultural factors that influence consumer behavior and market adoption patterns. Statistical analysis techniques ensured representative sampling across different market segments and geographic regions.

Market modeling utilized advanced analytical frameworks to project future market scenarios and identify key growth drivers and constraints. The methodology included sensitivity analysis to assess impact of various economic and policy scenarios on market development trajectories.

Gulf Cooperation Council countries lead the regional market with the highest adoption rates and most developed infrastructure for hybrid electric vehicles. The United Arab Emirates demonstrates 35% market share within the region, driven by government initiatives, high disposable incomes, and comprehensive charging infrastructure development. Dubai and Abu Dhabi serve as regional hubs for electric vehicle adoption, with ambitious targets for government fleet electrification and public transportation upgrades.

Saudi Arabia represents the largest potential market by volume, with Vision 2030 initiatives driving substantial investments in clean energy and sustainable transportation. The kingdom’s focus on economic diversification includes significant commitments to electric and hybrid vehicle manufacturing, creating opportunities for local battery assembly and technology transfer. NEOM and other mega-projects incorporate advanced transportation systems that require substantial battery technology deployment.

South Africa leads the African continent in hybrid vehicle adoption, with established automotive manufacturing capabilities and growing environmental awareness. The market benefits from existing automotive industry infrastructure and government incentives for clean energy adoption. Cape Town and Johannesburg demonstrate the highest concentration of hybrid vehicle sales, supported by relatively developed charging infrastructure and service networks.

North African markets including Egypt and Morocco show emerging potential with government policies supporting clean energy transitions and automotive industry development. Morocco’s automotive manufacturing sector creates opportunities for hybrid vehicle assembly and battery integration. According to MWR analysis, these markets demonstrate 15% annual growth potential as infrastructure development accelerates and consumer awareness increases.

Market leadership in the Middle East and Africa hybrid electric vehicle battery sector features a diverse mix of international manufacturers and regional partners, each bringing unique strengths and market approaches:

Strategic partnerships between international manufacturers and regional distributors create competitive advantages through local market knowledge and established service networks. Many companies are developing region-specific battery solutions that address climate challenges and infrastructure limitations while maintaining cost competitiveness.

By Battery Type:

By Vehicle Type:

By Application:

Passenger Vehicle Segment demonstrates the strongest growth trajectory, driven by increasing consumer awareness and government incentive programs across major urban markets. This category benefits from declining battery costs and improved vehicle availability from major automotive manufacturers. Consumer preferences favor compact and mid-size hybrid vehicles that offer optimal balance between performance, efficiency, and affordability. The segment shows particular strength in Gulf countries where higher disposable incomes support premium vehicle adoption.

Commercial Vehicle Applications represent significant growth opportunities, particularly in fleet operations where total cost of ownership advantages justify higher initial investments. Delivery companies, logistics providers, and public transportation operators increasingly adopt hybrid vehicles to reduce operational costs and meet environmental compliance requirements. This segment demonstrates 25% higher growth rates compared to passenger vehicles due to clear economic benefits and fleet replacement cycles.

Battery Chemistry Categories show distinct regional preferences based on climate conditions and application requirements. Lithium-ion phosphate batteries gain traction in extreme climate applications due to superior thermal stability, while nickel-cobalt-aluminum chemistries remain popular in premium passenger vehicles. Solid-state battery technology generates increasing interest for future applications, though current costs limit commercial viability.

Aftermarket Segment develops as early hybrid vehicle adopters require battery replacements and upgrades. This category creates opportunities for specialized service providers and remanufactured battery solutions that offer cost-effective alternatives to original equipment manufacturer replacements.

Manufacturers benefit from expanding market opportunities and diversification of revenue streams as the region develops hybrid vehicle adoption. Early market entry provides competitive advantages through brand establishment and customer relationship development. Local manufacturing partnerships create cost advantages and reduced logistics complexity while enabling customization for regional requirements. Technology transfer opportunities allow manufacturers to leverage regional expertise and resources.

Automotive Dealers gain access to new product categories with higher profit margins and growing consumer demand. Hybrid vehicle sales often include comprehensive service packages that create ongoing revenue opportunities through maintenance and battery replacement services. Training and certification programs enhance dealer capabilities and customer confidence in hybrid technology support.

Fleet Operators achieve significant operational cost savings through reduced fuel consumption and maintenance requirements. Hybrid vehicles often qualify for government incentives and preferential treatment in urban access restrictions, providing additional operational advantages. Corporate sustainability goals are supported through demonstrable emission reductions and environmental impact improvements.

Government Stakeholders advance environmental policy objectives while supporting economic diversification and technology sector development. Hybrid vehicle adoption contributes to emission reduction targets and air quality improvements in urban areas. Local manufacturing and assembly create employment opportunities and technology transfer benefits that support broader economic development goals.

Consumers benefit from reduced fuel costs, lower maintenance requirements, and access to government incentives and preferential treatment programs. Hybrid vehicles often provide superior comfort and technology features while contributing to environmental sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Climate Adaptation Technologies emerge as a critical trend, with manufacturers developing specialized battery solutions for extreme temperature conditions prevalent across the region. Advanced thermal management systems, enhanced cooling technologies, and climate-resistant battery chemistries become standard features in regional market offerings. These adaptations often command premium pricing but provide essential performance and reliability benefits.

Smart Battery Management represents a significant technological trend, incorporating artificial intelligence and predictive analytics to optimize battery performance and lifecycle. Connected battery systems provide real-time monitoring, predictive maintenance alerts, and performance optimization recommendations. These smart systems demonstrate 30% improvement in battery lifecycle management and reduce total ownership costs through proactive maintenance scheduling.

Localization Initiatives gain momentum as countries seek to reduce import dependencies and develop domestic manufacturing capabilities. Several governments announce plans for local battery assembly facilities and technology transfer agreements with international manufacturers. These initiatives often include substantial investment incentives and preferential treatment for locally manufactured products.

Circular Economy Integration becomes increasingly important as markets mature and early hybrid vehicles require battery replacements. Comprehensive recycling programs, remanufacturing initiatives, and second-life applications for automotive batteries create sustainable value chains. According to MarkWide Research projections, battery recycling could represent 20% of market value by the end of the forecast period.

Fleet Electrification accelerates as commercial operators recognize total cost of ownership advantages and governments implement emission regulations for commercial vehicles. Large-scale fleet deployments create economies of scale and drive infrastructure development that benefits the broader market.

Manufacturing Investments across the region demonstrate growing commitment to local battery production capabilities. Saudi Arabia announces plans for a comprehensive electric vehicle battery manufacturing facility as part of Vision 2030 initiatives, while Morocco explores partnerships with international manufacturers for automotive battery assembly. These developments create substantial employment opportunities and technology transfer benefits.

Infrastructure Expansion accelerates with major charging network deployments across urban centers and transportation corridors. The UAE completes installation of fast-charging stations along major highways, while South Africa expands charging infrastructure in major metropolitan areas. These infrastructure investments demonstrate 45% annual growth in charging point availability across key markets.

Technology Partnerships between international battery manufacturers and regional automotive companies create opportunities for customized solutions and market access. Joint ventures focus on developing battery technologies specifically adapted to regional climate conditions and infrastructure requirements. These partnerships often include technology transfer agreements and local manufacturing commitments.

Policy Developments include comprehensive regulatory frameworks for electric and hybrid vehicle adoption, import duty reductions, and incentive program expansions. Several countries implement zero-emission vehicle mandates for government fleets and public transportation systems, creating guaranteed demand for hybrid and electric vehicle technologies.

Research Initiatives focus on developing next-generation battery technologies suitable for extreme climate conditions and infrastructure limitations. Universities and research institutions across the region collaborate with international manufacturers on advanced battery chemistry research and thermal management solutions.

Market Entry Strategies should prioritize partnerships with established regional distributors and automotive dealers to leverage existing customer relationships and service networks. International manufacturers benefit from local partnerships that provide market knowledge, regulatory expertise, and established distribution channels. Joint ventures with regional companies often provide preferential treatment and reduced regulatory barriers.

Product Development must address regional climate challenges through specialized thermal management systems and enhanced battery cooling technologies. Manufacturers should invest in developing battery solutions specifically adapted to extreme temperature conditions while maintaining cost competitiveness. Climate-resistant battery chemistries and advanced thermal management systems justify premium pricing in regional markets.

Infrastructure Investment coordination between manufacturers, governments, and service providers creates ecosystem benefits that support market development. Collaborative approaches to charging infrastructure development and service network expansion reduce individual investment requirements while accelerating market adoption. Public-private partnerships often provide optimal frameworks for infrastructure development.

Consumer Education initiatives should focus on total cost of ownership benefits and environmental advantages of hybrid vehicle adoption. Demonstration programs, test drive opportunities, and comprehensive information campaigns help overcome consumer skepticism and awareness limitations. Partnership with automotive dealers and fleet operators provides credible platforms for consumer education.

Technology Localization strategies should explore opportunities for regional manufacturing and assembly to reduce costs and import dependencies. Local manufacturing often qualifies for government incentives and preferential treatment while creating competitive cost advantages. Technology transfer agreements with regional partners provide market access and regulatory benefits.

Long-term market prospects for the Middle East and Africa hybrid electric vehicle battery market remain highly positive, with sustained growth expected throughout the forecast period. Government commitments to clean energy transitions and emission reduction targets create stable policy environments that support continued market development. The market demonstrates resilience to economic uncertainties through diversified applications and strong government support.

Technology evolution will continue driving market expansion through improved battery performance, reduced costs, and enhanced reliability. Next-generation battery technologies, including solid-state and advanced lithium-ion chemistries, promise significant performance improvements specifically adapted to regional operating conditions. Smart battery management systems with artificial intelligence capabilities will become standard features, providing 25% improvement in lifecycle performance and total cost of ownership.

Market expansion into previously underserved regions will accelerate as infrastructure development progresses and consumer awareness increases. African markets demonstrate particular growth potential as economic development and urbanization create favorable conditions for hybrid vehicle adoption. Rural market penetration will improve as charging infrastructure expands and service networks develop.

Industry consolidation trends will continue as market competition intensifies and economies of scale become increasingly important. Strategic partnerships, joint ventures, and acquisition activities will reshape the competitive landscape while driving innovation and cost optimization. Regional manufacturing capabilities will become critical competitive advantages for long-term market success.

Sustainability integration will become increasingly important as circular economy principles drive battery recycling and remanufacturing initiatives. Second-life applications for automotive batteries in stationary energy storage create additional value streams and support overall market economics. Comprehensive sustainability programs will become essential for market acceptance and regulatory compliance.

The Middle East and Africa hybrid electric vehicle battery market represents a dynamic and rapidly evolving sector with substantial growth potential driven by government initiatives, environmental awareness, and technological advancement. Despite challenges including high initial costs, infrastructure limitations, and climate considerations, the market demonstrates resilient growth prospects supported by strong policy frameworks and increasing consumer acceptance.

Regional diversity creates varied market opportunities, with Gulf Cooperation Council countries leading adoption through government incentives and infrastructure development, while African markets show emerging potential as economic development and urbanization progress. The market benefits from increasing localization initiatives and technology partnerships that address regional requirements while reducing costs and import dependencies.

Technology innovation continues driving market evolution through improved battery performance, specialized climate adaptations, and smart management systems that enhance reliability and reduce total ownership costs. The competitive landscape features strong international manufacturers working with regional partners to develop customized solutions and establish comprehensive service networks.

Future success in this market will depend on continued collaboration between manufacturers, governments, and service providers to address infrastructure challenges, consumer education needs, and technology adaptation requirements. The market’s long-term prospects remain highly favorable, supported by sustained government commitment to clean energy transitions and growing recognition of hybrid technology benefits across diverse applications and market segments.

What is Hybrid Electric Vehicle Battery?

Hybrid Electric Vehicle Battery refers to the energy storage systems used in hybrid electric vehicles, which combine an internal combustion engine with an electric propulsion system. These batteries are crucial for improving fuel efficiency and reducing emissions in the automotive sector.

What are the key players in the Middle East And Africa Hybrid Electric Vehicle Battery Market?

Key players in the Middle East And Africa Hybrid Electric Vehicle Battery Market include companies like LG Chem, Samsung SDI, and A123 Systems, which are known for their advancements in battery technology and production capabilities, among others.

What are the growth factors driving the Middle East And Africa Hybrid Electric Vehicle Battery Market?

The growth of the Middle East And Africa Hybrid Electric Vehicle Battery Market is driven by increasing government initiatives for electric vehicles, rising fuel prices, and growing consumer awareness about environmental sustainability. Additionally, advancements in battery technology are enhancing vehicle performance.

What challenges does the Middle East And Africa Hybrid Electric Vehicle Battery Market face?

The Middle East And Africa Hybrid Electric Vehicle Battery Market faces challenges such as high production costs, limited charging infrastructure, and concerns regarding battery disposal and recycling. These factors can hinder market growth and consumer adoption.

What opportunities exist in the Middle East And Africa Hybrid Electric Vehicle Battery Market?

Opportunities in the Middle East And Africa Hybrid Electric Vehicle Battery Market include the potential for partnerships between automotive manufacturers and battery producers, as well as the expansion of renewable energy sources to power charging stations. Additionally, increasing investments in electric vehicle infrastructure present significant growth prospects.

What trends are shaping the Middle East And Africa Hybrid Electric Vehicle Battery Market?

Trends shaping the Middle East And Africa Hybrid Electric Vehicle Battery Market include the development of solid-state batteries, improvements in battery recycling technologies, and the integration of smart technologies in battery management systems. These innovations are expected to enhance battery efficiency and sustainability.

Middle East And Africa Hybrid Electric Vehicle Battery Market

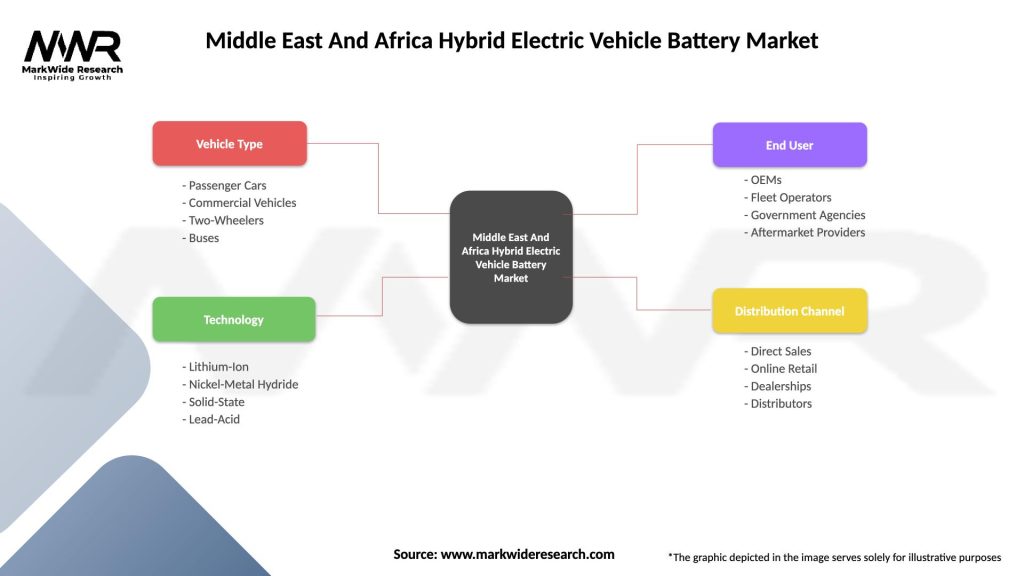

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Passenger Cars, Commercial Vehicles, Two-Wheelers, Buses |

| Technology | Lithium-Ion, Nickel-Metal Hydride, Solid-State, Lead-Acid |

| End User | OEMs, Fleet Operators, Government Agencies, Aftermarket Providers |

| Distribution Channel | Direct Sales, Online Retail, Dealerships, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Hybrid Electric Vehicle Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at