444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East and Africa gas generator market has witnessed significant growth in recent years. Gas generators are widely used in various industries and sectors to provide a reliable and continuous power supply. These generators operate on natural gas, which is an abundant and cost-effective fuel source in the region. The Middle East and Africa are home to several gas-rich countries, making it an ideal market for gas generators.

Meaning

A gas generator is a type of power generation equipment that runs on natural gas or liquefied petroleum gas (LPG). It consists of an internal combustion engine, an alternator, and a control system. Gas generators are known for their efficiency, low emissions, and cost-effectiveness. They are commonly used in residential, commercial, industrial, and utility applications to provide backup power or as a primary source of electricity.

Executive Summary

The Middle East and Africa gas generator market is expected to experience steady growth in the coming years. Factors such as increasing power demand, rapid industrialization, and the need for reliable power backup solutions are driving the market. Additionally, the abundant availability of natural gas resources in the region further boosts the adoption of gas generators. However, the market faces challenges due to the volatile nature of gas prices and the dependency on gas infrastructure.

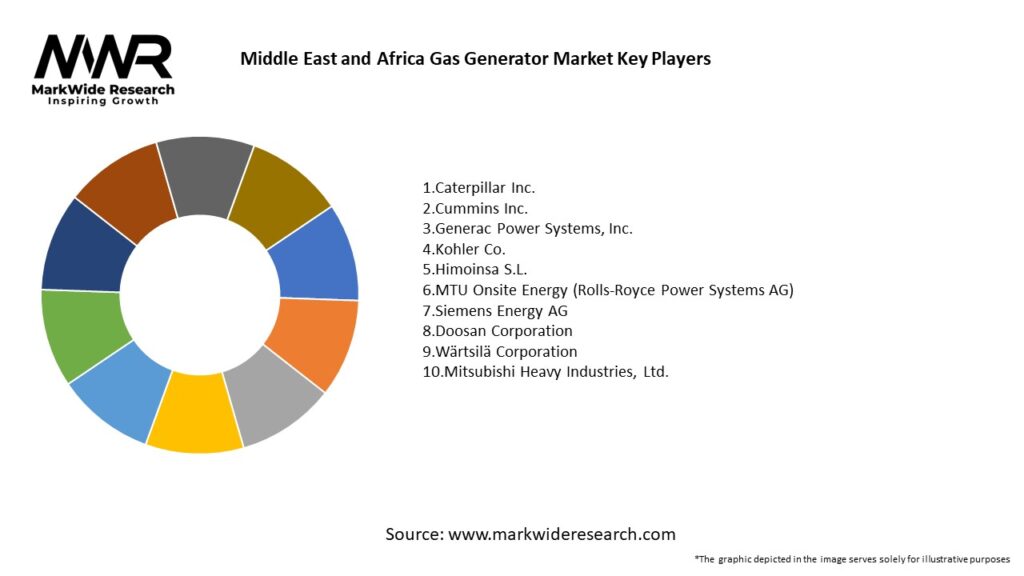

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Middle East and Africa gas generator market is driven by a combination of factors, including increasing power demand, favorable government policies, and the abundance of natural gas resources. However, the market faces challenges due to volatile gas prices, dependency on gas infrastructure, and competition from alternative power generation technologies. Despite these challenges, there are opportunities for the market to grow by leveraging hybrid power solutions, catering to remote and off-grid applications, and participating in infrastructure development projects.

Regional Analysis

The Middle East and Africa gas generator market can be segmented into different regions, each with its own unique characteristics and opportunities. Let’s explore some of the key regions in the market:

Competitive Landscape

Leading Companies in Middle East and Africa Gas Generator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Middle East and Africa gas generator market can be segmented based on various factors, including generator capacity, end-use industry, and region. Let’s explore these segments in more detail:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides an overview of the Middle East and Africa gas generator market’s internal and external factors. Let’s analyze the market using the SWOT framework:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Middle East and Africa gas generator market. The initial phase of the pandemic resulted in disruptions to supply chains, project delays, and a decline in industrial and commercial activities. However, the need for reliable power supply remained critical, particularly for healthcare facilities and essential services.

The pandemic also highlighted the importance of backup power solutions in various sectors. Hospitals, quarantine centers, and testing laboratories relied on gas generators to ensure uninterrupted power supply for critical equipment and medical devices. Similarly, the increased demand for remote work and online activities emphasized the need for backup power in residential and commercial settings.

The post-pandemic recovery phase is expected to drive the market growth as countries focus on infrastructure development, industrial revitalization, and economic rebound. The Middle East and Africa governments’ initiatives to diversify their economies and reduce dependency on oil are likely to fuel investments in the gas generator market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Middle East and Africa gas generator market is positive, with several factors contributing to its growth. The region’s abundant natural gas resources, increasing power demand, and infrastructure development projects create a favorable market environment. The market is expected to witness technological advancements, including the integration of gas generators with renewables and the adoption of digitalization and remote monitoring solutions.

The shift towards cleaner and more sustainable energy sources will drive the demand for gas generators, particularly in industries where reliability and low emissions are crucial. Hybrid power solutions combining gas generators with renewable energy sources will gain traction, providing a balanced and environmentally friendly power generation system.

Government support through favorable policies, incentives, and investments in gas infrastructure will further propel the market. As countries in the region diversify their economies and focus on sustainable development, gas generators will play a vital role in ensuring reliable and efficient power supply.

Conclusion

The Middle East and Africa gas generator market is poised for steady growth in the coming years. Gas generators offer a reliable, cost-effective, and environmentally friendly power generation solution. The region’s abundant natural gas resources, increasing power demand, and infrastructure development projects provide favorable market conditions.

Although challenges such as volatile gas prices, dependency on gas infrastructure, and competition from alternative technologies exist, the market presents opportunities for hybrid power solutions, remote and off-grid applications, and participation in infrastructure projects.

What is Gas Generator?

Gas generators are devices that convert gas fuel into electrical energy, commonly used in various applications such as backup power, remote power supply, and industrial operations.

What are the key players in the Middle East and Africa Gas Generator Market?

Key players in the Middle East and Africa Gas Generator Market include Caterpillar Inc., Cummins Inc., and Generac Holdings, among others.

What are the main drivers of growth in the Middle East and Africa Gas Generator Market?

The growth of the Middle East and Africa Gas Generator Market is driven by increasing demand for reliable power supply, expansion of infrastructure projects, and the rising need for backup power solutions in various sectors.

What challenges does the Middle East and Africa Gas Generator Market face?

Challenges in the Middle East and Africa Gas Generator Market include fluctuating fuel prices, regulatory compliance issues, and competition from renewable energy sources.

What opportunities exist in the Middle East and Africa Gas Generator Market?

Opportunities in the Middle East and Africa Gas Generator Market include advancements in generator technology, increasing investments in energy infrastructure, and the growing trend towards hybrid power systems.

What trends are shaping the Middle East and Africa Gas Generator Market?

Trends in the Middle East and Africa Gas Generator Market include the adoption of cleaner fuel technologies, integration of IoT for monitoring and management, and a shift towards more efficient and compact generator designs.

Middle East and Africa Gas Generator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Diesel Generators, Gas Generators, Hybrid Generators, Portable Generators |

| End User | Industrial, Commercial, Residential, Construction |

| Power Rating | Below 100 kW, 100-500 kW, 500-1000 kW, Above 1000 kW |

| Installation | Onshore, Offshore, Standby, Prime Power |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Middle East and Africa Gas Generator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at