444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa gaming headsets market represents one of the fastest-growing segments in the regional gaming peripherals industry. This dynamic market encompasses a diverse range of audio devices specifically designed for gaming applications, including wired and wireless headsets, gaming earbuds, and premium audiophile-grade gaming audio solutions. The region’s gaming ecosystem has experienced remarkable transformation, driven by increasing digital connectivity, rising disposable incomes, and a growing population of tech-savvy consumers.

Market dynamics in the Middle East and Africa reflect a unique blend of traditional gaming preferences and emerging technological trends. The market has witnessed substantial growth, with gaming headset adoption rates reaching 42% among active gamers across major metropolitan areas. Countries such as the United Arab Emirates, Saudi Arabia, South Africa, and Egypt have emerged as key growth drivers, contributing significantly to regional market expansion.

Consumer behavior patterns indicate a strong preference for high-quality audio experiences, with gamers increasingly investing in premium gaming headsets that offer superior sound quality, comfort, and advanced features. The market encompasses various price segments, from budget-friendly options to high-end professional gaming headsets, catering to diverse consumer needs and preferences across different economic segments.

The Middle East and Africa gaming headsets market refers to the comprehensive ecosystem of specialized audio devices designed specifically for gaming applications within the MEA region. This market encompasses all forms of gaming-oriented headphones, headsets, and audio peripherals that enhance the gaming experience through superior sound quality, communication capabilities, and ergonomic design features.

Gaming headsets in this context include wired and wireless devices featuring integrated microphones, noise cancellation technology, surround sound capabilities, and gaming-specific audio enhancements. The market covers products ranging from entry-level gaming headphones to professional esports-grade audio solutions, serving casual gamers, enthusiasts, and competitive players across various gaming platforms including PC, console, and mobile gaming.

Regional characteristics define this market through unique consumer preferences, cultural considerations, and economic factors specific to Middle Eastern and African countries. The market includes both international brand penetration and emerging local manufacturers, creating a diverse competitive landscape that serves the region’s growing gaming community.

Strategic market analysis reveals that the Middle East and Africa gaming headsets market is experiencing unprecedented growth momentum, driven by digital transformation initiatives and increasing gaming adoption across all age demographics. The market demonstrates strong resilience and adaptability, with manufacturers successfully navigating regional preferences and economic variations to establish sustainable growth trajectories.

Key performance indicators highlight significant market expansion, with wireless gaming headsets accounting for 58% of total market share as consumers increasingly prioritize mobility and convenience. The premium segment has shown remarkable growth, with high-end gaming headsets experiencing 35% year-over-year growth in key markets such as the UAE and Saudi Arabia.

Competitive landscape dynamics showcase a healthy mix of established international brands and emerging regional players, creating diverse product offerings that cater to various consumer segments. Market leaders have successfully implemented localization strategies, adapting their products and marketing approaches to resonate with regional gaming communities and cultural preferences.

Future market projections indicate sustained growth potential, supported by increasing internet penetration, expanding gaming infrastructure, and rising consumer spending on gaming peripherals. The market is expected to benefit from ongoing digital entertainment investments and the growing popularity of esports across the region.

Consumer preference analysis reveals several critical insights that shape the Middle East and Africa gaming headsets market landscape:

Digital infrastructure expansion serves as a primary catalyst for gaming headset market growth across the Middle East and Africa. Governments and private sector investments in high-speed internet connectivity, 5G networks, and digital entertainment infrastructure have created favorable conditions for gaming market expansion. These developments enable seamless online gaming experiences that require high-quality audio equipment.

Youth demographic trends significantly influence market dynamics, with a large percentage of the regional population falling within the gaming-active age groups. The tech-savvy younger generation demonstrates strong preferences for premium gaming experiences, driving demand for advanced gaming headsets with cutting-edge features and superior audio quality.

Esports ecosystem development has emerged as a powerful market driver, with regional tournaments, gaming leagues, and professional gaming organizations creating awareness and demand for professional-grade gaming equipment. The growing recognition of esports as a legitimate sport and career path has elevated the importance of high-quality gaming peripherals.

Economic diversification initiatives across Gulf countries and emerging African economies have increased disposable income levels and consumer spending on entertainment and technology products. This economic growth has expanded the addressable market for premium gaming headsets and created opportunities for market segmentation across different price points.

Social gaming culture and community-driven gaming experiences have amplified the importance of communication-enabled gaming headsets. The rise of multiplayer online games and social gaming platforms has made integrated microphones and clear audio communication essential features for gaming headsets.

Economic volatility in certain regional markets creates challenges for consistent market growth, as fluctuating oil prices and currency variations impact consumer purchasing power. These economic uncertainties can lead to delayed purchase decisions and increased price sensitivity among potential customers.

Import dependency and associated costs present significant challenges for market accessibility, as most gaming headsets are manufactured outside the region. Import duties, shipping costs, and currency exchange fluctuations can substantially increase product prices, limiting market penetration in price-sensitive segments.

Infrastructure limitations in certain areas, particularly in rural and developing regions, restrict market expansion opportunities. Limited internet connectivity, unreliable power supply, and inadequate retail distribution networks can hinder product availability and consumer adoption.

Cultural and regulatory considerations in some markets may impact product design requirements and marketing strategies. Compliance with local regulations, cultural sensitivities, and content restrictions can increase operational complexity and costs for international manufacturers.

Competition from alternative products such as traditional headphones, speakers, and mobile device audio solutions can limit dedicated gaming headset adoption. Some consumers may opt for multipurpose audio devices rather than specialized gaming equipment, particularly in price-conscious market segments.

Mobile gaming expansion presents substantial opportunities for gaming headset manufacturers, as mobile gaming continues to gain popularity across the region. The development of mobile-optimized gaming headsets with enhanced portability and smartphone compatibility can capture this growing market segment effectively.

Local manufacturing initiatives offer opportunities for cost reduction and market localization. Establishing regional manufacturing facilities or partnerships can reduce import costs, improve supply chain efficiency, and enable customization for local preferences and requirements.

Educational sector integration provides new market avenues as educational institutions increasingly adopt gaming-based learning and virtual reality applications. Gaming headsets designed for educational use can tap into this emerging market segment with specialized features and institutional pricing models.

Corporate and enterprise applications represent untapped potential, as businesses adopt gamification strategies and virtual collaboration tools. Professional-grade gaming headsets can serve corporate training, virtual meetings, and team-building applications in the growing remote work environment.

Subscription and service models offer innovative revenue opportunities through headset-as-a-service offerings, maintenance programs, and upgrade services. These models can improve customer retention and create recurring revenue streams while making premium products more accessible to price-sensitive consumers.

Supply chain dynamics in the Middle East and Africa gaming headsets market reflect a complex interplay of global manufacturing, regional distribution, and local retail networks. The market relies heavily on international supply chains, with most products manufactured in Asia and distributed through regional importers and retailers. This structure creates both opportunities and challenges in terms of cost management and market responsiveness.

Technological advancement cycles drive continuous market evolution, with manufacturers regularly introducing new features such as advanced noise cancellation, spatial audio, and wireless connectivity improvements. The rapid pace of innovation requires market participants to maintain competitive positioning through continuous product development and feature enhancement.

Consumer education initiatives play a crucial role in market development, as many potential customers require guidance on gaming headset features, benefits, and selection criteria. Manufacturers and retailers invest significantly in educational content, demonstrations, and community engagement to build market awareness and drive adoption.

Seasonal demand patterns influence market dynamics, with peak sales periods typically occurring during gaming events, holiday seasons, and back-to-school periods. Understanding and preparing for these cyclical patterns enables better inventory management and marketing strategy optimization.

Partnership ecosystems between headset manufacturers, gaming platform providers, and content creators create synergistic market opportunities. These collaborations often result in co-branded products, exclusive features, and integrated marketing campaigns that enhance market reach and consumer engagement.

Comprehensive market analysis for the Middle East and Africa gaming headsets market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data collection through surveys, sales analysis, and market measurement techniques, alongside qualitative insights gathered through interviews, focus groups, and expert consultations.

Primary research activities include extensive consumer surveys across major metropolitan areas in key countries, retailer interviews, and manufacturer consultations. These activities provide direct insights into consumer preferences, purchasing behaviors, market trends, and competitive dynamics from multiple stakeholder perspectives.

Secondary research sources encompass industry reports, government statistics, trade association data, and company financial disclosures. This information provides context for market sizing, trend analysis, and competitive landscape assessment, ensuring comprehensive market understanding.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis, and expert review procedures. The methodology includes regional market segmentation analysis, demographic profiling, and economic factor correlation to provide nuanced market insights.

Analytical frameworks applied include market sizing models, growth projection algorithms, and competitive positioning analysis. These tools enable accurate market assessment and reliable forecasting for strategic decision-making purposes.

Gulf Cooperation Council countries represent the most mature and lucrative segment of the Middle East and Africa gaming headsets market. The UAE and Saudi Arabia lead regional adoption, with 68% of GCC gaming headset sales concentrated in these two markets. High disposable incomes, advanced digital infrastructure, and strong gaming culture contribute to premium product adoption and market growth.

North African markets, particularly Egypt and Morocco, demonstrate significant growth potential driven by large youth populations and increasing internet penetration. These markets show preference for mid-range products with 47% of sales occurring in the moderate price segment, reflecting economic considerations while maintaining quality expectations.

Sub-Saharan Africa presents emerging opportunities, with South Africa leading regional adoption and Nigeria showing rapid growth potential. The market in this region is characterized by price sensitivity and mobile gaming preferences, with 39% of consumers prioritizing mobile-compatible gaming headsets.

Levant region countries including Jordan and Lebanon maintain steady market presence despite economic challenges. These markets demonstrate resilience and adaptability, with consumers showing strong brand loyalty and preference for durable, long-lasting gaming headset solutions.

Regional market distribution indicates that urban centers account for 73% of total market activity, while rural and semi-urban areas represent significant untapped potential for future expansion as infrastructure development continues across the region.

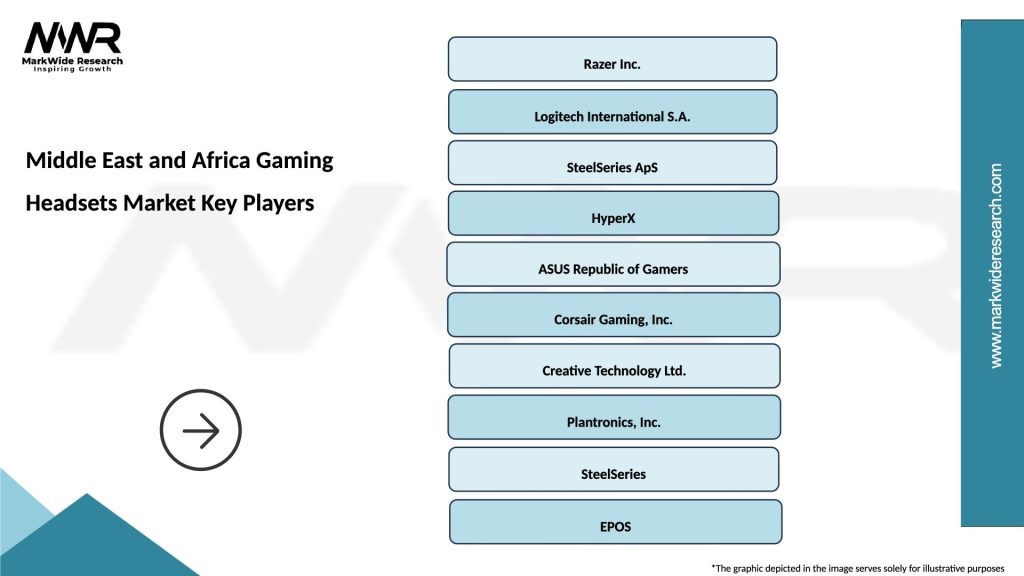

Market leadership dynamics in the Middle East and Africa gaming headsets market feature a diverse mix of international brands and emerging regional players. The competitive environment is characterized by innovation-driven differentiation, strategic pricing, and localized marketing approaches.

Leading market participants include:

Competitive strategies focus on technological innovation, regional partnerships, and customer experience enhancement. Companies invest heavily in research and development to introduce advanced features while maintaining competitive pricing structures that appeal to diverse regional market segments.

Market positioning approaches vary from premium performance-focused brands to value-oriented offerings, creating comprehensive market coverage across different consumer segments and price points.

By Technology:

By Platform Compatibility:

By Price Range:

By Application:

Wireless gaming headsets dominate the premium market segment, offering advanced features such as low-latency connectivity, extended battery life, and seamless multi-device pairing. This category has experienced remarkable growth, with consumers increasingly valuing the freedom and convenience of wireless operation for extended gaming sessions.

Console-specific headsets maintain strong market presence, particularly in regions with high console gaming adoption. These products offer optimized integration with gaming platforms, exclusive features, and enhanced user experiences that justify premium pricing and drive brand loyalty among console gamers.

Mobile gaming headsets represent the fastest-growing category, driven by the explosive popularity of mobile gaming across the region. These products emphasize portability, smartphone compatibility, and versatile functionality that appeals to on-the-go gaming preferences.

Professional esports headsets cater to the growing competitive gaming community, offering tournament-grade performance, professional endorsements, and specialized features required for competitive play. This category commands premium pricing and demonstrates strong growth potential as esports popularity continues expanding.

Multi-platform compatibility has become increasingly important, with consumers preferring headsets that work seamlessly across PC, console, and mobile gaming platforms. This trend drives product development toward universal compatibility and adaptive functionality.

Manufacturers benefit from the expanding Middle East and Africa gaming headsets market through increased revenue opportunities, market diversification, and brand expansion possibilities. The region’s growing gaming community provides a substantial customer base for innovative products and premium offerings.

Retailers and distributors gain access to high-margin product categories with strong consumer demand and repeat purchase potential. Gaming headsets offer attractive profit margins and opportunities for value-added services such as extended warranties and customization options.

Consumers receive enhanced gaming experiences through improved audio quality, communication capabilities, and comfort features. The competitive market environment ensures continuous innovation and competitive pricing, providing excellent value propositions across different price segments.

Gaming ecosystem stakeholders including game developers, streaming platforms, and esports organizations benefit from improved user engagement and enhanced gaming experiences that gaming headsets enable. Better audio quality and communication capabilities contribute to more immersive and social gaming experiences.

Economic stakeholders in the region benefit from job creation, technology transfer, and economic diversification opportunities as the gaming industry continues expanding. The market contributes to digital economy growth and technological advancement across participating countries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless technology adoption continues accelerating across the Middle East and Africa gaming headsets market, with consumers increasingly preferring the freedom and convenience of wireless connectivity. Advanced wireless protocols and improved battery technology have addressed traditional concerns about latency and battery life, driving widespread adoption.

Mobile gaming integration has emerged as a dominant trend, with manufacturers developing headsets specifically optimized for smartphone and tablet gaming. This trend reflects the region’s strong mobile gaming culture and the need for portable, versatile gaming audio solutions.

Customization and personalization trends are gaining momentum, with consumers seeking headsets that reflect their individual style and preferences. RGB lighting, customizable audio profiles, and modular design elements have become important differentiating factors in purchasing decisions.

Sustainability and eco-consciousness are increasingly influencing consumer choices, with manufacturers responding through sustainable materials, recyclable packaging, and environmentally responsible manufacturing processes. This trend aligns with growing environmental awareness across the region.

Professional gaming influence continues shaping market preferences, with esports athletes and content creators driving demand for high-performance gaming headsets. Professional endorsements and tournament usage significantly impact consumer brand preferences and product selection.

Strategic partnerships between gaming headset manufacturers and regional distributors have expanded market reach and improved product availability across the Middle East and Africa. These partnerships often include localized marketing support, technical service capabilities, and customized product offerings for regional preferences.

Technology innovations in spatial audio, active noise cancellation, and wireless connectivity have revolutionized gaming headset capabilities. MarkWide Research indicates that these technological advances have contributed to 31% improvement in consumer satisfaction ratings across premium product categories.

Retail channel expansion has improved product accessibility through online marketplaces, gaming specialty stores, and electronics retailers. The growth of e-commerce platforms has particularly benefited market expansion in previously underserved areas.

Esports ecosystem development has created new market opportunities through tournament sponsorships, professional team partnerships, and gaming event collaborations. These developments have elevated brand visibility and credibility within the gaming community.

Educational sector adoption has opened new market segments as schools and universities integrate gaming technology into learning environments. This trend has created demand for specialized educational gaming headsets with enhanced durability and classroom-appropriate features.

Market entry strategies should prioritize regional partnerships and localized approaches to effectively penetrate the Middle East and Africa gaming headsets market. Companies should focus on understanding cultural preferences, economic conditions, and gaming habits specific to each target market within the region.

Product development priorities should emphasize mobile gaming compatibility, wireless connectivity, and multi-platform functionality to align with regional gaming preferences. Manufacturers should also consider climate-specific design elements such as enhanced ventilation and moisture resistance for regional conditions.

Pricing strategies must account for diverse economic conditions across the region, with portfolio approaches offering products across multiple price segments. Value-oriented positioning in emerging markets combined with premium offerings in developed markets can maximize market penetration and revenue potential.

Distribution channel optimization should leverage both traditional retail networks and emerging e-commerce platforms to ensure comprehensive market coverage. Investment in local technical support and customer service capabilities will enhance brand reputation and customer satisfaction.

Marketing approaches should emphasize community engagement, influencer partnerships, and esports sponsorships to build brand awareness and credibility within regional gaming communities. Cultural sensitivity and local language support are essential for effective market communication.

Long-term growth prospects for the Middle East and Africa gaming headsets market remain highly positive, supported by continued digital infrastructure development, growing gaming populations, and increasing consumer spending on entertainment technology. MWR analysis projects sustained market expansion with compound annual growth rates exceeding 12% across key regional markets.

Technology evolution will continue driving market innovation, with emerging technologies such as spatial audio, haptic feedback, and AI-powered audio enhancement creating new product categories and consumer experiences. These technological advances will likely command premium pricing and drive market value growth.

Market maturation is expected to bring increased competition, product standardization, and consumer sophistication. This evolution will likely benefit consumers through improved product quality, competitive pricing, and enhanced feature sets across all market segments.

Regional market development will likely see continued growth in established markets while emerging markets gain significance through infrastructure improvements and economic development. The market is expected to become more geographically distributed as gaming adoption spreads beyond major metropolitan areas.

Industry consolidation may occur as the market matures, with successful companies expanding their regional presence through acquisitions, partnerships, or organic growth strategies. This consolidation could lead to improved distribution efficiency and enhanced customer service capabilities.

The Middle East and Africa gaming headsets market represents a dynamic and rapidly evolving sector within the broader gaming peripherals industry. Characterized by strong growth momentum, diverse consumer preferences, and significant untapped potential, this market offers substantial opportunities for manufacturers, retailers, and industry stakeholders willing to invest in regional market development and localization strategies.

Market fundamentals remain robust, supported by favorable demographic trends, improving economic conditions, and continued digital infrastructure development across the region. The combination of growing gaming populations, increasing disposable incomes, and evolving consumer preferences creates a sustainable foundation for long-term market expansion and value creation.

Strategic success factors in this market include understanding regional diversity, adapting to local preferences, and building strong distribution partnerships. Companies that can effectively navigate the complex regional landscape while delivering innovative, high-quality products at competitive price points are positioned to capture significant market share and establish lasting competitive advantages in this promising market segment.

What is Gaming Headsets?

Gaming headsets are specialized audio devices designed for immersive gaming experiences, featuring high-quality sound, noise cancellation, and often a built-in microphone for communication. They are used by gamers to enhance gameplay and communication during multiplayer sessions.

What are the key players in the Middle East and Africa Gaming Headsets Market?

Key players in the Middle East and Africa Gaming Headsets Market include companies like Razer, Logitech, SteelSeries, and HyperX, which are known for their innovative gaming audio solutions and accessories, among others.

What are the growth factors driving the Middle East and Africa Gaming Headsets Market?

The growth of the Middle East and Africa Gaming Headsets Market is driven by the increasing popularity of esports, the rise in online gaming communities, and advancements in audio technology that enhance user experience. Additionally, the growing youth population and rising disposable incomes contribute to market expansion.

What challenges does the Middle East and Africa Gaming Headsets Market face?

The Middle East and Africa Gaming Headsets Market faces challenges such as high competition among brands, fluctuating consumer preferences, and the impact of economic instability in certain regions. These factors can affect sales and brand loyalty.

What opportunities exist in the Middle East and Africa Gaming Headsets Market?

Opportunities in the Middle East and Africa Gaming Headsets Market include the potential for growth in mobile gaming, the introduction of wireless technology, and the increasing demand for high-fidelity audio experiences. Additionally, partnerships with gaming platforms can enhance market reach.

What trends are shaping the Middle East and Africa Gaming Headsets Market?

Trends shaping the Middle East and Africa Gaming Headsets Market include the rise of customizable headsets, the integration of virtual reality (VR) audio solutions, and the growing emphasis on ergonomic designs for prolonged use. These trends reflect the evolving needs of gamers.

Middle East and Africa Gaming Headsets Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wired, Wireless, Over-Ear, In-Ear |

| Technology | Bluetooth, USB-C, Noise Cancellation, Surround Sound |

| End User | Casual Gamers, Professional Gamers, Streamers, Esports Teams |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Gaming Headsets Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at