444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle-East and Africa electric vehicle battery anode market represents a rapidly evolving segment within the broader electric mobility ecosystem, driven by increasing environmental consciousness and government initiatives promoting sustainable transportation solutions. This specialized market encompasses the production, distribution, and technological advancement of anode materials specifically designed for electric vehicle batteries across the MEA region.

Regional dynamics indicate that the Middle-East and Africa electric vehicle battery anode market is experiencing unprecedented growth momentum, with several countries implementing ambitious electric vehicle adoption targets. The market demonstrates significant potential for expansion, particularly as regional governments introduce supportive policies and infrastructure development programs. Growth projections suggest the market is expanding at a robust 12.5% CAGR, reflecting the increasing demand for advanced battery technologies in electric vehicles.

Key market characteristics include the dominance of graphite-based anode materials, emerging silicon-enhanced technologies, and growing investments in local manufacturing capabilities. The region’s unique geographical position offers strategic advantages for both raw material sourcing and market access to European and Asian markets. Market penetration rates vary significantly across different countries, with the UAE and South Africa leading adoption efforts at approximately 8.2% and 6.7% respectively.

Technological advancement remains a critical factor driving market evolution, with manufacturers increasingly focusing on developing high-performance anode materials that offer improved energy density, faster charging capabilities, and enhanced safety features. The integration of artificial intelligence and advanced manufacturing processes is revolutionizing production efficiency and product quality standards across the region.

The Middle-East and Africa electric vehicle battery anode market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and application of anode materials specifically designed for electric vehicle battery systems within the MEA geographical region. This market represents the negative electrode component of lithium-ion batteries that plays a crucial role in energy storage and release processes.

Anode materials serve as the foundation for electric vehicle battery performance, directly influencing factors such as energy density, charging speed, cycle life, and overall battery efficiency. The market encompasses various anode technologies including traditional graphite-based solutions, advanced silicon-graphite composites, and emerging next-generation materials designed to meet evolving electric vehicle requirements.

Market scope includes raw material procurement, manufacturing processes, quality control systems, supply chain management, and end-user applications across diverse electric vehicle categories. The definition extends to encompass research and development activities, technological innovations, and strategic partnerships that drive market advancement and competitive positioning within the regional landscape.

Market transformation within the Middle-East and Africa electric vehicle battery anode sector reflects a paradigm shift toward sustainable mobility solutions, driven by environmental regulations, technological innovations, and changing consumer preferences. The market demonstrates exceptional growth potential, supported by increasing electric vehicle adoption rates and expanding charging infrastructure development across key regional markets.

Strategic developments indicate that regional governments are implementing comprehensive policies to accelerate electric vehicle adoption, creating favorable conditions for battery anode market expansion. Investment flows into manufacturing facilities, research centers, and technology partnerships are establishing the foundation for long-term market sustainability and competitive advantage.

Technology trends reveal a significant shift toward high-performance anode materials, with silicon-enhanced graphite composites gaining market traction due to their superior energy density characteristics. Adoption rates for advanced anode technologies are increasing at approximately 15.3% annually, reflecting growing demand for improved battery performance and extended vehicle range capabilities.

Competitive landscape features a mix of international technology providers and emerging regional manufacturers, creating dynamic market conditions that foster innovation and cost optimization. Strategic partnerships between global anode material suppliers and local electric vehicle manufacturers are establishing integrated value chains that enhance market efficiency and reduce dependency on external suppliers.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Middle-East and Africa electric vehicle battery anode market. These insights provide valuable guidance for stakeholders seeking to understand market dynamics and identify strategic opportunities for growth and expansion.

Government initiatives represent the primary driving force behind market expansion, with regional governments implementing comprehensive electric vehicle adoption strategies that include financial incentives, infrastructure development programs, and regulatory frameworks supporting sustainable transportation solutions. These policy measures create favorable market conditions that encourage investment and accelerate technology adoption.

Environmental consciousness is increasingly influencing consumer behavior and corporate decision-making processes, driving demand for cleaner transportation alternatives. Growing awareness of climate change impacts and air quality concerns is motivating individuals and organizations to embrace electric vehicle technologies, creating sustained demand for high-performance battery components including advanced anode materials.

Technological advancement in battery chemistry and manufacturing processes is enabling the development of superior anode materials that offer improved performance characteristics. Innovations in silicon-graphite composites, nanostructured materials, and advanced coating technologies are expanding the possibilities for electric vehicle battery performance, driving market growth through enhanced product capabilities.

Infrastructure development across the region is creating an enabling environment for electric vehicle adoption, with expanding charging networks reducing range anxiety and improving user confidence. The correlation between charging infrastructure availability and electric vehicle sales is driving coordinated investments in both sectors, creating positive feedback loops that accelerate market development.

Cost reduction trends in battery manufacturing are making electric vehicles increasingly competitive with traditional internal combustion engine vehicles. Economies of scale, manufacturing process improvements, and supply chain optimization are contributing to cost reductions that expand market accessibility and drive volume growth across diverse consumer segments.

High initial costs associated with advanced anode materials and manufacturing equipment represent significant barriers to market entry and expansion. The capital-intensive nature of battery manufacturing requires substantial upfront investments that may limit participation from smaller companies and delay market development in certain regional markets with limited financial resources.

Technical complexity in anode material development and manufacturing processes creates challenges for companies seeking to establish competitive positions in the market. The specialized knowledge requirements, quality control standards, and safety regulations demand significant expertise and experience that may not be readily available in all regional markets.

Supply chain dependencies on international raw material suppliers create potential vulnerabilities for regional manufacturers. Limited local availability of key materials such as high-purity graphite and silicon compounds may result in supply disruptions, cost volatility, and reduced competitiveness compared to markets with more developed supply chain ecosystems.

Infrastructure limitations in certain regional markets may constrain electric vehicle adoption rates, indirectly impacting demand for battery anode materials. Inadequate charging infrastructure, unreliable electricity supply, and limited maintenance capabilities can slow market development and reduce the attractiveness of electric vehicle investments.

Regulatory uncertainty regarding long-term policy support and standards harmonization may create hesitation among potential investors and market participants. Inconsistent regulations across different countries within the region can complicate market entry strategies and increase compliance costs for companies operating across multiple jurisdictions.

Manufacturing localization presents substantial opportunities for companies seeking to establish competitive advantages through reduced logistics costs, improved supply chain control, and enhanced responsiveness to local market requirements. The development of regional manufacturing capabilities can create jobs, build technical expertise, and reduce dependency on imported materials and components.

Technology partnerships between international anode material developers and regional companies offer opportunities for knowledge transfer, market access, and risk sharing. These collaborative arrangements can accelerate technology adoption, reduce development costs, and create mutually beneficial relationships that strengthen market positions for all participants.

Emerging applications beyond passenger vehicles are creating new market segments with significant growth potential. Commercial vehicles, public transportation systems, and stationary energy storage applications represent expanding opportunities for anode material suppliers seeking to diversify their customer base and reduce market concentration risks.

Sustainability initiatives are driving demand for environmentally responsible manufacturing processes and recyclable materials. Companies that develop sustainable anode technologies and circular economy solutions can differentiate their offerings and capture market share from environmentally conscious customers and regulatory-compliant applications.

Research collaboration opportunities with regional universities, research institutions, and government agencies can provide access to funding, technical expertise, and market intelligence. These partnerships can accelerate innovation, reduce development risks, and create pathways for commercializing advanced technologies in regional markets.

Supply and demand dynamics within the Middle-East and Africa electric vehicle battery anode market are characterized by rapidly evolving conditions that reflect the nascent stage of regional electric vehicle adoption. Demand growth is outpacing supply capacity in several key markets, creating opportunities for new entrants and capacity expansion by existing players.

Competitive intensity is increasing as international companies establish regional operations and local players develop technical capabilities. This competition is driving innovation, cost reduction, and service improvement, ultimately benefiting end-users through better products and more competitive pricing structures.

Technology evolution is reshaping market dynamics by introducing new performance standards and cost structures. The transition from traditional graphite anodes to silicon-enhanced composites is creating market disruption that favors companies with advanced technical capabilities and manufacturing flexibility.

Regulatory influences are becoming increasingly important in shaping market dynamics, with government policies affecting demand patterns, investment decisions, and competitive positioning. Companies that effectively navigate regulatory requirements and align with policy objectives are gaining competitive advantages in market access and customer relationships.

Investment flows into the sector are accelerating, driven by recognition of long-term growth potential and strategic importance of electric vehicle technologies. MarkWide Research analysis indicates that investment activity is increasing at approximately 35% annually, reflecting growing confidence in market prospects and technology advancement opportunities.

Comprehensive research approach employed in analyzing the Middle-East and Africa electric vehicle battery anode market combines primary and secondary research methodologies to ensure accuracy, completeness, and reliability of market insights. The methodology encompasses multiple data collection techniques and analytical frameworks designed to provide holistic market understanding.

Primary research activities include structured interviews with industry executives, technical experts, government officials, and end-users across the regional market. These interviews provide firsthand insights into market conditions, technology trends, competitive dynamics, and future outlook perspectives that inform strategic analysis and forecasting activities.

Secondary research components encompass analysis of industry reports, government publications, academic research, patent databases, and financial disclosures from publicly traded companies. This comprehensive information gathering approach ensures that market analysis incorporates diverse perspectives and validated data sources.

Data validation processes include cross-referencing information from multiple sources, conducting expert reviews, and applying statistical analysis techniques to identify trends and patterns. Quality assurance measures ensure that research findings meet professional standards for accuracy and reliability.

Analytical frameworks applied in the research process include market sizing methodologies, competitive analysis models, technology assessment criteria, and regional comparison techniques. These frameworks provide structured approaches for evaluating market conditions and developing actionable insights for stakeholders.

United Arab Emirates leads the regional market with the most advanced electric vehicle adoption rates and supportive government policies. The country’s strategic location, advanced infrastructure, and commitment to sustainability make it an attractive market for anode material suppliers. Market share within the region reaches approximately 28%, driven by government fleet electrification programs and private sector investments.

South Africa represents the second-largest market opportunity, benefiting from established automotive manufacturing capabilities and growing environmental awareness. The country’s mining industry provides potential advantages in raw material access, while its manufacturing infrastructure offers opportunities for local production development. Regional market contribution stands at approximately 22%.

Saudi Arabia is emerging as a significant market driven by Vision 2030 initiatives and substantial investments in sustainable transportation infrastructure. The kingdom’s focus on economic diversification and environmental sustainability is creating favorable conditions for electric vehicle adoption and related technology development.

Egypt presents growing opportunities supported by government initiatives to reduce air pollution and promote sustainable transportation solutions. The country’s large population and expanding middle class create substantial long-term market potential for electric vehicle technologies and battery components.

Other regional markets including Morocco, Kenya, and Nigeria are showing early signs of electric vehicle interest, driven by urbanization trends, environmental concerns, and government policy initiatives. These markets represent longer-term opportunities as infrastructure development and economic conditions continue to improve.

Market leadership within the Middle-East and Africa electric vehicle battery anode market is characterized by a combination of international technology providers and emerging regional players. The competitive environment reflects the early-stage nature of market development, with opportunities for both established companies and new entrants to gain market share.

Strategic partnerships are becoming increasingly important for market success, with companies forming alliances to combine technical expertise, manufacturing capabilities, and market access. These collaborations enable participants to share risks, reduce development costs, and accelerate market entry timelines.

By Material Type: The market segmentation by material type reveals distinct categories with varying performance characteristics and application suitability. Graphite-based anodes currently dominate market share due to their proven performance and cost-effectiveness, while silicon-enhanced composites are gaining traction for high-performance applications requiring superior energy density.

By Application: Market segmentation by application demonstrates the diverse range of electric vehicle categories driving demand for anode materials. Passenger vehicles represent the largest segment, while commercial applications are showing rapid growth rates.

By Technology: Technological segmentation reflects the evolution of anode materials toward higher performance and specialized applications. Advanced coating technologies and nanostructured materials are creating new market categories with premium pricing potential.

Natural Graphite Category maintains market leadership due to its cost-effectiveness and proven performance in standard electric vehicle applications. This category benefits from established supply chains and manufacturing processes, making it attractive for price-sensitive market segments. Market penetration in this category reaches approximately 62% of total regional demand.

Silicon-Enhanced Composites represent the fastest-growing category, driven by demand for improved energy density and extended vehicle range. These advanced materials command premium pricing but offer significant performance advantages that justify higher costs for premium electric vehicle applications. Growth rates in this category exceed 25% annually.

Synthetic Graphite Solutions serve specialized applications requiring high purity and consistent performance characteristics. This category targets premium electric vehicle manufacturers and applications where performance reliability is critical. Manufacturing complexity and quality requirements create barriers to entry that protect established players.

Lithium Titanate Technologies address specific market niches requiring fast charging capabilities and extended cycle life. While representing a smaller market segment, these materials offer unique advantages for commercial applications and specialized use cases where rapid charging is essential.

Emerging Technologies including solid-state compatible anodes and next-generation composite materials represent future growth opportunities. These technologies are in early development stages but offer potential for significant performance improvements and new application possibilities.

Manufacturers benefit from expanding market opportunities driven by increasing electric vehicle adoption and supportive government policies. The growing demand creates revenue growth potential while technological advancement enables product differentiation and premium pricing strategies for innovative solutions.

Suppliers gain from vertical integration opportunities and long-term partnership arrangements with battery manufacturers and electric vehicle producers. These relationships provide revenue stability, market intelligence, and collaborative development opportunities that enhance competitive positioning.

Investors benefit from exposure to high-growth market segments with strong long-term fundamentals driven by environmental trends and technological innovation. The market offers diversification opportunities across different technology categories and regional markets with varying risk-return profiles.

End Users benefit from improved battery performance, extended vehicle range, and reduced charging times enabled by advanced anode technologies. Cost reductions achieved through manufacturing scale and competition translate into more affordable electric vehicle options for consumers.

Governments benefit from economic development opportunities including job creation, technology transfer, and reduced environmental impact from transportation sector emissions. Local manufacturing development can reduce import dependencies and create export opportunities.

Research Institutions benefit from collaboration opportunities with industry partners, funding for advanced research projects, and pathways for commercializing innovative technologies. These partnerships accelerate knowledge transfer and create practical applications for academic research.

Strengths:

Weaknesses:

Opportunities:

Threats:

Silicon Integration Trend represents the most significant technological development in anode materials, with manufacturers increasingly incorporating silicon components to enhance energy density and battery performance. This trend is driving research investments and manufacturing process innovations across the industry.

Localization Movement is gaining momentum as companies seek to establish regional manufacturing capabilities to reduce costs, improve supply chain control, and enhance market responsiveness. This trend is creating opportunities for local partnerships and technology transfer arrangements.

Sustainability Focus is becoming increasingly important as environmental regulations tighten and consumer awareness grows. Companies are investing in sustainable manufacturing processes, recyclable materials, and circular economy solutions to meet evolving market requirements.

Quality Standardization is driving market consolidation as international quality standards become mandatory for electric vehicle applications. This trend favors established players with proven quality systems while creating barriers for new entrants without adequate quality infrastructure.

Cost Optimization remains a critical trend as manufacturers seek to reduce production costs through process improvements, economies of scale, and supply chain optimization. Cost reduction achievements of approximately 20% over the past two years demonstrate the effectiveness of these efforts.

Application Diversification is expanding beyond traditional automotive applications to include energy storage systems, marine applications, and specialized industrial uses. This diversification reduces market concentration risks and creates new revenue opportunities for anode material suppliers.

Manufacturing Investments are accelerating across the region as companies establish production facilities to serve growing local demand and export markets. Recent announcements include several major manufacturing projects with combined capacity exceeding regional demand projections, indicating confidence in long-term market growth.

Technology Partnerships between international anode material developers and regional companies are creating pathways for knowledge transfer and market access. These partnerships combine global technical expertise with local market knowledge and manufacturing capabilities.

Research Initiatives are expanding with new collaborations between industry participants and academic institutions. These initiatives focus on developing next-generation anode technologies specifically adapted to regional market requirements and operating conditions.

Quality Certifications are being pursued by regional manufacturers seeking to meet international standards and access global markets. These certification efforts demonstrate commitment to quality and create competitive advantages in premium market segments.

Supply Chain Development activities include investments in raw material processing capabilities and logistics infrastructure to support growing manufacturing operations. These developments reduce dependency on imported materials and improve cost competitiveness.

Policy Developments include new government initiatives supporting electric vehicle adoption and battery technology development. Recent policy announcements indicate sustained government commitment to sustainable transportation solutions and related technology advancement.

Investment Strategy recommendations emphasize the importance of selective market entry focused on high-growth segments and strategic partnerships with established players. MWR analysis suggests that companies should prioritize technology development and quality certification to establish competitive advantages in evolving market conditions.

Technology Focus should emphasize silicon-enhanced composite materials and advanced manufacturing processes that offer superior performance characteristics. Companies investing in next-generation technologies are positioned to capture premium market segments and achieve sustainable competitive advantages.

Partnership Approach is recommended for companies seeking to enter regional markets, combining international technical expertise with local market knowledge and manufacturing capabilities. Strategic alliances can accelerate market entry while reducing risks and development costs.

Quality Investment in certification processes and quality management systems is essential for long-term market success. Companies that achieve international quality standards gain access to premium market segments and establish credibility with demanding customers.

Market Timing considerations suggest that early market entry offers advantages in establishing customer relationships and market position before competition intensifies. However, companies should ensure adequate technical capabilities and financial resources before committing to market entry strategies.

Diversification Strategy should include multiple application areas and technology platforms to reduce market concentration risks and capture emerging opportunities. Companies with diversified portfolios are better positioned to navigate market volatility and technological disruption.

Market trajectory for the Middle-East and Africa electric vehicle battery anode market indicates sustained growth driven by accelerating electric vehicle adoption, technological advancement, and supportive government policies. Long-term projections suggest the market will continue expanding at robust rates exceeding 18% annually through the next decade.

Technology evolution will continue favoring advanced materials with superior performance characteristics, particularly silicon-enhanced composites and next-generation anode technologies. Companies investing in research and development are positioned to capture growing demand for high-performance battery solutions.

Manufacturing development will accelerate as companies establish regional production capabilities to serve growing local demand and export opportunities. MarkWide Research projects that regional manufacturing capacity will increase substantially, reducing dependency on imported materials and components.

Market maturation will bring increased competition, quality standardization, and cost optimization pressures. Companies with strong technical capabilities, quality systems, and cost-effective manufacturing processes will gain competitive advantages in mature market conditions.

Application expansion beyond automotive markets will create new growth opportunities in energy storage, marine, and industrial applications. This diversification will reduce market concentration risks and provide multiple revenue streams for successful companies.

Sustainability requirements will become increasingly important as environmental regulations tighten and consumer awareness grows. Companies developing sustainable manufacturing processes and recyclable materials will gain competitive advantages in environmentally conscious market segments.

Market assessment of the Middle-East and Africa electric vehicle battery anode market reveals a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, government support, and increasing environmental consciousness. The market presents significant opportunities for companies with appropriate technical capabilities, strategic partnerships, and long-term commitment to regional market development.

Strategic positioning in this market requires careful consideration of technology choices, quality standards, and partnership strategies. Companies that successfully navigate these requirements while maintaining focus on innovation and customer satisfaction are positioned to achieve sustainable competitive advantages and participate in long-term market growth.

Future success in the Middle-East and Africa electric vehicle battery anode market will depend on companies’ ability to adapt to evolving technology requirements, maintain quality standards, and develop cost-effective manufacturing capabilities. The market offers substantial rewards for companies that successfully execute comprehensive strategies addressing these critical success factors while contributing to the region’s sustainable transportation transformation.

What is Electric Vehicle Battery Anode?

Electric Vehicle Battery Anode refers to the component in a battery that allows the flow of lithium ions during the charging and discharging process. It plays a crucial role in the performance and efficiency of electric vehicle batteries.

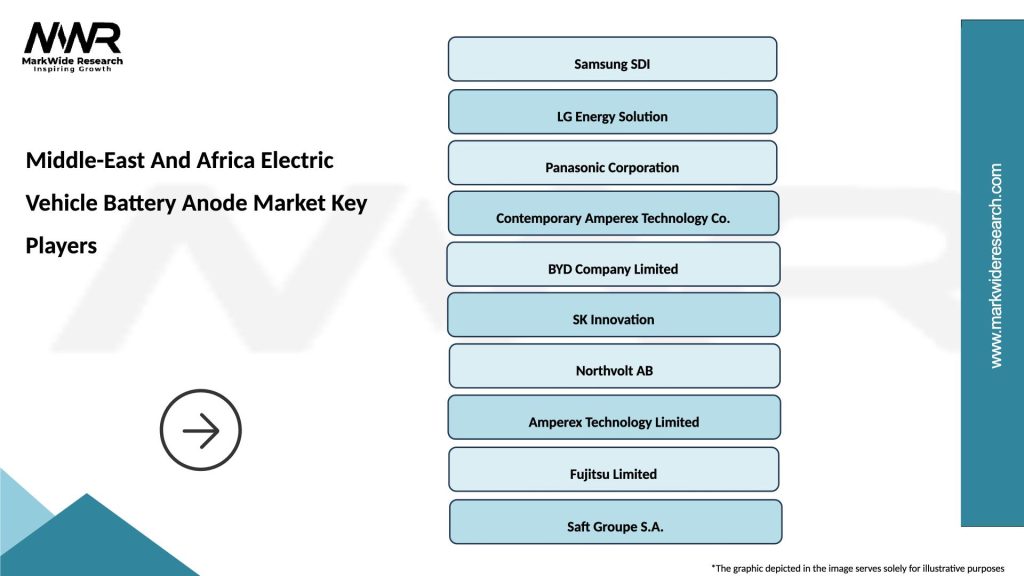

What are the key players in the Middle-East And Africa Electric Vehicle Battery Anode Market?

Key players in the Middle-East And Africa Electric Vehicle Battery Anode Market include companies like BASF, LG Chem, and Samsung SDI, which are known for their advancements in battery technology and materials, among others.

What are the growth factors driving the Middle-East And Africa Electric Vehicle Battery Anode Market?

The growth of the Middle-East And Africa Electric Vehicle Battery Anode Market is driven by increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation.

What challenges does the Middle-East And Africa Electric Vehicle Battery Anode Market face?

Challenges in the Middle-East And Africa Electric Vehicle Battery Anode Market include supply chain disruptions, high production costs, and the need for improved recycling processes for battery materials.

What opportunities exist in the Middle-East And Africa Electric Vehicle Battery Anode Market?

Opportunities in the Middle-East And Africa Electric Vehicle Battery Anode Market include the development of new anode materials, expansion of electric vehicle infrastructure, and increasing investments in renewable energy sources.

What trends are shaping the Middle-East And Africa Electric Vehicle Battery Anode Market?

Trends in the Middle-East And Africa Electric Vehicle Battery Anode Market include the shift towards silicon-based anodes, innovations in battery recycling technologies, and the growing focus on sustainability in battery production.

Middle-East And Africa Electric Vehicle Battery Anode Market

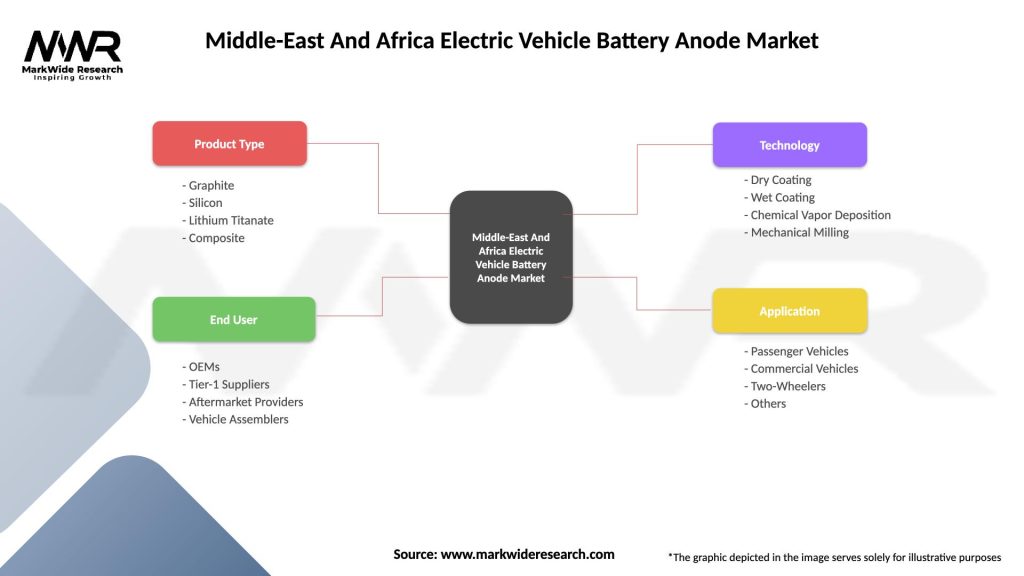

| Segmentation Details | Description |

|---|---|

| Product Type | Graphite, Silicon, Lithium Titanate, Composite |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | Dry Coating, Wet Coating, Chemical Vapor Deposition, Mechanical Milling |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle-East And Africa Electric Vehicle Battery Anode Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at