444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle-East and Africa electric-bike market represents one of the most rapidly evolving segments in the region’s transportation ecosystem. This emerging market encompasses a diverse range of electric bicycles designed for urban commuting, recreational activities, and commercial applications across various countries including the United Arab Emirates, Saudi Arabia, South Africa, Egypt, and Nigeria. Market dynamics indicate substantial growth potential driven by increasing urbanization, environmental consciousness, and government initiatives promoting sustainable transportation solutions.

Regional adoption patterns show significant variation across different countries, with the Gulf Cooperation Council (GCC) nations leading in premium electric-bike adoption while African markets demonstrate growing interest in affordable mobility solutions. The market encompasses various electric-bike categories including pedal-assist bicycles, throttle-controlled e-bikes, cargo electric bikes, and high-performance electric mountain bikes. Growth trajectories suggest the market is expanding at a remarkable 12.5% CAGR, reflecting increasing consumer acceptance and infrastructure development initiatives.

Infrastructure development across major cities in the region has created favorable conditions for electric-bike adoption, with dedicated cycling lanes, charging stations, and bike-sharing programs becoming increasingly common. The market benefits from diverse consumer segments ranging from environmentally conscious urban professionals to delivery service providers seeking cost-effective transportation solutions. Technology integration has enhanced product offerings with smart connectivity features, GPS tracking, and mobile app integration becoming standard features in premium electric-bike models.

The Middle-East and Africa electric-bike market refers to the comprehensive ecosystem of electric bicycle manufacturing, distribution, sales, and supporting services across the Middle-Eastern and African regions. This market encompasses all types of electrically-assisted bicycles that combine traditional pedaling with electric motor assistance to provide enhanced mobility solutions for various user segments and applications.

Electric bicycles in this context include pedal-assist systems where electric motors provide supplementary power during pedaling, as well as throttle-controlled systems that can operate independently of pedaling. The market covers various product categories including urban commuter e-bikes, recreational electric bicycles, cargo e-bikes for commercial applications, and specialized electric mountain bikes designed for off-road adventures. Supporting infrastructure such as charging networks, maintenance services, and rental programs forms an integral part of this market ecosystem.

Geographic scope encompasses diverse markets from oil-rich Gulf nations with high purchasing power to emerging African economies seeking affordable transportation alternatives. The market includes both imported electric bicycles from established global manufacturers and locally assembled or manufactured products designed to meet specific regional requirements and price points.

Market performance in the Middle-East and Africa electric-bike sector demonstrates exceptional growth momentum driven by urbanization trends, environmental awareness, and supportive government policies. The region’s unique combination of affluent urban centers and emerging markets creates diverse opportunities for electric-bike manufacturers and service providers. Consumer adoption has accelerated significantly, with urban professionals and young demographics leading the transition toward electric mobility solutions.

Key market drivers include rising fuel costs, traffic congestion in major cities, and increasing health consciousness among consumers. Government initiatives promoting sustainable transportation have resulted in policy support representing approximately 35% of market growth factors. The market benefits from technological advancements in battery technology, motor efficiency, and smart connectivity features that enhance user experience and product reliability.

Competitive dynamics show a mix of international brands establishing regional presence and local companies developing products tailored to specific market needs. Distribution channels have evolved to include traditional bicycle retailers, specialized e-bike stores, online platforms, and corporate fleet sales. Market segmentation reveals strong demand across multiple price points, from premium models in Gulf countries to affordable options in African markets.

Future prospects indicate continued expansion supported by infrastructure development, declining battery costs, and increasing consumer awareness of electric mobility benefits. The market is positioned for sustained growth as regional governments implement smart city initiatives and sustainable transportation policies.

Consumer behavior analysis reveals distinct purchasing patterns across different regional markets, with premium features and brand reputation driving decisions in affluent markets while affordability and durability remain primary concerns in price-sensitive segments. The following key insights characterize the current market landscape:

Market maturity levels differ substantially across the region, with UAE and Saudi Arabia showing advanced adoption patterns while emerging African markets demonstrate significant growth potential. Price sensitivity analysis indicates that 60% of consumers prioritize value-for-money propositions over premium features, particularly in developing markets.

Environmental consciousness has emerged as a primary driver for electric-bike adoption across the Middle-East and Africa region. Growing awareness of air pollution and climate change impacts motivates consumers to seek sustainable transportation alternatives. Government initiatives supporting carbon emission reduction and sustainable mobility create favorable policy environments that encourage electric-bike adoption through subsidies, tax incentives, and infrastructure development programs.

Urbanization trends across the region have intensified traffic congestion and parking challenges in major cities, making electric bikes attractive alternatives for urban commuting. Rising fuel costs and vehicle maintenance expenses drive consumers toward more economical transportation solutions. Health and fitness awareness contributes to market growth as consumers recognize the physical activity benefits of electric-assisted cycling while maintaining convenience for longer distances.

Technological advancements in battery technology, motor efficiency, and smart connectivity features enhance product appeal and reliability. Improved battery life, faster charging capabilities, and reduced maintenance requirements address previous consumer concerns about electric-bike ownership. Infrastructure development including dedicated cycling lanes, secure parking facilities, and charging stations creates supportive environments for electric-bike usage.

Economic factors such as rising disposable incomes in certain regional markets enable premium electric-bike purchases, while affordable models serve price-sensitive segments. The emergence of bike-sharing programs and rental services reduces barriers to electric-bike access and familiarizes consumers with electric mobility benefits.

High initial costs remain a significant barrier to electric-bike adoption, particularly in price-sensitive markets across Africa where consumer purchasing power limits access to quality electric bicycles. Premium electric-bike models often cost several times more than conventional bicycles, creating affordability challenges for mainstream consumers. Limited financing options and installment payment programs restrict market accessibility in many regional markets.

Infrastructure limitations in certain areas lack adequate cycling lanes, secure parking facilities, and charging infrastructure, creating practical barriers to electric-bike usage. Safety concerns related to sharing roads with motor vehicles discourage potential users, particularly in cities with limited cycling infrastructure. Climate challenges including extreme heat in Gulf countries and seasonal weather variations affect year-round electric-bike usage patterns.

Technical concerns about battery life, replacement costs, and maintenance requirements create hesitation among potential buyers. Limited availability of authorized service centers and spare parts in certain markets raises concerns about long-term ownership costs. Range anxiety related to battery performance and charging availability affects consumer confidence, particularly for longer commutes.

Regulatory uncertainties in some markets lack clear guidelines for electric-bike classification, licensing requirements, and usage regulations. Cultural factors and traditional transportation preferences may slow adoption rates in certain demographic segments. Import duties and taxes on electric bicycles increase retail prices, limiting market accessibility in price-sensitive regions.

Government smart city initiatives across the region present substantial opportunities for electric-bike integration into urban transportation systems. Many countries are developing comprehensive sustainable transportation strategies that include electric mobility promotion, creating favorable market conditions for industry growth. Public-private partnerships for bike-sharing programs and infrastructure development offer significant expansion opportunities for electric-bike manufacturers and service providers.

Corporate fleet opportunities emerge as businesses seek sustainable transportation solutions for employee commuting and commercial operations. Delivery services, logistics companies, and corporate campuses represent growing market segments for electric-bike adoption. Tourism sector integration provides opportunities for electric-bike rental services and guided tour applications, particularly in scenic destinations across the region.

Technology partnerships with mobile app developers, GPS providers, and IoT companies create opportunities for enhanced electric-bike features and services. Integration with smart city platforms and transportation management systems opens new revenue streams and value propositions. Local manufacturing opportunities can reduce costs and improve market accessibility while creating employment opportunities.

Educational institutions and university campuses present significant opportunities for electric-bike adoption among students and staff. Healthcare sector applications for medical professionals and emergency services create specialized market segments. The growing emphasis on last-mile delivery solutions driven by e-commerce growth creates substantial commercial opportunities for electric-bike applications.

Supply chain dynamics in the Middle-East and Africa electric-bike market reflect a complex interplay of international manufacturers, regional distributors, and local assembly operations. Global supply chains dominate component sourcing, with batteries, motors, and electronic systems primarily imported from established manufacturing hubs. Regional assembly and customization operations are emerging to serve local market preferences and reduce costs.

Demand patterns show seasonal variations influenced by weather conditions, with peak sales occurring during cooler months in Gulf countries and dry seasons in African markets. Consumer preferences vary significantly across different regional markets, with premium features and brand reputation important in affluent areas while affordability and durability drive decisions in emerging markets. Price dynamics reflect ongoing cost reductions in battery technology offset by increasing feature sophistication and quality improvements.

Distribution channel evolution shows traditional bicycle retailers adapting to electric-bike sales while specialized e-bike stores emerge in major urban centers. Online sales platforms gain importance, particularly for reaching consumers in areas with limited physical retail presence. Service network development becomes increasingly critical as the installed base of electric bikes grows, requiring maintenance and repair capabilities.

Competitive dynamics intensify as international brands establish regional presence while local companies develop products tailored to specific market needs. Innovation cycles accelerate with continuous improvements in battery technology, motor efficiency, and smart connectivity features driving product differentiation and market expansion.

Primary research methodology employed comprehensive data collection through structured interviews with industry stakeholders including manufacturers, distributors, retailers, and end-users across key markets in the Middle-East and Africa region. Survey instruments captured quantitative data on market size, growth rates, consumer preferences, and purchasing behaviors from representative samples in major urban centers and emerging markets.

Secondary research involved extensive analysis of industry reports, government publications, trade association data, and company financial statements to validate primary findings and establish market baselines. Market intelligence gathering included monitoring of industry publications, trade shows, and expert interviews to identify emerging trends and technological developments affecting the electric-bike market.

Data validation processes employed triangulation methods comparing multiple data sources to ensure accuracy and reliability of market estimates and projections. Regional analysis required customized research approaches recognizing significant variations in market maturity, consumer behavior, and regulatory environments across different countries and sub-regions.

Analytical frameworks incorporated both quantitative modeling and qualitative assessment techniques to develop comprehensive market insights. Forecasting methodologies utilized historical trend analysis, regression modeling, and scenario planning to project future market developments under various assumptions about economic conditions, policy changes, and technological advancement.

Gulf Cooperation Council (GCC) markets demonstrate the highest adoption rates and premium product preferences, with the United Arab Emirates leading regional electric-bike sales. UAE market dynamics show strong demand for high-end electric bicycles with advanced features, supported by excellent infrastructure and high disposable incomes. Dubai and Abu Dhabi have implemented comprehensive cycling infrastructure including dedicated lanes and charging stations, creating favorable conditions for electric-bike adoption.

Saudi Arabia represents the largest potential market in the region, with government Vision 2030 initiatives promoting sustainable transportation and healthy lifestyle choices. Market penetration in Saudi Arabia currently stands at approximately 8% of the total bicycle market, with significant growth potential as infrastructure development accelerates. The kingdom’s focus on smart city development and environmental sustainability creates opportunities for electric-bike integration into urban transportation systems.

African markets show diverse characteristics with South Africa leading in market development and consumer adoption. South African market benefits from established cycling culture, relatively developed infrastructure, and growing environmental awareness among urban consumers. Nigeria and Egypt represent large population markets with emerging electric-bike interest, though affordability remains a primary consideration for mainstream adoption.

North African markets including Egypt and Morocco demonstrate growing interest in electric mobility solutions, supported by government initiatives promoting sustainable transportation. Regional market share distribution shows GCC countries accounting for approximately 45% of regional sales volume, while African markets represent 35% of unit sales but focus primarily on affordable product segments.

Market leadership in the Middle-East and Africa electric-bike market reflects a combination of established international brands and emerging regional players. The competitive environment demonstrates significant diversity in product positioning, pricing strategies, and market approaches tailored to different regional segments and consumer preferences.

Competitive strategies vary significantly across different market segments, with premium brands emphasizing technology innovation and brand prestige while value-oriented competitors focus on affordability and practical functionality. Distribution partnerships with local retailers and service providers become increasingly important for market success, particularly in regions with limited infrastructure and service capabilities.

Innovation competition centers on battery technology improvements, smart connectivity features, and specialized applications for commercial and recreational use. Market positioning strategies reflect regional preferences and purchasing power variations, requiring flexible approaches to product development and pricing.

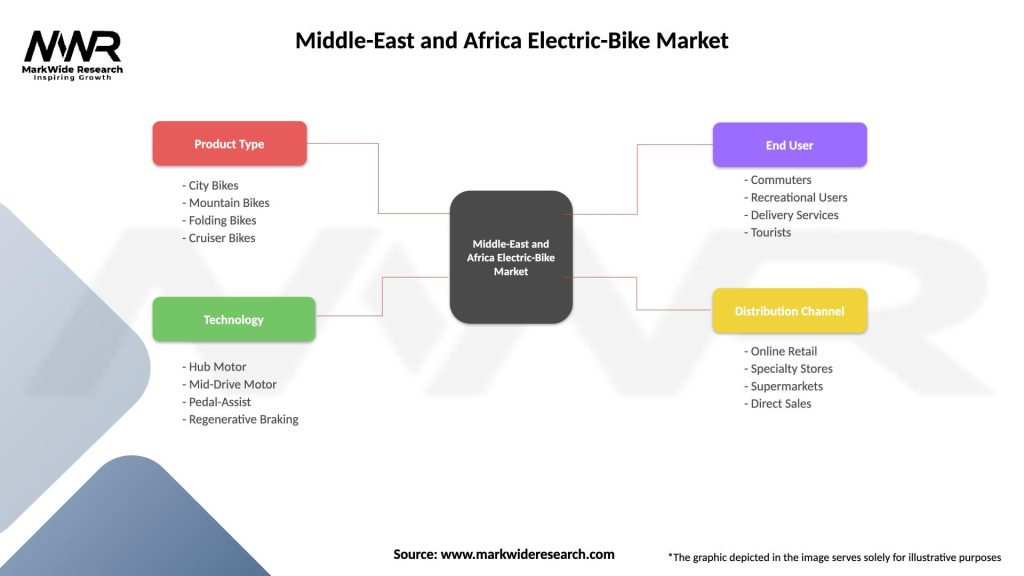

Product segmentation in the Middle-East and Africa electric-bike market reflects diverse consumer needs and applications across different regional markets. By product type, the market encompasses pedal-assist bicycles, throttle-controlled e-bikes, cargo electric bikes, and specialized applications including mountain bikes and urban commuters.

By Technology:

By Application:

By Price Range:

Urban commuter electric bikes represent the fastest-growing category, driven by increasing traffic congestion and parking challenges in major regional cities. This segment benefits from government infrastructure investments and corporate adoption programs. Feature preferences in urban commuter bikes emphasize reliability, battery range, and integrated security systems to address theft concerns in urban environments.

Recreational electric bikes show strong growth in affluent markets where consumers seek enhanced cycling experiences for fitness and leisure activities. This category benefits from growing health consciousness and outdoor recreation trends. Mountain electric bikes gain popularity in regions with suitable terrain, offering adventure tourism opportunities and specialized retail channels.

Cargo electric bikes emerge as a significant commercial segment, particularly for delivery services and small business applications. Load capacity and durability become primary considerations for commercial users, with customization options for specific industry requirements. This segment shows adoption rates of approximately 25% among urban delivery services in major cities.

Folding electric bikes address space constraints and multi-modal transportation needs, particularly appealing to urban professionals using combined transportation methods. Portability features and compact design drive adoption in high-density urban areas with limited storage space. Smart electric bikes with integrated connectivity features attract tech-savvy consumers seeking enhanced functionality and security features.

Manufacturers benefit from expanding market opportunities across diverse regional segments with varying price points and feature requirements. The growing market enables economies of scale in production while regional customization creates competitive advantages. Technology partnerships with component suppliers and software developers enhance product differentiation and market positioning capabilities.

Retailers and distributors gain access to high-growth market segments with attractive profit margins and recurring revenue opportunities through service and maintenance contracts. Market expansion creates opportunities for specialized electric-bike stores and service centers, while traditional bicycle retailers can diversify their product portfolios and customer base.

Consumers benefit from improved transportation options that combine environmental sustainability with cost-effectiveness and health benefits. Electric-bike adoption provides solutions to urban mobility challenges while offering flexibility and convenience for various transportation needs. Technology integration enhances user experience through smart features and connectivity options.

Government stakeholders achieve sustainable transportation objectives while reducing urban congestion and air pollution. Economic benefits include job creation in manufacturing, retail, and service sectors, while infrastructure investments support broader smart city initiatives. Public health improvements result from increased physical activity and reduced air pollution in urban areas.

Commercial users including delivery services and logistics companies benefit from reduced operational costs and improved efficiency in last-mile transportation. Corporate adoption supports sustainability goals while providing employee transportation benefits and reducing parking requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as a dominant trend with electric bikes incorporating GPS tracking, mobile app connectivity, and IoT features for enhanced user experience and security. Theft protection systems including remote locking, alarm systems, and tracking capabilities address major consumer concerns about electric-bike security in urban environments.

Battery technology advancement continues to drive market evolution with longer-range capabilities, faster charging times, and improved durability. Removable battery systems gain popularity for convenient charging and theft prevention, while battery-as-a-service models emerge to address replacement cost concerns. Charging infrastructure expansion includes solar-powered stations and integration with existing urban infrastructure.

Customization and personalization trends show consumers seeking electric bikes tailored to specific needs and preferences. Modular design approaches enable component upgrades and customization while maintaining cost-effectiveness. Subscription and rental models gain traction as alternatives to ownership, particularly in urban areas with bike-sharing programs.

Commercial application expansion shows growing adoption in delivery services, logistics, and corporate transportation. Specialized cargo bikes and fleet management solutions address commercial user requirements. Integration with e-commerce platforms creates new distribution channels and customer engagement opportunities.

Sustainability focus drives demand for environmentally responsible manufacturing processes and recyclable components. Circular economy principles influence product design and end-of-life management strategies.

Manufacturing expansion initiatives show several international electric-bike manufacturers establishing regional assembly operations to serve Middle-East and Africa markets more effectively. Local partnership agreements between global brands and regional distributors enhance market reach and customer service capabilities while reducing import costs and delivery times.

Government policy developments include new regulations supporting electric-bike adoption through tax incentives, import duty reductions, and infrastructure investment programs. Smart city initiatives in major urban centers incorporate electric-bike integration into comprehensive transportation planning and sustainable mobility strategies.

Technology partnerships between electric-bike manufacturers and software companies create enhanced connectivity features and mobile platform integration. Battery technology collaborations with energy companies and technology providers drive improvements in range, charging speed, and overall system reliability.

Infrastructure investments by governments and private companies expand charging networks, dedicated cycling lanes, and secure parking facilities. Bike-sharing program launches in major cities introduce electric bikes to broader consumer segments while demonstrating practical applications and benefits.

According to MarkWide Research analysis, recent industry developments show increasing focus on local market adaptation and regional customization strategies. Investment announcements in manufacturing facilities and service networks indicate strong industry confidence in long-term market growth potential across the region.

Market entry strategies should prioritize understanding regional variations in consumer preferences, purchasing power, and infrastructure development. Successful market penetration requires tailored approaches for different countries and market segments, with particular attention to price sensitivity in emerging markets versus feature preferences in affluent areas.

Product development focus should emphasize durability and reliability for challenging regional conditions while incorporating smart features that appeal to tech-savvy consumers. Battery technology improvements remain critical for addressing range anxiety and reducing total ownership costs. Modular design approaches enable customization while maintaining manufacturing efficiency.

Distribution strategy optimization requires building comprehensive service networks and partnerships with local retailers who understand regional market dynamics. Online sales channels become increasingly important for reaching consumers in areas with limited physical retail presence. Corporate sales programs offer significant growth opportunities for fleet applications.

Infrastructure collaboration with government agencies and urban planners creates opportunities for market development while supporting broader sustainable transportation initiatives. Educational marketing programs help build consumer awareness and understanding of electric-bike benefits and applications.

Financial innovation through flexible payment options, leasing programs, and subscription models can address affordability barriers and expand market accessibility. Service excellence becomes a key differentiator as the market matures and competition intensifies.

Market expansion prospects indicate continued robust growth driven by urbanization trends, environmental consciousness, and supportive government policies across the Middle-East and Africa region. Technology evolution will continue to enhance product capabilities while reducing costs, making electric bikes accessible to broader consumer segments. MWR projections suggest the market will maintain strong growth momentum with annual expansion rates exceeding 15% in several key regional markets.

Infrastructure development will accelerate as smart city initiatives gain momentum and governments prioritize sustainable transportation solutions. Charging network expansion and dedicated cycling infrastructure will create more favorable conditions for electric-bike adoption. Integration opportunities with public transportation systems and urban mobility platforms will enhance electric-bike utility and appeal.

Commercial applications will drive significant market growth as businesses recognize electric bikes’ efficiency and cost advantages for delivery services and employee transportation. Fleet adoption rates are projected to reach 40% of commercial bicycle applications within the next five years. Tourism sector integration will create additional growth opportunities in destination markets.

Technology convergence with autonomous systems, artificial intelligence, and smart city platforms will create new value propositions and market opportunities. Sustainability trends will continue to drive consumer preference toward electric mobility solutions, supported by increasing environmental awareness and corporate responsibility initiatives.

Regional market maturation will show varying patterns with Gulf countries achieving higher penetration rates while African markets demonstrate strong growth potential from lower baseline levels. Local manufacturing development will improve market accessibility and create employment opportunities while reducing dependence on imports.

The Middle-East and Africa electric-bike market represents a dynamic and rapidly evolving sector with substantial growth potential driven by urbanization, environmental consciousness, and supportive government initiatives. Market diversity across different regional segments creates opportunities for various product positioning strategies and business models, from premium offerings in affluent Gulf markets to affordable solutions in emerging African economies.

Technology advancement continues to address previous barriers to adoption while creating new value propositions through smart connectivity and enhanced performance capabilities. Infrastructure development and government support provide favorable conditions for sustained market expansion, while growing commercial applications demonstrate the practical benefits of electric-bike adoption across various industry sectors.

Success factors for market participants include understanding regional variations, building comprehensive service networks, and developing products that address specific local needs and preferences. Future growth prospects remain strong as the market benefits from multiple positive trends including smart city development, sustainable transportation policies, and increasing consumer awareness of electric mobility benefits. The Middle-East and Africa electric-bike market is positioned for continued expansion as it becomes an integral component of regional sustainable transportation ecosystems.

What is Electric-Bike?

Electric-bikes, or e-bikes, are bicycles equipped with an electric motor that assists with pedaling. They are designed for various applications, including commuting, recreational riding, and delivery services.

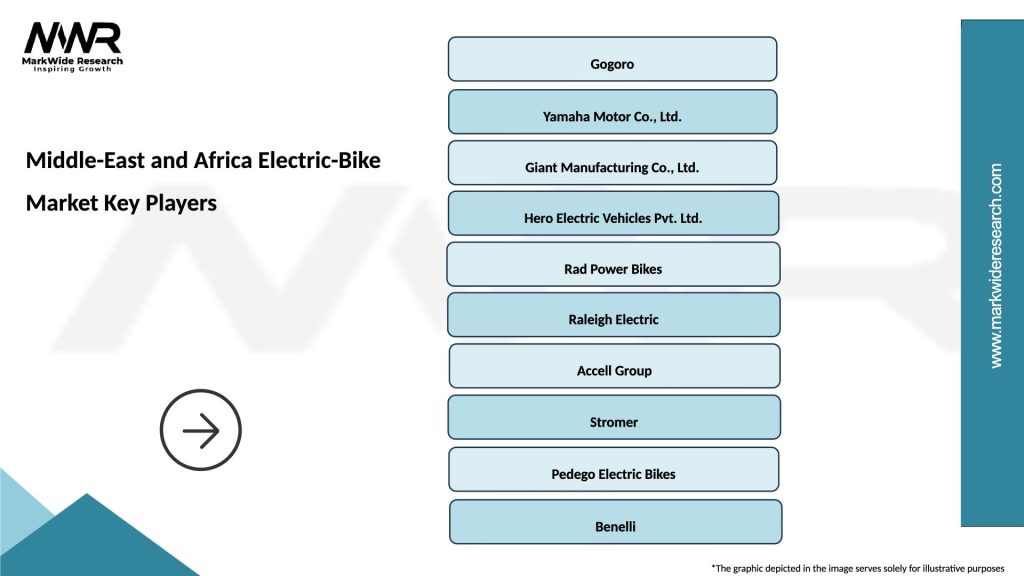

What are the key players in the Middle-East and Africa Electric-Bike Market?

Key players in the Middle-East and Africa Electric-Bike Market include companies like Trek Bicycle Corporation, Giant Manufacturing Co., and Accell Group, among others.

What are the main drivers of growth in the Middle-East and Africa Electric-Bike Market?

The growth of the Middle-East and Africa Electric-Bike Market is driven by increasing urbanization, rising fuel prices, and a growing emphasis on sustainable transportation solutions.

What challenges does the Middle-East and Africa Electric-Bike Market face?

Challenges in the Middle-East and Africa Electric-Bike Market include regulatory hurdles, limited charging infrastructure, and varying consumer acceptance across different regions.

What opportunities exist in the Middle-East and Africa Electric-Bike Market?

Opportunities in the Middle-East and Africa Electric-Bike Market include the expansion of e-bike sharing programs, advancements in battery technology, and increasing government support for eco-friendly transportation.

What trends are shaping the Middle-East and Africa Electric-Bike Market?

Trends in the Middle-East and Africa Electric-Bike Market include the rise of smart e-bikes with integrated technology, the popularity of cargo e-bikes for delivery services, and a growing focus on health and fitness among consumers.

Middle-East and Africa Electric-Bike Market

| Segmentation Details | Description |

|---|---|

| Product Type | City Bikes, Mountain Bikes, Folding Bikes, Cruiser Bikes |

| Technology | Hub Motor, Mid-Drive Motor, Pedal-Assist, Regenerative Braking |

| End User | Commuters, Recreational Users, Delivery Services, Tourists |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle-East and Africa Electric-Bike Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at