444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East and Africa (MEA) Dissolved Gas Analyzer (DGA) market is experiencing significant growth and is expected to continue expanding in the coming years. DGA is a crucial component in monitoring the health and condition of power transformers, as it provides insights into the presence of dissolved gases that indicate potential faults or abnormalities. The MEA region, which includes countries such as Saudi Arabia, UAE, South Africa, and Nigeria, among others, has a substantial demand for DGA solutions due to its extensive power infrastructure and increasing focus on ensuring reliable electricity supply.

Meaning

A Dissolved Gas Analyzer (DGA) is a device used to analyze the gases dissolved in transformer oil. Power transformers contain insulating oil, which can degrade over time, leading to the generation of gases. These gases, such as methane, ethane, ethylene, and acetylene, among others, are indicative of specific transformer faults or abnormal operating conditions. By analyzing the composition and concentration of these gases, DGA systems provide critical insights into the condition of power transformers, helping utilities and industries to proactively identify potential faults, prevent failures, and ensure uninterrupted power supply.

Executive Summary

The Middle East and Africa Dissolved Gas Analyzer (DGA) market is poised for substantial growth in the forecast period. Factors such as the aging power infrastructure, increasing demand for reliable power supply, and rising emphasis on preventive maintenance are driving the adoption of DGA solutions in the region. The market is witnessing the introduction of advanced DGA technologies, including online monitoring systems and portable analyzers, which offer real-time insights and enhance the efficiency of maintenance activities. Moreover, the market is characterized by the presence of both global and regional players, fostering competition and innovation.

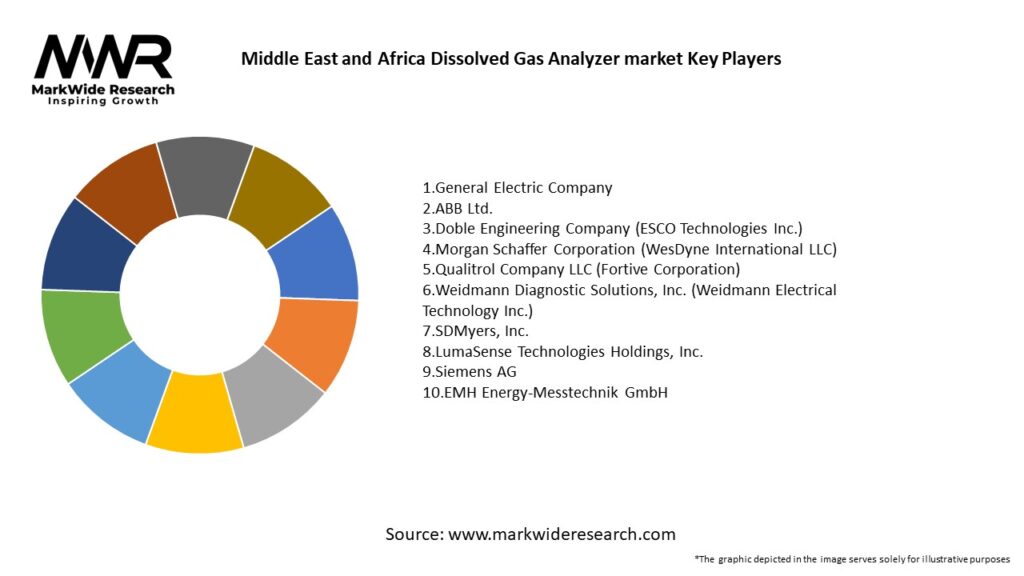

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MEA Dissolved Gas Analyzer (DGA) market is driven by a combination of factors, including increasing demand for reliable power supply, growing awareness of predictive maintenance, stringent regulations, and technological advancements. These drivers are fueling the adoption of DGA solutions across various sectors in the region. However, the market faces challenges such as high implementation costs, a shortage of skilled workforce, and limited awareness. Despite these challenges, there are ample opportunities for market players to capitalize on the untapped market potential, integrate with smart grid technologies, form collaborations, and target the renewable energy segment.

Regional Analysis

The Middle East and Africa Dissolved Gas Analyzer (DGA) market can be segmented into various regions, including:

Competitive Landscape

Leading Companies in Middle East and Africa Dissolved Gas Analyzer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Middle East and Africa Dissolved Gas Analyzer (DGA) market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Middle East and Africa Dissolved Gas Analyzer (DGA) market, like many other industries, experienced the impact of the COVID-19 pandemic. The pandemic caused disruptions in supply chains, delayed projects, and impacted investments in power infrastructure. However, the demand for reliable electricity supply remained critical, leading to the increased emphasis on preventive maintenance and monitoring solutions like DGA.

During the pandemic, utilities and industries recognized the importance of maintaining their power infrastructure to ensure uninterrupted power supply, especially with the surge in remote work and increased reliance on digital services. This realization boosted the adoption of DGA systems as a proactive approach to asset management.

The pandemic also accelerated the digitization and remote monitoring trends in the DGA market. Online monitoring systems gained traction as they offered the advantage of remote data collection and analysis, reducing the need for on-site visits and minimizing the risk of exposure to the virus.

While the pandemic presented challenges, it also created opportunities for DGA solution providers to showcase the value of their offerings in maintaining critical infrastructure and adapting to changing operational requirements.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Middle East and Africa Dissolved Gas Analyzer (DGA) market is expected to witness continued growth in the coming years. The aging power infrastructure, increasing demand for reliable power supply, and the focus on preventive maintenance are driving the adoption of DGA solutions in the region. Technological advancements, integration with smart grid technologies, and collaborations with stakeholders present opportunities for market expansion.

However, market players need to address challenges such as high implementation costs, skill shortages, and limited awareness. By raising awareness, optimizing costs, and offering tailored solutions, industry participants can unlock the market’s potential and contribute to the region’s power infrastructure development.

Conclusion

In conclusion, the Middle East and Africa Dissolved Gas Analyzer (DGA) market is poised for substantial growth in the coming years. The demand for DGA solutions is driven by factors such as the aging power infrastructure, increasing need for reliable power supply, and the focus on preventive maintenance. DGA systems play a crucial role in monitoring the health and condition of power transformers, enabling utilities, industries, and commercial sectors to proactively detect faults and ensure uninterrupted power supply.

What is Dissolved Gas Analyzer?

A Dissolved Gas Analyzer is a device used to measure the concentration of dissolved gases in liquids, particularly in transformer oil. It is essential for monitoring the health of electrical equipment and preventing failures by analyzing gases like hydrogen, methane, and ethylene.

What are the key players in the Middle East and Africa Dissolved Gas Analyzer market?

Key players in the Middle East and Africa Dissolved Gas Analyzer market include Siemens, General Electric, and ABB, among others. These companies are known for their advanced technologies and solutions in gas analysis for various industrial applications.

What are the growth factors driving the Middle East and Africa Dissolved Gas Analyzer market?

The growth of the Middle East and Africa Dissolved Gas Analyzer market is driven by increasing investments in power generation and distribution infrastructure, the need for predictive maintenance in electrical systems, and rising awareness of safety standards in industrial operations.

What challenges does the Middle East and Africa Dissolved Gas Analyzer market face?

Challenges in the Middle East and Africa Dissolved Gas Analyzer market include the high cost of advanced analyzers, a lack of skilled personnel for operation and maintenance, and varying regulatory standards across different countries that can complicate market entry.

What opportunities exist in the Middle East and Africa Dissolved Gas Analyzer market?

Opportunities in the Middle East and Africa Dissolved Gas Analyzer market include the growing demand for renewable energy sources, advancements in sensor technology, and the increasing adoption of smart grid solutions that require efficient gas monitoring.

What trends are shaping the Middle East and Africa Dissolved Gas Analyzer market?

Trends in the Middle East and Africa Dissolved Gas Analyzer market include the integration of IoT technology for real-time monitoring, the development of portable analyzers for field use, and a shift towards automated data analysis to enhance decision-making processes.

Middle East and Africa Dissolved Gas Analyzer market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Analyzers, Fixed Analyzers, Online Analyzers, Laboratory Analyzers |

| Technology | Infrared Spectroscopy, Gas Chromatography, Electrochemical Sensors, Mass Spectrometry |

| End User | Oil & Gas, Water Treatment, Chemical Manufacturing, Environmental Monitoring |

| Application | Quality Control, Emission Monitoring, Process Optimization, Research & Development |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Middle East and Africa Dissolved Gas Analyzer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at