444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa digital signage market represents one of the fastest-growing technology sectors in the region, driven by rapid urbanization, increasing retail modernization, and substantial investments in smart city initiatives. This dynamic market encompasses a wide range of digital display solutions, from interactive kiosks and video walls to outdoor LED displays and indoor information systems, serving diverse industries including retail, hospitality, transportation, healthcare, and education.

Market growth in the Middle East and Africa is particularly robust, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% as businesses and organizations increasingly recognize the value of dynamic visual communication. The region’s strategic position as a global business hub, combined with major events like Expo 2020 Dubai and the FIFA World Cup in Qatar, has accelerated digital signage adoption across multiple sectors.

Key market drivers include the region’s young, tech-savvy population, increasing smartphone penetration rates of 78% across major urban centers, and government initiatives promoting digital transformation. The retail sector leads adoption with 42% market share, followed by transportation hubs and hospitality venues that leverage digital signage to enhance customer experiences and operational efficiency.

Technological advancement in the region focuses on cloud-based content management systems, artificial intelligence integration, and interactive touchscreen solutions that cater to multilingual audiences. The market benefits from increasing investments in infrastructure development, smart city projects, and the region’s position as a gateway between Europe, Asia, and Africa.

The Middle East and Africa digital signage market refers to the comprehensive ecosystem of electronic display technologies, content management systems, and related services used to deliver dynamic visual communications across various industries and applications throughout the MEA region. This market encompasses hardware components including LED displays, LCD screens, projection systems, and interactive kiosks, alongside software solutions for content creation, management, and distribution.

Digital signage solutions in this context represent a shift from traditional static advertising and information displays to dynamic, programmable systems that can deliver targeted content based on time, location, audience demographics, and real-time data inputs. These systems enable organizations to communicate more effectively with their audiences while providing measurable analytics and return on investment.

Market scope includes both indoor and outdoor applications, ranging from small retail displays to large-scale architectural installations in shopping malls, airports, hotels, corporate offices, educational institutions, and public spaces. The technology serves multiple functions including advertising, wayfinding, information dissemination, brand promotion, and interactive customer engagement across diverse cultural and linguistic contexts specific to the Middle East and Africa region.

Strategic market positioning of digital signage in the Middle East and Africa reflects the region’s rapid economic development and technological adoption. The market demonstrates strong growth momentum driven by urbanization trends, retail sector expansion, and significant infrastructure investments across key economies including the UAE, Saudi Arabia, South Africa, and Nigeria.

Technology adoption patterns show increasing preference for cloud-based solutions, with 67% of new installations incorporating remote content management capabilities. This trend reflects the region’s distributed geography and the need for centralized control across multiple locations. Interactive displays represent the fastest-growing segment, driven by enhanced customer engagement requirements and the region’s focus on premium customer experiences.

Market segmentation reveals diverse application areas with retail leading at 42% market share, followed by transportation at 23%, hospitality at 18%, and corporate communications at 17%. The outdoor advertising segment shows particular strength in major metropolitan areas, benefiting from relaxed advertising regulations and increased consumer spending power.

Regional dynamics highlight the Gulf Cooperation Council (GCC) countries as primary growth drivers, accounting for approximately 58% of regional market activity. However, emerging markets in Africa, particularly Nigeria, Kenya, and Egypt, demonstrate accelerating adoption rates as infrastructure development and economic growth create new opportunities for digital signage deployment.

Market intelligence reveals several critical insights shaping the Middle East and Africa digital signage landscape. The region’s unique characteristics, including extreme weather conditions, multilingual requirements, and diverse economic development levels, create specific demands for robust, adaptable digital signage solutions.

Technology trends indicate growing demand for artificial intelligence-powered content optimization, real-time data integration, and advanced analytics capabilities. According to MarkWide Research analysis, organizations are increasingly seeking solutions that provide measurable business outcomes rather than simple display capabilities.

Economic diversification initiatives across the Middle East and Africa serve as primary market drivers for digital signage adoption. Government programs aimed at reducing oil dependency and developing knowledge-based economies create substantial demand for modern communication technologies in retail, tourism, and service sectors.

Smart city development represents a major growth catalyst, with cities like Dubai, Riyadh, and Cape Town investing heavily in digital infrastructure. These initiatives require comprehensive digital signage networks for public information, wayfinding, and emergency communications, driving demand for integrated, scalable solutions.

Retail modernization accelerates market growth as traditional retailers upgrade their customer experience capabilities. The rise of shopping malls, modern retail formats, and international brand presence creates substantial demand for sophisticated digital signage solutions that can deliver personalized, culturally appropriate content.

Tourism industry expansion fuels demand for multilingual, interactive digital signage solutions in airports, hotels, attractions, and transportation hubs. Major events and increasing tourist arrivals require advanced wayfinding and information systems that can serve diverse international audiences effectively.

Corporate communication needs drive adoption in office buildings, industrial facilities, and educational institutions. Organizations increasingly recognize digital signage as essential for internal communications, safety messaging, and brand reinforcement across their facilities.

Technology cost reduction makes digital signage more accessible to smaller businesses and emerging markets. Declining hardware costs and cloud-based software models enable broader market penetration across diverse economic segments throughout the region.

Infrastructure limitations pose significant challenges in certain markets, particularly in rural areas and developing economies where reliable internet connectivity and stable power supply remain inconsistent. These constraints limit the deployment of advanced digital signage solutions that require constant connectivity and power.

High initial investment costs continue to deter smaller businesses and organizations from adopting digital signage solutions. Despite declining hardware costs, the total cost of ownership, including installation, content creation, and ongoing maintenance, remains substantial for many potential users.

Regulatory complexity across multiple countries creates compliance challenges for solution providers and end users. Varying advertising regulations, content restrictions, and technical standards require significant adaptation and local expertise, increasing deployment complexity and costs.

Cultural and linguistic barriers complicate content creation and management processes. The need for culturally appropriate, multilingual content that complies with local customs and regulations requires specialized expertise and ongoing content management resources.

Technical expertise shortage limits market growth as organizations struggle to find qualified personnel for system installation, maintenance, and content management. The specialized nature of digital signage technology requires ongoing training and support that may not be readily available in all markets.

Environmental challenges including extreme temperatures, dust, and humidity in many regional locations require specialized hardware solutions that command premium pricing. These environmental factors also increase maintenance requirements and operational costs.

Emerging market penetration presents substantial opportunities as African economies develop and urbanization accelerates. Countries like Nigeria, Kenya, Ghana, and Morocco show increasing receptivity to digital signage solutions as their retail and service sectors modernize.

Integration with IoT ecosystems creates new value propositions for digital signage solutions. Smart building integration, environmental monitoring, and data-driven content optimization represent growing opportunities for solution providers who can deliver comprehensive connected experiences.

Healthcare sector expansion offers significant growth potential as hospitals, clinics, and healthcare facilities modernize their patient communication and wayfinding systems. The COVID-19 pandemic has accelerated demand for touchless, digital communication solutions in healthcare environments.

Education technology adoption drives opportunities in schools, universities, and training centers throughout the region. Digital signage solutions for campus communications, emergency notifications, and interactive learning environments represent a growing market segment.

Transportation infrastructure development creates substantial opportunities as new airports, metro systems, and bus rapid transit networks require comprehensive digital signage solutions for passenger information, wayfinding, and commercial messaging.

Artificial intelligence integration enables new applications including facial recognition for targeted advertising, predictive maintenance, and automated content optimization. These advanced capabilities create opportunities for premium solution offerings and recurring revenue models.

Competitive dynamics in the Middle East and Africa digital signage market reflect a mix of global technology leaders and regional specialists. International companies leverage their technological capabilities and global experience, while local providers offer specialized knowledge of regional requirements and cultural nuances.

Technology evolution drives continuous market transformation as display technologies improve and costs decline. The shift toward LED displays, higher resolution capabilities, and interactive features creates ongoing upgrade opportunities while potentially obsoleting older installations.

Customer expectations continue to evolve toward more sophisticated, personalized experiences. Organizations increasingly demand solutions that provide measurable business outcomes, advanced analytics, and seamless integration with existing business systems and processes.

Supply chain considerations impact market dynamics as global component shortages and shipping disruptions affect availability and pricing. Regional assembly and distribution capabilities become increasingly important for maintaining competitive positioning and customer service levels.

Partnership ecosystems play crucial roles in market development as solution providers collaborate with system integrators, content creators, and technology partners to deliver comprehensive offerings. These partnerships enable market expansion and specialized expertise development.

Regulatory evolution influences market dynamics as governments develop new standards for digital advertising, data privacy, and technical specifications. Staying ahead of regulatory changes becomes essential for sustained market participation and growth.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East and Africa digital signage market. Primary research includes extensive interviews with industry stakeholders, solution providers, system integrators, and end users across key markets in the region.

Data collection processes incorporate both quantitative and qualitative research approaches. Structured surveys capture market sizing data, adoption rates, and technology preferences, while in-depth interviews provide insights into market drivers, challenges, and future trends affecting the digital signage ecosystem.

Secondary research leverages industry reports, government statistics, trade association data, and company financial information to validate primary research findings and provide comprehensive market context. This approach ensures robust data triangulation and accuracy in market assessments.

Regional segmentation methodology accounts for the diverse economic, cultural, and technological landscapes across the Middle East and Africa. Separate analysis frameworks address the unique characteristics of GCC countries, North African markets, and sub-Saharan African economies.

Technology assessment includes detailed evaluation of hardware components, software platforms, and emerging technologies affecting the digital signage market. This technical analysis provides insights into innovation trends and future market evolution patterns.

Market validation processes include expert panel reviews, stakeholder feedback sessions, and cross-referencing with multiple data sources to ensure accuracy and reliability of market insights and projections.

Gulf Cooperation Council (GCC) countries dominate the regional digital signage market, accounting for approximately 58% of total market activity. The UAE leads with sophisticated retail and hospitality sectors driving demand for premium digital signage solutions, while Saudi Arabia shows rapid growth driven by Vision 2030 initiatives and mega-project developments.

North African markets demonstrate strong growth potential, with Egypt, Morocco, and Tunisia showing increasing adoption rates. These markets benefit from growing tourism sectors, retail modernization, and government digitization initiatives. Egypt’s large population and economic development create substantial opportunities for digital signage deployment across multiple sectors.

South Africa represents the largest market in sub-Saharan Africa, with well-developed retail and corporate sectors driving steady demand for digital signage solutions. The country’s advanced infrastructure and established technology ecosystem support sophisticated digital signage deployments across major metropolitan areas.

West African markets, particularly Nigeria, Ghana, and Ivory Coast, show accelerating adoption as economic growth and urbanization create new opportunities. Nigeria’s large population and growing middle class drive demand for retail and corporate digital signage solutions, while infrastructure development supports market expansion.

East African economies including Kenya, Ethiopia, and Tanzania demonstrate emerging market potential as infrastructure development and economic growth create foundations for digital signage adoption. These markets show particular strength in transportation and public sector applications.

Market penetration rates vary significantly across the region, with GCC countries showing 73% urban market penetration compared to 28% average penetration in emerging African markets, indicating substantial growth potential in developing economies.

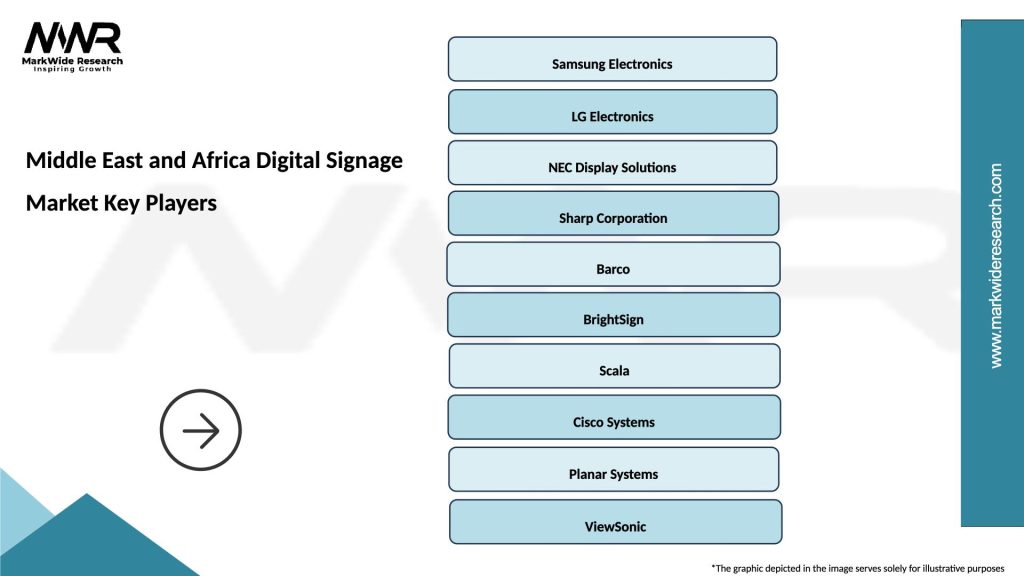

Market leadership in the Middle East and Africa digital signage sector includes a diverse mix of global technology companies and regional specialists, each bringing unique strengths and market positioning strategies.

Regional players complement global companies by providing specialized local expertise, cultural understanding, and customized solutions for specific market requirements. These companies often serve as system integrators and value-added resellers for international technology providers.

Competitive strategies focus on technology innovation, local partnership development, and comprehensive service offerings that address the unique requirements of Middle Eastern and African markets. Companies increasingly emphasize total cost of ownership, reliability, and ongoing support capabilities.

Technology-based segmentation reveals distinct market preferences and growth patterns across different display technologies and solution types in the Middle East and Africa digital signage market.

By Display Technology:

By Application Sector:

By Installation Type:

Retail digital signage demonstrates the strongest growth momentum in the Middle East and Africa, driven by shopping mall expansion and international retail brand presence. These installations focus on promotional content, wayfinding, and customer engagement, with increasing emphasis on interactive capabilities and mobile integration.

Transportation applications show consistent growth as infrastructure development creates new airports, metro systems, and bus rapid transit networks. These installations require robust, reliable solutions capable of delivering real-time information in multiple languages while withstanding high-traffic environments.

Outdoor advertising represents a significant opportunity category, particularly in major metropolitan areas where traditional billboard advertising is being replaced by dynamic digital displays. These installations require high-brightness capabilities and weather resistance suitable for extreme regional climate conditions.

Corporate communications category shows steady growth as organizations recognize digital signage as essential for internal communications, safety messaging, and brand reinforcement. These applications often integrate with existing IT infrastructure and business systems for automated content delivery.

Healthcare digital signage emerges as a growing category driven by hospital modernization and patient experience improvement initiatives. These installations focus on wayfinding, patient information, and health education content delivery in multilingual formats.

Interactive solutions represent the fastest-growing category across all applications, with 62% annual growth rate as organizations seek enhanced customer engagement capabilities. These solutions incorporate touch screens, gesture recognition, and mobile device integration for comprehensive interactive experiences.

Technology providers benefit from the region’s rapid economic development and infrastructure investment, creating substantial opportunities for hardware and software sales. The diverse market requirements enable companies to develop specialized solutions and establish long-term customer relationships across multiple sectors.

System integrators gain from the complex, multilingual requirements that necessitate specialized expertise and local knowledge. The region’s diverse regulatory environment and cultural considerations create barriers to entry that protect established integrators while providing opportunities for expansion.

Content creators benefit from increasing demand for culturally appropriate, multilingual content that complies with local regulations and customs. The region’s emphasis on high-quality customer experiences creates opportunities for premium content development and ongoing content management services.

End-user organizations gain competitive advantages through enhanced customer engagement, improved operational efficiency, and measurable return on investment. Digital signage enables organizations to communicate more effectively with diverse audiences while providing valuable analytics and insights.

Real estate developers benefit from digital signage as a value-added amenity that enhances property attractiveness and enables additional revenue streams through advertising opportunities. Modern buildings with integrated digital signage command premium rents and attract quality tenants.

Government entities leverage digital signage for public information dissemination, emergency communications, and smart city initiatives. These applications improve citizen services while supporting economic development and modernization objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-based content management emerges as the dominant trend, with organizations increasingly preferring Software-as-a-Service solutions that enable centralized control across distributed locations. This trend reflects the region’s geographic diversity and the need for efficient content management across multiple time zones and cultural contexts.

Artificial intelligence integration gains momentum as organizations seek automated content optimization, predictive maintenance, and advanced analytics capabilities. AI-powered solutions enable personalized content delivery based on audience demographics, time of day, and environmental factors.

Interactive touchscreen adoption accelerates across all sectors as organizations recognize the value of customer engagement and data collection. These solutions incorporate gesture recognition, mobile device integration, and multi-language support for comprehensive user experiences.

Sustainability focus drives demand for energy-efficient displays and environmentally responsible solutions. Organizations increasingly consider total environmental impact, including energy consumption, component recyclability, and carbon footprint reduction in their digital signage decisions.

Integration with mobile devices becomes standard as customers expect seamless connectivity between digital signage and their smartphones. QR codes, NFC technology, and mobile apps enable enhanced interactivity and personalized content delivery.

Real-time data integration enables dynamic content that responds to current conditions, inventory levels, weather, traffic, and other relevant factors. This capability transforms digital signage from static displays to intelligent communication systems that provide timely, relevant information.

Major infrastructure projects throughout the region create substantial opportunities for digital signage deployment. Projects like NEOM in Saudi Arabia, the New Administrative Capital in Egypt, and various smart city initiatives require comprehensive digital communication systems.

Technology partnerships between global providers and regional integrators accelerate market development and localization capabilities. These collaborations enable better understanding of local requirements while leveraging international technological expertise and resources.

Regulatory standardization efforts across GCC countries create more consistent requirements for digital signage deployment, reducing compliance complexity and enabling more efficient market expansion strategies for solution providers.

Educational sector adoption accelerates as universities and schools modernize their communication systems. The COVID-19 pandemic has particularly highlighted the importance of digital communication capabilities for emergency notifications and health information dissemination.

Healthcare digitization drives adoption of digital signage solutions for patient information, wayfinding, and health education. Modern hospitals and clinics increasingly recognize digital signage as essential for improving patient experience and operational efficiency.

Retail format evolution toward experiential shopping creates demand for immersive digital signage solutions that enhance customer engagement and brand differentiation. Shopping malls and retail stores increasingly compete on technological sophistication and customer experience quality.

Market entry strategies should prioritize partnership development with established local integrators who understand regional requirements, cultural nuances, and regulatory environments. MWR analysis indicates that successful market penetration requires combination of global technological capabilities with local market expertise and cultural understanding.

Technology focus should emphasize climate-resistant solutions capable of operating in extreme temperature conditions while maintaining high visibility in bright ambient light. Organizations should invest in robust cooling systems, high-brightness displays, and weather-resistant enclosures for outdoor applications.

Content management capabilities must address multilingual requirements, cultural sensitivity, and regulatory compliance across diverse markets. Solutions should incorporate sophisticated approval workflows, automated translation capabilities, and cultural content filtering to ensure appropriate messaging.

Service model development should emphasize comprehensive support including installation, training, ongoing maintenance, and content creation services. The region’s technical expertise limitations create opportunities for service-oriented business models that provide complete solution management.

Pricing strategies should accommodate diverse economic conditions across the region, with flexible financing options and scalable solutions that enable market penetration across different economic segments. Leasing and subscription models can reduce barriers to entry for smaller organizations.

Innovation investment should focus on AI integration, mobile connectivity, and IoT capabilities that provide measurable business value and competitive differentiation. Organizations should prioritize solutions that deliver clear return on investment and operational improvements.

Market growth projections indicate continued expansion driven by economic diversification, infrastructure development, and technological advancement throughout the Middle East and Africa. The sector is expected to maintain robust growth rates as digital transformation initiatives accelerate across multiple industries and geographic markets.

Technology evolution will focus on increased intelligence, interactivity, and integration capabilities. Future digital signage solutions will incorporate advanced AI, machine learning, and IoT connectivity to deliver personalized, context-aware experiences that provide measurable business value for organizations.

Market maturation in developed regional markets will drive focus toward replacement cycles, upgrade opportunities, and value-added services. Emerging markets will continue to show strong growth as infrastructure development and economic advancement create new deployment opportunities.

Sector diversification will expand beyond traditional retail and advertising applications to include healthcare, education, smart cities, and industrial applications. These sectors offer substantial growth potential as organizations recognize digital signage as essential infrastructure for modern operations.

Regional integration efforts may create more standardized requirements and larger addressable markets as trade agreements and economic cooperation initiatives reduce barriers between countries. This integration could accelerate technology adoption and market development across the region.

Sustainability requirements will increasingly influence technology choices as organizations prioritize environmental responsibility and energy efficiency. Future solutions will emphasize renewable energy integration, component recyclability, and reduced environmental impact throughout the product lifecycle.

The Middle East and Africa digital signage market represents a dynamic, rapidly evolving sector with substantial growth potential driven by economic development, infrastructure investment, and technological advancement. The region’s unique characteristics, including diverse cultural requirements, extreme climate conditions, and varying economic development levels, create both opportunities and challenges for market participants.

Market fundamentals remain strong with robust demand across retail, transportation, hospitality, and emerging sectors including healthcare and education. The region’s young, tech-savvy population and increasing smartphone penetration create favorable conditions for digital signage adoption and interactive solution development.

Success factors for market participants include understanding local requirements, developing appropriate partnerships, and delivering solutions that address the region’s specific challenges including climate resilience, multilingual support, and cultural sensitivity. Organizations that can combine global technological capabilities with local market expertise will be best positioned for sustained growth.

Future market development will be characterized by increased intelligence, interactivity, and integration as digital signage evolves from simple display systems to comprehensive communication platforms. The integration of AI, IoT, and mobile technologies will create new value propositions and business models that drive continued market expansion throughout the Middle East and Africa digital signage market.

What is Digital Signage?

Digital signage refers to the use of digital displays to convey information, advertisements, and other content in various settings such as retail, transportation, and corporate environments. It encompasses technologies like LCD, LED, and projection systems.

What are the key players in the Middle East and Africa Digital Signage Market?

Key players in the Middle East and Africa Digital Signage Market include Samsung Electronics, LG Display, and NEC Display Solutions, among others. These companies are known for their innovative display technologies and solutions tailored for various industries.

What are the growth factors driving the Middle East and Africa Digital Signage Market?

The growth of the Middle East and Africa Digital Signage Market is driven by increasing demand for interactive displays, the rise of smart cities, and the growing adoption of digital advertising in retail and transportation sectors.

What challenges does the Middle East and Africa Digital Signage Market face?

Challenges in the Middle East and Africa Digital Signage Market include high initial investment costs, the need for technical expertise, and issues related to content management and integration with existing systems.

What opportunities exist in the Middle East and Africa Digital Signage Market?

Opportunities in the Middle East and Africa Digital Signage Market include the expansion of e-commerce, advancements in display technology, and the increasing use of digital signage in public spaces for information dissemination.

What trends are shaping the Middle East and Africa Digital Signage Market?

Trends in the Middle East and Africa Digital Signage Market include the integration of AI and machine learning for personalized content delivery, the rise of cloud-based solutions for content management, and the growing focus on sustainability in display technologies.

Middle East and Africa Digital Signage Market

| Segmentation Details | Description |

|---|---|

| Product Type | LED, LCD, OLED, Projection |

| Technology | Cloud-Based, On-Premise, Interactive, Digital Signage Software |

| End User | Retail, Transportation, Education, Healthcare |

| Installation | Indoor, Outdoor, Wall-Mounted, Freestanding |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Digital Signage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at