444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa diabetes treatment market represents one of the fastest-growing healthcare segments in the region, driven by alarming diabetes prevalence rates and increasing healthcare infrastructure investments. This comprehensive market encompasses a wide range of therapeutic solutions, including insulin therapies, oral antidiabetic drugs, glucose monitoring devices, and advanced diabetes management technologies. Regional diabetes prevalence has reached critical levels, with the Middle East experiencing some of the highest diabetes rates globally at approximately 12.8% of the adult population.

Market dynamics in the Middle East and Africa are characterized by significant healthcare transformation initiatives, government-led diabetes awareness programs, and substantial investments in medical infrastructure. The region’s unique demographic profile, including high obesity rates, sedentary lifestyles, and genetic predisposition, contributes to the escalating diabetes burden. Healthcare expenditure on diabetes management has increased substantially, with governments allocating greater resources to address this growing health crisis.

Technological advancement in diabetes care delivery has accelerated across the region, with digital health solutions, continuous glucose monitoring systems, and insulin delivery devices gaining significant traction. The market demonstrates robust growth potential, supported by increasing healthcare accessibility, rising patient awareness, and expanding insurance coverage for diabetes treatments.

The Middle East and Africa diabetes treatment market refers to the comprehensive ecosystem of pharmaceutical products, medical devices, and healthcare services designed to manage and treat diabetes mellitus across the MEA region. This market encompasses both Type 1 and Type 2 diabetes management solutions, including insulin formulations, oral medications, glucose monitoring systems, and supportive care technologies.

Market scope extends beyond traditional pharmaceutical interventions to include digital health platforms, telemedicine solutions, diabetes education programs, and integrated care management systems. The definition encompasses all therapeutic approaches, from basic blood glucose testing strips to sophisticated continuous glucose monitoring devices and insulin pump technologies.

Regional characteristics define this market through unique healthcare delivery models, varying regulatory frameworks, and diverse economic conditions across different countries. The market addresses the specific needs of populations with high genetic susceptibility to diabetes, particularly in Gulf Cooperation Council countries, while also serving emerging healthcare markets across sub-Saharan Africa.

Strategic market positioning reveals the Middle East and Africa diabetes treatment market as a high-growth opportunity driven by demographic trends, lifestyle changes, and healthcare infrastructure development. The region faces a dual challenge of managing existing diabetes cases while preventing new diagnoses through comprehensive care strategies.

Key growth drivers include government healthcare initiatives, increasing diabetes awareness campaigns, and expanding access to advanced treatment options. The market benefits from significant pharmaceutical investments, with international companies establishing regional manufacturing facilities and distribution networks. Digital health adoption has accelerated, with approximately 38% of diabetes patients now utilizing some form of digital monitoring or management tool.

Market segmentation demonstrates strong performance across multiple categories, with insulin therapies maintaining dominant market share while oral antidiabetic drugs show rapid adoption rates. The glucose monitoring segment experiences particularly strong growth, driven by increased patient self-management awareness and healthcare provider recommendations for regular monitoring.

Competitive landscape features both global pharmaceutical giants and emerging regional players, creating a dynamic environment for innovation and market expansion. Strategic partnerships between international companies and local healthcare providers have become increasingly common, facilitating market penetration and patient access improvements.

Primary market insights reveal several critical trends shaping the Middle East and Africa diabetes treatment landscape:

Market intelligence indicates that patient-centric care models are gaining prominence, with healthcare providers focusing on personalized treatment approaches and comprehensive diabetes management programs. The integration of artificial intelligence and machine learning technologies in glucose monitoring and insulin dosing recommendations represents a significant advancement in regional diabetes care.

Demographic transformation serves as the primary market driver, with rapidly aging populations and increasing urbanization contributing to higher diabetes incidence rates. The region’s young population faces elevated risk factors, including sedentary lifestyles, processed food consumption, and genetic predisposition, creating sustained demand for diabetes treatment solutions.

Government healthcare initiatives provide substantial market momentum through national diabetes strategies, screening programs, and treatment subsidies. Countries across the region have implemented comprehensive diabetes care policies, including mandatory health insurance coverage for diabetes medications and regular monitoring supplies. Healthcare spending on diabetes management has increased by approximately 45% over the past five years, reflecting government commitment to addressing this health crisis.

Economic prosperity in Gulf countries enables significant healthcare investments, while emerging African markets benefit from international development aid and healthcare infrastructure projects. The expansion of private healthcare sectors creates additional market opportunities, particularly for premium diabetes management solutions and advanced monitoring technologies.

Technological advancement drives market growth through improved treatment efficacy, patient convenience, and healthcare provider efficiency. The introduction of long-acting insulin formulations, continuous glucose monitoring systems, and smartphone-integrated diabetes management apps has revolutionized patient care experiences and treatment outcomes.

Economic disparities across the region create significant market access challenges, with treatment affordability remaining a primary concern for many patients. Despite government subsidies, out-of-pocket expenses for advanced diabetes management technologies can be prohibitive, particularly in lower-income countries and rural areas.

Healthcare infrastructure limitations in certain regions restrict market growth, including inadequate cold chain storage for insulin products, limited specialist availability, and insufficient diabetes education resources. Rural healthcare access remains challenging, with approximately 35% of diabetes patients lacking regular access to specialized care services.

Regulatory complexities across multiple countries create market entry barriers for pharmaceutical companies and medical device manufacturers. Varying approval processes, registration requirements, and quality standards can delay product launches and increase compliance costs. Cultural and linguistic diversity requires tailored patient education materials and healthcare provider training programs.

Supply chain vulnerabilities occasionally disrupt medication availability, particularly for temperature-sensitive insulin products. Import dependencies for many diabetes medications and devices create potential shortages during economic or political instabilities, affecting patient treatment continuity.

Digital health expansion presents tremendous opportunities for innovative diabetes management solutions, including telemedicine platforms, AI-powered glucose prediction algorithms, and integrated care coordination systems. The growing smartphone penetration and internet connectivity across the region enable widespread adoption of digital diabetes management tools.

Preventive care initiatives offer substantial market potential through early intervention programs, lifestyle modification support, and prediabetes management solutions. Corporate wellness programs increasingly include diabetes screening and prevention services, creating new market segments for healthcare providers and pharmaceutical companies.

Regional manufacturing opportunities emerge as governments encourage local pharmaceutical production through incentives, tax benefits, and regulatory support. Establishing regional manufacturing facilities can reduce costs, improve supply chain reliability, and create employment opportunities while serving growing market demand.

Public-private partnerships enable innovative financing models for diabetes care delivery, including outcome-based contracts, shared savings programs, and integrated care management initiatives. These collaborations can expand treatment access while ensuring sustainable healthcare delivery models.

Supply-demand equilibrium in the Middle East and Africa diabetes treatment market reflects complex interactions between increasing patient populations, expanding treatment options, and evolving healthcare delivery models. Demand acceleration continues outpacing supply capacity in many regions, creating opportunities for market expansion and innovation.

Competitive dynamics intensify as global pharmaceutical companies compete with regional players and generic manufacturers. Price competition remains significant, particularly for established diabetes medications, while innovation-driven segments command premium pricing. Market consolidation trends include strategic acquisitions and partnerships to strengthen regional presence and expand product portfolios.

Regulatory evolution influences market dynamics through streamlined approval processes, harmonized standards, and enhanced post-market surveillance requirements. MarkWide Research analysis indicates that regulatory improvements have reduced average product approval times by approximately 25% across major regional markets.

Technology disruption reshapes traditional diabetes care delivery models, with digital health solutions enabling remote monitoring, personalized treatment recommendations, and improved patient engagement. The integration of artificial intelligence and machine learning technologies creates new possibilities for predictive diabetes management and complications prevention.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East and Africa diabetes treatment market. Primary research includes extensive interviews with healthcare professionals, pharmaceutical executives, regulatory officials, and diabetes patients across representative countries in the region.

Data collection strategies incorporate both quantitative and qualitative research approaches, including structured surveys, focus group discussions, and in-depth expert interviews. Secondary research leverages government health statistics, pharmaceutical industry reports, academic publications, and international health organization databases to validate primary findings.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing patient population data, treatment penetration rates, and healthcare expenditure patterns. Regional variations in healthcare systems, economic conditions, and diabetes prevalence rates require country-specific analysis and aggregation methodologies.

Quality assurance protocols ensure data accuracy through triangulation of multiple sources, expert validation, and statistical verification processes. Continuous monitoring of market developments and regular research updates maintain the relevance and accuracy of market insights and projections.

Gulf Cooperation Council countries dominate the regional diabetes treatment market, accounting for approximately 55% of total market share despite representing a smaller population base. These countries benefit from advanced healthcare infrastructure, comprehensive insurance coverage, and high per-capita healthcare spending, enabling access to premium diabetes management solutions.

Saudi Arabia leads the regional market with extensive government healthcare investments, national diabetes strategies, and widespread availability of advanced treatment options. The country’s Vision 2030 initiative includes significant healthcare transformation goals, with diabetes care improvement as a priority focus area.

United Arab Emirates demonstrates strong market growth through healthcare innovation initiatives, medical tourism development, and strategic partnerships with international pharmaceutical companies. The country serves as a regional hub for clinical trials and new product launches.

North African markets show substantial growth potential, with Egypt representing the largest patient population in the region. Government subsidies for diabetes medications and expanding healthcare infrastructure create favorable market conditions, though economic challenges affect premium product adoption rates.

Sub-Saharan Africa presents emerging opportunities with increasing healthcare investments, international development partnerships, and growing awareness of diabetes management importance. Market penetration remains relatively low at approximately 28% of diagnosed patients receiving regular treatment, indicating significant growth potential.

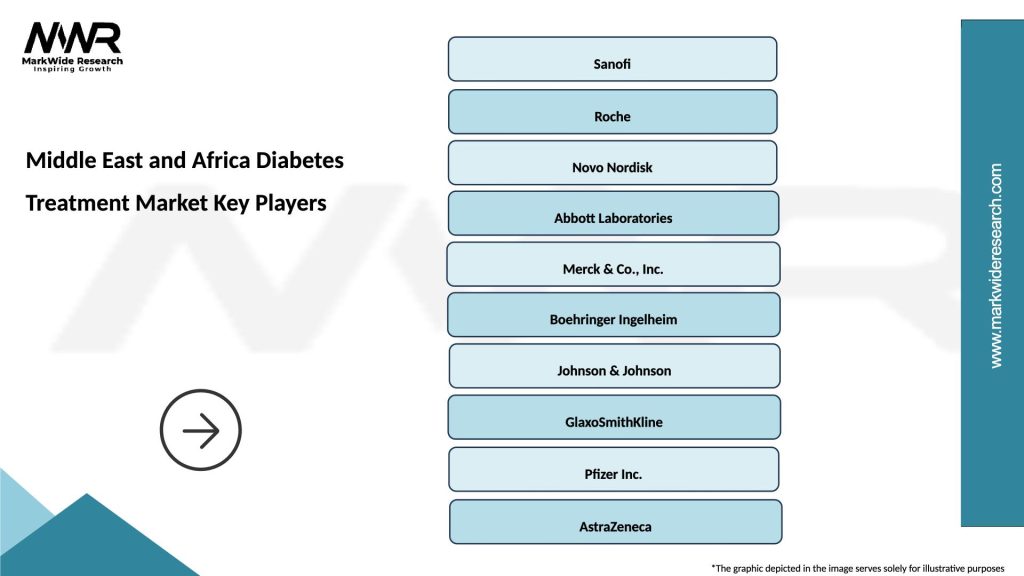

Market leadership in the Middle East and Africa diabetes treatment sector is characterized by intense competition among global pharmaceutical giants and emerging regional players. The competitive environment features diverse strategies including product innovation, strategic partnerships, and market access initiatives.

Leading market participants include:

Competitive strategies focus on product differentiation, patient access programs, healthcare provider education, and digital health integration. Companies increasingly invest in regional manufacturing capabilities, local partnerships, and tailored market approaches to address diverse regional needs and regulatory requirements.

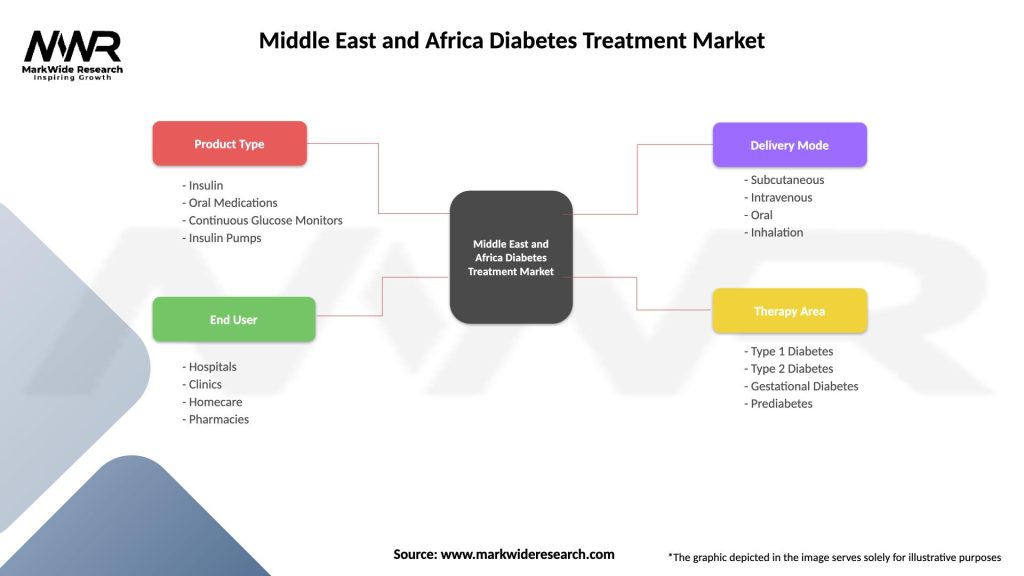

By Product Type:

By Diabetes Type:

By Distribution Channel:

Insulin Therapies Category maintains market dominance through continuous innovation in formulation technologies, delivery devices, and patient convenience features. Long-acting insulin analogs show particularly strong adoption rates, with healthcare providers preferring their improved glycemic control and reduced hypoglycemia risk. The category benefits from expanding insurance coverage and government subsidies across the region.

Oral Antidiabetic Drugs demonstrate robust growth driven by increasing Type 2 diabetes prevalence and patient preference for oral medications. Metformin remains the first-line treatment choice, while newer drug classes like SGLT-2 inhibitors and GLP-1 receptor agonists gain market share through superior efficacy and cardiovascular benefits.

Glucose Monitoring Segment experiences rapid transformation through technological advancement and increased patient self-management awareness. Continuous glucose monitoring adoption accelerates, particularly among Type 1 diabetes patients and insulin-dependent Type 2 patients. Traditional glucometer sales remain stable, supported by affordability and widespread availability.

Digital Health Solutions emerge as a high-growth category, encompassing mobile applications, telemedicine platforms, and integrated diabetes management systems. Patient engagement through digital tools shows significant improvement in treatment adherence and glycemic control outcomes.

Pharmaceutical Companies benefit from substantial market growth opportunities, driven by increasing patient populations and expanding treatment access. The region offers attractive return on investment potential through premium pricing for innovative products and growing healthcare expenditure. Strategic partnerships with local distributors and healthcare providers facilitate market penetration and brand establishment.

Healthcare Providers gain access to advanced diabetes management tools, improving patient outcomes and care efficiency. Comprehensive diabetes care programs enable healthcare systems to address the growing disease burden while optimizing resource utilization. Clinical outcomes improve through better treatment options and patient monitoring capabilities.

Patients experience enhanced quality of life through improved treatment access, better medication options, and comprehensive care support. Government subsidies and insurance coverage expansion reduce financial barriers to essential diabetes treatments. Treatment adherence improves through patient education programs and simplified dosing regimens.

Government Healthcare Systems achieve better population health outcomes through effective diabetes management programs, reducing long-term complications and healthcare costs. Strategic investments in diabetes care infrastructure generate economic benefits through reduced disability rates and improved workforce productivity.

Investors find attractive opportunities in the growing diabetes treatment market, with consistent demand growth and innovation-driven returns. The market’s defensive characteristics and essential nature provide stability during economic uncertainties.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized Medicine emerges as a dominant trend, with healthcare providers increasingly adopting individualized treatment approaches based on patient genetics, lifestyle factors, and treatment response patterns. Precision diabetes care utilizes advanced diagnostics and biomarker analysis to optimize treatment selection and dosing strategies.

Digital Health Integration accelerates across the region, with artificial intelligence and machine learning technologies enhancing glucose prediction, insulin dosing recommendations, and complication risk assessment. Mobile health applications and connected devices enable continuous patient monitoring and real-time treatment adjustments.

Value-Based Care Models gain traction as healthcare systems focus on patient outcomes rather than treatment volume. Outcome-based contracts between pharmaceutical companies and healthcare providers align incentives toward improved glycemic control and reduced complications.

Combination Therapy Adoption increases as healthcare providers recognize the benefits of multi-mechanism approaches to diabetes management. Fixed-dose combinations improve patient compliance while providing superior glycemic control compared to monotherapy approaches.

Preventive Care Emphasis grows through comprehensive screening programs, lifestyle intervention initiatives, and prediabetes management strategies. Population health management approaches address diabetes risk factors at community levels, potentially reducing future treatment demand.

Regulatory Harmonization initiatives across Gulf Cooperation Council countries streamline pharmaceutical approval processes and facilitate regional product launches. The unified regulatory framework reduces compliance costs and accelerates patient access to innovative diabetes treatments.

Manufacturing Investments by international pharmaceutical companies establish regional production capabilities, improving supply chain reliability and reducing medication costs. Local manufacturing initiatives support government economic diversification goals while ensuring treatment availability.

Strategic Partnerships between global pharmaceutical companies and regional healthcare providers create comprehensive diabetes care networks. These collaborations combine international expertise with local market knowledge to deliver culturally appropriate and accessible diabetes management solutions.

Technology Acquisitions by established pharmaceutical companies expand digital health capabilities and patient engagement platforms. MarkWide Research data indicates that digital health investments in the diabetes sector have increased by approximately 180% over the past three years.

Clinical Trial Expansion in the region provides local patients with access to cutting-edge diabetes treatments while generating valuable real-world evidence for regulatory approvals. The growing clinical research infrastructure supports innovation and accelerates new product development.

Market Entry Strategies should prioritize government partnerships and regulatory compliance to ensure successful product launches and market penetration. Companies entering the region should invest in local expertise and cultural understanding to navigate diverse market conditions effectively.

Product Development Focus should emphasize affordability, ease of use, and cultural appropriateness to maximize market acceptance. Innovation priorities should include heat-stable formulations, simplified dosing regimens, and multilingual patient education materials.

Distribution Network Optimization requires strategic partnerships with established regional distributors and healthcare providers. Companies should invest in cold chain infrastructure and rural healthcare access initiatives to expand market reach and ensure product availability.

Digital Health Investment represents a critical success factor for future market competitiveness. Companies should develop or acquire digital health capabilities to enhance patient engagement, improve treatment outcomes, and differentiate their market offerings.

Regulatory Strategy should focus on early engagement with regulatory authorities and harmonized approval strategies across multiple countries. Proactive regulatory planning can significantly reduce time-to-market and compliance costs.

Market growth trajectory remains strongly positive, driven by demographic trends, healthcare infrastructure investments, and increasing diabetes awareness. The region is projected to experience continued robust growth, with compound annual growth rates expected to exceed global averages significantly over the next decade.

Technology integration will accelerate, with artificial intelligence, machine learning, and Internet of Things technologies becoming standard components of diabetes care delivery. Digital health adoption is projected to reach approximately 75% of diabetes patients within the next five years, transforming traditional care models.

Treatment paradigm shifts toward prevention and early intervention will create new market segments and opportunities. MWR analysis suggests that preventive care investments could reduce long-term diabetes treatment costs by up to 40% while improving population health outcomes.

Regional manufacturing expansion will continue as governments promote healthcare sector localization and supply chain independence. Local production capabilities will improve treatment affordability and accessibility while supporting economic diversification objectives.

Regulatory evolution will facilitate faster product approvals and harmonized standards across the region, reducing market entry barriers and accelerating innovation adoption. Enhanced post-market surveillance and real-world evidence requirements will ensure patient safety while supporting continued market growth.

The Middle East and Africa diabetes treatment market represents a compelling growth opportunity characterized by strong fundamentals, supportive government policies, and significant unmet medical needs. The region’s unique combination of high diabetes prevalence, increasing healthcare investments, and technological advancement creates favorable conditions for sustained market expansion.

Strategic market positioning requires understanding of diverse regional dynamics, regulatory requirements, and cultural considerations. Success in this market depends on comprehensive approaches that address affordability, accessibility, and clinical effectiveness while respecting local healthcare delivery preferences and patient needs.

Innovation and technology integration will continue driving market evolution, with digital health solutions, personalized medicine approaches, and advanced diabetes management technologies reshaping traditional care models. Companies that invest in these capabilities while maintaining focus on patient outcomes and healthcare system sustainability will achieve competitive advantages.

The future outlook remains highly positive, with demographic trends, economic development, and healthcare infrastructure improvements supporting continued robust growth. The market’s essential nature and defensive characteristics provide stability and predictable returns, making it an attractive opportunity for pharmaceutical companies, healthcare providers, and investors seeking exposure to growing healthcare markets with significant social impact potential.

What is Diabetes Treatment?

Diabetes Treatment refers to the various medical interventions and lifestyle changes aimed at managing diabetes, a chronic condition that affects how the body processes blood sugar. This includes insulin therapy, oral medications, dietary modifications, and regular monitoring of blood glucose levels.

What are the key players in the Middle East and Africa Diabetes Treatment Market?

Key players in the Middle East and Africa Diabetes Treatment Market include Novo Nordisk, Sanofi, and Merck, among others. These companies are involved in the development and distribution of insulin products, oral hypoglycemics, and diabetes management devices.

What are the growth factors driving the Middle East and Africa Diabetes Treatment Market?

The growth of the Middle East and Africa Diabetes Treatment Market is driven by increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in treatment technologies. Additionally, government initiatives to improve healthcare access contribute to market expansion.

What challenges does the Middle East and Africa Diabetes Treatment Market face?

The Middle East and Africa Diabetes Treatment Market faces challenges such as limited access to healthcare facilities, high costs of diabetes medications, and varying levels of awareness among the population. These factors can hinder effective diabetes management and treatment adherence.

What opportunities exist in the Middle East and Africa Diabetes Treatment Market?

Opportunities in the Middle East and Africa Diabetes Treatment Market include the potential for innovative treatment solutions, increased investment in healthcare infrastructure, and the growing demand for personalized medicine. These factors can enhance patient outcomes and expand market reach.

What trends are shaping the Middle East and Africa Diabetes Treatment Market?

Trends shaping the Middle East and Africa Diabetes Treatment Market include the rise of digital health technologies, such as mobile health applications for diabetes management, and the increasing focus on preventive care. Additionally, there is a growing emphasis on patient education and self-management strategies.

Middle East and Africa Diabetes Treatment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Medications, Continuous Glucose Monitors, Insulin Pumps |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Delivery Mode | Subcutaneous, Intravenous, Oral, Inhalation |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Diabetes Treatment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at