444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa diabetes drugs treatment market represents a rapidly expanding healthcare sector driven by increasing diabetes prevalence, growing healthcare awareness, and improving medical infrastructure across the region. This market encompasses a comprehensive range of therapeutic solutions including insulin preparations, oral antidiabetic medications, injectable non-insulin therapies, and combination drug formulations designed to manage both Type 1 and Type 2 diabetes mellitus.

Regional dynamics indicate significant growth potential, with the market experiencing robust expansion at a CAGR of 8.2% during the forecast period. The increasing burden of diabetes across Middle Eastern and African nations has created substantial demand for effective treatment options, positioning this market as one of the fastest-growing pharmaceutical segments in the region.

Healthcare transformation initiatives across countries like Saudi Arabia, UAE, Egypt, and South Africa are driving improved access to diabetes medications and treatment protocols. The market benefits from government healthcare reforms, insurance coverage expansion, and growing private healthcare investments that collectively enhance patient access to essential diabetes therapies.

Demographic trends show alarming increases in diabetes prevalence, with approximately 73 million adults currently living with diabetes across the Middle East and North Africa region alone. This epidemiological shift, combined with rising obesity rates and sedentary lifestyles, continues to fuel demand for comprehensive diabetes management solutions.

The Middle East and Africa diabetes drugs treatment market refers to the comprehensive pharmaceutical ecosystem encompassing all therapeutic medications, delivery systems, and treatment protocols specifically designed to manage diabetes mellitus across the diverse healthcare landscapes of Middle Eastern and African nations. This market includes prescription medications, over-the-counter supplements, medical devices for drug delivery, and integrated treatment solutions that address the complex needs of diabetic patients in these regions.

Market scope extends beyond traditional pharmaceutical products to include innovative drug delivery mechanisms, combination therapies, and personalized treatment approaches that cater to the unique genetic, cultural, and socioeconomic factors prevalent across Middle Eastern and African populations. The market encompasses both established therapeutic categories and emerging treatment modalities that represent the evolving landscape of diabetes care.

Geographic coverage includes major markets such as Saudi Arabia, United Arab Emirates, Egypt, South Africa, Nigeria, Morocco, and other significant economies where diabetes prevalence continues to rise. Each regional market presents distinct regulatory environments, healthcare infrastructure capabilities, and patient access patterns that collectively shape the overall market dynamics.

Market leadership in the Middle East and Africa diabetes drugs treatment sector is characterized by strong growth momentum driven by epidemiological trends, healthcare infrastructure development, and increasing patient awareness. The market demonstrates exceptional resilience and expansion potential, supported by government healthcare initiatives and growing private sector investments in diabetes care solutions.

Key growth drivers include rising diabetes prevalence rates, which have increased by 35% over the past decade across the region, coupled with improved healthcare access and insurance coverage expansion. The market benefits from increasing urbanization, changing dietary patterns, and growing awareness of diabetes complications that drive demand for effective treatment options.

Therapeutic innovation continues to reshape market dynamics, with advanced insulin formulations, GLP-1 receptor agonists, and combination therapies gaining significant market traction. These innovations address unmet medical needs while providing healthcare providers with more effective tools for diabetes management across diverse patient populations.

Regional variations in market development reflect different healthcare maturity levels, with Gulf Cooperation Council countries leading in terms of treatment accessibility and advanced therapeutic adoption, while African markets show strong growth potential driven by improving healthcare infrastructure and increasing disease awareness programs.

Strategic market positioning reveals several critical insights that define the current and future landscape of diabetes treatment across the Middle East and Africa region:

Epidemiological factors serve as the primary catalyst for market expansion, with diabetes prevalence continuing to rise across all age groups and demographic segments. The increasing incidence of Type 2 diabetes, particularly among younger populations, creates sustained demand for comprehensive treatment solutions that address both immediate therapeutic needs and long-term disease management requirements.

Healthcare infrastructure development across the region significantly enhances market accessibility and treatment delivery capabilities. Government investments in healthcare facilities, medical equipment, and healthcare professional training programs create favorable conditions for diabetes care expansion and improved patient outcomes.

Economic prosperity in key markets, particularly Gulf countries, drives increased healthcare spending and insurance coverage expansion. Rising disposable incomes enable greater access to advanced diabetes treatments, while government healthcare initiatives ensure broader population coverage for essential medications.

Lifestyle transformation associated with urbanization, dietary changes, and reduced physical activity levels contributes to increasing diabetes risk factors across the region. These demographic shifts create sustained market demand while highlighting the importance of comprehensive diabetes prevention and treatment strategies.

Pharmaceutical innovation continues to introduce more effective and convenient treatment options that improve patient compliance and clinical outcomes. Advanced drug formulations, extended-release preparations, and combination therapies address previously unmet medical needs while expanding treatment possibilities for healthcare providers.

Economic disparities across the region create significant challenges in ensuring equitable access to diabetes medications, particularly in lower-income countries where healthcare budgets remain constrained. These economic limitations affect both individual patient access and healthcare system capacity to provide comprehensive diabetes care services.

Regulatory complexities vary significantly across different countries, creating challenges for pharmaceutical companies seeking to introduce new diabetes treatments. Varying approval processes, pricing regulations, and import restrictions can delay market entry and limit treatment availability for patients in need.

Healthcare infrastructure limitations in certain regions restrict the effective delivery of diabetes care services. Insufficient healthcare facilities, limited specialist availability, and inadequate cold chain storage capabilities for insulin products create barriers to optimal treatment delivery.

Cultural and educational barriers sometimes impede effective diabetes management, particularly in communities where traditional medicine practices conflict with modern pharmaceutical interventions. Limited health literacy and cultural stigma associated with chronic disease management can affect treatment adherence and clinical outcomes.

Supply chain challenges including logistics difficulties, customs procedures, and storage requirements for temperature-sensitive medications create operational complexities that can affect product availability and pricing across different markets within the region.

Telemedicine integration presents substantial opportunities for expanding diabetes care access, particularly in remote areas where specialist availability remains limited. Digital health platforms combined with pharmaceutical interventions can create comprehensive care models that improve patient outcomes while reducing healthcare delivery costs.

Public-private partnerships offer significant potential for expanding diabetes treatment access through collaborative healthcare initiatives. These partnerships can leverage government healthcare infrastructure with private sector innovation and efficiency to create scalable diabetes care solutions.

Biosimilar market development creates opportunities for cost-effective diabetes treatment alternatives that can improve accessibility while maintaining therapeutic efficacy. The growing acceptance of biosimilar insulin products opens new market segments and competitive dynamics.

Preventive care programs represent emerging opportunities for pharmaceutical companies to engage in comprehensive diabetes management ecosystems. These programs can integrate medication management with lifestyle interventions and patient education to create holistic treatment approaches.

Personalized medicine approaches offer opportunities to develop targeted therapies that address specific genetic and demographic characteristics prevalent in Middle Eastern and African populations. These specialized treatments can improve clinical outcomes while creating differentiated market positions.

Competitive intensity continues to increase as both international pharmaceutical companies and regional manufacturers expand their diabetes treatment portfolios. This competition drives innovation, improves product accessibility, and creates more favorable pricing dynamics for healthcare systems and patients across the region.

Regulatory harmonization efforts across Gulf Cooperation Council countries and African Union initiatives are gradually creating more streamlined approval processes for diabetes medications. These developments reduce market entry barriers while ensuring consistent quality standards across different jurisdictions.

Healthcare digitization trends are transforming diabetes care delivery through electronic health records, prescription management systems, and patient monitoring platforms. These technological advances create new opportunities for pharmaceutical companies to integrate their products with comprehensive care management solutions.

Insurance coverage expansion across the region improves patient access to diabetes medications while creating more predictable revenue streams for pharmaceutical companies. Government healthcare reforms and private insurance growth collectively enhance market stability and growth potential.

Clinical research expansion in the region provides opportunities for pharmaceutical companies to conduct diabetes studies that address specific population needs while supporting regulatory approvals and market access strategies. Local clinical data strengthens market positioning and physician confidence in treatment options.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Middle East and Africa diabetes drugs treatment market. The research approach combines quantitative data analysis with qualitative insights gathered from industry stakeholders, healthcare professionals, and market participants across the region.

Primary research activities include structured interviews with key opinion leaders, healthcare providers, pharmaceutical executives, and regulatory officials across major markets. These interviews provide firsthand insights into market dynamics, treatment trends, and future opportunities that shape the diabetes treatment landscape.

Secondary research sources encompass government health statistics, pharmaceutical industry reports, clinical trial databases, and academic publications that provide comprehensive background information on diabetes prevalence, treatment patterns, and market developments across the region.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques that confirm findings and eliminate potential biases. This rigorous approach maintains research integrity while providing reliable market intelligence.

Market modeling techniques utilize advanced analytical frameworks to project future market trends, assess competitive dynamics, and evaluate growth opportunities. These models incorporate demographic trends, healthcare policy changes, and economic factors that influence diabetes treatment market development.

Gulf Cooperation Council countries represent the most mature diabetes treatment market segment, with Saudi Arabia and UAE leading in terms of treatment accessibility and advanced therapeutic adoption. These markets benefit from robust healthcare infrastructure, comprehensive insurance coverage, and government initiatives that prioritize diabetes care quality and accessibility.

North African markets including Egypt, Morocco, and Algeria demonstrate strong growth potential driven by large patient populations and improving healthcare systems. Egypt particularly shows significant market expansion with approximately 28% of regional diabetes patients, creating substantial demand for cost-effective treatment solutions.

Sub-Saharan Africa presents emerging opportunities despite infrastructure challenges, with South Africa leading regional market development. Nigeria and Kenya show promising growth trajectories supported by increasing healthcare investments and growing awareness of diabetes management importance.

Market penetration rates vary significantly across countries, with Gulf states achieving 85% treatment coverage compared to 45% in many African markets. This disparity creates opportunities for market expansion while highlighting the need for accessible treatment solutions that address diverse economic conditions.

Regional collaboration initiatives including pharmaceutical procurement programs and regulatory harmonization efforts are creating more integrated market dynamics that benefit both patients and pharmaceutical companies operating across multiple jurisdictions within the region.

Market leadership is distributed among several key pharmaceutical companies that have established strong regional presence through strategic partnerships, local manufacturing, and comprehensive distribution networks:

Competitive strategies focus on product differentiation, pricing optimization, and strategic partnerships with local healthcare providers and distributors. Companies increasingly emphasize patient support programs, healthcare professional education, and digital health integration to create competitive advantages.

Market consolidation trends show increasing collaboration between international pharmaceutical companies and regional partners to leverage local market knowledge while accessing global research and development capabilities.

By Drug Type:

By Diabetes Type:

By Distribution Channel:

Insulin category maintains market dominance through continuous innovation in formulation technology and delivery mechanisms. Long-acting insulin analogs show particularly strong adoption rates due to improved patient convenience and better glycemic control outcomes. The segment benefits from both branded and biosimilar product availability, creating diverse pricing options for different market segments.

Oral antidiabetic medications demonstrate steady growth driven by increasing Type 2 diabetes prevalence and preference for non-injectable treatments. Metformin remains the foundation therapy, while newer drug classes including SGLT-2 inhibitors and DPP-4 inhibitors gain market traction through improved efficacy profiles and reduced side effect risks.

Injectable non-insulin therapies represent the fastest-growing category, with GLP-1 receptor agonists showing exceptional adoption rates among healthcare providers. These medications offer multiple benefits including weight management, cardiovascular protection, and convenient dosing schedules that appeal to both patients and physicians.

Combination therapy products address the growing need for simplified treatment regimens that improve patient adherence while maintaining therapeutic effectiveness. Fixed-dose combinations reduce pill burden and medication complexity, particularly important for elderly patients and those with multiple comorbidities.

Pediatric diabetes treatments constitute a specialized category requiring age-appropriate formulations and dosing considerations. This segment shows growing importance as childhood diabetes rates increase across the region, necessitating specialized treatment approaches and family-centered care models.

Pharmaceutical companies benefit from substantial market growth opportunities driven by increasing diabetes prevalence and expanding healthcare access. The market offers diverse therapeutic categories, multiple distribution channels, and opportunities for both innovative and generic product development that can address different market segments and price points.

Healthcare providers gain access to comprehensive treatment options that enable personalized diabetes management approaches. Advanced therapeutic alternatives, combination products, and digital health integration tools enhance clinical decision-making capabilities while improving patient outcomes and satisfaction levels.

Patients benefit from expanding treatment accessibility, improved medication effectiveness, and growing insurance coverage that reduces out-of-pocket costs. The market evolution provides more convenient dosing options, reduced side effects, and comprehensive care programs that support long-term diabetes management success.

Healthcare systems achieve improved cost-effectiveness through generic medication availability, preventive care programs, and digital health solutions that reduce long-term diabetes complications. These benefits translate into reduced healthcare costs and improved population health outcomes across the region.

Investors find attractive opportunities in a growing market supported by demographic trends, government healthcare initiatives, and technological innovation. The market offers diverse investment options across pharmaceutical manufacturing, distribution, digital health, and healthcare service delivery segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital health integration emerges as a transformative trend reshaping diabetes care delivery across the region. Connected glucose monitoring devices, mobile health applications, and telemedicine platforms create comprehensive care ecosystems that combine pharmaceutical interventions with continuous patient monitoring and support services.

Personalized medicine approaches gain momentum as healthcare providers seek treatment solutions tailored to specific patient populations and genetic characteristics. This trend drives demand for specialized formulations and dosing regimens that address the unique needs of Middle Eastern and African diabetes patients.

Biosimilar adoption accelerates across the region as healthcare systems seek cost-effective alternatives to branded diabetes medications. MarkWide Research indicates that biosimilar insulin products show 22% annual growth in prescription rates, driven by improved accessibility and physician confidence in therapeutic equivalence.

Combination therapy preference increases among healthcare providers seeking simplified treatment regimens that improve patient adherence. Fixed-dose combination products address multiple therapeutic targets while reducing medication complexity and improving clinical outcomes.

Preventive care focus expands beyond traditional treatment approaches to include comprehensive diabetes prevention and early intervention programs. This trend creates opportunities for pharmaceutical companies to engage in broader healthcare ecosystems that address diabetes risk factors and complications.

Regulatory harmonization initiatives across Gulf Cooperation Council countries streamline diabetes medication approval processes, reducing time-to-market for new treatments while ensuring consistent quality standards. These developments facilitate regional market access strategies and improve treatment availability for patients.

Manufacturing capacity expansion by both international and regional pharmaceutical companies enhances local production capabilities for diabetes medications. These investments improve supply chain reliability while creating opportunities for cost-effective treatment options that address diverse market needs.

Strategic partnerships between pharmaceutical companies and healthcare providers create integrated care models that combine medication management with comprehensive diabetes support services. These collaborations improve patient outcomes while creating sustainable business models for long-term market growth.

Digital health platform launches by pharmaceutical companies provide comprehensive diabetes management solutions that integrate medication adherence monitoring, glucose tracking, and healthcare provider communication. These platforms enhance treatment effectiveness while creating new revenue opportunities.

Clinical research expansion in the region generates local evidence for diabetes treatment effectiveness while supporting regulatory approvals and physician adoption of new therapeutic options. These studies address specific population needs and cultural considerations that influence treatment success.

Market entry strategies should prioritize partnerships with established regional distributors and healthcare providers to leverage local market knowledge and existing relationships. Companies entering the market should focus on building comprehensive support networks that address both product distribution and clinical education requirements.

Product portfolio optimization should emphasize cost-effective treatment options that address the diverse economic conditions across the region. Developing tiered pricing strategies and generic alternatives can improve market accessibility while maintaining profitability across different market segments.

Digital health integration represents a critical success factor for companies seeking sustainable competitive advantages. Investing in connected health solutions and patient support platforms can differentiate products while improving clinical outcomes and patient satisfaction levels.

Regulatory compliance requires dedicated resources and local expertise to navigate varying approval processes across different countries. Establishing regional regulatory affairs capabilities and maintaining strong relationships with health authorities facilitates market access and operational efficiency.

Healthcare provider education programs should focus on clinical evidence, treatment guidelines, and patient management best practices that support optimal diabetes care delivery. These educational initiatives build physician confidence while driving appropriate product utilization and patient outcomes.

Market expansion projections indicate continued robust growth driven by demographic trends, healthcare infrastructure development, and increasing treatment accessibility across the Middle East and Africa region. The market is expected to maintain strong momentum with projected growth rates of 8.5% CAGR over the next five years.

Therapeutic innovation will continue reshaping treatment landscapes through advanced drug formulations, personalized medicine approaches, and integrated care solutions. Emerging technologies including continuous glucose monitoring integration and artificial intelligence-powered treatment optimization will create new market opportunities and improve patient outcomes.

Healthcare digitization trends will accelerate, creating comprehensive diabetes management ecosystems that combine pharmaceutical interventions with digital health platforms. These integrated solutions will improve treatment effectiveness while creating new business models and revenue streams for market participants.

Regional market integration will increase through regulatory harmonization, cross-border healthcare initiatives, and pharmaceutical company regional strategies. This integration will create more efficient market dynamics while improving treatment accessibility for patients across different countries.

Preventive care emphasis will expand market scope beyond traditional treatment approaches to include comprehensive diabetes prevention and risk management programs. According to MWR analysis, preventive care initiatives could reduce diabetes complications by 40% while creating sustainable healthcare cost savings across the region.

The Middle East and Africa diabetes drugs treatment market represents a dynamic and rapidly expanding healthcare sector with substantial growth potential driven by increasing disease prevalence, improving healthcare infrastructure, and growing treatment accessibility. The market demonstrates strong fundamentals supported by demographic trends, government healthcare initiatives, and continuous therapeutic innovation that collectively create favorable conditions for sustained expansion.

Strategic opportunities abound for pharmaceutical companies, healthcare providers, and investors willing to navigate the complex regional dynamics while addressing diverse patient needs and economic conditions. Success in this market requires comprehensive understanding of local healthcare systems, regulatory environments, and cultural factors that influence treatment adoption and patient outcomes.

Future market evolution will be characterized by increased digitization, personalized treatment approaches, and integrated care models that combine pharmaceutical interventions with comprehensive diabetes management solutions. Companies that embrace these trends while maintaining focus on accessibility and clinical effectiveness will be best positioned to capitalize on the substantial growth opportunities ahead.

The market outlook remains highly positive, with continued expansion expected across all therapeutic categories and regional markets. As healthcare systems mature and treatment accessibility improves, the Middle East and Africa diabetes drugs treatment market will continue serving as a critical component of regional healthcare development while providing essential therapeutic solutions for millions of diabetes patients across the region.

What is Diabetes Drugs Treatment?

Diabetes Drugs Treatment refers to the various medications used to manage diabetes, including insulin and oral hypoglycemic agents. These treatments help control blood sugar levels and prevent complications associated with diabetes.

What are the key players in the Middle East and Africa Diabetes Drugs Treatment Market?

Key players in the Middle East and Africa Diabetes Drugs Treatment Market include Novo Nordisk, Sanofi, and Merck, among others. These companies are known for their innovative diabetes medications and extensive market presence.

What are the growth factors driving the Middle East and Africa Diabetes Drugs Treatment Market?

The growth of the Middle East and Africa Diabetes Drugs Treatment Market is driven by increasing diabetes prevalence, rising healthcare expenditure, and advancements in drug development. Additionally, greater awareness of diabetes management contributes to market expansion.

What challenges does the Middle East and Africa Diabetes Drugs Treatment Market face?

The Middle East and Africa Diabetes Drugs Treatment Market faces challenges such as high treatment costs, limited access to healthcare facilities, and varying regulatory environments. These factors can hinder the availability and affordability of diabetes medications.

What opportunities exist in the Middle East and Africa Diabetes Drugs Treatment Market?

Opportunities in the Middle East and Africa Diabetes Drugs Treatment Market include the development of new drug formulations, increasing investment in healthcare infrastructure, and the potential for telemedicine solutions. These factors can enhance patient access to diabetes care.

What trends are shaping the Middle East and Africa Diabetes Drugs Treatment Market?

Trends shaping the Middle East and Africa Diabetes Drugs Treatment Market include the rise of personalized medicine, the integration of digital health technologies, and a focus on preventive care. These trends aim to improve patient outcomes and streamline diabetes management.

Middle East and Africa Diabetes Drugs Treatment Market

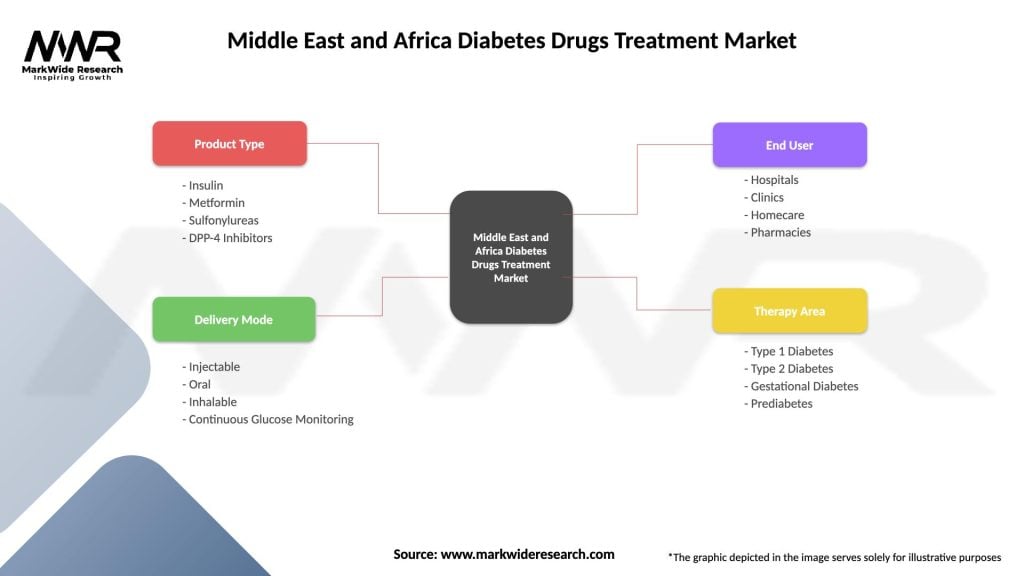

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Metformin, Sulfonylureas, DPP-4 Inhibitors |

| Delivery Mode | Injectable, Oral, Inhalable, Continuous Glucose Monitoring |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Diabetes Drugs Treatment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at