444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East and Africa Contract Packaging Market refers to the outsourcing of packaging activities by companies to third-party service providers in the Middle East and Africa region. Contract packaging involves the packaging of products on behalf of the brand owners or manufacturers. This process includes various activities such as filling, labeling, bundling, and assembling of products into final packaging for distribution.

Meaning

Contract packaging is a strategic approach adopted by companies to streamline their packaging operations and focus on their core competencies. By outsourcing packaging activities to specialized contract packaging providers, companies can benefit from cost savings, improved efficiency, and access to specialized packaging expertise.

Executive Summary

The Middle East and Africa Contract Packaging Market has witnessed significant growth in recent years. This can be attributed to the increasing demand for contract packaging services across various industries such as food and beverage, pharmaceuticals, personal care, and household products. The market is driven by factors such as the growing need for flexible and scalable packaging solutions, the rise in outsourcing of non-core activities, and the focus on reducing operational costs.

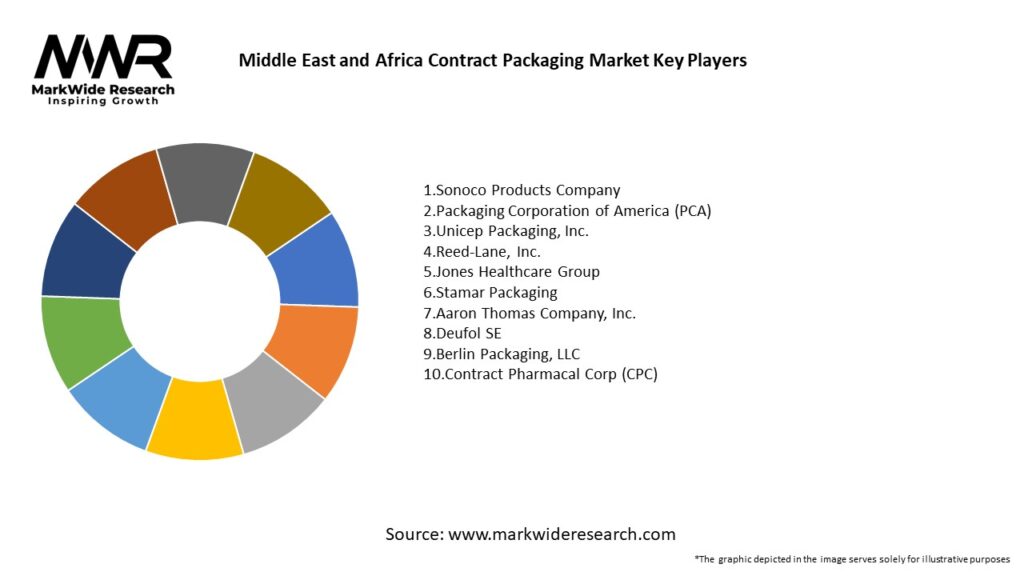

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Middle East and Africa Contract Packaging Market is influenced by various dynamic factors. These include changing consumer preferences, industry trends, technological advancements, and macroeconomic factors. The market dynamics play a crucial role in shaping the competitive landscape and the future prospects of the contract packaging industry in the region.

Regional Analysis

The Middle East and Africa Contract Packaging Market can be segmented into different regions, including:

Each region has its own unique market characteristics, such as consumer preferences, regulatory frameworks, and infrastructure capabilities. Understanding these regional dynamics is essential for contract packaging providers to tailor their services and strategies accordingly.

Competitive Landscape

Leading Companies in Middle East and Africa Contract Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Middle East and Africa Contract Packaging Market can be segmented based on various factors, including:

Segmenting the market helps in identifying specific customer requirements and tailoring packaging solutions accordingly. It also enables contract packaging providers to focus on specific market segments and optimize their operations.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the Middle East and Africa Contract Packaging Market.

Positive Impacts:

Negative Impacts:

Overall, the contract packaging industry has shown resilience during the pandemic and is expected to recover and grow as economies stabilize.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Middle East and Africa Contract Packaging Market appears promising, with steady growth expected in the coming years. Factors such as increasing outsourcing trends, demand for flexible packaging solutions, and focus on cost optimization are driving the market.

The market will witness significant opportunities in sectors like e-commerce, sustainable packaging, and untapped regions. Contract packagers need to embrace technological advancements, offer customized solutions, and prioritize sustainability to stay competitive in the evolving market landscape.

Conclusion

The Middle East and Africa Contract Packaging Market is experiencing growth due to the increasing demand for outsourcing packaging activities. Companies in various industries are recognizing the benefits of contract packaging, including cost savings, enhanced efficiency, and access to specialized expertise.

While challenges such as lack of standardization and infrastructure limitations exist, there are ample opportunities for contract packaging providers to expand into untapped markets, cater to the e-commerce sector, and focus on sustainable packaging solutions.

By embracing technology, collaboration, and sustainability, contract packagers can position themselves for success in the evolving market, meet the changing needs of brand owners, and contribute to the growth of the Middle East and Africa Contract Packaging Market.

What is Contract Packaging?

Contract packaging refers to the outsourcing of packaging services to a third-party company. This can include various services such as filling, labeling, and packaging products for different industries, including food, pharmaceuticals, and consumer goods.

What are the key players in the Middle East and Africa Contract Packaging Market?

Key players in the Middle East and Africa Contract Packaging Market include companies like Amcor, WestRock, and Smurfit Kappa, which provide a range of packaging solutions across various sectors, among others.

What are the growth factors driving the Middle East and Africa Contract Packaging Market?

The growth of the Middle East and Africa Contract Packaging Market is driven by increasing demand for packaged food and beverages, the rise of e-commerce, and the need for sustainable packaging solutions.

What challenges does the Middle East and Africa Contract Packaging Market face?

Challenges in the Middle East and Africa Contract Packaging Market include regulatory compliance issues, fluctuating raw material prices, and the need for advanced technology to meet consumer demands.

What opportunities exist in the Middle East and Africa Contract Packaging Market?

Opportunities in the Middle East and Africa Contract Packaging Market include the expansion of the pharmaceutical sector, increasing consumer preference for eco-friendly packaging, and the growth of private label products.

What trends are shaping the Middle East and Africa Contract Packaging Market?

Trends in the Middle East and Africa Contract Packaging Market include the adoption of smart packaging technologies, the shift towards sustainable materials, and the increasing use of automation in packaging processes.

Middle East and Africa Contract Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Flexible Packaging, Rigid Packaging, Semi-Rigid Packaging, Pouches |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Electronics |

| Material | Plastic, Paper, Glass, Metal |

| Technology | Thermoforming, Injection Molding, Blow Molding, Vacuum Forming |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Middle East and Africa Contract Packaging Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at