444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle-East and Africa commercial aircraft aviation fuels market represents a dynamic and rapidly evolving sector within the global aviation industry. This region has emerged as a critical hub for international air travel, driven by strategic geographical positioning, substantial investments in airport infrastructure, and the presence of world-class airlines. The market encompasses various fuel types including conventional jet fuel, sustainable aviation fuel (SAF), and emerging alternative fuel technologies that are reshaping the aviation landscape.

Regional dynamics indicate that the Middle-East and Africa aviation fuels market is experiencing robust growth, with the sector projected to expand at a compound annual growth rate (CAGR) of 6.2% over the forecast period. This growth trajectory is supported by increasing passenger traffic, expanding airline fleets, and significant infrastructure development across major aviation hubs including Dubai, Doha, Istanbul, and Johannesburg.

Market characteristics in this region are distinguished by the presence of major international airlines, strategic geographic positioning as a connecting point between continents, and substantial government investments in aviation infrastructure. The region’s aviation fuel consumption patterns reflect both domestic demand and significant transit traffic, with approximately 45% of fuel consumption attributed to international connecting flights.

Sustainability initiatives are increasingly influencing market dynamics, with regional governments and airlines committing to carbon reduction targets. The adoption of sustainable aviation fuels is gaining momentum, though it currently represents a smaller percentage of total fuel consumption compared to conventional jet fuel.

The Middle-East and Africa commercial aircraft aviation fuels market refers to the comprehensive ecosystem encompassing the production, distribution, supply, and consumption of various fuel types used by commercial airlines operating within and through the Middle-East and Africa regions. This market includes conventional jet fuel (Jet A and Jet A-1), sustainable aviation fuels, biofuels, and emerging alternative fuel technologies designed to power commercial aircraft operations.

Market scope extends beyond simple fuel supply to encompass fuel quality management, storage infrastructure, distribution networks, pricing mechanisms, and regulatory compliance frameworks. The market serves diverse stakeholders including international airlines, regional carriers, cargo operators, fuel suppliers, airport authorities, and government regulatory bodies.

Geographic coverage spans the entire Middle-East and Africa regions, incorporating major aviation hubs, secondary airports, and emerging markets. The market dynamics are influenced by regional economic conditions, political stability, infrastructure development, environmental regulations, and international aviation agreements.

Technological evolution within this market includes advancements in fuel efficiency, sustainable fuel production methods, fuel quality monitoring systems, and innovative distribution technologies that enhance operational efficiency and environmental performance.

Strategic positioning of the Middle-East and Africa commercial aircraft aviation fuels market reflects the region’s critical role in global aviation connectivity. The market demonstrates strong fundamentals driven by geographic advantages, substantial infrastructure investments, and growing passenger demand. Regional airlines have established themselves as major players in international aviation, creating sustained demand for aviation fuels across various categories.

Market performance indicators reveal consistent growth patterns, with fuel consumption volumes increasing in line with expanding airline operations and route networks. The region benefits from its position as a natural transit hub connecting Europe, Asia, and Africa, generating significant fuel demand from both originating and connecting flights.

Sustainability transformation is becoming increasingly important, with regional stakeholders recognizing the need to balance growth with environmental responsibility. Airlines and fuel suppliers are investing in sustainable aviation fuel initiatives, though adoption rates remain in early stages compared to conventional fuel usage.

Competitive dynamics feature established international fuel suppliers alongside regional players, creating a diverse supply ecosystem. Market consolidation trends are evident as companies seek to optimize distribution networks and achieve operational efficiencies.

Future trajectory points toward continued expansion supported by infrastructure development, fleet modernization, and evolving fuel technology adoption. The market is positioned to benefit from regional economic diversification efforts and increasing focus on aviation as a key economic sector.

Fundamental market drivers reveal several critical insights that shape the Middle-East and Africa commercial aircraft aviation fuels landscape:

Market maturity levels vary significantly across the region, with established hubs demonstrating sophisticated fuel infrastructure while emerging markets present growth opportunities. This diversity creates a complex but dynamic market environment with multiple growth vectors.

Primary growth catalysts propelling the Middle-East and Africa commercial aircraft aviation fuels market include several interconnected factors that create sustained demand momentum.

Strategic geographic positioning remains the most significant driver, with the region serving as a natural bridge between major global markets. This positioning generates consistent fuel demand from international carriers utilizing regional hubs for connecting flights, creating a stable foundation for market growth.

Infrastructure development initiatives across the region are substantially expanding airport capacity and capabilities. Major projects including airport expansions, new terminal construction, and enhanced fuel storage facilities are creating the infrastructure necessary to support increased aviation activity and fuel consumption.

Economic diversification strategies implemented by regional governments are positioning aviation as a key economic sector. These initiatives include substantial investments in national carriers, airport development, and supporting infrastructure that directly translates to increased fuel demand.

Tourism sector growth is generating significant passenger traffic increases, particularly in destinations that have invested heavily in tourism infrastructure and marketing. This growth creates direct demand for aviation fuels as airlines expand capacity to serve these markets.

Cargo and logistics expansion reflects the region’s growing role in global trade, with major hubs developing as cargo centers. This trend creates additional fuel demand from cargo carriers and combination passenger-cargo operations.

Fleet modernization programs by regional airlines are introducing more fuel-efficient aircraft that, while consuming less fuel per passenger, are enabling route expansion and frequency increases that drive overall fuel demand growth.

Significant challenges facing the Middle-East and Africa commercial aircraft aviation fuels market create headwinds that market participants must navigate effectively.

Economic volatility in various regional markets creates uncertainty that can impact aviation demand and fuel consumption patterns. Currency fluctuations, political instability, and economic downturns in key markets can significantly affect airline operations and fuel demand.

Infrastructure limitations in certain markets constrain growth potential, particularly in secondary cities and emerging markets where fuel storage, distribution, and quality control capabilities may be inadequate to support expanded aviation operations.

Regulatory complexity across different countries creates operational challenges for fuel suppliers and airlines operating across multiple jurisdictions. Varying fuel quality standards, safety regulations, and import procedures can increase operational costs and complexity.

Supply chain vulnerabilities can impact fuel availability and pricing, particularly in markets dependent on fuel imports. Geopolitical tensions, shipping disruptions, or refinery outages can create supply constraints that affect market stability.

Environmental regulations are becoming increasingly stringent, requiring investments in cleaner fuel technologies and emissions reduction measures that can increase operational costs for market participants.

Competition from alternative transportation modes, particularly high-speed rail and improved road connectivity, can impact short-haul aviation demand in certain markets, affecting regional fuel consumption patterns.

Skilled workforce shortages in technical areas related to fuel handling, quality control, and safety management can constrain operational capabilities and market expansion in certain regions.

Emerging growth opportunities within the Middle-East and Africa commercial aircraft aviation fuels market present significant potential for market expansion and value creation.

Sustainable aviation fuel development represents a transformative opportunity as airlines and governments commit to carbon reduction targets. Early movers in SAF production and distribution can establish competitive advantages in this emerging segment, with SAF adoption rates projected to reach 15% by 2030 in leading regional markets.

Digital transformation initiatives offer opportunities to optimize fuel management, improve supply chain efficiency, and enhance customer service through advanced analytics, IoT technologies, and automated systems. These technologies can reduce operational costs while improving service quality.

Regional connectivity expansion presents opportunities as secondary cities develop aviation infrastructure and airlines expand route networks to serve underserved markets. This expansion creates new fuel demand centers and distribution opportunities.

Public-private partnerships in infrastructure development can accelerate market growth while sharing investment risks. Collaborative approaches to fuel infrastructure development can create more efficient and comprehensive supply networks.

Cargo and logistics growth driven by e-commerce expansion and regional trade development creates opportunities for specialized fuel services and dedicated cargo hub development.

Technology partnerships between fuel suppliers, airlines, and technology providers can create innovative solutions that improve operational efficiency, reduce environmental impact, and enhance safety performance.

Market consolidation opportunities exist as smaller players seek strategic partnerships or acquisition opportunities, potentially creating more efficient and comprehensive service offerings.

Complex market interactions within the Middle-East and Africa commercial aircraft aviation fuels sector create a dynamic environment influenced by multiple interconnected factors.

Supply and demand balance fluctuates based on seasonal travel patterns, economic conditions, and airline capacity decisions. Peak travel seasons can create temporary supply constraints, while economic downturns may result in excess capacity. Understanding these cyclical patterns is crucial for effective market participation.

Pricing mechanisms reflect global oil market conditions, regional supply-demand dynamics, and competitive pressures. Fuel pricing strategies must balance profitability with competitive positioning, particularly in markets with multiple suppliers competing for airline contracts.

Quality standards evolution continues as regulatory authorities implement more stringent fuel quality requirements and airlines demand higher performance standards. These evolving standards create opportunities for suppliers who can consistently meet enhanced requirements while potentially disadvantaging those with limited quality control capabilities.

Sustainability pressures are reshaping market dynamics as airlines face increasing pressure to reduce carbon emissions. This trend is driving demand for sustainable aviation fuels and creating new market segments, though adoption rates remain constrained by availability and cost considerations.

Technology integration is transforming operational processes, from fuel quality monitoring to inventory management and distribution logistics. Companies that effectively leverage technology can achieve operational efficiencies and service improvements that provide competitive advantages.

Regulatory harmonization efforts across the region are gradually reducing operational complexity and creating more efficient market conditions. However, the pace of harmonization varies, creating ongoing challenges for multi-market operations.

Comprehensive research approach employed for analyzing the Middle-East and Africa commercial aircraft aviation fuels market incorporates multiple data sources and analytical methodologies to ensure accuracy and reliability.

Primary research activities include extensive interviews with industry stakeholders across the value chain, including airline fuel managers, fuel suppliers, airport authorities, regulatory officials, and industry associations. These interviews provide insights into market trends, operational challenges, and strategic priorities that shape market dynamics.

Secondary research methodology encompasses analysis of industry reports, government publications, regulatory filings, company annual reports, and trade association data. This research provides quantitative data on fuel consumption patterns, market shares, pricing trends, and regulatory developments.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market trends and growth patterns. These models incorporate multiple variables including economic indicators, airline capacity data, passenger traffic statistics, and fuel efficiency improvements.

Regional analysis framework examines market conditions across different countries and sub-regions, recognizing the diverse economic, regulatory, and infrastructure conditions that influence market dynamics in different areas.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review, and consistency checks. This rigorous approach helps ensure that research findings accurately reflect market realities.

Continuous monitoring systems track market developments, regulatory changes, and industry announcements to maintain current and relevant market intelligence throughout the research period.

Geographic market segmentation reveals distinct characteristics and growth patterns across different areas within the Middle-East and Africa commercial aircraft aviation fuels market.

Gulf Cooperation Council (GCC) markets represent the most mature and sophisticated segment, with UAE and Qatar accounting for approximately 35% of regional fuel consumption. These markets benefit from world-class infrastructure, major international airlines, and strategic positioning as global transit hubs. Dubai International Airport and Hamad International Airport serve as primary fuel consumption centers, supported by advanced fuel storage and distribution infrastructure.

Saudi Arabia’s market demonstrates strong growth potential driven by Vision 2030 initiatives that prioritize aviation sector development. The kingdom’s investments in national carrier expansion, new airport development, and tourism infrastructure are creating substantial fuel demand growth opportunities.

Turkey’s aviation sector serves as a bridge between Europe and Asia, with Istanbul Airport emerging as a major hub. The market benefits from the country’s strategic location and the growth of Turkish Airlines as a global carrier, though economic volatility creates periodic challenges.

South African market represents the most developed aviation sector in sub-Saharan Africa, with Johannesburg serving as the primary hub for the region. The market faces challenges from economic constraints but benefits from its role as a gateway to the broader African continent.

North African markets including Egypt and Morocco are experiencing growth driven by tourism recovery and infrastructure investments. These markets present opportunities for fuel suppliers seeking to establish positions in emerging aviation markets.

East African region shows promising growth potential with Ethiopia leading development through Ethiopian Airlines’ expansion and Addis Ababa’s emergence as a continental hub. However, infrastructure limitations and economic challenges constrain growth in some markets.

Market structure in the Middle-East and Africa commercial aircraft aviation fuels sector features a combination of international suppliers, regional players, and integrated oil companies competing across different market segments.

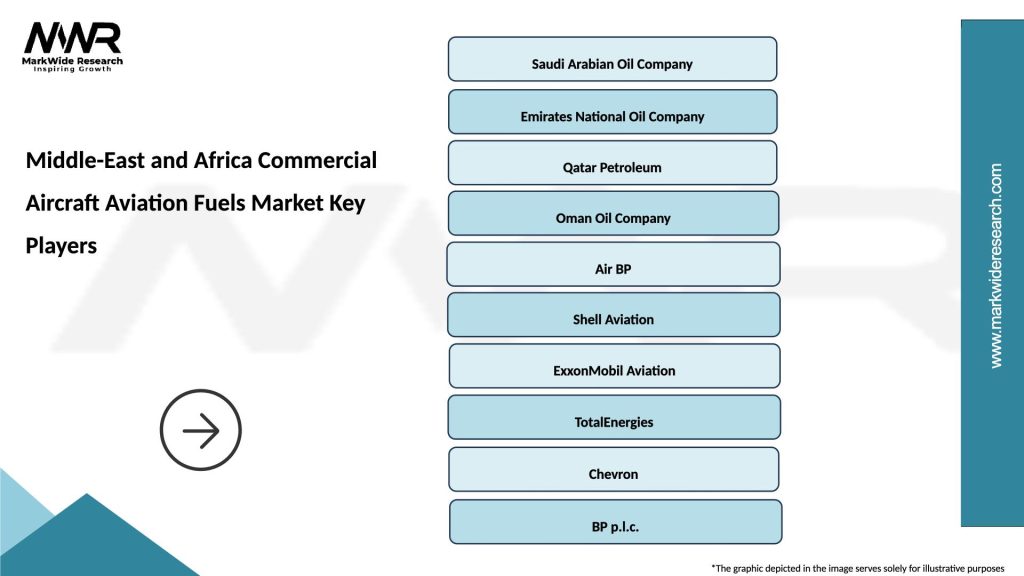

Leading market participants include:

Competitive strategies focus on infrastructure investment, service quality enhancement, sustainability initiatives, and strategic partnerships with airlines and airports. Companies are investing in fuel storage capacity, distribution networks, and digital technologies to improve operational efficiency and customer service.

Market consolidation trends are evident as companies seek to optimize operations and achieve economies of scale. Strategic partnerships and joint ventures are becoming more common as companies collaborate to serve large airline customers and develop new market opportunities.

Innovation focus areas include sustainable aviation fuel development, digital fuel management systems, and enhanced quality control technologies that provide competitive differentiation.

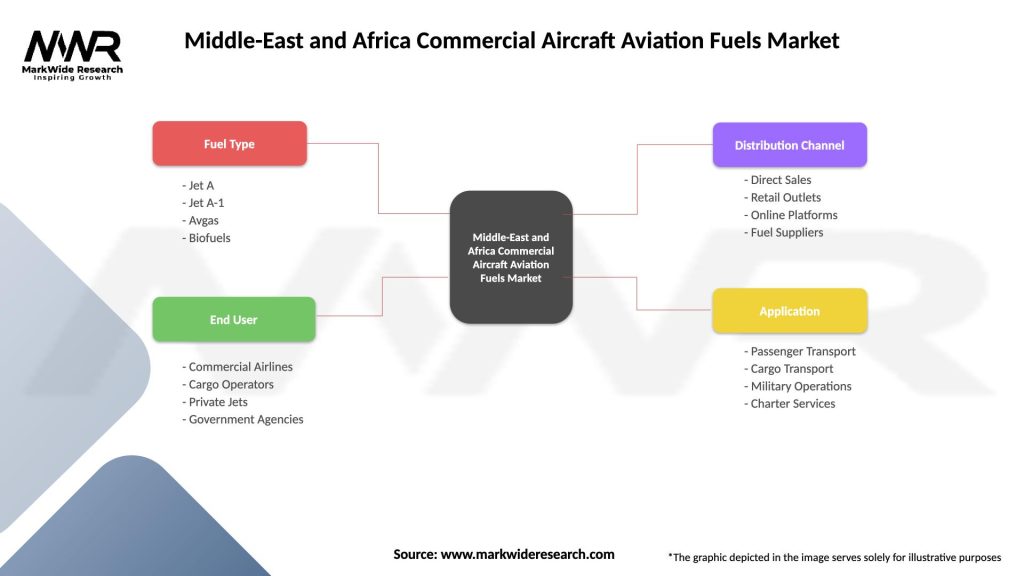

Market segmentation analysis reveals distinct categories within the Middle-East and Africa commercial aircraft aviation fuels market based on multiple classification criteria.

By Fuel Type:

By Application:

By Distribution Channel:

By End User:

Conventional jet fuel category maintains its dominant position in the Middle-East and Africa market, with Jet A-1 specification preferred across the region due to its superior performance characteristics and international acceptance. This category benefits from established supply chains, proven reliability, and comprehensive quality standards that ensure consistent performance across diverse operating conditions.

Sustainable aviation fuel segment represents the fastest-growing category, though from a small base. Regional airlines and governments are increasingly committing to SAF adoption targets, with several major carriers targeting 10% SAF usage by 2030. However, limited production capacity and higher costs remain significant constraints to widespread adoption.

Passenger airline segment drives the majority of fuel consumption, with full-service carriers and low-cost carriers representing different consumption patterns. Full-service carriers typically operate longer routes with higher fuel consumption per flight, while low-cost carriers focus on operational efficiency and fuel cost management.

Cargo operations category is experiencing robust growth driven by e-commerce expansion and regional trade development. Dedicated cargo carriers and passenger airlines with cargo operations are increasing their fuel consumption as freight demand grows across the region.

Business aviation segment demonstrates steady growth in certain markets, particularly in the Gulf region where economic prosperity and business connectivity drive demand for private and corporate aviation services. This segment typically requires more flexible fuel services and premium service levels.

Regional connectivity category shows significant potential as secondary cities develop aviation infrastructure and airlines expand route networks to serve underserved markets. This trend creates new fuel demand centers and opportunities for suppliers to establish presence in emerging markets.

Strategic advantages available to participants in the Middle-East and Africa commercial aircraft aviation fuels market create multiple value propositions across different stakeholder categories.

For Fuel Suppliers:

For Airlines:

For Airport Authorities:

For Governments:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Middle-East and Africa commercial aircraft aviation fuels market reflect broader changes in the aviation industry and global energy landscape.

Sustainability Integration represents the most significant trend, with airlines, fuel suppliers, and governments increasingly prioritizing environmental responsibility. This trend is driving investments in sustainable aviation fuel production, carbon offset programs, and fuel efficiency improvements. MarkWide Research analysis indicates that sustainability considerations are becoming primary factors in fuel procurement decisions.

Digital Transformation is revolutionizing fuel management processes through advanced analytics, IoT sensors, and automated systems. These technologies enable real-time fuel quality monitoring, predictive maintenance, inventory optimization, and enhanced safety management. Airlines and fuel suppliers are investing heavily in digital capabilities to improve operational efficiency.

Infrastructure Modernization continues across the region with airports upgrading fuel storage and distribution systems to handle increased capacity and new fuel types. These investments include automated fuel handling systems, enhanced safety equipment, and expanded storage capacity to support growing aviation operations.

Strategic Partnerships are becoming more prevalent as airlines and fuel suppliers seek to optimize operations and share risks. Long-term supply agreements, joint infrastructure investments, and collaborative sustainability initiatives are creating more integrated supply relationships.

Quality Enhancement trends focus on exceeding minimum fuel quality standards to provide superior performance and reliability. Fuel suppliers are investing in advanced refining processes, quality control systems, and additive technologies that improve fuel performance characteristics.

Regional Integration efforts are gradually harmonizing fuel quality standards, safety regulations, and operational procedures across different countries, creating more efficient market conditions and reducing operational complexity.

Recent industry developments highlight the dynamic nature of the Middle-East and Africa commercial aircraft aviation fuels market and indicate future direction trends.

Sustainable Aviation Fuel Initiatives have gained significant momentum with several major regional airlines announcing SAF adoption targets and investment commitments. Emirates, Qatar Airways, and Saudi Arabian Airlines have established partnerships with SAF producers and committed to increasing SAF usage percentages over the next decade.

Infrastructure Expansion Projects continue across the region with major airports investing in fuel storage and distribution capacity. Dubai International Airport, Hamad International Airport, and King Abdulaziz International Airport have announced significant fuel infrastructure expansion projects to support growing operations.

Technology Partnerships between fuel suppliers and technology companies are creating innovative solutions for fuel management, quality control, and distribution optimization. These partnerships focus on developing digital platforms that improve operational efficiency and customer service.

Regulatory Harmonization efforts are progressing with regional aviation authorities working to align fuel quality standards and safety regulations. These initiatives aim to reduce operational complexity and improve market efficiency across different countries.

Market Consolidation Activities include strategic acquisitions and partnerships as companies seek to optimize operations and expand market presence. Several regional fuel suppliers have announced consolidation plans to achieve economies of scale and improve competitive positioning.

Environmental Compliance initiatives reflect increasing focus on emissions reduction and environmental responsibility. Airlines and fuel suppliers are investing in carbon offset programs, fuel efficiency improvements, and alternative fuel research to meet evolving environmental requirements.

Strategic recommendations for market participants in the Middle-East and Africa commercial aircraft aviation fuels sector focus on positioning for long-term success while navigating current market challenges.

Infrastructure Investment Priority should focus on flexible systems capable of handling multiple fuel types including conventional jet fuel and sustainable aviation fuels. Companies should invest in infrastructure that can adapt to evolving fuel specifications and environmental requirements while maintaining operational efficiency.

Sustainability Strategy Development is crucial for long-term competitiveness. Market participants should establish clear sustainability goals, invest in SAF capabilities, and develop partnerships with airlines committed to environmental responsibility. Early positioning in sustainable fuel markets can create competitive advantages as adoption accelerates.

Digital Transformation Acceleration should encompass fuel management systems, customer service platforms, and operational optimization tools. Companies that effectively leverage technology can achieve significant operational efficiencies and service improvements that differentiate them from competitors.

Regional Market Diversification can reduce risks associated with economic volatility in individual countries. Companies should consider expanding presence across multiple markets while maintaining operational efficiency through standardized processes and systems.

Strategic Partnership Development with airlines, airports, and other stakeholders can create mutual benefits through shared investments, risk mitigation, and operational optimization. Long-term partnerships provide stability and growth opportunities in competitive markets.

Quality Excellence Focus should exceed minimum standards to provide superior value to airline customers. Investments in quality control systems, staff training, and process optimization can create competitive differentiation and customer loyalty.

Regulatory Compliance Preparation for evolving environmental and safety requirements should be proactive rather than reactive. Companies should monitor regulatory developments and invest in compliance capabilities before requirements become mandatory.

Long-term market prospects for the Middle-East and Africa commercial aircraft aviation fuels market indicate continued growth driven by fundamental regional advantages and evolving industry dynamics.

Growth trajectory projections suggest sustained expansion over the next decade, with fuel consumption expected to grow at annual rates of 6-8% in key markets. This growth will be supported by continued infrastructure investment, airline fleet expansion, and increasing passenger demand across the region.

Sustainable aviation fuel adoption is expected to accelerate significantly, with MWR projecting that SAF could represent 20-25% of total fuel consumption in leading regional markets by 2035. This transition will require substantial investments in production capacity, distribution infrastructure, and regulatory frameworks.

Technology integration will continue transforming market operations with artificial intelligence, machine learning, and IoT technologies becoming standard components of fuel management systems. These technologies will enable predictive maintenance, optimized inventory management, and enhanced safety monitoring.

Market consolidation is likely to continue as companies seek economies of scale and operational efficiency. Strategic partnerships, joint ventures, and acquisitions will reshape the competitive landscape while maintaining service quality and innovation.

Infrastructure development will focus on flexibility and sustainability, with new facilities designed to handle multiple fuel types and incorporate environmental protection measures. Smart infrastructure incorporating digital technologies will become the standard for new developments.

Regulatory evolution will continue toward greater harmonization across the region while incorporating stricter environmental standards. Companies that proactively prepare for regulatory changes will be better positioned for long-term success.

Regional connectivity expansion will create new market opportunities as secondary cities develop aviation infrastructure and airlines expand route networks. This expansion will require flexible supply strategies and local market expertise.

The Middle-East and Africa commercial aircraft aviation fuels market represents a dynamic and rapidly evolving sector with substantial growth potential driven by strategic geographic advantages, infrastructure investments, and expanding aviation operations. The market benefits from the region’s position as a global aviation hub, substantial government support for aviation sector development, and the presence of world-class airlines that create sustained fuel demand.

Market fundamentals remain strong despite periodic challenges from economic volatility and regulatory complexity. The region’s role as a natural transit point between major global markets creates consistent fuel demand from both originating and connecting flights, providing a stable foundation for market growth. Infrastructure investments across major hubs continue to expand capacity and capabilities, supporting long-term market expansion.

Sustainability transformation is emerging as a critical factor that will reshape market dynamics over the coming decade. While sustainable aviation fuel adoption remains in early stages, increasing commitments from airlines and governments indicate significant growth potential for companies that position themselves effectively in this evolving segment. The transition to more sustainable fuel options will require substantial investments but also creates opportunities for market differentiation and competitive advantage.

Technology integration continues to transform operational processes and create opportunities for efficiency improvements and service enhancement. Companies that effectively leverage digital technologies, advanced analytics, and automated systems will be better positioned to compete in an increasingly sophisticated market environment.

Future success in the Middle-East and Africa commercial aircraft aviation fuels market will depend on strategic positioning that balances growth opportunities with operational excellence, sustainability commitments, and technological innovation. Market participants who invest in flexible infrastructure, develop strategic partnerships, and maintain focus on quality and service excellence will be best positioned to capitalize on the region’s continued aviation sector expansion and evolving fuel requirements.

What is Commercial Aircraft Aviation Fuels?

Commercial Aircraft Aviation Fuels refer to the specialized fuels used in the aviation industry for commercial aircraft operations. These fuels are essential for powering various types of aircraft, ensuring efficiency and safety during flights.

What are the key players in the Middle-East and Africa Commercial Aircraft Aviation Fuels Market?

Key players in the Middle-East and Africa Commercial Aircraft Aviation Fuels Market include companies like TotalEnergies, Shell Aviation, and BP, which provide a range of aviation fuel products and services, among others.

What are the growth factors driving the Middle-East and Africa Commercial Aircraft Aviation Fuels Market?

The growth of the Middle-East and Africa Commercial Aircraft Aviation Fuels Market is driven by increasing air travel demand, expansion of airline fleets, and the rise of low-cost carriers in the region. Additionally, advancements in fuel technology are contributing to market growth.

What challenges does the Middle-East and Africa Commercial Aircraft Aviation Fuels Market face?

The Middle-East and Africa Commercial Aircraft Aviation Fuels Market faces challenges such as fluctuating crude oil prices, regulatory compliance issues, and the need for sustainable fuel alternatives. These factors can impact fuel supply and pricing stability.

What opportunities exist in the Middle-East and Africa Commercial Aircraft Aviation Fuels Market?

Opportunities in the Middle-East and Africa Commercial Aircraft Aviation Fuels Market include the development of sustainable aviation fuels (SAFs) and the potential for partnerships between fuel suppliers and airlines to enhance fuel efficiency. The growing focus on reducing carbon emissions also presents new avenues for innovation.

What trends are shaping the Middle-East and Africa Commercial Aircraft Aviation Fuels Market?

Trends in the Middle-East and Africa Commercial Aircraft Aviation Fuels Market include the increasing adoption of biofuels, advancements in fuel efficiency technologies, and a shift towards more environmentally friendly fuel options. These trends are influencing how airlines approach fuel sourcing and usage.

Middle-East and Africa Commercial Aircraft Aviation Fuels Market

| Segmentation Details | Description |

|---|---|

| Fuel Type | Jet A, Jet A-1, Avgas, Biofuels |

| End User | Commercial Airlines, Cargo Operators, Private Jets, Government Agencies |

| Distribution Channel | Direct Sales, Retail Outlets, Online Platforms, Fuel Suppliers |

| Application | Passenger Transport, Cargo Transport, Military Operations, Charter Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle-East and Africa Commercial Aircraft Aviation Fuels Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at