444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa combined heat and power market represents a rapidly evolving sector within the region’s energy infrastructure landscape. This market encompasses advanced energy systems that simultaneously generate electricity and useful thermal energy from a single fuel source, delivering exceptional efficiency improvements compared to conventional separate heat and power generation methods. The region’s growing industrial base, increasing energy demand, and commitment to sustainable development are driving significant adoption of CHP technologies across various sectors.

Market dynamics in the Middle East and Africa are characterized by substantial government investments in energy infrastructure modernization and industrial diversification initiatives. The market demonstrates robust growth potential, with analysts projecting a compound annual growth rate of 8.2% through the forecast period. Key regional markets including the United Arab Emirates, Saudi Arabia, South Africa, and Nigeria are leading adoption efforts, supported by favorable regulatory frameworks and increasing awareness of energy efficiency benefits.

Industrial applications dominate the regional market landscape, with manufacturing facilities, petrochemical complexes, and food processing plants representing primary adoption segments. The region’s abundant natural gas resources provide a competitive advantage for CHP implementation, while growing renewable energy integration creates new opportunities for hybrid CHP systems incorporating solar thermal and biomass technologies.

The Middle East and Africa combined heat and power market refers to the comprehensive ecosystem of technologies, services, and infrastructure solutions that enable simultaneous generation of electricity and thermal energy from single fuel sources across the MEA region. This market encompasses various CHP technologies including gas turbines, steam turbines, reciprocating engines, and fuel cells, along with associated control systems, maintenance services, and integration solutions.

CHP systems operate on the principle of capturing and utilizing waste heat that would otherwise be lost in conventional power generation processes. By recovering this thermal energy for heating, cooling, or industrial processes, CHP systems achieve overall efficiency levels of 75-85% compared to approximately 50% efficiency from separate heat and power generation. This fundamental efficiency advantage drives adoption across energy-intensive industries throughout the Middle East and Africa.

Regional market characteristics include strong government support for energy efficiency initiatives, abundant fossil fuel resources, growing industrial sectors, and increasing focus on carbon emission reduction. The market serves diverse applications from large-scale industrial facilities to commercial buildings and district energy systems, with technology selection influenced by local fuel availability, regulatory requirements, and specific thermal energy demands.

Strategic market positioning of combined heat and power technologies in the Middle East and Africa reflects the region’s transition toward more efficient and sustainable energy systems. The market benefits from strong fundamentals including growing industrial activity, supportive government policies, and increasing recognition of CHP’s role in achieving energy security and environmental objectives. Key market drivers include rising energy costs, grid reliability concerns, and mandatory energy efficiency standards in several countries.

Technology adoption patterns vary significantly across the region, with gas turbine-based systems dominating in Gulf Cooperation Council countries due to abundant natural gas availability, while reciprocating engine systems gain traction in sub-Saharan Africa markets. The market demonstrates increasing sophistication in system integration, with modern CHP installations incorporating advanced control systems, predictive maintenance capabilities, and grid interconnection features.

Competitive landscape dynamics feature a mix of international technology providers and regional engineering contractors, with market leaders focusing on turnkey project delivery and long-term service agreements. The market shows strong potential for growth, supported by industrial expansion plans, urban development projects, and increasing emphasis on distributed energy resources. Regional manufacturing capabilities are expanding, creating opportunities for local content development and cost optimization.

Primary market insights reveal several critical trends shaping the Middle East and Africa combined heat and power landscape:

Energy efficiency mandates represent a fundamental driver for CHP adoption across the Middle East and Africa region. Government initiatives aimed at reducing energy intensity and improving industrial competitiveness create strong demand for high-efficiency energy systems. Many countries have established energy efficiency targets that specifically recognize CHP’s contribution to national energy goals, providing regulatory support and financial incentives for implementation.

Industrial expansion programs throughout the region drive substantial CHP market growth, particularly in manufacturing, petrochemicals, and food processing sectors. Major industrial development projects incorporate CHP systems from the design phase, recognizing the long-term operational and environmental benefits. The region’s focus on economic diversification away from oil dependence supports industrial growth and associated energy infrastructure requirements.

Grid reliability concerns in several regional markets create strong demand for distributed energy solutions including CHP systems. Industrial facilities increasingly seek energy security through on-site generation capabilities, while CHP systems provide valuable grid support services including frequency regulation and voltage support. This dual benefit of energy security and grid services enhances the value proposition for CHP investments.

Environmental compliance requirements drive CHP adoption as governments implement stricter emission standards and carbon reduction targets. CHP systems’ inherent efficiency advantages translate directly to reduced carbon emissions per unit of useful energy output, supporting corporate sustainability goals and regulatory compliance. The technology’s ability to utilize cleaner fuels and integrate with renewable energy sources further enhances its environmental profile.

High capital investment requirements present a significant barrier to CHP adoption, particularly for smaller industrial facilities and commercial applications. The substantial upfront costs associated with CHP system installation, including equipment, engineering, and infrastructure modifications, can challenge project economics despite attractive long-term operational benefits. Limited access to project financing in some regional markets further constrains market development.

Technical complexity challenges related to CHP system design, installation, and operation require specialized expertise that may be limited in certain regional markets. The integration of electrical and thermal systems demands sophisticated engineering capabilities and ongoing technical support, creating barriers for organizations lacking internal expertise. Maintenance requirements and spare parts availability can also present operational challenges in remote locations.

Regulatory uncertainties in some markets create hesitation among potential CHP investors, particularly regarding grid interconnection standards, electricity export policies, and long-term regulatory stability. Inconsistent policies across different countries and jurisdictions complicate regional market development and technology standardization efforts. Permitting processes and approval timelines can also delay project implementation and increase development costs.

Fuel supply considerations impact CHP project viability, particularly in markets with limited natural gas infrastructure or volatile fuel pricing. While the region generally benefits from abundant fossil fuel resources, local availability and pricing structures can vary significantly, affecting project economics and technology selection decisions. Competition with other industrial users for fuel supplies may also influence CHP development in certain areas.

Renewable energy integration presents substantial opportunities for hybrid CHP systems that combine conventional technologies with solar thermal, biomass, or biogas resources. The region’s abundant solar resources and growing agricultural waste streams create potential for innovative CHP configurations that enhance sustainability while maintaining operational reliability. These hybrid systems can achieve even higher efficiency levels and reduced environmental impact compared to conventional CHP installations.

District energy development in rapidly growing urban areas offers significant market expansion opportunities, particularly in Gulf countries with major city development projects. Centralized CHP systems serving multiple buildings or industrial complexes can achieve economies of scale while providing efficient heating, cooling, and power services. Smart city initiatives increasingly incorporate district energy systems as core infrastructure components.

Industrial cluster development creates opportunities for shared CHP infrastructure serving multiple facilities within industrial parks or special economic zones. This approach can optimize capital utilization while providing reliable energy services to multiple users. Regional governments’ focus on industrial zone development supports this market opportunity through infrastructure planning and regulatory frameworks.

Technology localization initiatives present opportunities for regional manufacturing and service capabilities development. As the market matures, demand grows for local content, technical expertise, and service support. International technology providers increasingly seek regional partnerships to establish manufacturing facilities and service centers, creating opportunities for local companies and workforce development.

Supply chain evolution in the Middle East and Africa CHP market reflects increasing regional capabilities and international technology transfer. Major equipment manufacturers establish regional presence through partnerships, joint ventures, and direct investment, while local engineering and construction companies develop specialized CHP expertise. This supply chain development reduces project costs and delivery times while building regional technical capabilities.

Technology advancement trends focus on improved efficiency, reduced emissions, and enhanced operational flexibility. Modern CHP systems incorporate advanced control systems, predictive maintenance capabilities, and grid integration features that enhance value proposition and operational performance. Digital technologies including IoT sensors, data analytics, and remote monitoring systems become standard features in new installations.

Market consolidation patterns emerge as the industry matures, with larger players acquiring specialized companies and expanding service capabilities. This consolidation creates more comprehensive solution providers while potentially reducing competition in certain market segments. Strategic partnerships between technology providers, engineering companies, and financial institutions become increasingly important for project development and execution.

Customer sophistication levels continue to increase as regional markets gain experience with CHP technologies and applications. Industrial customers develop internal expertise and more sophisticated procurement approaches, while service requirements become more demanding. This market evolution drives continuous improvement in technology performance, service quality, and project delivery capabilities.

Comprehensive market analysis for the Middle East and Africa combined heat and power market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research activities include extensive interviews with industry stakeholders, technology providers, end users, and regulatory officials across key regional markets. These interviews provide insights into market dynamics, technology trends, and future development plans that inform overall market assessment.

Secondary research components encompass analysis of government publications, industry reports, company financial statements, and technical literature to establish market context and validate primary research findings. Regulatory analysis covers energy policies, environmental standards, and economic incentives across different countries and jurisdictions within the region. Technology assessment includes evaluation of performance data, cost trends, and innovation developments from leading CHP system providers.

Data validation processes ensure research accuracy through triangulation of multiple information sources and expert review of findings. Market sizing and forecasting methodologies incorporate bottom-up analysis of individual market segments and top-down validation using macroeconomic indicators and industry benchmarks. Regional variations in market conditions, regulatory frameworks, and technology adoption patterns receive specific attention to ensure accurate representation of diverse market conditions.

Analytical frameworks applied in this research include competitive landscape analysis, technology assessment, regulatory impact evaluation, and economic modeling of CHP project economics under various scenarios. Market segmentation analysis covers technology types, applications, end-user industries, and geographic regions to provide comprehensive market understanding and identify specific growth opportunities.

Gulf Cooperation Council countries represent the most advanced CHP market within the Middle East and Africa region, accounting for approximately 45% of regional installed capacity. The United Arab Emirates leads regional adoption with major industrial and district energy projects, while Saudi Arabia’s Vision 2030 program drives substantial CHP investment in manufacturing and petrochemical sectors. Qatar and Kuwait demonstrate growing market activity supported by industrial diversification initiatives and energy efficiency programs.

North African markets show increasing CHP adoption driven by industrial development and energy security concerns. Egypt’s expanding manufacturing sector creates demand for efficient energy solutions, while Morocco’s renewable energy initiatives include hybrid CHP applications. Algeria and Tunisia demonstrate growing interest in CHP technologies for industrial applications, supported by government energy efficiency programs and international development funding.

Sub-Saharan Africa markets present significant growth potential despite current limited CHP penetration. South Africa leads regional development with established industrial base and supportive regulatory framework, while Nigeria’s manufacturing sector growth creates CHP opportunities. Kenya, Ghana, and other emerging markets show increasing interest in CHP technologies for industrial and commercial applications, supported by international development programs and private investment.

Regional market characteristics vary significantly in terms of technology preferences, fuel availability, regulatory frameworks, and market maturity levels. Gulf markets favor large-scale gas turbine systems, while sub-Saharan markets often prefer smaller reciprocating engine systems. Natural gas availability influences technology selection, with biomass and biogas CHP systems gaining traction in agricultural regions with limited gas infrastructure.

Market leadership positions in the Middle East and Africa CHP market are held by established international technology providers with strong regional presence and local partnerships. The competitive landscape features both global equipment manufacturers and specialized regional service providers, creating a diverse ecosystem of solution providers.

Competitive strategies focus on technology innovation, local partnerships, and comprehensive service offerings. Leading companies invest in regional manufacturing capabilities, service centers, and technical training programs to enhance market position and customer support. Strategic alliances with local engineering companies and financial institutions become increasingly important for project development and execution.

Technology-based segmentation reveals distinct market preferences and applications across the Middle East and Africa region:

By Technology Type:

By Fuel Type:

By Application Sector:

Industrial CHP applications demonstrate the strongest market performance, driven by continuous operation profiles and substantial thermal energy requirements. Petrochemical facilities represent the largest single application category, utilizing CHP systems for process heating, steam generation, and power supply. Food processing industries show growing adoption rates, particularly in dairy, beverage, and agricultural processing facilities where both heating and cooling demands create optimal CHP applications.

Commercial CHP systems gain traction in healthcare facilities, hotels, and large office complexes where reliable power supply and thermal energy needs justify CHP investment. Hospital applications particularly benefit from CHP’s reliability advantages and ability to provide emergency power during grid outages. Hotel applications leverage CHP for space heating, hot water, and cooling through absorption chillers, achieving significant operational cost savings.

District energy systems represent an emerging high-growth category, particularly in Gulf countries with major urban development projects. These systems serve multiple buildings or facilities from centralized CHP plants, achieving economies of scale and optimized efficiency. Smart city developments increasingly incorporate district CHP systems as core infrastructure components, supporting sustainable development goals and energy efficiency targets.

Renewable-integrated CHP systems show growing market interest as hybrid configurations combining conventional CHP with solar thermal, biomass, or biogas resources. These systems achieve enhanced sustainability profiles while maintaining operational reliability, appealing to organizations with strong environmental commitments. Agricultural regions particularly benefit from biomass and biogas CHP systems that utilize local waste streams while providing energy services.

End-user organizations realize substantial benefits from CHP implementation including reduced energy costs, improved energy security, and enhanced environmental performance. Industrial facilities typically achieve energy cost reductions of 20-30% compared to separate heat and power procurement, while also gaining energy supply reliability and independence from grid disruptions. The technology’s high efficiency translates directly to reduced carbon emissions and improved sustainability metrics.

Technology providers benefit from growing market demand and opportunities for long-term service relationships with CHP system owners. The complexity of CHP systems creates ongoing service revenue opportunities through maintenance contracts, performance optimization, and system upgrades. Regional market development enables technology providers to establish local presence and build customer relationships that support business expansion.

Government stakeholders achieve multiple policy objectives through CHP market development including energy efficiency improvement, industrial competitiveness enhancement, and environmental protection. CHP systems contribute to national energy security by reducing import dependence and improving overall energy system efficiency. The technology supports economic development through industrial expansion and job creation in manufacturing and service sectors.

Financial institutions find attractive investment opportunities in CHP projects with predictable cash flows and strong economic fundamentals. The technology’s proven performance record and long asset life create suitable conditions for project financing and investment. Growing market maturity and standardization reduce investment risks while creating opportunities for portfolio development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation initiatives reshape CHP system capabilities through integration of IoT sensors, data analytics, and artificial intelligence technologies. Modern CHP installations incorporate predictive maintenance systems that optimize performance and reduce downtime, while advanced control systems enable dynamic response to changing energy demands and grid conditions. MarkWide Research analysis indicates that digitally-enabled CHP systems achieve efficiency improvements of 8-12% compared to conventional installations.

Sustainability integration trends drive development of hybrid CHP systems that combine conventional technologies with renewable energy sources. Solar thermal integration becomes increasingly common in Gulf markets, while biomass and biogas CHP systems gain traction in agricultural regions. These hybrid configurations achieve enhanced environmental performance while maintaining operational reliability and economic competitiveness.

Modular system designs enable more flexible CHP deployment across diverse applications and market segments. Standardized, factory-built CHP modules reduce installation time and costs while improving quality and reliability. This trend particularly benefits smaller industrial facilities and commercial applications that previously faced economic barriers to CHP adoption.

Service model evolution toward comprehensive energy-as-a-service offerings changes how CHP systems are procured and operated. Performance-based contracts and guaranteed savings programs reduce customer risks while enabling broader market adoption. Third-party ownership models and energy service companies create new business opportunities and financing mechanisms for CHP development.

Major project announcements across the region demonstrate growing CHP market momentum and investor confidence. The UAE’s industrial sector has witnessed several large-scale CHP installations in petrochemical and manufacturing facilities, while Saudi Arabia’s NEOM project incorporates advanced CHP technologies as part of its sustainable city development. These high-profile projects showcase CHP capabilities and encourage broader market adoption.

Technology partnerships between international providers and regional companies accelerate market development and capability building. Joint ventures for CHP manufacturing, engineering services, and project development create local expertise while reducing costs and delivery times. These partnerships also facilitate technology transfer and workforce development that support long-term market growth.

Regulatory developments in several countries enhance CHP market conditions through improved interconnection standards, streamlined permitting processes, and financial incentives. Egypt’s new energy efficiency law includes specific provisions for CHP systems, while Morocco’s industrial energy program provides support for CHP implementation. These regulatory improvements reduce barriers and create more favorable investment conditions.

Financing innovations including green bonds, blended finance mechanisms, and international development funding expand CHP project financing options. Development finance institutions increasingly recognize CHP’s contribution to sustainable development goals and provide favorable financing terms. Private equity and infrastructure funds also show growing interest in CHP investments as the market matures.

Market entry strategies for new participants should focus on partnership development with established regional players and gradual capability building rather than direct competition with market leaders. Successful market entry requires understanding of local regulations, customer preferences, and business practices that vary significantly across different countries and market segments. Building relationships with key industrial customers and government stakeholders proves essential for long-term success.

Technology positioning recommendations emphasize the importance of offering comprehensive solutions rather than equipment-only approaches. Customers increasingly seek turnkey project delivery, financing assistance, and long-term service support that require integrated capabilities across multiple disciplines. Companies should develop or partner for engineering, construction, financing, and service capabilities to compete effectively in the regional market.

Investment prioritization should focus on markets with established industrial bases, supportive regulatory frameworks, and demonstrated CHP adoption patterns. Gulf markets offer the most immediate opportunities due to abundant natural gas resources and advanced industrial sectors, while North African markets present medium-term growth potential supported by industrial development programs. Sub-Saharan markets require longer-term investment horizons but offer substantial growth potential.

Risk mitigation strategies should address regulatory uncertainties, fuel supply considerations, and technical capability requirements that can impact project success. Diversification across multiple markets and applications reduces concentration risks, while local partnerships provide market knowledge and regulatory navigation capabilities. Comprehensive due diligence on fuel supply arrangements and long-term availability proves critical for project viability.

Long-term market projections indicate sustained growth for the Middle East and Africa CHP market driven by industrial expansion, urbanization, and increasing focus on energy efficiency. MWR forecasts suggest the market will maintain robust growth momentum with expanding applications across industrial, commercial, and district energy segments. Technology advancement and cost reduction trends support broader market adoption and enhanced economic competitiveness.

Technology evolution trends point toward more efficient, flexible, and environmentally sustainable CHP systems that integrate seamlessly with renewable energy sources and smart grid infrastructure. Fuel cell technologies show particular promise for high-efficiency applications, while hybrid systems combining multiple technologies optimize performance across diverse operating conditions. Digital integration continues advancing with artificial intelligence and machine learning capabilities enhancing system optimization and predictive maintenance.

Market expansion patterns suggest geographic diversification beyond current concentration in Gulf markets, with growing adoption in North and Sub-Saharan Africa driven by industrial development and energy access initiatives. District energy applications show strong growth potential in rapidly urbanizing areas, while agricultural and rural applications benefit from biomass and biogas CHP systems that utilize local resources.

Investment outlook remains positive supported by strong market fundamentals, improving regulatory conditions, and growing recognition of CHP’s economic and environmental benefits. The market expects continued technology cost reductions and performance improvements that enhance project economics and broaden adoption opportunities. International development funding and climate finance mechanisms provide additional support for sustainable CHP projects across the region.

The Middle East and Africa combined heat and power market represents a dynamic and rapidly evolving sector with substantial growth potential driven by industrial expansion, energy efficiency requirements, and sustainability objectives. The market benefits from strong regional fundamentals including abundant fuel resources, growing industrial base, and increasing government support for efficient energy technologies. While challenges exist related to capital costs, technical complexity, and regulatory variations, the overall market outlook remains highly positive.

Strategic opportunities abound for technology providers, investors, and end users who understand regional market dynamics and develop appropriate strategies for market participation. The evolution toward more sophisticated, digitally-enabled CHP systems creates new value propositions while expanding addressable markets. Hybrid technologies incorporating renewable energy sources position the market for long-term sustainability and continued growth.

Market maturation trends indicate increasing sophistication among customers, service providers, and regulatory frameworks that support continued development and adoption. The establishment of regional manufacturing capabilities, service networks, and technical expertise creates a foundation for sustained market growth and innovation. As the market continues evolving, participants who invest in comprehensive capabilities and strategic partnerships will be best positioned to capitalize on emerging opportunities and achieve long-term success in this dynamic and promising market segment.

What is Combined Heat & Power?

Combined Heat & Power (CHP) refers to a technology that simultaneously generates electricity and useful heat from the same energy source. This process enhances energy efficiency and is commonly used in industrial, commercial, and residential applications.

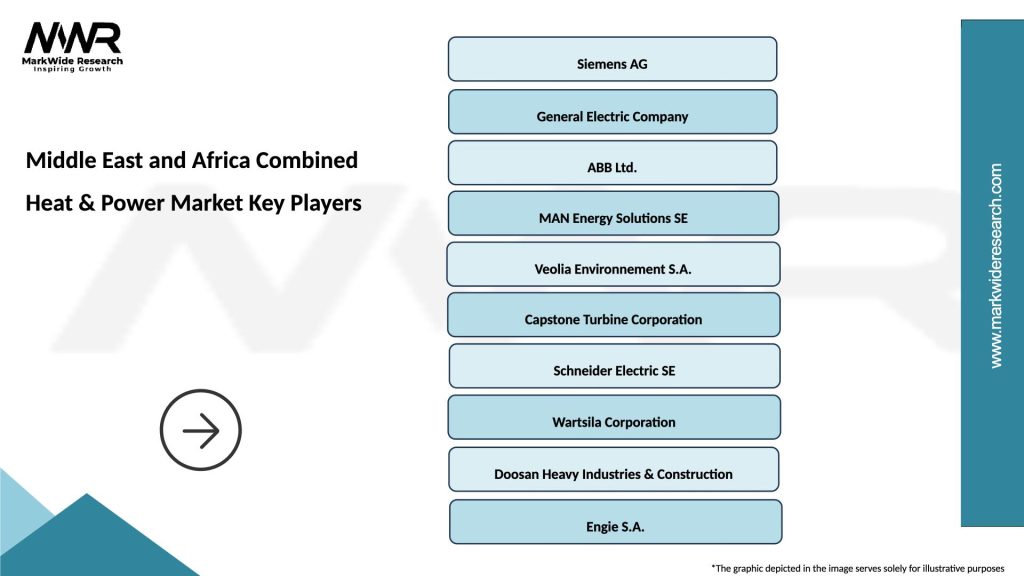

What are the key players in the Middle East and Africa Combined Heat & Power Market?

Key players in the Middle East and Africa Combined Heat & Power Market include Siemens AG, General Electric, and Wärtsilä, among others. These companies are involved in the development and implementation of CHP systems across various sectors.

What are the growth factors driving the Middle East and Africa Combined Heat & Power Market?

The growth of the Middle East and Africa Combined Heat & Power Market is driven by increasing energy efficiency demands, rising energy costs, and the need for reliable power supply in industrial sectors. Additionally, government initiatives promoting sustainable energy solutions contribute to market expansion.

What challenges does the Middle East and Africa Combined Heat & Power Market face?

The Middle East and Africa Combined Heat & Power Market faces challenges such as high initial investment costs, regulatory hurdles, and the need for skilled workforce. These factors can hinder the widespread adoption of CHP technologies in the region.

What opportunities exist in the Middle East and Africa Combined Heat & Power Market?

Opportunities in the Middle East and Africa Combined Heat & Power Market include the growing demand for renewable energy integration, advancements in CHP technology, and increasing investments in infrastructure. These factors can enhance the market’s potential for growth.

What trends are shaping the Middle East and Africa Combined Heat & Power Market?

Trends shaping the Middle East and Africa Combined Heat & Power Market include the rise of decentralized energy systems, increased focus on sustainability, and the integration of smart technologies. These trends are influencing how CHP systems are designed and implemented.

Middle East and Africa Combined Heat & Power Market

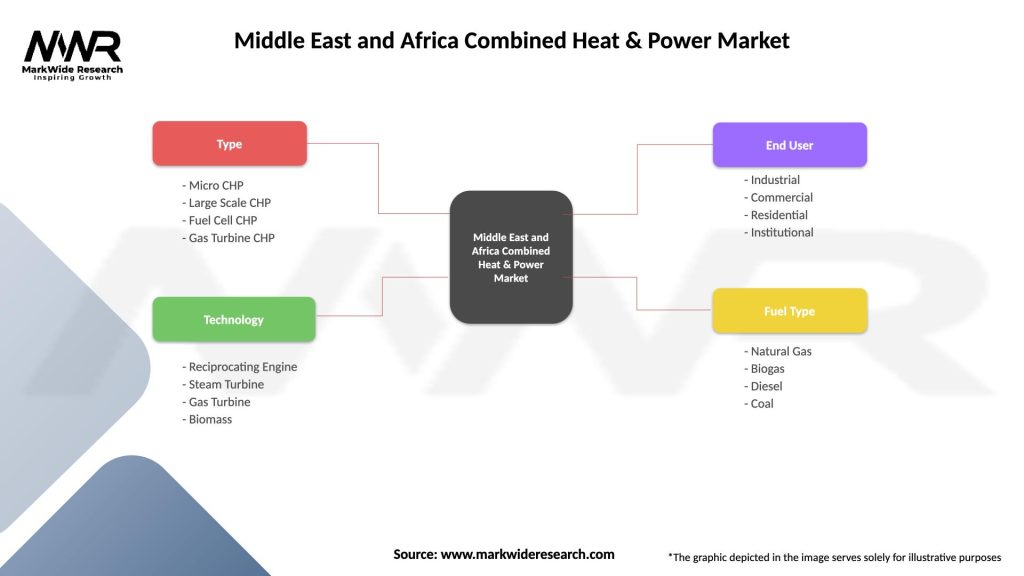

| Segmentation Details | Description |

|---|---|

| Type | Micro CHP, Large Scale CHP, Fuel Cell CHP, Gas Turbine CHP |

| Technology | Reciprocating Engine, Steam Turbine, Gas Turbine, Biomass |

| End User | Industrial, Commercial, Residential, Institutional |

| Fuel Type | Natural Gas, Biogas, Diesel, Coal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Combined Heat & Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at