444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa collagen supplement market represents a rapidly expanding segment within the broader nutraceuticals industry, driven by increasing health consciousness and growing awareness of anti-aging benefits. This dynamic market encompasses various collagen-based products including powders, capsules, tablets, and liquid formulations designed to support skin health, joint function, and overall wellness. The region’s diverse demographic profile, coupled with rising disposable incomes and urbanization trends, has created substantial opportunities for collagen supplement manufacturers and distributors.

Market dynamics in the Middle East and Africa are characterized by evolving consumer preferences toward preventive healthcare and beauty-from-within concepts. The market demonstrates significant growth potential, with MarkWide Research indicating a robust compound annual growth rate of 8.2% CAGR projected through the forecast period. Key contributing factors include expanding retail infrastructure, increased penetration of e-commerce platforms, and growing influence of social media marketing on consumer purchasing decisions.

Regional variations play a crucial role in market development, with the Gulf Cooperation Council countries leading in terms of market penetration and consumer adoption rates. South Africa and Nigeria represent emerging markets with substantial growth opportunities, while North African countries show increasing interest in premium wellness products. The market’s evolution reflects broader trends toward personalized nutrition and functional food supplements across diverse cultural and economic landscapes.

The Middle East and Africa collagen supplement market refers to the commercial ecosystem encompassing the production, distribution, and consumption of collagen-based nutritional supplements across countries in the Middle Eastern and African regions. These supplements contain hydrolyzed collagen peptides derived from various sources including bovine, marine, porcine, and plant-based alternatives, formulated to support skin elasticity, joint health, bone strength, and overall wellness.

Collagen supplements function by providing bioavailable amino acids that serve as building blocks for the body’s natural collagen synthesis processes. The market includes various product formats such as powdered supplements for mixing with beverages, encapsulated forms for convenient consumption, chewable tablets, and ready-to-drink liquid formulations. These products target diverse consumer segments including health-conscious individuals, aging populations, athletes, and beauty enthusiasts seeking comprehensive wellness solutions.

Market significance extends beyond traditional nutritional supplementation, encompassing beauty and cosmetic applications, sports nutrition, and therapeutic uses for joint and bone health. The regional market reflects unique cultural preferences, regulatory frameworks, and economic conditions that influence product development, marketing strategies, and consumer adoption patterns across different countries within the Middle East and Africa.

Strategic market analysis reveals the Middle East and Africa collagen supplement market as a high-growth sector benefiting from demographic trends, lifestyle changes, and increasing health awareness. The market demonstrates strong momentum driven by urbanization, rising female workforce participation, and growing emphasis on preventive healthcare approaches. Consumer preferences increasingly favor multi-functional supplements that address both health and beauty concerns simultaneously.

Key market drivers include expanding middle-class populations, increasing exposure to global wellness trends, and growing influence of digital marketing channels. The market benefits from 65% of consumers expressing interest in natural and organic supplement options, reflecting broader trends toward clean-label products. E-commerce penetration has accelerated market access, particularly in urban areas where traditional retail infrastructure may be limited.

Competitive landscape features a mix of international brands and regional players, with market leaders focusing on product innovation, strategic partnerships, and localized marketing approaches. Distribution channels span traditional pharmacies, health stores, supermarkets, and rapidly growing online platforms. The market’s future trajectory appears promising, supported by favorable demographic trends and increasing consumer education about collagen benefits.

Consumer behavior analysis reveals several critical insights shaping market development across the Middle East and Africa. The following key insights demonstrate the market’s evolution and growth potential:

Market penetration varies significantly across different countries, with Gulf states showing higher adoption rates compared to sub-Saharan African markets. However, emerging economies demonstrate rapid growth potential as consumer education and product availability improve through enhanced distribution networks and marketing initiatives.

Demographic transitions serve as primary market drivers, with aging populations in developed Middle Eastern countries and growing middle-class segments across Africa creating substantial demand for health and wellness products. The region’s young demographic profile, combined with increasing life expectancy, establishes long-term market sustainability and growth opportunities for collagen supplement manufacturers.

Lifestyle modernization significantly influences market expansion, as urbanization and changing work patterns increase stress levels and reduce physical activity. These factors contribute to growing awareness of preventive healthcare needs and willingness to invest in nutritional supplements. Additionally, increasing female workforce participation correlates with higher disposable income and greater focus on personal health and beauty maintenance.

Digital transformation accelerates market growth through enhanced consumer education and improved product accessibility. Social media platforms, health blogs, and influencer marketing create awareness about collagen benefits while e-commerce channels provide convenient purchasing options. The proliferation of smartphones and internet connectivity enables broader market reach, particularly in previously underserved regions.

Healthcare system evolution toward preventive care models supports supplement market growth. Rising healthcare costs encourage consumers to invest in preventive measures, while healthcare professionals increasingly recommend nutritional supplements as part of comprehensive wellness strategies. Government initiatives promoting healthy aging and wellness tourism further support market development across the region.

Economic volatility presents significant challenges for market growth, particularly in countries experiencing currency fluctuations, inflation, or political instability. These factors affect consumer purchasing power and willingness to spend on non-essential health products. Import-dependent markets face additional challenges from currency devaluation and trade restrictions that impact product pricing and availability.

Regulatory complexities create barriers for market entry and expansion, as different countries maintain varying standards for supplement registration, labeling, and marketing claims. Inconsistent regulatory frameworks across the region complicate product development and distribution strategies, particularly for companies seeking to establish regional presence. Halal certification requirements add additional compliance layers for certain market segments.

Consumer skepticism regarding supplement efficacy and safety concerns limit market penetration in some regions. Limited clinical research specific to regional populations and cultural preferences for traditional remedies create resistance to modern supplement adoption. Additionally, prevalence of counterfeit products in some markets undermines consumer confidence in supplement quality and effectiveness.

Infrastructure limitations constrain market development, particularly in rural and remote areas where cold chain logistics and reliable distribution networks remain underdeveloped. Limited retail infrastructure in certain regions restricts product availability and consumer access, while inadequate storage facilities may compromise product quality and shelf life.

Untapped market segments present substantial growth opportunities, particularly in emerging African economies where supplement penetration remains low but economic development accelerates. Countries like Kenya, Ghana, and Ethiopia demonstrate growing middle-class populations with increasing health awareness and disposable income. These markets offer significant potential for companies willing to invest in local market development and consumer education initiatives.

Product innovation opportunities exist in developing region-specific formulations that address local health concerns and cultural preferences. Opportunities include combining collagen with traditional herbs and nutrients popular in regional markets, developing affordable product formats for price-sensitive consumers, and creating specialized formulations for specific demographic groups such as athletes or elderly populations.

Digital market expansion offers significant opportunities for reaching underserved consumers through e-commerce platforms, mobile applications, and social media marketing. The rapid adoption of digital payment systems and smartphone technology creates new channels for product distribution and consumer engagement. Telemedicine and digital health platforms provide additional opportunities for supplement recommendation and sales.

Partnership opportunities with local distributors, healthcare providers, and retail chains can accelerate market penetration and brand establishment. Collaborations with fitness centers, beauty salons, and wellness clinics create new distribution channels while building consumer trust through professional recommendations. Strategic partnerships with local manufacturers can reduce costs and improve market access.

Supply chain dynamics significantly influence market development, with most collagen raw materials imported from established global suppliers while finished products may be manufactured locally or regionally. The market benefits from improving logistics infrastructure and trade agreements that facilitate product movement across borders. However, supply chain disruptions and raw material price volatility can impact product availability and pricing strategies.

Competitive dynamics feature intense competition between international brands and emerging local players, with market share battles fought primarily on price, quality, and brand recognition. International companies leverage global expertise and marketing resources, while local players compete through cultural understanding, competitive pricing, and localized distribution networks. Market consolidation trends may accelerate as successful companies expand through acquisitions and strategic partnerships.

Technology adoption influences market dynamics through improved manufacturing processes, enhanced product formulations, and innovative delivery systems. Advanced extraction and processing technologies enable higher-quality collagen peptides with improved bioavailability. Digital technologies transform marketing, sales, and customer engagement approaches, creating new competitive advantages for technology-savvy companies.

Regulatory dynamics continue evolving as governments develop more comprehensive frameworks for supplement oversight and consumer protection. Harmonization efforts across regional economic communities may simplify regulatory compliance and facilitate cross-border trade. However, increasing regulatory scrutiny may also raise compliance costs and market entry barriers for smaller companies.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves extensive interviews with industry stakeholders including manufacturers, distributors, retailers, and consumers across different countries and market segments. This approach provides firsthand insights into market trends, challenges, and opportunities from various perspectives within the value chain.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. Academic research papers and clinical studies provide scientific context for market trends and consumer behavior patterns. International trade statistics help quantify market size and growth patterns across different countries and product categories.

Market segmentation analysis utilizes demographic data, consumer surveys, and sales analytics to identify distinct market segments and their characteristics. Geographic analysis considers economic indicators, population demographics, and cultural factors that influence market development across different regions. Product category analysis examines sales data, pricing trends, and innovation patterns to understand competitive dynamics and growth opportunities.

Forecasting methodology combines quantitative modeling with qualitative expert insights to project future market trends and growth trajectories. Economic indicators, demographic projections, and industry trend analysis inform baseline forecasts, while scenario analysis considers potential market disruptions and growth accelerators. Regular model updates incorporate new data and market developments to maintain forecast accuracy and relevance.

Gulf Cooperation Council countries represent the most mature and developed segment of the regional market, with 42% market share driven by high disposable incomes, advanced retail infrastructure, and strong health awareness. The United Arab Emirates and Saudi Arabia lead market development, benefiting from diverse expatriate populations and government initiatives promoting wellness tourism. These markets demonstrate preference for premium products and international brands, with growing interest in personalized nutrition solutions.

North African markets including Egypt, Morocco, and Tunisia show steady growth potential supported by large populations and improving economic conditions. These markets demonstrate 23% regional market share with growing middle-class segments driving demand for health and beauty products. Local manufacturing capabilities and proximity to European markets create competitive advantages for regional distribution and product development.

Sub-Saharan African markets represent the highest growth potential segment, with countries like South Africa, Nigeria, and Kenya leading market development. Despite currently holding 35% regional market share, these markets demonstrate rapid growth rates as economic development accelerates and consumer awareness increases. Urban centers drive market growth while rural markets remain largely untapped opportunities for future expansion.

Market infrastructure varies significantly across regions, with Gulf states offering advanced retail and logistics networks while many African markets rely on traditional distribution channels. E-commerce penetration grows rapidly in urban areas, creating new opportunities for market access and consumer engagement. Regional trade agreements and economic integration initiatives facilitate cross-border commerce and market expansion strategies.

Market leadership features a diverse mix of international corporations and regional specialists competing across different market segments and price points. The competitive landscape continues evolving as market growth attracts new entrants while established players expand their regional presence through strategic investments and partnerships.

Competitive strategies focus on product differentiation, brand building, and distribution network expansion. Companies invest heavily in consumer education, clinical research, and marketing partnerships to establish market presence and consumer loyalty. Local partnerships and cultural adaptation remain critical success factors for international brands entering regional markets.

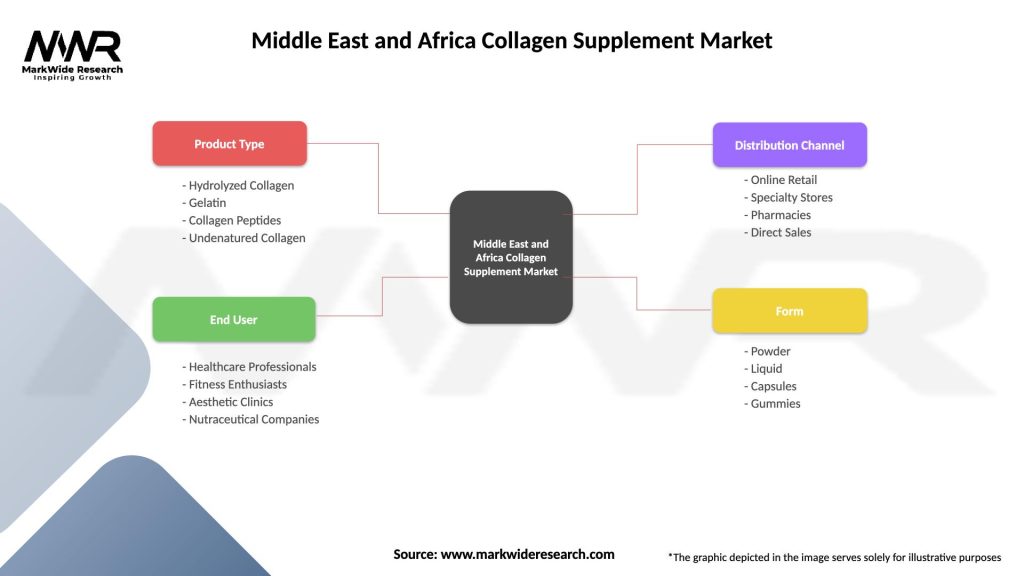

Product type segmentation reveals diverse consumer preferences across different formats and formulations. The market encompasses various product categories designed to meet specific consumer needs and usage preferences:

Source-based segmentation reflects cultural preferences and dietary restrictions across different regional markets:

Application-based segmentation demonstrates diverse consumer motivations and usage patterns across the regional market, with beauty applications showing 38% segment share while joint health represents 31% of applications.

Beauty and skincare applications dominate market demand, driven by growing awareness of collagen’s role in maintaining skin elasticity and reducing visible signs of aging. This category benefits from strong marketing support through beauty influencers and dermatologist recommendations. Consumer preferences favor products with additional beauty-enhancing ingredients such as vitamins C and E, hyaluronic acid, and antioxidants.

Joint health and mobility represents a rapidly growing category, particularly among aging populations and active individuals. Products targeting this segment often combine collagen with glucosamine, chondroitin, and anti-inflammatory compounds. The category benefits from increasing sports participation and growing awareness of preventive joint care among younger demographics.

General wellness and nutrition encompasses products positioned as comprehensive health supplements supporting multiple bodily functions. This category appeals to health-conscious consumers seeking convenient ways to enhance their overall nutritional intake. Products often feature additional proteins, vitamins, and minerals to provide comprehensive nutritional support.

Sports and fitness nutrition targets athletes and fitness enthusiasts seeking performance enhancement and recovery support. This specialized category emphasizes rapid absorption, muscle recovery benefits, and combination with other performance-supporting nutrients. The segment benefits from growing fitness culture and increasing participation in organized sports across the region.

Manufacturers benefit from expanding market opportunities across diverse geographic regions and demographic segments. The growing market provides opportunities for capacity expansion, product innovation, and brand development. Companies can leverage economies of scale while developing specialized products for different regional preferences and price points. Strategic partnerships with local distributors and retailers facilitate market entry and expansion.

Distributors and retailers gain access to high-growth product categories with attractive profit margins and strong consumer demand. The supplement market offers opportunities for category expansion and customer base development. Retailers benefit from increased foot traffic and basket size as consumers often purchase complementary health and wellness products. E-commerce platforms particularly benefit from the convenience-focused nature of supplement purchasing.

Healthcare professionals can offer patients additional tools for preventive health management and wellness optimization. Collagen supplements provide evidence-based options for supporting patient health goals related to aging, joint health, and overall wellness. Professional recommendations enhance patient outcomes while building practice reputation and patient loyalty.

Consumers receive convenient access to scientifically-supported wellness solutions that address multiple health and beauty concerns. The market’s growth ensures improved product quality, competitive pricing, and enhanced product availability. Increased competition drives innovation, resulting in more effective formulations and convenient delivery systems for consumer benefit.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trends drive demand for customized collagen supplements tailored to individual health needs, age groups, and lifestyle factors. Companies increasingly offer personalized nutrition consultations and customized product formulations based on consumer assessments and health goals. This trend reflects broader movement toward precision nutrition and individualized wellness approaches.

Clean label movement influences product development toward natural, organic, and minimally processed collagen supplements. Consumers increasingly scrutinize ingredient lists and prefer products free from artificial additives, preservatives, and synthetic compounds. This trend drives innovation in natural flavoring, organic sourcing, and transparent manufacturing processes.

Sustainability focus shapes consumer preferences toward environmentally responsible collagen sources and packaging. Marine collagen from sustainable fisheries gains popularity while companies invest in eco-friendly packaging solutions. Corporate social responsibility initiatives become important differentiators in competitive markets, particularly among environmentally conscious consumers.

Functional food integration represents emerging trend toward incorporating collagen into everyday food and beverage products. Companies develop collagen-enhanced coffee, smoothies, snacks, and meal replacements to provide convenient supplementation options. This trend expands market reach beyond traditional supplement consumers to mainstream food markets.

Digital health integration connects collagen supplementation with health tracking apps, wearable devices, and telemedicine platforms. Companies develop digital tools for tracking supplement effectiveness, providing usage reminders, and connecting consumers with healthcare professionals. This integration enhances consumer engagement and supports long-term supplementation adherence.

Manufacturing expansion initiatives across the region reflect growing market confidence and demand projections. Several international companies have announced plans for local production facilities to reduce costs, improve supply chain reliability, and better serve regional markets. These investments demonstrate long-term commitment to market development and create employment opportunities in local communities.

Regulatory harmonization efforts progress across various regional economic communities, potentially simplifying cross-border trade and market access. Organizations like the African Union and Gulf Cooperation Council work toward standardized supplement regulations that could facilitate market expansion and reduce compliance costs for manufacturers and distributors.

Research and development investments increase as companies seek to develop region-specific products and validate health claims through clinical studies. Local universities and research institutions collaborate with industry partners to conduct studies on regional populations, potentially leading to more targeted and effective product formulations.

Digital transformation initiatives accelerate across the industry as companies invest in e-commerce platforms, mobile applications, and digital marketing capabilities. These developments improve market access, enhance consumer engagement, and create new opportunities for direct-to-consumer sales models that bypass traditional distribution channels.

Strategic partnerships between international brands and local companies facilitate market entry and expansion while providing local partners with access to advanced technologies and global marketing expertise. These collaborations often result in improved product quality, enhanced distribution networks, and accelerated market development across the region.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and distribution channels before launching products. Companies should invest in consumer education and brand building activities to establish market presence and credibility. Partnerships with local distributors and retailers can accelerate market penetration while reducing entry risks and costs.

Product development focus should emphasize affordability, cultural adaptation, and multi-functional benefits to appeal to diverse regional markets. Companies should consider developing entry-level products for price-sensitive consumers while maintaining premium offerings for affluent segments. Halal certification and natural ingredient sourcing become critical for market acceptance in many regions.

Distribution strategy optimization requires multi-channel approaches combining traditional retail, modern trade, and digital platforms. E-commerce investment becomes essential for reaching urban consumers and expanding market access. Companies should develop flexible distribution models that can adapt to varying infrastructure levels across different countries and regions.

Marketing and communication strategies should emphasize education, scientific validation, and cultural relevance to build consumer trust and awareness. Digital marketing channels offer cost-effective ways to reach target audiences while traditional media remains important in certain markets. Influencer partnerships and healthcare professional endorsements can enhance credibility and accelerate adoption.

Long-term sustainability requires investment in local capabilities, supply chain development, and regulatory compliance systems. Companies should consider backward integration opportunities and local sourcing initiatives to reduce costs and improve supply chain resilience. Sustainability initiatives and corporate social responsibility programs can enhance brand reputation and consumer loyalty.

Market trajectory indicates sustained growth momentum driven by favorable demographic trends, increasing health awareness, and improving economic conditions across the region. MWR analysis projects continued market expansion with compound annual growth rates exceeding 8% in key markets through the forecast period. The market’s evolution toward mainstream acceptance positions collagen supplements as essential components of preventive healthcare and wellness routines.

Innovation acceleration will drive market development through advanced formulations, improved delivery systems, and personalized nutrition approaches. Companies investing in research and development capabilities will gain competitive advantages through superior product efficacy and consumer satisfaction. Technological integration with digital health platforms will enhance consumer engagement and support long-term market growth.

Geographic expansion will extend market reach into previously underserved regions as infrastructure development and economic growth create new opportunities. Rural market penetration will accelerate through improved distribution networks and affordable product offerings. Cross-border trade facilitation and regulatory harmonization will support regional market integration and growth.

Market maturation will bring increased competition, product standardization, and consumer sophistication. Companies must prepare for evolving competitive dynamics through brand differentiation, customer loyalty programs, and continuous innovation. Market consolidation may accelerate as successful companies expand through acquisitions and strategic partnerships.

Sustainability integration will become increasingly important as consumers demand environmentally responsible products and companies face pressure to demonstrate social responsibility. Companies investing in sustainable sourcing, eco-friendly packaging, and community development initiatives will build stronger market positions and consumer loyalty for long-term success.

The Middle East and Africa collagen supplement market represents a compelling growth opportunity characterized by favorable demographics, increasing health consciousness, and evolving consumer preferences toward preventive wellness solutions. Market development reflects broader regional trends including urbanization, economic development, and digital transformation that create new opportunities for innovative companies and strategic investors.

Strategic success factors include deep understanding of local market conditions, cultural adaptation, and flexible business models that can accommodate diverse economic and regulatory environments. Companies that invest in consumer education, brand building, and distribution network development will establish sustainable competitive advantages in this dynamic market. The integration of digital technologies and personalized nutrition approaches will further enhance market opportunities and consumer engagement.

Long-term market prospects remain highly positive, supported by demographic advantages, improving healthcare infrastructure, and growing integration with global wellness trends. The market’s evolution toward mainstream acceptance positions collagen supplements as essential components of modern healthcare and beauty routines. Companies that align their strategies with regional market dynamics while maintaining global quality standards will capture the most significant opportunities in this expanding market landscape.

What is Collagen Supplement?

Collagen supplements are products designed to provide the body with collagen, a protein that plays a crucial role in maintaining skin elasticity, joint health, and overall structural integrity of various tissues. These supplements are often derived from animal sources and are available in various forms such as powders, capsules, and drinks.

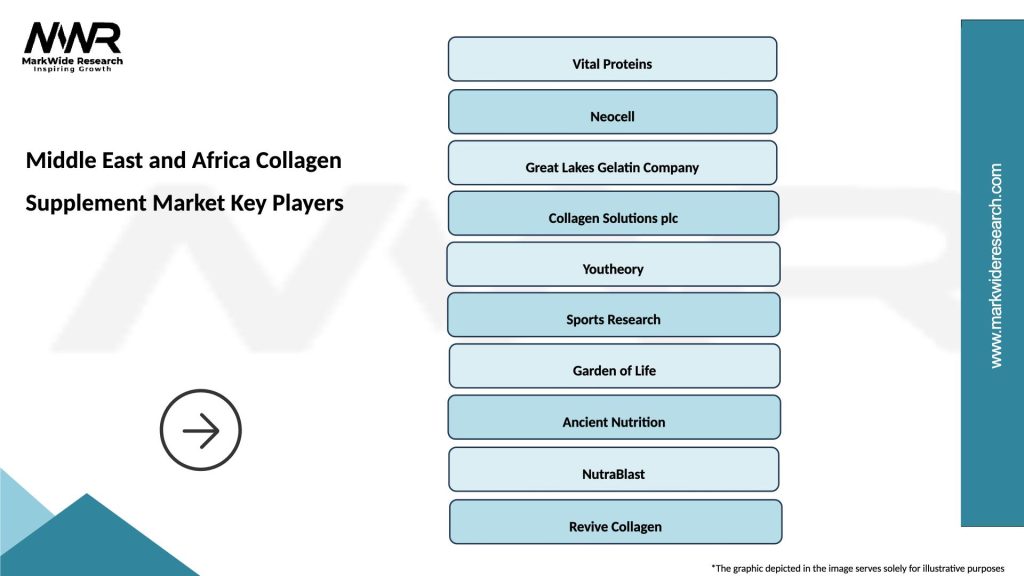

What are the key players in the Middle East and Africa Collagen Supplement Market?

Key players in the Middle East and Africa Collagen Supplement Market include companies like Vital Proteins, NeoCell, and Great Lakes Gelatin, which are known for their diverse range of collagen products. These companies focus on innovation and quality to meet the growing consumer demand for health and beauty supplements, among others.

What are the growth factors driving the Middle East and Africa Collagen Supplement Market?

The Middle East and Africa Collagen Supplement Market is driven by increasing consumer awareness of health benefits associated with collagen, rising demand for beauty and anti-aging products, and a growing trend towards preventive healthcare. Additionally, the expansion of e-commerce platforms has made these supplements more accessible to consumers.

What challenges does the Middle East and Africa Collagen Supplement Market face?

Challenges in the Middle East and Africa Collagen Supplement Market include regulatory hurdles regarding product safety and labeling, competition from alternative protein sources, and varying consumer perceptions about the efficacy of collagen supplements. These factors can impact market growth and consumer trust.

What opportunities exist in the Middle East and Africa Collagen Supplement Market?

The Middle East and Africa Collagen Supplement Market presents opportunities for growth through product innovation, such as plant-based collagen alternatives and functional foods. Additionally, increasing partnerships with health and wellness influencers can enhance brand visibility and consumer engagement.

What trends are shaping the Middle East and Africa Collagen Supplement Market?

Trends in the Middle East and Africa Collagen Supplement Market include a rising interest in clean label products, the incorporation of collagen into various food and beverage items, and a focus on sustainability in sourcing ingredients. These trends reflect changing consumer preferences towards health and wellness.

Middle East and Africa Collagen Supplement Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hydrolyzed Collagen, Gelatin, Collagen Peptides, Undenatured Collagen |

| End User | Healthcare Professionals, Fitness Enthusiasts, Aesthetic Clinics, Nutraceutical Companies |

| Distribution Channel | Online Retail, Specialty Stores, Pharmacies, Direct Sales |

| Form | Powder, Liquid, Capsules, Gummies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Collagen Supplement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at