444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa cargo and vehicle screening market represents a rapidly expanding sector driven by heightened security concerns, increasing trade volumes, and stringent regulatory requirements across the region. This dynamic market encompasses advanced screening technologies designed to detect threats, contraband, and prohibited items in cargo containers, vehicles, and transportation infrastructure. Security screening solutions have become indispensable components of modern logistics and transportation networks, particularly in strategic locations such as ports, airports, border crossings, and critical infrastructure facilities.

Regional dynamics indicate that the Middle East and Africa region is experiencing unprecedented growth in cargo screening adoption, with implementation rates increasing by approximately 12.5% annually across major transportation hubs. The market encompasses various screening technologies including X-ray systems, gamma-ray imaging, neutron detection, explosive detection systems, and advanced computed tomography solutions. Government initiatives focused on enhancing national security and facilitating legitimate trade have created substantial opportunities for screening technology providers.

Infrastructure development across the region, particularly in the Gulf Cooperation Council countries and emerging African markets, has accelerated demand for sophisticated screening solutions. The integration of artificial intelligence, machine learning, and automated threat recognition capabilities has transformed traditional screening operations into highly efficient, technology-driven processes. Trade facilitation remains a key driver, as organizations seek to balance security requirements with operational efficiency demands.

The Middle East and Africa cargo and vehicle screening market refers to the comprehensive ecosystem of technologies, services, and solutions designed to inspect, analyze, and secure cargo containers, vehicles, and transportation assets throughout the region’s logistics and transportation networks. This market encompasses both stationary and mobile screening systems that utilize various detection technologies to identify potential security threats, contraband materials, and prohibited items while facilitating legitimate trade and transportation activities.

Screening technologies within this market include advanced imaging systems, radiation detection equipment, explosive detection systems, and integrated security platforms that provide comprehensive threat identification capabilities. The market serves diverse end-users including government agencies, port authorities, airport operators, customs organizations, and private sector logistics providers who require reliable security screening solutions to meet regulatory compliance and operational security requirements.

Market momentum in the Middle East and Africa cargo and vehicle screening sector continues to accelerate, driven by increasing security threats, expanding trade volumes, and evolving regulatory frameworks. The region’s strategic position as a global trade hub has intensified focus on implementing advanced screening technologies that can effectively balance security requirements with operational efficiency demands. Technology adoption rates have increased significantly, with modern screening solutions demonstrating 35% improved detection capabilities compared to legacy systems.

Investment patterns reveal substantial commitments from both public and private sector organizations toward upgrading screening infrastructure and implementing next-generation detection technologies. The integration of artificial intelligence and automated threat recognition systems has emerged as a key differentiator, enabling organizations to process higher cargo volumes while maintaining stringent security standards. Regional cooperation initiatives have facilitated knowledge sharing and standardization efforts across multiple countries.

Market segmentation analysis indicates strong growth across multiple technology categories, with X-ray screening systems maintaining dominant market positions while emerging technologies such as computed tomography and advanced imaging solutions gain increasing adoption. The competitive landscape features both established international providers and emerging regional specialists who offer customized solutions tailored to specific market requirements and operational environments.

Strategic insights from comprehensive market analysis reveal several critical trends shaping the Middle East and Africa cargo and vehicle screening landscape:

Security imperatives represent the primary driving force behind cargo and vehicle screening market expansion across the Middle East and Africa region. Heightened awareness of security threats, including terrorism, smuggling, and contraband trafficking, has prompted government agencies and private organizations to invest substantially in advanced screening technologies. Threat landscape evolution continues to drive demand for more sophisticated detection capabilities that can identify emerging risks and adapt to changing security challenges.

Trade volume growth across major transportation hubs creates sustained demand for efficient screening solutions that can process increased cargo flows without compromising security standards. The region’s position as a critical link between Asia, Europe, and Africa has intensified focus on implementing screening technologies that facilitate legitimate trade while maintaining robust security protocols. Economic diversification initiatives in many countries have led to expanded logistics infrastructure and corresponding screening requirements.

Regulatory frameworks continue to evolve, with international organizations and national governments implementing stricter security standards that mandate advanced screening capabilities. Compliance requirements drive consistent technology upgrades and system enhancements across multiple sectors. Infrastructure development projects, including new ports, airports, and border facilities, create substantial opportunities for screening technology deployment and integration.

Technological advancement in screening capabilities, including improved detection accuracy, faster processing speeds, and enhanced user interfaces, makes modern solutions increasingly attractive to potential adopters. The integration of artificial intelligence and automated analysis capabilities addresses traditional challenges related to operator training and consistency in threat identification.

Capital investment requirements present significant challenges for many organizations considering advanced screening technology implementation. High-end screening systems require substantial upfront investments, ongoing maintenance costs, and specialized infrastructure modifications that may strain organizational budgets. Budget constraints particularly affect smaller ports, border facilities, and emerging market operators who may lack sufficient financial resources for comprehensive screening upgrades.

Technical complexity associated with modern screening systems creates implementation challenges, particularly in regions with limited technical expertise and support infrastructure. Organizations must invest in extensive training programs, technical support arrangements, and ongoing maintenance capabilities to ensure effective system operation. Integration difficulties with existing security infrastructure and operational procedures can complicate deployment timelines and increase implementation costs.

Operational disruption during system installation and commissioning phases can impact cargo processing capabilities and create temporary inefficiencies. Organizations must carefully plan implementation schedules to minimize operational impact while ensuring successful technology deployment. Change management challenges related to new operational procedures and technology adoption can affect user acceptance and system effectiveness.

Regulatory variations across different countries and jurisdictions create complexity for organizations operating in multiple markets. Varying standards, certification requirements, and operational procedures necessitate customized solutions and specialized compliance efforts that increase overall project complexity and costs.

Infrastructure expansion across the Middle East and Africa region creates substantial opportunities for screening technology providers. Major infrastructure projects, including new ports, airports, logistics hubs, and border facilities, require comprehensive screening solutions from initial design phases. Smart city initiatives and urban development projects increasingly incorporate advanced security technologies as integral components of modern infrastructure planning.

Technology modernization programs present significant opportunities as organizations seek to upgrade legacy screening systems with advanced capabilities. The transition from traditional X-ray systems to computed tomography, artificial intelligence-enabled platforms, and integrated security solutions creates sustained demand for next-generation technologies. Retrofit opportunities in existing facilities provide additional market potential for technology providers offering flexible upgrade solutions.

Regional cooperation initiatives and international partnerships facilitate market expansion opportunities for screening technology providers. Collaborative security programs, knowledge sharing initiatives, and standardization efforts create platforms for technology demonstration and adoption across multiple countries. Capacity building programs supported by international organizations provide funding and technical assistance for screening technology implementation in emerging markets.

Private sector expansion in logistics, transportation, and industrial sectors creates new market segments for screening technology adoption. Manufacturing facilities, distribution centers, and logistics providers increasingly recognize the value of implementing screening solutions to protect their operations and comply with security requirements. Supply chain security concerns drive demand for comprehensive screening capabilities throughout logistics networks.

Competitive dynamics within the Middle East and Africa cargo and vehicle screening market reflect a complex interplay between established international providers and emerging regional specialists. Market leaders leverage extensive experience, comprehensive product portfolios, and global support networks to maintain competitive advantages, while regional providers focus on customized solutions, local support capabilities, and cost-effective alternatives. Technology differentiation has become increasingly important as providers seek to distinguish their offerings through advanced capabilities and innovative features.

Customer requirements continue to evolve, with organizations seeking screening solutions that provide enhanced detection capabilities, improved operational efficiency, and comprehensive integration with existing security infrastructure. The demand for turnkey solutions that include equipment, installation, training, and ongoing support has increased as customers prefer single-source providers who can manage entire project lifecycles.

Partnership strategies have emerged as critical success factors, with technology providers establishing relationships with local distributors, system integrators, and service providers to enhance market reach and support capabilities. Strategic alliances between international technology providers and regional partners facilitate market entry and provide access to local expertise and customer relationships.

Innovation cycles continue to accelerate, with providers investing substantially in research and development to maintain competitive positions and address evolving customer requirements. The integration of artificial intelligence, machine learning, and advanced analytics capabilities represents a key focus area for technology development and market differentiation.

Comprehensive analysis of the Middle East and Africa cargo and vehicle screening market employed multiple research methodologies to ensure accurate and reliable market insights. Primary research activities included extensive interviews with industry executives, government officials, end-users, and technology providers across the region. Survey instruments were designed to capture quantitative data regarding market trends, technology adoption patterns, and future investment plans.

Secondary research encompassed detailed analysis of industry reports, government publications, regulatory documents, and company financial statements to validate primary research findings and provide comprehensive market context. Market modeling techniques were employed to analyze historical trends, identify growth patterns, and develop projections for future market development.

Regional analysis involved country-specific research activities to understand local market conditions, regulatory environments, and competitive dynamics. Field research in key markets provided insights into operational challenges, technology preferences, and implementation experiences that inform market understanding and strategic recommendations.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews, and employing statistical analysis techniques to ensure research accuracy and reliability. Expert panels and industry advisory groups provided additional validation and insights to enhance research quality and market understanding.

Gulf Cooperation Council countries represent the most mature and technologically advanced segment of the Middle East and Africa cargo and vehicle screening market. The United Arab Emirates, Saudi Arabia, and Qatar have implemented comprehensive screening infrastructure across major ports, airports, and border facilities, with adoption rates exceeding 85% at major transportation hubs. Investment levels in these markets remain robust, driven by continued infrastructure expansion and technology modernization initiatives.

North African markets demonstrate significant growth potential, with countries such as Egypt, Morocco, and Tunisia investing in screening technology upgrades to support expanding trade volumes and enhanced security requirements. Regional integration initiatives and international partnerships have facilitated technology transfer and capacity building programs that accelerate market development.

Sub-Saharan Africa presents emerging opportunities as infrastructure development accelerates and security awareness increases across multiple countries. South Africa maintains the most developed screening market in the region, while countries such as Nigeria, Kenya, and Ghana demonstrate increasing adoption of advanced screening technologies. Market penetration in these regions currently stands at approximately 25% of potential installations, indicating substantial growth opportunities.

Regional cooperation initiatives, including the African Continental Free Trade Area and various bilateral agreements, create platforms for standardization efforts and technology sharing that benefit the overall market development. Infrastructure financing from international development organizations supports screening technology implementation in emerging markets throughout the region.

Market leadership in the Middle East and Africa cargo and vehicle screening sector is characterized by a diverse mix of international technology providers and regional specialists who offer comprehensive screening solutions. The competitive environment reflects varying approaches to market development, technology innovation, and customer service delivery.

Competitive strategies vary significantly among market participants, with established providers leveraging global resources and comprehensive support networks while regional specialists focus on local expertise and customized solutions. Technology partnerships and strategic alliances have become increasingly important for market expansion and capability enhancement.

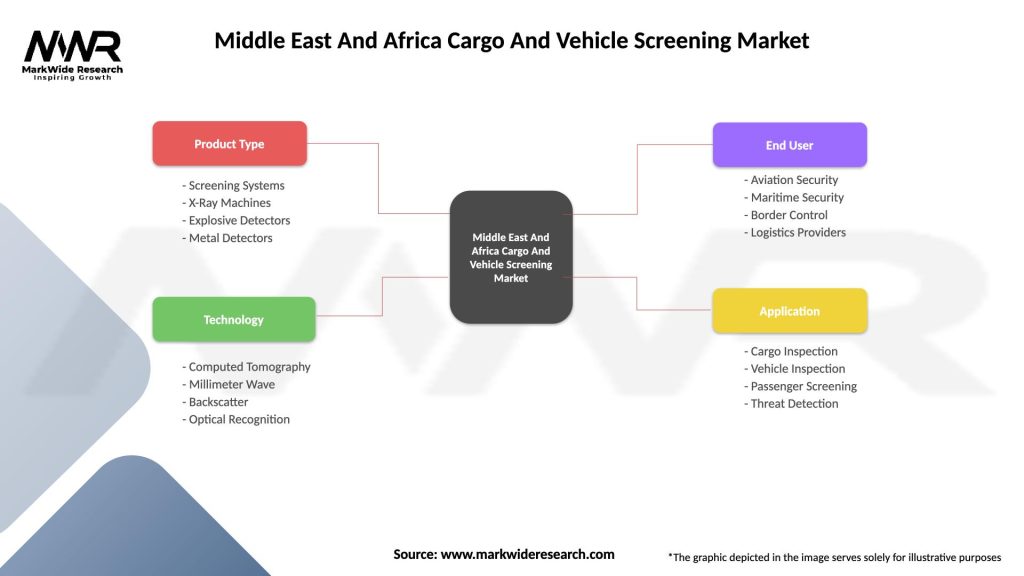

Technology segmentation within the Middle East and Africa cargo and vehicle screening market encompasses multiple detection methodologies and system configurations designed to address diverse security requirements and operational environments.

By Technology:

By Application:

By End-User:

X-ray screening systems maintain dominant market positions across the Middle East and Africa region, representing approximately 60% of total installations due to their versatility, proven effectiveness, and relatively moderate implementation costs. These systems provide reliable detection capabilities for most common security threats while offering operational flexibility and user-friendly interfaces. Technology evolution within this category includes enhanced image quality, automated threat recognition, and improved processing speeds.

Computed tomography systems demonstrate the fastest growth rates among screening technologies, driven by superior detection capabilities and advanced analysis features. These systems provide three-dimensional imaging that enables more accurate threat identification and reduces false alarm rates. Adoption patterns indicate increasing preference for CT systems at high-volume facilities where detection accuracy and operational efficiency are critical requirements.

Mobile screening solutions represent an emerging category with significant growth potential, particularly in regions with temporary security requirements or limited infrastructure. These systems provide operational flexibility and rapid deployment capabilities that address specific market needs. Application diversity includes event security, temporary installations, and emergency response scenarios.

Integrated platforms that combine multiple detection technologies gain increasing adoption as organizations seek comprehensive security solutions. These systems provide enhanced detection capabilities while simplifying operational procedures and reducing training requirements. Market preference trends indicate growing demand for turnkey solutions that include multiple screening technologies within unified platforms.

Government agencies benefit from enhanced national security capabilities, improved border control effectiveness, and strengthened regulatory compliance through advanced screening technology implementation. These systems enable more efficient processing of legitimate trade while maintaining robust security standards that protect national interests. Operational benefits include reduced manual inspection requirements, improved threat detection accuracy, and enhanced inter-agency coordination capabilities.

Port and airport operators realize significant operational advantages through screening technology adoption, including increased cargo processing capacity, reduced inspection delays, and improved customer satisfaction. Advanced screening systems enable operators to handle growing cargo volumes while maintaining security standards and regulatory compliance. Competitive advantages include enhanced service quality, reduced operational costs, and improved facility reputation.

Logistics providers benefit from streamlined security processes, reduced cargo delays, and enhanced supply chain visibility through screening technology integration. These systems enable more predictable transit times and improved customer service delivery while ensuring compliance with security requirements. Business benefits include reduced insurance costs, enhanced customer confidence, and improved operational efficiency.

Technology providers gain access to expanding market opportunities, long-term service relationships, and recurring revenue streams through screening system deployment and support services. The market provides platforms for technology innovation, regional expansion, and strategic partnership development. Growth opportunities include system upgrades, training services, and maintenance contracts that generate sustained revenue streams.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the cargo and vehicle screening market, with AI-powered systems demonstrating 45% improved threat detection accuracy compared to traditional screening technologies. Machine learning algorithms enable automated threat recognition, reduced false alarm rates, and enhanced operational efficiency. Technology evolution continues to advance AI capabilities, including predictive analytics and adaptive learning systems.

Mobile and portable solutions gain increasing market traction as organizations seek flexible screening capabilities for temporary deployments and diverse operational requirements. These systems provide rapid deployment capabilities and operational flexibility that address specific security needs. Innovation focus includes enhanced mobility, improved detection capabilities, and simplified operation procedures.

Cloud-based platforms emerge as important trends, enabling remote monitoring, centralized management, and data analytics capabilities that enhance screening operations. These platforms facilitate multi-site coordination, performance optimization, and predictive maintenance programs. Digital transformation initiatives drive adoption of cloud-enabled screening solutions across multiple market segments.

Sustainability considerations increasingly influence technology selection decisions, with organizations seeking energy-efficient systems and environmentally responsible solutions. Green technology initiatives and sustainability requirements create demand for eco-friendly screening systems. Environmental compliance becomes an important factor in technology evaluation and selection processes.

Technology partnerships between international providers and regional organizations have accelerated market development and capability enhancement across the Middle East and Africa region. Recent collaborations focus on technology transfer, local manufacturing capabilities, and specialized training programs that build regional expertise. Strategic alliances enable market expansion while providing access to local knowledge and customer relationships.

Government initiatives supporting infrastructure development and security enhancement have created substantial opportunities for screening technology deployment. National security strategies and trade facilitation programs drive consistent demand for advanced screening capabilities. Policy developments include standardization efforts, certification programs, and regulatory frameworks that support market growth.

Innovation investments by technology providers focus on next-generation capabilities including artificial intelligence, advanced imaging, and integrated security platforms. Research and development activities emphasize improved detection accuracy, operational efficiency, and user experience enhancements. Technology advancement continues to drive market differentiation and competitive positioning.

Market expansion activities by leading providers include establishment of regional offices, local partnerships, and specialized support capabilities that enhance market presence and customer service delivery. Geographic expansion strategies focus on emerging markets with significant growth potential and infrastructure development requirements.

MarkWide Research analysis indicates that organizations considering screening technology investments should prioritize solutions that offer scalability, integration capabilities, and long-term technology roadmaps. Investment strategies should focus on comprehensive platforms that can accommodate future expansion requirements and technology upgrades while providing immediate operational benefits.

Technology selection decisions should emphasize solutions that provide proven performance, comprehensive support capabilities, and strong vendor stability. Organizations should evaluate total cost of ownership, including implementation, training, maintenance, and upgrade costs, rather than focusing solely on initial acquisition costs. Vendor evaluation should include assessment of local support capabilities, training programs, and long-term partnership potential.

Implementation planning should incorporate comprehensive change management strategies, extensive training programs, and phased deployment approaches that minimize operational disruption. Organizations should invest in building internal technical capabilities and establishing ongoing maintenance and support arrangements. Project management expertise becomes critical for successful technology deployment and integration.

Regional cooperation initiatives provide opportunities for knowledge sharing, standardization efforts, and collaborative procurement programs that can reduce costs and enhance capabilities. Organizations should actively participate in industry associations, regional forums, and collaborative programs that facilitate market development and technology advancement.

Market trajectory for the Middle East and Africa cargo and vehicle screening sector indicates sustained growth driven by continued infrastructure development, evolving security requirements, and advancing technology capabilities. MarkWide Research projections suggest that technology adoption rates will continue accelerating, with advanced screening systems achieving 75% market penetration at major transportation facilities within the next five years.

Technology evolution will focus on artificial intelligence integration, automated analysis capabilities, and comprehensive security platforms that provide enhanced detection accuracy and operational efficiency. The convergence of screening technologies with broader security and logistics systems will create integrated solutions that address multiple operational requirements. Innovation trends include predictive analytics, remote monitoring capabilities, and adaptive learning systems.

Regional development patterns indicate that emerging markets across Africa will experience accelerated growth as infrastructure projects advance and security awareness increases. Investment in screening technology will become increasingly important for countries seeking to enhance trade facilitation and security capabilities. Market expansion will be supported by international partnerships, capacity building programs, and technology transfer initiatives.

Industry consolidation trends may emerge as market maturity increases and competitive pressures intensify. Strategic partnerships, mergers, and acquisitions could reshape the competitive landscape while creating opportunities for enhanced capabilities and market reach. Competitive dynamics will continue evolving as technology providers seek to differentiate their offerings and expand market presence.

The Middle East and Africa cargo and vehicle screening market represents a dynamic and rapidly expanding sector with substantial growth potential driven by security imperatives, infrastructure development, and technological advancement. The region’s strategic position as a global trade hub, combined with increasing security awareness and regulatory requirements, creates sustained demand for advanced screening technologies across multiple market segments.

Market opportunities remain robust, with emerging markets presenting significant potential for technology deployment and capacity building initiatives. The evolution toward artificial intelligence-enabled systems, integrated security platforms, and comprehensive screening solutions will continue driving market development and competitive differentiation. Organizations that invest in advanced screening technologies while building internal capabilities and strategic partnerships will be well-positioned to capitalize on expanding market opportunities and contribute to regional security and trade facilitation objectives.

What is Cargo And Vehicle Screening?

Cargo and vehicle screening refers to the processes and technologies used to inspect cargo and vehicles for security threats, contraband, and compliance with regulations. This includes the use of X-ray machines, metal detectors, and other advanced scanning technologies to ensure safety in transportation and logistics.

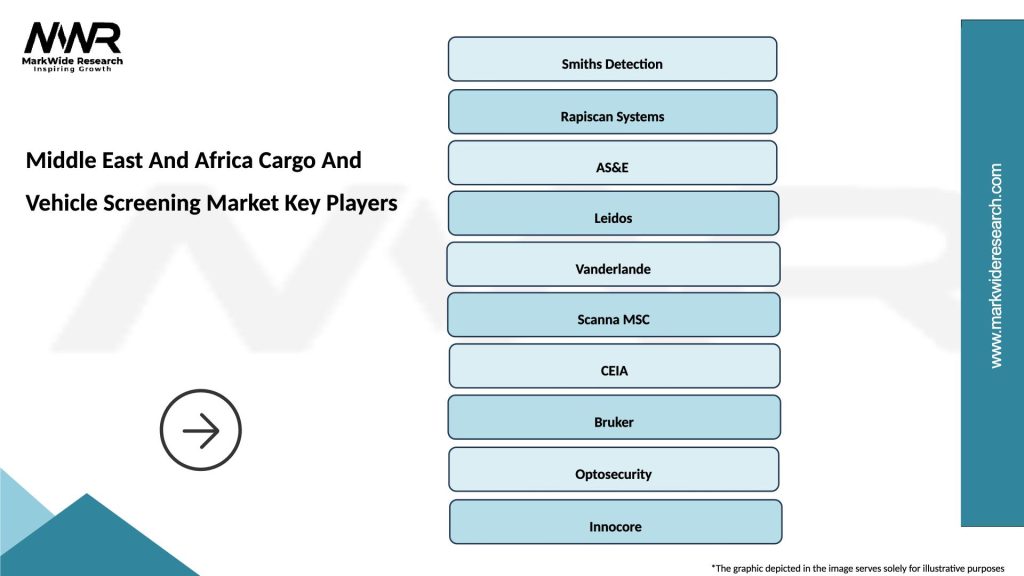

What are the key players in the Middle East And Africa Cargo And Vehicle Screening Market?

Key players in the Middle East and Africa Cargo and Vehicle Screening Market include companies like Smiths Detection, Rapiscan Systems, and L3Harris Technologies. These companies provide a range of screening solutions for airports, seaports, and land borders, among others.

What are the growth factors driving the Middle East And Africa Cargo And Vehicle Screening Market?

The growth of the Middle East and Africa Cargo and Vehicle Screening Market is driven by increasing security concerns, rising trade volumes, and the need for compliance with international regulations. Additionally, advancements in screening technology and infrastructure development in the region contribute to market expansion.

What challenges does the Middle East And Africa Cargo And Vehicle Screening Market face?

Challenges in the Middle East and Africa Cargo and Vehicle Screening Market include high initial investment costs for advanced screening technologies and the need for skilled personnel to operate these systems. Additionally, varying regulations across countries can complicate compliance efforts.

What opportunities exist in the Middle East And Africa Cargo And Vehicle Screening Market?

Opportunities in the Middle East and Africa Cargo and Vehicle Screening Market include the increasing demand for automated screening solutions and the potential for public-private partnerships to enhance security infrastructure. The growth of e-commerce also presents new avenues for cargo screening innovations.

What trends are shaping the Middle East And Africa Cargo And Vehicle Screening Market?

Trends in the Middle East and Africa Cargo and Vehicle Screening Market include the integration of artificial intelligence and machine learning in screening processes, as well as the development of mobile screening units. These innovations aim to improve efficiency and accuracy in threat detection.

Middle East And Africa Cargo And Vehicle Screening Market

| Segmentation Details | Description |

|---|---|

| Product Type | Screening Systems, X-Ray Machines, Explosive Detectors, Metal Detectors |

| Technology | Computed Tomography, Millimeter Wave, Backscatter, Optical Recognition |

| End User | Aviation Security, Maritime Security, Border Control, Logistics Providers |

| Application | Cargo Inspection, Vehicle Inspection, Passenger Screening, Threat Detection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Cargo And Vehicle Screening Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at