444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa booster compressor market represents a dynamic and rapidly expanding sector within the region’s industrial infrastructure landscape. This market encompasses sophisticated compression equipment designed to enhance pressure levels in various industrial applications, from oil and gas operations to manufacturing processes. The region’s strategic position as a global energy hub, combined with ongoing industrialization efforts, has created substantial demand for advanced booster compressor systems.

Market dynamics in the Middle East and Africa are primarily driven by the region’s extensive petroleum industry, growing manufacturing sector, and increasing focus on energy efficiency. Countries such as Saudi Arabia, UAE, Nigeria, and South Africa are leading the adoption of advanced compression technologies, with growth rates reaching 8.5% CAGR in key segments. The market benefits from substantial investments in infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries and emerging African economies.

Regional characteristics include diverse industrial requirements ranging from upstream oil and gas operations to downstream processing facilities. The market serves multiple sectors including petrochemicals, power generation, water treatment, and general manufacturing. Technology adoption varies significantly across the region, with Gulf states leading in advanced automation and digital integration, while African markets focus on reliable, cost-effective solutions. The increasing emphasis on environmental compliance and energy efficiency is driving demand for modern, high-performance booster compressor systems throughout the region.

The Middle East and Africa booster compressor market refers to the comprehensive ecosystem of pressure enhancement equipment, services, and technologies specifically designed to increase gas or air pressure in industrial applications across the Middle Eastern and African regions. These systems play a crucial role in optimizing operational efficiency and maintaining consistent pressure levels in various industrial processes.

Booster compressors are specialized mechanical devices that compress gases or air from a lower pressure to a higher pressure, enabling efficient transportation, storage, and utilization in industrial applications. In the Middle East and Africa context, these systems are particularly vital for oil and gas operations, where they facilitate pipeline transportation, gas processing, and enhanced oil recovery techniques. The market encompasses various compressor types including reciprocating, centrifugal, and rotary screw configurations, each designed for specific operational requirements.

Market scope includes manufacturing, installation, maintenance, and aftermarket services for booster compression equipment. The regional market is characterized by unique challenges such as extreme operating conditions, varying infrastructure development levels, and diverse regulatory frameworks. Applications span across upstream exploration, midstream processing, downstream refining, petrochemical production, power generation, and industrial manufacturing, making it an integral component of the region’s industrial infrastructure.

Strategic positioning of the Middle East and Africa booster compressor market reflects the region’s critical role in global energy production and emerging industrial development. The market demonstrates robust growth potential driven by ongoing infrastructure investments, expanding industrial base, and increasing focus on operational efficiency. Key growth drivers include rising energy demand, infrastructure modernization initiatives, and growing emphasis on environmental compliance, with adoption rates increasing by 12% annually in key industrial sectors.

Market segmentation reveals diverse applications across oil and gas, petrochemicals, power generation, and manufacturing industries. The Gulf Cooperation Council countries dominate market share due to extensive petroleum operations and advanced industrial infrastructure, while African markets show significant growth potential driven by industrialization efforts and resource development projects. Technology trends indicate increasing adoption of digitally integrated systems, energy-efficient designs, and environmentally compliant solutions.

Competitive landscape features both international manufacturers and regional service providers, creating a dynamic market environment. The market benefits from substantial government investments in industrial infrastructure, particularly in Saudi Arabia’s Vision 2030 initiative and similar development programs across the region. Future prospects remain positive, supported by continued energy sector expansion, growing manufacturing activities, and increasing focus on operational optimization across various industrial applications.

Primary market insights reveal several critical factors shaping the Middle East and Africa booster compressor landscape:

Market penetration varies significantly across the region, with Gulf states showing higher adoption rates of advanced technologies compared to emerging African markets. The increasing focus on operational efficiency and cost optimization is driving demand for modern, reliable booster compressor systems across all market segments.

Primary market drivers propelling growth in the Middle East and Africa booster compressor market include expanding energy infrastructure, industrial diversification initiatives, and increasing operational efficiency requirements. The region’s position as a global energy hub creates continuous demand for advanced compression technologies to support oil and gas operations, pipeline transportation, and processing facilities.

Infrastructure development represents a significant growth catalyst, with countries across the region investing heavily in industrial modernization and capacity expansion. Major projects such as NEOM in Saudi Arabia, new industrial cities in Egypt, and expanding petrochemical complexes throughout the Gulf create substantial demand for reliable compression equipment. Government initiatives promoting economic diversification are driving industrial growth beyond traditional energy sectors, creating new market opportunities in manufacturing, water treatment, and power generation.

Technological advancement requirements are pushing market growth as industries seek more efficient, reliable, and environmentally compliant compression solutions. The increasing focus on operational optimization, predictive maintenance, and energy efficiency is driving adoption of advanced booster compressor systems with integrated digital capabilities. Regional industrialization efforts, particularly in African countries developing their natural resources and manufacturing capabilities, are creating new market segments and driving demand for cost-effective compression solutions tailored to local requirements and operating conditions.

Economic volatility in the Middle East and Africa region poses significant challenges to market growth, particularly fluctuating oil prices that directly impact investment decisions in energy sector infrastructure. Political instability in certain regions creates uncertainty for long-term industrial projects, potentially delaying equipment procurement and installation schedules. Currency fluctuations and economic sanctions in some countries can complicate international trade and technology transfer, affecting market accessibility and pricing structures.

Technical challenges include extreme operating conditions prevalent across the region, including high temperatures, corrosive environments, and remote locations that demand specialized equipment designs and robust maintenance support. The shortage of skilled technical personnel for installation, operation, and maintenance of advanced compression systems creates operational challenges and increases lifecycle costs. Infrastructure limitations in certain areas, including inadequate power supply, transportation networks, and support facilities, can hinder market development and equipment deployment.

Regulatory complexity varies significantly across different countries, creating challenges for manufacturers and operators in ensuring compliance with diverse standards and requirements. Environmental regulations are becoming increasingly stringent, requiring investments in cleaner technologies that may increase initial costs. Competition from alternative technologies and the availability of refurbished equipment can pressure pricing and market share for new booster compressor systems, particularly in cost-sensitive market segments.

Emerging opportunities in the Middle East and Africa booster compressor market are substantial, driven by ongoing industrialization, infrastructure development, and energy transition initiatives. The growing focus on gas utilization and processing creates significant demand for compression equipment, particularly as countries develop their natural gas resources for domestic use and export. Renewable energy integration projects, including hydrogen production and compressed air energy storage systems, present new application areas for specialized compression technologies.

Industrial diversification initiatives across the region are creating opportunities beyond traditional oil and gas applications. Manufacturing sector growth, particularly in automotive, chemicals, and food processing, requires reliable compression solutions for various production processes. Water treatment and desalination projects, critical for the region’s water security, present growing opportunities for specialized compression equipment. The expansion of data centers and technology infrastructure creates demand for precision air compression and cooling systems.

Service market expansion offers significant growth potential as operators increasingly focus on maximizing equipment uptime and operational efficiency. Digital transformation initiatives create opportunities for smart compression systems with integrated monitoring, predictive maintenance, and remote operation capabilities. Local manufacturing development presents opportunities for establishing regional production facilities, reducing costs, and improving supply chain reliability while supporting local economic development objectives. The growing emphasis on environmental sustainability creates demand for energy-efficient, low-emission compression solutions.

Market dynamics in the Middle East and Africa booster compressor sector are characterized by the interplay between traditional energy industry requirements and emerging industrial applications. The region’s established petroleum infrastructure creates steady demand for replacement and upgrade projects, while new industrial developments drive demand for modern, efficient compression solutions. Supply chain considerations have become increasingly important, with regional conflicts and global disruptions highlighting the need for local manufacturing capabilities and diversified supplier networks.

Competitive dynamics feature both established international manufacturers and emerging regional players, creating a diverse market landscape. Technology transfer and local partnership arrangements are becoming more common as companies seek to establish regional presence and meet local content requirements. Price sensitivity varies across different market segments, with premium applications in oil and gas willing to invest in advanced technologies, while emerging industrial sectors focus on cost-effective solutions with proven reliability.

Innovation cycles are accelerating as digitalization and environmental compliance drive technological advancement. The integration of artificial intelligence, machine learning, and IoT technologies is transforming traditional compression equipment into smart, connected systems capable of autonomous operation and predictive maintenance. Market consolidation trends are evident as larger players acquire specialized companies to expand their technology portfolios and regional capabilities. According to MarkWide Research analysis, efficiency improvements of 15-25% are achievable through modern compression technologies, driving replacement cycles and market growth.

Research approach for analyzing the Middle East and Africa booster compressor market employs a comprehensive methodology combining primary and secondary research techniques. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, end-users, and service providers across key markets in the region. Data collection encompasses both quantitative and qualitative information gathering through structured surveys, in-depth interviews, and expert consultations with industry professionals.

Secondary research involves analysis of industry reports, company financial statements, government publications, trade association data, and technical literature. Market sizing and forecasting utilize multiple approaches including top-down and bottom-up analysis, cross-validation through different data sources, and expert opinion synthesis. Regional coverage includes detailed analysis of major markets such as Saudi Arabia, UAE, Qatar, Kuwait, Nigeria, South Africa, Egypt, and Algeria, with additional insights from emerging markets across the region.

Data validation processes ensure accuracy and reliability through triangulation of information sources, expert review panels, and statistical analysis techniques. Market segmentation analysis considers multiple dimensions including technology type, application sector, end-user industry, and geographic distribution. Forecasting models incorporate various scenarios considering economic conditions, regulatory changes, technological developments, and industry trends to provide comprehensive market projections and strategic insights for stakeholders.

Gulf Cooperation Council countries dominate the Middle East and Africa booster compressor market, accounting for approximately 60% market share due to extensive oil and gas infrastructure and ongoing industrial development projects. Saudi Arabia leads regional demand driven by Vision 2030 initiatives, NEOM development, and expanding petrochemical sector. The UAE demonstrates strong growth in manufacturing and logistics sectors, while Qatar’s focus on gas processing and LNG production creates substantial compression equipment demand.

North African markets show significant growth potential, with Egypt leading through expanding industrial base and natural gas development projects. Algeria’s energy sector modernization and Libya’s infrastructure reconstruction efforts contribute to regional demand. Sub-Saharan Africa presents emerging opportunities, with Nigeria’s oil and gas sector driving current demand while South Africa’s industrial diversification creates new application areas. Ghana, Angola, and Mozambique represent growing markets supported by natural resource development and industrial expansion.

Regional variations in technology adoption reflect different development stages and market maturity levels. Gulf states favor advanced, digitally integrated systems with comprehensive service packages, while African markets often prioritize cost-effective, reliable solutions with local support capabilities. Investment patterns show increasing focus on regional manufacturing and service capabilities to support local content requirements and improve supply chain resilience. The region’s strategic location between Europe, Asia, and Africa creates opportunities for export-oriented manufacturing and regional distribution centers.

Market leadership in the Middle East and Africa booster compressor sector is characterized by a mix of global manufacturers and regional specialists, each bringing unique strengths to serve diverse market requirements. The competitive environment features both established industrial giants and innovative technology companies focused on specific applications or market segments.

Competitive strategies focus on local manufacturing, comprehensive service offerings, and technology innovation to meet specific regional requirements. Many companies are establishing regional headquarters, manufacturing facilities, and service centers to better serve local markets and meet increasing local content requirements. Partnership arrangements with local distributors and service providers are common strategies for market penetration and customer support.

Technology-based segmentation of the Middle East and Africa booster compressor market reveals distinct preferences and applications across different compression technologies:

By Technology:

By Application:

By End-User Industry:

Oil and Gas Category represents the largest and most mature segment of the Middle East and Africa booster compressor market, driven by extensive upstream exploration, production, and processing activities. This category benefits from established infrastructure, experienced operators, and willingness to invest in advanced technologies for operational efficiency and safety. Technology preferences in this category favor high-pressure, high-reliability systems capable of handling corrosive gases and extreme operating conditions.

Petrochemical Category shows rapid growth as regional governments promote industrial diversification and value-added processing of hydrocarbon resources. This segment requires specialized compression solutions for various chemical processes, with emphasis on precision control, safety systems, and environmental compliance. Investment patterns in this category reflect long-term strategic planning with focus on integrated compression systems and comprehensive service support.

Manufacturing Category demonstrates significant growth potential as the region develops its industrial base beyond traditional energy sectors. This category encompasses diverse applications from automotive assembly to food processing, requiring flexible, cost-effective compression solutions. Technology adoption in manufacturing focuses on energy efficiency, reliability, and ease of maintenance, with growing interest in smart, connected systems for operational optimization. The category benefits from government initiatives promoting local manufacturing and industrial development across the region.

Manufacturers benefit from substantial market opportunities driven by regional industrial growth, infrastructure development, and technology modernization requirements. The diverse market landscape allows for multiple entry strategies, from premium technology solutions to cost-effective alternatives tailored for specific regional needs. Revenue diversification opportunities exist across various industrial sectors, reducing dependence on traditional oil and gas markets while expanding into emerging applications.

End-users gain access to advanced compression technologies that improve operational efficiency, reduce energy consumption, and enhance system reliability. Modern booster compressor systems offer significant benefits including reduced maintenance requirements, improved safety features, and integrated monitoring capabilities. Cost optimization opportunities include energy savings of 20-30% through efficient compression technologies and predictive maintenance programs that minimize unplanned downtime.

Service providers benefit from growing demand for comprehensive maintenance, monitoring, and optimization services as operators focus on maximizing equipment uptime and performance. The increasing complexity of modern compression systems creates opportunities for specialized technical services and digital solutions. Regional development initiatives create opportunities for local content participation, skill development, and technology transfer arrangements that support long-term business growth and market presence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends are transforming the Middle East and Africa booster compressor market through integration of IoT sensors, cloud-based monitoring systems, and artificial intelligence for predictive maintenance and operational optimization. Smart compression systems capable of autonomous operation and real-time performance adjustment are becoming increasingly popular, particularly in high-value applications where downtime costs are significant. Remote monitoring capabilities allow operators to manage multiple facilities from centralized control centers, improving efficiency and reducing operational costs.

Environmental sustainability is driving demand for energy-efficient compression technologies and low-emission solutions that comply with increasingly stringent environmental regulations. The trend toward carbon footprint reduction is influencing equipment selection criteria, with operators prioritizing systems that offer superior energy efficiency and reduced environmental impact. Circular economy principles are gaining traction, with increased focus on equipment lifecycle management, refurbishment programs, and sustainable disposal practices.

Service integration represents a significant market trend as operators seek comprehensive solutions that include equipment, installation, maintenance, and performance optimization services. The shift from capital expenditure to operational expenditure models is driving demand for service-based contracts that provide predictable costs and guaranteed performance levels. Local content requirements are increasing across the region, driving trends toward regional manufacturing, local partnerships, and technology transfer arrangements that support economic development objectives while ensuring supply chain reliability.

Recent industry developments in the Middle East and Africa booster compressor market reflect ongoing technological advancement and market expansion initiatives. Major manufacturers are establishing regional manufacturing facilities and service centers to better serve local markets and meet increasing local content requirements. Technology partnerships between international companies and regional firms are facilitating knowledge transfer and capability development while creating new market opportunities.

Product innovations include development of specialized compression systems designed for extreme operating conditions prevalent in the region, including high-temperature environments, corrosive atmospheres, and remote locations with limited infrastructure support. Advanced materials and coatings are being incorporated to improve equipment durability and reduce maintenance requirements. Digital integration developments include cloud-based monitoring platforms, mobile applications for field service, and AI-powered optimization algorithms that continuously improve system performance.

Market expansion activities include new facility openings, distribution network expansion, and strategic acquisitions that strengthen regional presence and capabilities. Several companies have announced significant investments in regional manufacturing capabilities to support growing demand and meet local content requirements. Sustainability initiatives are driving development of more energy-efficient compression technologies and comprehensive recycling programs for end-of-life equipment, reflecting the industry’s commitment to environmental responsibility and circular economy principles.

Strategic recommendations for market participants include focusing on regional presence development through local manufacturing, service capabilities, and partnership arrangements that ensure long-term market access and customer support. Companies should prioritize technology development that addresses specific regional requirements including extreme operating conditions, energy efficiency, and environmental compliance. Investment priorities should emphasize digital integration capabilities, predictive maintenance technologies, and comprehensive service offerings that provide ongoing value to customers.

Market entry strategies should consider the diverse nature of regional markets, with different approaches required for established Gulf markets versus emerging African economies. Partnership with local distributors and service providers can accelerate market penetration while ensuring adequate customer support capabilities. Product development should focus on modular, scalable solutions that can be adapted to various applications and operating conditions while maintaining cost competitiveness.

Risk management strategies should address political and economic volatility through diversified market presence, flexible supply chain arrangements, and comprehensive insurance coverage. Companies should develop contingency plans for supply chain disruptions and maintain strategic inventory levels to ensure customer service continuity. Talent development initiatives should focus on building local technical capabilities through training programs, knowledge transfer arrangements, and partnerships with educational institutions to address the regional skills shortage and support long-term market development.

Long-term prospects for the Middle East and Africa booster compressor market remain positive, supported by continued industrial development, infrastructure investment, and energy sector expansion across the region. The market is expected to benefit from ongoing economic diversification initiatives that reduce dependence on traditional oil and gas sectors while creating new opportunities in manufacturing, processing, and renewable energy applications. Growth projections indicate sustained expansion with CAGR rates of 7-9% expected over the next decade, driven by both replacement demand and new capacity additions.

Technology evolution will continue to shape market development through advancement in digital integration, artificial intelligence, and sustainable compression technologies. The integration of renewable energy sources and hydrogen production facilities will create new application areas requiring specialized compression solutions. Market maturation in Gulf states will drive focus on replacement, upgrade, and service markets, while emerging African economies will provide opportunities for new installations and capacity expansion.

Regional integration trends suggest increasing cooperation and standardization across Middle Eastern and African markets, potentially creating larger, more unified market opportunities. According to MWR analysis, the shift toward sustainable industrial practices will drive demand for energy-efficient compression technologies, with efficiency improvements of 25-35% expected from next-generation systems. The growing emphasis on local content and regional manufacturing will reshape supply chains and create new opportunities for technology transfer and capability development throughout the region.

The Middle East and Africa booster compressor market represents a dynamic and evolving sector with substantial growth potential driven by regional industrial development, infrastructure investment, and technological advancement. The market’s foundation in the region’s extensive energy infrastructure provides stability while emerging industrial applications create new opportunities for expansion and diversification. Key success factors for market participants include regional presence, technology innovation, comprehensive service capabilities, and adaptability to diverse market requirements across different countries and industrial sectors.

Market transformation through digitalization, environmental compliance, and service integration is creating new value propositions and competitive dynamics that favor companies with advanced technological capabilities and comprehensive customer support. The increasing focus on operational efficiency, predictive maintenance, and sustainable practices is driving demand for modern, intelligent compression systems that deliver superior performance and reduced lifecycle costs. Strategic positioning in this market requires understanding of regional variations, regulatory requirements, and customer preferences while maintaining technological leadership and service excellence.

Future success in the Middle East and Africa booster compressor market will depend on companies’ ability to balance global technology leadership with regional market knowledge, local presence, and customer-focused service delivery. The market’s continued evolution toward more sophisticated, efficient, and sustainable compression solutions presents significant opportunities for companies that can effectively navigate the region’s diverse and dynamic industrial landscape while delivering value to customers across multiple sectors and applications.

What is Booster Compressor?

A booster compressor is a type of mechanical device used to increase the pressure of gases, commonly utilized in various applications such as refrigeration, air conditioning, and industrial processes.

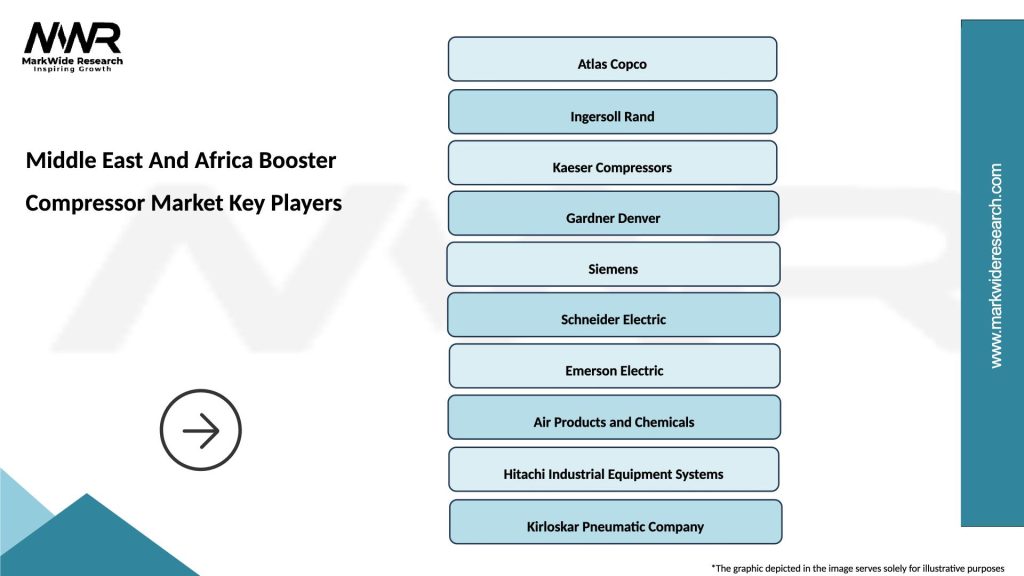

What are the key players in the Middle East And Africa Booster Compressor Market?

Key players in the Middle East And Africa Booster Compressor Market include Atlas Copco, Ingersoll Rand, and Siemens, among others.

What are the main drivers of growth in the Middle East And Africa Booster Compressor Market?

The growth of the Middle East And Africa Booster Compressor Market is driven by increasing industrialization, rising demand for energy-efficient solutions, and the expansion of the oil and gas sector.

What challenges does the Middle East And Africa Booster Compressor Market face?

Challenges in the Middle East And Africa Booster Compressor Market include fluctuating oil prices, stringent environmental regulations, and the need for regular maintenance and servicing.

What opportunities exist in the Middle East And Africa Booster Compressor Market?

Opportunities in the Middle East And Africa Booster Compressor Market include advancements in technology, the growing focus on renewable energy sources, and increasing investments in infrastructure development.

What trends are shaping the Middle East And Africa Booster Compressor Market?

Trends in the Middle East And Africa Booster Compressor Market include the adoption of smart compressor technologies, integration of IoT for monitoring and efficiency, and a shift towards sustainable and eco-friendly solutions.

Middle East And Africa Booster Compressor Market

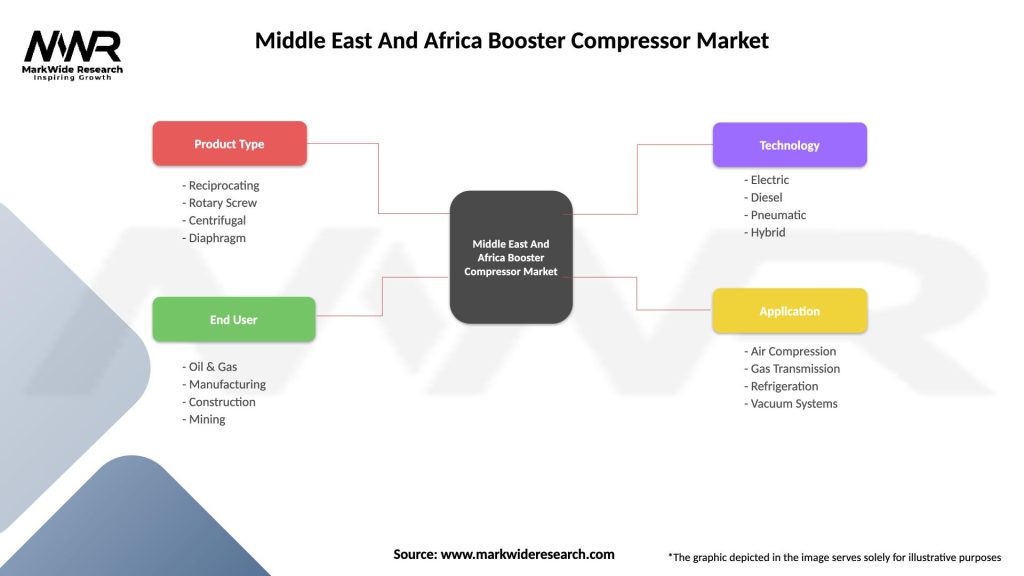

| Segmentation Details | Description |

|---|---|

| Product Type | Reciprocating, Rotary Screw, Centrifugal, Diaphragm |

| End User | Oil & Gas, Manufacturing, Construction, Mining |

| Technology | Electric, Diesel, Pneumatic, Hybrid |

| Application | Air Compression, Gas Transmission, Refrigeration, Vacuum Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Booster Compressor Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at