444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East and Africa (MEA) beauty and personal care products market is a thriving industry that caters to the grooming and self-care needs of consumers in the region. This market encompasses a wide range of products, including skincare, haircare, makeup, fragrances, and personal hygiene products. The MEA region is known for its diverse consumer base, which includes a mix of local residents, expatriates, and tourists. The demand for beauty and personal care products in this region is driven by factors such as increasing disposable income, changing lifestyle patterns, and a growing awareness of personal grooming.

Meaning

The beauty and personal care products market in the Middle East and Africa refers to the industry involved in the production, distribution, and sale of various products that are used for enhancing one’s appearance and maintaining personal hygiene. These products include cosmetics, skincare items, haircare products, fragrances, and personal hygiene products such as soaps and body washes. The market encompasses both mass-market products that are widely available and premium products that cater to specific consumer segments.

Executive Summary

The Middle East and Africa beauty and personal care products market is experiencing steady growth, driven by various factors such as the increasing urbanization, rising disposable income, and a growing emphasis on personal grooming and self-care. The market offers a wide range of products, catering to diverse consumer preferences and needs. Skincare products, including moisturizers, cleansers, and sunscreens, constitute a significant share of the market, followed by haircare and fragrance products. The market is highly competitive, with both international and local players vying for market share.

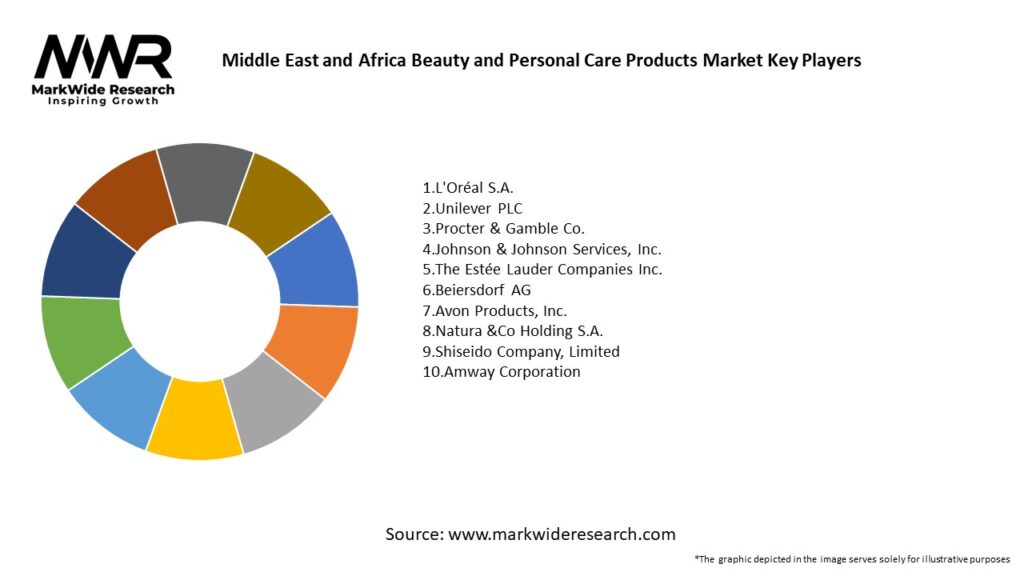

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MEA beauty and personal care products market is characterized by intense competition among both international and local players. Companies are focusing on product innovation, brand positioning, and marketing strategies to differentiate themselves and gain a competitive advantage. The market dynamics are influenced by changing consumer preferences, advancements in technology, regulatory developments, and socio-cultural factors. Companies need to adapt to these dynamics and stay abreast of market trends to succeed in this competitive landscape.

Regional Analysis

The Middle East and Africa beauty and personal care products market can be segmented into various regions, including the Gulf Cooperation Council (GCC) countries, North Africa, South Africa, and the rest of Africa. The GCC countries, including the United Arab Emirates, Saudi Arabia, and Qatar, have emerged as key markets due to their high disposable income levels and a strong culture of personal grooming. North Africa, comprising countries such as Egypt, Morocco, and Algeria, also presents significant market potential, driven by a large consumer base and increasing urbanization. South Africa, with its developed retail infrastructure and growing consumer spending, is another important market in the region.

Competitive Landscape

Leading Companies in the Middle East and Africa Beauty and Personal Care Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The MEA beauty and personal care products market can be segmented based on product type, distribution channel, and consumer demographics. Product segmentation includes skincare, haircare, fragrances, makeup, and personal hygiene products. Distribution channels comprise offline retail (supermarkets, hypermarkets, specialty stores) and online retail (e-commerce platforms). Consumer demographics include women, men, and children.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The beauty and personal care products market in the Middle East and Africa was not immune to the impact of the COVID-19 pandemic. The region witnessed disruptions in the supply chain, temporary store closures, and changes in consumer behavior. The demand for essential hygiene products, such as hand sanitizers and soaps, surged during the pandemic, while the sales of color cosmetics and fragrance products experienced a decline due to reduced social gatherings and events. E-commerce channels gained prominence during the pandemic as consumers turned to online shopping. The industry showed resilience, with companies adapting to the changing landscape by focusing on digital marketing, product innovation, and hygiene-focused offerings.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Middle East and Africa beauty and personal care products market is poised for continued growth in the coming years. Factors such as urbanization, rising disposable income, changing lifestyle patterns, and increasing consumer awareness will drive market expansion. Companies that prioritize innovation, sustainability, and digitalization are likely to thrive in this evolving landscape. The market will continue to witness the introduction of new products, expansion into untapped segments, and the adoption of technology to enhance the consumer experience.

Conclusion

The Middle East and Africa beauty and personal care products market is a dynamic and competitive industry that caters to the diverse grooming and self-care needs of consumers in the region. The market offers a wide range of products, including skincare, haircare, makeup, fragrances, and personal hygiene items. Factors such as urbanization, rising disposable income, changing consumer preferences, and increasing awareness of personal grooming are driving market growth. Industry participants should focus on innovation, localization, and sustainability to seize opportunities, navigate challenges, and meet the evolving demands of consumers in the MEA region.

What is Beauty and Personal Care Products?

Beauty and Personal Care Products encompass a wide range of items designed to enhance personal appearance and hygiene, including skincare, haircare, cosmetics, and fragrances.

What are the key players in the Middle East and Africa Beauty and Personal Care Products Market?

Key players in the Middle East and Africa Beauty and Personal Care Products Market include L’Oréal, Unilever, Procter & Gamble, and Estée Lauder, among others.

What are the main drivers of growth in the Middle East and Africa Beauty and Personal Care Products Market?

The growth of the Middle East and Africa Beauty and Personal Care Products Market is driven by increasing consumer awareness of personal grooming, rising disposable incomes, and the influence of social media on beauty trends.

What challenges does the Middle East and Africa Beauty and Personal Care Products Market face?

Challenges in the Middle East and Africa Beauty and Personal Care Products Market include regulatory hurdles, cultural differences in beauty standards, and competition from local brands.

What opportunities exist in the Middle East and Africa Beauty and Personal Care Products Market?

Opportunities in the Middle East and Africa Beauty and Personal Care Products Market include the growing demand for organic and natural products, the rise of e-commerce, and the expansion of product lines targeting diverse consumer needs.

What trends are shaping the Middle East and Africa Beauty and Personal Care Products Market?

Trends in the Middle East and Africa Beauty and Personal Care Products Market include the increasing popularity of sustainable packaging, the rise of personalized beauty solutions, and the integration of technology in product development.

Middle East and Africa Beauty and Personal Care Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Skincare, Haircare, Makeup, Fragrance |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| End User | Women, Men, Children, Unisex |

| Price Tier | Premium, Mid-range, Economy, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Middle East and Africa Beauty and Personal Care Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at