444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa automated material handling market represents a rapidly evolving landscape driven by industrial modernization, infrastructure development, and the region’s strategic positioning as a global logistics hub. This dynamic market encompasses sophisticated technologies including automated storage and retrieval systems, conveyor systems, robotic solutions, and warehouse management systems that are transforming traditional material handling operations across diverse industries.

Regional growth dynamics indicate substantial expansion opportunities, with the market experiencing a robust 8.2% CAGR driven by increasing adoption of Industry 4.0 technologies and smart manufacturing initiatives. The integration of artificial intelligence, Internet of Things (IoT), and advanced robotics is revolutionizing material handling processes, enabling organizations to achieve unprecedented levels of operational efficiency and cost optimization.

Key market drivers include the region’s massive infrastructure investments, particularly in the UAE, Saudi Arabia, and South Africa, where mega-projects and industrial diversification initiatives are creating substantial demand for automated material handling solutions. The e-commerce boom, accelerated by changing consumer behaviors and digital transformation, has further intensified the need for sophisticated warehouse automation and distribution center optimization.

Technological advancement remains a cornerstone of market evolution, with manufacturers increasingly investing in smart material handling systems that offer real-time monitoring, predictive maintenance capabilities, and seamless integration with existing enterprise resource planning systems. These innovations are enabling businesses to reduce operational costs by up to 35% while significantly improving throughput and accuracy.

The automated material handling market refers to the comprehensive ecosystem of technologies, systems, and solutions designed to automate the movement, storage, control, and protection of materials throughout manufacturing, warehousing, distribution, and logistics operations without direct human intervention.

Core components of automated material handling systems include sophisticated conveyor networks, automated guided vehicles (AGVs), robotic picking and packing systems, automated storage and retrieval systems (AS/RS), and intelligent warehouse management software that orchestrates seamless material flow optimization. These integrated solutions enable organizations to achieve consistent, reliable, and efficient material handling operations while minimizing human error and maximizing operational productivity.

System integration represents a critical aspect of modern automated material handling, where multiple technologies work in harmony to create comprehensive solutions tailored to specific industry requirements. This integration encompasses everything from basic conveyor systems to complex robotic cells capable of handling diverse product types, weights, and configurations with precision and reliability.

Technological sophistication in contemporary automated material handling extends beyond mechanical automation to include advanced analytics, machine learning algorithms, and predictive maintenance capabilities that continuously optimize system performance and prevent costly downtime through proactive intervention strategies.

Market transformation across the Middle East and Africa automated material handling sector reflects a fundamental shift toward intelligent automation solutions that address complex logistical challenges while supporting regional economic diversification objectives. The convergence of technological innovation, infrastructure investment, and changing market dynamics has created an environment conducive to rapid adoption of advanced material handling technologies.

Strategic investments in automated material handling systems are being driven by organizations seeking to enhance operational efficiency, reduce labor dependency, and improve supply chain resilience. Manufacturing companies are reporting productivity improvements of up to 42% following implementation of comprehensive automated material handling solutions, while distribution centers are achieving significant reductions in order fulfillment times and error rates.

Regional leadership in automated material handling adoption is being demonstrated by the United Arab Emirates and Saudi Arabia, where government-backed industrial transformation initiatives are accelerating technology deployment across multiple sectors. These countries are establishing themselves as regional hubs for advanced manufacturing and logistics operations, creating substantial demand for sophisticated material handling solutions.

Future growth prospects remain exceptionally strong, with MarkWide Research analysis indicating sustained expansion driven by continued infrastructure development, increasing e-commerce penetration, and growing recognition of automation’s role in maintaining competitive advantage in global markets.

Technology adoption patterns reveal several critical insights that are shaping the automated material handling landscape across the Middle East and Africa region:

Market segmentation analysis reveals distinct adoption patterns across different industries, with automotive manufacturing, food and beverage processing, and pharmaceutical production leading in terms of technology deployment and operational sophistication.

Economic diversification initiatives across the Middle East and Africa are creating substantial demand for automated material handling solutions as governments and private sector organizations invest heavily in manufacturing capabilities and industrial infrastructure development. These strategic initiatives are designed to reduce dependency on traditional economic sectors while building competitive advantages in global manufacturing and logistics markets.

Labor market dynamics represent another significant driver, as organizations seek to address skilled labor shortages and reduce dependency on manual processes that are prone to errors and inconsistencies. Automated material handling systems provide reliable, consistent performance while enabling human workers to focus on higher-value activities that require creativity and problem-solving capabilities.

E-commerce expansion throughout the region is generating unprecedented demand for sophisticated warehouse automation and distribution center optimization solutions. The rapid growth of online retail platforms and changing consumer expectations for fast, accurate order fulfillment are compelling organizations to invest in advanced material handling technologies that can support high-volume, high-velocity operations.

Supply chain resilience has become a critical priority following global disruptions, with organizations recognizing that automated material handling systems provide greater flexibility and adaptability compared to traditional manual processes. These systems enable rapid reconfiguration and optimization in response to changing market conditions and operational requirements.

Regulatory compliance requirements in industries such as pharmaceuticals, food processing, and chemicals are driving adoption of automated systems that provide comprehensive tracking, documentation, and quality control capabilities essential for meeting stringent regulatory standards and maintaining product integrity throughout the supply chain.

Capital investment requirements represent the most significant barrier to automated material handling adoption, particularly for small and medium-sized enterprises that may lack the financial resources necessary for comprehensive system implementation. The substantial upfront costs associated with advanced automation technologies can create challenges for organizations operating with limited capital budgets or uncertain return on investment timelines.

Technical complexity associated with modern automated material handling systems requires specialized expertise for design, implementation, and ongoing maintenance. The shortage of qualified technical personnel in many regional markets creates challenges for organizations seeking to deploy and optimize these sophisticated technologies effectively.

Integration challenges with existing infrastructure and legacy systems can complicate implementation processes and increase project costs and timelines. Organizations with established facilities and older equipment may face significant challenges in retrofitting automated solutions without disrupting ongoing operations.

Cultural resistance to automation in some regional markets stems from concerns about job displacement and changes to traditional work practices. Overcoming these cultural barriers requires comprehensive change management strategies and clear communication about the benefits of human-machine collaboration.

Infrastructure limitations in certain areas of the region, including reliable power supply, internet connectivity, and transportation networks, can constrain the effectiveness of automated material handling systems and limit deployment opportunities in some geographic markets.

Smart city initiatives across the Middle East and Africa present substantial opportunities for automated material handling solution providers, as urban development projects incorporate advanced logistics and distribution capabilities to support growing populations and economic activities. These mega-projects require sophisticated material handling systems for construction, ongoing operations, and maintenance activities.

Manufacturing sector expansion driven by government industrial policies and foreign investment is creating demand for comprehensive automated material handling solutions across diverse industries. Organizations establishing new manufacturing facilities are increasingly incorporating automation from the design phase, creating opportunities for integrated system providers.

Logistics hub development in strategic locations such as Dubai, Doha, and Johannesburg is generating demand for world-class automated material handling capabilities to support international trade and distribution operations. These facilities require sophisticated systems capable of handling diverse product types and supporting complex routing and sorting requirements.

Technology partnerships between regional organizations and international automation providers are creating opportunities for knowledge transfer, local capacity building, and customized solution development that addresses specific regional requirements and market conditions.

Sustainability initiatives are driving demand for energy-efficient automated material handling systems that support environmental objectives while delivering operational benefits. Organizations are increasingly prioritizing solutions that reduce energy consumption, minimize waste, and support circular economy principles.

Competitive landscape evolution in the Middle East and Africa automated material handling market reflects increasing sophistication and specialization among solution providers. International technology leaders are establishing regional partnerships and local presence to better serve market demands, while regional companies are developing specialized expertise in specific industry segments and application areas.

Technology convergence is creating new possibilities for integrated solutions that combine multiple automation technologies into comprehensive material handling ecosystems. The integration of robotics, artificial intelligence, IoT connectivity, and advanced analytics is enabling unprecedented levels of operational optimization and system intelligence.

Customer expectations are evolving rapidly, with organizations demanding solutions that provide immediate operational benefits while offering long-term scalability and adaptability. This shift is driving innovation in modular system designs, cloud-based management platforms, and flexible automation architectures that can evolve with changing business requirements.

Investment patterns reveal increasing focus on total cost of ownership rather than initial capital costs, with organizations recognizing that automated material handling systems deliver substantial long-term value through reduced labor costs, improved accuracy, and enhanced operational efficiency. MWR data indicates that organizations are achieving payback periods of less than three years for comprehensive automation implementations.

Regulatory environment development is supporting market growth through standards and guidelines that promote safety, interoperability, and performance consistency across automated material handling systems. These regulatory frameworks are building confidence among potential adopters while ensuring system reliability and safety.

Comprehensive market analysis for the Middle East and Africa automated material handling market employed a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy, reliability, and depth of insights. The research framework incorporated quantitative data analysis, qualitative assessments, and expert interviews to develop a complete understanding of market dynamics and trends.

Primary research activities included extensive interviews with industry executives, technology providers, end-users, and market experts across key regional markets. These interviews provided valuable insights into market challenges, opportunities, technology trends, and competitive dynamics that shape the automated material handling landscape.

Secondary research encompassed comprehensive analysis of industry reports, company financial statements, government publications, trade association data, and academic research to validate primary findings and provide additional market context. This research included analysis of patent filings, technology developments, and regulatory changes affecting the market.

Data validation processes ensured information accuracy through cross-referencing multiple sources, expert review, and statistical analysis techniques. Market sizing and forecasting methodologies incorporated historical trend analysis, regression modeling, and scenario planning to develop robust projections for market growth and development.

Geographic coverage included detailed analysis of major regional markets including the United Arab Emirates, Saudi Arabia, South Africa, Egypt, Nigeria, Kenya, and other significant markets across the Middle East and Africa region, with particular attention to market-specific factors and development patterns.

United Arab Emirates leads regional adoption of automated material handling technologies, driven by Dubai’s position as a global logistics hub and Abu Dhabi’s industrial diversification initiatives. The country accounts for approximately 28% of regional market activity, with significant investments in smart warehouse facilities, automated distribution centers, and advanced manufacturing capabilities supporting continued growth.

Saudi Arabia represents the fastest-growing market segment, with Vision 2030 initiatives driving substantial investments in industrial automation and manufacturing capabilities. The kingdom’s focus on developing domestic manufacturing capacity and reducing import dependency is creating substantial demand for sophisticated material handling solutions across multiple industry sectors.

South Africa maintains its position as the leading market in the Africa region, with established manufacturing industries and advanced logistics infrastructure supporting steady adoption of automated material handling technologies. The country’s strategic location and well-developed transportation networks make it an attractive base for regional distribution operations.

Egypt is emerging as a significant market opportunity, with government initiatives to modernize manufacturing industries and develop new industrial zones creating demand for automated material handling solutions. The country’s large domestic market and strategic location between Africa, Asia, and Europe provide substantial growth potential.

Nigeria represents the largest potential market in West Africa, with ongoing economic diversification efforts and infrastructure development projects creating opportunities for automated material handling solution providers. The country’s growing manufacturing sector and expanding e-commerce market are driving technology adoption.

Kenya serves as the East African hub for automated material handling technology adoption, with Nairobi’s position as a regional business center and the country’s growing manufacturing sector supporting steady market development and technology deployment.

Market leadership in the Middle East and Africa automated material handling sector is characterized by a mix of international technology providers and regional specialists who offer comprehensive solutions tailored to local market requirements and industry needs.

Competitive strategies focus on developing regional partnerships, establishing local service capabilities, and creating customized solutions that address specific market requirements and regulatory compliance needs. Companies are investing in research and development to create innovative technologies that provide competitive advantages in efficiency, reliability, and cost-effectiveness.

By Technology:

By Application:

By End-User Industry:

Automated Storage and Retrieval Systems represent the fastest-growing segment, with organizations recognizing the space optimization and inventory management benefits these systems provide. Modern AS/RS solutions incorporate advanced robotics and artificial intelligence to maximize storage density while minimizing retrieval times, making them particularly attractive for high-value inventory applications.

Robotic Systems are experiencing rapid adoption across multiple industries, with collaborative robots (cobots) gaining particular traction due to their ability to work safely alongside human operators. These systems are achieving 85% accuracy rates in complex picking operations while providing flexibility to handle diverse product types and packaging configurations.

Conveyor Systems continue to form the backbone of many automated material handling installations, with modern systems incorporating intelligent controls, energy-efficient motors, and modular designs that enable easy reconfiguration and expansion. Smart conveyor systems with integrated sensors and analytics capabilities are providing real-time optimization and predictive maintenance benefits.

Automated Guided Vehicles are evolving rapidly with advances in navigation technology, battery systems, and fleet management software. Modern AGV systems provide flexible material transport solutions that can adapt to changing facility layouts and operational requirements without infrastructure modifications.

Sortation Systems are becoming increasingly sophisticated, with high-speed solutions capable of handling thousands of items per hour while maintaining exceptional accuracy levels. These systems are particularly valuable in e-commerce fulfillment operations where rapid, accurate order processing is essential for customer satisfaction.

Operational Efficiency Enhancement represents the primary benefit for organizations implementing automated material handling systems, with typical installations delivering productivity improvements of 40-60% compared to manual operations. These efficiency gains result from consistent system performance, reduced handling time, and optimized material flow throughout facilities.

Cost Reduction Opportunities extend beyond labor savings to include reduced product damage, improved inventory accuracy, and lower facility operating costs. Organizations report total cost reductions of up to 25% within two years of comprehensive automation implementation, with continued savings as systems optimize and mature.

Quality and Accuracy Improvements are achieved through precise system controls, consistent handling procedures, and integrated quality monitoring capabilities. Automated systems eliminate human error in repetitive tasks while providing comprehensive tracking and documentation for quality assurance and regulatory compliance purposes.

Scalability and Flexibility benefits enable organizations to adapt quickly to changing business requirements and market conditions. Modern automated material handling systems provide modular architectures that support incremental expansion and reconfiguration without major disruption to ongoing operations.

Safety Enhancement through automation reduces workplace accidents and creates safer working environments by eliminating human exposure to hazardous materials, repetitive strain injuries, and dangerous equipment operations. Automated systems incorporate comprehensive safety features and monitoring capabilities that exceed traditional safety standards.

Competitive Advantage development through automation enables organizations to offer superior service levels, faster delivery times, and more competitive pricing while maintaining higher profit margins. These advantages become increasingly important as market competition intensifies and customer expectations continue to rise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming automated material handling systems by enabling predictive analytics, dynamic optimization, and autonomous decision-making capabilities. AI-powered systems can analyze vast amounts of operational data to identify patterns, predict maintenance needs, and optimize system performance in real-time, delivering substantial efficiency improvements and cost reductions.

Internet of Things Connectivity is creating intelligent material handling ecosystems where sensors, devices, and systems communicate seamlessly to provide comprehensive operational visibility and control. IoT integration enables remote monitoring, predictive maintenance, and data-driven optimization that maximizes system performance and minimizes downtime.

Sustainability Focus is driving demand for energy-efficient automated material handling solutions that support environmental objectives while delivering operational benefits. Organizations are prioritizing systems that reduce energy consumption, minimize waste generation, and support circular economy principles through improved resource utilization.

Collaborative Robotics represents a significant trend toward human-machine collaboration rather than replacement, with cobots designed to work safely alongside human operators while enhancing productivity and reducing physical strain. These systems provide flexibility and adaptability that pure automation cannot match while maintaining safety and efficiency benefits.

Cloud-Based Management platforms are enabling centralized control and optimization of distributed material handling operations, providing real-time visibility, analytics, and control capabilities across multiple facilities and geographic locations. Cloud solutions offer scalability, accessibility, and cost-effectiveness that traditional on-premise systems cannot provide.

Modular System Design is becoming increasingly important as organizations seek flexible solutions that can evolve with changing business requirements. Modular architectures enable incremental expansion, easy reconfiguration, and technology upgrades without major system disruption or replacement.

Strategic Partnerships between international technology providers and regional organizations are accelerating market development through knowledge transfer, local capacity building, and customized solution development. These partnerships are creating comprehensive service networks and support capabilities that enhance customer confidence and system reliability.

Technology Innovation continues at a rapid pace, with breakthrough developments in robotics, artificial intelligence, and sensor technologies creating new possibilities for automated material handling applications. Recent innovations include advanced machine vision systems, autonomous mobile robots, and intelligent warehouse management platforms that deliver unprecedented operational capabilities.

Investment Announcements from major regional organizations demonstrate growing confidence in automated material handling technologies and their potential to deliver competitive advantages. These investments are driving market growth while creating demonstration sites that showcase technology capabilities to potential adopters.

Regulatory Development is supporting market growth through standards and guidelines that promote safety, interoperability, and performance consistency across automated material handling systems. New regulations are addressing cybersecurity, data privacy, and worker safety concerns while facilitating technology adoption.

Acquisition Activity among technology providers is consolidating market capabilities and creating comprehensive solution portfolios that address diverse customer requirements. These acquisitions are combining complementary technologies and expertise to deliver integrated solutions that provide superior value propositions.

Research and Development investments are accelerating innovation in automated material handling technologies, with particular focus on artificial intelligence, machine learning, and advanced robotics applications. These R&D efforts are creating next-generation solutions that will define future market development.

Technology Evaluation should focus on total cost of ownership rather than initial capital costs, with organizations conducting comprehensive analysis of long-term operational benefits, maintenance requirements, and scalability potential. MarkWide Research recommends evaluating multiple technology options and vendor capabilities before making investment decisions.

Implementation Planning requires careful consideration of existing infrastructure, operational requirements, and change management needs to ensure successful technology deployment. Organizations should develop phased implementation strategies that minimize operational disruption while maximizing system benefits and user acceptance.

Vendor Selection should prioritize providers with strong regional presence, comprehensive service capabilities, and proven track records in similar applications. Local support capabilities, training programs, and ongoing maintenance services are critical factors for long-term system success and optimization.

Skills Development initiatives should begin early in the implementation process to ensure adequate technical expertise for system operation, maintenance, and optimization. Organizations should invest in comprehensive training programs and consider partnerships with educational institutions to develop required capabilities.

Performance Monitoring systems should be established to track key performance indicators, identify optimization opportunities, and demonstrate return on investment. Regular performance reviews and system optimization efforts are essential for maximizing technology benefits and maintaining competitive advantages.

Future Planning should consider technology evolution and expansion possibilities when designing initial implementations. Modular system architectures and scalable platforms provide flexibility for future growth and technology upgrades without major system replacement requirements.

Market expansion across the Middle East and Africa automated material handling sector is expected to accelerate significantly over the next decade, driven by continued economic development, infrastructure investment, and technological advancement. The convergence of multiple growth drivers creates an exceptionally favorable environment for sustained market development and technology adoption.

Technology evolution will continue to enhance system capabilities and reduce implementation barriers, with advances in artificial intelligence, robotics, and connectivity creating more accessible and cost-effective solutions for organizations of all sizes. These technological improvements will expand market opportunities while improving return on investment for automation initiatives.

Regional leadership in automated material handling adoption will likely shift as different countries develop specialized expertise and competitive advantages in specific technology areas or industry applications. This specialization will create centers of excellence that support regional market development and technology transfer.

Industry transformation will accelerate as organizations recognize automation’s critical role in maintaining competitiveness and operational excellence. The shift from viewing automation as optional to considering it essential will drive widespread adoption across industries and organization sizes.

Innovation acceleration will continue as technology providers invest heavily in research and development to create next-generation solutions that address emerging market requirements and application opportunities. These innovations will expand the scope and effectiveness of automated material handling systems while reducing costs and complexity.

Market maturation will bring increased standardization, improved interoperability, and more sophisticated service ecosystems that support comprehensive automation strategies. This maturation will reduce implementation risks while improving system reliability and performance consistency across different applications and environments.

The Middle East and Africa automated material handling market represents one of the most dynamic and promising technology sectors in the global automation landscape, characterized by strong growth fundamentals, supportive government policies, and increasing recognition of automation’s strategic importance for competitive advantage and operational excellence.

Market transformation is being driven by the convergence of multiple factors including economic diversification initiatives, infrastructure development, technological advancement, and changing customer expectations that collectively create substantial opportunities for automated material handling solution providers and end-users alike.

Technology evolution continues to enhance system capabilities while reducing implementation barriers, making automated material handling solutions increasingly accessible and cost-effective for organizations across diverse industries and size categories. The integration of artificial intelligence, IoT connectivity, and advanced robotics is creating unprecedented possibilities for operational optimization and competitive differentiation.

Regional development patterns indicate sustained growth potential across multiple markets, with different countries developing specialized strengths and competitive advantages that support overall market expansion and technology adoption. This geographic diversity provides resilience and multiple growth vectors for market participants.

Future prospects remain exceptionally positive, with continued economic development, infrastructure investment, and technological innovation creating a supportive environment for sustained market growth and evolution. Organizations that embrace automated material handling technologies today will be well-positioned to capitalize on emerging opportunities and maintain competitive advantages in increasingly dynamic global markets.

What is Automated Material Handling?

Automated Material Handling refers to the use of automated systems and equipment to manage the movement, storage, and control of materials and products within a facility. This includes technologies such as conveyor systems, automated guided vehicles, and robotic arms, which enhance efficiency and reduce labor costs.

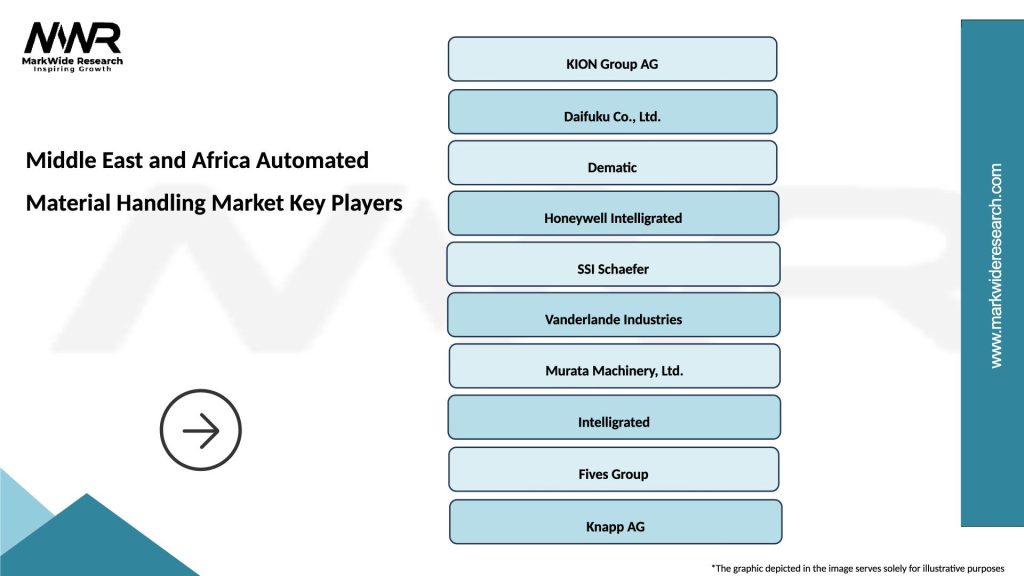

What are the key players in the Middle East and Africa Automated Material Handling Market?

Key players in the Middle East and Africa Automated Material Handling Market include KION Group, Daifuku Co., Ltd., and Honeywell Intelligrated, among others. These companies are known for their innovative solutions and extensive product offerings in the automated handling sector.

What are the growth factors driving the Middle East and Africa Automated Material Handling Market?

The growth of the Middle East and Africa Automated Material Handling Market is driven by increasing demand for efficiency in logistics and warehousing, the rise of e-commerce, and advancements in automation technologies. Additionally, the need for improved safety and reduced operational costs contributes to market expansion.

What challenges does the Middle East and Africa Automated Material Handling Market face?

Challenges in the Middle East and Africa Automated Material Handling Market include high initial investment costs, a shortage of skilled labor, and the complexity of integrating automated systems with existing infrastructure. These factors can hinder the adoption of automated solutions in various industries.

What opportunities exist in the Middle East and Africa Automated Material Handling Market?

Opportunities in the Middle East and Africa Automated Material Handling Market include the growing adoption of Industry Four Point Zero technologies, increased investment in smart warehouses, and the expansion of logistics networks. These trends present significant potential for innovation and growth in the sector.

What trends are shaping the Middle East and Africa Automated Material Handling Market?

Trends shaping the Middle East and Africa Automated Material Handling Market include the rise of robotics and AI in material handling processes, the integration of IoT for real-time tracking, and the focus on sustainability in operations. These trends are transforming how materials are managed across various industries.

Middle East and Africa Automated Material Handling Market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Conveyor Systems, Robotic Arms, Sortation Systems |

| Technology | IoT, AI, Machine Learning, Robotics |

| End User | Manufacturing, Warehousing, Retail, Logistics |

| Application | Order Fulfillment, Inventory Management, Material Handling, Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East and Africa Automated Material Handling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at