444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa air purifier market represents a rapidly expanding sector driven by increasing awareness of indoor air quality, rising pollution levels, and growing health consciousness among consumers. This dynamic market encompasses various air purification technologies designed to remove contaminants, allergens, and pollutants from indoor environments across residential, commercial, and industrial applications.

Market dynamics in the Middle East and Africa region are characterized by unique environmental challenges, including dust storms, industrial emissions, and urban pollution that significantly impact air quality. The market is experiencing substantial growth momentum with increasing adoption rates across major metropolitan areas and industrial centers throughout the region.

Regional variations play a crucial role in market development, with countries like the United Arab Emirates, Saudi Arabia, and South Africa leading adoption trends. The market demonstrates strong growth potential with projected expansion at a compound annual growth rate of 8.2% over the forecast period, driven by urbanization, industrial development, and heightened environmental awareness.

Technology advancement continues to shape market evolution, with manufacturers introducing sophisticated filtration systems, smart connectivity features, and energy-efficient designs tailored to regional climate conditions and air quality challenges specific to Middle Eastern and African environments.

The Middle East and Africa air purifier market refers to the comprehensive ecosystem of air cleaning devices, technologies, and services designed to improve indoor air quality across residential, commercial, and industrial sectors within the MEA region. This market encompasses various purification technologies including HEPA filtration, activated carbon systems, UV sterilization, and ionic purification methods.

Air purifiers in this context represent sophisticated devices engineered to remove airborne particles, allergens, volatile organic compounds, bacteria, viruses, and other contaminants from indoor environments. These systems address specific regional challenges such as desert dust infiltration, industrial pollution, and climate-related air quality issues prevalent throughout Middle Eastern and African territories.

Market scope includes portable air purifiers, whole-house systems, commercial-grade units, and specialized industrial air cleaning solutions. The definition extends beyond hardware to encompass replacement filters, maintenance services, and integrated smart home technologies that enhance air purification effectiveness and user convenience.

Strategic market positioning reveals the Middle East and Africa air purifier market as an emerging high-growth sector with significant expansion opportunities driven by environmental concerns, health awareness, and technological innovation. The market demonstrates robust demand patterns across diverse applications ranging from residential homes to large-scale commercial installations.

Key growth drivers include increasing urbanization rates, rising disposable incomes, growing awareness of air pollution health impacts, and supportive government initiatives promoting indoor air quality standards. The market benefits from technological convergence with smart home systems and IoT integration, creating enhanced value propositions for consumers.

Regional leadership is concentrated in Gulf Cooperation Council countries, with the UAE and Saudi Arabia representing approximately 45% of regional market share. South Africa emerges as the dominant market in the African continent, driven by industrial development and urban air quality challenges.

Competitive landscape features both international manufacturers and regional players, with market consolidation trends favoring companies offering comprehensive product portfolios, strong distribution networks, and localized customer support capabilities tailored to regional requirements.

Market intelligence reveals several critical insights shaping the Middle East and Africa air purifier landscape:

Environmental factors serve as primary market drivers, with deteriorating air quality in major urban centers creating urgent demand for indoor air purification solutions. Desert dust storms, industrial emissions, and vehicular pollution contribute to challenging air quality conditions that drive consumer awareness and purchase decisions.

Health consciousness represents a fundamental driver as consumers increasingly recognize connections between air quality and respiratory health, allergies, and overall well-being. Medical professionals and health organizations actively promote indoor air quality improvement, creating educational awareness that translates into market demand.

Urbanization trends accelerate market growth as expanding metropolitan areas concentrate populations in environments with elevated pollution levels. Rapid urban development, construction activities, and increased traffic density create microenvironments where air purification becomes essential for maintaining healthy indoor spaces.

Government initiatives supporting environmental protection and public health create favorable regulatory environments for air purifier adoption. Building codes, indoor air quality standards, and green building certifications increasingly require or incentivize air purification systems in commercial and residential developments.

Technological advancement drives market expansion through improved product performance, energy efficiency, and user-friendly features. Smart home integration, mobile connectivity, and automated operation capabilities enhance value propositions and attract technology-oriented consumers seeking convenient air quality management solutions.

Economic constraints pose significant challenges to market expansion, particularly in price-sensitive segments where initial investment costs and ongoing maintenance expenses limit adoption rates. Economic volatility and currency fluctuations in certain regional markets create additional barriers to consistent market growth.

Limited awareness in certain demographic segments and geographic areas restricts market penetration, as many consumers remain unaware of air purification benefits or lack understanding of technology differences and selection criteria. Educational gaps create obstacles to market expansion beyond early adopter segments.

Infrastructure limitations in some African markets present challenges for distribution, service support, and reliable electricity supply necessary for air purifier operation. Inadequate retail networks and limited technical support capabilities constrain market development in emerging territories.

Cultural factors and traditional building practices in certain regions may not prioritize indoor air quality, creating resistance to air purifier adoption. Preference for natural ventilation and skepticism toward technological solutions can limit market acceptance in traditional communities.

Maintenance requirements and filter replacement costs create ongoing ownership expenses that may deter cost-conscious consumers. Lack of local service providers and limited availability of replacement parts in remote areas further complicate product ownership and satisfaction.

Emerging market segments present substantial growth opportunities, particularly in commercial applications including offices, healthcare facilities, educational institutions, and hospitality venues where air quality directly impacts occupant health and productivity. These sectors demonstrate increasing willingness to invest in comprehensive air purification solutions.

Technology integration opportunities exist in developing smart building systems, IoT connectivity, and integration with HVAC systems to create comprehensive indoor environmental management solutions. Advanced features like air quality monitoring, predictive maintenance, and automated operation create differentiation opportunities for innovative manufacturers.

Regional expansion into underserved African markets offers significant growth potential as economic development, urbanization, and health awareness increase. Countries experiencing rapid industrial growth and urban development represent untapped markets for air purification solutions tailored to local conditions and price points.

Partnership opportunities with construction companies, real estate developers, and facility management firms can accelerate market penetration through integrated building solutions. Collaborative approaches with healthcare providers, educational institutions, and government agencies create channels for large-scale deployments.

Product innovation focused on regional-specific challenges such as sand and dust filtration, energy efficiency in hot climates, and cost-effective solutions for emerging markets can create competitive advantages and expand addressable market segments.

Supply chain dynamics in the Middle East and Africa air purifier market reflect complex interactions between international manufacturers, regional distributors, and local retailers. Global supply chain disruptions have highlighted the importance of regional distribution capabilities and local inventory management to ensure consistent product availability.

Competitive dynamics demonstrate increasing intensity as both established international brands and emerging regional players compete for market share. Price competition intensifies in mid-market segments while premium brands focus on technology differentiation and superior customer service to maintain positioning.

Consumer behavior dynamics show evolving preferences toward smart, connected devices with mobile app integration and automated operation capabilities. Seasonal purchasing patterns align with dust storm seasons and peak pollution periods, creating predictable demand cycles that influence inventory and marketing strategies.

Regulatory dynamics continue evolving as governments implement stricter indoor air quality standards and building codes. Environmental regulations and energy efficiency requirements shape product development priorities and create opportunities for compliant manufacturers while challenging non-compliant competitors.

Technology dynamics drive continuous innovation in filtration efficiency, energy consumption, noise reduction, and smart features. According to MarkWide Research analysis, technological advancement contributes to annual efficiency improvements of 12% across leading product categories, enhancing value propositions and market appeal.

Primary research methodology encompasses comprehensive surveys, interviews, and focus groups conducted across key markets in the Middle East and Africa region. Research participants include consumers, retailers, distributors, manufacturers, and industry experts providing diverse perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, government publications, trade association data, and company financial statements to validate primary findings and provide comprehensive market context. Academic research, environmental studies, and health organization reports contribute additional insights into market drivers and consumer behavior patterns.

Data collection methods utilize both quantitative and qualitative approaches, including structured questionnaires, in-depth interviews, observational studies, and market testing initiatives. Geographic coverage spans major metropolitan areas, emerging markets, and rural regions to ensure representative sampling across diverse market segments.

Analytical framework employs statistical modeling, trend analysis, and comparative benchmarking to identify market patterns, growth drivers, and competitive dynamics. Cross-validation techniques ensure data accuracy and reliability while sensitivity analysis tests key assumptions and projections.

Quality assurance protocols include peer review, expert validation, and continuous monitoring of market developments to maintain research accuracy and relevance. Regular updates and revisions ensure findings reflect current market conditions and emerging trends affecting the air purifier industry.

Gulf Cooperation Council countries dominate the Middle East air purifier market, with the United Arab Emirates leading adoption rates due to high disposable incomes, environmental awareness, and challenging air quality conditions. Dubai and Abu Dhabi represent primary growth centers with strong market penetration rates exceeding 25% in premium residential segments.

Saudi Arabia demonstrates rapid market expansion driven by Vision 2030 initiatives promoting environmental sustainability and quality of life improvements. Major cities including Riyadh, Jeddah, and Dammam show increasing demand for both residential and commercial air purification solutions, supported by government health initiatives and urban development projects.

South Africa leads the African continent in air purifier adoption, with Johannesburg, Cape Town, and Durban representing primary markets. Industrial pollution, urban air quality challenges, and growing middle-class awareness drive market development, with annual growth rates approaching 11.5% in metropolitan areas.

Egypt emerges as a significant growth market driven by Cairo’s air quality challenges and increasing health consciousness among urban populations. Government initiatives promoting indoor air quality and growing tourism industry create demand for commercial air purification solutions in hotels, restaurants, and public facilities.

Nigeria represents substantial long-term potential despite current market limitations, with Lagos and Abuja showing early adoption trends among affluent consumers. Economic development and urbanization create foundation for future market expansion as awareness and purchasing power increase across broader population segments.

Market leadership in the Middle East and Africa air purifier market features a diverse competitive landscape combining established international brands with emerging regional players. Competition intensifies across multiple dimensions including technology innovation, pricing strategies, distribution capabilities, and customer service excellence.

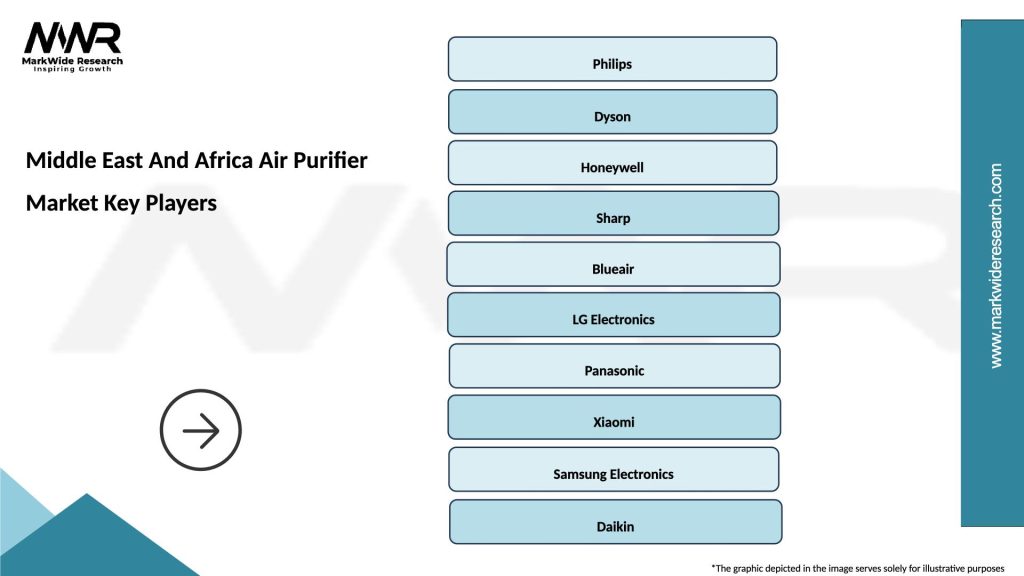

Leading market participants include:

Competitive strategies emphasize product differentiation through advanced filtration technologies, smart connectivity features, and energy efficiency improvements. Distribution network expansion, local partnerships, and customer service capabilities become increasingly important competitive factors in regional markets.

Market consolidation trends favor companies with strong financial resources, comprehensive product portfolios, and established distribution networks capable of serving diverse regional requirements and customer segments effectively.

By Technology:

By Application:

By Price Range:

Residential air purifiers dominate market volume with strong growth driven by increasing health awareness, home improvement trends, and rising disposable incomes. Consumer preferences favor mid-range products offering reliable performance, energy efficiency, and user-friendly operation. Smart connectivity features gain importance among tech-savvy consumers seeking integrated home automation solutions.

Commercial applications demonstrate robust growth potential with businesses increasingly recognizing air quality impacts on employee productivity, customer satisfaction, and regulatory compliance. Office buildings, retail spaces, and hospitality venues drive demand for scalable air purification solutions with low maintenance requirements and quiet operation.

Healthcare segment requires specialized air purification systems meeting stringent performance standards for infection control and patient safety. Hospitals, clinics, and medical facilities prioritize high-efficiency filtration, UV sterilization capabilities, and compliance with healthcare industry regulations and standards.

Portable air purifiers represent the fastest-growing product category, offering flexibility, ease of installation, and cost-effective solutions for diverse applications. Consumer preference for portable units reflects practical considerations including rental housing, temporary installations, and multi-room usage scenarios.

Smart air purifiers with IoT connectivity and mobile app integration capture increasing market attention, particularly among younger demographics and technology enthusiasts. Features including air quality monitoring, remote control, and predictive maintenance create enhanced value propositions and differentiation opportunities for manufacturers.

Manufacturers benefit from expanding market opportunities driven by growing environmental awareness and health consciousness across the Middle East and Africa region. Diversified product portfolios, regional customization capabilities, and strong distribution networks create competitive advantages and sustainable growth potential in emerging markets.

Distributors and retailers capitalize on increasing consumer demand through expanded product offerings, educational marketing initiatives, and value-added services including installation and maintenance support. Strong relationships with manufacturers and comprehensive market coverage create opportunities for revenue growth and market share expansion.

Consumers gain access to improved indoor air quality solutions addressing regional environmental challenges including dust storms, pollution, and allergens. Advanced technology features, energy efficiency improvements, and competitive pricing provide enhanced value propositions and better health outcomes for families and individuals.

Commercial enterprises achieve improved workplace environments, enhanced employee productivity, and regulatory compliance through professional air purification solutions. Investment in air quality systems demonstrates corporate responsibility while creating healthier, more attractive work environments that support talent retention and business success.

Healthcare providers enhance patient care quality and infection control capabilities through specialized air purification systems designed for medical environments. Advanced filtration and sterilization technologies support clinical outcomes while meeting stringent healthcare industry standards and regulatory requirements.

Government agencies advance public health objectives and environmental protection goals through supportive policies, building codes, and procurement initiatives promoting indoor air quality improvement across public facilities and commercial developments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as a dominant trend with air purifiers increasingly featuring IoT capabilities, mobile app control, and integration with smart home ecosystems. Consumers demand real-time air quality monitoring, remote operation capabilities, and automated adjustment based on environmental conditions and usage patterns.

Energy efficiency focus intensifies as environmental consciousness and operating cost considerations drive demand for low-power consumption air purifiers. MWR data indicates that energy-efficient models show adoption rates 35% higher than standard alternatives, reflecting consumer preference for sustainable and cost-effective solutions.

Multi-stage filtration systems gain popularity as consumers seek comprehensive air purification addressing diverse contaminants including particles, gases, odors, and biological pollutants. Hybrid technologies combining HEPA, activated carbon, and UV sterilization provide superior performance and broader market appeal.

Portable and compact designs respond to consumer preferences for flexible, space-efficient solutions suitable for diverse living environments. Aesthetic considerations become increasingly important as air purifiers integrate into home décor and commercial interior design schemes.

Health-focused marketing emphasizes specific benefits including allergy relief, respiratory health improvement, and protection against airborne pathogens. Medical endorsements and clinical studies support product claims and build consumer confidence in air purification effectiveness.

Subscription service models for filter replacement and maintenance create recurring revenue streams while simplifying product ownership for consumers. Automated delivery and reminder systems enhance customer satisfaction and ensure optimal product performance over time.

Product innovation continues accelerating with manufacturers introducing advanced filtration technologies, improved energy efficiency, and enhanced smart features. Recent developments include AI-powered air quality optimization, predictive maintenance capabilities, and integration with voice assistants for hands-free operation.

Market expansion initiatives by leading manufacturers focus on establishing stronger regional presence through local partnerships, distribution network development, and customer service capabilities. Strategic investments in emerging African markets demonstrate long-term growth commitment and market development priorities.

Regulatory developments across the region include updated building codes, indoor air quality standards, and energy efficiency requirements that influence product specifications and market demand patterns. Government initiatives promoting environmental protection and public health create supportive policy environments for market growth.

Technology partnerships between air purifier manufacturers and smart home platform providers create integrated solutions and expanded market reach. Collaborations with healthcare organizations and research institutions support product development and clinical validation of health benefits.

Sustainability initiatives focus on recyclable filter materials, reduced packaging waste, and energy-efficient operation to address growing environmental consciousness among consumers and regulatory requirements for sustainable product design.

Digital transformation efforts include e-commerce platform development, digital marketing strategies, and online customer service capabilities that enhance market accessibility and customer engagement across diverse regional markets.

Market entry strategies for new participants should prioritize regional customization, competitive pricing, and strong distribution partnerships to establish market presence effectively. Understanding local environmental challenges, consumer preferences, and regulatory requirements becomes critical for successful market penetration and sustainable growth.

Product development recommendations emphasize energy efficiency, smart connectivity, and multi-stage filtration capabilities that address comprehensive air quality needs. Manufacturers should invest in regional testing and validation to ensure products perform effectively under local environmental conditions including high temperatures and dust exposure.

Distribution strategy optimization requires balanced approach combining traditional retail channels with expanding e-commerce platforms and direct-to-consumer sales models. Strong after-sales service capabilities and local technical support become increasingly important competitive differentiators in regional markets.

Marketing approaches should focus on education and awareness building to expand market beyond early adopters. Health-focused messaging, environmental benefits, and cost-effectiveness arguments resonate strongly with target consumer segments across diverse demographic groups.

Partnership opportunities with construction companies, real estate developers, and facility management firms can accelerate commercial market penetration through integrated building solutions and large-scale deployments that demonstrate air purification value propositions effectively.

Investment priorities should emphasize technology innovation, regional market development, and customer service capabilities that support long-term competitive positioning and market share growth in expanding Middle East and Africa markets.

Market trajectory indicates continued robust growth driven by increasing environmental awareness, urbanization trends, and health consciousness across the Middle East and Africa region. Technological advancement and product innovation will create new market opportunities while expanding addressable consumer segments through improved affordability and performance.

Technology evolution will focus on artificial intelligence integration, advanced sensor capabilities, and predictive maintenance features that enhance user experience and product effectiveness. Smart home integration and IoT connectivity will become standard features rather than premium options, driving market adoption across broader consumer segments.

Geographic expansion into underserved African markets presents substantial growth potential as economic development, urbanization, and middle-class expansion create favorable conditions for air purifier adoption. Infrastructure development and distribution network expansion will support market accessibility in emerging territories.

Commercial market development will accelerate as businesses increasingly recognize air quality impacts on employee productivity, customer satisfaction, and regulatory compliance. Healthcare, education, and hospitality sectors will drive significant demand for specialized air purification solutions tailored to specific industry requirements.

Regulatory environment evolution will create additional growth drivers through stricter indoor air quality standards, building codes, and environmental protection requirements. Government initiatives promoting public health and environmental sustainability will support market expansion and technology adoption across multiple sectors.

Market maturation will bring increased competition, price optimization, and service differentiation as key competitive factors. Companies with strong regional presence, comprehensive product portfolios, and superior customer service capabilities will capture disproportionate market share and growth opportunities.

The Middle East and Africa air purifier market represents a dynamic and rapidly expanding sector with substantial growth potential driven by environmental challenges, health awareness, and technological innovation. Regional environmental conditions including dust storms, urban pollution, and industrial emissions create compelling demand for effective indoor air purification solutions across residential, commercial, and healthcare applications.

Market fundamentals remain strong with increasing urbanization, rising disposable incomes, and growing health consciousness supporting sustained demand growth. Technology advancement in filtration efficiency, smart connectivity, and energy performance creates enhanced value propositions that expand market appeal across diverse consumer segments and price points.

Competitive dynamics favor companies with comprehensive product portfolios, strong regional distribution capabilities, and customer service excellence. Market success requires understanding of local environmental challenges, consumer preferences, and regulatory requirements that influence product specifications and marketing strategies.

Future prospects indicate continued market expansion with emerging opportunities in underserved African markets, commercial applications, and technology integration with smart building systems. Companies positioned to capitalize on these trends through strategic investments, regional partnerships, and product innovation will achieve sustainable competitive advantages and market leadership positions in this growing sector.

What is Air Purifier?

An air purifier is a device designed to remove contaminants from the air in a room or an entire building. These devices are commonly used to improve indoor air quality by filtering out pollutants such as dust, pollen, smoke, and volatile organic compounds.

What are the key players in the Middle East And Africa Air Purifier Market?

Key players in the Middle East And Africa Air Purifier Market include companies like Philips, Honeywell, and Dyson, which are known for their innovative air purification technologies and product offerings. These companies focus on various applications, including residential, commercial, and industrial air purification solutions, among others.

What are the growth factors driving the Middle East And Africa Air Purifier Market?

The growth of the Middle East And Africa Air Purifier Market is driven by increasing air pollution levels, rising health awareness among consumers, and a growing demand for energy-efficient appliances. Additionally, urbanization and industrialization in the region contribute to the need for effective air purification solutions.

What challenges does the Middle East And Africa Air Purifier Market face?

The Middle East And Africa Air Purifier Market faces challenges such as high initial costs of advanced air purifiers and a lack of awareness regarding the benefits of air purification. Furthermore, varying regulatory standards across countries can complicate market entry for new products.

What opportunities exist in the Middle East And Africa Air Purifier Market?

Opportunities in the Middle East And Africa Air Purifier Market include the increasing adoption of smart home technologies and the potential for product innovation in air purification systems. Additionally, growing investments in healthcare and environmental sustainability initiatives can further enhance market growth.

What trends are shaping the Middle East And Africa Air Purifier Market?

Trends shaping the Middle East And Africa Air Purifier Market include the rise of portable air purifiers, advancements in filtration technologies, and a shift towards eco-friendly products. Consumers are increasingly seeking devices that not only purify air but also integrate with smart home systems.

Middle East And Africa Air Purifier Market

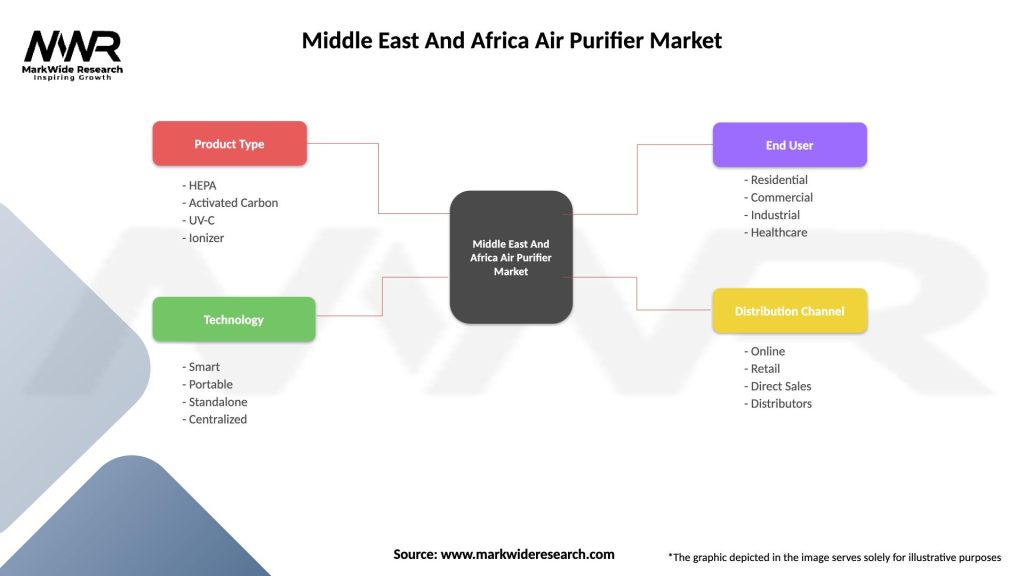

| Segmentation Details | Description |

|---|---|

| Product Type | HEPA, Activated Carbon, UV-C, Ionizer |

| Technology | Smart, Portable, Standalone, Centralized |

| End User | Residential, Commercial, Industrial, Healthcare |

| Distribution Channel | Online, Retail, Direct Sales, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East And Africa Air Purifier Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at