444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa sugar substitutes market represents a rapidly evolving sector driven by increasing health consciousness and rising diabetes prevalence across the region. Sugar substitutes, including artificial sweeteners, natural alternatives, and sugar alcohols, are experiencing unprecedented demand as consumers seek healthier dietary options without compromising taste preferences. The market encompasses diverse product categories ranging from stevia and aspartame to monk fruit and erythritol, catering to various consumer segments and applications.

Regional dynamics indicate significant growth potential, with the market expanding at a robust CAGR of 8.2% over the forecast period. Countries like Saudi Arabia, UAE, South Africa, and Egypt are leading adoption rates, driven by government health initiatives and increasing awareness of lifestyle-related diseases. The food and beverage industry’s transformation toward healthier formulations has created substantial opportunities for sugar substitute manufacturers and suppliers throughout the region.

Market penetration varies significantly across different countries, with Gulf Cooperation Council (GCC) nations showing higher adoption rates of 65% compared to sub-Saharan African markets. The diverse cultural preferences, regulatory frameworks, and economic conditions across the Middle East and Africa create a complex but promising landscape for sugar alternatives and innovative sweetening solutions.

The Middle East & Africa sugar substitutes market refers to the comprehensive ecosystem of alternative sweetening products designed to replace traditional sugar while providing similar or enhanced taste profiles with reduced caloric content. These products include artificial sweeteners like aspartame and sucralose, natural alternatives such as stevia and monk fruit, and sugar alcohols including erythritol and xylitol, specifically marketed and distributed across Middle Eastern and African countries.

Sugar substitutes serve multiple purposes beyond simple sweetening, offering functional benefits such as dental health protection, blood glucose management, and weight control support. The market encompasses various product forms including powders, liquids, tablets, and granules, designed for both consumer retail and industrial food manufacturing applications. Regional preferences significantly influence product development, with manufacturers adapting formulations to meet local taste expectations and cultural dietary requirements.

Market dynamics in the Middle East & Africa sugar substitutes sector reflect a fundamental shift toward healthier consumption patterns driven by rising diabetes rates and obesity concerns. The region’s unique demographic profile, characterized by young populations and increasing disposable income, creates favorable conditions for premium sugar alternatives and innovative sweetening solutions. Government health initiatives across multiple countries are accelerating market adoption through awareness campaigns and regulatory support.

Key growth drivers include the expanding food and beverage industry, increasing health consciousness among consumers, and growing prevalence of diabetes affecting approximately 12.8% of the adult population in the region. The market benefits from diverse distribution channels including hypermarkets, specialty health stores, and e-commerce platforms, enabling broader consumer access to sugar substitute products.

Competitive landscape features both international manufacturers and regional players, with companies focusing on product innovation, local partnerships, and culturally appropriate marketing strategies. The market’s future trajectory appears promising, supported by favorable demographic trends, increasing health awareness, and continuous product development initiatives targeting specific regional preferences and requirements.

Consumer behavior analysis reveals significant insights into Middle East & Africa sugar substitutes adoption patterns and preferences. The following key insights shape market development and strategic planning:

Health consciousness represents the primary driver propelling Middle East & Africa sugar substitutes market growth, with consumers increasingly recognizing the connection between sugar consumption and various health complications. The rising prevalence of diabetes, affecting significant portions of the population across Gulf states and North African countries, has created urgent demand for effective sugar alternatives that enable dietary management without sacrificing taste preferences.

Government initiatives across the region actively promote healthier dietary choices through public awareness campaigns, taxation policies on high-sugar products, and regulatory support for sugar substitute adoption. Countries like Saudi Arabia and UAE have implemented comprehensive health programs that specifically encourage reduced sugar consumption, creating favorable market conditions for alternative sweetening solutions.

Food industry transformation drives substantial demand as manufacturers reformulate products to meet changing consumer expectations and regulatory requirements. The beverage sector, particularly soft drinks and fruit juices, leads this transformation with major brands introducing sugar-free variants and reduced-calorie options. Additionally, the expanding bakery and confectionery industries are incorporating sugar substitutes to create healthier product lines while maintaining taste appeal.

Demographic trends support market growth, with younger populations showing greater willingness to adopt innovative food products and health-conscious lifestyle choices. Rising disposable income levels, particularly in Gulf countries, enable consumers to invest in premium health products, including high-quality natural sugar alternatives that command higher price points than traditional sweeteners.

Price sensitivity remains a significant constraint, particularly in African markets where economic conditions limit consumer spending on premium health products. Traditional sugar’s low cost creates a substantial price gap that many consumers find difficult to justify, especially when natural sugar substitutes can cost several times more than conventional sweeteners. This economic barrier particularly affects mass market adoption and limits penetration in price-conscious consumer segments.

Taste preferences and cultural acceptance present ongoing challenges, as many consumers report dissatisfaction with aftertastes or different sweetness profiles associated with various sugar alternatives. Regional taste preferences, developed over generations of traditional sugar consumption, create resistance to change that manufacturers must carefully navigate through product development and consumer education initiatives.

Regulatory complexity across different countries creates operational challenges for manufacturers and distributors. Varying approval processes, labeling requirements, and safety standards increase compliance costs and complicate market entry strategies. Some countries maintain restrictive policies regarding certain artificial sweeteners, limiting product availability and market development opportunities.

Limited awareness in certain market segments, particularly rural areas and lower-income demographics, restricts market expansion potential. Many consumers lack sufficient knowledge about sugar substitute benefits and appropriate usage, creating barriers to adoption that require significant educational marketing investments to overcome effectively.

Product innovation presents substantial opportunities for companies developing culturally adapted sugar substitutes that meet regional taste preferences while delivering health benefits. The growing demand for natural alternatives creates space for innovative products combining multiple sweetening sources or incorporating functional ingredients that provide additional health benefits beyond simple sugar replacement.

E-commerce expansion offers significant growth potential, particularly as internet penetration increases across the region and consumers become more comfortable with online purchasing. Digital platforms enable direct consumer education, subscription services, and targeted marketing that can effectively communicate sugar substitute benefits while building brand loyalty and repeat purchases.

Industrial partnerships with food and beverage manufacturers create opportunities for bulk supply agreements and co-development projects. As more companies commit to reducing sugar content in their products, sugar substitute suppliers can establish long-term relationships that provide stable revenue streams and market expansion opportunities across multiple product categories.

Healthcare sector collaboration presents emerging opportunities through partnerships with hospitals, clinics, and diabetes management programs. These relationships can drive product recommendations, educational initiatives, and targeted marketing to consumers who most benefit from sugar reduction strategies, creating both social impact and commercial value.

Supply chain evolution in the Middle East & Africa sugar substitutes market reflects increasing sophistication as demand grows and distribution networks expand. International suppliers are establishing regional partnerships and local manufacturing capabilities to reduce costs and improve product availability. The cold chain requirements for certain natural sweeteners necessitate infrastructure investments that are gradually being addressed through strategic partnerships and technology adoption.

Consumer education initiatives play a crucial role in market dynamics, with manufacturers investing heavily in awareness campaigns that explain proper usage, health benefits, and taste optimization techniques. These educational efforts are showing measurable impact, with consumer acceptance rates improving by 25% in markets where comprehensive education programs have been implemented consistently over extended periods.

Competitive intensity continues increasing as both international brands and local manufacturers recognize market potential and invest in product development, marketing, and distribution capabilities. This competition drives innovation, improves product quality, and gradually reduces prices, making sugar alternatives more accessible to broader consumer segments across different economic levels.

Regulatory harmonization efforts across regional trade blocs are gradually simplifying market access and reducing compliance complexity. These developments enable more efficient distribution strategies and reduce operational costs, ultimately benefiting both manufacturers and consumers through improved product availability and competitive pricing structures.

Primary research for the Middle East & Africa sugar substitutes market analysis involved comprehensive data collection through structured interviews with industry stakeholders, including manufacturers, distributors, retailers, and end consumers across key markets. The research methodology employed both quantitative surveys and qualitative focus groups to gather insights into consumer preferences, purchasing behaviors, and market trends affecting sugar substitute adoption throughout the region.

Secondary research encompassed extensive analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. MarkWide Research analysts conducted thorough examination of regulatory frameworks, import/export statistics, and demographic data to understand market dynamics and growth potential across different countries and consumer segments.

Data validation processes included cross-referencing multiple sources, conducting expert interviews with industry professionals, and employing statistical analysis techniques to ensure accuracy and reliability of market insights. The research team utilized both bottom-up and top-down approaches to estimate market parameters and validate growth projections for sugar alternatives across various product categories and applications.

Market segmentation analysis involved detailed examination of product types, distribution channels, end-user applications, and geographic regions to provide comprehensive understanding of market structure and competitive dynamics. This multi-dimensional approach enables stakeholders to identify specific opportunities and develop targeted strategies for sugar substitute market participation and growth.

Gulf Cooperation Council (GCC) countries lead the Middle East & Africa sugar substitutes market, accounting for approximately 48% of regional consumption. Saudi Arabia and UAE demonstrate the highest adoption rates, driven by government health initiatives, high disposable income, and strong awareness of diabetes-related health risks. The GCC market shows preference for premium natural sweeteners and imported brands, with consumers willing to pay higher prices for perceived quality and health benefits.

North African markets, including Egypt, Morocco, and Tunisia, represent significant growth opportunities with expanding middle-class populations and increasing health consciousness. These markets show 22% of regional market share, with local manufacturing capabilities developing to serve growing demand for affordable sugar alternatives. Cultural preferences for traditional beverages create specific product development opportunities for companies willing to adapt formulations to local tastes.

Sub-Saharan Africa presents emerging opportunities, particularly in South Africa, Nigeria, and Kenya, where urbanization and rising income levels support market development. This region currently represents 18% of market share but shows the highest growth potential due to large population bases and increasing health awareness. Price sensitivity remains a key consideration, with consumers favoring cost-effective sugar substitute options that provide clear value propositions.

Levant region countries, including Jordan, Lebanon, and Iraq, demonstrate steady market growth despite economic challenges. These markets account for 12% of regional consumption, with consumers showing increasing interest in health-focused products and natural alternatives. Political stability and economic recovery in certain areas are expected to accelerate market development and improve distribution infrastructure.

Market leadership in the Middle East & Africa sugar substitutes sector is characterized by a mix of international corporations and emerging regional players, each employing distinct strategies to capture market share and build consumer loyalty. The competitive environment continues evolving as new entrants recognize growth opportunities and established companies expand their regional presence through strategic partnerships and localized product development.

Key market participants include:

Strategic initiatives among competitors include product innovation, local manufacturing investments, distribution partnership development, and consumer education programs designed to build market awareness and drive adoption of sugar alternative products across diverse consumer segments and applications.

Product type segmentation reveals distinct market dynamics across different categories of sugar substitutes, with each segment serving specific consumer needs and application requirements. The market demonstrates clear preferences for certain product types based on factors including taste profile, health benefits, cost considerations, and cultural acceptance levels throughout the Middle East & Africa region.

By Product Type:

By Application:

By Distribution Channel:

Natural sweeteners category demonstrates the strongest growth trajectory, driven by consumer preference for clean label products and perceived health benefits associated with plant-based alternatives. Stevia leads this segment with widespread acceptance and improving taste profiles through advanced processing techniques. Regional preferences show particular interest in date-based sweeteners that align with cultural dietary traditions and provide familiar flavor profiles.

Artificial sweeteners maintain significant market presence, particularly in price-sensitive applications and industrial food manufacturing. Despite concerns about synthetic ingredients, these products offer cost-effectiveness and proven functionality that appeals to budget-conscious consumers and manufacturers seeking economical reformulation solutions. Product innovation focuses on improving taste profiles and addressing consumer concerns through enhanced formulations.

Sugar alcohols represent a growing niche, particularly popular among health-conscious consumers seeking products with additional functional benefits such as dental health protection and digestive wellness. These products command premium pricing but offer unique value propositions that justify higher costs for specific consumer segments interested in specialized health benefits.

Beverage applications drive the largest portion of market demand, with soft drink manufacturers leading adoption of sugar substitute technologies. The category shows continuous innovation in taste optimization and functional enhancement, with companies investing heavily in research and development to create products that match or exceed traditional sugar-sweetened alternatives in consumer acceptance and satisfaction.

Manufacturers benefit from expanding market opportunities that enable product line diversification and premium pricing strategies. The growing demand for sugar alternatives allows companies to develop innovative products that command higher margins while addressing important consumer health concerns. Additionally, partnerships with food and beverage companies create stable revenue streams through long-term supply agreements and co-development projects.

Retailers gain advantages through category expansion and improved customer loyalty by offering comprehensive selections of health-focused products. The sugar substitutes category typically generates higher margins than traditional sweeteners while attracting health-conscious consumers who often purchase additional premium products. Educational marketing opportunities enable retailers to position themselves as health and wellness destinations.

Consumers benefit from increased product availability, improved taste profiles, and enhanced health outcomes through effective sugar reduction strategies. The expanding market provides greater choice in terms of product types, price points, and application methods, enabling individuals to find sugar substitute solutions that meet their specific dietary needs, taste preferences, and budget constraints.

Healthcare systems experience positive impacts through reduced diabetes-related complications and improved population health outcomes as consumers adopt sugar reduction strategies. The availability of effective sugar alternatives supports medical recommendations for dietary modification while maintaining patient compliance through acceptable taste experiences and convenient product formats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient preference represents the dominant trend shaping Middle East & Africa sugar substitutes market development, with consumers increasingly seeking plant-based alternatives that align with clean eating philosophies and cultural dietary traditions. This trend drives significant investment in stevia cultivation, monk fruit processing, and date-based sweetener development, creating opportunities for companies that can deliver natural products with acceptable taste profiles and competitive pricing.

Functional enhancement emerges as a key trend, with manufacturers developing sugar substitutes that provide additional health benefits beyond simple sugar replacement. Products incorporating probiotics, vitamins, minerals, and antioxidants appeal to consumers seeking comprehensive wellness solutions. This trend enables premium positioning and justifies higher price points while addressing multiple consumer health concerns simultaneously.

Customization and personalization trends reflect growing consumer desire for products tailored to specific dietary requirements, taste preferences, and health conditions. Companies are developing specialized formulations for diabetic consumers, weight management programs, and cultural taste preferences. This trend supports market segmentation strategies and enables targeted marketing approaches that resonate with specific consumer groups.

Sustainability focus increasingly influences consumer purchasing decisions, with environmentally conscious consumers preferring sugar alternatives produced through sustainable farming practices and eco-friendly manufacturing processes. This trend creates competitive advantages for companies that can demonstrate environmental responsibility while maintaining product quality and affordability standards that meet market expectations.

Manufacturing expansion initiatives across the region reflect growing confidence in market potential and commitment to serving local demand through regional production capabilities. Several international companies have announced significant investments in Middle Eastern and African manufacturing facilities, reducing import dependence and improving product availability while creating local employment opportunities and economic development benefits.

Product launches continue accelerating as companies introduce innovative sugar substitute formulations designed specifically for regional taste preferences and cultural dietary requirements. Recent developments include date-based sweetener blends, culturally adapted stevia products, and specialized formulations for traditional Middle Eastern and African beverages and desserts that maintain authentic taste experiences.

Strategic partnerships between international manufacturers and local distributors are expanding market reach and improving consumer access to sugar alternative products. These collaborations combine global expertise in product development and manufacturing with local market knowledge and distribution capabilities, creating more effective market penetration strategies and consumer education programs.

Regulatory approvals for new sweetener types and expanded applications are opening additional market opportunities and enabling product innovation. Recent approvals for monk fruit extracts and novel stevia formulations in several countries provide manufacturers with expanded ingredient options and enable development of improved products that better meet consumer expectations for taste and functionality.

Market entry strategies should prioritize understanding local taste preferences and cultural dietary traditions before launching sugar substitute products in new markets. MWR analysis indicates that companies achieving the highest success rates invest significantly in local market research and product adaptation rather than simply introducing global formulations without modification. This approach requires patience and investment but delivers superior long-term market penetration and consumer acceptance.

Pricing strategies must balance premium positioning with accessibility concerns, particularly in price-sensitive African markets where economic constraints significantly influence purchasing decisions. Successful companies develop tiered product portfolios that include both premium natural sweeteners for affluent consumers and cost-effective alternatives for mass market segments, enabling broad market coverage and sustainable growth across diverse economic conditions.

Distribution channel development should emphasize multi-channel approaches that combine traditional retail with emerging e-commerce opportunities. Digital platforms offer particular advantages for consumer education and targeted marketing, while traditional channels provide essential market coverage and consumer trust. Companies should invest in omnichannel strategies that leverage the strengths of each distribution method while maintaining consistent brand messaging and product availability.

Consumer education initiatives represent critical investments for long-term market success, as awareness and understanding of sugar substitute benefits directly correlate with adoption rates and brand loyalty. Educational programs should address proper usage techniques, health benefits, and taste optimization methods while building trust through transparent communication about product ingredients and manufacturing processes.

Growth trajectory for the Middle East & Africa sugar substitutes market appears highly promising, with sustained expansion expected across all major product categories and geographic regions. MarkWide Research projections indicate continued acceleration in adoption rates, driven by persistent health concerns, government policy support, and ongoing product innovation that addresses current market limitations and consumer preferences.

Technology advancement will play a crucial role in market evolution, with improvements in taste profile optimization, cost reduction, and functional enhancement expected to drive broader consumer acceptance. Emerging technologies in natural sweetener processing and hybrid product development promise to address current taste and pricing challenges while expanding application possibilities across food and beverage categories.

Market consolidation trends suggest increasing merger and acquisition activity as companies seek to expand geographic coverage, enhance product portfolios, and achieve economies of scale. This consolidation will likely result in stronger market leaders with comprehensive product offerings and improved distribution capabilities, while creating opportunities for specialized niche players focusing on specific consumer segments or product categories.

Regulatory harmonization efforts across regional trade blocs are expected to simplify market access and reduce compliance complexity, enabling more efficient distribution strategies and accelerated market development. These regulatory improvements will particularly benefit smaller manufacturers and new market entrants by reducing barriers to entry and operational costs associated with multi-country market participation.

The Middle East & Africa sugar substitutes market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing health consciousness, rising diabetes prevalence, and supportive government initiatives across the region. Market expansion continues accelerating, with natural sweeteners leading growth trends while artificial alternatives maintain significant presence in cost-sensitive applications and industrial food manufacturing.

Regional diversity creates both opportunities and challenges, with Gulf countries leading adoption rates while African markets present emerging opportunities characterized by large population bases and increasing health awareness. Successful market participants must navigate cultural preferences, economic constraints, and regulatory complexity while delivering products that meet local taste expectations and provide clear value propositions for diverse consumer segments.

Innovation and adaptation remain critical success factors, with companies investing heavily in product development, consumer education, and distribution channel expansion to capture market share and build sustainable competitive advantages. The future outlook appears highly favorable, supported by demographic trends, technological advancement, and continued policy support for healthier dietary choices throughout the Middle East & Africa region.

What is Sugar Substitutes?

Sugar substitutes are substances used to provide a sweet taste in food and beverages without the calories associated with sugar. They are often derived from natural sources or synthesized to mimic the sweetness of sugar, making them popular in various dietary applications.

What are the key players in the Middle East & Africa Sugar Substitutes Market?

Key players in the Middle East & Africa Sugar Substitutes Market include companies like Cargill, Tate & Lyle, and DuPont, which are known for their innovative sweetening solutions and extensive product portfolios, among others.

What are the growth factors driving the Middle East & Africa Sugar Substitutes Market?

The growth of the Middle East & Africa Sugar Substitutes Market is driven by increasing health consciousness among consumers, rising demand for low-calorie food products, and the growing prevalence of diabetes and obesity in the region.

What challenges does the Middle East & Africa Sugar Substitutes Market face?

Challenges in the Middle East & Africa Sugar Substitutes Market include regulatory hurdles regarding the safety of artificial sweeteners, consumer skepticism about the health effects of sugar substitutes, and competition from natural sweeteners.

What opportunities exist in the Middle East & Africa Sugar Substitutes Market?

Opportunities in the Middle East & Africa Sugar Substitutes Market include the rising trend of clean label products, increasing demand for plant-based sweeteners, and the potential for product innovation in the food and beverage sector.

What trends are shaping the Middle East & Africa Sugar Substitutes Market?

Trends shaping the Middle East & Africa Sugar Substitutes Market include the growing popularity of natural sweeteners like stevia and monk fruit, advancements in food technology, and a shift towards healthier eating habits among consumers.

Middle East & Africa Sugar Substitutes Market

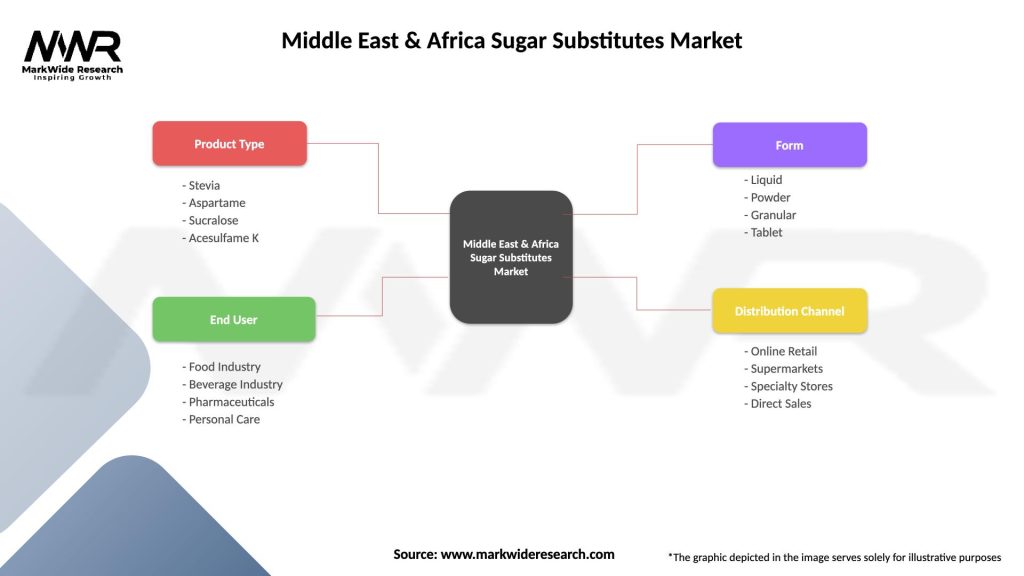

| Segmentation Details | Description |

|---|---|

| Product Type | Stevia, Aspartame, Sucralose, Acesulfame K |

| End User | Food Industry, Beverage Industry, Pharmaceuticals, Personal Care |

| Form | Liquid, Powder, Granular, Tablet |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Sugar Substitutes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at