444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa specialty fertilizer market represents a dynamic and rapidly evolving sector within the global agricultural industry. This market encompasses advanced fertilizer formulations designed to address specific crop nutritional needs, soil conditions, and environmental challenges unique to the region. Specialty fertilizers differ from conventional fertilizers by offering enhanced nutrient delivery, improved efficiency, and targeted application methods that optimize crop yields while minimizing environmental impact.

Regional characteristics significantly influence market dynamics, with the Middle East’s arid climate and Africa’s diverse agricultural landscapes creating distinct demand patterns. The market is experiencing robust growth, driven by increasing agricultural productivity demands, water scarcity concerns, and the need for sustainable farming practices. Growth rates in the region are projected at approximately 6.2% CAGR over the forecast period, reflecting strong adoption of precision agriculture technologies.

Key market segments include controlled-release fertilizers, water-soluble fertilizers, liquid fertilizers, and micronutrient fertilizers. Each segment addresses specific agricultural challenges prevalent in the region, from desert farming initiatives in the Gulf states to smallholder agriculture across sub-Saharan Africa. The market’s expansion is further supported by government initiatives promoting food security and agricultural modernization across both regions.

The Middle East & Africa specialty fertilizer market refers to the regional trade and consumption of advanced fertilizer products specifically formulated to deliver enhanced nutritional value, improved efficiency, and targeted crop support compared to conventional fertilizer options. These specialized formulations incorporate advanced technologies such as controlled-release mechanisms, chelated micronutrients, and precision application systems designed to optimize agricultural productivity in challenging environmental conditions.

Specialty fertilizers encompass various product categories including slow-release fertilizers, foliar fertilizers, fertigation products, and bio-enhanced formulations. Unlike traditional NPK fertilizers, these products are engineered to address specific soil deficiencies, crop growth stages, and environmental stressors common in Middle Eastern and African agricultural systems. The market includes both imported products from global manufacturers and locally produced formulations tailored to regional crop requirements.

Market participants range from multinational fertilizer corporations to regional distributors and local agricultural input suppliers. The sector serves diverse agricultural segments including commercial farming operations, greenhouse cultivation, precision agriculture systems, and smallholder farming communities across both regions.

Market dynamics in the Middle East & Africa specialty fertilizer sector reflect a complex interplay of agricultural modernization, environmental challenges, and economic development priorities. The region’s unique combination of water scarcity, soil salinity issues, and diverse cropping systems creates substantial demand for specialized fertilizer solutions that can deliver superior performance under challenging conditions.

Growth drivers include increasing adoption of precision agriculture technologies, government support for agricultural productivity enhancement, and rising awareness of sustainable farming practices. The market benefits from approximately 78% adoption rate of specialty fertilizers among commercial farming operations in the Gulf states, while African markets show growing penetration rates averaging 34% annually.

Regional variations significantly impact market development, with Middle Eastern countries focusing on high-tech agricultural solutions for desert farming and greenhouse cultivation, while African markets emphasize affordable specialty products for smallholder farmers and cash crop production. The sector’s evolution is supported by increasing foreign investment in agricultural infrastructure and technology transfer initiatives.

Competitive landscape features both global fertilizer manufacturers and emerging regional players developing products specifically for local market conditions. Innovation focuses on water-efficient formulations, heat-resistant products, and cost-effective solutions that can deliver measurable yield improvements across diverse agricultural systems.

Strategic insights reveal several critical factors shaping the Middle East & Africa specialty fertilizer market landscape:

Primary growth drivers propelling the Middle East & Africa specialty fertilizer market include multiple interconnected factors that address regional agricultural challenges and opportunities. Water scarcity concerns across both regions create substantial demand for fertilizer products that can deliver optimal nutrition with minimal water requirements, driving innovation in water-soluble and fertigation-compatible formulations.

Agricultural productivity demands represent another crucial driver, as governments and farming communities seek to maximize crop yields from limited arable land. The need to feed growing populations while managing resource constraints has led to increased adoption of precision fertilizer applications that can deliver measurable yield improvements. Commercial farming operations report yield increases of 25-40% when transitioning from conventional to specialty fertilizer programs.

Government initiatives supporting agricultural modernization provide significant market momentum through subsidies, technology transfer programs, and infrastructure development projects. Many countries in the region have established agricultural development funds that specifically support adoption of advanced farming technologies, including specialty fertilizer systems.

Climate adaptation requirements drive demand for fertilizer products that can perform effectively under extreme temperature conditions, high salinity environments, and irregular rainfall patterns. The development of heat-resistant and salt-tolerant formulations addresses specific environmental challenges prevalent across the region.

Significant challenges constrain market growth and adoption rates across the Middle East & Africa specialty fertilizer sector. High product costs compared to conventional fertilizers create barriers for price-sensitive agricultural segments, particularly smallholder farmers who represent a substantial portion of the regional agricultural community. The premium pricing of specialty products can limit adoption despite their superior performance characteristics.

Limited technical knowledge among farming communities poses another substantial restraint, as effective utilization of specialty fertilizers often requires understanding of application timing, dosage rates, and compatibility with other agricultural inputs. The lack of comprehensive extension services in many areas restricts farmers’ ability to maximize benefits from advanced fertilizer technologies.

Infrastructure limitations in rural areas affect product distribution and storage capabilities, particularly for liquid fertilizers and temperature-sensitive formulations. Poor transportation networks and inadequate storage facilities can compromise product quality and increase distribution costs, limiting market penetration in remote agricultural regions.

Regulatory complexities across different countries create challenges for market participants seeking to operate across multiple jurisdictions. Varying registration requirements, import procedures, and quality standards can increase compliance costs and delay product introductions, particularly for innovative formulations requiring extensive testing and approval processes.

Emerging opportunities in the Middle East & Africa specialty fertilizer market present substantial potential for growth and innovation. Precision agriculture adoption creates demand for sophisticated fertilizer products that can integrate with GPS-guided application systems, soil sensors, and variable-rate technology platforms. This technological convergence offers opportunities for developing smart fertilizer solutions that optimize nutrient delivery based on real-time field conditions.

Organic agriculture expansion represents a growing market segment, with organic farming areas increasing at approximately 18% annually across the region. This trend creates opportunities for bio-based specialty fertilizers, organic-certified products, and natural nutrient enhancement solutions that meet organic certification requirements while delivering competitive performance.

Greenhouse cultivation growth in Middle Eastern countries offers opportunities for specialized fertigation products, hydroponic nutrients, and controlled-environment fertilizer systems. The expansion of protected agriculture creates demand for precise nutrient management solutions that can optimize plant growth in controlled conditions.

Smallholder market development presents opportunities for affordable specialty fertilizer products designed specifically for small-scale farming operations. Developing cost-effective formulations and packaging sizes appropriate for smallholder farmers could unlock significant market potential across sub-Saharan Africa.

Complex market dynamics shape the Middle East & Africa specialty fertilizer sector through interactions between supply-side factors, demand patterns, and external influences. Supply chain evolution reflects ongoing improvements in distribution networks, with regional distributors expanding their reach to previously underserved agricultural areas and developing specialized storage and handling capabilities for advanced fertilizer products.

Demand patterns vary significantly between countries and agricultural systems, with commercial farming operations driving demand for high-performance products while smallholder farmers seek affordable solutions that can deliver measurable benefits. Seasonal variations in demand correspond to regional planting and growing seasons, creating opportunities for supply chain optimization and inventory management strategies.

Technology transfer initiatives between international fertilizer manufacturers and regional partners facilitate knowledge sharing and local capacity building. These partnerships often result in adapted product formulations that address specific regional challenges while leveraging global research and development capabilities.

Market consolidation trends reflect increasing cooperation between global manufacturers and regional distributors, creating integrated value chains that can deliver comprehensive agricultural solutions. According to MarkWide Research analysis, strategic partnerships in the region have increased by 42% over the past three years, indicating growing collaboration between market participants.

Comprehensive research methodology employed for analyzing the Middle East & Africa specialty fertilizer market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of findings. Primary research involves direct engagement with market participants including fertilizer manufacturers, distributors, agricultural retailers, and end-users across both regions to gather firsthand insights into market conditions, trends, and challenges.

Secondary research encompasses analysis of industry reports, government publications, trade statistics, and academic studies related to agricultural development and fertilizer markets in the Middle East and Africa. This approach provides historical context and validates primary research findings through triangulation of multiple data sources.

Market segmentation analysis utilizes both quantitative and qualitative research methods to identify distinct market segments, assess their relative importance, and understand specific requirements and growth patterns within each segment. Regional analysis incorporates country-level data collection to capture variations in market conditions across different geographical areas.

Expert interviews with industry professionals, agricultural extension specialists, and policy makers provide insights into market dynamics, regulatory environments, and future development prospects. These discussions help identify emerging trends and potential market disruptions that may not be apparent through quantitative analysis alone.

Regional market characteristics reveal distinct patterns and opportunities across the Middle East & Africa specialty fertilizer landscape. Middle Eastern markets demonstrate strong demand for high-tech fertilizer solutions, with countries like UAE, Saudi Arabia, and Israel leading adoption of precision agriculture technologies and advanced fertigation systems. These markets account for approximately 68% of regional specialty fertilizer consumption by value, reflecting their focus on high-value agricultural production.

Gulf Cooperation Council countries show particular strength in greenhouse and controlled-environment agriculture, driving demand for specialized hydroponic nutrients and precision fertilizer delivery systems. Government investments in food security initiatives and agricultural diversification programs support continued market expansion in these countries.

North African markets including Egypt, Morocco, and Tunisia demonstrate growing adoption of specialty fertilizers for cash crop production, particularly in citrus, vegetables, and export-oriented agricultural sectors. These countries benefit from established agricultural infrastructure and proximity to European markets, creating incentives for quality enhancement through advanced fertilizer programs.

Sub-Saharan African markets present significant growth potential, with countries like South Africa, Kenya, and Nigeria leading regional adoption trends. Market development in these areas focuses on affordable specialty products that can deliver measurable benefits for smallholder farmers while supporting commercial agricultural expansion. Regional market share distribution shows 45% concentration in commercial farming segments and 35% penetration among progressive smallholder operations.

Competitive dynamics in the Middle East & Africa specialty fertilizer market feature a diverse mix of global manufacturers, regional producers, and local distributors competing across different market segments and geographical areas. Market leadership varies by product category and region, with different companies holding strong positions in specific niches or countries.

Key market participants include:

Competitive strategies focus on product innovation, regional partnerships, and development of solutions tailored to local agricultural conditions and requirements.

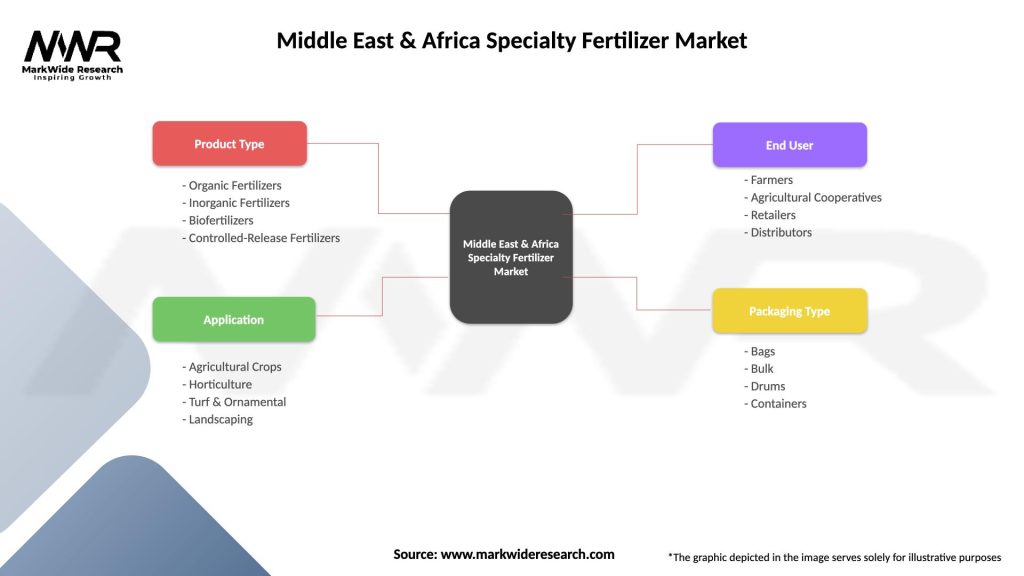

Market segmentation reveals distinct categories within the Middle East & Africa specialty fertilizer market, each addressing specific agricultural needs and applications. By Product Type: The market divides into controlled-release fertilizers, water-soluble fertilizers, liquid fertilizers, and micronutrient fertilizers, with each category serving different application methods and crop requirements.

By Application Method: Segmentation includes soil application, foliar application, fertigation, and seed treatment, reflecting diverse delivery mechanisms used across regional agricultural systems. Fertigation applications show particularly strong growth, representing approximately 38% of specialty fertilizer usage in commercial operations.

By Crop Type: Market segments encompass cereals and grains, fruits and vegetables, cash crops, and ornamental plants. Each crop category requires specific nutritional programs and application timing, creating distinct market opportunities for specialized products.

By End User: Segmentation includes commercial farms, greenhouse operations, smallholder farmers, and landscaping applications. Commercial farming operations represent the largest market segment by volume, while greenhouse applications show the highest growth rates.

By Geography: Regional segmentation covers Middle Eastern countries (GCC states, Levant region) and African countries (North Africa, East Africa, West Africa, Southern Africa), each with distinct market characteristics and growth patterns.

Controlled-release fertilizers represent the fastest-growing category within the regional market, driven by water conservation requirements and precision agriculture adoption. These products offer extended nutrient availability and reduced application frequency, making them particularly suitable for arid climate conditions prevalent across the Middle East. Adoption rates for controlled-release products have increased by 52% over the past five years among commercial farming operations.

Water-soluble fertilizers maintain strong market position due to their compatibility with irrigation systems and fertigation applications. This category particularly benefits from greenhouse agriculture expansion and precision irrigation system adoption across both regions. Products in this category offer rapid nutrient uptake and precise application control.

Liquid fertilizers show growing popularity for their ease of application and uniform nutrient distribution capabilities. This category benefits from increasing adoption of liquid application equipment and custom blending services that allow farmers to tailor nutrient programs to specific field conditions.

Micronutrient fertilizers address widespread soil deficiencies across the region, particularly zinc, iron, and boron deficiencies that limit crop productivity. Growing awareness of micronutrient importance drives demand for chelated products and specialized formulations designed for alkaline soil conditions common in the region.

Industry participants in the Middle East & Africa specialty fertilizer market realize multiple strategic advantages through engagement in this dynamic sector. Manufacturers benefit from growing demand for innovative products that command premium pricing compared to conventional fertilizers, enabling improved profit margins and return on research and development investments.

Distributors and retailers gain access to high-value product categories that offer better margins and opportunities for value-added services such as technical support, application guidance, and custom blending. The specialty fertilizer segment enables agricultural input suppliers to differentiate their offerings and build stronger customer relationships.

Farmers and agricultural producers realize significant benefits including improved crop yields, enhanced product quality, reduced input costs per unit of production, and better environmental stewardship. Yield improvements typically range from 15-35% when transitioning from conventional to specialty fertilizer programs, depending on crop type and growing conditions.

Government stakeholders benefit from increased agricultural productivity, improved food security, reduced environmental impact from agricultural activities, and enhanced competitiveness of domestic agricultural sectors. Specialty fertilizer adoption supports policy objectives related to sustainable agriculture and rural development.

Environmental benefits include reduced nutrient runoff, improved soil health, decreased greenhouse gas emissions, and more efficient resource utilization, supporting regional sustainability goals and environmental protection initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends are reshaping the Middle East & Africa specialty fertilizer market landscape, with digitalization emerging as a primary driver of innovation and efficiency improvements. Smart fertilizer systems that integrate with precision agriculture platforms enable real-time nutrient management and application optimization based on soil conditions, weather patterns, and crop growth stages.

Sustainability focus continues to gain momentum, with increasing demand for environmentally friendly fertilizer formulations that minimize ecological impact while maintaining high performance standards. Bio-based products, organic-certified formulations, and slow-release technologies that reduce nutrient leaching are experiencing strong market acceptance.

Customization trends reflect growing demand for tailored fertilizer solutions that address specific soil conditions, crop varieties, and local growing conditions. Custom blending services and site-specific nutrient recommendations are becoming standard offerings among leading market participants.

Supply chain localization represents another significant trend, with increasing investment in regional manufacturing facilities and distribution networks. This trend aims to reduce import dependence, improve product availability, and lower costs for end users. MWR data indicates that local production capacity has expanded by 28% over the past three years across key regional markets.

Recent industry developments highlight the dynamic nature of the Middle East & Africa specialty fertilizer market, with significant investments in production capacity, technology advancement, and market expansion initiatives. Manufacturing investments include establishment of new production facilities in strategic locations across both regions, enabling local production of previously imported specialty products.

Technology partnerships between international fertilizer manufacturers and regional agricultural technology companies are creating integrated solutions that combine advanced fertilizer products with precision application systems and digital farming platforms. These collaborations aim to deliver comprehensive agricultural solutions rather than standalone products.

Research and development initiatives focus on developing products specifically adapted to regional conditions, including heat-resistant formulations, salt-tolerant products, and water-efficient fertilizer systems. Several companies have established regional R&D centers to accelerate product development for local market conditions.

Distribution network expansion includes development of specialized storage and handling facilities for liquid fertilizers and temperature-sensitive products. Companies are investing in cold storage capabilities and specialized transportation equipment to maintain product quality throughout the supply chain.

Regulatory developments include harmonization of fertilizer standards across regional trade blocs and implementation of quality assurance programs that ensure product efficacy and safety for end users.

Strategic recommendations for market participants in the Middle East & Africa specialty fertilizer sector emphasize the importance of regional adaptation and customer-centric approaches. Product development strategies should prioritize formulations that address specific regional challenges such as water scarcity, soil salinity, and extreme temperature conditions while maintaining cost-effectiveness for target market segments.

Market entry strategies for new participants should focus on partnership approaches with established regional distributors and agricultural service providers rather than attempting to build independent distribution networks. These partnerships can provide market knowledge, customer relationships, and regulatory expertise essential for successful market penetration.

Investment priorities should emphasize local manufacturing capabilities, particularly for high-volume products where transportation costs significantly impact competitiveness. Regional production facilities can improve supply chain reliability while reducing costs for end customers.

Customer education initiatives represent critical success factors, as effective utilization of specialty fertilizers requires technical knowledge that may not be readily available in all market segments. Companies should invest in extension services, demonstration programs, and technical support capabilities to maximize customer success and product adoption.

Digital integration strategies should focus on developing smart fertilizer solutions that can integrate with emerging precision agriculture platforms, providing farmers with data-driven insights and application recommendations that optimize both productivity and resource efficiency.

Future market prospects for the Middle East & Africa specialty fertilizer sector appear highly promising, with multiple growth drivers supporting continued expansion and innovation. Market evolution is expected to accelerate as agricultural modernization initiatives gain momentum across both regions, supported by government policies promoting food security and sustainable agriculture practices.

Technology integration will likely drive the next phase of market development, with smart fertilizer systems becoming increasingly sophisticated and accessible to farmers across different scales of operation. The convergence of fertilizer technology with precision agriculture platforms is expected to create new market opportunities and value propositions.

Regional production capacity is projected to expand significantly, with several major investments in manufacturing facilities planned across key markets. This localization trend should improve product availability, reduce costs, and enable development of region-specific formulations that address local agricultural challenges.

Market penetration among smallholder farmers is expected to increase as affordable specialty products become available and extension services expand to reach previously underserved agricultural communities. According to MarkWide Research projections, smallholder adoption rates could reach 58% by the end of the forecast period.

Sustainability initiatives will continue to shape product development and market positioning, with increasing emphasis on environmentally friendly formulations and circular economy principles in fertilizer production and application.

The Middle East & Africa specialty fertilizer market represents a dynamic and rapidly evolving sector with substantial growth potential driven by agricultural modernization, environmental challenges, and technological advancement. Market fundamentals remain strong, supported by increasing demand for agricultural productivity enhancement, government initiatives promoting food security, and growing adoption of precision agriculture technologies across both regions.

Regional diversity creates multiple market opportunities, from high-tech agricultural solutions in Middle Eastern countries to affordable specialty products for expanding African agricultural sectors. The market’s evolution reflects broader trends toward sustainable agriculture, resource efficiency, and technology integration that are reshaping global agricultural systems.

Success factors for market participants include regional adaptation, customer education, strategic partnerships, and continuous innovation in product development and service delivery. Companies that can effectively address local market needs while leveraging global technology and expertise are well-positioned to capitalize on emerging opportunities.

Long-term prospects remain highly favorable, with the Middle East & Africa specialty fertilizer market expected to continue its growth trajectory as agricultural sectors across both regions modernize and adopt advanced farming technologies. The sector’s contribution to regional food security, environmental sustainability, and agricultural competitiveness positions it as a critical component of future agricultural development strategies.

What is Specialty Fertilizer?

Specialty fertilizer refers to a category of fertilizers that are designed to meet specific nutrient requirements of plants, often used in precision agriculture. These fertilizers can include controlled-release formulations, water-soluble products, and micronutrient blends tailored for various crops and soil types.

What are the key players in the Middle East & Africa Specialty Fertilizer Market?

Key players in the Middle East & Africa Specialty Fertilizer Market include Yara International, Haifa Group, and ICL Group, among others. These companies are known for their innovative products and extensive distribution networks across the region.

What are the growth factors driving the Middle East & Africa Specialty Fertilizer Market?

The growth of the Middle East & Africa Specialty Fertilizer Market is driven by increasing agricultural productivity demands, the need for sustainable farming practices, and the rising adoption of precision agriculture techniques. Additionally, government initiatives to enhance food security are also contributing to market expansion.

What challenges does the Middle East & Africa Specialty Fertilizer Market face?

The Middle East & Africa Specialty Fertilizer Market faces challenges such as fluctuating raw material prices, regulatory hurdles, and environmental concerns regarding fertilizer use. These factors can impact production costs and market accessibility for farmers.

What opportunities exist in the Middle East & Africa Specialty Fertilizer Market?

Opportunities in the Middle East & Africa Specialty Fertilizer Market include the development of eco-friendly fertilizers, advancements in fertilizer application technologies, and the growing trend of organic farming. These factors are expected to create new avenues for growth and innovation.

What trends are shaping the Middle East & Africa Specialty Fertilizer Market?

Trends shaping the Middle East & Africa Specialty Fertilizer Market include the increasing use of digital agriculture tools, the rise of customized fertilizer solutions, and a focus on sustainable practices. These trends are influencing how fertilizers are formulated and applied in various agricultural settings.

Middle East & Africa Specialty Fertilizer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Organic Fertilizers, Inorganic Fertilizers, Biofertilizers, Controlled-Release Fertilizers |

| Application | Agricultural Crops, Horticulture, Turf & Ornamental, Landscaping |

| End User | Farmers, Agricultural Cooperatives, Retailers, Distributors |

| Packaging Type | Bags, Bulk, Drums, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Specialty Fertilizer Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at