444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa small UAV market represents one of the most rapidly evolving segments in the global unmanned aerial vehicle industry. This dynamic market encompasses lightweight, compact unmanned aircraft systems designed for diverse applications ranging from military surveillance to commercial agriculture and infrastructure monitoring. The region’s unique geographical challenges, security concerns, and economic diversification initiatives have created substantial demand for small UAV solutions across multiple sectors.

Market growth in the Middle East & Africa has been particularly robust, with the sector experiencing a compound annual growth rate of 12.8% over recent years. This expansion is driven by increasing adoption of drone technology in oil and gas operations, border security applications, and emerging commercial use cases. The small UAV segment specifically benefits from lower operational costs, enhanced portability, and reduced regulatory barriers compared to larger unmanned systems.

Regional dynamics vary significantly across the Middle East & Africa, with Gulf Cooperation Council countries leading in terms of technology adoption and investment, while African nations show growing interest in agricultural and humanitarian applications. The market’s evolution reflects broader trends toward digitalization and automation across traditional industries, positioning small UAVs as critical enablers of operational efficiency and strategic capabilities.

The Middle East & Africa small UAV market refers to the regional ecosystem encompassing the development, manufacturing, distribution, and deployment of unmanned aerial vehicles with maximum takeoff weights typically under 25 kilograms. These systems integrate advanced technologies including autonomous flight capabilities, high-resolution imaging sensors, and real-time data transmission systems designed for specialized regional applications.

Small UAVs in this context include fixed-wing aircraft, multi-rotor systems, and hybrid configurations optimized for diverse operational environments ranging from desert conditions to urban landscapes. The market encompasses both military-grade systems for defense and security applications, as well as commercial platforms serving industries such as energy, agriculture, construction, and emergency services.

Market participants include international manufacturers, regional system integrators, service providers, and end-users across government and private sectors. The ecosystem also incorporates supporting infrastructure such as training facilities, maintenance services, and regulatory frameworks that enable safe and effective UAV operations throughout the region.

Strategic market positioning of small UAVs in the Middle East & Africa reflects the region’s commitment to technological advancement and operational modernization across critical sectors. The market demonstrates strong fundamentals driven by government investments in defense capabilities, private sector adoption of automation technologies, and growing recognition of UAV benefits for challenging operational environments.

Technology adoption rates show significant variation across the region, with 65% of current deployments concentrated in Gulf states, while African markets represent emerging opportunities with substantial growth potential. Key applications include pipeline monitoring, agricultural surveying, border patrol, and disaster response operations, each requiring specialized UAV configurations and operational protocols.

Market maturation is evidenced by increasing local manufacturing capabilities, expanding service provider networks, and evolving regulatory frameworks that support broader UAV integration. The sector benefits from favorable government policies promoting technological innovation and economic diversification, particularly in countries seeking to reduce dependence on traditional energy sectors.

Competitive dynamics feature a mix of established international players and emerging regional companies, with partnerships and joint ventures becoming increasingly common. Market leaders focus on developing region-specific solutions that address unique environmental challenges, regulatory requirements, and operational needs characteristic of Middle Eastern and African markets.

Primary market drivers include escalating security concerns, infrastructure development requirements, and increasing adoption of precision agriculture techniques. The region’s vast geographical areas and challenging terrain make small UAVs particularly valuable for monitoring and surveillance applications where traditional methods prove costly or impractical.

Technology trends emphasize enhanced autonomy, improved sensor capabilities, and extended operational ranges. Market participants increasingly focus on developing solutions that can operate effectively in extreme weather conditions and challenging electromagnetic environments common throughout the region.

Security imperatives represent the most significant driver for small UAV adoption across the Middle East & Africa region. Ongoing geopolitical tensions, border security challenges, and counterterrorism operations create substantial demand for advanced surveillance and reconnaissance capabilities. Small UAVs offer cost-effective solutions for persistent monitoring of large areas while minimizing risk to personnel.

Economic diversification initiatives throughout the region drive adoption of advanced technologies including UAV systems. Governments actively promote innovation and technological advancement as part of broader strategies to reduce dependence on traditional industries and develop knowledge-based economies. This policy environment creates favorable conditions for small UAV market expansion.

Infrastructure development projects across the region require efficient monitoring and management solutions that small UAVs can provide. Major construction initiatives, smart city developments, and transportation network expansions benefit from drone-based surveying, progress tracking, and quality assurance capabilities.

Agricultural modernization efforts drive increasing adoption of precision farming techniques that rely heavily on UAV technology. With agricultural efficiency improvements of up to 35% reported through drone-assisted operations, farmers and agribusiness companies recognize the value proposition of small UAV systems for crop management and resource optimization.

Technological advancement in UAV capabilities makes these systems increasingly attractive for diverse applications. Improvements in battery life, sensor quality, autonomous operation, and data processing enable small UAVs to address previously challenging operational requirements while reducing total cost of ownership.

Regulatory complexity presents significant challenges for small UAV market development across the Middle East & Africa region. Varying national regulations, airspace restrictions, and certification requirements create barriers to widespread adoption and cross-border operations. Many countries lack comprehensive UAV regulatory frameworks, leading to uncertainty and delayed implementation of drone programs.

Technical limitations of current small UAV technology constrain certain applications, particularly in extreme weather conditions common throughout the region. High temperatures, sandstorms, and electromagnetic interference can impact system performance and reliability, limiting operational effectiveness in critical scenarios.

Skills shortage in UAV operation and maintenance represents a significant constraint on market growth. The specialized knowledge required for effective drone deployment, data analysis, and system maintenance is not widely available, creating bottlenecks in market expansion and increasing operational costs.

Security concerns regarding UAV technology transfer and potential misuse create additional market constraints. Some countries impose restrictions on advanced UAV imports or require extensive security clearances that slow market development and increase compliance costs for manufacturers and operators.

Infrastructure limitations in certain regions affect UAV operations, particularly regarding communication networks, maintenance facilities, and support services. Remote areas may lack the connectivity and technical infrastructure necessary for advanced UAV operations, limiting market penetration in these regions.

Emerging applications in smart city development present substantial opportunities for small UAV market expansion. Urban planning initiatives, traffic management systems, and environmental monitoring programs increasingly incorporate drone technology as cities across the region modernize their infrastructure and services.

Regional manufacturing opportunities are emerging as governments promote local production capabilities and technology transfer agreements. Establishing small UAV manufacturing facilities within the region can reduce costs, improve supply chain reliability, and create high-value employment opportunities while serving growing local demand.

Service sector development offers significant growth potential as specialized UAV service providers emerge to serve diverse industry needs. Professional services including aerial surveying, inspection services, and data analytics create new revenue streams while making UAV technology accessible to smaller organizations without significant capital investment.

Cross-sector integration opportunities arise as different industries recognize the value of UAV technology for their specific applications. Healthcare delivery, logistics operations, and environmental conservation represent emerging sectors with substantial potential for small UAV adoption and customized solution development.

Technology partnerships between international manufacturers and regional companies create opportunities for knowledge transfer, market access, and joint product development. These collaborations can accelerate market development while ensuring solutions meet specific regional requirements and regulatory standards.

Supply chain evolution in the Middle East & Africa small UAV market reflects increasing regional capabilities and reduced dependence on international suppliers. Local assembly operations, component manufacturing, and service networks are developing to support growing market demand while improving cost competitiveness and delivery times.

Competitive intensity is increasing as more players enter the market, driving innovation and price competition. Established international manufacturers face growing competition from regional companies and new entrants offering specialized solutions or cost-effective alternatives tailored to local market needs.

Technology convergence trends see small UAVs increasingly integrated with artificial intelligence, Internet of Things systems, and advanced analytics platforms. This convergence creates new capabilities and applications while requiring market participants to develop broader technological competencies and partnership strategies.

Customer sophistication is growing as end-users develop deeper understanding of UAV capabilities and requirements. This trend drives demand for more specialized solutions, comprehensive service packages, and performance-based contracting models that align supplier incentives with customer outcomes.

Regulatory evolution continues to shape market dynamics as governments develop more comprehensive and standardized approaches to UAV regulation. Progressive regulatory frameworks enable market growth while ensuring safety and security requirements are met, creating more predictable operating environments for market participants.

Comprehensive market analysis for the Middle East & Africa small UAV market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes extensive interviews with industry executives, government officials, end-users, and technology providers across key markets within the region.

Secondary research incorporates analysis of government publications, industry reports, regulatory documents, and company financial statements to validate primary findings and identify market trends. Trade association data, patent filings, and academic research provide additional insights into technological developments and competitive dynamics.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and growth projections. Regional variations in adoption rates, regulatory environments, and economic conditions are carefully considered to ensure accurate representation of market dynamics across different countries and sub-regions.

Quantitative analysis includes statistical modeling of market drivers, correlation analysis of key variables, and scenario planning to assess potential market outcomes under different conditions. This analytical framework supports robust forecasting and strategic planning for market participants.

Expert validation processes involve review of findings by industry experts, academic researchers, and regulatory specialists to ensure accuracy and relevance of conclusions. This validation approach helps identify potential biases and ensures comprehensive coverage of market dynamics and trends.

Gulf Cooperation Council countries lead the Middle East & Africa small UAV market, accounting for approximately 58% of regional adoption. The United Arab Emirates and Saudi Arabia demonstrate particularly strong market development, driven by substantial government investments in defense capabilities and smart city initiatives. These markets benefit from favorable regulatory environments, advanced infrastructure, and strong financial resources supporting UAV technology adoption.

North African markets show growing interest in small UAV applications, particularly for agricultural and security purposes. Egypt and Morocco lead regional adoption, with agricultural applications representing 45% of deployments in these markets. Government support for agricultural modernization and food security initiatives drives increasing investment in precision farming technologies including UAV systems.

Sub-Saharan Africa represents an emerging opportunity with significant growth potential, though current adoption remains limited by infrastructure constraints and regulatory challenges. South Africa leads the region in UAV technology adoption, while countries like Kenya and Nigeria show increasing interest in drone applications for agriculture, conservation, and emergency services.

Levant region markets face unique challenges due to ongoing security concerns and regulatory restrictions, though specialized applications in border security and infrastructure monitoring drive selective adoption. Jordan and Lebanon show growing interest in UAV technology for various civilian applications as regulatory frameworks develop.

Regional cooperation initiatives are emerging to harmonize UAV regulations and promote technology sharing across borders. These efforts aim to create more integrated markets and reduce barriers to cross-border UAV operations, potentially accelerating overall market development throughout the region.

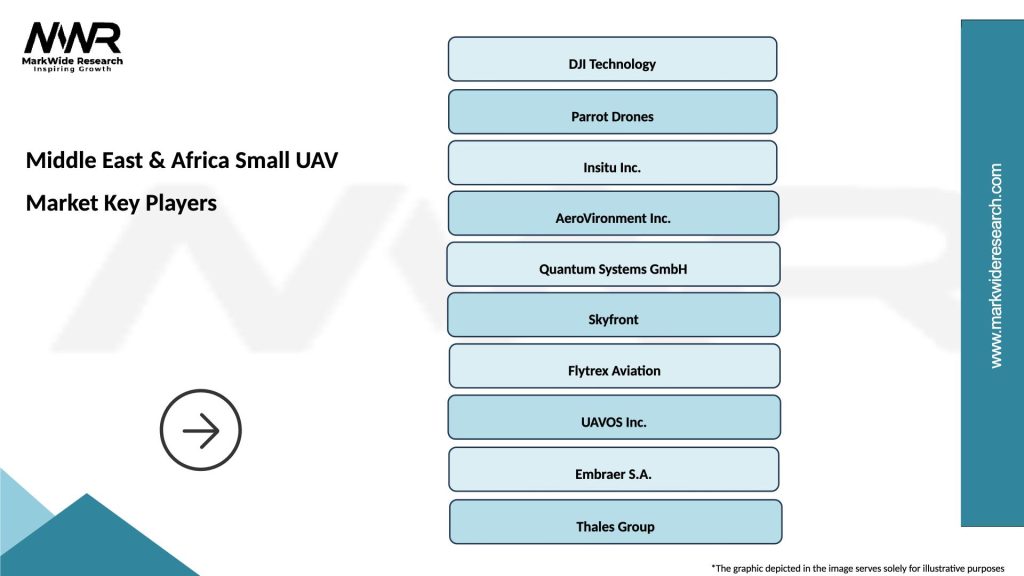

Market leadership in the Middle East & Africa small UAV sector features a diverse mix of international manufacturers, regional system integrators, and specialized service providers. Competition intensifies as market opportunities expand and barriers to entry decrease for certain application segments.

Strategic partnerships between international manufacturers and regional companies are increasingly common, enabling market access, technology transfer, and localized production capabilities. These collaborations help address regulatory requirements while building local expertise and support infrastructure.

Emerging competitors include regional startups and technology companies developing specialized solutions for local market needs. These companies often focus on specific applications or geographic markets where they can leverage local knowledge and relationships to compete effectively against larger international players.

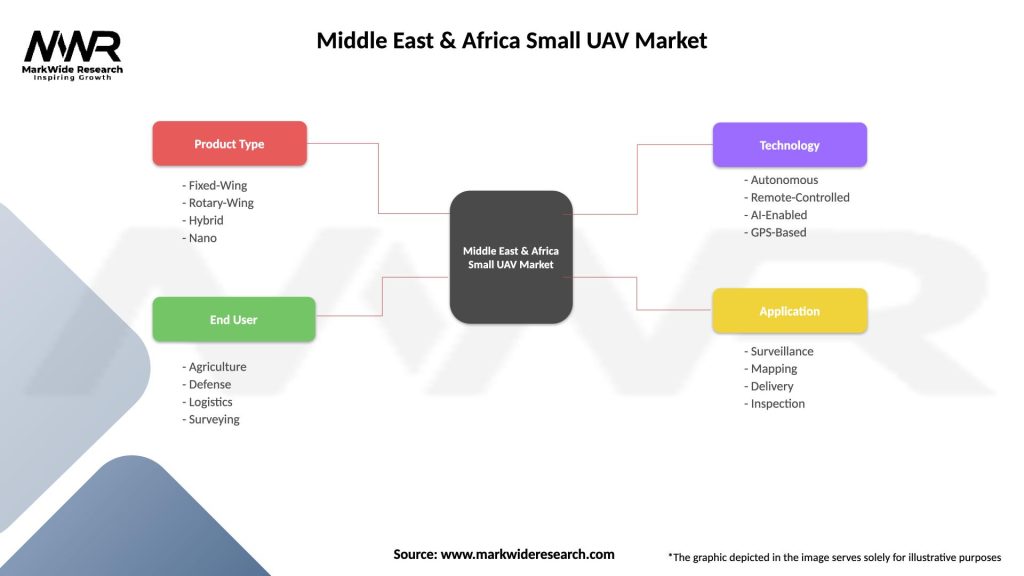

By Platform Type: The Middle East & Africa small UAV market segments into distinct platform categories, each serving specific operational requirements and applications. Fixed-wing UAVs dominate long-range surveillance and mapping applications, while multi-rotor systems excel in close-range inspection and monitoring tasks.

By Application Sector: Market segmentation by application reveals diverse use cases driving small UAV adoption across the region, with security and energy sectors leading current deployments.

By End-User Category: Market segmentation by end-user type shows strong government sector dominance, with growing commercial adoption across multiple industries.

Defense Applications represent the most mature segment of the Middle East & Africa small UAV market, with established procurement processes and operational protocols. Military forces increasingly integrate small UAV systems into standard operations, recognizing their value for force protection, intelligence gathering, and tactical support missions.

Commercial Energy Sector adoption accelerates as oil and gas companies recognize operational benefits of UAV technology for asset monitoring and maintenance. Pipeline inspection efficiency improvements of up to 60% compared to traditional methods drive continued investment in specialized UAV systems designed for energy sector applications.

Agricultural Technology Integration shows significant growth potential as farmers and agribusiness companies adopt precision farming techniques. Small UAVs enable detailed crop monitoring, targeted pesticide application, and yield prediction capabilities that improve agricultural productivity and resource efficiency.

Infrastructure Development applications benefit from UAV capabilities for surveying, monitoring, and inspection of major construction projects. The technology enables safer, faster, and more cost-effective assessment of construction progress and structural integrity across diverse project types.

Emergency Response capabilities demonstrate the humanitarian value of small UAV technology for disaster assessment, search and rescue operations, and emergency logistics support. Government agencies and international organizations increasingly incorporate UAV systems into emergency response protocols and disaster preparedness planning.

Operational Efficiency improvements represent primary benefits for organizations adopting small UAV technology. Automated data collection, reduced personnel requirements, and faster mission completion times enable significant cost savings while improving operational effectiveness across diverse applications.

Enhanced Safety outcomes result from UAV deployment in hazardous environments where human presence poses risks. Energy sector operations, emergency response scenarios, and security missions benefit from remote sensing capabilities that maintain personnel safety while ensuring mission success.

Data Quality improvements through advanced sensor technologies and automated collection processes provide stakeholders with more accurate, timely, and comprehensive information for decision-making. High-resolution imaging, multispectral analysis, and real-time data transmission capabilities enhance operational intelligence and strategic planning.

Cost Reduction benefits emerge from reduced labor requirements, lower equipment costs compared to traditional alternatives, and improved resource utilization. MarkWide Research analysis indicates that organizations typically achieve cost savings of 25-40% through strategic UAV implementation across appropriate applications.

Scalability Advantages allow organizations to expand operations efficiently as UAV fleets can be deployed flexibly across multiple locations and applications. This scalability supports business growth while maintaining operational consistency and quality standards.

Competitive Differentiation opportunities arise as early adopters of UAV technology gain advantages in service quality, operational efficiency, and customer satisfaction. Organizations leveraging advanced UAV capabilities can offer enhanced services while reducing costs compared to competitors using traditional methods.

Strengths:

Weaknesses:

Opportunities:

Threats:

Autonomous Operation capabilities are becoming increasingly sophisticated, with small UAVs incorporating advanced artificial intelligence and machine learning algorithms for independent mission execution. This trend reduces operator requirements while improving mission reliability and effectiveness across diverse applications.

Sensor Integration advances enable small UAVs to carry multiple specialized sensors simultaneously, creating comprehensive data collection platforms. Multispectral imaging, thermal sensors, and environmental monitoring equipment expand UAV capabilities while maintaining compact form factors suitable for diverse operational requirements.

Swarm Technology development allows coordinated operation of multiple small UAVs for complex missions requiring extensive area coverage or redundant capabilities. This technology trend enables new applications in surveillance, search and rescue, and agricultural monitoring while improving operational efficiency.

Edge Computing integration enables real-time data processing aboard small UAV platforms, reducing communication requirements and enabling autonomous decision-making capabilities. This trend supports operations in areas with limited connectivity while improving response times for time-critical applications.

Hybrid Power Systems combine battery and fuel cell technologies to extend operational endurance while maintaining the compact size advantages of small UAV platforms. These power system advances enable longer missions and expand the range of applications suitable for small UAV deployment.

Regulatory Harmonization efforts across the region aim to create more consistent and predictable operating environments for UAV operations. This trend supports market development by reducing compliance complexity and enabling more efficient cross-border operations and technology transfer.

Manufacturing Localization initiatives are expanding across the region as governments promote domestic UAV production capabilities. Several countries have established local assembly operations and component manufacturing facilities to reduce import dependence while building indigenous technological capabilities.

Strategic Partnerships between international manufacturers and regional companies continue to evolve, creating joint ventures and technology transfer agreements that accelerate market development. These partnerships enable access to local markets while building regional expertise and support infrastructure.

Regulatory Framework development progresses as governments establish comprehensive UAV regulations and certification processes. Recent regulatory advances in several countries create clearer operating guidelines while maintaining safety and security requirements essential for market growth.

Training Program expansion addresses the growing need for qualified UAV operators and maintenance personnel. Educational institutions, government agencies, and private companies are developing comprehensive training programs to build the skilled workforce necessary for market expansion.

Technology Innovation continues at a rapid pace, with regional research institutions and companies developing specialized solutions for local market needs. These innovations often focus on environmental adaptation, security features, and cost optimization for regional operating conditions.

Service Sector development accelerates as specialized UAV service providers emerge to serve diverse industry needs. These companies offer comprehensive solutions including equipment, training, maintenance, and data analysis services that make UAV technology accessible to smaller organizations.

Market Entry Strategy recommendations emphasize the importance of understanding local regulatory requirements and building strong regional partnerships. Companies entering the Middle East & Africa small UAV market should prioritize compliance with varying national regulations while establishing local support capabilities.

Technology Adaptation strategies should focus on developing solutions specifically designed for regional operating conditions. Environmental challenges, security requirements, and infrastructure limitations require customized approaches that may differ significantly from solutions developed for other global markets.

Partnership Development represents a critical success factor for international companies seeking to establish market presence. MWR analysis suggests that successful market participants typically establish multiple partnership types including distribution agreements, joint ventures, and technology licensing arrangements.

Investment Priorities should emphasize local capability building, regulatory compliance, and customer support infrastructure. Companies that invest in regional manufacturing, training programs, and service networks typically achieve stronger market positions and customer relationships.

Application Focus strategies should prioritize high-value applications with clear return on investment and established market demand. Defense, energy, and agricultural applications currently offer the strongest opportunities for market entry and expansion across the region.

Long-term Planning should account for evolving regulatory environments, changing security requirements, and advancing technology capabilities. Market participants need flexible strategies that can adapt to changing conditions while maintaining competitive positioning and customer relationships.

Market Evolution over the next decade will likely see continued expansion of small UAV applications across diverse sectors, with projected growth rates of 14.2% annually through 2030. This growth will be supported by improving regulatory frameworks, advancing technology capabilities, and increasing recognition of UAV value propositions across traditional industries.

Technology Advancement will continue to drive market development, with artificial intelligence, advanced sensors, and autonomous operation capabilities becoming standard features in small UAV systems. These technological improvements will enable new applications while reducing operational costs and complexity for end-users.

Regional Integration efforts are expected to accelerate, creating more harmonized regulatory environments and enabling efficient cross-border operations. This integration will support market consolidation and enable economies of scale that benefit both suppliers and customers throughout the region.

Industry Maturation will bring more standardized products, established service networks, and professional certification programs that support broader market adoption. As the industry matures, barriers to entry for new applications and users will continue to decrease while service quality and reliability improve.

Economic Impact of the small UAV market will extend beyond direct technology sales to include job creation, productivity improvements, and new business model development. MarkWide Research projects that UAV-enabled economic benefits could reach significant multiples of direct market values through productivity gains and new service capabilities.

Emerging Applications in smart cities, environmental monitoring, and logistics will create new market segments and growth opportunities. These applications will benefit from advancing technology capabilities while addressing pressing regional challenges related to urbanization, climate change, and economic development.

The Middle East & Africa small UAV market represents a dynamic and rapidly evolving sector with substantial growth potential across diverse applications and geographic regions. Strong government support, increasing commercial adoption, and advancing technology capabilities create favorable conditions for continued market expansion and development.

Strategic opportunities exist for companies that can navigate regulatory complexity, adapt to regional operating conditions, and build strong local partnerships. Success in this market requires understanding of diverse customer needs, regulatory requirements, and operational challenges that vary significantly across different countries and applications.

Market fundamentals remain strong, supported by ongoing security concerns, infrastructure development requirements, and economic diversification initiatives throughout the region. The combination of government investment, private sector adoption, and technological advancement creates a robust foundation for sustained market growth.

Future development will likely see continued technology advancement, regulatory harmonization, and market maturation that benefits all stakeholders. Organizations that invest in regional capabilities, customer relationships, and technology adaptation are well-positioned to capitalize on the substantial opportunities presented by this expanding market.

What is Small UAV?

Small UAV refers to unmanned aerial vehicles that are typically lightweight and can be used for various applications such as surveillance, agriculture, and delivery services.

What are the key players in the Middle East & Africa Small UAV Market?

Key players in the Middle East & Africa Small UAV Market include DJI, Parrot, and Elbit Systems, among others.

What are the main drivers of the Middle East & Africa Small UAV Market?

The main drivers of the Middle East & Africa Small UAV Market include the increasing demand for aerial surveillance, advancements in drone technology, and the growing adoption of UAVs in agriculture and logistics.

What challenges does the Middle East & Africa Small UAV Market face?

Challenges in the Middle East & Africa Small UAV Market include regulatory hurdles, airspace restrictions, and concerns regarding privacy and security.

What opportunities exist in the Middle East & Africa Small UAV Market?

Opportunities in the Middle East & Africa Small UAV Market include the expansion of drone applications in sectors like infrastructure inspection, environmental monitoring, and emergency response.

What trends are shaping the Middle East & Africa Small UAV Market?

Trends shaping the Middle East & Africa Small UAV Market include the integration of AI and machine learning in UAV operations, the rise of delivery drones, and increased investment in drone research and development.

Middle East & Africa Small UAV Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed-Wing, Rotary-Wing, Hybrid, Nano |

| End User | Agriculture, Defense, Logistics, Surveying |

| Technology | Autonomous, Remote-Controlled, AI-Enabled, GPS-Based |

| Application | Surveillance, Mapping, Delivery, Inspection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Small UAV Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at