444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa organic baby food market represents a rapidly expanding segment within the broader infant nutrition industry, driven by increasing parental awareness about health and nutrition. This dynamic market encompasses a comprehensive range of organic baby food products, including cereals, purees, snacks, and formula alternatives that meet stringent organic certification standards. Regional growth patterns indicate significant momentum across key markets including the United Arab Emirates, Saudi Arabia, South Africa, and Nigeria, with urban centers leading adoption rates.

Market dynamics reveal that health-conscious parents are increasingly prioritizing organic options for their infants, driving demand for products free from synthetic pesticides, artificial additives, and genetically modified ingredients. The market demonstrates robust growth potential with expanding retail infrastructure and growing disposable income among middle-class families. Distribution channels have evolved significantly, with modern trade formats, specialty stores, and e-commerce platforms gaining prominence alongside traditional retail outlets.

Consumer preferences in the region show strong alignment with global trends toward natural and organic products, while also reflecting local cultural considerations and dietary requirements. The market benefits from increasing urbanization rates across major cities, growing working mother populations, and enhanced awareness about early childhood nutrition’s long-term health implications.

The Middle East & Africa organic baby food market refers to the commercial ecosystem encompassing the production, distribution, and sale of certified organic food products specifically formulated for infants and toddlers aged 0-36 months across the Middle East and Africa regions. These products must comply with international organic certification standards, ensuring they are produced without synthetic chemicals, pesticides, or artificial additives while maintaining nutritional adequacy for infant development.

Organic baby food products in this market include various categories such as infant cereals, fruit and vegetable purees, meat-based products, snacks, and organic formula alternatives. The market encompasses both locally manufactured products and imported brands that meet regional regulatory requirements and cultural preferences. Certification bodies play a crucial role in validating organic claims, ensuring products meet established standards for organic production, processing, and labeling.

Market participants include international brands, regional manufacturers, distributors, retailers, and e-commerce platforms that collectively serve the growing demand for organic infant nutrition products across diverse demographic segments and geographic markets within the Middle East and Africa regions.

Strategic market analysis reveals that the Middle East & Africa organic baby food market is experiencing unprecedented growth momentum, driven by fundamental shifts in consumer behavior and increasing health consciousness among parents. The market demonstrates strong growth trajectory supported by rising disposable incomes, urbanization trends, and growing awareness about the benefits of organic nutrition for infant development.

Key market drivers include increasing working mother populations, expanding retail infrastructure, and growing penetration of international organic baby food brands. The market shows significant regional variations with Gulf Cooperation Council countries leading in terms of premium product adoption, while African markets demonstrate strong potential for affordable organic options. E-commerce penetration has accelerated market accessibility, particularly in urban areas where convenience and product variety are highly valued.

Competitive landscape analysis indicates a mix of established international brands and emerging regional players competing across different price segments. The market benefits from favorable regulatory environment in key countries, supporting organic product imports and local manufacturing initiatives. Future growth prospects remain robust, with expanding middle-class populations and increasing health awareness creating sustained demand for organic baby food products across the region.

Market intelligence reveals several critical insights shaping the Middle East & Africa organic baby food landscape. Consumer behavior patterns indicate strong preference for products with clear organic certification, transparent ingredient lists, and culturally appropriate flavors and formulations.

Primary growth drivers propelling the Middle East & Africa organic baby food market stem from fundamental demographic, economic, and social transformations occurring across the region. Rising disposable incomes among middle-class families create increased purchasing power for premium organic products, while urbanization trends concentrate target consumers in accessible retail markets.

Health consciousness represents a dominant market driver, with parents increasingly aware of the potential long-term health implications of early nutrition choices. Growing concerns about conventional food production methods, including pesticide use and artificial additives, motivate parents to seek organic alternatives for their infants. Educational initiatives by healthcare professionals and nutrition experts further reinforce the importance of organic nutrition during critical developmental stages.

Lifestyle changes significantly impact market dynamics, particularly the increasing number of working mothers who value convenient, high-quality baby food options. Urbanization patterns create concentrated markets with improved retail infrastructure and better access to premium products. Digital connectivity enables parents to research products, compare options, and access information about organic baby food benefits, driving informed purchasing decisions.

Regulatory support in key markets facilitates organic product imports and encourages local manufacturing initiatives. Government initiatives promoting healthy eating habits and child nutrition awareness campaigns contribute to market expansion by educating consumers about organic food benefits.

Significant challenges constrain the Middle East & Africa organic baby food market growth, primarily centered around economic accessibility and infrastructure limitations. Premium pricing of organic products creates barriers for price-sensitive consumer segments, limiting market penetration in lower-income demographics despite growing awareness of organic benefits.

Supply chain complexities present ongoing challenges, particularly in African markets where logistics infrastructure may be underdeveloped. Import dependencies for many organic ingredients and finished products create vulnerability to currency fluctuations and trade disruptions. Cold chain requirements for certain organic baby food products demand sophisticated storage and transportation capabilities that may be limited in some regional markets.

Regulatory variations across different countries create compliance complexities for manufacturers and distributors operating in multiple markets. Consumer education gaps persist in some market segments where awareness about organic food benefits remains limited, requiring sustained marketing investments to build understanding and demand.

Cultural preferences may sometimes conflict with available organic product formulations, requiring costly product adaptation or limiting market acceptance. Shelf life concerns associated with organic products without synthetic preservatives can create inventory management challenges for retailers and increase product waste.

Substantial growth opportunities characterize the Middle East & Africa organic baby food market, driven by untapped consumer segments and evolving market dynamics. Local manufacturing initiatives present significant opportunities for reducing costs, improving supply chain efficiency, and creating products tailored to regional preferences and requirements.

E-commerce expansion offers tremendous potential for reaching consumers in underserved geographic areas and providing convenient access to organic baby food products. Subscription-based models can create recurring revenue streams while offering convenience to busy parents. Mobile commerce platforms specifically designed for the region’s mobile-first consumer behavior can capture significant market share.

Product innovation opportunities include developing organic baby food products that incorporate traditional regional ingredients and flavors, creating unique value propositions for local markets. Packaging innovations that address climate considerations and storage challenges in the region can provide competitive advantages.

Partnership opportunities with healthcare providers, pediatricians, and maternal health organizations can build credibility and drive product recommendations. Educational initiatives targeting new parents can expand market awareness and create long-term customer relationships. Private label opportunities with major retailers can provide cost-effective market entry strategies for manufacturers.

Complex market dynamics shape the Middle East & Africa organic baby food landscape, reflecting the interplay between consumer demand, supply chain capabilities, and regulatory environments. Demand patterns show strong correlation with urbanization rates, with metropolitan areas demonstrating significantly higher organic product adoption compared to rural regions.

Competitive dynamics reveal intense competition between international brands and emerging regional players, with differentiation occurring through product quality, pricing strategies, and local market adaptation. Supply chain dynamics are evolving rapidly, with improvements in logistics infrastructure and cold chain capabilities expanding market reach and product availability.

Pricing dynamics reflect the premium nature of organic products, with successful brands balancing quality perceptions against affordability considerations. Distribution dynamics show shifting preferences toward modern retail formats and online channels, requiring manufacturers to adapt their go-to-market strategies accordingly.

Innovation dynamics drive continuous product development, with manufacturers investing in research and development to create products that meet specific regional nutritional requirements and taste preferences. Regulatory dynamics continue evolving, with governments implementing stricter quality standards and organic certification requirements that impact market entry and operational strategies.

Comprehensive research methodology employed for analyzing the Middle East & Africa organic baby food market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes structured interviews with industry stakeholders, including manufacturers, distributors, retailers, and consumers across key markets in the region.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to gather quantitative and qualitative market insights. Market surveys conducted among target consumer demographics provide valuable insights into purchasing behavior, brand preferences, and product satisfaction levels.

Data validation processes include cross-referencing multiple sources and conducting expert interviews to verify findings and ensure research accuracy. Statistical analysis techniques are applied to identify trends, correlations, and market patterns that inform strategic recommendations and future projections.

Regional analysis methodology involves country-specific research to understand local market dynamics, regulatory requirements, and consumer preferences. Competitive analysis includes detailed evaluation of major market participants, their strategies, market positioning, and performance metrics to provide comprehensive market landscape understanding.

Regional market analysis reveals distinct characteristics and growth patterns across different geographic segments within the Middle East & Africa organic baby food market. Gulf Cooperation Council countries lead in terms of market maturity and premium product adoption, with the United Arab Emirates and Saudi Arabia demonstrating the highest per-capita consumption rates and strongest growth momentum.

North African markets show significant potential, with Egypt and Morocco emerging as key growth markets driven by large populations and increasing middle-class segments. South Africa represents the most developed market in sub-Saharan Africa, with established retail infrastructure and growing consumer awareness supporting steady market expansion.

West African markets including Nigeria and Ghana demonstrate strong growth potential despite infrastructure challenges, with urban centers showing increasing demand for organic baby food products. East African markets such as Kenya and Ethiopia are emerging as attractive opportunities, supported by improving economic conditions and growing health consciousness.

Market penetration rates vary significantly across regions, with Gulf countries achieving approximately 35% penetration among target demographics, while African markets typically range between 8-15% penetration rates. Growth projections indicate that African markets may experience faster expansion rates as infrastructure and consumer awareness continue developing.

Competitive landscape analysis reveals a diverse ecosystem of international brands, regional manufacturers, and emerging local players competing across different market segments and price points. Market leadership is primarily held by established international brands that leverage strong brand recognition, extensive distribution networks, and proven product quality.

Competitive strategies focus on product differentiation, local market adaptation, and building strong distribution partnerships. Regional players are emerging with cost-effective solutions and products tailored to local preferences, creating increased competition in specific market segments.

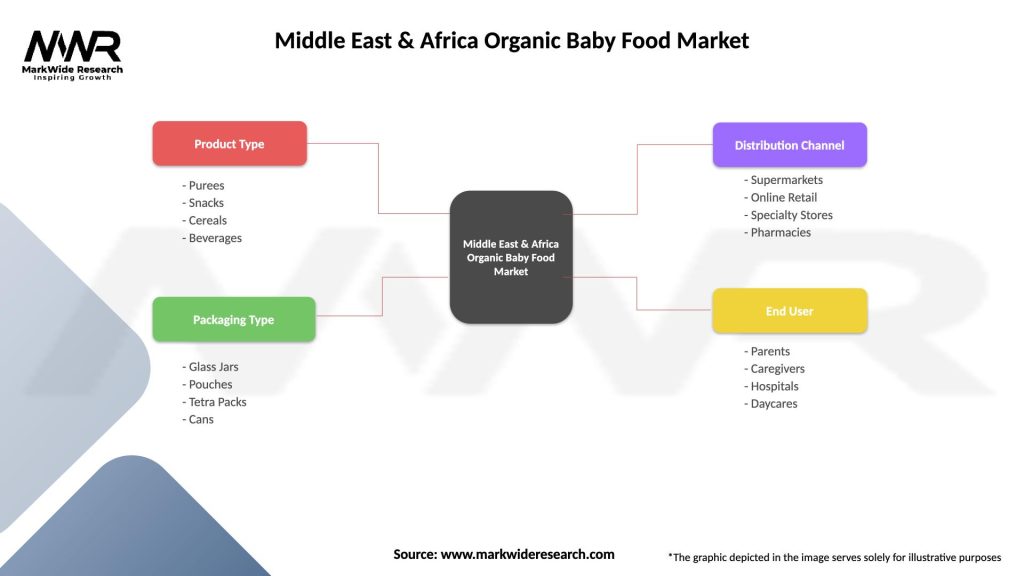

Market segmentation analysis provides comprehensive understanding of different product categories, consumer demographics, and distribution channels within the Middle East & Africa organic baby food market. Product-based segmentation reveals distinct growth patterns and consumer preferences across various organic baby food categories.

By Product Type:

By Age Group:

By Distribution Channel:

Detailed category analysis reveals specific trends, growth drivers, and consumer preferences within each organic baby food segment. Organic baby cereals maintain market leadership due to their role as primary weaning foods, with rice-based and multi-grain varieties showing strongest performance across regional markets.

Organic purees category demonstrates significant innovation potential, with manufacturers developing unique flavor combinations that incorporate regional fruits and vegetables. Single-ingredient purees remain popular among health-conscious parents, while mixed varieties appeal to consumers seeking convenience and flavor diversity.

Organic snacks segment shows tremendous growth potential as toddler populations increase and parents seek healthy alternatives to conventional snack options. Finger foods and puffed snacks made from organic grains are gaining popularity, particularly in urban markets where convenience is highly valued.

Organic formula category represents the highest-value segment, with specialized formulations for specific dietary requirements and age groups commanding premium pricing. Goat milk-based formulas and plant-based alternatives are emerging as niche segments with strong growth potential in health-conscious consumer segments.

Packaging innovations across all categories focus on convenience, portion control, and environmental sustainability, with recyclable materials and resealable packaging becoming standard features that influence purchasing decisions.

Industry participants in the Middle East & Africa organic baby food market benefit from multiple value creation opportunities and strategic advantages. Manufacturers gain access to rapidly expanding consumer segments with strong purchasing power and willingness to pay premium prices for quality organic products.

Retailers benefit from higher profit margins associated with organic baby food products compared to conventional alternatives, while also attracting health-conscious consumers who typically demonstrate higher lifetime value and brand loyalty. Distribution partners can leverage the growing demand to expand their product portfolios and strengthen relationships with key retail accounts.

Investors find attractive opportunities in a market demonstrating consistent growth momentum and resilience to economic fluctuations, as parents prioritize infant nutrition regardless of broader economic conditions. Local manufacturers can capitalize on import substitution opportunities while creating products specifically tailored to regional preferences and requirements.

Healthcare stakeholders benefit from improved infant nutrition outcomes and reduced healthcare costs associated with better early childhood nutrition. Government entities gain from increased tax revenues, job creation, and improved public health outcomes resulting from expanded access to quality organic baby food products.

Consumers ultimately benefit from increased product availability, competitive pricing through market competition, and access to high-quality organic nutrition options that support optimal infant development and long-term health outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends are reshaping the Middle East & Africa organic baby food landscape, driven by evolving consumer preferences and technological advancements. Clean label movement continues gaining momentum, with parents increasingly demanding products with minimal, recognizable ingredients and transparent sourcing information.

Personalized nutrition represents a growing trend, with manufacturers developing products tailored to specific dietary requirements, cultural preferences, and individual nutritional needs. Subscription-based purchasing models are gaining popularity among busy parents who value convenience and consistent product availability.

Sustainable packaging initiatives are becoming increasingly important, with environmentally conscious parents preferring products with recyclable, biodegradable, or reduced packaging materials. Plant-based alternatives are emerging as significant trends, with organic plant-based formulas and baby foods gaining acceptance among health-conscious consumers.

Digital engagement trends include increased use of mobile apps for product information, feeding schedules, and nutritional guidance. Social media influence continues growing, with parent communities and influencers significantly impacting brand awareness and purchasing decisions.

Local sourcing trends emphasize products made with regionally sourced organic ingredients, appealing to consumers interested in supporting local agriculture and reducing environmental impact. Functional ingredients such as probiotics, omega-3 fatty acids, and organic superfoods are increasingly incorporated into baby food formulations.

Significant industry developments are transforming the Middle East & Africa organic baby food market landscape through strategic initiatives, technological innovations, and regulatory changes. Manufacturing investments by major international brands are establishing local production capabilities to reduce costs and improve market responsiveness.

Strategic partnerships between international brands and regional distributors are expanding market reach and improving product availability across diverse geographic markets. Acquisition activities involve established companies acquiring regional brands to gain local market knowledge and distribution networks.

Regulatory developments include implementation of stricter organic certification standards and improved import procedures that enhance product quality and consumer confidence. Technology adoption in manufacturing processes is improving product quality, extending shelf life, and reducing production costs.

E-commerce platform launches by major retailers and specialized baby product companies are creating new distribution channels and improving consumer access to organic baby food products. Research and development investments focus on developing products with enhanced nutritional profiles and improved taste characteristics.

Sustainability initiatives include implementation of environmentally friendly packaging solutions and sustainable sourcing practices that appeal to environmentally conscious consumers. Educational campaigns by industry associations and healthcare organizations are increasing awareness about organic baby food benefits and proper infant nutrition practices.

Strategic recommendations for market participants focus on capitalizing on growth opportunities while addressing key challenges in the Middle East & Africa organic baby food market. MarkWide Research analysis suggests that companies should prioritize local manufacturing investments to reduce costs and improve supply chain resilience.

Product development strategies should emphasize culturally adapted formulations that incorporate regional ingredients and flavors while maintaining international organic standards. Distribution strategy optimization requires balanced investment in both traditional retail channels and rapidly growing e-commerce platforms.

Brand positioning recommendations include focusing on quality, safety, and nutritional benefits while building trust through transparent communication about sourcing and manufacturing processes. Pricing strategies should consider local market conditions and consumer purchasing power while maintaining premium positioning.

Partnership development with healthcare professionals, pediatricians, and maternal health organizations can build credibility and drive product recommendations. Digital marketing investments should target mobile-first consumers and leverage social media platforms popular among target demographics.

Supply chain optimization requires investment in cold chain infrastructure and logistics capabilities to ensure product quality and availability across diverse regional markets. Regulatory compliance strategies should anticipate evolving standards and maintain flexibility to adapt to changing requirements across different countries.

Future market projections indicate sustained growth momentum for the Middle East & Africa organic baby food market, driven by fundamental demographic and economic trends. Population growth in key markets, combined with increasing urbanization and rising disposable incomes, creates favorable conditions for continued market expansion.

Technology integration will likely transform product development, manufacturing processes, and consumer engagement strategies. Artificial intelligence and data analytics may enable personalized nutrition recommendations and customized product formulations based on individual infant requirements and preferences.

Market consolidation trends may accelerate as larger companies acquire regional players to expand their geographic reach and local market expertise. Vertical integration strategies may become more common as companies seek to control supply chains and reduce dependency on external suppliers.

Sustainability initiatives will likely become increasingly important, with companies investing in environmentally friendly packaging, sustainable sourcing practices, and carbon-neutral manufacturing processes. Regulatory harmonization across regional markets may simplify compliance requirements and facilitate cross-border trade.

Innovation acceleration is expected in areas such as functional ingredients, personalized nutrition, and convenient packaging solutions. Market penetration rates are projected to increase significantly, with African markets potentially achieving 25-30% penetration within the next decade as infrastructure and consumer awareness continue developing.

The Middle East & Africa organic baby food market represents a dynamic and rapidly evolving industry with substantial growth potential driven by increasing health consciousness, rising disposable incomes, and expanding urban populations. Market fundamentals remain strong, supported by demographic trends that favor continued expansion and consumer preferences increasingly aligned with organic and natural products.

Strategic opportunities abound for companies willing to invest in local manufacturing, product innovation, and distribution network development. Success factors include understanding regional preferences, maintaining product quality standards, and building strong relationships with healthcare professionals and retail partners. The market’s resilient nature and essential product category characteristics provide stability even during economic uncertainties.

Future growth prospects remain robust, with MWR analysis indicating that companies adopting comprehensive strategies addressing local market needs while maintaining international quality standards will be best positioned to capture emerging opportunities. The organic baby food market in the Middle East & Africa is poised for sustained expansion, offering attractive returns for stakeholders committed to long-term market development and consumer value creation.

What is Organic Baby Food?

Organic baby food refers to food products specifically designed for infants and toddlers that are made from organic ingredients, free from synthetic pesticides, fertilizers, and genetically modified organisms. These products are often perceived as healthier options for young children.

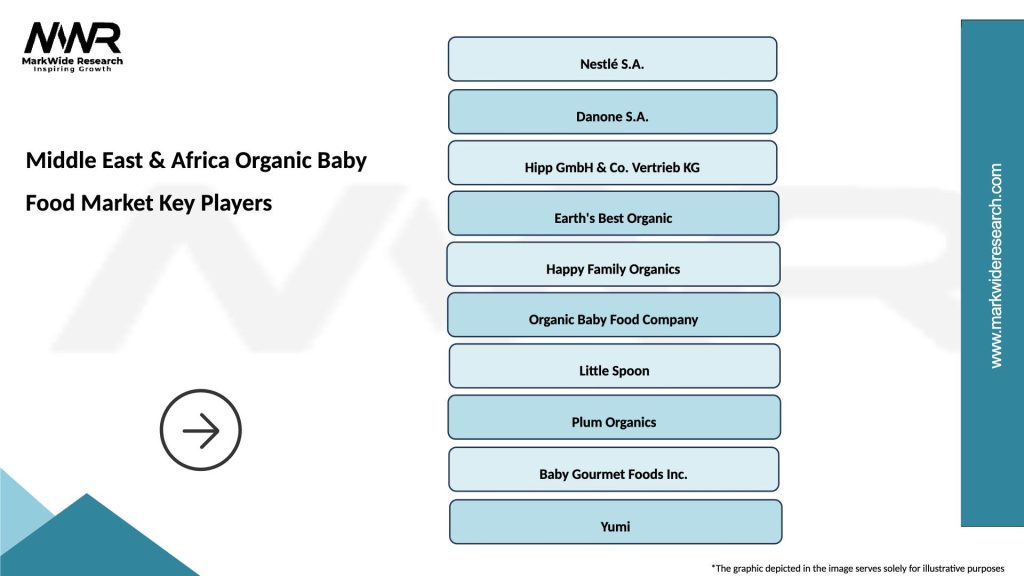

What are the key players in the Middle East & Africa Organic Baby Food Market?

Key players in the Middle East & Africa Organic Baby Food Market include companies like Nestlé, Danone, and Hero Group, which offer a range of organic baby food products. These companies focus on providing nutritious options that cater to the growing demand for organic food among parents, among others.

What are the growth factors driving the Middle East & Africa Organic Baby Food Market?

The growth of the Middle East & Africa Organic Baby Food Market is driven by increasing health consciousness among parents, a rise in disposable incomes, and a growing preference for organic products. Additionally, the expansion of retail channels and online shopping is facilitating access to these products.

What challenges does the Middle East & Africa Organic Baby Food Market face?

The Middle East & Africa Organic Baby Food Market faces challenges such as high production costs associated with organic farming and stringent regulations regarding food safety and labeling. Additionally, consumer skepticism about the authenticity of organic claims can hinder market growth.

What opportunities exist in the Middle East & Africa Organic Baby Food Market?

Opportunities in the Middle East & Africa Organic Baby Food Market include the potential for product innovation, such as introducing new flavors and formats, and expanding distribution networks. There is also a growing trend towards plant-based organic baby food, which can attract health-conscious consumers.

What trends are shaping the Middle East & Africa Organic Baby Food Market?

Trends shaping the Middle East & Africa Organic Baby Food Market include an increasing demand for transparency in ingredient sourcing, the rise of subscription services for baby food delivery, and a focus on sustainability in packaging. These trends reflect changing consumer preferences towards healthier and environmentally friendly options.

Middle East & Africa Organic Baby Food Market

| Segmentation Details | Description |

|---|---|

| Product Type | Purees, Snacks, Cereals, Beverages |

| Packaging Type | Glass Jars, Pouches, Tetra Packs, Cans |

| Distribution Channel | Supermarkets, Online Retail, Specialty Stores, Pharmacies |

| End User | Parents, Caregivers, Hospitals, Daycares |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Organic Baby Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at