444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa micronutrient fertilizer market represents a rapidly expanding segment within the global agricultural inputs industry, driven by increasing awareness of soil health and crop productivity optimization. This dynamic market encompasses essential nutrients including zinc, iron, manganese, copper, boron, and molybdenum, which play crucial roles in plant metabolism and yield enhancement. Agricultural stakeholders across the region are increasingly recognizing the importance of micronutrient supplementation to address widespread soil deficiencies and improve crop quality.

Regional agricultural systems in the Middle East and Africa face unique challenges including arid climates, soil alkalinity, and intensive farming practices that deplete essential micronutrients. The market is experiencing robust growth at a CAGR of 8.2%, reflecting the urgent need for sustainable agricultural solutions. Government initiatives promoting food security and agricultural modernization are further accelerating market adoption across key countries including Saudi Arabia, UAE, South Africa, Kenya, and Nigeria.

Market dynamics are influenced by diverse factors including increasing population pressure, climate change impacts, and the transition toward precision agriculture practices. The region’s agricultural sector is witnessing significant transformation as farmers adopt advanced fertilization techniques to maximize productivity while minimizing environmental impact. Micronutrient fertilizers are becoming integral components of comprehensive crop nutrition programs, supporting sustainable agricultural development across diverse cropping systems.

The Middle East & Africa micronutrient fertilizer market refers to the commercial ecosystem encompassing the production, distribution, and application of essential trace element fertilizers across agricultural systems in the Middle Eastern and African regions. These specialized fertilizers contain vital nutrients required in small quantities but essential for optimal plant growth, development, and productivity.

Micronutrient fertilizers address specific nutritional deficiencies in crops by providing elements such as zinc, iron, manganese, copper, boron, and molybdenum in bioavailable forms. Unlike macronutrients, these trace elements are needed in minimal quantities but serve critical functions in enzyme activation, photosynthesis, protein synthesis, and overall plant metabolism. Agricultural applications span diverse crop types including cereals, fruits, vegetables, and cash crops prevalent throughout the region.

Market participants include international fertilizer manufacturers, regional distributors, agricultural cooperatives, and specialty nutrition companies. The market encompasses various product formulations including chelated micronutrients, sulfate-based compounds, and foliar spray applications designed to meet specific soil and crop requirements across different agro-climatic zones.

Strategic market analysis reveals the Middle East & Africa micronutrient fertilizer market as a high-growth sector driven by agricultural intensification and sustainability imperatives. The market demonstrates strong momentum across multiple segments, with zinc-based fertilizers commanding the largest market share at approximately 35% of total consumption. Regional demand patterns reflect diverse agricultural practices and crop preferences, with significant growth opportunities in emerging markets.

Key market drivers include widespread micronutrient deficiencies in regional soils, increasing adoption of precision agriculture technologies, and growing awareness of crop quality enhancement. The market benefits from supportive government policies promoting agricultural productivity and food security initiatives. Technology advancement in fertilizer formulations, particularly chelated and slow-release products, is expanding application possibilities and improving nutrient use efficiency.

Competitive landscape features a mix of global agricultural giants and specialized regional players, with increasing focus on product innovation and sustainable formulations. Market growth is supported by expanding distribution networks, enhanced farmer education programs, and integration with digital agriculture platforms. Future prospects indicate continued expansion driven by population growth, climate adaptation needs, and sustainable intensification of agricultural systems across the region.

Market intelligence reveals several critical insights shaping the Middle East & Africa micronutrient fertilizer landscape:

Agricultural intensification serves as the primary driver for micronutrient fertilizer adoption across the Middle East and Africa. Increasing population pressure and food security concerns are compelling farmers to maximize productivity from existing agricultural land. Crop yield optimization through balanced nutrition programs has become essential for meeting growing food demand while maintaining economic viability of farming operations.

Soil health awareness is driving significant market growth as agricultural stakeholders recognize the long-term impacts of micronutrient deficiencies. Intensive farming practices, combined with natural soil conditions, have created widespread nutrient imbalances requiring targeted supplementation. Scientific research demonstrating clear correlations between micronutrient availability and crop performance is influencing adoption decisions across diverse agricultural systems.

Government support initiatives are accelerating market development through subsidies, extension programs, and agricultural modernization projects. National food security strategies increasingly emphasize sustainable intensification approaches that include comprehensive crop nutrition management. International development programs are also promoting micronutrient fertilizer adoption as part of broader agricultural development initiatives.

Technology advancement in fertilizer formulations is expanding market opportunities by improving product efficacy and application convenience. Innovations in chelation chemistry, slow-release mechanisms, and foliar application systems are making micronutrient supplementation more accessible and cost-effective for farmers. Precision agriculture technologies are enabling targeted application strategies that optimize nutrient use efficiency and economic returns.

Economic constraints represent significant barriers to micronutrient fertilizer adoption, particularly among smallholder farmers who constitute a large portion of the regional agricultural sector. The higher cost per unit compared to conventional fertilizers creates affordability challenges, especially in markets with limited access to agricultural credit. Price sensitivity remains a critical factor influencing purchasing decisions and market penetration rates.

Limited awareness and technical knowledge among farmers pose substantial challenges to market growth. Many agricultural producers lack understanding of micronutrient functions, deficiency symptoms, and appropriate application methods. Extension service gaps in rural areas limit access to technical information and support, hindering adoption of advanced nutrition management practices.

Infrastructure limitations in distribution and storage systems create logistical challenges for market expansion. Remote agricultural areas often lack adequate supply chains for specialized fertilizer products, resulting in limited availability and higher costs. Quality control issues in some markets affect product reliability and farmer confidence in micronutrient fertilizers.

Regulatory complexities and varying standards across different countries create market fragmentation and compliance challenges for manufacturers and distributors. Inconsistent quality standards and registration requirements can limit product availability and increase market entry costs. Import dependencies for raw materials and finished products expose the market to supply chain disruptions and currency fluctuations.

Precision agriculture adoption presents substantial opportunities for micronutrient fertilizer market expansion. Integration with soil testing services, variable rate application technologies, and digital farming platforms can enhance product value propositions and improve farmer outcomes. Data-driven nutrition management approaches are creating new market segments focused on customized fertilizer recommendations and application strategies.

Organic agriculture growth is generating demand for naturally-derived micronutrient products that meet organic certification standards. This expanding market segment offers premium pricing opportunities and aligns with sustainability trends. Specialty crop production for export markets requires high-quality nutrition programs that include comprehensive micronutrient supplementation.

Public-private partnerships in agricultural development create opportunities for market expansion through subsidized programs and farmer education initiatives. Collaboration with government agencies, NGOs, and international development organizations can accelerate adoption and market penetration. Climate adaptation programs increasingly recognize micronutrient supplementation as essential for crop resilience and stress tolerance.

Product innovation opportunities exist in developing region-specific formulations, improved delivery systems, and combination products that address multiple nutritional needs. Biofortification initiatives aimed at improving crop nutritional content are driving demand for specialized micronutrient applications that enhance food quality and human nutrition outcomes.

Supply chain dynamics in the Middle East & Africa micronutrient fertilizer market are characterized by complex interactions between global raw material suppliers, regional manufacturers, and local distributors. Raw material availability and pricing fluctuations significantly impact market stability and product costs. The market demonstrates increasing vertical integration as companies seek to control supply chains and ensure product quality consistency.

Demand patterns vary significantly across the region, influenced by crop calendars, seasonal rainfall patterns, and agricultural practices. Market seasonality creates challenges for inventory management and cash flow optimization. Regional variations in soil conditions and crop preferences drive demand for specialized product formulations and application methods.

Competitive dynamics are intensifying as market growth attracts new entrants and existing players expand their product portfolios. Innovation competition focuses on product efficacy, application convenience, and cost-effectiveness. Strategic partnerships and acquisitions are reshaping market structure as companies seek to enhance their regional presence and technical capabilities.

Regulatory evolution is influencing market dynamics through changing quality standards, environmental regulations, and safety requirements. Sustainability pressures are driving development of environmentally friendly formulations and packaging solutions. Market participants are adapting to increasing scrutiny of agricultural inputs and their environmental impacts.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary data sources to provide accurate insights into the Middle East & Africa micronutrient fertilizer market. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, agricultural consultants, and end-users across key markets in the region.

Secondary research encompasses analysis of industry reports, government statistics, academic publications, and company financial statements. Market data validation involves cross-referencing multiple sources and conducting expert consultations to ensure accuracy and reliability. Regional market variations are captured through country-specific analysis and local market intelligence gathering.

Quantitative analysis includes statistical modeling of market trends, growth projections, and segment performance indicators. Qualitative assessment covers market dynamics, competitive positioning, and strategic implications for industry participants. The research methodology incorporates both historical trend analysis and forward-looking projections to provide comprehensive market understanding.

Data collection protocols ensure consistency and reliability across different markets and time periods. Market segmentation analysis employs multiple classification criteria including product type, application method, crop category, and geographic region. Regular market monitoring and data updates maintain research currency and relevance for strategic decision-making.

Saudi Arabia represents the largest market for micronutrient fertilizers in the Middle East, driven by extensive agricultural development programs and government support for food security initiatives. The country’s Vision 2030 emphasizes agricultural sustainability and productivity enhancement, creating favorable conditions for market growth. Date palm cultivation and greenhouse agriculture are key application segments driving demand for specialized micronutrient formulations.

South Africa dominates the African segment with approximately 28% market share, supported by advanced agricultural infrastructure and established distribution networks. The country’s diverse agricultural sector, including field crops, horticulture, and viticulture, creates demand for comprehensive micronutrient solutions. Export-oriented agriculture drives adoption of high-quality nutrition programs that include micronutrient supplementation.

Nigeria presents significant growth opportunities driven by large-scale agricultural development and increasing awareness of soil fertility management. The country’s focus on agricultural transformation and food security is creating demand for modern fertilization practices. Smallholder farmer programs are gradually introducing micronutrient concepts and products to traditional farming systems.

Kenya demonstrates strong market potential with growing adoption of precision agriculture and high-value crop production. The country’s horticultural exports require comprehensive nutrition programs that include micronutrient management. Coffee and tea production sectors are increasingly recognizing the importance of balanced nutrition for quality and yield optimization.

UAE serves as a regional hub for product distribution and technology transfer, with advanced agricultural systems driving demand for premium micronutrient products. The country’s focus on food security and sustainable agriculture creates opportunities for innovative fertilizer solutions. Controlled environment agriculture applications require precise micronutrient management systems.

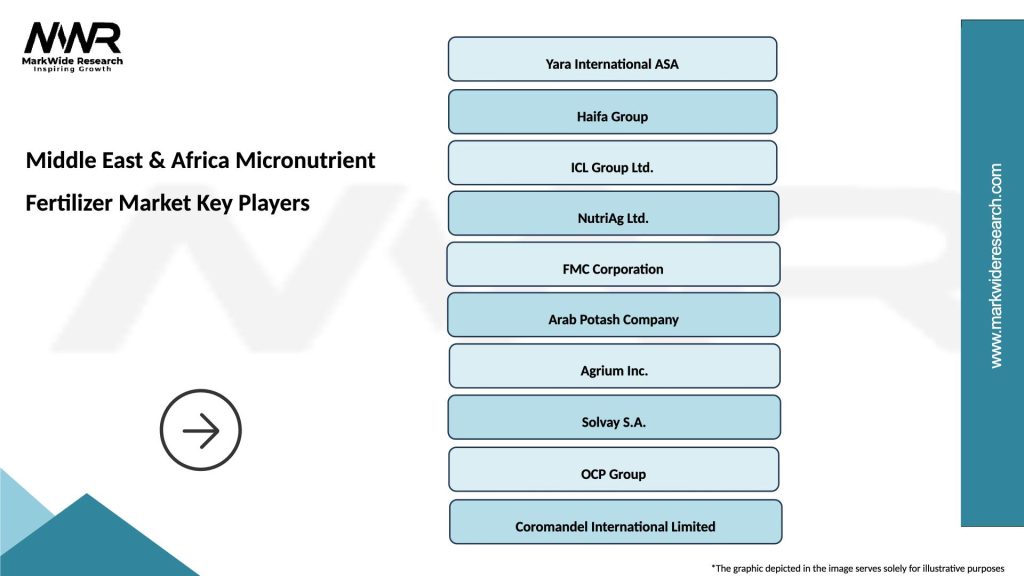

Market leadership in the Middle East & Africa micronutrient fertilizer sector is distributed among several key players, each bringing unique strengths and market positioning strategies:

Competitive strategies focus on product innovation, regional partnerships, and technical service enhancement. Companies are investing in research and development to create region-specific formulations and improve product efficacy. Market consolidation trends are evident as larger players acquire specialized companies to expand their micronutrient portfolios and regional capabilities.

Product Type Segmentation:

Application Method Segmentation:

Crop Type Segmentation:

Chelated Micronutrients represent the premium segment of the market, offering superior bioavailability and reduced soil fixation. These products command higher prices but provide enhanced efficacy, particularly in alkaline soils common throughout the region. Market adoption is increasing among progressive farmers and high-value crop producers who recognize the cost-benefit advantages of improved nutrient efficiency.

Sulfate-based Products constitute the traditional and most widely used category, offering cost-effective nutrition solutions for broad-acre applications. These products maintain strong market presence due to their affordability and proven performance across diverse soil conditions. Bulk applications in cereal production and extensive farming systems continue to drive demand in this segment.

Foliar Micronutrients are experiencing rapid growth as farmers seek quick correction methods for nutrient deficiencies. This category offers flexibility in application timing and can address in-season deficiencies effectively. Liquid formulations are particularly popular for their ease of application and compatibility with other crop protection products.

Organic-compliant Products represent an emerging category driven by organic agriculture expansion and sustainability trends. These products must meet strict certification standards while providing effective nutrition solutions. Premium pricing and specialized distribution channels characterize this growing market segment.

Farmers and Agricultural Producers benefit from micronutrient fertilizers through enhanced crop yields, improved product quality, and increased profitability. Yield improvements of 15-25% are commonly observed with proper micronutrient management programs. Quality enhancement includes better nutritional content, appearance, and shelf life of agricultural products, leading to premium market prices and improved competitiveness.

Fertilizer Manufacturers gain access to high-margin product segments with growing demand and limited competition. Product differentiation opportunities allow companies to establish premium positioning and build customer loyalty. Technical service integration creates additional revenue streams and strengthens customer relationships through value-added consulting services.

Distributors and Retailers benefit from expanding product portfolios and improved profit margins associated with specialty fertilizer products. Market expansion opportunities exist in underserved regions and crop segments. Technical expertise development enhances competitive positioning and customer service capabilities.

Government and Policy Makers achieve food security objectives through improved agricultural productivity and sustainability. Environmental benefits include reduced fertilizer waste and improved nutrient use efficiency. Economic development in rural areas results from increased agricultural income and employment opportunities in the fertilizer value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision Agriculture Integration is transforming micronutrient fertilizer applications through data-driven decision making and variable rate application technologies. Soil testing and plant tissue analysis are becoming standard practices for determining specific nutrient requirements. GPS-guided application systems enable precise placement and optimal timing of micronutrient supplements.

Sustainable Formulation Development focuses on environmentally friendly products with reduced environmental impact and improved nutrient use efficiency. Biodegradable chelates and organic-compliant formulations are gaining market acceptance. Slow-release technologies minimize nutrient losses and reduce application frequency requirements.

Digital Platform Adoption is revolutionizing farmer education and product recommendations through mobile applications and online platforms. Decision support systems provide customized nutrition advice based on soil conditions, crop requirements, and local conditions. Supply chain digitization improves product traceability and quality assurance.

Biofortification Programs are driving demand for specialized micronutrient applications aimed at improving crop nutritional content. Zinc biofortification initiatives in staple crops are creating new market opportunities. Public-private partnerships support research and development of biofortified crop varieties with enhanced micronutrient content.

Strategic partnerships between international fertilizer companies and regional distributors are expanding market reach and improving technical service delivery. Technology transfer agreements facilitate knowledge sharing and product adaptation to local conditions. Joint ventures in manufacturing and distribution are reducing costs and improving market access.

Research and development investments are accelerating product innovation and efficacy improvements. University collaborations support field research and validation of new formulations. Government research programs focus on addressing regional soil fertility challenges and crop-specific nutrition requirements.

Manufacturing capacity expansion is occurring across the region to meet growing demand and reduce import dependencies. Local production facilities improve supply chain efficiency and reduce product costs. Quality control systems are being enhanced to meet international standards and ensure product consistency.

Market consolidation through mergers and acquisitions is reshaping the competitive landscape. Vertical integration strategies enable companies to control supply chains and improve margins. Portfolio expansion through acquisitions adds complementary products and technologies to existing offerings.

MarkWide Research analysis indicates that companies should prioritize farmer education programs to accelerate market adoption and build long-term customer relationships. Technical service investment will differentiate market leaders from commodity suppliers and justify premium pricing strategies. Regional customization of products and services will be essential for success in diverse agricultural markets.

Strategic recommendations include developing cost-effective formulations for smallholder farmers while maintaining premium product lines for commercial agriculture. Distribution network expansion should focus on underserved rural markets with high growth potential. Digital technology integration will become increasingly important for competitive positioning and customer engagement.

Investment priorities should emphasize research and development of region-specific solutions and sustainable formulations. Partnership strategies with agricultural cooperatives, government agencies, and NGOs can accelerate market penetration and build credibility. Supply chain optimization will be critical for managing costs and ensuring product availability.

Market entry strategies for new participants should focus on niche segments and specialized applications before expanding to broader markets. Regulatory compliance and quality assurance systems must be established early to build market credibility and avoid costly setbacks.

Market projections indicate continued robust growth for the Middle East & Africa micronutrient fertilizer market, driven by agricultural intensification and sustainability imperatives. Long-term growth is expected to maintain strong momentum with projected CAGR exceeding 8% through the forecast period. Market maturation in developed segments will be offset by expansion in emerging markets and new application areas.

Technology evolution will continue to drive product innovation and application efficiency improvements. Nanotechnology applications and smart delivery systems represent future growth opportunities. Biofortification programs will create specialized market segments focused on nutritional enhancement of food crops.

Regional development patterns suggest accelerating growth in Sub-Saharan Africa as agricultural modernization programs gain momentum. Climate adaptation requirements will increase demand for micronutrient solutions that enhance crop resilience and stress tolerance. Precision agriculture adoption will drive demand for customized nutrition solutions and data-driven application strategies.

Sustainability trends will reshape product development priorities and market positioning strategies. Circular economy principles will influence packaging and product lifecycle management. Carbon footprint reduction initiatives will favor local production and efficient distribution systems. MWR analysis suggests that companies investing in sustainable innovation and regional market development will achieve superior long-term performance.

The Middle East & Africa micronutrient fertilizer market represents a dynamic and rapidly expanding sector with substantial growth potential driven by agricultural modernization, food security imperatives, and sustainability trends. Market fundamentals remain strong with widespread soil deficiencies, increasing crop productivity requirements, and growing awareness of balanced nutrition benefits supporting continued expansion.

Strategic opportunities exist across multiple market segments, from premium chelated products for commercial agriculture to cost-effective solutions for smallholder farmers. Technology advancement and precision agriculture integration are creating new value propositions and competitive advantages for innovative market participants. Regional diversity offers multiple growth pathways and risk diversification opportunities for companies with appropriate market strategies.

Success factors in this evolving market include technical expertise, regional market knowledge, sustainable product development, and comprehensive farmer support services. Long-term market outlook remains highly positive with demographic trends, climate challenges, and agricultural intensification needs supporting sustained demand growth. Companies that invest in innovation, regional partnerships, and sustainable solutions are well-positioned to capitalize on the significant opportunities in this expanding market.

What is Micronutrient Fertilizer?

Micronutrient Fertilizer refers to fertilizers that contain essential micronutrients required for plant growth, such as zinc, iron, manganese, and copper. These nutrients play a crucial role in various physiological functions of plants, enhancing their overall health and productivity.

What are the key players in the Middle East & Africa Micronutrient Fertilizer Market?

Key players in the Middle East & Africa Micronutrient Fertilizer Market include Yara International, Haifa Group, and Nutrien, among others. These companies are involved in the production and distribution of various micronutrient fertilizers tailored for different crops and soil types.

What are the growth factors driving the Middle East & Africa Micronutrient Fertilizer Market?

The growth of the Middle East & Africa Micronutrient Fertilizer Market is driven by increasing agricultural productivity demands, the need for soil health improvement, and the rising adoption of precision farming techniques. Additionally, government initiatives to enhance food security are also contributing to market growth.

What challenges does the Middle East & Africa Micronutrient Fertilizer Market face?

The Middle East & Africa Micronutrient Fertilizer Market faces challenges such as fluctuating raw material prices, limited awareness among farmers regarding micronutrient benefits, and regulatory hurdles in fertilizer approvals. These factors can hinder market expansion and adoption.

What opportunities exist in the Middle East & Africa Micronutrient Fertilizer Market?

Opportunities in the Middle East & Africa Micronutrient Fertilizer Market include the development of innovative fertilizer formulations, increasing investments in agricultural technology, and the growing trend of sustainable farming practices. These factors can lead to enhanced product offerings and market penetration.

What trends are shaping the Middle East & Africa Micronutrient Fertilizer Market?

Trends shaping the Middle East & Africa Micronutrient Fertilizer Market include the rising use of bio-based fertilizers, advancements in nutrient delivery systems, and a shift towards integrated nutrient management practices. These trends are aimed at improving crop yields and promoting environmental sustainability.

Middle East & Africa Micronutrient Fertilizer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Iron, Zinc, Manganese, Copper |

| Application | Agriculture, Horticulture, Turf Management, Hydroponics |

| End User | Farmers, Agricultural Cooperatives, Retailers, Distributors |

| Packaging Type | Bags, Bulk, Bottles, Sachets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Micronutrient Fertilizer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at